Looking for the best cryptocurrency payment gateway in Singapore? As digital currencies continue to reshape the financial landscape, more businesses in Singapore are integrating crypto payment solutions to meet growing customer demand and stay ahead of the curve. Whether you’re a startup, eCommerce store, or enterprise seeking secure, fast, and cost-effective crypto transactions, choosing the right provider is critical. In this guide, we explore the top-rated crypto payment gateways in Singapore for 2026, compare their features, and help you make an informed decision for your business growth.

Contents

- 1 Introduction: Singapore’s Crypto Payment Revolution in 2026

- 2 What is a Cryptocurrency Payment Gateway in Singapore?

- 3 2026 Cryptocurrency Payment Gateway Trends in Singapore

- 4 Top 6 Cryptocurrency Payment Gateway in Singapore (2026)

- 5 Legal Updates: MAS Guidelines for 2026

- 6 XAIGATE’s 2026 Innovations: A Case Study

- 7 How to Integrate a Cryptocurrency Payment Gateway in Singapore: XAIGATE’s 4-Step Process

- 8 Challenges & Solutions for 2026

- 9 Future Predictions: What’s Next After 2026?

- 10 Future of Cryptocurrency Payments in Singapore

- 11 Why Singapore Is a Growing Hub for Crypto Payments

- 12 Regulatory Compliance for Crypto Payment Gateways in Singapore

- 13 FAQs – Best Cryptocurrency Payment Gateway in Singapore

- 14 Conclusion: Lead the 2026

- 15 Crypto Economy with XAIGATE

Introduction: Singapore’s Crypto Payment Revolution in 2026

Singapore has emerged as a global hub for cryptocurrency innovation, with its pro-blockchain regulations and tech-savvy population. Over 23% of Singaporean businesses now accept crypto payments, driven by the rise of secure, low-cost cryptocurrency payment gateways. This guide explores everything you need to know about integrating a crypto payment gateway in Singapore, from top providers to legal frameworks

Singapore has established itself as a global hub for fintech and blockchain innovations. As cryptocurrency adoption continues to rise, businesses in Singapore are increasingly looking for reliable cryptocurrency payment gateways to facilitate seamless transactions.

By 2026, Singapore has solidified its position as Asia’s cryptocurrency epicenter, with 40% of businesses adopting crypto payment gateways. Driven by MAS’s progressive regulations and AI-powered platforms like XAIGATE, the city-state now processes $12B monthly in crypto transactions. This guide dives into the latest trends, top gateways, and how XAIGATE is redefining secure, scalable crypto payments for enterprises.

In this guide, we will explore the role of cryptocurrency payment gateway in Singapore, their benefits, regulatory considerations, top providers, and how businesses can integrate them efficiently.

What is a Cryptocurrency Payment Gateway in Singapore?

A cryptocurrency payment gateway in Singapore is a service that enables businesses to accept digital assets such as Bitcoin (BTC), Ethereum (ETH), and stablecoins (USDT, USDC) as payment for goods and services. These gateways act as intermediaries, converting crypto payments into fiat currency or allowing merchants to retain crypto directly.

Key Functions of a Cryptocurrency Payment Gateway in Singapore:

✔️ Instant crypto-to-fiat conversion

✔️ Secure transaction processing

✔️ Multi-currency support

✔️ Blockchain-based transparency

✔️ Integration with e-commerce platforms

Comparative Matrix: Strategic Aspects of Cryptocurrency Payment Gateways in Singapore

| Aspect | XAIGATE | Global Gateways (BitPay / Coinbase Commerce / CoinsPaid) |

|---|---|---|

| Regulatory Alignment with MAS | ✅ Designed to align with Singapore’s PS Act and recent stablecoin framework | ❌ Global-first approach; Singapore often treated as a secondary region |

| Local Fiat Integration | ✅ Roadmap for PayNow / FAST compatibility (following models like OKX + DBS) | ❌ Limited or no local fiat integration; relies on USD or EUR |

| Real-Time SGD Conversion | ✅ Supports instant crypto-to-SGD conversion, minimizing volatility risks | ⚠️ Often settles in USD; slower conversion to SGD via 3rd parties |

| Stablecoin Utility | ✅ Built-in support for MAS-approved stablecoins (e.g., XSGD, USDP) | ⚠️ USDC/USDT focused; regulatory compatibility may be uncertain |

