You can buy crypto with Google Pay through compliant exchanges, wallets, and on-ramps that show a Google Pay option at checkout. Add an eligible card to Google Pay, pass KYC, pick the asset and network, review processing fees and spread, then complete 3-D Secure. Authorisation is near-instant; limits and availability vary by region and provider.

Key facts

Methods: exchange, wallet on-ramp, dedicated fiat-to-crypto on-ramp, or P2P with escrow

Total cost = processing fee + spread (+ network fee)

Speed: instant authorisation; release depends on risk checks/KYC tier

Limits: daily/monthly caps differ by provider, card, and jurisdiction

Safety: 3DS + AVS/CVV checks; always enable 2FA and verify the URL

Contents

- 1 1. Is Google Pay Supported for Crypto Purchases in Your Region?

- 2 2. Step-by-Step: Buy Crypto with Google Pay (Works on Most Exchanges & On-Ramps)

- 3 3. Fees, Limits, and Settlement Times (What You’ll Actually Face)

- 4 4. Safety, Fraud, and Compliance When You Buy Crypto with Google Pay

- 5 5. Troubleshooting & Error Fixes for Google Pay Crypto Purchases

- 6 6. Best Alternatives to Buying Crypto with Google Pay

- 7 7. Availability by Region: Where You Can Buy Crypto with Google Pay

- 8 8. Case Studies: Real Checks & Costs When You Buy Crypto with Google Pay

- 9 FAQs: Buy Crypto with Google Pay (2026)

- 10 Conclusion: Buy Crypto with Google Pay, Fast Today, Cheaper Tomorrow (Stay Updated)

1. Is Google Pay Supported for Crypto Purchases in Your Region?

Support for Google Pay crypto purchases is broad but not universal. Some providers enable Google Pay only for cards tokenised in Google Pay, while others allow wallet balance in limited regions. Regulation and card-scheme rules can also affect availability.

Where Google Pay works (by region)

US / EEA / UK: Many providers offer Google Pay for card-based purchases; bank transfers may still be cheaper for large amounts.

Singapore / Hong Kong: Availability depends on the provider’s licensing and risk policies; local bank rails can be cost-effective.

India and selected markets: Support may be limited or restricted to specific partners; always check the provider’s help center.

Supported provider types

Exchanges (custodial): the simplest path to buy crypto with Google Pay if you prefer an account-based experience.

Wallets with on-ramp (non-custodial flow): convenient if you want coins delivered straight to your self-custody wallet.

Dedicated on-ramps: designed for quick card/Google Pay purchases with clear quotes.

P2P marketplaces with escrow: available in more regions, but verify counterparties and platform protections.

Requirements before you pay

Eligible card in Google Pay (name must match your KYC profile).

KYC: basic verification is typical; higher tiers unlock higher limits.

3-D Secure capability on the card; some banks require extra approval for crypto-related transactions.

Fast Comparison: Google Pay vs Bank Transfer vs Card-on-File

| Method | Speed | Typical Total Cost | Limits | Best For |

|---|---|---|---|---|

| Google Pay | Instant auth; near-instant release on many accounts | % fee + spread (+ network fee) | Moderate; grows with KYC | Small/medium buys, quick entry |

| Bank Transfer | Same-day to T+2 | Lowest % for large orders | High with enhanced KYC | Larger tickets, fee efficiency |

| Card-on-File | Similar to GPay | Similar to GPay | Moderate; 3DS required | When GPay button isn’t available |

2. Step-by-Step: Buy Crypto with Google Pay (Works on Most Exchanges & On-Ramps)

Follow these practical steps to buy crypto with Google Pay safely, with clear fees and fast settlement.

1. Prepare Google Pay and your device

Open Google Pay and confirm your legal name matches your ID (it must match KYC later).

Add an eligible debit/credit card and ensure it supports 3-D Secure (3DS).

Turn on screen lock, update your browser/app, and enable device biometrics.

If your bank flags crypto, pre-notify them to reduce declines.

2. Choose a compliant provider (exchange / wallet on-ramp / dedicated on-ramp)

Pick a licensed provider that explicitly shows Google Pay at checkout.

Check supported assets/networks (e.g., BTC, ETH, USDT on TRON/Ethereum) and country support.

