The world of online business is changing rapidly. Traditional payment methods such as credit cards, PayPal, and bank transfers still dominate, but more customers now expect to pay with cryptocurrency. For merchants, learning how to accept crypto payments on website is no longer just an option – it’s becoming a necessity to stay competitive.

Accepting digital assets, especially stablecoins like USDT or USDC, allows businesses to tap into a growing global audience that values faster settlements, lower transaction fees, and borderless accessibility. In this guide, we will explore the practical steps to integrate crypto payments, highlight the benefits, and analyze the challenges you should prepare for.

Contents

- 1 1. What Does It Mean to Accept Crypto Payments on Website?

- 2 2. How Do I accept Crypto Payments on Website?

- 3 3. Benefits of Accepting Crypto Payments on Website

- 4 4. Crypto Payments for Business

- 5 5. Challenges & Risks of Accepting Crypto Payments on Website

- 6 6. Best Crypto Payment Gateways in 2025

- 7 7. XaiGate As a best Payment Gateway for website

- 8 8. How to Accept Cryptocurrency Payments as a Business

- 9 9. Future Trends of Accepting Crypto Payments on Website

- 10 FAQs – Accepting Crypto Payments on Website

- 11 Conclusion: Why You Should Start Accepting Crypto Payments on Website in 2025

1. What Does It Mean to Accept Crypto Payments on Website?

When a business decides to accept crypto payments on website, it simply means customers can use digital currencies such as Bitcoin, Ethereum, or stablecoins to pay directly for goods and services. The process usually involves a crypto payment gateway that converts crypto into fiat automatically or settles in digital coins depending on the merchant’s preference.

Unlike traditional processors that take several days to clear transactions, blockchain-based payments confirm within minutes and carry much lower fees. Stablecoins make this even more practical by eliminating the risk of price volatility. For example, a merchant who accepts 100 USDT today can be confident that the value remains close to 100 USD tomorrow – something not always true with Bitcoin or Ethereum.

This shift doesn’t only represent a new payment method. It’s part of a larger movement toward decentralization, financial independence, and global digital trade. By adding the option to pay with crypto, businesses send a clear signal that they are future-ready and open to a broader customer base.

Cryptocurrency transactions refer to innovative ways of conducting transactions using digital currency like Bitcoin, Ethereum and other cryptos. They are beneficial in many ways including lower transaction fees, faster processing time as well as higher levels of security compared to traditional forms of payment. Through blockchain technology, crypto payments guarantee transparency and minimize chances of fraud. Moreover, by choosing option accepting crypto payments a company can reach out to a wider group through attracting tech-oriented customers and foreign clients who prefer using digital forms money. With ongoing increase in popularity of cryptocurrencies, embracing crypto payment choices offers competitive advantage as well as lifelong security for business enterprises to come in an ever-changing virtual economy.

2. How Do I accept Crypto Payments on Website?

Accept crypto payments on website typically entails various major steps to secure a smooth and safe transaction process. To start with, it’s necessary to have a digital wallet prepared in order to keep the coins received. Next, you should choose a trustworthy cryptocurrency payment gateway like Coinbase Commerce or BitPay that will help execute transactions while providing essential protection mechanisms. Then incorporate this payment gateway into your site usually by utilizing either a plug-in or an API so that clients can utilize different forms of cryptocurrencies when buying from your online store. Finally, updating your website including clear directions as well as possible help for internet shoppers opting for digital currency can really improve their shopping experience as well as expand your marketing coverage.

3. Benefits of Accepting Crypto Payments on Website

For many businesses, the decision to accept crypto payments on website is driven by a combination of cost savings, global reach, and brand positioning. Traditional payment options remain important, but they often come with high transaction fees, delays, and risks of chargebacks. By contrast, crypto offers a more efficient and secure alternative.

1. Borderless Transactions

When you accept cryptocurrency, you immediately open your doors to customers from anywhere in the world. There are no limitations tied to local banks or credit card providers. This is especially valuable for industries such as e-commerce, gaming, and travel, where international customers play a huge role.

2. Lower Transaction Costs

Credit card processors typically charge 2–4% per transaction. With a reliable gateway, merchants can accept stablecoins like USDT or USDC with fees often under 1%. For businesses processing large volumes, this difference translates into significant savings.

3. Faster Settlement

Bank transfers may take several days to clear, especially cross-border transactions. Crypto payments, on the other hand, are confirmed within minutes. This faster settlement improves cash flow and reduces the risk of delays in fulfilling orders.

