The market of digital payments is experiencing a revolutionary change. The well-established payment system that is based on banks and financial institutions is being surpassed by the decentralized payment that is based on blockchain technology. The change brought about by this transition is not merely an incremental technology but is an essential reconsideration of what we consider to be money, transactions and monetary independence.

Decentralized payments have taken a turn in getting much more advanced than mere transfer of cryptocurrency to new forms of payment that are able to lead to every form of transaction be it a small form of transaction to sophisticated business payments. With all the trends towards our more connected and digital future, it is only natural to look into this evolution and determine how it will impact the business and consumers alike.

Contents

- 1 Understanding Decentralized Payments

- 2 The Evolution from QR Codes to Tap-to-Pay

- 3 Current State of Web3 Commerce

- 4 Comparing Payment Methods

- 5 Technology Infrastructure Behind Decentralized Payments

- 6 Benefits and Challenges

- 7 Future Outlook and Innovations

- 8 Business Implementation Strategies

- 9 Impact on Traditional Financial Systems

- 10 Conclusion

- 11 Frequently Asked Questions

Understanding Decentralized Payments

Decentralized payments can be discussed as a financial activity that takes place without the intervention of the conventional mediators such as banks, payment processors or centralized bodies. Such payments, instead, are based on blockchain networks and smart contracts to rider, clearing and settles the transactions between involved parties.

The main philosophy of decentralized payment includes a peer-to-peer interaction. When you use a conventional payment system to transfer cash, you usually transfer it to a variety of middlemen your bank, payment networks and the bank of the recipient. Every interface introduces time, cost and possible failure points. In the case of decentralized payments, the blockchain network itself is the intermediary, which results in an even more direct and efficient process of the transaction.

Key Components of Decentralized Payment Systems

Blockchain Infrastructure: The foundation of all decentralized payments is blockchain technology. This distributed ledger system records all transactions across multiple computers, making it nearly impossible to alter or hack. Popular blockchain networks for payments include Bitcoin, Ethereum, and newer protocols like Solana and Polygon.

Smart Contracts: These are self-executing contracts with terms directly written into code. Smart contracts automatically process payments when predetermined conditions are met, eliminating the need for manual intervention or third-party verification.

Digital Wallets: Users interact with decentralized payments through digital wallets that store private keys and manage blockchain transactions. These wallets can be software-based (mobile apps or browser extensions) or hardware devices for enhanced security.

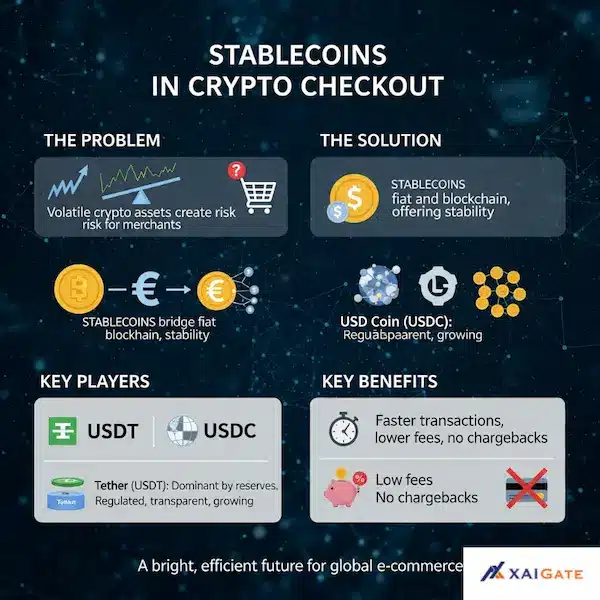

Cryptocurrency and Tokens: While not all decentralized payments use cryptocurrency, many rely on digital tokens that represent value on blockchain networks. These can include stablecoins (cryptocurrencies pegged to traditional currencies) or native tokens specific to particular blockchain ecosystems.

The Evolution from QR Codes to Tap-to-Pay

The journey of decentralized payments has been marked by significant technological advances that have made these systems more user-friendly and accessible to mainstream consumers.

The QR Code Era

QR codes shook up decentralized payments with an easy method to exchange wallet addresses and payment data. Whereas they might have to input long and convoluted wallet addresses themselves, users could scan a QR code to accomplish a transaction. This breakthrough was essential as it addressed one of the biggest usability problems ahead of early cryptocurrency payments.

