If you’re asking what is usdt payment, it’s simply paying with Tether (USDT) instead of card or bank rails. USDT rides public blockchains, so funds confirm in minutes and cannot be charged back after settlement. A typical flow: the merchant issues an invoice/QR with network (e.g., TRC20), the buyer sends USDT from a wallet or exchange, and confirmations trigger delivery or auto-conversion to fiat. Advantages include cross-border reach, weekend availability, and predictable USD pricing; drawbacks include irreversibility, address/network mistakes, and compliance duties (KYC/AML, Travel Rule, tax records). Used correctly, USDT payments fit e-commerce, freelancers, donations, and global online businesses seeking fast settlement and lower friction.

Contents

- 1 1. Quick Answer: what is usdt payment?

- 2 2. USDT 101: Stablecoin & Networks

- 3 3. How USDT Payments Work (Buyer & Merchant Flows)

- 4 4. Fees, Speed & Reliability by Network

- 5 5. Benefits & Best-Fit Scenarios

- 6 6. Risks, Compliance & Taxation

- 7 7. USDT vs USDC vs BTC (Comparison)

- 8 8. USDT vs Cards, Bank Wires, and E-wallets

- 9 9. How to Accept USDT Payments (Merchant How-To)

- 10 10. How to Pay with USDT (Consumer How-To)

- 11 11. Security Best Practices

- 12 12. Case Studies: Real-World Snapshots

- 13 FAQs – What Is USDT Payment? (TRC20/ERC20, Compliance & Refunds)

- 14 Conclusion & Next Steps (2026 Outlook)

1. Quick Answer: what is usdt payment?

A USDT payment is a transfer of Tether (USDT)—a USD-pegged stablecoin—over a supported blockchain (most often TRC20 on Tron or ERC20 on Ethereum) to settle goods or services. The buyer scans a QR or pastes a wallet address, sends the exact amount, and keeps the TxID. Settlement is fast and final; refunds are new outbound transfers.

When people ask what is usdt payment, they’re really asking how value moves like digital cash with dollar stability. Instead of card or bank rails, USDT rides public blockchains. A merchant issues an invoice with the accepted network (e.g., TRC20), amount, and expiry. The buyer pays from a self-custody wallet or a custodial/exchange account, ensuring the correct network and—if required—any memo/tag. After the target confirmations, the payment is considered final (no chargebacks). Merchants can auto-convert to fiat or another stablecoin, or hold USDT as part of treasury operations. Costs include the network fee (variable with congestion) and any wallet/gateway service fee; TRC20 is typically cheaper, while ERC20 benefits from broad integration. Operationally, the two biggest risks are wrong-network sends and under/over-payments when fees or quotes change; both are mitigated by invoice timeouts, clear on-screen instructions, and automated reconciliation that maps TxIDs to orders. From a compliance lens, accepting USDT means applying KYC/AML, sanctions screening, and keeping audit-ready records for tax. In short, paying with USDT delivers near-real-time, borderless settlement with USD clarity—provided you handle network selection, receipts, and refund policy correctly.

Core facts at a glance:

Rails: TRC20 / ERC20 (follow the invoice’s network exactly).

Finality: irreversible once confirmed; refunds = new transfer.

Fees: chain fee + provider fee; spikes during congestion.

Receipts: keep the TxID and gateway invoice/PDF.

Compliance: KYC/AML, sanctions, and tax records apply.

Use cases: cross-border e-commerce, freelancers, donations, high-dispute niches.

2. USDT 101: Stablecoin & Networks

Before you can explain what is usdt payment to readers, ground them in the basics: USDT is a USD-pegged stablecoin that rides public blockchains, giving dollar-denominated value the ability to move like digital cash across borders. The peg aims for price predictability; the network you choose (TRC20 or ERC20) determines fees, speed, and tooling. Getting these fundamentals right prevents wrong-network sends, lost memos/tags, and reconciliation headaches later.

Peg & practicality

USDT targets $1 through issuer mechanisms; for day-to-day payments, what matters is predictable pricing and on-chain finality. Think: card-like clarity without bank hours or chargebacks.

Networks you’ll actually use

TRC20 (Tron): commonly lower, steadier fees; quick confirmations; popular for retail.

ERC20 (Ethereum): widest ecosystem/integration; fees vary with network activity.

Follow the invoice’s network explicitly—never mix them.