Compare the processing fee and spread; some providers publish transparent quotes.

Look for: Clear refund/chargeback policy, live status page, and help docs mentioning “Google Pay crypto purchase”.

3. Create your account & pass KYC (name match matters)

Sign up using your full legal name (exactly as in Google Pay).

Complete basic KYC: government ID; add proof of address for higher limits.

Enable 2FA (authenticator app preferred) before you transact.

Fix declines fast: Name or DOB mismatches are a top cause of holds.

4. Select the asset & network (opt for lower on-chain fees when possible)

Choose your coin (e.g., BTC/ETH/USDT).

If buying stablecoins, consider a low-fee network your provider supports (e.g., TRON for USDT, or an L2 for ETH).

Double-check the destination network if sending to a self-custody wallet.

Network must match your wallet’s network—no cross-chain mistakes.

5. Enter the amount and review the full quote

Input fiat amount and review: processing fee, spread, estimated network fee, and final receive.

Scan for rate locks (how long your quote is valid) and any new user limits.

Do: Take a screenshot of the quote before paying.

6. Pay with Google Pay (3DS challenge)

Choose Google Pay at checkout and complete the 3-D Secure challenge if prompted.

Stay inside the official app/site; never complete payments from unsolicited links.

If 3DS fails, retry on the same device/browser with strong connectivity.

Lower the amount slightly, disable VPN, or try another 3DS-enabled card.

7. Settlement & receipt

Authorisation is near-instant; release can be immediate or short-delayed by risk checks.

Save the transaction receipt and provider reference (helps with support/tax).

Verify KYC status, recent activity flags, or request support chat escalation.

8. Secure storage & optional withdrawal

For custodial accounts, enable withdrawal allowlists and keep 2FA on.

For self-custody, back up your seed phrase offline and test a small send first.

Record your cost basis and fees for tax reporting.

Aggregate purchases (via Google Pay) then do one on-chain move to cut repeated fees.

3. Fees, Limits, and Settlement Times (What You’ll Actually Face)

When you buy crypto with Google Pay, your total cost and speed depend on three components and two guardrails.

The three cost components

Processing fee: charged by the exchange/on-ramp or its card processor (commonly a percentage; sometimes tiered).

Spread: the gap between mid-market price and your quoted rate (widens during volatility or low liquidity).

Network fee: blockchain fee if coins are moved on-chain to your wallet (varies by asset/network congestion).

Quick rule: Small, instant buys via a Google Pay crypto purchase prioritise speed over the absolute lowest fee. For larger tickets, bank transfer rails often win on cost.

Typical patterns (illustrative)

<$300: expect a higher % total but near-instant authorisation.

$300–$2,000: fees stabilise; spreads shrink during calm markets.

$2,000: consider bank transfer on-ramps for lower %; Google Pay remains useful for speed or testing.

Limits and how to raise them

Per-transaction caps: driven by provider risk rules and your card profile.

Daily/30-day limits: tied to KYC tiers (basic vs enhanced).

How to unlock more: complete enhanced KYC (ID + proof of address + sometimes source-of-funds), build a clean purchase history, and keep name/card details consistent.

Settlement timing you can expect

Authorisation: typically instant with Google Pay (3-D Secure may add seconds).

Release of crypto: immediate on many accounts; short holds may apply for new users, high amounts, or random risk checks.

On-chain delivery: if you withdraw to self-custody, timing = provider release + blockchain confirmation (faster on low-fee networks).

Cost-control tips (actionable)

Prefer low-fee networks for stablecoins (e.g., TRON for USDT where supported, or an L2 for ERC-20 assets).

Batch small purchases, then perform one on-chain transfer to reduce repeated network fees.

Check the rate-lock window on your quote; confirm before it expires to avoid a worse spread.

Keep a record of fees + cost basis for tax and reconciliations.