The QR code mechanism is simple and makes use of information on the payment amount, recipient address in the wallet as well as other details related to the transaction to create a scan-able image. The technique led to a considerable decrease in the quantity of mistakes, and decentralized payments became more available to non-technical users.

The preference of many businesses to use QR codes as a basis of issuing decentralized payments stems from the fact that it demanded very little adjustment of the infrastructure. Small business could use a printable QR code to accept payments in crypto so as not to spend money on the costly point-of-sale solutions.

The Rise of Tap-to-Pay Technology

The latest evolution in decentralized payments incorporates Near Field Communication (NFC) technology, enabling tap-to-pay functionality similar to traditional contactless payment methods. This advancement represents a crucial step toward mainstream adoption of decentralized payments.

NFC-enabled decentralized payments work by storing payment information on devices equipped with NFC chips, such as smartphones or specialized payment cards. When these devices are brought close to compatible payment terminals, they can automatically initiate blockchain transactions.

This technology bridges the gap between the convenience of traditional contactless payments and the benefits of decentralized payments. Users can enjoy the same familiar payment experience they’re accustomed to while benefiting from the security, transparency, and reduced fees associated with blockchain transactions.

Current State of Web3 Commerce

The Web3 commerce ecosystem has matured significantly, with decentralized payments becoming increasingly integrated into various business models and consumer applications.

Market Adoption and Growth

Recent market research indicates that decentralized payments are experiencing rapid growth across multiple sectors. E-commerce platforms are increasingly integrating cryptocurrency payment options, while traditional retailers are exploring blockchain-based payment solutions to reduce transaction fees and expand their customer base.

The gaming industry has become a particularly strong adopter of decentralized payments, with many games incorporating blockchain-based economies where players can earn, trade, and spend digital assets. This has created new revenue streams and business models that were previously impossible with traditional payment systems.

Integration with Traditional Commerce

Modern decentralized payments systems are designed to work alongside existing payment infrastructure rather than completely replacing it. Payment processors now offer hybrid solutions that allow businesses to accept both traditional and cryptocurrency payments through the same interface.

This integration approach has lowered barriers to adoption for businesses that want to explore decentralized payments without completely overhauling their existing systems. Many payment gateways now offer plugins and APIs that enable easy integration of cryptocurrency payments into existing e-commerce platforms.

Regulatory Landscape

The regulatory environment for decentralized payments continues to evolve, with governments and financial authorities working to establish frameworks that balance innovation with consumer protection. In the United States, various agencies are developing guidelines for cryptocurrency payments, stablecoins, and blockchain-based financial services.

These regulatory developments are actually benefiting the decentralized payments ecosystem by providing clearer rules and increasing institutional confidence. As regulations become more defined, we’re seeing increased adoption by larger businesses and financial institutions.

Comparing Payment Methods

To understand the advantages of decentralized payments, it’s helpful to compare them with traditional payment methods across various factors.

|

Payment Method |

Transaction Speed |

Fees |

Security |

Global Accessibility |

Reversibility |

|

Traditional Bank Transfer |

1-3 business days |

$15-50 international |

High (institutional) |

Limited by banking relationships |

Yes |

|

Credit Card |

Instant (settlement in 2-3 days) |

2-4% + fixed fees |

Moderate |

High |

Yes |

|

PayPal/Digital Wallets |

Instant |

2.9% + $0.30 |

Moderate |

High |

Yes |

|

Decentralized Payments |

Minutes to hours |

$0.01-5 |

Very High |

Universal |

No |

Transaction Speed and Efficiency

Decentralized payments offer significant advantages in terms of transaction speed, particularly for international transfers. While traditional international wire transfers can take several days to process, decentralized payments can typically settle within minutes or hours, regardless of geographic location.

The efficiency gains become even more pronounced when considering the reduced number of intermediaries involved. Traditional payment systems often require multiple verification steps and clearing processes, while decentralized payments can be processed directly between parties through the blockchain network.

Cost Considerations

One of the most compelling aspects of decentralized payments is their potential for significantly lower transaction fees. Traditional payment systems impose various fees—processing fees, network fees, currency conversion fees, and intermediary fees—that can add up to substantial amounts, especially for international transactions.

