Singapore is already comfortable with cards, PayNow and bank transfers, so adding one more rail only makes sense if it brings in new customers or smoother cross border payments. PYUSD sits at the intersection of PayPal’s reach and stablecoin speed, and a well designed PYUSD Payment Gateway Singapore setup can let you price in SGD, accept PYUSD from familiar wallets and still give finance and compliance the clear reports and controls they expect.

Contents

- 1 1. What a PYUSD Payment Gateway Singapore Setup Looks Like

- 2 2. PYUSD 101 for Singapore merchants

- 3 3. MAS, Stablecoins and the Regulatory Context for PYUSD Payment Gateway Singapore

- 4 4. Reference architecture for a PYUSD Payment Gateway Singapore integration

- 5 5. Onboarding and KYC for PYUSD Merchants in Singapore

- 6 6. Payment flows: how a PYUSD Payment Gateway Singapore setup works in practice

- 7 7. FX, pricing and treasury management with PYUSD

- 8 8. Risk, compliance and technology risk management for PYUSD Payment Gateway Singapore

- 9 9. Integration patterns for different Singapore segments

- 10 10. Performance, scalability and reliability for a PYUSD Payment Gateway Singapore stack

- 11 11. Comparison: PYUSD Payment Gateway Singapore vs other options

- 12 12. 2026 outlook: the future of PYUSD Payment Gateway Singapore

- 13 FAQs: PYUSD Payment Gateway Singapore

- 14 Conclusion: Is A PYUSD Payment Gateway Singapore Rail Worth It?

1. What a PYUSD Payment Gateway Singapore Setup Looks Like

At a practical level, a PYUSD Payment Gateway Singapore setup lets you keep pricing and accounting in SGD while some customers pay in PYUSD from wallets they already use. Orders, invoices and payouts stay the same in your systems, while the gateway quietly handles addresses, confirmations and rate locking in the background.

1. High level definition for busy merchants and developers

For most teams, a PYUSD Payment Gateway Singapore integration is simply one more payment option beside cards and PayNow. At checkout or on an invoice page, the customer picks PYUSD, the gateway creates a payment session, shows the amount and wallet details, then marks the payment as confirmed and settled once enough PYUSD has arrived. Your stack only needs to read clear payment states, not raw blockchain data.

2. Core building blocks in a PYUSD focused payment flow

Behind the scenes you normally have four pieces: an API or plugin, a checkout component that shows PYUSD, services that watch the chain for incoming transfers, and a layer that can convert PYUSD into SGD or leave it in stablecoin form. A dashboard ties this together so finance and operations can see every PYUSD Payment Gateway Singapore transaction, fee and payout without using a block explorer.

3. When PYUSD is worth adding next to cards and PayNow

PYUSD earns its place when you already have global customers who live in the PayPal or Web3 world and are comfortable with stablecoins. A SaaS company billing US clients, a Singapore hotel hosting tech events or an agency with cross border retainers can all use a PYUSD Payment Gateway Singapore rail to reduce friction and FX noise. In these cases PYUSD is an extra option for the right buyers, not a replacement for your existing card and bank channels.

2. PYUSD 101 for Singapore merchants

Before you commit engineering effort to a PYUSD Payment Gateway Singapore setup it helps to be clear what PYUSD actually is, how it compares to other stablecoins you may already know, and where it might sit inside your existing mix of cards, PayNow and bank transfers.

1. What PYUSD is and how it compares to other stablecoins

PYUSD is a US dollar backed stablecoin issued in partnership with PayPal, designed to track 1 to 1 with USD while moving on chain. Compared with USDT or USDC it brings the weight of a large consumer brand and existing wallet base, but today its ecosystem is still smaller than the older stablecoins. For a merchant the key question is not only price stability but also which assets your customers already hold and feel comfortable spending.

2. Where PYUSD fits in a typical Singapore payment mix

In practice PYUSD is an add on rail that sits next to cards, PayNow, bank transfers and maybe one or two other stablecoins. Retail and SaaS merchants can offer it as an extra option for global customers who already live in PayPal or Web3 wallets, while still keeping SGD as the main pricing currency. You do not need to redesign your whole checkout, just surface PYUSD as an additional method where it makes sense.