4. Protection Against Chargebacks

Unlike credit cards, blockchain payments are irreversible. Once a customer pays, the funds cannot be pulled back through fraudulent claims. This helps merchants avoid costly disputes and financial losses.

5. Stablecoin Advantage

Accepting stablecoins on your website removes one of the biggest concerns – volatility. With USDT, USDC, or PYUSD, the value remains pegged to fiat currency, giving both businesses and customers confidence in the transaction’s stability.

Quick Comparison Table

| Feature | Traditional Payments | Crypto Payments |

|---|---|---|

| Transaction Fees | 2–4% | 0.5–1% |

| Settlement Speed | 2–5 days | Minutes |

| Chargeback Risk | High | None |

| Global Accessibility | Limited | Borderless |

4. Crypto Payments for Business

For global transactions with clients, enterprises are offered by way of doing business accepts cryptocurrencies as a modern secure method. Some advantages are lower transaction fees, fast processing times and better security due to the incorporation of models that make this a commonplace idea among some companies. Furthermore, brands appealing to the tech-savvy that use these currencies can attract them as well as take on new markets in order to have more advantage over competitors operating in their respective regions.

1. Blockchain

Blockchain is a digital system used to distribute a secured record of multiple transactions via numerous computers. It is made up of blocks that contain lists of transactions combined to form a time-like structure. The clarity and unchangeable character offer outstanding means to ascertain confidence in various areas for example; banking services, management of supplies disposal, voting systems as well as identification assurance. Moreover, as it eliminates intermediaries and makes way for person-to-person conversations, there are high chances that it will alter sectors and promote creativity.

2. Cryptocurrency

Cryptocurrency refers to an online or digital type of currency that makes use of cryptography in order to confer security, making it hard if not impossible to counterfeit or duplicate. Cryptocurrencies are decentralized unlike fiat money which is issued by central banks and have their occurrence on different platforms based on blockchain technology that promotes transparency and immutability making them different from each other. Some of the best-known cryptocurrencies like Bitcoin, Litecoin and Ethereum have become widely accepted thus facilitating transactions among users, investment as well as engagement in diverse digital financial services. The usage of Cryptocurrencies is on the rise causing them to disrupt traditional finances so that they become alternative means of accessing banking services while facilitating global person-to-person payments.

3. Nodes and Miners

The nodes and miners are important for a blockchain network, since they help to secure it and ensure that it works well. Nodes refer to different computers storing and preserving copies of the blockchain, verifying transactions across the network while relaying them. Complex mathematical computations are used by miners to validate transactions as well as add fresh blocks onto the blockchain thereby getting rewarded in cryptocurrency. Therefore nodes coupled with miners play an integral role in maintaining decentralization which makes blockchain durable and reliable.

4. Public Addresses and Private Keys

Public addresses, just like private keys, constitute the basic building blocks of security in cryptocurrency. Similar to an account number found in conventional banking systems, public addresses are unique identifiers that enable others to send you cryptocurrencies. On the other hand, a private key is a secret code that allows someone to access the funds of this particular public address, which can be compared to a password. Therefore, it is very important to protect your private key because anybody who has it can manipulate your crypto currency holdings.

5. Wallets

There are different kinds of wallets that are essential tools for managing and storing cryptocurrencies securely. Software wallets are applications or online platforms, while hardware wallets are physical devices offering enhanced security. With their wallets, individuals are able to send, receive, and keep track of their digital assets hence safe transactions as well as protection against theft or loss. Public keys make wallets a critical element in the world of digital finance by offering control over one’s cryptocurrency holdings.

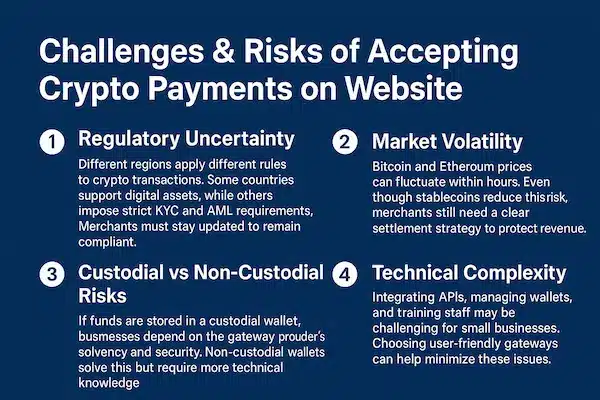

5. Challenges & Risks of Accepting Crypto Payments on Website

While the advantages are clear, businesses should also consider potential risks before they accept crypto payments on website.

