In today’s volatile e-commerce environment, running fast and staying in front means continuous innovation and optimization of every business aspect, starting from marketing to logistics, but what ecosystem do you pay for? For years, credit cards and bank transfers have remained the modus operandi but carry many deficits attached to high fees, settlement times that are way slower than ideal, and perpetual chargeback threats. Today an emerging potent alternative is due to bring about a revolution in the operation of online businesses: the acceptance of stablecoins.

Forward-thinking merchants are quickly turning to USDT, and USDC stablecoins as the preferred mode of payment. They bring together fast crypto transactions with relative stability from traditional fiat forms of money. If you run an online store and have not thought about accepting stablecoins, then you are surely missing out on a big opportunity to cut your costs, widen your customer base, and future-proof your business. This article will go deep into the tangible benefits of adopting such new payment technology and clearly show a way out on which the initiation can be made.

Contents

- 1 What Are Stablecoins, and Why Are They Different?

- 2 The Top 5 Benefits of Accepting Stablecoins in E-Commerce

- 3 How to Start Accepting Stablecoins in Your E-Commerce Store

- 4 A Quick Comparison: Stablecoins vs. Traditional Payments

- 5 Common Concerns and How to Address Them

- 6 The Future Is Stable: Why Now Is the Time to Act

- 7 FAQs – Benefits of Accepting Stablecoins like USDT and USDC in E-Commerce

- 8 Paving the Way for a New Era of E-Commerce

What Are Stablecoins, and Why Are They Different?

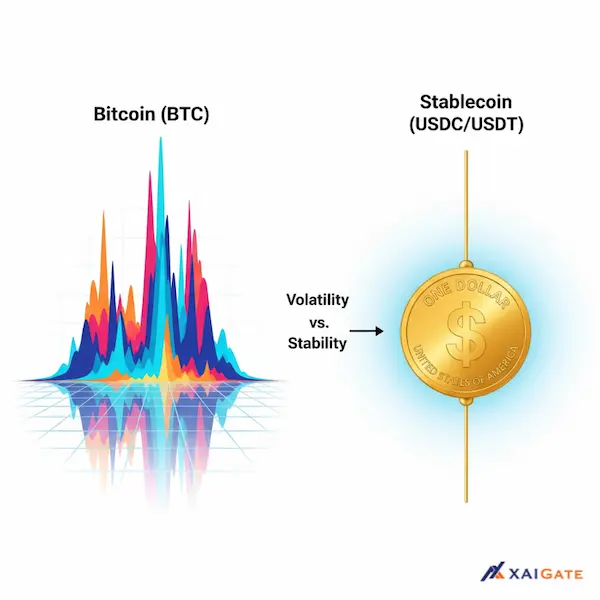

To get where stablecoins are so important, first, we have to get to the problem they address. All this potential for revolution by cryptocurrency brings but has the problem of extreme price volatility. You’ve likely heard the stories of the price of Bitcoin rising one day and crashing the next. It makes for an incredibly risky bet for everyday commercial transactions.

Imagine selling a $500 product but using Bitcoin as the means of payment. $500 worth of buying power at the time you settle/‘cash out’ in your local currency may have dropped to $450 in value. You are, all of a sudden, losing money. This is a risk so great that it will be a non-starter for most businesses that very much want guaranteed and stable channels of revenue.

This very problem was meant to liquidate stablecoins. A special kind of cryptocurrency was these, keeping a constant price, usually against a fiat currency such as the US Dollar in a 1:1 ratio. This would ensure one stablecoin (e.g., 1 USDC or 1 USDT) would always be worth one dollar. It thus gives e-commerce an easy to handle and predictable medium of exchange.

