As digital currencies continue to reshape how we perceive value, businesses worldwide are exploring innovative ways to stay competitive and relevant. Among the various options, USDT (Tether) has emerged as a stable, reliable, and globally accepted digital asset. For merchants, integrating a USDT payment gateway into their online or point-of-sale systems is no longer a question of if — it’s a matter of when.

At XAIGATE.COM, we specialize in simplifying crypto payments for businesses of all sizes. In this comprehensive guide, we’ll walk you through what a USDT payment gateway is, why your business needs it, how to integrate one seamlessly, and the strategic advantages you gain by doing so.

In this guide, I’ll walk you through everything you need to know about accepting USDT payments — from how it works, which blockchain versions are best (TRC20 vs ERC20), and how to set it up effortlessly with XAIGATE.com, our no-KYC, lightning-fast crypto gateway.

Contents

- 1 1. Understanding USDT and Its Role in Business Payments

- 2 2. What Is a USDT Payment Gateway?

- 3 3. Why Businesses Need a USDT Payment Gateway

- 4 4. Core Features of a Reliable USDT Payment Gateway

- 5 5. Key Benefits of Integrating a USDT Payment Gateway

- 6 6. How to Integrate a USDT Payment Gateway

- 7 7. Case Studies & Real-World Applications

- 8 8. Challenges & Risks to Consider

- 9 9. Compliance, Taxes, and Legal Considerations

- 10 10. How to Choose the Right USDT Payment Gateway

- 11 11. Latest News & Market Updates (2026)

- 12 12. How to Set Up a USDT Payment Gateway (Step by Step)

- 13 FAQs – USDT Payment Gateway for Business

- 14 Conclusion – How to integrate USDT payments?

1. Understanding USDT and Its Role in Business Payments

1. What is USDT Payments?

USDT, or Tether, is a stablecoin that mirrors the value of the US dollar. Unlike volatile cryptocurrencies like Bitcoin or Ethereum, USDT is pegged 1:1 with the USD, which means 1 USDT = 1 USD (in theory). This stability makes it highly appealing for business transactions, as it reduces the risks of price swings.

2. Why Businesses Prefer USDT Payments

If you run an online business today, you’ve probably noticed a shift — more customers are asking to pay in crypto, and among all the options, USDT stands out. But why is this stablecoin becoming the top choice for businesses of all sizes?

- ✅ Price Stability: You’re not gambling with exchange rates every time you accept a payment.

- ✅ Global Acceptance: USDT is supported on multiple blockchains (Ethereum, Tron, Solana, etc.) and is widely used in cross-border trade.

- ✅ Fast Settlement: Transactions are completed within minutes, regardless of borders or bank hours.

- ✅ Low Fees: Compared to traditional payment processors or SWIFT wires, blockchain-based USDT payments often cost a fraction.

USDT is issued by Tether Limited, a regulated company that publishes regular attestations and reserves transparency. Learn more at Tether.to

Table 1: USDT Payment Gateway vs Traditional Payment Methods

| Feature | USDT Payment Gateway | Traditional Banking/PayPal |

|---|---|---|

| Transaction Fees | 0.2% – 1% (flat, transparent) | 2% – 4% per transaction |

| Settlement Speed | Minutes (on-chain confirmation) | 2–5 business days |

| Global Accessibility | Borderless, no currency conversion needed | Limited, often requires FX fees |

| Security | Blockchain transparency + encryption | Centralized, vulnerable to chargebacks |

| Chargebacks | Not possible (irreversible payments) | Frequent issue for merchants |

| Integration | API/Plugins for eCommerce platforms | Bank contracts, complex setup |

2. What Is a USDT Payment Gateway?

The way businesses accept money is changing fast. Over the past decade, credit cards, bank transfers, and PayPal have been the default options for most online stores. But these methods are often expensive, slow, and complicated when it comes to international customers.

This is where USDT Payment Gateways come in. Powered by Tether (USDT) — the most widely used stablecoin — these gateways allow merchants to accept payments that are fast, borderless, and cost-efficient. Unlike Bitcoin or Ethereum, which can swing wildly in value, USDT is pegged to the US dollar, making it a stable choice for businesses that want the benefits of crypto without the risks of volatility.