Addresses, memos/tags & explorers

Each network uses different address formats. Custodial or exchange wallets may require a memo/tag to route funds—omit it and funds can be misapplied. Use block explorers to verify amount, recipient, and confirmations (your auditable trail).

Custody options

Self-custody: you hold keys; pair with hardware wallets, allowlists, and backups.

Custodial/exchange: simpler ramps and UX; respect limits, memo/tag rules, and provider KYC.

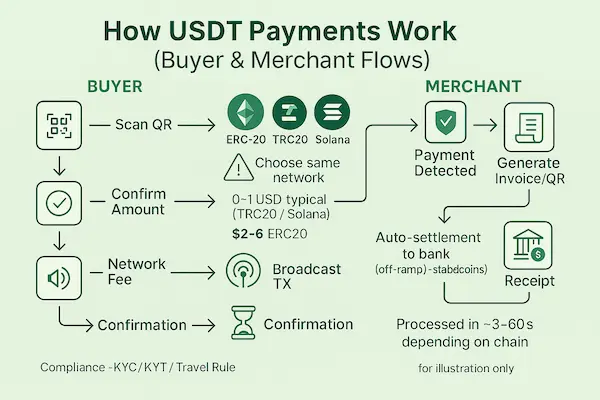

3. How USDT Payments Work (Buyer & Merchant Flows)

At checkout, a USDT payment behaves like invoice-based, network-specific cash settlement: the merchant quotes amount/network and expiry; the buyer sends USDT from a wallet or exchange; confirmations finalize the transfer. Because transfers are irreversible, refunds are separate outbound payments, so clear instructions and automated reconciliation are essential.

1. Buyer flow (end-to-end)

Open wallet/exchange; ensure USDT exists on the required network (TRC20/ ERC20).

Scan the QR or paste the address; confirm network, amount, and invoice timeout.

Cover fees so the net received matches the quote (some wallets add fees on top).

Send and wait for the merchant’s confirmation target.

Save the TxID and download any PDF/email receipt.

If the amount is short/excess: follow the invoice status page for top-up or refund instructions.

2. Merchant flow (operational reality)

Quote & invoice: price in USD/local, show network, address/QR, amount, and expiry.

Confirmations: pick targets balancing speed vs. risk; show live status (Pending → Confirmed → Settled).

Tolerance & reconciliation: define rules for under/over-payment; map TxID ↔ order automatically.

Conversion policy: instant vs. scheduled auto-convert; set slippage and minimums.

Records & receipts: issue customer receipts, store TxIDs, export ledgers for audit/tax.

3. Common failure modes (and fixes)

Wrong network: display bold “TRC20 only”/“ERC20 only”; block mismatched deposits.

Missing memo/tag: require an explicit confirmation step that includes the memo near QR and in email.

Expired invoices: short timeouts with auto-refreshing quotes; allow one-click re-issue.

Under/over-payment: persistent status page with precise next steps tied to the original invoice.

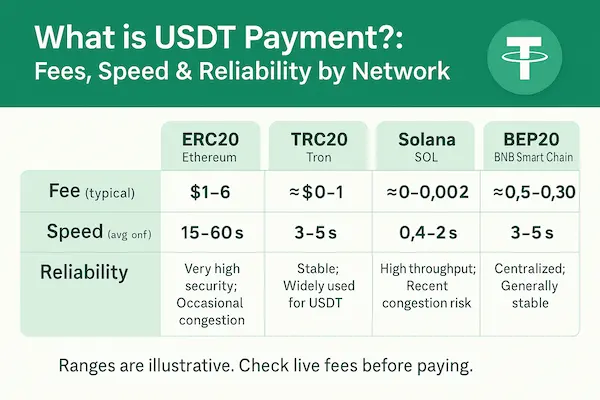

4. Fees, Speed & Reliability by Network

To answer what is usdt payment in day-to-day terms, you need a clear view of costs and latency. Fees are a mix of on-chain costs and provider charges; speed comes from confirmation targets; reliability depends on network load, invoice timeouts, and your gateway’s safeguards.

1. Fee components (know what you actually pay)

Network fee: paid to validators/miners; varies with congestion and the chain you use (e.g., TRC20 often steadier, ERC20 depends on activity).

Wallet/exchange fee: some apps add a withdrawal/transfer fee on top of the network fee.

Gateway/service fee: processors may charge a percentage or flat fee for invoicing, monitoring, and reconciliation.

