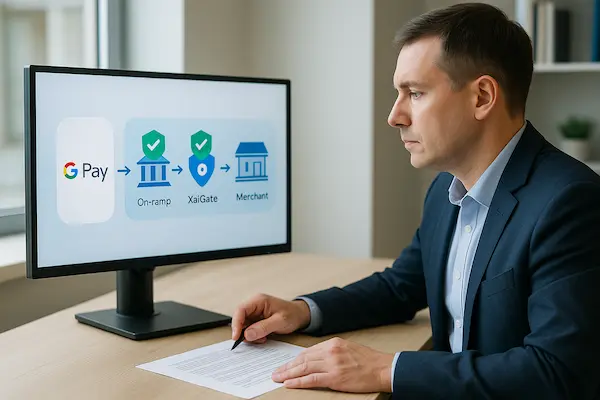

In 2025, more shoppers are using Google Pay to fund crypto and stablecoins, and merchants don’t want to miss that spend. Instead of trying to plug Google Pay directly into a wallet, this guide shows how to accept crypto via Google Pay for merchants using XaiGate by turning a simple “Google Pay → on-ramp → stablecoins → XaiGate → merchant” flow into a safe, compliant payment rail.

Contents

- 1 1. Key Takeaways for Merchants Who Want to Accept Crypto via Google Pay

- 2 2. What “Accept Crypto via Google Pay” Really Means for Merchants

- 3 3. Why Accept Crypto Funded via Google Pay? Business Benefits for Merchants

- 4 4. XaiGate’s Role in Accepting Crypto Paid via Google Pay

- 5 5. Step by Step: How Merchants Can Accept Crypto Paid via Google Pay Using XaiGate

- 6 6. Compliance and Risk: Combining Google Pay, Crypto and XaiGate Safely

- 7 7. Fees, Settlement Times and Volatility Management for Merchants

- 8 8. Comparison Table: Traditional Card vs Direct Crypto vs Crypto Funded via Google Pay

- 9 9. Regional and Policy Overview for Google Pay and Crypto (2025 Snapshot)

- 10 10. Real World Use Cases: Merchants Accepting Crypto Paid via Google Pay With XaiGate

- 11 11. Implementation Patterns with XaiGate for Google Pay Funded Crypto Payments

- 12 12. Future Trends: Google Pay, Stablecoins and Agent Based Payments for Merchants

- 13 FAQs – Accept Crypto via Google Pay for Merchants (Using XaiGate)

- 14 Conclusion – Turn Google Pay Funding Into Real Crypto Payments

1. Key Takeaways for Merchants Who Want to Accept Crypto via Google Pay

Before we dive into details, it helps to see the big picture. Accepting crypto via Google Pay is not a magic new button in your PSP; it’s a payment journey that starts with a familiar wallet and ends with a crypto gateway your finance team can trust.

- Google Pay stays on the card side; crypto lives on separate rails. You connect them with regulated on-ramps and XaiGate.

- The real architecture is “Google Pay → on-ramp → stablecoins → XaiGate → merchant”. Customers fund crypto; you get paid through XaiGate.

- Stablecoins keep numbers stable for your team. Assets like USDT or USDC make pricing and reconciliation easier than volatile coins.

- XaiGate acts as your crypto payment layer. It abstracts networks, coins and confirmations so you can focus on product, not wallets and nodes.

2. What “Accept Crypto via Google Pay” Really Means for Merchants

The phrase “accept crypto via Google Pay for merchants” can be confusing if you imagine Google Pay sending coins straight into your business wallet. In reality, Google Pay sits on the card side and crypto sits on separate rails. The two worlds only meet when you add a regulated on-ramp and a crypto payment gateway like XaiGate.

Google Pay Is a Funding Method, Not a Crypto Rail

Google Pay is a tokenized card wallet. It stores card details securely, shortens checkout, and lets customers pay with their phone instead of typing card numbers. It does not hold private keys and it does not broadcast blockchain transactions for your business.

So when you tell customers that you accept crypto paid via Google Pay, what really happens is simple. They use Google Pay to pay an on-ramp in fiat. The on-ramp converts that fiat into crypto or stablecoins and sends the assets to a wallet that the customer controls.

The Real Flow: Google Pay → On Ramp → Stablecoins → XaiGate → Merchant

Once the on-ramp delivers stablecoins, the crypto part of the journey begins and XaiGate takes over as the gateway on your side:

- The customer uses Google Pay on a licensed on-ramp to buy stablecoins.