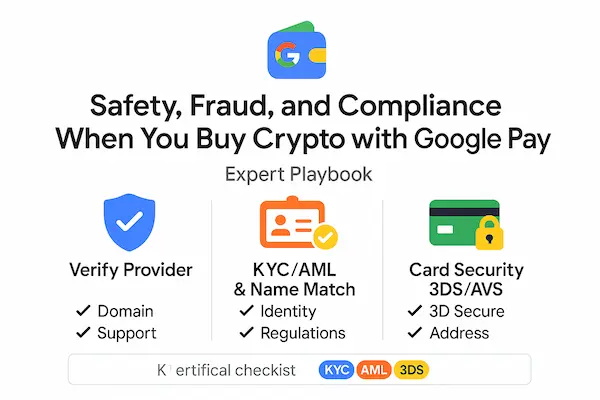

4. Safety, Fraud, and Compliance When You Buy Crypto with Google Pay

Buying fast is great—staying safe is non-negotiable. Use this section to minimise disputes, holds, and scams when you buy crypto with Google Pay.

1. Verify Provider Legitimacy Before Paying

Licensing & footprint: Prefer regulated exchanges/on-ramps with visible licences and a real company address.

Domain hygiene: Bookmark the official domain; avoid links from DMs/pop-ups. Check SSL and typo-domains.

Support surface: 24/7 chat or ticketing, documented Google Pay steps, and a public status page.

2. KYC/AML & Name Match (Top Reason for Holds)

Exact legal name on your account must match the Google Pay card profile.

Have ID + proof of address ready; enhanced tiers unlock higher limits and fewer manual reviews.

If asked, provide source-of-funds (bank statement/pay slip) to clear large or first-time transactions.

3. Pass Card Security: 3-D Secure, AVS, CVV

Complete 3DS on the same device/browser you used for checkout; strong signal reduces false declines.

Ensure your billing address and postcode are AVS-accurate; fix typos before retrying.

If your bank blocks crypto MCC, call ahead or use a different 3DS-enabled card.

4. Chargebacks, Refunds, and Disputes on Card Rails

Know the window: card networks allow dispute periods; providers may hold coins for risk.

Document everything: keep the quote screenshot, receipt, and provider reference ID.

Refund path: read the provider’s policy for cancelled/failed Google Pay crypto purchases.

5. Anti-Phishing & Session Hygiene Checklist

✅ Navigate from your own bookmark, not in-app webviews or ad redirects

✅ Check the padlock + full domain; avoid shortened URLs

✅ Use authenticator-based 2FA (not SMS) on account and email

✅ No public Wi-Fi; keep OS/browser up-to-date; disable shady extensions

✅ Never share OTP/3DS codes in chats—support will never ask

6. Data Privacy & Device Security (Do This Once)

Turn on passkeys or hardware-key 2FA where supported.

Create an allowlist for withdrawal addresses on custodial accounts.

For self-custody, back up your seed phrase offline; test a small on-chain send first.

7. Red Flags That Signal a Risky Google Pay Crypto Checkout

“Too-good-to-be-true” rates, pressure countdown timers, or mandatory off-platform chat.

Payment page loads inside a framed window or third-party mirror.

Provider refuses to show company details, licences, or fee tables.

8. If Funds Are Delayed: 7-Minute Triage

Confirm authorisation succeeded in your Google Pay/card app.

Check the provider’s status page and notifications.

Verify KYC shows “approved”; re-submit any failed checks.

Review limits (new-user or per-transaction caps).

Inspect email for risk review requests (SOF/POA).

Open a support ticket with timestamp, amount, last 4 digits, and receipt.

Avoid repeated retries until support responds (prevents duplicate flags).

9. Regional Compliance Pointers (General, Non-Exhaustive)

US/UK/EU: Expect stricter KYC and clearer receipts; bank transfers may be cheaper for large orders.

SG/HK: Licensed providers often faster to release; keep proof of address current.

IN/selected markets: Availability can be limited; always confirm Google Pay support and local card policies.