3. Key benefits and limits for accepting PYUSD today

The main upside today is access to buyers who trust PayPal but also want the speed and flexibility of a stablecoin. PYUSD can reduce FX noise on cross border invoices and make it easier to move value between platforms that already support it. The trade off is that adoption is still growing, so most merchants will treat PYUSD as a targeted option for specific segments rather than a universal default for all customers.

3. MAS, Stablecoins and the Regulatory Context for PYUSD Payment Gateway Singapore

Any PYUSD Payment Gateway Singapore setup sits inside rules from the Monetary Authority of Singapore for digital payment tokens and stablecoins. Even if you never hold a licence yourself, you still plug into providers who must answer tough questions on risk, technology and controls, so your integration should assume that from day one.

1. Why stablecoin rules matter for PYUSD merchants

Stablecoin rules affect how payments are screened, how long records are kept and what banks and partners expect to see in your reports. If your checkout and back office flows ignore this layer, PYUSD payments may work technically but still trigger uncomfortable questions from compliance or auditors. Building with MAS style expectations in mind early makes it much easier to raise limits later without rebuilding the rail.

2. How PYUSD fits into Singapore stablecoin expectations

PYUSD is marketed as a fully backed dollar stablecoin, so merchants should treat it like any other serious asset, not a casual experiment. Ask how reserves are held, how redemptions work and how the issuer plans for stress scenarios. In a PYUSD Payment Gateway Singapore integration, these answers show up in practice through limits, risk flags, reporting detail and payout rules offered by your provider.

3. Questions to ask any PYUSD payment gateway provider

Before you send real volume, ask which licence or regulatory regime they operate under, how they handle KYC, AML and blockchain analytics for PYUSD flows, and what logs, exports and audit support they can give your finance and compliance teams. Clear, specific answers here are often a better signal of long term reliability than any marketing claim or one time discount.

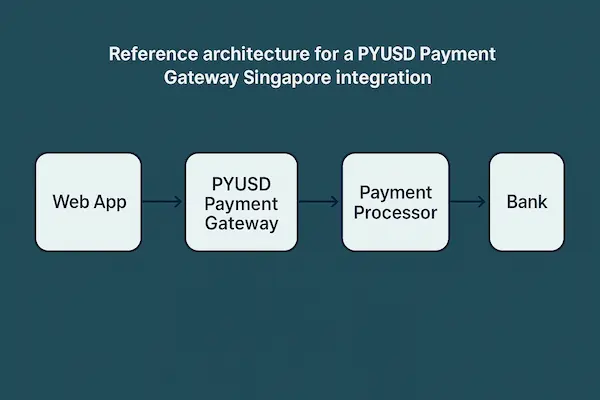

4. Reference architecture for a PYUSD Payment Gateway Singapore integration

A strong PYUSD Payment Gateway Singapore setup is easiest to manage when you see it as three layers: what developers and product teams touch, what talks to the chain and your ledgers, and a control layer that secures and monitors everything.

1. External components for developers and product teams

On the surface you have HTTPS APIs or plugins, plus a checkout widget that shows PYUSD next to cards and PayNow. Developers work with payment, refund and payout objects, while support and finance use a dashboard to search transactions, download reports and manage keys or webhook URLs without changing code.

2. On chain and off chain engines handling PYUSD

Behind that sit services that watch the network for PYUSD transfers, link them to payment sessions and update an internal ledger with amounts, rates, fees and payout status. A conversion module applies your rules for swapping PYUSD into SGD or keeping it in stablecoin form, and a payout engine groups confirmed balances into bank transfers or stablecoin payouts that finance can reconcile easily.

3. Security, governance and observability controls

Around these engines you still need proper controls: role based access for keys and payouts, audit logs for every sensitive change, and secrets stored in a vault with rotation policies. Centralised logs and metrics track latency, error rates, webhook success and settlement times, so alerts fire quickly if anything in the PYUSD rail drifts away from normal.

5. Onboarding and KYC for PYUSD Merchants in Singapore

Before a PYUSD Payment Gateway Singapore rail goes live, your business and the provider both need a clear picture of who you are, what you sell and how payments will be monitored. A tidy onboarding phase now saves a lot of friction later with banks and auditors.