- The stablecoins arrive in the customer’s wallet.

- At your checkout, XaiGate shows a payment request with the exact amount and a QR code or address.

- The customer sends the stablecoins from their wallet to XaiGate.

- You receive the value in your XaiGate merchant account, either as stablecoins or as fiat, depending on your settings.

To the shopper, it feels like one smooth journey that starts with Google Pay and ends with a crypto payment. To you, it is a clear, auditable architecture that lets you accept crypto paid via Google Pay without breaking how either system is designed to work.

3. Why Accept Crypto Funded via Google Pay? Business Benefits for Merchants

For merchants, payments are about conversion, reach and risk, not just adding more logos. Using XaiGate to accept crypto via Google Pay for merchants lets you keep a familiar Google Pay experience for shoppers while moving settlement onto fast, stablecoin based rails.

1. Higher Conversion with a Familiar Google Pay Experience

Customers already trust Google Pay and know how to use it. If they can tap Google Pay to fund crypto on a regulated on ramp and then pay you through XaiGate, they stay in a flow that feels simple and safe. Less friction at checkout usually means fewer abandoned carts and more completed orders.

2. Access to Global Buyers and Stablecoin Spending Power

Card payments can fail or become expensive across borders. When buyers use Google Pay to fund stablecoins in their own region and then pay you in those stablecoins, you gain wider reach with prices that still map cleanly to fiat. XaiGate aggregates these payments for you so your team does not have to manage multiple wallets or networks.

3. Less Chargeback Risk and Faster Settlement

On the Google Pay side, disputes live between the customer, their card issuer and the on ramp. On the crypto side, payments sent through XaiGate are push transactions recorded on chain, not pull based card debits. That means fewer chargebacks against your business and faster, more predictable settlement in stablecoins or fiat, depending on how you configure your XaiGate account.

Used together with stablecoins, this gives a practical way to accept crypto via Google Pay for merchants that want better conversion and reach.

4. XaiGate’s Role in Accepting Crypto Paid via Google Pay

Once Google Pay and the on ramp have done the funding, you still need a clean way to receive and reconcile the crypto. XaiGate is the layer that turns that technical flow into a usable payment method so you can accept crypto via Google Pay for merchants without becoming a blockchain expert.

1. XaiGate as the Crypto Payment Gateway Layer

XaiGate sits between your customer’s wallet and your back office systems. It:

- Generates payment requests and QR codes for each order

- Watches the network and confirms when funds arrive

- Shows every crypto payment in a simple merchant dashboard

You keep control of prices and checkout UX while XaiGate handles the on chain work in the background.

2. Supported Assets and Networks for Google Pay Funded Crypto

Most buyers who fund crypto with Google Pay end up with stablecoins on popular networks. XaiGate is built for that reality. You can:

- Select which coins and stablecoins you accept

- Use fast, low fee networks that match your users

- Decide whether you hold value in stablecoins or convert to fiat

This keeps the journey smooth for customers and makes accounting easier for your team.

3. Plugins, APIs and Payment Links for Merchants

XaiGate fits different merchant profiles and tech stacks:

- Ready made plugins for common ecommerce platforms

- An API for custom sites or mobile apps

- Simple payment links and invoices for merchants who do not want to touch code

You can start with payment links to test demand from customers who fund crypto with Google Pay, then move to a deeper integration later while keeping XaiGate as your single crypto gateway.

In day to day work, this is how XaiGate quietly powers the stack behind you to accept crypto via Google Pay for merchants without adding technical debt.

5. Step by Step: How Merchants Can Accept Crypto Paid via Google Pay Using XaiGate

You do not need a complex project to accept crypto via Google Pay for merchants. Follow these short steps and you have a working flow you can test and scale later.

1. Check Your Jurisdiction and Business Model

Confirm where card funded crypto is allowed and whether your business type has extra rules.

Ask legal or compliance to review how you mention Google Pay and crypto on your site.

2. Choose the Crypto and Stablecoins You Will Accept

Start with one or two major stablecoins so pricing matches your fiat catalog.

Pick networks that are cheap and fast and that customers can reach easily from common on ramps.

3. Open and Configure Your XaiGate Merchant Account

Create your XaiGate account and complete onboarding.

Enable your chosen assets and networks, then set how you want to receive value in stablecoins or in fiat.

