A USDT payment gateway in Singapore helps merchants accept stablecoin payments with MAS-aligned controls, low end-to-end fees, TRC20/ ERC20 coverage, and fast options to settle part in USDT or off-ramp to SGD.

Executive Summary

Lower total cost than international cards and SWIFT wires for cross-border orders.

Minutes-level settlement and no card chargebacks (still apply fraud/risk rules).

Offer both TRC20 and ERC20 so buyers can choose their preferred network.

Keep airtight records (TXIDs, timestamps, rates) to satisfy audits and tax reporting.

Split settlement: hold some in USDT for treasury flexibility, off-ramp the rest to SGD.

Contents

- 1 1. What Is a USDT Payment Gateway?

- 2 2. Why Singapore Merchants Prefer Stablecoins Over Cards & Wires

- 3 3. How a USDT Gateway Works (Buyer → Merchant → Settlement)

- 4 4. Network Options for USDT in Singapore

- 5 5. Fees, Settlement & FX (What to Budget)

- 6 6. Compliance in Singapore (Non-Negotiables)

- 7 7. Integration Guide (for CTO/Developers)

- 8 8. Best-Fit Use Cases in Singapore

- 9 9. Case Studies

- 10 FAQs: USDT Payment Gateway Singapore

- 11 Conclusion

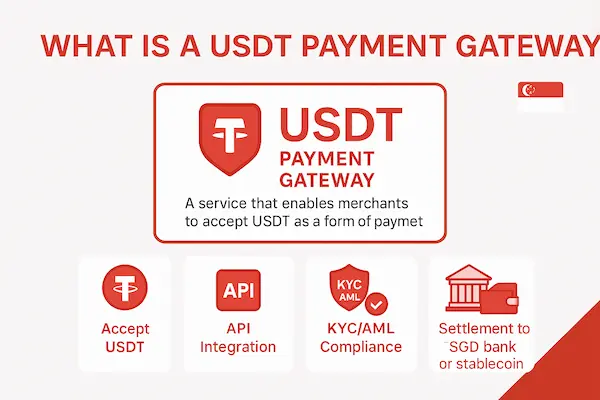

1. What Is a USDT Payment Gateway?

A USDT payment gateway lets your checkout generate a payment intent, quote a USDT amount, and guide buyers to pay on-chain. In Singapore, the fit is strong: fintech infrastructure is mature, expectations around compliance are clearer, and off-ramp partners for SGD are widely available. For merchants evaluating a USDT Payment Gateway Singapore solution, the north star is simple—reduce friction and cost without weakening controls or reporting.

Buyer → Merchant Flow

Quote & lock: The gateway quotes how much USDT is due and locks the rate for a short window.

On-chain payment: The buyer sends USDT on the selected network (TRC20/ ERC20).

Confirmations & callback: After minimum confirmations, the gateway calls your webhook.

Reconciliation: The order is auto-matched to its TXID; under/over-pays are handled per policy.

Payout/settlement: You keep USDT, swap to another stablecoin, or off-ramp a portion to SGD.

2. Why Singapore Merchants Prefer Stablecoins Over Cards & Wires

For Singapore businesses selling across borders, the mix of MDR, FX spreads, bank cut-offs, and chargebacks makes legacy rails costly and slow. By contrast, adopting a USDT payment gateway Singapore setup delivers predictable fees, minutes-level settlement, and on-chain finality—without giving up compliance, audit trails, or customer support standards.

1. Cost Structure That Protects Margin

Cards stack MDR, cross-border add-ons, and FX spreads; SWIFT adds fixed fees and opaque lifts. Stablecoin payments replace that with a transparent gateway fee and a small network fee—often materially lower on international baskets and high-frequency orders.

2. Speed & Cash Flow You Can Feel

On uncongested networks, confirmations arrive in minutes, shrinking order-to-cash and enabling faster vendor payouts. This lifts working-capital efficiency and reduces reliance on expensive short-term credit.

3. Global Reach & Better Conversion

Crypto-native buyers exist in every region. Offering USDT at checkout reduces declines on international cards, opens geographies with weak card penetration, and signals flexibility to high-intent buyers.

4. Finality Without Card-Style Chargebacks

Blockchains settle with finality, eliminating card chargebacks that erode margin and create back-office drag. You still need refund rules, sanctions screening, and abuse controls—but you avoid the structural dispute model of cards.