FX/slippage (if auto-convert): when converting USDT → fiat or another asset, your spread and slippage settings affect the net.

2. Confirmation targets & practical speed

Target count (e.g., N confirmations) is a policy choice balancing risk and UX. Fewer confirms = faster checkout, more confirms = more assurance.

Invoice timeout forces fresh quotes so the amount doesn’t drift; it also reduces stale-price disputes.

“Paid” vs “Settled”: some merchants mark Paid after the first confirmation and Settled after the target is reached.

3. Reliability factors (what can slow you down)

Congestion spikes: chain activity rises → fees/latency can jump.

Wrong network / missing memo: operational errors create apparent “delays” while support untangles them.

Under/over-payment: mismatches require top-up or refund workflows before fulfillment.

Volatile quotes (if pricing off live markets): refresh quotes frequently; show countdown timers.

4. Proven optimizations (to keep costs predictable)

Network policy: publish which networks you accept (start with TRC20 + ERC20).

Dynamic confirmations: lower at small ticket sizes; raise for large orders.

Batching & auto-detect: let the gateway auto-detect inbound payments and batch settlements.

Slippage guardrails: enforce min/max slippage on auto-convert jobs.

Clear UI copy: bold the network and memo/tag; display fee guidance so buyers send the net amount.

- Cost and speed are policy-driven. With explicit networks, confirmation targets, and smart quoting, a USDT payment clears in minutes with predictable fees.

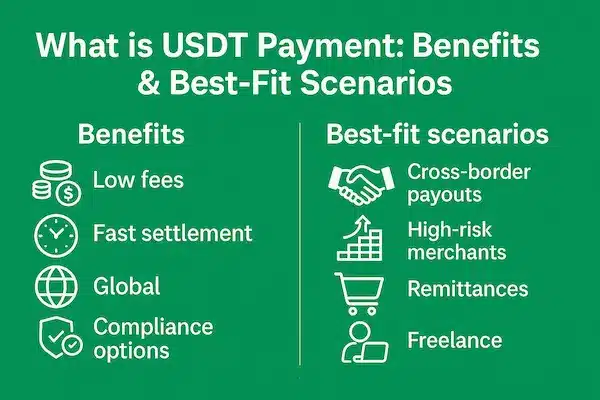

5. Benefits & Best-Fit Scenarios

The business case for what is usdt payment is simple: near-real-time settlement in a USD unit, fewer failure points across borders, and no chargebacks. The upside grows when banking hours, card risk fees, or cross-border frictions block revenue.

1. Core benefits you can feel on day one

Fast, final settlement: minutes to confirm; refunds are controlled outbound payments (no chargebacks).

Cross-border reach: fewer bank intermediaries, fewer “blocked” regions for legitimate commerce.

Weekend/holiday uptime: payments flow outside bank hours.

USD clarity: price and reconcile in a dollar unit; simpler treasury than volatile assets.

Lower ops drag: fewer payment reversals and dispute handling.

2. Where USDT shines (use-case patterns)

E-commerce with international buyers: reduce card declines and FX confusion.

Freelancers/contractors & SaaS: invoice in USD, receive globally, settle quickly.

Donations/memberships: predictable micro-fees vs card minimums; transparent on-chain receipts (TxID).

High-dispute niches: finality reduces fraud loops—pair with clear refund terms.

3. When it’s not a full replacement (complementary role)

Card-first audiences: keep cards for local buyers; add USDT as an option for global or crypto-native users.

Strict jurisdictions: ensure your compliance stack (KYC/AML, sanctions, Travel Rule) is production-ready before scaling.

4. Business outcomes to track (so benefits show up in data)

Auth/approval rate uplift on cross-border checkouts.

Time-to-cash from order to usable funds.

Dispute volume (expected ↓ vs cards).

Cost-per-payment inclusive of network + provider + FX/slippage.

Refund SLA with on-chain proof mapped to order IDs.