Understanding USDT and USDC Mechanics

USDT (Tether) and USDC (USD Coin) – the two biggest and most popular stablecoins in terms of market cap and circulating supply. Both are fiat-backed, which means the issuer has in reserves an equivalent amount of fiat currency or monetary value to cover every coin in circulation at the time in the form of short-term US Treasury bills. It is this system of reserves that infuses value and stability to these coins and hence in themselves. Think of it as moving a digital dollar anywhere in the world at any time of the day, supported by all features of blockchain technology.

Comparison Table: Benefits of Accepting Stablecoins

| Key Benefit | Description |

|---|---|

| Lower Transaction Fees | Credit card processing fees typically range from 1.5%–3.5% plus fixed charges, while stablecoin payments only incur minimal network fees (often just a few cents). |

| Fast, Global, and Instant Settlement | Bank transfers or card payments may take days, but stablecoin transactions are confirmed within minutes or even seconds, without business-hour restrictions. |

| No Chargebacks or Payment Fraud | Blockchain transactions are irreversible, protecting merchants from fraudulent disputes and chargebacks. |

| Access to a Global Customer Base | Customers only need a smartphone and internet connection to pay with stablecoins, making it easy to reach unbanked or underbanked populations worldwide. |

| Simplified Cross-Border Payments | Stablecoins like USDT and USDC are pegged to the U.S. dollar, reducing the complexity of currency conversion and easing accounting processes for international business. |

The Top 5 Benefits of Accepting Stablecoins in E-Commerce

So you understand what stablecoins are, and now, let’s delve into the robust advantages they serve e-commerce merchants.

Benefit 1: Lower Transaction Costs & Fees

Credit card processing fees are indeed a substantial and painful expense for many online businesses. They usually levy a percentage of each transaction, which usually ranges between 1.5% and 3.5%, coupled with a fixed fee, and something like that for high volume it can sum to thousands, even hundreds of thousands a year in fees paid per business.

Acceptance of stablecoins reduces this cost dramatically. After all, the transaction is peer-to-peer and runs on a blockchain network, bypassing traditional financial intermediaries. There is just a minimal network or “gas” fee attached to them, which could range just in cents based on the blockchain used such as Ethereum, Polygon, Solana etc.

A Direct Comparison: Stablecoins vs. Credit Cards

To put it in perspective, let’s look at a simple comparison:

| Feature | Credit Card Payment | Stablecoin Payment (via Blockchain) |

| Transaction Fees | 1.5% – 3.5% + fixed fee | A few cents in network fees |

| Intermediaries | Multiple (card networks, banks, processors) | Zero (peer-to-peer on the blockchain) |

| Chargebacks | Possible and common | Eliminated by blockchain finality |

| Settlement Time | 2-5 business days | Minutes or seconds |

This stark difference in fees directly impacts your bottom line, allowing you to increase profit margins without raising prices.

Benefit 2: Faster, Borderless Transactions and Instant Settlements

Faster, Borderless Transactions and Instant Settlements Traditional payments, especially when they are international ones, can be incredibly slow. ACH transfers can take days, and international wire transfers can take a week or more to clear. This, of course, introduces some serious cash flow issues for businesses.

Another asset is that they are received in no time. A customer’s crypto wallet to your company’s wallet transaction may be received in a few minutes from anywhere in the globe and be already confirmed and usable for your business. That whole ‘always-online’ aspect regarding blockchain will further allow you to receive payments all day, every day, all year, without any wait for banking hours.

Breaking down global barriers

For an e-commerce business with a client base outside national borders, this is a game-changer, the same as easing cross-border transactions with no friction resulting from time zones, banking holidays, and old slow legacy systems.

Benefit 3: Elimination of Chargebacks and Fraud

Chargebacks have always been a pain point for e-commerce. The customer can go ahead and dispute the charge with their credit card company; in most cases, the merchant bears the cost even when the product or service was legitimately delivered to them. It becomes another long, tedious process that is expensive and adds up to significant revenue loss.