| Merchant Customization | ✅ Modular API, white-label, branding control, webhooks, custom UIs | ❌ Mostly templated checkout systems, limited control |

| Transaction Privacy Flexibility | ✅ Optional KYC per transaction level (e.g., anonymous donations or user-based rules) | ❌ Full KYC required for all parties, reducing donor/user anonymity |

| Crypto-Native Features | ✅ Gas station (network fee subsidy), multi-network (Solana, BNB Chain, Polygon, etc.) | ❌ Ethereum/L1 only focus; few offer Layer 2 or advanced UX tooling |

| Local Support & Onboarding | ✅ Singapore-based support team, fast onboarding, no timezone delay | ❌ Overseas teams, slower response for SG clients |

| Tax & Reporting Tools | ✅ Built-in IRAS GST-friendly export formats, crypto-to-fiat accounting | ⚠️ General reports, no localized tax compliance templates |

| Merchant Cost Efficiency | ✅ 0.2% fee, no minimum monthly cost, no hidden cross-border charges | ❌ 0.8–1.5% fees + monthly minimums + FX conversion fees |

2026 Cryptocurrency Payment Gateway Trends in Singapore

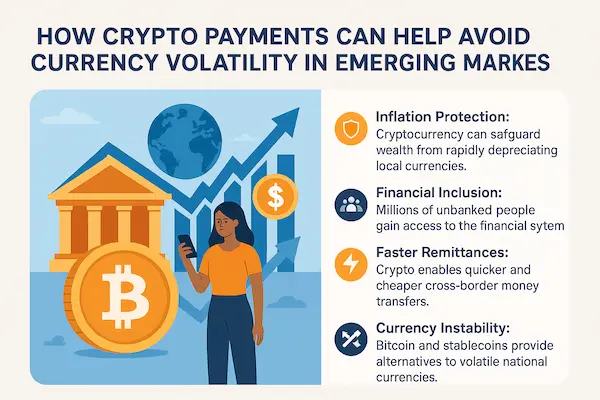

In 2026, cryptocurrency payment gateways in Singapore are expected to move beyond basic transaction processing to become full financial ecosystems. Businesses are adopting stablecoins for lower fees and faster cross-border settlements, while regulators tighten compliance to ensure security and transparency. At the same time, merchants in e-commerce, travel, and even high-risk industries are turning to advanced gateways like XAIGATE to meet customer demand for flexible, instant, and compliant payment options. These trends are shaping the future of how crypto payments will power Singapore’s digital economy.

1 AI-Driven Fraud Detection

Platforms like XAIGATE now leverage generative AI to predict and block suspicious transactions in real time, reducing fraud by 90% compared to 2024.

2 Central Bank Digital Currency (CBDC) Integration

The Digital Singapore Dollar (DSGD), piloted by MAS, is now accepted by major gateways, bridging crypto and traditional finance.

3 DeFi Liquidity Pools

Gateways integrate decentralized exchanges (DEXs) for instant liquidity, slashing conversion fees to 0.1%.

4 NFT-Based Loyalty Programs

Retailers like Lazada Singapore reward customers with NFTs redeemable for discounts via crypto payments.

Top 6 Cryptocurrency Payment Gateway in Singapore (2026)

XAIGATE

- Regulation: MAS Major Payment Institution License.

- Fees: 0.2% per transaction (lowest in SG).

- Features:

- AI-powered AML compliance.

- DSGD and 100+ crypto support.

- Instant fiat settlements via UPI 2.0.

- Best For: Enterprises and high-traffic e-commerce platforms.

TripleA 2.0

- MAS-licensed, now offers cross-chain swaps (e.g., Solana to Ethereum).

- Fees: 0.4% + SGD 0.20.

CoinGate Pro

- Added quantum-resistant encryption for bulletproof security.

- Supports CBDCs from 5+ countries.

Binance Pay+

- Integrated with Binance’s zk-Rollup Layer 2, enabling 10K TPS.

- Zero fees for merchants using BNB.

DBS Digital Exchange

- Singapore’s largest bank now processes crypto payments for SMEs.

- Fees: 0.5% (waived for DBS corporate clients).

Crypto.com Nexus

- Offers crypto loans collateralized via best cryptocurrency payment gateway in Singapore.

- MAS-approved for real estate transactions.

