Taking the example of Swiss bank UBS’s project, let’s take a look at the promising power of blockchain for cross border payment and its benefits for today’s gloomy financial markets.

Contents

Swiss bank’s hyped pilot project

As we know, recently, the large Swiss banking group UBS has launched “UBS Digital Cash”. This is a pilot project using blockchain technology, which is meant to allow participants to make both domestic and international transactions on a blockchain network, improving settlement times while providing the necessary transparency. UBS clients can transact in Swiss francs as well as US dollars, euros and yuan with this initiative.

Mr. Janko Hahn, one of the partners participating in the pilot, said: “The UBS Digital Cash pilot has demonstrated the important benefits of blockchain-based payment solutions. They enable faster, more timely cross-border transactions and provide seamless tracking, which is very beneficial in a global environment.“

Payment transactions are carried out through smart contracts, allowing for automatic payments when conditions have been determined. This is clearly what multinational corporations need most right now! Especially since this blockchain network is both private and allows for round-the-clock payment processing. Great, right?

READ MORE: TREND FORECAST 2025: The Surge of Business That Accept Cryptocurrency

The Future of Finance with Blockchain for Cross Border Payment

I believe that the financial industry is currently in a rather recessionary situation, with rising interest rates, inflation, and ambiguous policies. The financial services industry is known for its conservatism and strict requirements. While not ignoring the hype about blockchain, businesses in this industry are still waiting for a more secure guarantee for this new technology.

However, with this move by UBS, blockchain promises to be a strong boost for the near future of the financial industry.

We need to understand the advantages of blockchain for cross border payment!

Blockchain is a decentralized distributed ledger technology, with the following characteristics: immutable, transparent, secure and reliable. Does it sound familiar? Yes, these characteristics have a natural similarity with the financial sector, helping to solve major problems in cross-border payments.

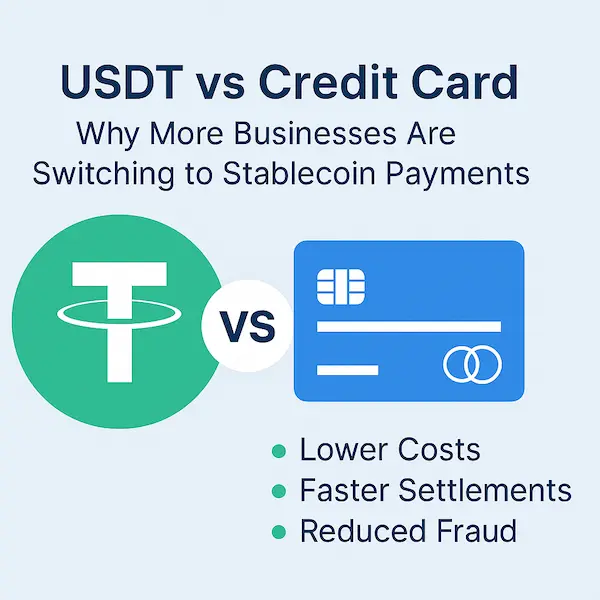

The biggest benefit of blockchain is to reduce costs and time, reduce costs and time, reduce costs and time optimally. It is important to say it three times! Using smart contracts and private transactions for real-time payments in the blockchain network can help reduce transaction costs and processing times. Using blockchain helps organizations reduce operating costs and data management. I understand it simply like this: Using blockchain to create a distributed database and apply it will simplify and automate most payment processes, of course, which will also significantly reduce possible errors.

Second, blockchain helps save manpower. Talent is the lifeblood of a nation. The most boring thing in life is to recruit a talented person to a bank through many interviews and arrange for that person to be on duty to monitor online transactions that blockchain can do. That is the brain drain!

The third thing that organizations put first when deciding to use blockchain is data security. All participants own the information stored on the blockchain network, thus minimizing damage from attacks on the database.

READ MORE: TRENDS AND THE FUTURE OF CRYPTOCURRENCY PAYMENT GATEWAY

New investment opportunities with blockchain

Fintech, short for Financial Technology, refers to the creative use of technology in the operations of the financial services industry. In addition, forms of capital mobilization such as crowdfunding and peer-to-peer lending (P2P Lending) also help save time and costs.

In particular, with rural areas still facing many difficulties in accessing traditional financial services, Fintech can overcome this by providing convenient financial services at affordable costs. This could be a potential market for Fintech to exploit in the future. Because even though their people do not care about what blockchain is, the benefits it brings are too attractive for them to refuse.

We can learn from China or India, where the rural area is still quite large, so their rural financial market is always a pain point for the government. These countries have adopted quite interesting methods! For example: lending without collateral or guarantors when opening an account or electronic payment gateways. They also focus on improving and training people on entrepreneurship as well as free training courses on technology.

—

And you, what do you think the future of blockchain for cross border payments will be like?

Let secure crypto payment gateway know!

How to Set up Crypto Payment Gateway on WooCommerce

We’re also on X (@mxaigate), GitHub and Linkedin! Follow us!