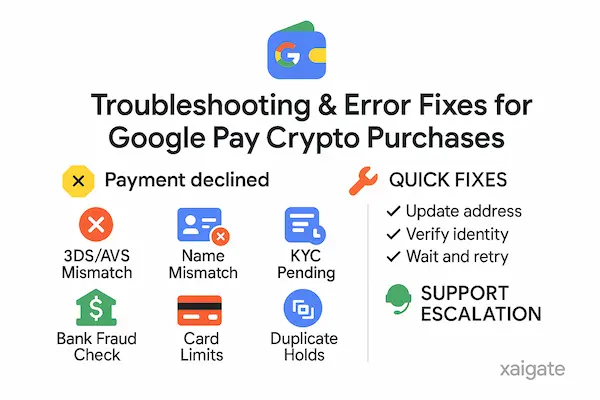

5. Troubleshooting & Error Fixes for Google Pay Crypto Purchases

Run through these targeted fixes when you buy crypto with Google Pay and something breaks. Keep your device/browser ready; most issues resolve in minutes.

1. “Payment method not available” at checkout

Likely causes: unsupported region/card, temporary provider block, velocity limits.

Fix fast:

Switch to a 3DS-enabled debit/credit card in Google Pay.

Reduce the amount by 10–20% and retry.

Disable VPN/proxy; retry on the same device/browser.

If the provider is down, use a listed alternative on-ramp or card-on-file.

2. “Verification required” / KYC pending or failed

Likely causes: name mismatch with Google Pay profile, low-quality ID scans.

Fix fast:

Re-submit KYC with exact legal name (must match Google Pay card).

Use bright, flat lighting; upload front/back ID + proof of address.

Clear cache, relaunch app, and re-open the verification flow.

3. Card declined (AVS/CVV mismatch, bank block)

Likely causes: wrong billing address/ZIP, bank blocks crypto MCC.

Fix fast:

Ensure billing address exactly matches your bank statement.

Call the bank to allow online/foreign/crypto merchant codes.

Try a smaller test purchase, then scale.

4. 3-D Secure (3DS) challenge doesn’t appear or fails

Likely causes: pop-up blocked, weak signal, app-in-webview quirks.

Fix fast:

Use the same device/browser end-to-end; disable content blockers.

Switch to stable Wi-Fi or cellular; retry the Google Pay flow.

If the bank app requests approval, open it immediately and confirm.

5. Name or profile mismatch holds your order

Likely causes: nickname in Google Pay, different middle name, diacritics mismatch.

Fix fast:

Align account name = Google Pay card name = ID name.

Re-run KYC; upload a bank statement with the same name as secondary proof.

6. Quote expired / price changed mid-checkout

Likely causes: rate-lock window elapsed, volatile market.

Fix fast:

Refresh the quote and confirm within the rate-lock time.

Avoid switching tabs/apps during checkout.

7. “Processing” for too long after authorisation

Likely causes: first purchase risk checks, random review, high amount.

Fix fast:

Verify KYC shows Approved and limits aren’t exceeded.

Check provider status page; avoid repeat payments.

Open support with timestamp, amount, last 4 digits, receipt.

8. Duplicate charge concern

Likely causes: multiple retries, page refresh during 3DS.

Fix fast:

Check card app for authorisation holds vs posted transactions.

Contact support before retrying; provide the previous attempt ID.

9. Refunds & chargebacks on Google Pay crypto purchases

Know this: card rails allow disputes; providers may withhold coin release if a refund/chargeback occurs.

Fix fast:

Use the provider’s refund flow first; document everything (quote screenshot, receipt).

If unresolved, escalate via bank dispute with full evidence.

10. VPN/proxy, device, or extension conflicts

Likely causes: geolocation mismatch, script blockers, outdated app.

Fix fast:

Disable VPN/proxy; update app/browser; try a clean profile/incognito.

Remove suspicious extensions; restart the device.

One-Glance Fix Table

| Error message/symptom | Primary cause | Quick fix |

|---|---|---|

| Payment method not available | Region/card unsupported, velocity limit | 3DS card, lower amount, disable VPN, alternate on-ramp |

| Verification required | Name/ID mismatch, poor scans | Exact legal name, clear ID/POA re-upload |

| Card declined (AVS/CVV) | Billing mismatch, bank block | Correct address, call bank, smaller test |

| 3DS failed/no prompt | Pop-up blocked, weak signal | Same device/browser, stable network, reattempt |

| Quote expired | Rate-lock elapsed | Refresh quote, confirm within window |

| Processing too long | Risk review | Check KYC/limits, status page, open ticket |

| Duplicate charge worry | Multi-retries | Verify holds vs posts, contact support |

| Refund/chargeback | Policy disputes | Use provider refund, then bank with evidence |

6. Best Alternatives to Buying Crypto with Google Pay

If you can’t buy crypto with Google Pay in your region or on a specific provider, these rails keep you moving—often at a lower total cost for bigger tickets.