4. Integrate XaiGate into Your Website or App

If you use a supported ecommerce platform, install the XaiGate plugin and enable “Pay with crypto” at checkout.

If you run a custom site, use the API or begin with payment links and invoices to test demand.

5. Explain the Google Pay Funded Crypto Flow to Customers

Add a short help block near checkout, for example.

Use Google Pay on a listed on ramp to buy stablecoins, select “Pay with crypto”, scan the XaiGate QR code and send the exact amount.

6. Test, Monitor and Adjust

Run a few small internal payments and check orders, XaiGate status and reconciliation.

After launch, watch completion rate and support questions, then refine wording and settings until this new rail feels as stable as your existing payment methods.

Once these steps are live, you have a simple but complete flow that lets you accept crypto via Google Pay for merchants in a controlled and testable way.

6. Compliance and Risk: Combining Google Pay, Crypto and XaiGate Safely

To accept crypto via Google Pay for merchants in a serious way, you need a clean story on rules, roles and records. Think simple, but documented.

1. Respect Local Rules and Google Pay Policies

- Check where card funded crypto and stablecoins are allowed for your business type.

- Read the terms of Google Pay and the on ramps you plan to mention.

- In all copy, say that customers fund crypto using Google Pay on licensed partners, not that Google Pay sends crypto directly to you.

2. Map Where KYC and AML Happen

- On ramp: KYC and card side AML when the customer uses Google Pay.

- XaiGate: crypto side checks, address screening and risk monitoring.

- Your company: knowing your customer and why they pay you.

Put this in one simple diagram so legal, compliance and product all see the same flow.

3. Define Disputes, Refunds and Records

- Card and Google Pay disputes stay between the customer, issuer and on ramp.

- For refunds on the crypto side, write a short policy for when you refund in stablecoins and when you refund in fiat.

- Keep clear logs from XaiGate, your order system and your accounting tool so each payment funded via Google Pay can be traced end to end.

With these three blocks in place, you can offer a modern crypto option while still showing that risk and compliance are under control.

With this split of duties, you can explain to regulators exactly how you accept crypto via Google Pay for merchants while keeping risk inside clear boundaries.

7. Fees, Settlement Times and Volatility Management for Merchants

When you accept crypto via Google Pay for merchants with XaiGate, think in three quick blocks: cost, speed, and price risk.

1. What the Customer Pays

- On ramp fee or spread when they buy crypto with Google Pay

- Network fee when they send crypto to your XaiGate address

You can ease the pain by recommending low fee networks and trusted on ramps in your help docs.

2. What Your Business Pays

- XaiGate processing fees

- Optional conversion cost from crypto or stablecoins to fiat

For cross border or high value payments, this is often similar to or better than card costs. Track it like any other payment rail.

3. Managing Volatility With Stablecoins

- Make one or two major stablecoins your main assets

- Let XaiGate convert volatile coins into those stablecoins

- Set a simple rule: what part you keep in stablecoins and what part you auto convert to fiat

So you get the benefits of crypto funded by Google Pay, while still planning and reporting in normal fiat.

8. Comparison Table: Traditional Card vs Direct Crypto vs Crypto Funded via Google Pay

When you explain this idea inside your team, a simple side by side view helps a lot. The table below compares classic card payments, direct crypto, and the flow where customers fund crypto with Google Pay and pay you through XaiGate. It shows why this new rail can make sense when you want to accept crypto via Google Pay for merchants.

Table 1. Comparing payment flows for merchants

| Flow type | Who controls customer UX | Funding source | Settlement asset for merchant | Chargeback risk | Typical settlement speed | Best suited for |

|---|---|---|---|---|---|---|

| Traditional card payment via Google Pay | Google Pay, card issuer, PSP | Customer card via Google Pay | Fiat currency | High, card chargebacks possible | T+1 to T+7 depending on acquirer | Mainstream domestic buyers, standard ecommerce and subscriptions |

| Direct crypto payment (customer already holds crypto) | Merchant and customer wallet | Existing crypto balance | Crypto or stablecoins | Low, on chain push payment | Near real time after confirmation | Crypto native users, web3 projects, DeFi and NFT flows |

| Crypto funded via Google Pay, paid through XaiGate | Google Pay, on ramp, merchant, XaiGate | Customer card via Google Pay on an on ramp | Stablecoins or fiat via XaiGate | Low, on chain push payment | Near real time on chain, fiat on payout schedule | Merchants who want to accept crypto via Google Pay, cross border buyers, stablecoin friendly markets |

How to use this table internally

- Product teams can use it to decide when to offer each option at checkout and where a crypto funded via Google Pay flow adds real value.