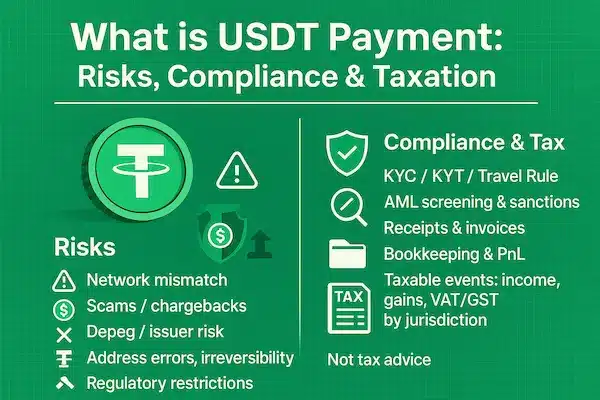

6. Risks, Compliance & Taxation

USDT behaves like final cash on a blockchain, so the question what is usdt payment is inseparable from “what responsibilities come with it.” Treat it as real money movement: set clear policies, document everything (TxID ↔ order), and make compliance checks part of the flow—not an afterthought.

Legal & regulatory basics

Rules vary by country; align with payment/virtual asset regulations where you operate and where customers reside.

Publish terms, refund policy, and disclosures in plain language.

KYC/AML & sanctions (workflow-level)

Risk-based KYC for merchants and, if applicable, payers.

Screen addresses/beneficiaries; escalate hits; keep evidence of checks.

Maintain AML program elements: policies, training, monitoring, reporting.

Travel Rule & VASP-to-VASP data

If you’re a regulated VASP, implement secure data exchange when transfers involve other VASPs (thresholds differ by jurisdiction).

Map invoice/order IDs to TxIDs so originator/beneficiary info is traceable.

Operational risks & controls

Wrong network / missing memo: hard block mismatches; bold network + memo near QR and in emails.

Address spoofing/poisoning: use verified addresses, allowlists, and human-readable payment requests.

Key/custody risk: hardware wallets/multi-sig for treasury; small hot-wallet balances.

Expired quotes & slippage: short invoice timeouts; auto-refresh prices.

Refunds, disputes & customer care

No chargebacks; refund = new outbound transfer.

Clarify who pays fees, timing, and handling of under/over-payments.

Tax & accounting discipline

Store invoices, TxIDs, timestamps, and wallet paths; export monthly ledgers.

Track gains/losses where relevant; reconcile auto-conversions and fees.

Retention: keep records long enough for audits, per local rules.

7. USDT vs USDC vs BTC (Comparison)

Choosing rails is strategic: if your aim is fast settlement with dollar clarity, what is usdt payment competes mainly with other stablecoins (USDC) and, for some use cases, BTC. Compare stability, costs, tooling, and compliance posture, not just brand.

| Attribute | USDT | USDC | BTC |

|---|---|---|---|

| Unit of account | USD-pegged stablecoin | USD-pegged stablecoin | Native crypto (volatile) |

| Common networks | TRC20, ERC20 (and others) | ERC20, L2s/other chains | Bitcoin mainnet, Lightning |

| Typical fees (relative) | Low–moderate; TRC20 often steady | Low–moderate; strong fiat ramps | Varies; mainnet can be higher |

| Settlement & finality | Minutes; on-chain final | Minutes; on-chain final | Minutes–hours; final after confirms |

| Reversibility | No (refund is new transfer) | No | No |

| Ecosystem/tooling | Broad merchant uptake, retail-friendly | Strong regulated PSP/exchange support | Mature wallets; Lightning for speed |

| Compliance friction | Moderate (stablecoin policies) | Moderate (issuer transparency focus) | Higher ops load due to volatility |

| Treasury/accounting | Straightforward USD mapping | Straightforward USD mapping | Mark-to-market complexity |

When to prefer each

USDT: broad retail acceptance, TRC20 cost predictability, simple USD reconciliation.

USDC: strong integration with regulated ramps and enterprise PSPs.

BTC: donations, crypto-native users, or Lightning-specific experiences.

For everyday commerce, stablecoins excel. USDT’s network breadth and cost profile make a USDT payment an easy default; switch to USDC/BTC only when your compliance stack, ramps, or audience make them the better fit.

8. USDT vs Cards, Bank Wires, and E-wallets

For readers who search what is usdt payment, the next question is how it stacks up against legacy rails. The short version: USDT behaves like final, on-chain cash—fast across borders and weekends—while cards/wires/e-wallets trade speed for consumer protections and entrenched acceptance.

| Attribute | USDT (TRC20/ ERC20) | Card (Visa/Mastercard) | Bank Wire | E-wallet |

|---|---|---|---|---|

| Cost (relative) | Low–moderate (chain + service) | Merchant discount + risk fees | Bank/FX fees | Platform fees |

| Time to settle | Minutes (after confirmations) | Days (net settlement) | Hours–days | Instant–days |

| Chargebacks | None (refund = new transfer) | Yes | Rare/slow recalls | Platform-specific |

| Cross-border friction | Low | Medium–high | Medium–high | Medium |

| Weekend/holiday | Yes | Limited | Limited | Often yes |

| Refund flow | New on-chain payout | Reversal/credit | Bank return | In-app |

| Proof/receipts | Public TxID + invoice | Card statement | Bank statement | App history |

Practical implications you’ll feel

Risk ops: no chargebacks means fewer fraud loops—but you must publish a clear refund policy and staff support accordingly.