Comparison Table: Payment Gateways in Singapore

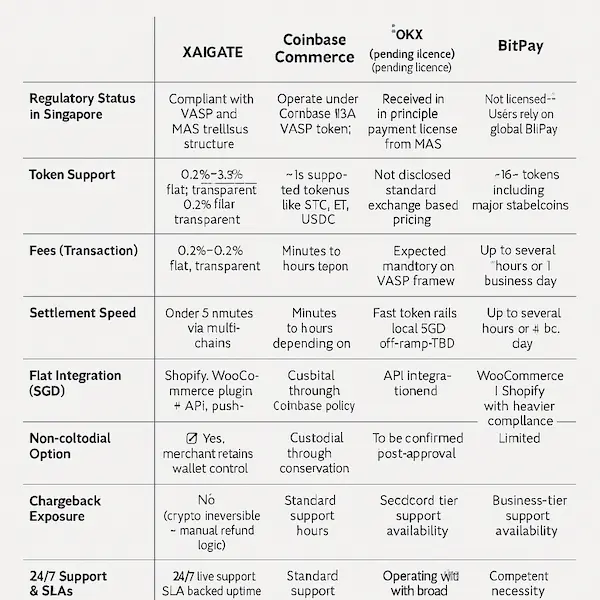

| Feature | XAIGATE (MAS‑friendly) | Coinbase Commerce | OKX Singapore (pending licence) | BitPay |

|---|---|---|---|---|

| Regulatory Status in Singapore | Compliant with VASP and MAS trellis structure | Operates under Coinbase Global VASP token; local agent required | Received in-principle payment licence from MAS | Not licensed locally—users rely on global BitPay |

| Token Support | 9,800+ crypto assets including USDT/USDC on TRC‑20, ERC-20 | ~10 supported tokens like BTC, ETH, USDC | Unknown full list; local operations pending | ~16+ tokens including major stablecoins |

| Fees (Transaction) | 0.2%–0.5% flat, transparent | ~1% + withdrawal fees | Not disclosed; standard exchange-based pricing | ~1% + maintenance and conversion fees |

| KYC Requirement for Merchants | Optional for most transactions | Mandatory for most accounts | Expected mandatory due to VASP framework | Mandatory institutional/business verification |

| Settlement Speed | Under 5 minutes via multiple chains | Minutes to hours depending on network | Fast token rails; local SGD off-ramp TBD | Up to several hours or 1 business day |

| Fiat Integration (SGD) | Supports SGD on/off‑ramp through fx partners | Supported via Stripe connections (static) | Local SGD rails via DBS PayNow, FAST soon Reuters | Fiat conversion via external banking |

| Plugin / Ecommerce Support | Shopify, WooCommerce plugin + API, push-button setup | Basic Shopify & Woo plugin via Coinbase | API integration pending | WooCommerce / Shopify with heavier compliance |

| Non-Custodial Option | ✅ Yes, merchant retains wallet control | ❌ Custodial through Coinbase Conservation | Likely custodial due to regulatory design | ❌ Custodial |

| Chargeback Exposure | No (crypto irreversible + manual refund logic) | Depends on Coinbase/Custodian policy | To be defined under MAS frameworks | Limited; via refund support services |

| 24/7 Support & SLAs | 24/7 live support, SLA-backed uptime | Standard support hours | To be confirmed post-approval | Business-tier support available |

| Local Compliance Assurance | Built for Singapore, Singapore-first contracts | Operates globally with broad compliance | Designed to serve Singapore institutions | Self-certifying via international frameworks |

Legal Updates: MAS Guidelines for 2026

The Monetary Authority of Singapore (MAS) is set to introduce new regulations in 2026 that will directly impact how businesses handle crypto payments in Singapore. These guidelines focus on strengthening anti-money laundering (AML) and know-your-customer (KYC) requirements, while also clarifying tax obligations for merchants.

1 Stricter KYC/AML Protocols

- Biometric verification (e.g., facial recognition) is mandatory for transactions over SGD 1,000.

- Gateways must report cross-border transfers to MAS within 1 hour.

2 Green Crypto Compliance

MAS penalizes gateways using non-eco-friendly blockchains (e.g., PoW coins). XAIGATE uses carbon-neutral Algorand for settlements.

3 Tax Reforms

- Crypto-to-crypto trades remain tax-free.

- Businesses accept crypto payments in Singapore must disclose crypto holdings in annual audits.