1. Business profiles most likely to be approved

Gateways usually move fastest with merchants that have simple models and repeat clients, such as SaaS, agencies, online services, travel and hospitality, education and digital products. Higher risk sectors or opaque ownership can still be onboarded, but expect more questions, lower starting limits and closer monitoring.

2. Documents and checks for a PYUSD payment gateway account

The checklist often looks like opening a business bank account, plus a bit more detail on use cases and geographies. You should be ready to provide registration records, director and owner details, a live website, expected volume and ticket sizes, main customer regions and an SGD settlement account, so the PYUSD Payment Gateway Singapore onboarding can move without long back and forth.

3. Aligning your internal policy with gateway KYC and AML

Once you understand how the gateway screens customers and payments, update your own policies to match. Define which countries or segments you will serve, when to escalate flagged payments and who can approve or block them, then put this in a short playbook for support, finance and compliance. When your rules line up with the provider controls, the PYUSD rail feels like part of your normal risk framework, not an exception.

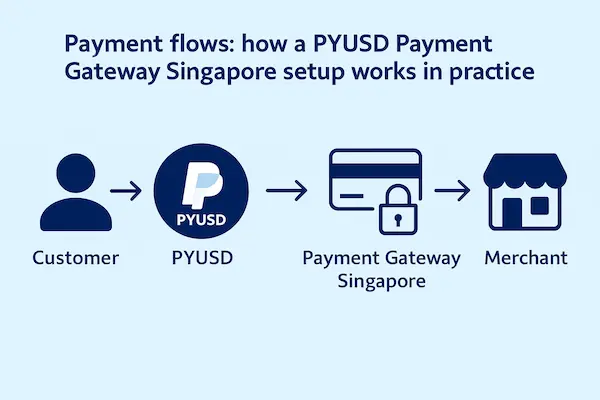

6. Payment flows: how a PYUSD Payment Gateway Singapore setup works in practice

Once onboarding is done, what matters most is how real money moves. A good PYUSD Payment Gateway Singapore setup should feel predictable for customers at checkout and boring for finance during reconciliation, even though there is a stablecoin rail under the hood.

1. Online checkout flows for ecommerce and SaaS

At checkout, the buyer picks PYUSD next to cards or PayNow, your system calls the gateway to create a payment, then shows the amount, QR code or wallet address and an expiry time. The customer sends PYUSD from a wallet or exchange, the gateway tracks the transfer and moves the payment from pending to confirmed and settled. Your app just listens for webhooks or polls a status endpoint, then marks the order paid, starts fulfilment and logs the reference for later refunds if needed.

2. Use cases for hotels, tourism and events in Singapore

For hotels and tour or event operators, PYUSD often starts as a deposit rail. The booking engine creates a payment for the deposit, waits for confirmation and attaches the payment id to the reservation. Staff can see in one place whether PYUSD has been fully received, partly received or not paid at all, and then apply normal rules for check in, upgrades, late cancellations or no show, using the gateway to trigger any refunds.

3. B2B invoicing and large ticket payments with PYUSD

With B2B clients, the system usually generates a secure payment link on the invoice that points to a hosted checkout or embedded widget. The client pays in PYUSD, the gateway confirms settlement and either converts to SGD or leaves funds in PYUSD according to your treasury rules. Your ERP then receives a webhook or batch file, marks the invoice as paid and records the rate, fee and settlement currency so finance can close the books without touching blockchain tools.

7. FX, pricing and treasury management with PYUSD

Money is where a PYUSD Payment Gateway Singapore setup becomes real for CFOs and finance teams. You need clear rules for how you price in SGD, how PYUSD amounts are quoted and how incoming flows turn into booked revenue or balances on your stablecoin rail.

Table: Pricing and treasury options for a PYUSD Payment Gateway Singapore setup

| Strategy | When to use | Advantages | Things to watch |

|---|---|---|---|

| Instant convert PYUSD to SGD | New to PYUSD, want zero stablecoin exposure | Simple accounting, clean SGD books | Relies on gateway FX, less upside from holding PYUSD |

| Keep a working PYUSD float | Regular PYUSD inflows and some PYUSD denominated costs | Faster payouts in PYUSD, less frequent conversions | Need clear limits and ownership for the float |

| Threshold based conversion | Mixed customer base, uneven PYUSD volume | Balances exposure and FX costs | Must define thresholds and review them periodically |

1. Pricing in SGD while accepting PYUSD

The simplest model is to keep all prices in SGD and let the gateway quote a PYUSD amount for each order or invoice. Your system passes the SGD total, the gateway returns a PYUSD figure and an expiry time, and you show both to the customer. When payment arrives, the rate used, the fee and the final SGD value are recorded so finance can see exactly how each PYUSD payment landed in your books.