In 2026, the demand for USDT Payment Gateways has grown rapidly. From small eCommerce stores to global enterprises, merchants are adopting this solution not just to cut costs, but also to tap into millions of Web3 users worldwide.

At XAIGATE.COM, our gateway acts as a bridge between your business and your customer’s crypto wallet. It handles:

- Wallet generation and management

- QR code generation for payment

- Transaction confirmation

- Real-time reporting and analytics

- Optional conversion to fiat or other crypto

Whether you run an e-commerce site, SaaS platform, gaming app, or a physical store, a best USDT gateway Gateway can be easily integrated with your existing systems.

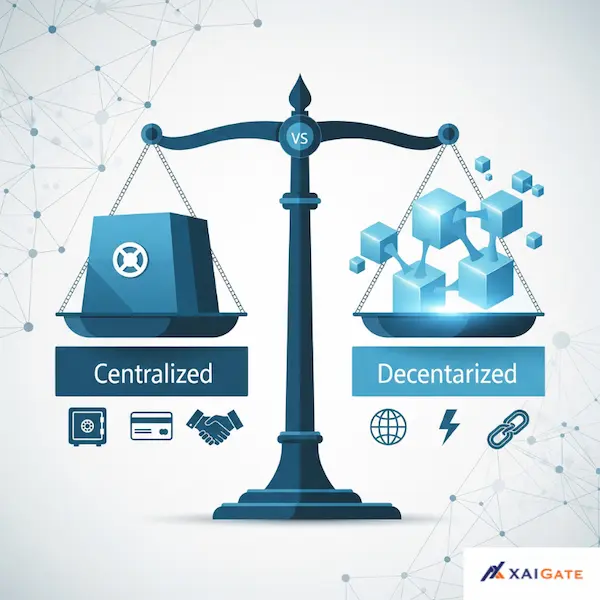

3. Why Businesses Need a USDT Payment Gateway

Traditional payment systems may have worked for decades, but they come with challenges that modern businesses can no longer ignore. High fees, currency conversion issues, and long settlement times often eat into profits and slow down growth. That’s why many companies are turning to USDT Payment Gateways as a smarter alternative.

1. High Transaction Costs in Traditional Banking

For every sale, merchants using credit cards or PayPal often lose between 2% and 4% in fees. This might not sound like much, but at scale, it cuts deep into margins. For example, an online shop processing $50,000 in monthly sales could be paying $1,500 or more in fees. By switching to a USDT Payment Gateway, the same merchant could save up to 80% on transaction costs.

2. Faster Global Accessibility

Bank wires take days to clear, especially for cross-border payments. With USDT, settlement happens in minutes, no matter if your customer is in New York, London, or Manila. This speed allows businesses to operate on a global level without the delays that frustrate customers and stall cash flow.

3. Stability of Stablecoins

Accepting Bitcoin or Ethereum may sound exciting, but price swings can cause unexpected losses. Imagine receiving $1,000 worth of Bitcoin and seeing it drop to $850 the next day. With USDT, value remains tied to the US dollar, making it a safe bridge between crypto adoption and stable cash flow.

4. Expanding to Emerging Markets

In regions like Latin America, Africa, and Southeast Asia, banking services can be expensive or unreliable. USDT has quickly become a preferred alternative for both customers and merchants. By integrating a USDT Payment Gateway, businesses can open new revenue streams in markets that were previously hard to reach.

4. Core Features of a Reliable USDT Payment Gateway

Not every payment gateway is built the same. While many providers claim to support crypto payments, only a few offer the level of reliability and security that businesses truly need. When evaluating a USDT Payment Gateway, merchants should look closely at the following features.

1. Security and Fraud Protection

Handling payments is all about trust. A good gateway must use multi-layer encryption, secure wallet management, and fraud detection systems. Cold storage options for funds and two-factor authentication (2FA) give merchants peace of mind that both their money and their customers are safe.

2. Multi-Currency Support

Even if USDT is the focus, many businesses want the flexibility to accept Bitcoin, Ethereum, or other stablecoins like USDC. A strong gateway will support multiple currencies under one platform, giving customers more options and reducing the need for multiple integrations.