1. Regulatory Uncertainty

Different regions apply different rules to crypto transactions. Some countries support digital assets, while others impose strict KYC and AML requirements. Merchants must stay updated to remain compliant.

2. Market Volatility

Bitcoin and Ethereum prices can fluctuate within hours. Even though stablecoins reduce this risk, merchants still need a clear settlement strategy to protect revenue.

3. Custodial vs Non-Custodial Risks

If funds are stored in a custodial wallet, businesses depend on the gateway provider’s solvency and security. Non-custodial wallets solve this but require more technical knowledge.

4. Technical Complexity

Integrating APIs, managing wallets, and training staff may be challenging for small businesses. Choosing user-friendly gateways can help minimize these issues.

6. Best Crypto Payment Gateways in 2025

If you want to accept crypto payments on website, the choice of gateway is crucial. Among the leading providers, XaiGate stands out as the No.1 option in 2025, thanks to its focus on stablecoins, ultra-low fees, and industry-specific solutions.

-

XaiGate – The top choice for businesses in 2025. XaiGate specializes in stablecoins (USDT, USDC, PYUSD), ensuring stability against volatility while offering some of the lowest fees in the industry (0.2–0.5%). With flexible plugins and a powerful API, it is designed for sectors such as travel, gaming, hospitality, and e-commerce. Its balance of compliance and simplicity makes it ideal for both startups and enterprises.

-

BitPay – A pioneer in the crypto payment industry. Supports BTC, ETH, and stablecoins. Well-suited for large enterprises that prioritize compliance.

-

Coinbase Commerce – A user-friendly solution backed by a major exchange. Offers seamless fiat conversion and strong integrations for e-commerce stores.

-

NOWPayments – Known for flexibility, supporting over 100 cryptocurrencies. Popular with gaming platforms and online marketplaces seeking diverse payment options.

Quick Comparison Table: Top Crypto Payment Gateways

| Gateway | Supported Coins | Fees | Integration | KYC/AML | Best For |

|---|---|---|---|---|---|

| XaiGate | USDT, USDC, PYUSD, + 9800 coins | 0.2–0.5% | API, Plugins | Flexible | Travel, Gaming, Hotels, E-commerce |

| BitPay | BTC, ETH, USDC, USDT | ~1% | Plugins, API | Yes | Enterprises, Retailers |

| Coinbase Commerce | BTC, ETH, USDT, USDC | ~1% | Plugins, API | Yes | E-commerce, SaaS |

| NOWPayments | 100+ coins incl. stable | 0.5–1% | Plugins, API | Optional | Gaming, Online Stores |

7. XaiGate As a best Payment Gateway for website

1. Introduction to XAIGATE

XAIGATE resembles PAYPAL; it is a current payment portal that enables users to transact effortlessly. Having said that, it is worth noting that XAIGATE can accommodate payments made in both popular fiat currencies and cryptocurrencies including Bitcoin (BTC), Ethereum(ETH), among others.

2. Diverse Payment Methods

When it comes to users’ flexibility, XAIGATE does bring that in maximally. Both traditional currencies and cryptocurrencies can be accepted, hence allowing the users to carry out their transactions at a global level without having to bother about conversion of currencies or any other payment barriers.

3. Support for Three Major Blockchain Platforms

XAIGATE currently supports three major blockchain platforms, including:

- Ethereum: An extremely well-known blockchain platform that has gained immense traction by virtue of its support for smart contracts and dApps.

- Binance Smart Chain: The Binance blockchain platform, know for high speed in transaction processing as well as being able to retain low transaction charges.

- TRON: A Blockchain Platform Intended to Construct a Decentralized Entertainment Ecosystem.

4. Support for Millions of Tokens

By supporting these three major blockchain platforms, XAIGATE allows users to transact with millions of different tokens. Any token operating on the Ethereum, Binance Smart Chain, and TRON platforms can be used on XAIGATE. This opens up numerous opportunities for users and businesses to leverage their digital assets.

5. Conclusion

XAIGATE is an ideal choice for those seeking a versatile and secure payment gateway. With support for both traditional currencies and cryptocurrencies, along with the integration of three major blockchain platforms, XAIGATE offers a comprehensive and convenient payment solution for users worldwide.