XAIGATE’s 2026 Innovations: A Case Study

1 AI-Optimized Currency Routing

XAIGATE’s algorithm automatically routes payments through the cheapest blockchain (e.g., Litecoin for micropayments, Solana for bulk transactions).

2 Embedded Wallet Solutions

Businesses can white-label XAIGATE’s wallet API, letting customers store crypto directly on e-commerce apps.

3 Partnership with GrabPay

XAIGATE powers crypto payments for Grab’s 20M+ Southeast Asian users, enabling BTC payments for rides and food delivery.

How to Integrate a Cryptocurrency Payment Gateway in Singapore: XAIGATE’s 4-Step Process

Getting started with a cryptocurrency payment gateway in Singapore is fast and straightforward when using XAIGATE.

Step 1: Sign Up for a XAIGATE Business Account

Register online and complete the simple onboarding process to unlock merchant tools.

Step 2: Install the XAIGATE Plugin or Connect via API

Choose a one-click plugin for platforms like Shopify or WooCommerce, or use API for custom integration.

Step 3: Customize and Test the Payment Gateway

Set up checkout in SGD, USD, or stablecoins (USDT, USDC, PYUSD), and run test transactions to ensure smooth operation.

Step 4: Go Live and Monitor Transactions

Launch your crypto checkout, receive instant settlements, and track real-time payments on XAIGATE’s secure dashboard.

With this streamlined process, Singaporean businesses can start accepting crypto confidently while ensuring compliance, low fees, and stablecoin-backed security.

Challenges & Solutions for 2026

- Volatility: XAIGATE’s dynamic hedging locks exchange rates at checkout.

- Regulatory Shifts: Subscribe to XAIGATE’s compliance alerts.

- Tech Barriers: Free developer sandboxes offered by top cryptocurrency payment gateway in Singapore.

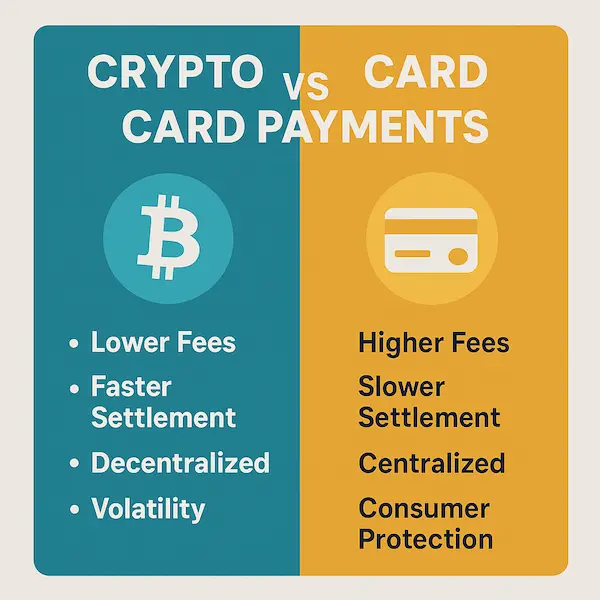

Table: Merchant Decision Matrix — Crypto Payment Gateways vs Traditional Processors in Singapore

| Key Factor | Crypto Payment Gateway Advantage | Traditional Processor Limitation |

|---|---|---|

| Speed to Receive Funds | Instant to <10 minutes, improving cash flow for SMEs and e-commerce merchants. | 1–5 business days, slowing inventory restock and payout cycles. |

| Cost Efficiency | Low processing fees (0.2% – 1%), allowing higher margins or more competitive pricing. | High fees (2% – 4% + FX charges), reducing profit per transaction. |

| Regulatory Alignment | Built-in MAS-compliant KYC/AML and travel rule enforcement; easy to operate legally in Singapore. | Manual compliance updates; higher risk of delays during regulatory changes. |

| Customer Reach | Borderless payments; accepts BTC, ETH, USDT, USDC, and SGD-pegged stablecoins — attractive to global customers. | Limited to fiat payments; often blocks transactions from certain countries. |

| Integration Time | Hours to a few days with API/SDK and e-commerce plugin support. | Weeks to months with bank approval processes. |

| Fraud & Chargeback Risk | Almost zero — irreversible blockchain transactions reduce disputes and refund abuse. | High — vulnerable to credit card fraud, identity theft, and chargebacks. |

| Volatility Control | Auto-converts crypto to SGD or stablecoins to prevent value loss. | Fixed fiat settlement; no hedge against currency devaluation. |

| Scalability for Growth | Easily supports expansion to overseas markets without extra infrastructure. | Requires new bank relationships and payment agreements when expanding abroad. |

Future Predictions: What’s Next After 2026?