3. Easy Integration with Popular Platforms

Merchants don’t want complicated technical setups. The best USDT Payment Gateways provide ready-made plugins and APIs that work seamlessly with platforms like Shopify, WooCommerce, Magento, and OpenCart. This means a business can start accepting crypto payments within hours, not weeks.

4. Compliance and Flexible KYC Options

Regulations around crypto are still evolving. A trusted provider should offer compliance-ready tools such as KYC/AML verification when needed, while also providing flexible options for businesses in different industries. This balance allows merchants to stay both legally safe and commercially agile.

5. Transparent Fees and Settlement

Hidden charges are a dealbreaker. A reliable gateway must offer flat, transparent fees and clear settlement terms so merchants know exactly what they’re paying for. Fast settlement — ideally instant or within the same day — is another must-have.

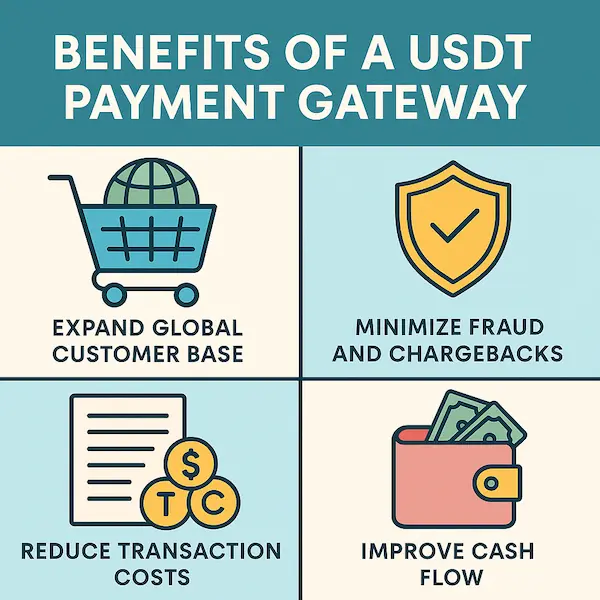

5. Key Benefits of Integrating a USDT Payment Gateway

Adopting a USDT Payment Gateway is not just about keeping up with trends — it delivers measurable business advantages. From lower costs to customer trust, here are the key benefits merchants gain.

A. Expand Your Global Customer Base

Traditional fiat systems can be a barrier to entry for international customers due to currency conversion, banking delays, or limitations in certain countries. With USDT, you open your doors to a truly global audience.

Example: A business based in Vietnam can receive payments from clients in Argentina or Turkey in minutes — no banks, no middlemen, no delays.

B. Reduce Transaction Costs

USDT Payment processors like Visa, PayPal, and Stripe typically charge 2.9%–4.5% per transaction, not to mention chargebacks and hidden fees. In contrast, using a USDT gateway can reduce costs to under 1%, especially if you use low-fee networks like Tron (TRC20) or Solana (SPL).

C. Minimize Fraud and Chargebacks

Once a USDT transaction is completed, it’s irreversible. This eliminates chargeback fraud, which is a major issue in e-commerce and digital services.

D. Improve Cash Flow

No more waiting days or weeks for bank settlements. Top USDT payment gateway are near-instant, improving your cash flow and liquidity management.

E. Enhance Privacy and Security

Blockchain payments offer a level of transparency and security unmatched by traditional methods. Your customer data is protected, and so is your business.

Table 2: Business Options to Accept USDT Payments (2026)

| Feature | XAIGATE (Managed USDT Gateway) | On‑Chain Direct Wallet Payouts | Exchange-Powered Checkout | Self‑Hosted Open‑Source Gateway |

|---|---|---|---|---|

| Setup Time | ~15–30 min via plugin/API | Instant (requires wallet setup) | ~1–2 hours (account + API config) | Days to weeks (setup nodes, hosting) |

| Technical Complexity | Minimal — plugin or REST API supported | Moderate — wallet experience needed | Low–Moderate — guided by platform UI | High — developer-hosted environment |

| Transaction Fees | 0.2% flat, transparent | Only gas cost (TRC20/Polygon cheapest) | 0.5%–1% + potential conversion spreads | No gateway fee; raw blockchain fees only |

| Wallet Custody Model | Non‑custodial (merchant retains keys) | Fully non‑custodial | Custodial (exchange holds funds) | Fully non‑custodial |