1. Bank Transfer On-Ramps (ACH / SEPA / FPS / FAST)

When to use: Larger buys where fees matter more than instant speed.

Pros: Lowest % fees, higher limits, strong audit trail.

Cons: Setup time, settlement can be same-day to T+2.

SEO cue: A solid fallback when a Google Pay crypto purchase is declined or capped.

2. Card-on-File (Visa/Mastercard) Without Google Pay

When to use: Your card works but the Google Pay toggle doesn’t appear.

Pros: Similar speed to GPay; broad acceptance.

Cons: Fees/spreads can match GPay; still needs 3DS + accurate billing.

3. P2P Marketplaces with Escrow (Licensed Platforms Only)

When to use: Regions with limited card support or strict banking.

Pros: Flexible pricing, many local payment methods.

Cons: Counterparty risk—stick to escrow, reputation scores, and in-platform chat only.

4. Vouchers/Cash Top-Up (Where Legal & Available)

When to use: Unbanked/underbanked scenarios or gift-card rails.

Pros: Convenient for cash-based users.

Cons: Fees can be higher; verify the issuer and redemption flow.

7. Availability by Region: Where You Can Buy Crypto with Google Pay

Coverage varies by jurisdiction and provider. Use this live snapshot as a guide, then confirm on the payment page before you buy crypto with Google Pay.

Add a “Last updated: YYYY-MM-DD (GMT+7)” line and a 2-bullet changelog whenever you edit fees/limits.

Table: Regional Support & Typical Costs

| Region/Country | Google Pay Support* | Typical Total Cost | Daily Limit (KYC1 / KYC2) | Notes for Buyers |

|---|---|---|---|---|

| United States | Many providers | ~1.5–3.0% + spread | ~$1k / ~$5k | 3DS required; bank transfer cheaper for large orders |

| European Union / EEA | Many providers | ~1.49–2.99% + spread | ~€1k / ~€5k | SEPA is a low-cost alternative for big tickets |

| United Kingdom | Many providers | ~1.5–3.0% + spread | ~£1k / ~£5k | FPS is fast; compare quotes before paying |

| Singapore | Provider-dependent | ~1.0–2.5% + spread | ~S$1k / ~S$5k | Local bank rails often competitive on fees |

| India | Limited/variable | ~1.5–3.0% + spread | Varies by bank/KYC | Card policies can restrict Google Pay crypto purchases |

| Hong Kong | Provider-dependent | ~1.2–2.5% + spread | HK$ caps vary | Check licensing + network options for stablecoins |

| Australia | Selected providers | ~1.5–3.0% + spread | A$ caps vary | 3DS, address accuracy, and bank policy matter |

8. Case Studies: Real Checks & Costs When You Buy Crypto with Google Pay

A few short, human stories from different markets. They show what people actually did, what it cost, and the tiny tweaks that made a Google Pay crypto purchase smoother the next time.

US: First-time $120 → USDT (TRON)

Mia added her debit card to Google Pay, passed basic KYC, and chose USDT on TRON to keep on-chain costs low. The Google Pay button appeared at checkout, 3-D Secure pinged her phone, and funds landed in ~2 minutes. Total cost was about $3. Next time she’ll leave the balance custodial until she aggregates, then do one transfer to her wallet.

EU: Returning €900 → BTC (L2 withdrawal)

Jonas already had enhanced KYC. He used Google Pay at checkout, locked the quote, and selected an L2 withdrawal rail supported by his exchange. Authorisation was instant; coins showed after two confirmations. Cost came to ~€17. He keeps a screenshot of the quote and prefers L2 over mainnet for cheaper exits.

Singapore: SME top-up S$3,500 → USDC (custodial → self-custody)

A small e-commerce team needed USDC quickly. The admin chose buy crypto with Google Pay, saw the custodial credit in ~3 minutes, then made a single outbound transfer to the company wallet on a low-fee network. End-to-end took under ten minutes. Lesson: batch the purchase, move on-chain once, and keep a withdrawal allowlist.