5. Compliance & Clean Record-Keeping

Gateways aligned to MAS expectations provide KYB/KYC, sanctions/AML monitoring, and audit-ready exports (TXIDs, timestamps, rates). Finance teams get tamper-evident logs and CSV/API feeds that reconcile cleanly.

6. Operational Simplicity & Treasury Options

Automatic TXID→order matching, webhook updates, and batch payouts reduce manual work. You can hold USDT, convert to USDC, or off-ramp a portion to SGD, enabling split-settlement policies that fit your treasury plan.

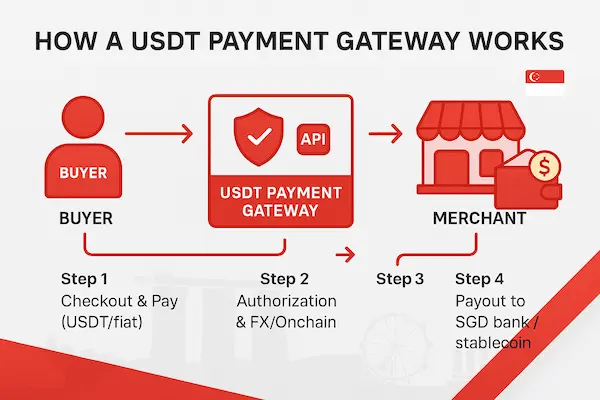

3. How a USDT Gateway Works (Buyer → Merchant → Settlement)

A USDT payment gateway in Singapore orchestrates the full path from price quote to payout, so finance and engineering teams get predictable settlement, clean reconciliation, and MAS-aligned controls—without redesigning your entire checkout or back office.

1. Quote & Lock Window

The gateway displays the due amount in USDT and a countdown (rate lock). If funds arrive after expiry or on a different network, your policy decides whether to accept, re-quote, or refund the difference.

2. On-Chain Payment & Confirmations

Buyers pay on TRC20 or ERC20. The gateway monitors mempools, enforces minimum confirmations, and validates destination addresses before marking the order as paid.

3. Webhooks, Idempotency & Order State

Signed webhooks update your system when statuses change (pending → confirmed → settled). Use idempotency keys so retries never double-book revenue or shipments.

4. Reconciliation & Reporting

Every transaction is bound to an order ID and TXID. Finance exports (CSV/API) include timestamps, quoted rates, and fees, enabling 1:1 reconciliation with your ledger and BI dashboards.

5. Settlement Paths (USDT, USDC, or SGD)

Keep funds in USDT, swap to another stablecoin, or off-ramp to SGD via regulated partners. Many Singapore merchants adopt split settlement (e.g., 70% SGD / 30% USDT) to balance OPEX needs with treasury flexibility.

6. Payouts & Batch Operations

Schedule batch payouts to vendors or affiliates, reduce on-chain transactions, and align release timing with your cash-flow calendar and bank cut-offs.

7. Exceptions & Refund Logic

Handle under-/over-pays, wrong network, late arrivals, and stale quotes with automated rules. Clear refund flows reduce support tickets and protect margin.

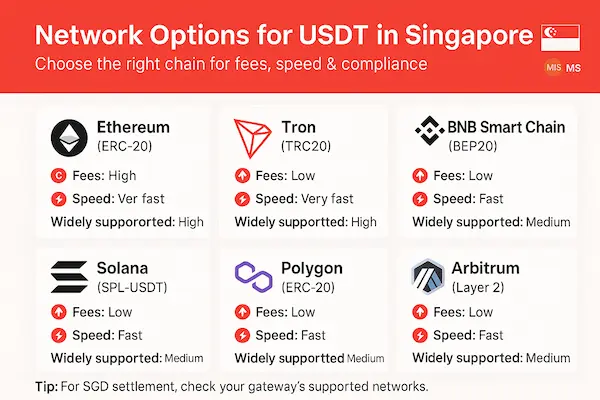

4. Network Options for USDT in Singapore

When you roll out a USDT payment gateway in Singapore, network choice drives buyer experience, cost, and support load. The pragmatic path is to start with TRC20 + ERC20, then add others only if your traffic warrants it.

TRC20 (Tron)

Why merchants like it: Typically low, predictable fees and quick confirmations—great for retail tickets and emerging markets.