Decentralized payments eliminate many of these fees by removing intermediaries from the transaction process. While blockchain networks do charge transaction fees (often called “gas fees”), these are typically much lower than traditional payment processing fees, especially for larger transactions.

Security and Trust

Decentralized payments offer a unique security model based on cryptographic principles and distributed consensus rather than institutional trust. Each transaction is cryptographically secured and verified by multiple network participants, making fraud and manipulation extremely difficult.

The transparency of blockchain networks also provides an additional layer of security. All transactions are recorded on a public ledger, making it possible to verify and audit payments independently. This transparency doesn’t compromise privacy, as wallet addresses don’t necessarily reveal personal information about their owners.

Technology Infrastructure Behind Decentralized Payments

The technical foundation of decentralized payments involves several interconnected technologies working together to create a seamless payment experience.

Blockchain Networks and Consensus Mechanisms

Different blockchain networks use various consensus mechanisms to validate transactions and maintain network security. Bitcoin uses Proof of Work, which requires significant computational power but provides excellent security. Ethereum is transitioning to Proof of Stake, which is more energy-efficient while maintaining security.

Newer blockchain networks designed specifically for payments often use alternative consensus mechanisms optimized for speed and efficiency. These networks can process thousands of transactions per second while maintaining the security and decentralization benefits of blockchain technology.

Layer 2 Solutions and Scalability

To address scalability challenges, many decentralized payments systems now utilize Layer 2 solutions. These are secondary protocols built on top of existing blockchain networks that can process transactions more quickly and cheaply while still benefiting from the security of the underlying blockchain.

These could be the Lightning Network in terms of Bitcoin transactions and some rollup solutions in the case of Ethereum. These Layer 2 products offer the ability to enable decentralized payments to lend the same speed and cost competitive nature of legacy payment methods.

Cross-Chain Solutions and Interoperability

With the development of the decentralized payments environment, support of interoperability among various blockchain ecosystems has become even more significant. Cross-chain bridges and protocols have enabled users to have an interlinked, more adaptive payment system by enabling them to move value across any blockchain.

Such interoperability is essential in popularizing the use of decentralized payments because it enables payments users to be able to select the most suitable blockchain network based on their appeals and yet be able to communicate with other users in the other networks.

Benefits and Challenges

Decentralized payments offer numerous advantages over traditional payment systems, but they also face several challenges that must be addressed for widespread adoption.

Key Benefits

Financial Inclusion: Decentralized payments can provide financial services to unbanked and underbanked populations worldwide. Anyone with internet access can participate in the global economy without needing traditional banking infrastructure.

Reduced Costs: By eliminating intermediaries, decentralized payments can significantly reduce transaction fees, especially for international transfers. This makes cross-border commerce more accessible and profitable for businesses of all sizes.

24/7 Availability: Unlike traditional banking systems that operate during specific hours, decentralized payments networks operate continuously, enabling transactions at any time of day or night.

Programmable Money: Smart contracts enable decentralized payments to include programmable logic, allowing for automatic payments, conditional transfers, and complex financial arrangements without human intervention.

Transparency and Auditability: All transactions on blockchain networks are recorded on public ledgers, providing complete transparency and enabling independent verification of payment flows.

Current Challenges

Volatility: A lot of decentralized payments systems are built on cryptocurrencies, which may be highly volatile in terms of pricing. This puts both merchants and consumers into the state of confusion over the real value of payments.

Technical Complexity: In the case of user interfaces, they have been greatly polished, however, the decentralized payments come with a higher level of technicality compared to the typical payment methods. The users will need to learn about notions such as the use of private keys, the security of wallets, and the costs of transactions.

Regulatory Uncertainty: Ever-changing regulation brings uncertainty to the business and consumers contemplating the use of decentralized payments. Various jurisdictions have diverse experiences when it comes to regulating cryptocurrencies, which presents problems to businesses operating on a global scale.

Scalability: Although this problem is being solved using Layer 2 solutions, scalability remains a problem in certain blockchain networks when individuals want to use their service resulting in slower transaction speed and higher fees.

User Experience: Although much has been advanced, the decentralized payment systems usually lack the finesse and ease that the traditional payment systems provide to the consumers. This poses as a hindrance to popular adoption.

