The emergence of cryptocurrency brings additional opportunities to local businesses to increase the scope of payment they offer and get access to more tech-savvy customers. But what scares numerous business owners to start embracing crypto payments is the thought that they are not compliant with regulations, and it is not going to be a fun time to pay taxes. This is a general guide to get you to realize how you can safely accept crypto payments without legal in your business without putting a foot on the wrong side of the law.

The truth is, you don’t have to be a tech wizard or a legal expert to start accepting crypto in a safe, compliant way. You just need the right guidance, a solid setup, and a little foresight. This guide breaks it all down—without jargon or hype—so you can take the first step toward modernizing your payments without inviting legal trouble. Whether you run a boutique, a café, or a freelance business, you’ll discover that adding crypto to your payment options is not only doable but smart for the future.

Contents

- 1 Understanding the Current Regulatory Landscape

- 2 Essential Legal Requirements for Local Businesses

- 3 Choosing the Right Payment Processing Solution

- 4 Implementation Strategies for Different Business Types

- 5 Best Practices for Legal Compliance

- 6 Common Legal Pitfalls to Avoid

- 7 Staying Current with Regulatory Changes

- 8 Building Customer Confidence

- 9 Financial Management and Accounting

- 10 Table 3: Compliance Checklist for Local Businesses

- 11 Future-Proofing Your Crypto Payment Strategy

- 12 Stablecoin Regulation Is Becoming a Game Changer for Crypto-Ready Businesses in 2026

- 13 IRS Enforcement on Crypto Income Is Here—Small Business Owners Can’t Afford to Wing It Anymore

- 14 Conclusion

- 15 Frequently Asked Questions – How Local Businesses Can Accept Crypto Payments Without Legal Headaches

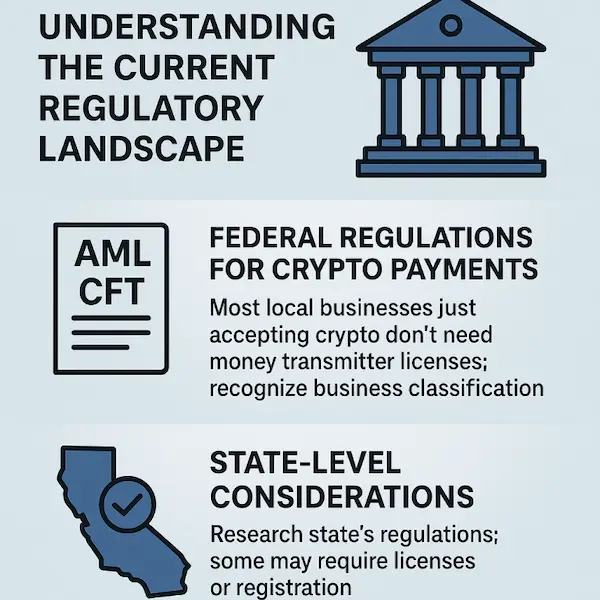

Understanding the Current Regulatory Landscape

Federal Regulations for Crypto Payments

The US has come up with a sophisticated yet manageable regulatory structure of the business that accepts cryptocurrency. Anti-money laundering (AML) and countering the financing of terrorism (CFT) standards still remain central to the regulatory framework of the cryptocurrency industry in 2026 and much of the cryptocurrency industry in most states will require money transmitter licenses in order to operate.

To the majority of local companies that merely accept crypto payments without legal, the burden of regulation is much lower than in case of being a crypto exchange or trading platform. The most important factor is the recognition of what classification your business takes under the existing rules.

State-Level Considerations

States have different regulation approaches to cryptocurrency. At the state level, various bills defining cryptocurrency and permitting the receipt of payments in cryptocurrency by the state agencies have been under discussion in the state legislatures, a positive sign of increased acceptance.

Conduct research on your state, before using cryptocurrencies as payment. There are states that might need other licenses or registration, whereas others already have a simplified procedure concerning businesses, which merely accept crypto payments without legal.