What to watch: Custody coverage and analytics vary by provider; ensure your reconciler reads TRC20 metadata reliably.

Good first switch: If cart values are modest or buyers are price-sensitive, TRC20 usually boosts completion rates.

ERC20 (Ethereum)

Why it matters: Deep liquidity, mature tooling, and institutional familiarity across auditors, custodians, and analytics.

Trade-offs: Fees can spike during congestion; set confirmation thresholds and quote windows to avoid slippage disputes.

Enterprise fit: If your treasury, compliance stack, or vendors standardize on Ethereum, ERC20 is non-negotiable.

Other Chains (BSC, Solana, etc.)

When to add: Only after real buyer demand shows up in support threads or abandonment logs.

Due diligence: Check custody support, explorer quality, uptime history, and—critically—SGD off-ramp availability.

Risk notes: Novel chains can add edge cases (wallet mis-sends, explorer delays) that increase support tickets.

Picking the Right Mix (fast checklist)

Buyer geography: If orders skew to fee-sensitive regions → enable TRC20 first.

Treasury/custody: If your stack is Ethereum-first → prioritize ERC20.

Ticket size: Small baskets favor low fees; high-value B2B tolerates ERC20 costs.

Ops simplicity: Fewer chains = fewer exceptions; start with two, monitor, then expand deliberately.

Off-ramp reality: Do not enable a chain your SGD partners can’t support at volume.

5. Fees, Settlement & FX (What to Budget)

Before you switch on a USDT payment gateway in Singapore, map the true end-to-end cost: on-chain fees, gateway charges, off-ramp spreads, and any bank fees on the SGD side. With the right setup, total cost is usually lower than international cards or SWIFT—especially for cross-border orders and frequent payouts.

Fee Components You’ll Actually See

Network fee: Paid on-chain; varies by TRC20/ERC20 and congestion.

Gateway fee: Your commercial rate for processing, tooling, and support.

Conversion/off-ramp fee: To swap USDT and reach SGD; spreads improve with volume.

Bank/rail fees: If you settle to SGD, check per-transfer charges and cut-off times.

Settlement Patterns That Reduce Friction

Hold USDT: Keep part of receipts in stablecoins for treasury flexibility.

Convert to USDC (optional): Aligns with some custody or policy preferences.

Off-ramp to SGD: Use licensed partners; automate rules by amount, day, or balance.

Split settlement: Common in Singapore—e.g., 70% SGD for OPEX, 30% USDT as buffer.

FX & Accounting Considerations

Recognition point: Record revenue at fiat fair value when funds confirm on-chain.

Gains/losses: If you hold USDT, track subsequent movements separately.

Reconciliation: Tie each order to a TXID; export timestamps, quotes, and fees for audits.

Cost/Speed Snapshot

| Method | Typical Total Cost | Time to Funds | Chargebacks | Notes |

|---|---|---|---|---|

| USDT (TRC20) | Low–Med | Near-instant → minutes | None (card-style) | Buyer-friendly fees; great for retail |

| USDT (ERC20) | Med–High (spikes) | Minutes | None (card-style) | Deep liquidity/tooling |

| Cards (International) | High | T+1–T+3 | Yes | MDR + FX spreads + disputes |

| SWIFT Wire | Med–High | T+1–T+5 | N/A | Fixed bank fees; cut-off delays |

6. Compliance in Singapore (Non-Negotiables)

Launching a USDT payment gateway in Singapore is not just a technical rollout; it’s a controls program. Your goal is to accept stablecoins while matching MAS-aligned expectations on KYB/KYC, sanctions/AML, record-keeping, and auditability—so finance can close the books cleanly and risk teams can defend every transaction.

MAS-Aligned Controls You Must Have

KYB/KYC: Verify merchants and, where applicable, counterparties; keep evidence on file.

Sanctions & Screening: Screen wallets, names, and geographies at onboarding and per-transaction.

AML Monitoring: Detect structuring, rapid in/out, and unusual velocity; set escalation paths.

Travel-Rule-Ready: Be prepared to exchange originator/beneficiary info via approved channels when required.

Record-Keeping & Audit-Ready Data

Immutable logs: TXID, timestamp, quoted rate, network (TRC20/ERC20), destination wallet, confirmations.