| Stablecoin Conversion | Optional auto-convert or hold as USDT | Manual transfer | Built-in conversion infrastructure | Manual by merchant |

| Refund & Reconciliation Logic | Built-in refund tools; dashboard/API | No automated logic — manual reconciliation | Refunds per platform rules | Requires custom development |

| Integration Options (eCommerce) | Plugins for WooCommerce, Shopify, Magento | Manual QR and invoice required | Plugin + checkout page | Fully custom, requires coding |

| Chain Support (ERC20, TRC20…) | Multi-chain support (Ethereum, Tron, Polygon) | Free agent to choose chain | Often limited to major chains | Custom support, limited by community scripts |

| Support & SLAs | 24/7 live support with uptime guarantee | None (self-supported) | Platform-based support | Community or internal support only |

| Scalability & Token Flexibility | Supports 9,800+ tokens including USDT smartchains | Limited by wallet management | Moderate — constrained to exchange-specified tokens | Fully customizable but development-heavy |

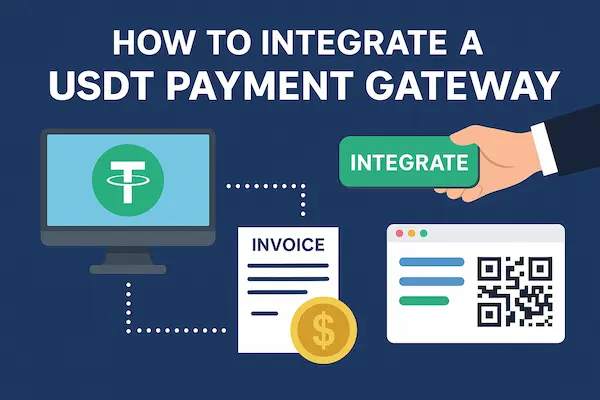

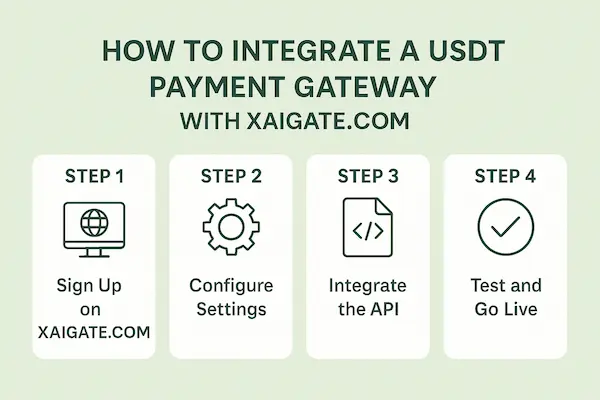

6. How to Integrate a USDT Payment Gateway

At XAIGATE.COM, we provide a developer-friendly, plug-and-play solution for integrating crypto payments — no need for blockchain expertise. Here’s how it works:

Step 1: Sign Up and Create Your Merchant Account

Set up your business profile in minutes. Our onboarding process verifies your identity, business legitimacy, and allows you to configure preferences like settlement options and supported chains.

Step 2: Choose Integration Method

We offer multiple methods to match your technical needs:

- ✅ API Integration – Perfect for custom applications, SaaS, and web platforms.

- ✅ E-commerce Plugins – WordPress/WooCommerce, OpenCart, Magento.

- ✅ No-Code Hosted Pages – Share a payment link or QR code to start accepting USDT immediately.

Step 3: Test and Go Live

Test in sandbox mode, then switch to live production. You can start receiving payments in minutes, with real-time notifications and secure transaction logs.

Optional: Auto-Conversion Feature

Not ready to hold crypto? We offer an optional feature to automatically convert received USDT into stablecoins, ETH, BTC, or even fiat (depending on jurisdiction).

7. Case Studies & Real-World Applications

The true value of a USDT Payment Gateway is best seen in action. Across industries, businesses are finding practical ways to use stablecoin payments to cut costs, expand reach, and improve customer satisfaction.

1. E-commerce Businesses

Selling digital goods, subscriptions, or merchandise? Crypto users are an increasingly powerful segment. Offering USDT as a payment method boosts conversion rates, especially for international orders.

2. SaaS & Online Services

Accepting crypto for subscriptions or one-time payments? Integrating our USDT gateway gateway can help you attract tech-savvy clients and reduce processing fees.