Essential Legal Requirements for Local Businesses

Know Your Customer (KYC) and Anti-Money Laundering (AML)

Most local businesses accepting crypto payments are not subject to full KYC/AML requirements that apply to exchanges and money transmitters. However, businesses should still implement basic verification procedures, especially for large transactions.

Consider these practical steps:

- Set reasonable transaction limits for crypto payments

- Maintain records of crypto transactions

- Implement basic customer identification for transactions over $1,000

- Report suspicious activities to appropriate authorities

Tax Reporting Obligations

For U.S. tax purposes, digital assets are considered property, not currency, which means accepting crypto payments has specific tax implications.

Business Income Reporting

When you receive cryptocurrency as payment, accept crypto payments without legal, you must report the fair market value at the time of receipt as business income. If employees are paid with digital assets, they must report the value of assets received as wages, and independent contractors must report income on Schedule C.

Record-Keeping Requirements

Businesses are required to report cryptocurrency income on IRS Form 1040 (for individual taxpayers) or Form 1120 (for corporations), with specific forms like Form 8949 and Schedule D required for reporting capital gains.

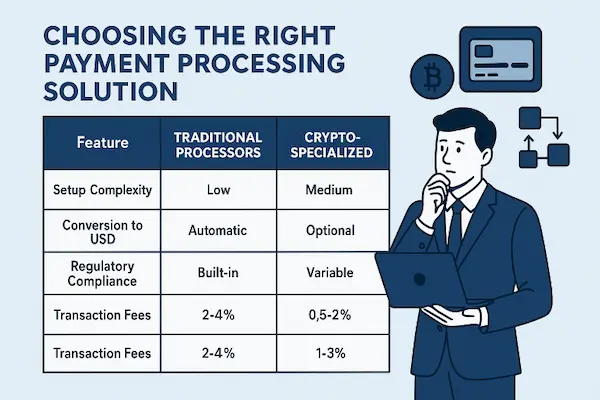

Choosing the Right Payment Processing Solution

Table 1: Crypto Payment Processor Comparison

| Feature | Traditional Processors | Crypto-Specialized | Hybrid Solutions |

| Setup Complexity | Low | Medium | Low-Medium |

| Conversion to USD | Automatic | Optional | Automatic |

| Regulatory Compliance | Built-in | Variable | Built-in |

| Transaction Fees | 2-4% | 0.5-2% | 1-3% |

| Customer Support | Excellent | Good | Good-Excellent |

Recommended Processing Options to accept crypto payments without legal

For beginners: Start with established payment processors that offer crypto integration. These typically handle compliance automatically and convert crypto to traditional currency immediately.

For advanced users: Consider specialized crypto payment gateways that offer more control over the process and potentially lower fees.

Implementation Strategies for Different Business Types

Retail Stores

Physical retail locations have unique considerations when implementing crypto payments:

- Point-of-sale integration – Ensure your POS system can handle crypto transactions seamlessly

- Staff training – Employees need basic understanding of crypto payment processing

- Customer education – Display clear instructions for crypto payment options

- Network reliability – Ensure stable internet for transaction processing

Service-Based Businesses

Professional services, contractors, and consultants can benefit significantly from crypto payments:

- Faster international payments without banking delays

- Reduced chargebacks compared to credit cards

- Appeal to tech-forward clientele

- Potential for automated smart contract payments

Table 2: Implementation Timeline by Business Type

| Business Type | Setup Time | Training Required | Regulatory Prep |

| Retail (Physical) | 1-2 weeks | 4-8 hours | Minimal |

| E-commerce | 3-5 days | 2-4 hours | Basic |

| Professional Services | 1 week | 2-3 hours | Basic |

| Restaurants | 1-2 weeks | 6-10 hours | Minimal |

| B2B Services | 2-3 weeks | 4-6 hours | Moderate |

Best Practices for Legal Compliance

Documentation and Record-Keeping

Maintaining proper records is crucial for accepting crypto payments without legal headaches. Follow these guidelines:

- Transaction records – Keep detailed logs of all crypto transactions including dates, amounts, and customer information

- Market value documentation – Record the USD value at the time of each transaction

- Wallet management – Maintain secure records of wallet addresses and private keys

- Tax preparation – Use specialized software to track crypto income and capital gains

Security Measures accept crypto payments without legal

Protecting your business and customers requires robust security practices:

- Use reputable wallet providers with insurance coverage

- Implement multi-signature wallets for large amounts

- Regular security audits and updates

- Employee training on crypto security best practices

- Clear policies for handling customer crypto data

Common Legal Pitfalls to Avoid

Misclassification of Business Type

One of the biggest mistakes businesses make is misunderstanding their regulatory classification. Most local businesses accepting crypto payments are not money transmitters and don’t need expensive licenses.

However, if your business:

- Exchanges crypto for other cryptocurrencies

- Holds customer funds for extended periods

- Provides crypto trading services

- Acts as an intermediary between crypto buyers and sellers

You may need additional licensing and compliance measures.

Tax Reporting Errors

Starting in 2026, cryptocurrency exchanges will be required to send 1099-DA forms, and brokers must issue these forms to report digital asset sales or exchanges. However, businesses are still responsible for accurate reporting regardless of whether they receive these forms.

Common tax mistakes include:

- Failing to report crypto income at fair market value

- Not tracking basis for capital gains calculations

- Mixing personal and business crypto transactions

- Inadequate record-keeping for audit purposes

Staying Current with Regulatory Changes

Recent Legislative Developments

Recent legislation includes the GENIUS Act regulating payment stablecoins with requirements for full reserve backing and monthly audits, and the CLARITY Act defining how digital assets are treated under federal securities laws.

Early 2026 has seen legislative proposals for stricter disclosure requirements and improved operational transparency for stablecoin issuers, which may affect businesses using stablecoins for payments.

Monitoring Resources

Stay informed about regulatory changes through:

- IRS cryptocurrency guidance updates

- State financial services department announcements

- Industry associations and trade groups

- Professional tax and legal advisors

- Regulatory news from reputable financial sources

Building Customer Confidence

Transparency and Education

Customers may be hesitant to accept crypto payments without legal due to unfamiliarity or security concerns. Address these by:

- Clear payment policies – Explain your crypto payment process in simple terms

- Security assurances – Detail the security measures you use to protect transactions

- Refund policies – Clarify how refunds work with crypto payments

- Customer support – Provide knowledgeable staff to assist with crypto payments

Marketing Your Crypto Acceptance

Effectively promoting your crypto payment option can attract new customers:

- Display crypto acceptance prominently in your store and online

- Use social media to announce your accept crypto payments without legal capability

- Partner with local crypto communities and meetups

- Highlight benefits like faster transactions and lower fees

Financial Management and Accounting

Handling Price Volatility

Cryptocurrency prices can be volatile, which creates challenges for business accounting:

Immediate conversion strategy: Convert crypto to USD immediately upon receipt to minimize volatility risk.

Holding strategy: Keep some crypto as an investment, but understand the tax and accounting implications.

Hybrid approach: Convert a percentage immediately while holding some for potential appreciation.

Integration with Existing Accounting Systems

Most modern accounting software can integrate with crypto payment processors. Consider:

- Automatic transaction import from payment processors

- Real-time USD conversion rate tracking

- Separate crypto and traditional payment reconciliation

- Year-end reporting capabilities for tax preparation

Table 3: Compliance Checklist for Local Businesses

| Requirement | Action Items | Frequency | Priority |

| Transaction Recording | Log all crypto payments with USD values | Daily | High |

| Tax Reporting | File appropriate forms with accurate crypto income | Annual | High |

| Security Updates | Update wallet software and security protocols | Monthly | High |

| Regulatory Monitoring | Check for new crypto regulations | Quarterly | Medium |

| Staff Training | Update team on crypto payment procedures | Bi-annual | Medium |

| Customer Communication | Review and update crypto payment policies | Annual | Medium |

Future-Proofing Your Crypto Payment Strategy

Preparing for Regulatory Evolution

The cryptocurrency regulatory landscape continues to evolve. Congressional consideration of stablecoin legislation including the Clarity for Payment Stablecoins Act and the Lummis-Gillibrand Payment Stablecoins Act indicates ongoing regulatory development.