- Finance teams can compare cost, settlement time and chargeback exposure across the three rails.

- Compliance teams can see who controls each part of the journey and where card rules end and crypto rules start when you accept crypto via Google Pay for merchants with XaiGate.

9. Regional and Policy Overview for Google Pay and Crypto (2025 Snapshot)

How you accept crypto via Google Pay for merchants will vary by region. The table below gives a quick 2025 snapshot so you can see where to launch first, where to move carefully and where to avoid this flow for now.

Table 2. Regional snapshot for Google Pay funded crypto

| Region type | Example focus markets | Google Pay + crypto reality (high level) | Merchant opportunity with XaiGate | Notes and caution points |

|---|---|---|---|---|

| Mature and relatively clear | US, EU, UK, selected APAC markets | Licensed on ramps and clearer rules in many segments | Good place to launch and test Google Pay funded crypto with XaiGate | Still need to pick compliant on ramps and keep copy accurate |

| Growing but rules still evolving | Parts of Asia, LatAm, MENA | Fast wallet growth, mixed clarity on card funded crypto | Pilot with limited messaging and monitor regulation closely | Treat guidance as changing and update playbooks regularly |

| Sensitive or heavily restricted | Markets with strict card–crypto rules | Card funded crypto limited, discouraged or unclear | Focus on other rails with XaiGate and avoid promoting this journey | Get legal advice before linking Google Pay and crypto in any way |

1. Markets Where Launching Is Straightforward

In mature markets, your main tasks are choosing compliant on ramps that support Google Pay, matching their assets in XaiGate and keeping your wording precise about how customers fund and pay.

2. Markets Where You Move Carefully

In growth markets with shifting rules, use soft launches, keep an updated note on local guidance and be ready to adjust or pause the Google Pay funded flow if regulators change direction.

3. Markets You Park for Later

Where card funded crypto is sensitive or tightly restricted, do not promote any Google Pay to crypto path. Use XaiGate for other rails and keep a short legal memo explaining why this specific flow is not offered there.

10. Real World Use Cases: Merchants Accepting Crypto Paid via Google Pay With XaiGate

These short examples show when it really makes sense to accept crypto via Google Pay for merchants using XaiGate.

1. Cross Border Ecommerce Brand

A fashion store in Europe sells to Asia and LatAm, where cards often fail or are expensive.

They suggest trusted on ramps that support Google Pay, let customers fund stablecoins and pay via XaiGate, then settle part in stablecoins and part in euros.

Result: more completed international orders and fewer card issues.

2. Global SaaS Merchant

A SaaS business charges customers worldwide and wants one extra rail for bigger or cross border invoices.

It adds “Pay with crypto”, explains how to fund stablecoins with Google Pay, and uses XaiGate to match each payment to a subscription.

Result: more flexibility for customers while finance still reports in fiat.

3. SME Importer Paying Suppliers

A small importer finds bank transfers to overseas suppliers slow and costly.

It funds stablecoins using Google Pay on a compliant on ramp, then pays suppliers through XaiGate payment links and tracks everything in the portal.

Result: faster supplier payments and clean records for every crypto transfer funded by Google Pay.

These examples show that the same pattern can be reused across many verticals whenever you want to accept crypto via Google Pay for merchants in a real business.

11. Implementation Patterns with XaiGate for Google Pay Funded Crypto Payments

You do not have to redesign your whole stack to accept crypto via Google Pay for merchants. XaiGate fits into different setups, from simple to advanced.

1. Plug and play on ecommerce platforms

If your store runs on a supported platform:

- install the XaiGate plugin

- connect your merchant account

- enable “Pay with crypto” at checkout

This is the fastest way to test crypto funded by Google Pay without writing code.

2. Custom websites and mobile apps with the API

If you own your stack:

- call the XaiGate API to create payment requests

- render your own UI for amount, QR code and status

- sync payment events back into your order system

You keep full control of UX while XaiGate handles pricing and on chain monitoring.

3. No code payment links and invoices for SMEs

If you want to start small:

- create payment links or invoices inside XaiGate

- share them by email, chat or messaging apps

- let customers fund stablecoins with Google Pay and pay those links

This gives you a quick way to see real volume before investing in deeper integration.