3. Digital Agencies & Freelancers

Avoid SWIFT delays and PayPal freezes. Get paid instantly in USDT, even across borders.

4. Real Estate and High-Ticket Sales

Many investors and high-net-worth individuals are crypto holders. Giving them a seamless way to pay in USDT can close deals faster.

5. Gaming & Web3 Apps

Let players or users make in-game purchases or pay for NFTs using USDT, boosting user retention and monetization.

Table 3: Before and After USDT Payment Gateway Integration

| Business Type | Before (Traditional Payments) | After (USDT Payment Gateway) |

|---|---|---|

| eCommerce Store | 3–4% fees, 3-day settlement | <1% fees, instant settlement |

| Online Casino | Frequent chargebacks, banking restrictions | No chargebacks, borderless access |

| Freelancer | $30–50 lost per transaction in fees | Near-zero fees, payments in minutes |

| Adult Industry | High-risk surcharges, limited providers | Stable, secure, and compliant solution |

8. Challenges & Risks to Consider

While USDT Payment Gateways offer undeniable advantages, businesses should also understand the risks involved. Being aware of these challenges ensures that merchants can take the right precautions before fully adopting the technology.

1. Regulatory Uncertainty

Crypto regulations vary widely between countries. Some governments embrace stablecoins, while others impose restrictions or lack clear guidelines. For example, the European Union’s MiCA framework provides rules for stablecoin use, but in countries with less clarity, merchants may face compliance risks. Businesses should always confirm whether accepting USDT payments is legally recognized in their operating regions.

2. Stablecoin Peg Risks

Although USDT is pegged to the US dollar, there have been occasional concerns about whether its reserves are fully backed. If USDT were to lose its peg, even temporarily, it could impact the value businesses receive. While such risks are rare, merchants should diversify their stablecoin options or have a clear risk-management strategy.

3. Security Concerns with Unverified Gateways

Not all payment providers are equally reliable. Some smaller or unverified gateways may lack strong security protocols, leaving businesses exposed to fraud or hacking. Choosing a trusted provider with a strong track record, transparent policies, and enterprise-grade infrastructure is essential.

4. Limited Customer Knowledge

Despite the growth of crypto adoption, many customers are still unfamiliar with paying via USDT. Merchants may need to educate their audience with clear payment instructions and customer support to ensure a smooth experience.

9. Compliance, Taxes, and Legal Considerations

Accepting USDT payments is legal in most countries, but always consult your local tax advisor. At XAIGATE.COM, we provide tools to help you:

- Export payment records for accounting

- Stay compliant with KYC/AML regulations

- Generate tax reports (coming soon)

We also integrate with crypto tax services to make your life easier during audit season.

10. How to Choose the Right USDT Payment Gateway

With so many providers entering the market, not every USDT Payment Gateway is worth trusting. The wrong choice could expose your business to security risks, hidden fees, or compliance issues. To avoid costly mistakes, here are the key factors every merchant should evaluate.

1. Transaction Fees

Low fees are one of the biggest advantages of crypto payments — but not all gateways are transparent. Some providers advertise cheap rates, only to add hidden costs later. Look for flat, clear pricing models where you know exactly what you’ll pay per transaction.

2. Security Certifications

When money is on the line, security cannot be compromised. A reliable gateway should use enterprise-grade encryption, multi-signature wallets, and fraud detection systems. Check whether the provider has undergone third-party audits or holds relevant security certifications.

3. Integration and Developer Support

Smooth integration saves time and money. The best gateways offer ready-to-use plugins for platforms like Shopify, WooCommerce, and Magento, as well as APIs for custom builds. Strong developer documentation and 24/7 support are also signs of a serious provider.

4. Compliance and KYC Policies

Different businesses have different needs. Some may require strict KYC for regulatory compliance, while others prefer more flexibility. A good USDT Payment Gateway should provide both options, ensuring merchants can operate legally without unnecessary friction.

5. Reputation and Track Record

Choosing a provider is not just about features — it’s about trust. Look at how long the gateway has been in the market, who their clients are, and whether they have a positive track record of uptime and reliability.

6. Why Choose XAIGATE as Your USDT Payment Gateway?

There are many USDT crypto gateways out there — but XAIGATE stands apart due to our focus on real business needs.