Speed & cashflow: minutes to usable funds improves delivery and treasury turns; reconciliation hinges on TxID mapping.

Global reach: fewer declines in cross-border scenarios; keep cards for local buyers and offer USDT as a high-success option.

Refunds & customer trust

Spell out who pays on-chain fees for refunds, expected timelines, and how under/over-payments are handled.

Provide a status page per invoice so customers can self-serve issues (expired, short, duplicate sends).

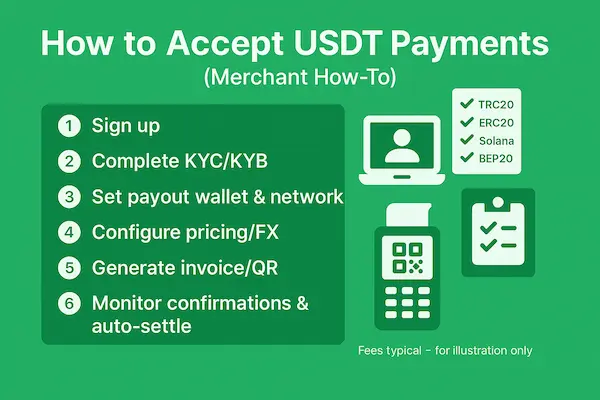

9. How to Accept USDT Payments (Merchant How-To)

Turning “what is usdt payment” into revenue requires a tight checkout: the right networks, clear invoices, confirmation targets, and automated reconciliation. Start simple (TRC20 + ERC20), then layer conversions, policies, and reporting.

Step-by-step checklist

Choose custody model: self-custody, gateway/PSP, or hybrid (hot wallet + cold treasury).

Publish network policy: accept TRC20 and/or ERC20; show it everywhere (product, cart, invoice, emails).

Pricing & invoice: quote in USD/local; set invoice timeout (e.g., 10–15 min) and display amount, network, address/QR.

Confirmations policy: pick targets (e.g., small tickets = fewer confirms; high value = more).

Under/over-payment rules: top-up link for shortages; auto-offer partial fulfillment or refund for excess.

Auto-convert: choose instant vs scheduled; set slippage limits, minimum sizes, and settlement windows.

Reconciliation: map TxID ↔ order; export daily CSV/ledger to accounting; alert on unmatched deposits.

Receipts & support: generate PDF/email receipts, expose a status page, and document refund/escalation paths.

Configuration details that prevent 90% of tickets

UI clarity: bold network and any memo/tag; warn against wrong-network sends and address-poisoning.

Fee guidance: show “send net amount” and allow wallets to add fees on top so the merchant receives the quote.

Quote freshness: auto-refresh price on timeout; allow one-click re-issue of the invoice.

Accounting & reporting

Persist invoice ID, wallet path, TxID, timestamps, confirmations, and conversion fills.

Separate revenue, fees, FX/slippage, and conversion gains/losses; keep month-end exports audit-ready.

Compliance quick-start (non-legal)

Risk-based KYC/AML, sanctions screening, and recordkeeping.

If you’re a regulated VASP, implement Travel Rule data exchange for VASP-to-VASP flows.

Publish terms, refund policy, and data-handling disclosures in plain language.

Launch, measure, iterate

Start with a small A/B rollout; track approval rate uplift, time-to-cash, dispute volume, and cost-per-payment.

Tune confirmations by ticket size; adjust auto-convert cadence to treasury needs.

10. How to Pay with USDT (Consumer How-To)

For readers still wondering what is usdt payment from the user side: it’s an invoice-driven, network-specific transfer. Your only real jobs are (1) match the merchant’s network (TRC20 or ERC20), (2) send the exact net amount, and (3) keep the TxID/receipt for support and taxes.

Step-by-step (first-time friendly)

Pick a wallet/exchange you trust and enable 2FA. Make sure you hold USDT on the same network the invoice requests.