Finality and immutability of transactions belong to one of the basic principles in blockchain technology. Once a stablecoin transaction has been confirmed within the chain, there can never be any reversal possible. This single feature totally eliminates chargebacks. It makes the payment process more secure and reliable, giving peace of mind to the merchants while protecting their revenue from fraudulent claims.

Benefit 4: Access to a Global, Digital-First Customer Base

And as the population using such services keeps growing, so does the number of people wanting this easy and fast way to pay for common goods and services. Not all these are just people investing in or using cryptos; they cover a wide range from across the globe who treasure the secrecy, efficacy, and autonomy that digital coins bring.

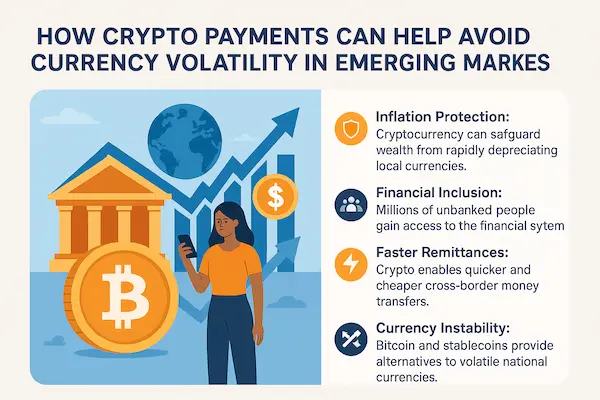

Reaching the Unbanked and Underbanked

There are billions of people globally that are unbanked or underbanked because they do not have access to traditional banking services. However, quite a chunk of this population does have access to a smartphone and the internet. For such people, stablecoins act as a bridge into the world of the global economy. The introduction of a stablecoin payment means that you are opening up a whole new market of potential customers who previously could not be reached.

Benefit 5: Simpler Cross-Border Payments and Currency Management

International e-commerce is muddled by the varying rates of foreign exchange and high charges on conversion. Merchants have to always play around with the variation in exchange rates and bear the costs associated with converting several different currencies back to their local one.

Stablecoins make the process very easy. Since USDC- a stablecoin- is pegged to the US dollar, in effect it offers a universal digital dollar. Receive payment from any part of the world and keep it in one, single steady currency without having to do cumbersome and costly currency conversions. This gives you better control over your treasury and also makes your accounting easier.

How to Start Accepting Stablecoins in Your E-Commerce Store

Want to get started? Here it is. All quite easy because of the new crypto payment gateways and services.

Choosing a Payment Gateway

You don’t have to be a blockchain expert to begin accepting stablecoins. The crypto payment gateway is an interface between the blockchain and your online store. It sorts out the technical hurdles, offers a smooth checkout experience for your clients, and normally allows you to automatically convert stablecoin payments into your local fiat currency and directly deposit that in your bank account.

Here’s a quick comparison of accepting stablecoins via a payment gateway versus direct bank transfers:

| Payment Method | Stablecoin Payment Gateway | Traditional Bank Transfer |

| Setup Process | API integration with your website, a few steps | Often requires multiple forms and bank approvals |

| Customer Experience | Scan a QR code or use a wallet app, instant confirmation | Manual bank entry, potential for errors |

| Fees | Low, often less than 1% or a flat fee | Varies, can be high for international transfers |

| Fraud Risk | Virtually none, no chargebacks | Risk of fraud and human error |

Shopify and big crypto payment solutions have integrated so the onboarding would likely be quite easy.

How to Integrate Step by Step

- Find and choose a crypto payment gateway: Look for services that back the stablecoins you plan to receive (e.g., USDT, USDC, etc.) and that are compatible with your online store (like Shopify or WooCommerce).

- Open an account: Make registration with the selected gateway provider and pass all obligatory verification procedures.

- Add it — Once ready, make use of the API or plugin through your website by following the provider’s instructions. Even, most often it’s an easily manageable task you can get done without a developer.

- Promote it – Inform your customers that you accept stablecoins now. A badge at your checkout page can draw in new customers.