The landscape of crypto payments in Singapore is evolving rapidly, and the next wave of innovation is already on the horizon.

AI Agents: Autonomous bots will soon be able to negotiate and execute crypto payments in Singapore on behalf of users, making transactions faster and more seamless.

Metaverse Commerce: As virtual worlds like Sandbox Singapore expand, gateways such as XAIGATE will play a crucial role in enabling secure crypto payments in Singapore for digital assets, events, and cross-border trade.

Interplanetary File System (IPFS): Decentralized storage will transform how receipts and audit trails are managed, adding transparency and reliability to the growing ecosystem of crypto payments in Singapore.

Future of Cryptocurrency Payments in Singapore

1. Growth of Stablecoins and CBDCs

The rise of SGD-backed stablecoins and the potential launch of a Singaporean CBDC (Central Bank Digital Currency) may enhance crypto payment adoption.

2. Increasing Merchant Adoption

Major brands and online businesses are starting to accept crypto payments, setting a trend for widespread usage.

3. Evolution of DeFi and Web3 Payments

With decentralized finance (DeFi) and Web3 innovations, businesses might soon adopt wallet-to-wallet transactions, bypassing traditional payment gateways altogether.

Why Singapore Is a Growing Hub for Crypto Payments

Singapore has rapidly emerged as one of the most crypto-friendly nations in the world, particularly for businesses looking to adopt digital assets as a payment method. There are several key factors that contribute to this transformation:

1. Progressive Regulatory Environment

Singapore’s regulatory approach, led by the Monetary Authority of Singapore (MAS), has been both clear and forward-looking. Instead of banning cryptocurrencies, MAS has focused on creating a well-defined framework that allows innovation to flourish while mitigating risks. The Payment Services Act (PSA) provides legal clarity on how crypto payment services can operate, making it easier for companies to launch and scale in compliance with the law.

2. Government Support for FinTech and Blockchain

The Singapore government actively supports the development of blockchain and crypto innovations through grants, tax incentives, and startup accelerators. Initiatives like Project Ubin—a collaboration between MAS and major banks to explore blockchain in financial infrastructure—signal the country’s long-term commitment to crypto.

3. High Digital Adoption Rate

Singapore has one of the highest smartphone and internet penetration rates in Asia. Consumers are tech-savvy and open to new crypto payment methods, including Bitcoin, Ethereum, and USDT. This environment accelerates the adoption of cryptocurrency in both eCommerce and physical retail.

4. Stable Financial and Political System

As a global financial hub, Singapore offers low corruption, stable governance, and strong banking infrastructure. This stability makes it an attractive base for crypto payment gateway providers in Singapore and merchants that require dependable operations.

5. Growing Merchant Adoption

More retailers, online businesses, and service providers in Singapore are beginning to accept cryptocurrency. From high-end restaurants to tech stores, crypto payment options are becoming more visible. This trend is driven by younger demographics, global clientele, and the demand for faster, cheaper cross-border transactions.

6. Favorable Tax Policy

Unlike many other countries, Singapore does not impose capital gains tax, which makes crypto transactions more attractive for both businesses and consumers. As long as the crypto activity is not considered speculative, businesses enjoy a simpler tax structure.

Regulatory Compliance for Crypto Payment Gateways in Singapore

1. Payment Services Act (PSA)

Under the PSA, crypto payment providers must obtain a Digital Payment Token (DPT) license from MAS. Companies like XAIGATE and Crypto.com comply with these regulations to operate legally in Singapore.

2. Anti-Money Laundering (AML) and Know Your Customer (KYC)

Crypto payment providers must implement strict KYC procedures to verify users and prevent illicit activities.

3. Tax Implications

Since 2020, Singapore has exempted cryptocurrency from Goods and Services Tax (GST), making it easier for businesses to accept crypto payments without additional tax burdens.

FAQs – Best Cryptocurrency Payment Gateway in Singapore

1. Can I use XAIGATE to accept crypto for NFT marketplaces in Singapore?

Yes, XAIGATE fully supports NFT payments and royalties. You can connect your NFT marketplace to XAIGATE’s multi-chain API, allowing you to receive payments on Ethereum, Solana, or BNB Chain with real-time royalty splits—ideal for artists, collectors, and Web3 platforms based in Singapore.