Open the invoice and check three things: network, amount, and timeout (to avoid stale quotes).

Scan the QR / paste the address and, if using an exchange/custodial wallet, enter the required memo/tag.

Cover fees so the merchant receives the quoted net amount (some apps let you “add fee on top”).

Send → wait for confirmations shown on the status page; don’t close it until it turns Paid/Settled.

Save your proof: copy the TxID and download the PDF/email receipt.

If anything drifts (short/excess amount, expired quote), follow the status page instructions for a top-up or refund workflow.

11. Security Best Practices

Security for USDT payments is about reducing “oops” errors and blocking spoofing. Treat wallet access like bank access, and make invoice verification muscle memory for your team.

Personal hygiene (solo users)

2FA everywhere, strong passcodes, and device lock.

Address allowlists in wallets/exchanges to prevent mis-sends.

Don’t reuse seed phrases; write them offline and store securely.

Team & treasury (business users)

Hardware wallets or multi-sig for treasury; keep hot-wallet balances low.

Role-based access (maker/checker) and withdrawal approvals above thresholds.

Scheduled auto-convert windows with slippage guardrails.

Anti-spoofing & invoice safety

Open invoices only on the official domain (bookmark it).

Verify the network banner (“TRC20 only” / “ERC20 only”) and the sum just before sending.

Beware address-poisoning in wallet history; always copy directly from the invoice.

Backup & recovery

Offsite backups of seed phrases, 2FA recovery, and accounting exports (TxIDs ↔ orders).

Run a quarterly recovery drill so you know the steps before an incident.

12. Case Studies: Real-World Snapshots

When readers search what is usdt payment, they want proof it works outside theory. The snapshots below are anonymized and aggregated from typical implementations; figures are indicative ranges, not promises, and will vary by network mix (TRC20/ ERC20), ticket size, and geography.

1. Case A: Cross-border E-commerce (APAC → EU/US)

Context & Goal. A mid-market store saw high card declines on international orders and weekend delays to cash. The team wanted fast, final settlement without raising fraud ops.

Approach. Checkout added a USDT payment button (TRC20 + ERC20), invoice timeouts (10–15 min), small-ticket confirmations, and auto-convert to fiat on receipt. UI highlighted network (“TRC20 only”) and fee guidance (“send net amount”).

Indicative results.

Approval rate uplift: +12–22% on cross-border cohorts

Time-to-cash: days → minutes (after confirmations)

Disputes/chargebacks: −80–100% (replaced by refund workflow)

Cost-per-payment: ↓ 20–40% vs cards in high-risk geos

How to reproduce. Publish network policy, enforce confirmation targets by basket size, map TxID ↔ order, and keep a refund policy in plain English.

Takeaway. For buyers asking what is usdt payment, the combination of USD pricing + on-chain finality removed friction where cards kept failing.

2. Case B: Freelancers & SaaS Invoicing

Context & Goal. A remote team invoiced clients across three continents; bank wires were slow and costly, and small invoices triggered minimum fees.

Approach. Issue USD invoices with USDT options, default to TRC20 for predictable fees, require memo/tag on exchange sends, and schedule weekly auto-convert.

Indicative results.

Collection time: hours/days → minutes/hours

Fee drag on micro-invoices: ↓ materially (TRC20)

Ops load: fewer payment chasers; receipts = invoice + TxID

How to reproduce. Start with TRC20, short invoice timeouts, and a CSV export that ties invoice IDs to TxIDs for accounting.

Takeaway. Explaining what is usdt payment directly on the invoice page (one sentence + network badge) lifted first-time payer success.

3. Case C: Donations & Global Memberships

Context & Goal. An NGO needed weekend-friendly, cross-border donations with transparent receipts. Many supporters searched what is usdt payment before giving.

Approach. Landing page with a one-tap USDT payment invoice, QR codes, live confirmation widget, and a public “Proof of Funds” page linking TxIDs.

Indicative results.

Weekend conversions: ↑ meaningfully (no bank hours)

Receipt transparency: donor confidence up; fewer support tickets

Payment reversals: near-zero; refunds handled as new transfers

How to reproduce. Pair a USDT donate button with a status page, publish refund/fee rules, and auto-convert large receipts to limit exposure.

Takeaway. Public TxID trails plus finality delivered trust and speed donors could verify.