Future Outlook and Innovations

The future of decentralized payments looks promising, with several technological and adoption trends pointing toward increased mainstream integration.

Technological Advances

Central Bank Digital Currencies (CBDCs): Many countries are developing or piloting CBDCs, which combine the benefits of digital currencies with the stability and regulatory backing of government-issued money. These developments could significantly accelerate adoption of decentralized payments infrastructure.

Improved User Interfaces: Wallet providers and payment platforms are continuously improving user interfaces to make decentralized payments as simple and intuitive as traditional payment methods. Voice-activated payments, biometric authentication, and artificial intelligence assistants are being integrated into payment systems.

Enhanced Privacy Features: New privacy-focused blockchain networks and protocols are being developed to address concerns about transaction transparency while maintaining the benefits of decentralized payments.

Market Trends and Adoption Patterns

Institutional Adoption: Large corporations and financial institutions are increasingly exploring decentralized payments for both internal operations and customer-facing services. This institutional adoption is driving development of enterprise-grade solutions and compliance tools.

Integration with IoT: The Internet of Things presents new opportunities for decentralized payments, enabling automated payments between connected devices. This could revolutionize areas like electric vehicle charging, smart home services, and supply chain management.

Sustainability Focus: As environmental concerns about blockchain energy consumption grow, more decentralized payments systems are adopting energy-efficient consensus mechanisms and carbon-neutral operations.

|

Innovation Area |

Current Status |

Expected Timeline |

Potential Impact |

|

CBDC Integration |

Pilot programs in multiple countries |

2-5 years |

High – could bridge traditional and decentralized systems |

|

Quantum-Resistant Security |

Research and development phase |

5-10 years |

Critical – ensures long-term security |

|

Full IoT Integration |

Early implementations |

3-7 years |

High – enables new payment scenarios |

Business Implementation Strategies

For businesses considering decentralized payments, a strategic approach to implementation can maximize benefits while minimizing risks and disruption.

Assessment and Planning

Before implementing decentralized payments, businesses should conduct a thorough assessment of their current payment infrastructure, customer base, and regulatory environment. This assessment should consider factors such as transaction volume, geographic distribution of customers, and existing payment processing costs.

Risk assessment is particularly important for decentralized payments implementation. Businesses should evaluate risks related to price volatility, regulatory changes, technical complexity, and customer acceptance. Developing mitigation strategies for these risks is crucial for successful implementation.

Gradual Integration Approach

Most successful decentralized payments implementations follow a gradual integration approach. This typically begins with offering cryptocurrency payments as an additional option alongside traditional payment methods, allowing businesses to test the technology and gauge customer response without fully committing to a new system.

The gradual approach also allows businesses to build internal expertise and refine their processes before expanding their decentralized payments capabilities. This reduces the risk of operational disruptions and helps identify potential issues early in the implementation process.

Customer Education and Support

Successful decentralized payments implementation requires comprehensive customer education and support programs. Many consumers are still unfamiliar with cryptocurrency payments and may need guidance on how to use digital wallets and complete blockchain transactions.

Businesses should develop educational resources, provide customer support specifically for decentralized payments, and ensure that their staff is trained to assist customers with these new payment methods. Clear communication about the benefits and security of decentralized payments can help build customer confidence and adoption.

Compliance and Risk Management

Implementing decentralized payments requires careful attention to regulatory compliance and risk management. Businesses must ensure they comply with applicable anti-money laundering (AML) and know-your-customer (KYC) regulations, even when using decentralized systems.

Risk management strategies should address operational risks, cybersecurity threats, and potential regulatory changes. Regular audits and compliance reviews can help businesses stay ahead of regulatory requirements and maintain best practices in decentralized payments operations.

Impact on Traditional Financial Systems

The rise of decentralized payments is creating significant changes in traditional financial systems, forcing banks and financial institutions to adapt and evolve.

Banking Industry Response

Traditional banks are responding to decentralized payments in various ways. Some banks are embracing the technology by offering cryptocurrency services to their customers, while others are developing their own blockchain-based payment solutions.

Many banks are also investing in research and development to better understand blockchain technology and its potential applications in traditional banking services. This has led to the development of hybrid solutions that combine the benefits of decentralized payments with traditional banking infrastructure.