Receipts & invoices: Tie every order to a TXID and an issued invoice; store currency conversion details.

Exports: CSV/API with pagination, signatures/hashes, and point-in-time snapshots for auditors.

Retention: Align with corporate policy and regulator guidance; document your retention schedule.

Tax & Accounting (IRAS-Friendly)

Recognition timing: Record revenue at fiat fair value when on-chain confirmations meet your policy.

Subsequent measurement: If holding USDT, track gains/losses separately from revenue.

Disclosures: Maintain notes on methodology (pricing source, cut-off time, FX) for year-end support.

Reconciliations: Daily roll-ups from TXID → order → invoice → ledger reduce audit cycles.

Policy Playbook for Edge Cases

Under/over-pays: Auto-calculate deltas; refund or credit per written rules.

Wrong network: Define accept/reject behavior; publish steps for buyer refunds.

Expired quotes: Clear timers and outcomes; minimize discretionary decisions by support.

Disputes & refunds: No card chargebacks, but you still need timelines, evidence, and approval tiers.

Operational Evidence Regulators Expect

Runbooks & SLAs: Incident response, uptime targets, and escalation contacts.

Vendor due diligence: Custody, node providers, analytics—keep SOC reports and pen-test summaries.

Change logs: Track versioning of risk rules, pricing sources, and confirmation thresholds.

Training: Annual refreshers for support/finance on sanctions red flags and refund handling.

7. Integration Guide (for CTO/Developers)

A production-grade USDT payment gateway in Singapore should drop into your stack with minimal risk: prove value fast with hosted flows, then harden via APIs, webhooks, and rigorous reconciliation so Finance, Ops, and Support all see fewer tickets and cleaner closes.

Integration Patterns (pick your starting lane)

Hosted checkout (pilot-fast): Redirect or modal; minimal engineering; perfect for A/B testing adoption and costs.

JS widget (brand control): Embed inline, keep your UX; gateway handles quoting, timers, and wallet UX.

Direct API + Webhooks (full control): Your app creates payment intents, owns state, and reacts to signed callbacks.

Plugins (where available): Shopify/Woo/POS to validate demand quickly before custom work.

Core Data Model (keep it boring and explicit)

Order ↔ PaymentIntent ↔ TXID(s): one-to-one (or one-to-many for split/partial) with unique keys.

Statuses:

quoted → pending → confirmed → settled → refunded(avoid “custom” synonyms).Quote metadata: network (TRC20/ ERC20), lock expiry, min confirmations, pricing source.

Finance fields: network fee, gateway fee, spread, fiat fair value at confirmation, payout batch ID.

Webhooks, Idempotency, and Retries

Signed webhooks: Verify HMAC and timestamp; reject stale deliveries.

Idempotency keys: On create/confirm/refund to prevent double-processing.

Retry policy: Exponential backoff with max attempts; webhooks are at-least-once—design handlers to be safe to repeat.

Reliability & Security Baselines

RPC/node redundancy: Primary + failover; detect lag and auto-switch.

Circuit breakers: Pause fulfillment when confirmations stall or explorers diverge.

Secrets management: KMS/Vault; rotate keys; scoped tokens for CI and support tooling.

Observability: Traces for quote→confirm→settle; dashboards for webhook latency and mismatch counts.

Reconciliation & Reporting (make Finance love you)

Auto-match: PaymentIntent ↔ TXID with order ID embedded in metadata where supported.

Daily exports: CSV/API snapshots with TXID, timestamps, rates, fees, and status deltas.

Checksums: Hash each export; keep point-in-time copies for audit.

Drill-through: From ledger line → TXID → explorer link in one click.

Exceptions You’ll Actually See (and how to automate them)

Wrong network: Detect and auto-message buyer; offer guided refund flow.

Under-/over-pay: Compute deltas; auto-credit/auto-refund under a set threshold; manual review above it.

Late arrival (post-expiry): Re-quote or refund per policy; never “maybe.”

Reorgs: Bump required confirmations; delay fulfillment until stable height.

Test Plan (catch issues before money moves)

Happy paths: TRC20 and ERC20 from quote to settled with webhooks replayed.

Failure sims: Drop webhooks, slow RPC, wrong-network sends, expired quotes, partial payments.

Accounting proofs: Recreate fiat valuation from pricing source at confirmation time; compare to exports.