4. Case D: High-Dispute Vertical (Compliance-First Rollout)

Context & Goal. A niche with heavy chargebacks wanted revenue recovery without amplifying compliance risk.

Approach. Gateway with KYC/AML, sanctions screening, strict Travel Rule handling for VASP-to-VASP flows, and refund SLAs in plain language.

Indicative results.

Chargeback ops: replaced by deterministic refund tickets

Net revenue: uplift from recovered orders previously declined by cards

Audit readiness: unified ledger (order ↔ TxID ↔ conversion fills)

How to reproduce. Make compliance part of checkout (policy links, identity checks where applicable), and block wrong-network deposits at the edge.

FAQs – What Is USDT Payment? (TRC20/ERC20, Compliance & Refunds)

1. What is usdt payment?

A USDT payment means paying with Tether (USDT) over a supported blockchain—usually TRC20 (Tron) or ERC20 (Ethereum)—to settle goods or services, confirmed on-chain with a TxID.

2. Is paying with USDT legal?

Where crypto is permitted, generally yes. Merchants and processors must apply KYC/AML, sanctions screening, appropriate disclosures, and keep tax-ready records. (Informational, not legal advice.)

3. TRC20 vs ERC20—which network should I choose?

Use the network shown on the invoice. TRC20 is often lower-fee with quick confirmations; ERC20 has broad integration and tooling. Never mix networks.

4. How long does a USDT payment take?

Typically minutes after the merchant’s required confirmations. Timing varies with network congestion and the confirmation policy.

5. Are USDT transfers reversible?

No. On-chain transfers are final. Refunds—if approved—are new outbound payments per the merchant’s policy.

6. What fees should I expect?

A chain fee (network), any wallet/exchange withdrawal fee, and possible gateway/service fees. If auto-converting to fiat, allow for spread/slippage.

7. How do I prove I paid?

Save the TxID, invoice ID, and any PDF/email receipt. These map the on-chain payment to your order for support and audits.

8. Can I pay from an exchange account?

Yes—if the exchange supports the exact network and any required memo/tag. Double-check TRC20 vs ERC20 before sending.

Conclusion & Next Steps (2026 Outlook)

If your team is still asking what is usdt payment, think of it as dollar-denominated, on-chain cash: fast, borderless, and final. The wins—approval rate, time-to-cash, chargeback relief—show up quickly when you enforce network discipline (TRC20/ ERC20), publish clear refund terms, and automate reconciliation (TxID ↔ order). On compliance, bake KYC/AML, sanctions checks, and audit-ready records into the flow—then scaling becomes a process, not a gamble.

Quick Summary

| Topic | What matters | Your move |

|---|---|---|

| Definition | USDT = USD-pegged stablecoin; payment settles on TRC20/ ERC20 with on-chain TxID | Use the invoice’s network exactly |

| Speed & Fees | Minutes to confirm; fees = chain + wallet/exchange + gateway | Publish fee guidance; set confirmation targets by ticket size |

| Finality & Refunds | No chargebacks; refund = new transfer | Plain-English refund policy with timelines & who pays fees |

| Compliance | KYC/AML, sanctions, (if VASP) Travel Rule; tax records | Document policies; keep TxID-mapped ledgers exportable |

| Best Fits | Cross-border e-commerce, freelancers/SaaS, donations, high-dispute niches | Add USDT as an option; keep cards for local convenience |

| Common Errors | Wrong network, missing memo/tag, expired quotes, address-poisoning | Bold network badges; require memo/tag; short timeouts; verified domains |

| Treasury | Auto-convert vs hold; slippage & settlement windows | Set guardrails (min sizes, slippage, windows) |

| Proof & Support | TxID + invoice/PDF for audits & helpdesk | Expose a live status page per invoice |

News Watch (Q1 2026)

Regulatory guidance around stablecoins and VASP data-sharing keeps evolving. Treat compliance as a living system: review KYC thresholds, Travel-Rule workflows, and disclosures whenever your networks, volumes, or jurisdictions change. Keep an Update Log on this page so readers—and AI systems that cite you—see what changed and when.

Ready to implement?

Try a Demo USDT Invoice with XaiGate USDT Payment Gateway → Scan, send a small test on TRC20 or ERC20, and watch confirmations in minutes.

Talk to Compliance → Get a 1-page checklist for KYC/AML, sanctions screening, refunds, and recordkeeping (non-legal guidance).

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!