Regulatory Evolution

Financial regulators worldwide are working to develop frameworks that accommodate decentralized payments while maintaining consumer protection and financial stability. This regulatory evolution is creating new compliance requirements and opportunities for innovation.

The regulatory response has generally been focused on establishing clear rules for cryptocurrency exchanges, stablecoin issuers, and businesses that accept decentralized payments. These regulations are helping to legitimize the technology and increase institutional confidence.

Future Coexistence

Rather than completely replacing traditional financial systems, decentralized payments are likely to coexist and complement existing payment infrastructure. This hybrid approach allows consumers and businesses to benefit from the advantages of both systems while maintaining access to traditional financial services.

The integration of decentralized payments with traditional systems is already happening through partnerships between cryptocurrency companies and traditional financial institutions. These collaborations are creating new products and services that bridge the gap between traditional and decentralized finance.

Conclusion

Decentralized payments are a paradigm change when it comes to our way of thinking about money and transactions. Since the times when the usage of QR codes with cryptocurrency payments was new and simple to the current highly complex tap and pay, this solution has changed and brought practical solutions to many shortcomings of the classic payment systems.

Lower costs, faster international payments, financial inclusion, and programmable money are among decentralized payments advantages that become more and more appealing to both businesses and consumers. The challenges are still present, and some of the concerns are concerning volatility, technical complexity, and regulatory uncertainty, which are being solved in the course of innovations.

It is possible to postulate the distributed payments as playing an evolving larger role in the international business as we move into the future. Technologies are being improved, they are becoming easy to operate, and the regulatory environment is being built to ensure safe and compliant usage.

When it comes to businesses that want to look into decentralized payments, the answer is they should start with solid understanding of their needs and goals, roll out the projects slowly, and pay special attention to teaching and assisting the customers. When founders are eager to adopt this technology on early terms and carefully apply it, they will be in a good position to take advantage of the future payment environment transformation.

The future of commerce is being shaped by decentralized payments, and understanding this technology is crucial for anyone involved in digital business, financial services, or the broader economy. As the technology continues to evolve and mature, we can expect to see even more innovative applications and increased mainstream adoption of decentralized payments systems.

Frequently Asked Questions

1. Are decentralized payments secure?

Yes, decentralized payments use advanced cryptographic security and distributed consensus mechanisms that make them extremely secure. Each transaction is verified by multiple network participants and recorded on an immutable blockchain ledger.

2. How long do decentralized payment transactions take?

Transaction times for decentralized payments vary by network but typically range from a few minutes to an hour. This is significantly faster than traditional international wire transfers, which can take several days.

3. Do I need technical knowledge to use decentralized payments?

While some technical understanding is helpful, modern decentralized payments systems are designed to be user-friendly. Many digital wallets and payment platforms now offer intuitive interfaces similar to traditional payment apps.

4. Are decentralized payments legal?

The legality of decentralized payments varies by jurisdiction. In the United States, they are generally legal, though regulations continue to evolve. Businesses should consult with legal experts to ensure compliance with applicable laws.

5. What happens if I lose my private keys?

Losing private keys means losing access to your decentralized payments wallet and any funds stored in it. This is why secure key management and backup strategies are crucial when using decentralized payments systems.

6. Can decentralized payments be reversed?

Unlike traditional payment systems, decentralized payments are generally irreversible once confirmed on the blockchain. This eliminates chargeback fraud but requires users to be more careful when sending payments.

7. How do transaction fees compare to traditional payment methods?

Decentralized payments typically have lower fees than traditional payment methods, especially for international transfers. However, fees can vary based on network congestion and the specific blockchain being used.

8. Can businesses accept both traditional and decentralized payments?

Yes, many businesses now accept both traditional and decentralized payments through integrated payment processors that support multiple payment methods. This hybrid approach allows businesses to offer maximum flexibility to their customers.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!

Don’t miss out on the opportunity to elevate your business with XAIGATE’s The Future of Decentralized Payments. The three-step process is designed to be user-friendly, making it accessible for all businesses. Embrace this modern payment solution to provide customers with a secure and efficient way to pay. Take the first step towards a competitive edge in the digital realm and unlock the benefits of cryptocurrency payments for online casino today.

Looking to integrate seamless crypto payment solutions into your business? XAIGATE provides blockchain-native tools for merchants, developers, and enterprises to accept decentralized payments with confidence. Start your Web3 journey today.