8. How to Accept Cryptocurrency Payments as a Business

If you want to get in on cryptomoney, the first step is finding a good crypto payment gateway that works for you. Establish a digital wallet to receive and keep your cryptos safe. Incorporate the payment gateway into your website or point-of-sale system for smooth transactions. Moreover, remember that there are always regulations and taxes when it comes to digital currency management. The following are steps on how businesses accept crypto payments;

Step 1 – Select Your Provider

It’s vital for companies intending to include cryptocurrencies in their work to choose the right provider for their crypto payment acceptance. While choosing a provider, it is necessary to consider such issues like the transaction costs, the supported types of cryptocurrencies, security functions and integration ease. A trustworthy service provider should offer easy and fast installation process, firm fraud defence mechanisms and efficient conversion alternatives to guarantee hassle-free payments. Thus, by examining these factors you will find an option that fits your company’s requirements and boosts its capacity for making payments.

Step 2 – Integrate into Your Website

Your website integration with cryptocurrency payment alternatives results in accessing a larger number of clients by your firm who use different currencies. Incorporation of such a system as a crypto payment gateway into the processor will make transactions seamless thus allowing secure and fast payments across several cryptocurrencies. Thus expanding the number of clients you can serve and increasing the options available for payments as well as their convenience is achieved through this method. Some advantages that come with the acceptance of crypto payment include easy installation procedures and security challenges that are difficult to overcome hence attracting more customers towards an organization’s products in e-commerce space.

Step 3 – Optimize for Conversion

When accepting cryptocurrencies, the key to optimizing conversion is to ensure that the checkout process is seamless and easy for clients who are using digital currencies. One way to do this would be by ensuring that your payment gateway is well integrated in your site and has instructions that are clear enough for clients making crypto acquisitions. To make it attractive to more users; offer a variety of common crypto coins at lowered costs. Furthermore, one way of building trust thereby encouraging people to pay with digital money frequently would be through giving prompt customer assistance services as well as addressing any worries regarding security.

Step 4 – Payment Selection

When a business makes a decision on which cryptocurrencies it will accept as means of payments, it involves selecting the payment gateway that is appropriate for it in order to do so. The fees associated with transactions made by using this type of currency are affected by this choice in addition to any kind of possible change in the value of these coins against one another or in relation to local currencies. Accepting several known coins will attract more clients; customers enjoy having options. For your company’s secure and sound payment operations, consider the stability and speed of each cryptocurrency.

Step 5 – Check Payment Details

If a business accepts crypto payments on website, it is very important to verify the payment information in detail in order to carry out transactions correctly. Checking the cryptocurrency wallet address again will eliminate mistakes since such transactions cannot be undone. Moreover, tracking transaction confirmations on the blockchain can be used to ascertain successful transfers. Strong security measures should be put in place and any money received must be related with invoices for fraud prevention and smoothness of finances handling.

Step 6 – Make the Payment

As a business accepting payments in cryptocurrency, it is essential to create simple and secure customer interface for making those payments. You can do so by setting up a trustworthy cryptocurrency payment gateway that deals directly with clients, tells them what to do, and allows them several options of altcoins. In addition, real-time conversion rates and confirmations should be integrated into your system to improve transparency as well as client confidence. Hence, some increase in the number of people you are able to reach would occur since it becomes easier for them to pay you while also simplifying financial functions.

Step 7 – Payment Processing

After a customer initiates a payment, it involves securely handling cryptocurrency transactions. This step includes authenticating and verifying the transaction on the blockchain for its authenticity and properness. If needed, the payment gateway or processor will convert crypto into your preferred currency that is most convenient for you, and then transfer funds to your account. In order to keep things moving smoothly, reliably, and efficiently while at the same time reducing chances of problems and improving financial operations in business, effective payment processing should be ensured.

Step 8 – Confirmation

Recognizing a successful transfer of crypto funds requires validating that it was effectively completed and consequently received. Mostly, this step constitutes confirming with the blockchain network to ascertain the legitimacy and recording of such cash payment. Besides, payment service providers have to authenticate such business transactions through the respective payment portal desk for correctness’ sake. Payment confirmation ensuring transaction security and a record for both your business as well as the customer marking an end of the entire payment process.