2. When to hold PYUSD and when to convert

Some merchants convert PYUSD to SGD as soon as payments settle, others keep a working balance in PYUSD for future expenses or payouts. A solid PYUSD Payment Gateway Singapore integration lets you choose rules such as convert everything on receipt, convert above a threshold or keep a fixed float in PYUSD. Whatever you pick, write it down and make sure treasury, finance and founders agree, so you do not argue later about why funds were still in stablecoin.

3. Working with your bank and accountant on PYUSD flows

Before volume grows, sit down with your accountant and at least one banking contact to explain how PYUSD flows will work. Map PYUSD to specific ledger accounts, decide how to show conversions and fees on statements and discuss how large PYUSD payouts or settlements might be viewed by your bank. When these conversations happen early, a PYUSD rail looks like a controlled payment method, not a surprise that appears in reports with no context.

8. Risk, compliance and technology risk management for PYUSD Payment Gateway Singapore

Even if volumes start small, a PYUSD Payment Gateway Singapore setup still touches money, customers and regulators. Treat it like any other serious payment rail and you are far less likely to run into surprises with banks, partners or auditors later.

1. Key risk categories for PYUSD payment acceptance

The main risks cluster around counterparty, technology, behaviour and rules. Counterparty risk is about the issuer behind PYUSD and the gateway you choose. Technology risk covers bugs, outages, key leaks and bad webhook handling. Behaviour and compliance risk is about who you allow to pay, how you watch for patterns that look like fraud or sanctions issues and how quickly you can freeze or refund when needed. A basic risk map for your PYUSD Payment Gateway Singapore rail helps keep these points visible.

2. Logs, monitoring and investigation readiness

You cannot manage what you cannot see, so make sure the gateway gives you detailed timestamps, ids, risk flags, rates, fees and payout references for each PYUSD payment. Pipe key events into your own logging and monitoring so you can spot spikes in errors, failed webhooks or unusual payout activity. When something looks wrong, a clean trail from customer action through the PYUSD Payment Gateway Singapore provider to your books makes investigations faster and less stressful.

3. Internal roles and ownership for PYUSD risk

Finally, decide who owns which part of the rail. Product and tech should own integration quality, error budgets and incident response. Finance should own reconciliation and treasury rules for PYUSD, while compliance or risk teams own screening policies and escalation on flagged payments. Writing this down in a short one page overview makes it clear that your PYUSD Payment Gateway Singapore setup is part of the core risk framework, not an orphaned experiment.

9. Integration patterns for different Singapore segments

Once the basics are in place, the real question is how a PYUSD Payment Gateway Singapore rail fits into your actual business model. The patterns repeat across sectors, but each segment has its own sweet spot and things to watch.

1. Singapore SMEs and online shops

For most SMEs the simplest pattern is to plug PYUSD into an existing ecommerce or billing platform using a plugin or hosted checkout. PYUSD shows up as an extra option for international buyers, while cards and PayNow stay as the default for local traffic. This lets you test the PYUSD Payment Gateway Singapore rail on a small slice of orders and see real demand before you invest in deeper custom work.

2. Hospitality, tourism and lifestyle merchants

Hotels, tour operators, event venues and premium lifestyle brands can use PYUSD mainly for deposits and higher value bookings from overseas guests. The booking system creates a PYUSD payment for the deposit, the gateway confirms settlement, and staff see the result next to other payment types in their normal tools. This keeps front office and finance workflows familiar while quietly adding a new rail for guests who already live in PayPal or Web3 wallets.

3. Web3 native and creator economy use cases

Web3 projects, NFT platforms and creators often already deal in crypto assets, but still need a bridge to more traditional customers and to Singapore based banking. In these cases a PYUSD Payment Gateway Singapore setup can sit between on chain activity and your fiat accounts, letting you accept PYUSD for memberships, digital collectibles or subscription access and then convert or hold according to treasury rules. The key is to design this rail so it feels simple and safe for non technical users, even if the audience is crypto friendly.