12. Future Trends: Google Pay, Stablecoins and Agent Based Payments for Merchants

The way customers pay is shifting fast. Building a clear flow now to accept crypto via Google Pay for merchants puts you in a good position for the next wave.

1. More on ramps and wallets supporting Google Pay

More licensed on ramps are adding Google Pay as a funding option.

That means more customers will be able to move from card to stablecoins in a few taps and then pay you through XaiGate.

2. Stablecoins moving closer to real time payments

Stablecoins are increasingly used for near instant settlement, especially across borders.

If your business already accepts stablecoins via XaiGate, funded by Google Pay or not, you are ready to plug into faster B2B and B2C flows.

3. Merchant systems that speak both card and crypto

Over time, merchants will not think in “card vs crypto” but in “which rail is best for this customer and this ticket size”.

By adding XaiGate now as your crypto layer, you prepare your stack for a future where Google Pay funding and stablecoin settlement sit naturally alongside cards, bank transfers and local methods.

FAQs – Accept Crypto via Google Pay for Merchants (Using XaiGate)

1. Can merchants accept crypto that customers funded via Google Pay?

Yes. Customers can use Google Pay on a licensed on ramp to buy crypto or stablecoins, then pay your business through XaiGate. In practice, this is how you accept crypto via Google Pay for merchants today.

2. Does Google Pay send crypto directly to my business wallet?

No. Google Pay is a tokenized card wallet, not a crypto wallet. It pays the on ramp in fiat, and the on ramp converts that into crypto or stablecoins.

3. How does the Google Pay to XaiGate flow work in simple terms?

Customers use Google Pay on an on ramp to buy stablecoins, receive them in their wallet, choose “Pay with crypto” at your checkout, scan the XaiGate QR code, and you receive the value in your XaiGate merchant account.

4. Is this Google Pay funded crypto flow available in every country?

No. Using Google Pay to fund crypto depends on the customer’s country and the on ramps you work with. Merchants should check local rules before promoting this flow.

5. What is XaiGate’s role in this setup?

XaiGate receives the on chain payment, tracks confirmations, locks the rate, and shows all crypto transactions in one merchant dashboard that your team can work with.

6. What fees should merchants expect?

Customers pay on ramp fees and network fees. Merchants pay XaiGate processing fees and any optional cost to convert from crypto or stablecoins into fiat.

7. Can XaiGate help manage volatility with stablecoins?

Yes. You can accept several coins but auto convert them into one or two main stablecoins, then decide how much to keep in stablecoins and how much to convert to fiat on a schedule.

8. How is compliance handled when I accept crypto paid via Google Pay?

The on ramp performs KYC and AML checks on the card and Google Pay side. XaiGate handles crypto side monitoring. Your business still needs to know who your customers are and why they are paying you.

Conclusion – Turn Google Pay Funding Into Real Crypto Payments

Customers are already using Google Pay to fund crypto and stablecoins. The merchants who win are the ones who give them a clear, safe way to spend that balance. With one well designed flow Google Pay → on ramp → stablecoins → XaiGate → merchant you turn a funding method into a real payment rail and quietly accept crypto via Google Pay for merchants in a way your finance and compliance teams can explain.

Quick summary at a glance

| What you gain | What you must prepare | What XaiGate handles |

|---|---|---|

| Extra rail for global and high value customers | Clear Google Pay to on ramp to stablecoin to checkout flow | On chain payments, rates, confirmations, dashboard |

| Fewer card issues on cross border transactions | Basic legal review per region and on ramp partners | Unified view of all crypto transactions |

| Stable, trackable revenue from crypto payments | Simple rules on assets, refunds and settlement preferences | Working with stablecoins or fiat without new infra |

What to do next

If you are planning your next payment upgrade, this is a good moment to test how you can accept crypto via Google Pay for merchants using XaiGate in one or two key markets first.

Keep it small and real to start, then scale what works:

- Open a free XaiGate merchant account and enable one or two main stablecoins.

- Add a “Pay with crypto” option plus a short help block that explains how customers can fund crypto with Google Pay on trusted on ramps.

- Run a few live test payments end to end, measure completion rate and feedback, then decide how big this rail should be in your payment mix.

Once you see real customers completing this journey, you are no longer just talking about future payments. You are already accepting crypto paid via Google Pay and using XaiGate to turn it into a stable, everyday part of your business.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)!