2. Are crypto payments reversible when using XAIGATE?

No, like all blockchain payments, crypto transactions are irreversible. However, XAIGATE offers optional smart contract escrow features that hold funds until delivery conditions are met—protecting both buyers and sellers in Singapore-based digital commerce.

3. How can Singapore businesses handle crypto tax reporting (DSGD, IRAS)?

XAIGATE automatically generates transaction reports compatible with IRAS guidelines. You’ll get downloadable CSV files showing every crypto payment, time-stamped with fiat values (SGD), which simplifies accounting and GST/income tax reporting for businesses in Singapore.

4. Which blockchain networks are approved or supported under MAS guidelines?

While the Monetary Authority of Singapore (MAS) doesn’t “approve” blockchains, networks like Ethereum (especially ETH 2.0), Algorand, and Hedera Hashgraph are frequently used by regulated platforms. XAIGATE supports all these chains for compliant operations in Singapore.

5. Is it legal to accept cryptocurrency payments in Singapore?

Yes. Crypto payments are legal in Singapore under the Payment Services Act (PSA), which governs digital payment token services. Businesses must ensure compliance by using licensed or exempted platforms, and XAIGATE helps merchants stay aligned with MAS regulations.

6. Can I accept crypto in Singapore without conducting KYC?

It depends on your business model. For micro-transactions or digital goods, some gateways like XAIGATE allow low-volume, no-KYC setups. However, for regulated sectors or larger payments, KYC/AML protocols are recommended to comply with MAS and IRAS standards.

7. What is the best crypto payment gateway for small businesses in Singapore?

XAIGATE is the best choice for small and mid-sized Singaporean businesses. It offers 0.2% flat fees, seamless integration with Shopify, Magento, and WooCommerce, and no monthly charges. With support for 9,800+ tokens including SGD-pegged stablecoins, it’s optimized for Singapore commerce.

8. Are crypto payments taxable in Singapore?

Yes. Crypto payments received for goods or services are subject to income tax and possibly GST, depending on the nature of the transaction. XAIGATE helps by providing exportable records and real-time SGD valuations, making crypto tax compliance easier for Singaporean businesses.

9. Can I convert crypto to SGD using XAIGATE?

XAIGATE itself is a non-custodial gateway, so it doesn’t convert funds directly. However, it integrates with fiat off-ramps and MAS-licensed exchanges in Singapore so you can convert BTC, ETH, or USDT to SGD securely and withdraw to a local bank.

10. Is crypto payment adoption growing in Singapore?

Absolutely. Singapore is one of Asia’s most crypto-progressive markets. Sectors like real estate, luxury retail, fintech, and digital services are increasingly adopting crypto payments. With XAIGATE, even SMEs can tap into this growth securely and legally.

Conclusion: Lead the 2026

Crypto Economy with XAIGATE

Cryptocurrency payment gateway are transforming how businesses in Singapore handle transactions. With lower fees, faster payments, and global accessibility, they provide a compelling alternative to traditional payment methods.

Singapore’s crypto payment gateway ecosystem is evolving at lightning speed, blending AI, DeFi, and regulatory clarity. By partnering with MAS-licensed innovators like XAIGATE, businesses can tap into a $5T+ global crypto market while ensuring compliance. Ready to future-proof your payments? Start your XAIGATE integration today at XAIGATE.COM

Quick Summary Table

| Criteria | Why It Matters in Singapore |

|---|---|

| Supported Coins | BTC, ETH, Stablecoins (USDT, USDC, PYUSD) |

| Fees & Settlement Speed | Low fees (0.2–1%), instant settlements |

| Compliance & Security | MAS regulations, AML/KYC, fraud protection |

| Industry Fit | E-commerce, travel, high-risk, freelancers |

| Global Reach | Accept payments worldwide, settle locally |

To find out more and get started, find XAIGATE: crypto for your business ! The interaction with customers at XAIGATE, extends beyond the completion of transactions. Customers are constantly accompanied and supported by us!

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!

Don’t miss out on the opportunity to elevate your business with XAIGATE’s cryptocurrency payment gateway In Singapore integration. The three-step process is designed to be user-friendly, making it accessible for all businesses. Embrace this modern payment solution to provide customers with a secure and efficient way to pay. Take the first step towards a competitive edge in the digital realm and unlock the benefits of cryptocurrency payments for online casino today.