10. Performance, scalability and reliability for a PYUSD Payment Gateway Singapore stack

When traffic grows, even a good PYUSD Payment Gateway Singapore setup can struggle if limits, error handling and monitoring are an afterthought. Treat it like any other core payment rail and plan for spikes, partial failures and provider issues from day one.

1. Rate limits, concurrency and traffic spikes

Every provider enforces some form of rate limit on API and webhooks. Your integration should reuse HTTP connections, respect published limits and back off cleanly when you see throttle responses. For busy systems, batch reads or scheduled exports usually work better than constant polling, and stress tests with realistic PYUSD flows help you understand how the rail behaves during sales, launches or event ticket drops.

2. High availability and graceful degradation

No gateway or chain is online 100 percent of the time, so design for detours. Run your own services in at least two instances, make sure timeouts and retries are sensible, and show clear messages when PYUSD checkout is temporarily unavailable. If the PYUSD Payment Gateway Singapore provider has an incident, your app should keep other payment methods working, queue non critical tasks and give staff a simple status view rather than leaving them guessing.

3. Monitoring, alerts and service level objectives

Set a small set of metrics that really matter: API latency, error rates, webhook success, PYUSD confirmation times and payout delays. Pipe them into dashboards that both tech and business can read, and add alerts for unusual patterns like sudden spikes in failures or long confirmation windows. With this in place, a PYUSD Payment Gateway Singapore rail becomes a visible, manageable part of your stack instead of a black box that only gets attention when something breaks in production.

11. Comparison: PYUSD Payment Gateway Singapore vs other options

Before you add another rail, it helps to see PYUSD in context. A PYUSD Payment Gateway Singapore setup is not the only way to serve global customers, so you should weigh it against other stablecoins and the card or bank methods you already run.

Table: PYUSD vs USDT vs USDC for Singapore merchants

| Asset | Main issuer or brand | Typical use case in Singapore | Accounting simplicity | Ecosystem and liquidity |

|---|---|---|---|---|

| PYUSD | PayPal linked stablecoin issuer | Payments from PayPal heavy or Web3 savvy international buyers | High, if priced in SGD and settled via gateway | Growing, smaller than USDT and USDC today |

| USDT | Tether | Trading, exchanges, some cross border settlements | Medium, many chains and venues to track | Very high liquidity across exchanges and chains |

| USDC | Circle and partners | More regulated facing use cases, institutional flows | High, clear backing and reporting | High liquidity, strong support on major venues |

1. PYUSD vs other stablecoins for Singapore merchants

USDT and USDC have a larger on chain footprint today, with more exchanges and DeFi tools supporting them, while PYUSD brings a closer link to PayPal and its consumer brand. If most of your buyers are already holding USDT or USDC on exchanges, those rails may deliver faster early volume. If your audience lives in PayPal and wants a stablecoin path that feels familiar, PYUSD can be a cleaner fit inside a single gateway than juggling several assets at once.

2. PYUSD vs traditional card and bank rails

Cards and bank transfers still win on ubiquity and mature dispute processes, but they bring chargebacks, higher fees on cross border routes and slower settlement in some cases. PYUSD gives you fast final settlement and lower FX noise for certain corridors, at the cost of narrower adoption and the need to work through a specialist provider. In practice most merchants treat PYUSD as a complement to cards and PayNow, not a replacement, using it where it clearly reduces friction for specific customer segments.

3. How to pick the right mix for your business

Start by mapping where your customers are, which wallets they already use and where margins are being eaten by FX or card fees. If international buyers in tech, Web3 or digital services are a growing share, a focused PYUSD Payment Gateway Singapore rail can pay for itself quickly, while local only merchants may see little benefit. The goal is not to chase every new asset, but to build a small, intentional mix of rails that fits your market, your risk appetite and the tools your team can realistically operate.

12. 2026 outlook: the future of PYUSD Payment Gateway Singapore

No one can predict exactly how PYUSD will grow in Singapore, but you can plan around a few clear trends. A PYUSD Payment Gateway Singapore rail will live or die on real adoption, stable rules and whether it makes life easier for both customers and finance teams in 2025 and 2026.