Step 9 – Settlement

In a business that serves for accepting cryptocurrency payments, it is important to turn the digital currencies received into your preferred fiat money or hold them in cryptocurrency. This function entails managing conversion rates, and transaction charges, as well as timely and reliable transfer of funds. Businesses must have safe ways of storing and handling their cryptocurrencies so as to lessen chances of price fluctuations and cyber threats. Effective settlement procedures can help improve the management of cash flows and incorporate cryptocurrency transactions within general financial operations.

9. Future Trends of Accepting Crypto Payments on Website

The way businesses accept crypto payments on website is evolving quickly. What started as an experiment with Bitcoin is now transforming into a global financial movement powered by stablecoins, CBDCs, and Web3 technologies. Here are the major trends shaping 2025 and beyond:

1. Stablecoins as the Standard

Merchants increasingly prefer stablecoins like USDT, USDC, and PYUSD because they remove the volatility risk. In 2025, more payment gateways are prioritizing stablecoin support as the default option for online commerce.

2. Rise of CBDCs (Central Bank Digital Currencies)

Governments worldwide are exploring digital currencies backed by central banks. While not decentralized like crypto, CBDCs will compete with stablecoins in online payments, giving consumers more digital payment options.

3. Web3 and DeFi Integration

As Web3 applications grow, more businesses will integrate crypto wallets directly into websites. This allows users to pay through DeFi platforms, NFT marketplaces, or decentralized identity systems, creating a seamless digital economy.

4. Industry-Specific Adoption

Travel, gaming, and hospitality are leading sectors in crypto adoption. For example, hotels and airlines already accept USDT and USDC to attract international customers without worrying about currency conversions.

5. KYC-Free and Borderless Solutions

In emerging markets, there is growing demand for KYC-free crypto payments. Merchants want to onboard global customers quickly, especially in industries like gaming and e-commerce, where frictionless checkout is critical.

FAQs – Accepting Crypto Payments on Website

1. What is the easiest way to accept crypto payments on website?

The easiest way is to use a payment gateway with plugins or API that integrates directly into your site.

2. Do I need a crypto wallet to accept payments online?

Yes. You can use a custodial wallet from the gateway or a non-custodial wallet for full control.

3. Which cryptocurrencies are best for website payments?

Stablecoins like USDT, USDC, and PYUSD are most reliable, but BTC and ETH are also popular.

4. Can small businesses accept crypto payments on website?

Yes. Even small e-commerce stores can integrate crypto payments easily with plugins.

5. How much are the fees for crypto payment gateways?

Typically between 0.3% and 1%, lower than most credit card processors.

6. Is it legal to accept crypto payments on website in every country?

It depends on the jurisdiction. Many regions allow it, but regulations vary.

7. Can I directly receive USDT or USDC on my website?

Yes. Many gateways support direct settlement in stablecoins.

8. How long does it take for crypto payments to settle?

Usually a few minutes, much faster than traditional bank transfers.

9. Do crypto payments protect against chargebacks?

Yes. Blockchain transactions are irreversible, eliminating chargeback fraud.

10. What are the main risks of accepting crypto payments on website?

Risks include regulation, volatility, and custodial dependence. Stablecoins and trusted gateways reduce these issues.

Conclusion: Why You Should Start Accepting Crypto Payments on Website in 2025

The way people pay online is changing, and businesses that adapt early gain the most benefits. Choosing to accept crypto payments on website means opening your store to a global audience, lowering transaction costs, and reducing risks tied to traditional methods. With stablecoins like USDT, USDC, and PYUSD, merchants can enjoy predictable value while giving customers the flexibility they expect.

To sum up, your website can be an attractive platform for wider clientele by accepting crypto payments. You can divide digital currencies effortlessly and keep transactions simple by incorporating a reliable crypto payment gateway and setting up a secure digital wallet. They should also know about their associated fees as well as security measures to ensure their operations run smoothly. Therefore, embracing cryptocurrencies would help businesses remain agile and in tune with changing digital money landscape.

Quick Summary Table

| Factor | Traditional Payments | Crypto Payments |

|---|---|---|

| Transaction Fees | 2–4% | 0.2–1% |

| Settlement Speed | 2–5 days | Minutes |

| Chargeback Risk | High | None |

| Global Reach | Limited | Borderless |

| Stability | Linked to banks | Stablecoins peg |

Don’t wait for your competitors to take the lead. Start integrating crypto today and give your customers the choice they’re already asking for. With the right gateway, you can accept crypto payments on website securely, reduce costs, and future-proof your business in the digital economy.

Ready to accept crypto? Explore trusted solutions like XaiGate and make your checkout global, fast, and stable.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!