We built XAIGATE because we saw the real-world pain points that merchants face: complicated onboarding, surprise fees, KYC delays, unstable APIs, and poor support. So we flipped the script.

Our Key Advantages:

- 🌐 Supports 9,800+ Tokens Across Multiple Chains

- 💸 Zero Monthly Fees

- 🔐 Enterprise-Grade Security

- 🧩 Easy Integration for All Platforms

- 🚀 Fast Onboarding, Start in Minutes

- 🌍 Global Business-Friendly Features

- 🤝 24/7 Dedicated Support

Our gateway was built by entrepreneurs for entrepreneurs – we know what matters to you.

Table 4: Top USDT Payment Gateway Providers in 2026

| Provider | Key Features | Fees | Best For |

|---|---|---|---|

| XAIGATE | Low fees, enterprise-grade security, compliance-ready, global scalability | ~0.2% | Enterprises & high-growth startups |

| CoinPayments | Multi-coin support, popular among SMEs | ~1% | Small to medium businesses |

| NOWPayments | No custody, easy integration | ~1% | Merchants needing quick setup |

| BitPay | Established brand, fiat conversion support | ~1% + extra for fiat | Merchants needing fiat settlements |

| BTCPay Server | Open-source, customizable | Free (self-hosted) | Developers & tech-savvy merchants |

Among these, XAIGATE is positioned as a leader in 2026 because it combines low fees, strong compliance, and scalability — making it ideal for global merchants who want to grow without limits.

11. Latest News & Market Updates (2026)

The rise of USDT Payment Gateways is not happening in isolation — it’s being fueled by real-world adoption and regulatory changes across the globe. In 2026, several key developments are shaping how businesses integrate stablecoin payments.

1. Growing Adoption in Emerging Markets

Latin America and Southeast Asia continue to lead in stablecoin usage. In countries like Argentina and the Philippines, where currency fluctuations hurt consumer confidence, USDT has become a reliable way to transact online. Local eCommerce platforms are now offering USDT as a default payment option, helping merchants expand into previously hard-to-reach markets.

2. Regulatory Clarity in Major Economies

The European Union’s MiCA regulation officially came into effect in 2024, creating a clear framework for stablecoins like USDT. This gave businesses across Europe more confidence to adopt crypto payment gateways without fear of sudden legal shifts. Meanwhile, U.S. regulators have started recognizing stablecoin-backed transactions as part of mainstream finance, further legitimizing their use.

3. High-Risk Industries Turning to Stablecoins

Industries such as online gaming, adult content, and forex trading are increasingly embracing USDT Payment Gateways. Traditional payment providers often block or overcharge these sectors, but stablecoins provide a secure, low-cost alternative. Reports show that by mid-2026, more than 35% of high-risk online businesses had already integrated USDT payments.

4. Institutional Confidence in Stablecoins

Large financial players are also paying attention. Hedge funds and fintech startups are exploring stablecoin infrastructure for settlement systems. This institutional interest adds credibility to USDT and strengthens the long-term stability of the ecosystem.

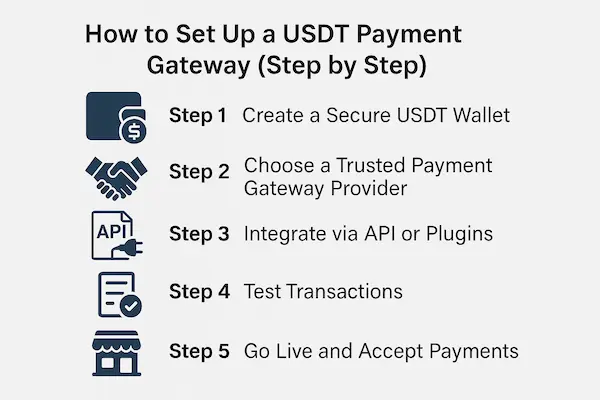

12. How to Set Up a USDT Payment Gateway (Step by Step)

Getting started with a USDT Payment Gateway doesn’t have to be complicated. Whether you’re running an online shop, a gaming platform, or a subscription-based service, you can integrate USDT payments in just a few steps.