Load: Burst 10× normal checkout; ensure queues, retries, and idempotency hold.

Go-Live Checklist (day-0 readiness)

Sandbox parity with production settings (confirmations, expiry, fees).

Alerts for stuck pending, node lag, webhook failure rate, off-ramp errors.

Refund runbook (tiers, approvers, SLAs) published to Support.

BI/ledger pipelines validated end-to-end with checksum and sample audits.

Incident contacts exchanged with the gateway; on-call calendar shared.

Post-Launch Hardening (week 1–4)

Tune confirmations by network risk and basket size.

Add split settlement (e.g., 70% SGD / 30% USDT) with scheduled off-ramps.

Improve UX copy around timers, network choice, and refund math.

Review metrics: Quote-expiry rate, partial-pay rate, webhook latency p95, reconcile mismatches/day.

Start simple, measure lift, then deepen control. With this path, your USDT Payment Gateway Singapore integration ships quickly, survives real-world edge cases, and gives Finance the evidence they need—without turning payments into a science project.

8. Best-Fit Use Cases in Singapore

The strongest returns from a USDT payment gateway in Singapore appear where card rails struggle with cross-border acceptance, FX friction, or dispute costs. Start where pain is highest, prove the lift, then scale.

1. Cross-Border E-commerce & Marketplaces

Why it works: Lower total cost per order, fewer international card declines, faster vendor payouts.

How to run it: Offer USDT alongside cards; default to TRC20 for retail tickets; keep ERC20 for enterprise buyers.

What to watch: Quote-expiry UX at peak traffic; automated refunds for under/over-pays.

2. SaaS & Digital Media Subscriptions

Why it works: Predictable fees and confirmation times reduce involuntary churn from card failures.

How to run it: Invoice links with timers; webhook-driven renewal states; retry flows before expiry.

What to watch: Partial payments and late arrivals—encode deterministic outcomes.

3. B2B Distributors & Exporters

Why it works: Large invoices and frequent cross-border payouts avoid SWIFT fees and cut-off delays.

How to run it: Split settlement (e.g., 70% SGD / 30% USDT) to balance OPEX vs. treasury flexibility.

What to watch: Vendor onboarding (wallet verification), approval tiers for refunds/credits.

4. Travel, Ticketing, Education Agents

Why it works: High FX friction and time-sensitive settlements; refunds are common.

How to run it: Clear refund math for expired quotes; batch payouts to partners; weekend operations.

What to watch: Network choice guidance for buyers; surge-time rate-lock windows.

5. Gaming, Creator & Affiliate Payouts

Why it works: Global recipients, micro-to-mid payouts, 24/7 settlement needs.

How to run it: Weekly USDT batch payouts; offer ERC20 lane for institutions.

What to watch: Jurisdiction screening, wallet allow-lists, and per-country disclosures.

Prioritise flows with cross-border exposure, thin margins, or dispute-heavy rails. Prove savings with TRC20 + ERC20, keep compliance tight, and expand the USDT payment gateway Singapore footprint across more SKUs and payout streams.

9. Case Studies

Real outcomes matter. These anonymized examples show how a USDT payment gateway in Singapore impacts cost, conversion, and cash flow—without compromising controls.

Marketplace A: Cross-Border Retail at Scale

Context: High volume, mid-ticket baskets; card declines on international buyers were >9%.

What changed: Enabled TRC20 + ERC20 alongside cards; quote window 15 minutes; auto-reconcile TXID→order.

Outcome (90 days): Total payment cost ↓ ~35–45% vs. cards on cross-border orders; settlement time from T+2 to minutes; vendor payout cycle shortened by 1–1.5 days.

Ops notes: Under/over-pay rules and webhook retries cut support tickets by ~22%.

SaaS B: Subscriptions Across APAC

Context: Recurring USD pricing; renewal failures from card expiries and bank geofencing.

What changed: Invoice links with timers; signed webhooks; split settlement 70% SGD / 30% USDT each Friday.

Outcome (2 billing cycles): Involuntary churn ↓ ~8–12%; DSO improved by ~0.6 day; finance close faster with CSV/API exports.

Ops notes: ERC20 kept for enterprise buyers using custody; TRC20 handled the bulk of retail.