1. Trends that could boost PYUSD adoption

If more wallets, exchanges and payment apps support PYUSD by default, the pool of buyers who can pay with it will grow. Clearer stablecoin rules in major markets and tighter links between PayPal accounts and on chain PYUSD would also help, especially for cross border e commerce and B2B invoices. For merchants, the big signal is simple: more customers asking to pay with PYUSD and more partners willing to receive it.

2. Scenarios where PYUSD stays niche

PYUSD could remain a specialist option if USDT and USDC keep dominating trading venues and DeFi, or if banks stay nervous about newer stablecoins. If your customer base is mostly local or prefers PayNow and cards, you may see little real traffic on the rail. In that case PYUSD is still useful as a targeted channel for certain global segments, but not something to push at every shopper.

3. How to stay flexible while the market evolves

Design your stack so you can add or remove assets without ripping out core logic. Use a gateway that treats PYUSD as one of several stablecoins, keep pricing in SGD and make asset support a configuration choice, not a code change. With that approach you can test a PYUSD Payment Gateway Singapore setup on a small slice of traffic, grow it if demand appears and scale it back if the market moves in another direction, all without redoing your payment architecture.

FAQs: PYUSD Payment Gateway Singapore

1. What is a PYUSD Payment Gateway Singapore merchants can use?

It is a setup that lets you price in SGD, accept PYUSD from customer wallets and settle in PYUSD or SGD, while the provider handles addresses, confirmations and FX behind the scenes.

2. Do Singapore merchants need their own MAS licence to accept PYUSD?

Usually no. In most cases the gateway operator carries or aligns with the licence and you act as a merchant receiving funds, while following your own internal risk and customer policies.

3. Which types of merchants benefit most from PYUSD?

Businesses with cross border, tech savvy customers benefit most, such as SaaS with US or EU clients, hotels and events serving international guests and agencies or creators paid from overseas platforms.

4. How are fees and FX handled in a PYUSD payment gateway?

You normally pay a platform fee plus network fees. The gateway provides a quote step that locks a PYUSD amount for a short time so you know what the customer must send and how much lands in SGD.

5. Is PYUSD too volatile for day to day pricing?

PYUSD tracks USD, so the main movement is normal USD to SGD FX, not wild token swings. If you keep prices in SGD and use per order quotes, most merchants find volatility manageable.

6. How fast do PYUSD payments usually confirm and settle?

On supported chains many payments are usable within a few minutes after the first confirmations. Higher value orders can wait for extra confirmations, but timing is still close to a fast bank transfer.

7. What are key security practices for a PYUSD integration?

Use separate sandbox and production keys in a vault, limit payout scopes, rotate secrets, verify all webhooks with HMAC and timestamps and keep handlers idempotent to avoid double actions.

8. How can we test a PYUSD Payment Gateway Singapore setup safely?

Begin in sandbox with staging systems, run full flows for checkout, refunds and payouts, then move to a small live pilot with low limits. Scale the PYUSD rail only after reconciliation and demand look solid.

Conclusion: Is A PYUSD Payment Gateway Singapore Rail Worth It?

For merchants with real cross border, PayPal heavy or Web3 native customers, a careful PYUSD Payment Gateway Singapore setup can be a useful extra rail, not a shiny toy. The test is simple: does it bring revenue and margin without adding chaos for finance, compliance and tech.

Quick summary table

| Area | Question | Good signal |

|---|---|---|

| Customers | Do buyers ask for stablecoin or PYUSD | Yes, at checkout or in sales calls |

| Economics | Are FX and card fees painful | Yes, on key cross border flows |

| Operations | Can we map PYUSD cleanly to SGD | Yes, with clear reports and logs |

If you can say yes on most lines, PYUSD is worth a focused pilot.

Next step with XaiGate

XaiGate gives you a ready made PYUSD Payment Gateway Singapore rail with simple APIs, signed webhooks and reports that finance and compliance can read without extra tooling.

Start small: open a XaiGate sandbox, enable PYUSD, wire one checkout or invoice flow and let your team see how payments, refunds and settlements look in practice. If usage and reconciliation are solid, you can safely route more volume through XaiGate and keep PYUSD as a permanent part of your payment stack.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)!