A Quick Comparison: Stablecoins vs. Traditional Payments

| Traditional Payments (Credit Cards, Bank Transfers) | Stablecoin Payments (USDT, USDC) | |

| Speed | Slow, especially cross-border | Near-instant settlement |

| Cost | High processing fees (1.5% – 3.5%+) | Very low network fees (cents) |

| Security | Susceptible to fraud and chargebacks | Irreversible, fraud-resistant |

| Global Reach | Limited by banking networks and FX | Global and borderless |

| User Base | Traditional, established customer base | Growing, digital-first customer base |

Common Concerns and How to Address Them

However, one may still have questions even though the advantages are evident. Navigating Regulatory Uncertainty As the adoption of cryptocurrencies continues, so does their regulatory landscape. Currently, it is unclear what to expect in terms of regulation for cryptocurrencies. Any possible action that may be taken by regulators could be a factor that significantly affects the value of any digital asset. Indeed, at the moment, it is difficult to tell the direction that regulators are going.

The Importance of a Reliable Stablecoint

Not all stablecoins are the same. To choose from, one needs strong, audited reserves, a history and issuer with repute. This is why USDT and USDC keep the lead in the market; their transparency and reliability speak for themselves.

With XaiGate, businesses can rely on a secure crypto payment gateway that ensures safe and seamless digital transactions.

The Future Is Stable: Why Now Is the Time to Act

Major e-commerce platforms like Shopify and Stripe are actively building infrastructure to support stablecoins, which signals a significant shift in the industry. For e-commerce merchants, this is an opportunity to not only stay current but also to gain a competitive advantage.

The Role of Major E-commerce Players

Leading e-commerce platforms, such as Shopify and Stripe are actively engaged in assembling infrastructures for stablecoins. In an industry that places much value on trends, this is a significant indication of change. For e-commerce merchants, it is more of an opportunity not just to keep up with the trend but also to stay ahead of the pack.

Shopify and Stripe getting in on the action is major validation for stablecoins as a payment solution. By plugging stablecoins like USDC into the same pipes their existing systems use, millions of merchants will be able to accept stablecoins without needing to become crypto experts. That’s what you need for mass adoption.

- Shopify – The platform had integrations going on with companies like Coinbase and Stripe to enable USDC payments for their merchants. As easy as that, the merchant will get his payout in USDC or it will automatically convert to the merchant’s local currency. This makes cross-border transactions easy and removes the foreign exchange fees.

- Stripe is among the top payment processors thereby making it a very critical player. Its support for stablecoin payments implies that firms will be able to undertake implementations of ‘Pay with Crypto’ as part of their checkouts. The whole transaction process is undertaken by Stripe, and merchants have an option of receiving their funds in fiat or stablecoins. This is a big move since it brings the advantages associated with stablecoins—low fees and no chargebacks—to a fairly large user base.

By taking stablecoins in, you’re not just making another way to pay; you’re creating a stronger and more up-to-date business. The online money world is going towards a less central and quicker cash system. Joining in now means:

- Game Changer: You put your brand as someone who uses the latest tech first, which can pull in a certain group of smart and worldwide-thinking buyers.

- Reduced reliance on legacy systems. You make less use of the traditional banking system, which is associated with delays and high costs. This gives you more control over your cash flow plus reduced operational friction.

- A broader customer base. As stablecoins gain global adoption, the business becomes accessible to a larger population who are unbanked or do not prefer using the classic means of payments.

The future of e-commerce payments is changing and stablecoins are leading it. Through the use of tools offered by market leaders such as Shopify and Stripe, merchants can stay ahead of the game and enjoy the benefits brought about by a more efficient, secure, and global payment system.