Distributor C: B2B Invoices & Frequent Payouts

Context: Large invoices, tight cash cycles, SWIFT fees and cut-off delays.

What changed: Default USDT settlement with weekly SGD off-ramp; approval tiers for refunds; explorer links embedded in ledger.

Outcome (quarter): Wire fees materially reduced; order-to-cash from 2–5 days → minutes/hours; fewer disputes due to on-chain finality.

Ops notes: Treasury policy capped USDT balance; alerts on node lag and webhook latency kept incidents near zero.

FAQs: USDT Payment Gateway Singapore

1. What is a USDT payment gateway in Singapore and who is it for?

A gateway lets you accept USDT at checkout (TRC20/ ERC20), reconcile on-chain payments, and settle in USDT or off-ramp to SGD. It suits cross-border e-commerce, SaaS, marketplaces, and payout-heavy businesses.

2. Why choose stablecoins over cards or SWIFT in Singapore?

Total cost is typically lower, confirmations arrive in minutes, and there are no card-style chargebacks. This improves conversion on international orders and shortens the order-to-cash cycle.

3. Which USDT network should I enable first—TRC20 or ERC20?

Enable both. TRC20 usually offers lower fees for retail; ERC20 provides deep liquidity, mature tooling, and institutional comfort—let buyers choose at checkout.

4. How fast are settlements and SGD off-ramps?

On-chain confirmations are usually minutes; SGD off-ramp timing depends on licensed partners and bank cut-offs (often same day to T+1). Publish your cut-off times to set expectations.

5. What fees should Singapore merchants expect end-to-end?

Network fee + gateway fee + optional conversion/off-ramp fee and spread. For cross-border baskets, the all-in cost is often lower than international cards or SWIFT wires.

6. Can I split settlement between USDT and SGD?

Yes. Many Singapore merchants run split rules (e.g., 70% SGD / 30% USDT) to cover OPEX while keeping a stablecoin buffer for treasury flexibility.

7. How do refunds, under/over-payments, and expired quotes work?

Use deterministic policies: auto-calculate deltas, return the difference (minus network fee), and re-quote when timers expire. Provide guided flows for wrong-network sends.

8. What accounting/tax records do I need under IRAS?

Recognize revenue at fiat fair value on confirmation; track gains/losses if you hold USDT. Keep TXIDs, timestamps, quoted rates, fees, and invoices for audit-ready exports.

Conclusion

For cross-border sales, recurring subscriptions, and payout-heavy ops, adopting a USDT payment gateway in Singapore is a practical way to cut total payment cost, speed up settlement to minutes, and reduce dispute overhead—while staying aligned with MAS expectations. Start with TRC20 + ERC20, wire in clean reconciliation (Order ↔ PaymentIntent ↔ TXID), and define deterministic refund rules. Pair that with SGD off-ramp capacity and audit-ready exports so Finance signs off and you scale with confidence.

Key Takeaways (at a glance)

Lower all-in costs versus international cards/SWIFT on cross-border baskets.

Minutes-level settlement; no card-style chargebacks (still apply fraud/AML controls).

TRC20 for fee-sensitive retail; ERC20 for deep liquidity and enterprise tooling.

MAS-aligned compliance + audit-ready records (TXIDs, timestamps, quotes, fees).

Split settlement to balance OPEX (SGD) and treasury flexibility (USDT buffer).

Quick Summary Table

| Topic | What to Do | Why It Matters |

|---|---|---|

| Networks | Enable TRC20 + ERC20 at launch | Capture more buyers; reduce abandonment |

| Costs | Model network + gateway + off-ramp/FX | Beat card/SWIFT cost on cross-border orders |

| Settlement | Set minutes-level confirmations; weekly SGD off-ramp | Improve cash flow; predictable treasury ops |

| Compliance | Enforce KYC/KYB/AML, sanctions, travel-rule-ready | Shorter audits; safer scale under MAS expectations |

| Reconciliation | Map Order ↔ TXID, export CSV/API daily | Clean closes; fewer finance tickets |

| Refund Policy | Deterministic rules for under/over-pay & expiry | Lower support load; better CX |

Try XaiGate Now!

Start accepting USDT in Singapore with MAS-aligned controls, TRC20/ ERC20 coverage, fast SGD off-ramps, and developer-friendly APIs.

Talk to XaiGate → Get live in days.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)!