Step 1 – Create a Secure USDT Wallet

Before accepting payments, you need a wallet to receive them. Most businesses use a combination of hot wallets (for quick access) and cold wallets (for long-term, secure storage). This balance ensures liquidity without sacrificing security.

Step 2 – Choose a Trusted Payment Gateway Provider

Not all gateways are created equal. Look for providers that offer low fees, strong security, and compliance options. In 2026, solutions like XAIGATE stand out for their ability to combine decentralization with enterprise-grade reliability.

Step 3 – Integrate via API or Plugins

For popular platforms like Shopify, WooCommerce, and Magento, most gateways provide ready-to-use plugins. If you’re running a custom-built site, APIs can be used to integrate payments seamlessly into your checkout system.

Step 4 – Test Transactions

Before going live, run test payments to ensure everything works smoothly. This includes confirming wallet addresses, transaction speeds, and settlement flows. Testing prevents issues when customers start using the system.

Step 5 – Go Live and Accept Payments

Once the setup is complete, enable USDT as a payment option at checkout. Make sure to clearly display it alongside traditional payment methods so customers know they can use it.

By following these steps, merchants can start accepting USDT payments within hours, unlocking access to global customers and enjoying faster, cheaper transactions.

FAQs – USDT Payment Gateway for Business

1. Why should businesses accept USDT payments?

USDT is a stablecoin tied to the U.S. dollar, offering fast and borderless crypto payments without volatility. It helps reduce fees and speed up global transactions.

2. What is a USDT payment gateway?

A USDT payment gateway is a tool that lets online businesses accept Tether (USDT) as a payment method directly on their website or app.

3. How can I integrate a USDT gateway into my site?

With XAIGATE, you can add USDT payments using plugins for platforms like WooCommerce or custom APIs for full control.

4. Are USDT transactions safe?

Yes. USDT transactions are recorded on blockchain networks like Ethereum and Tron, making them secure and transparent. XAIGATE is non-custodial, so funds go directly to your wallet.

5. What fees does XAIGATE charge for USDT transactions?

XAIGATE charges from 0.5% per transaction, with no monthly fees or KYC required. It’s one of the most affordable gateways available.

6. Which blockchains does USDT run on?

USDT runs on Ethereum (ERC-20), Tron (TRC-20), and Solana. XAIGATE supports all three to give merchants and users flexibility.

7. Is accepting USDT legal for businesses?

In most countries, yes. Accepting stablecoins like USDT is legal for eCommerce, but businesses should consult local crypto regulations.

8. What’s the difference between ERC20 and TRC20 USDT?

ERC20 runs on Ethereum and is more widely adopted in DeFi, but fees are higher. TRC20 on Tron is cheaper and faster—ideal for daily payments.

9. Can I accept USDT without KYC?

Yes. XAIGATE allows merchants to accept USDT without requiring KYC unless higher thresholds or local laws apply.

10. How long does it take to start accepting USDT with XAIGATE?

Integration takes under an hour using plugins or API. No blockchain expertise is needed—XAIGATE provides simple onboarding.

Conclusion – How to integrate USDT payments?

In the fast-evolving digital economy, adapting to new payment technologies isn’t a luxury — it’s a necessity. A USDT payment gateway gives your business:

- Stability

- Speed

- Global reach

- Lower costs

- Security

With XAIGATE.COM, you get a partner that understands the technical and business sides of crypto payments. Let us help you take the next step.

Ready to embrace the future of payments? Start with USDT. Start with XAIGATE.

To find out more and get started, find crypto payment gateway ! The interaction with customers at XAIGATE, extends beyond the completion of transactions. Customers are constantly accompanied and supported by us!

Getting Started Accepting USDT Payments with XAIGATE

Don’t wait for your competitors to outpace you with crypto adoption. Start integrating a best USDT payment gateway today and gain the competitive edge your business needs.

Visit XAIGATE.COM to create your free merchant account and start accepting crypto payments in under 10 minutes.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!

Don’t miss out on the opportunity to elevate your business with XAIGATE’s USDT payment gateway integration. The three-step process is designed to be user-friendly, making it accessible for all businesses. Embrace this modern payment solution to provide customers with a secure and efficient way to pay. Take the first step towards a competitive edge in the digital realm and unlock the benefits of cryptocurrency payments for online casino today.