Stablecoins vs. Traditional Payment Methods

| Feature / Benefit | Stablecoins (USDT, USDC, etc.) | Traditional Payments (Credit Card, Bank Transfer) |

|---|---|---|

| Transaction Fees | Very low (network fees often just a few cents) | High (1.5%–3.5% + fixed charges) |

| Settlement Speed | Instant or within minutes, 24/7 | 1–5 business days, limited by banking hours |

| Chargebacks & Fraud | Irreversible transactions, minimal fraud risk | Reversible, higher risk of chargebacks and disputes |

| Global Accessibility | Accessible to anyone with internet and a crypto wallet | Requires bank account or credit card; often geo-restricted |

| Currency Conversion | Pegged to USD, minimal FX complexity | Requires conversion, subject to fluctuating exchange rates |

| Operational Overhead | Simple blockchain-based process | Complex processes, intermediaries, and paperwork |

FAQs – Benefits of Accepting Stablecoins like USDT and USDC in E-Commerce

1. What is a stablecoin and how is it different from volatile cryptocurrencies like Bitcoin?

Stablecoins are digital currencies with a fixed value, usually pegged to the US dollar, unlike Bitcoin which fluctuates greatly, making them more suitable for e-commerce payments.

2. Why should merchants consider accepting USDT or USDC?

They combine the speed of crypto transactions with the stability of fiat currency, reducing the risk of price volatility.

3. Does accepting stablecoins actually reduce transaction fees compared to credit cards?

Yes — network fees are just a few cents, much lower than the 1.5–3.5% fees charged by credit cards.

4. Are stablecoin payments faster than bank transfers or credit card processing?

Yes — transactions settle in seconds or minutes, instead of the 2–5 days typical with banks or cards.

5. Can stablecoins prevent chargebacks and fraud?

Yes — thanks to the immutable nature of blockchain, transactions can’t be reversed, making chargebacks and fraud nearly impossible.

6. How does accepting stablecoins help reach more customers?

It opens your business to a global market, especially to digital-first customers and the unbanked.

7. Is it easy to integrate stablecoin payments into my online store?

Very easy — you can use a plugin or API from a crypto payment gateway like XAIGATE, with no deep blockchain knowledge required.

8. Do I need to worry about regulations when accepting stablecoins?

There is some regulatory uncertainty, but choosing reputable stablecoins like USDT or USDC with transparent reserves can help reduce risks.

9. Do major e-commerce platforms support stablecoins?

Yes — platforms like Shopify and Stripe already support USDC payments, allowing you to receive and, if desired, convert to local currency.

10. Should I start accepting stablecoins now?

If you want to cut costs, speed up payments, and expand your market, now is the right time to adopt stablecoins.

Paving the Way for a New Era of E-Commerce

For online sellers, a question of “if” vs “when” update to using stablecoins. The benefits of slashing transaction fees, eliminating chargebacks, and enabling instant payments and reaching new markets are just too enigmatic to ignore. You’ll streamline operations and drive profitability well on your way to easing your way toward whatever comes next in online trade by taking stablecoins. This will not only improve your bottom line but also is the right step to future-proof your business.

The past few years have made one thing clear: payment systems that are slow, costly, and geographically limited can no longer keep pace with modern commerce. For online merchants, the shift toward stablecoins like USDT and USDC is no longer just an experiment—it’s a competitive necessity. Backed by the stability of the US dollar and powered by blockchain efficiency, these digital assets deliver the speed, transparency, and cost savings today’s global shoppers demand.

Regulatory conversations around digital currencies are accelerating worldwide, and early movers are already reaping the benefits—lower fees, faster settlements, and expanded customer reach. In a climate where cross-border sales are growing and payment expectations are rising, waiting to adapt could mean losing ground to competitors who move first.

This is a rare moment where technology, consumer behavior, and market opportunity align. Businesses that act now will not only keep pace—they will set the pace.

XAIGATE makes integrating stablecoin payments seamless, secure, and scalable for your e-commerce store. Don’t just follow the trend—lead it. Start accepting stablecoins today and position your business at the forefront of the digital payment revolution.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!