India: “Payment method not available,” then a clean retry

Arjun’s first Google Pay crypto purchase stalled at the payment screen. He switched to a 3DS-enabled debit card inside Google Pay, trimmed the amount by ~15%, and re-submitted sharper KYC photos. Authorisation passed; coins arrived after a short review. Name match + 3DS + a smaller first ticket solved it.

UK: Higher amount £6,000 → ETH (split orders)

Sophie hit a per-transaction cap. She split the buy into two £3,000 Google Pay orders. Each settled in 5–8 minutes, then she consolidated to an L2 to cut gas. Fees were reasonable overall. She’s now upgrading KYC so future buying Bitcoin or ETH with Google Pay won’t require splitting.

FAQs: Buy Crypto with Google Pay (2026)

1. Can I buy crypto with Google Pay directly?

Yes—if the exchange, wallet on-ramp, or dedicated on-ramp shows Google Pay at checkout. Add an eligible 3-D Secure card to Google Pay, pass KYC, select the asset/network, review fees, and confirm.

2. Which exchanges or wallets support Google Pay for crypto?

Support varies by region and licensing. Check the provider’s payment methods page or the checkout screen for a Google Pay badge before you buy.

3. Are Google Pay crypto purchases instant?

Authorisation is near-instant. Coin release can be immediate or briefly delayed by risk checks, KYC tier, ticket size, or first-time activity.

4. What fees apply when I buy crypto with Google Pay?

Total cost usually includes a processing fee and a price spread; a blockchain network fee may apply if funds move on-chain to your wallet.

5. What limits apply and how do I raise them?

Per-transaction, daily, and 30-day limits depend on provider policy, card profile, region, and your KYC tier. Completing enhanced KYC and building clean history typically raises limits.

6. Why was my Google Pay crypto payment declined?

Common causes are 3-D Secure failures, AVS/CVV mismatch, bank blocks on crypto MCCs, name/KYC mismatch, velocity limits, or expired quotes. Retry on the same device, correct billing, or contact your bank.

7. Which networks are cheapest for stablecoins when paying with Google Pay?

Use a supported low-fee rail such as TRON for USDT or an Ethereum Layer-2 for ERC-20 assets when available. Always match the destination network to your wallet.

8. Is Google Pay or bank transfer cheaper for larger buys?

Google Pay wins on speed for small/medium tickets. For larger amounts, bank transfer on-ramps typically offer lower percentage costs and higher limits.

Conclusion: Buy Crypto with Google Pay, Fast Today, Cheaper Tomorrow (Stay Updated)

If you want speed and a clean checkout, buying crypto with Google Pay is hard to beat. Add a 3-D Secure card, pass KYC, confirm the quote within its rate-lock window, and you’re done—often in minutes.

Quick Summary (What Matters at Checkout)

| Topic | What to check in 20 seconds |

|---|---|

| Provider | Licensed, shows the Google Pay button, clear fee table |

| Card & KYC | 3DS-enabled card; legal name matches KYC profile |

| Quote | Processing fee + spread, rate-lock time, final receive amount |

| Network | Pick low-fee rail (e.g., TRON for USDT or L2 for ERC-20) |

| Limits | Per-transaction + 30-day caps; enhanced KYC raises limits |

| Safety | Same device/browser for 3DS, verified domain, 2FA on |

| After buy | Save receipt, consider 1 on-chain transfer after aggregating |

Buy crypto with Google Pay vie XaiGate now!!!

Ready to move from “test buy” to reliable flows? Start with a small Google Pay purchase, verify fees and settlement time, then scale with enhanced KYC and low-fee networks.

Prefer predictable fees and developer-friendly reporting? XaiGate helps merchants integrate compliant on/off-ramps and stablecoin payouts. Get a guided setup and run your first live transaction in minutes.

Next steps

Do a $50–$100 test via Google Pay to confirm 3DS and timing.

Enable 2FA, set a withdrawal allowlist, and back up keys/seed if self-custody.

For larger buys, switch to bank transfer on-ramps, then move funds on-chain once to reduce fees.

Bookmark this guide and check the “Last updated” line before each purchase.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)!