To future-proof your business:

- Choose flexible payment processors that can adapt to regulatory changes

- Maintain detailed records that exceed current requirements

- Stay connected with industry developments through professional networks

- Consider professional consultation for complex compliance questions

Technology Considerations

As crypto technology evolves, consider how new developments might benefit your business:

- Layer 2 solutions for faster, cheaper transactions

- Central Bank Digital Currencies (CBDCs) when they become available

- Smart contract automation for recurring accept crypto payments without legal

- Enhanced privacy features while maintaining compliance

Stablecoin Regulation Is Becoming a Game Changer for Crypto-Ready Businesses in 2026

The quiet revolution happening in stablecoin regulation could dramatically alter the way local businesses accept digital assets in 2026. While most headlines focus on Bitcoin volatility or ETF speculation, it’s the GENIUS Act and Clarity for Payment Stablecoins Act that may create the most direct impact on day-to-day operations. These bills propose strict regulatory frameworks for payment stablecoins—requiring full reserve backing, routine audits, and stringent issuer disclosures. Why does this matter? Because a growing number of small businesses now accept crypto payments without legal headaches by using stablecoins like USDC for predictable, low-risk transactions.

But those who ignore the legal tide may soon find themselves noncompliant. If your business accepts stablecoins without verifying how your provider is structured (or if it even complies with U.S. standards), you’re taking on silent liabilities. Many legacy crypto gateways operate in regulatory gray zones, while modern hybrid solutions offer instant conversion to USD, complete KYC/AML layers, and IRS-ready tax reporting—all while shielding you from price volatility or custodial risk.

2026 is shaping up to be the year stablecoin infrastructure matures. Businesses that future-proof now—by selecting compliant processors and maintaining transparent, real-time ledgers—can avoid last-minute compliance overhauls or costly legal fixes. Accepting crypto payments in this evolving landscape is less about hype and more about operational foresight. And if you get it right today, you’ll not only serve a tech-forward customer base, but also build a accept crypto payments without legal strategy that regulators can’t shake down tomorrow.

IRS Enforcement on Crypto Income Is Here—Small Business Owners Can’t Afford to Wing It Anymore

Crypto is no longer under the radar. With the IRS tightening digital asset enforcement in 2026, small business owners can no longer afford casual recordkeeping or “deal-with-it-later” tax strategies. The introduction of Form 1099-DA, mandated for crypto brokers and exchanges, means the government will now receive automated reports for any asset sale or swap you process—even if it’s just a customer buying coffee with USDT or ETH. If you’re looking to accept crypto payments without legal headaches, detailed documentation and tax readiness must now become part of your daily workflow.

Here’s the hard truth: it’s not the big amounts that trigger red flags—it’s the inconsistencies. Businesses that mix personal and business wallets, fail to log fair market value at the time of receipt, or skip cost basis tracking are prime audit targets. And with the IRS now using AI and blockchain analysis tools to identify gaps, even honest mistakes can turn into painful penalties or reputational damage.

The solution? Start treating crypto like every other financial channel. Use payment processors that automatically convert crypto to USD, record timestamps and valuation, and integrate directly with your accounting stack. Schedule quarterly check-ins with a crypto-literate tax advisor. Separate your business wallet infrastructure. And most importantly, educate your team—even part-time staff—on how to identify reportable activity.

Accepting crypto isn’t just a branding move anymore—it’s a serious financial channel with tax consequences. Done right, it opens doors to global clients, lower transaction fees, and marketing buzz. Done wrong, it exposes you to compliance chaos. In 2026, compliance isn’t just a box to check—it’s a moat that protects your business from regulatory disruption.

Conclusion

Basing an operation on accept crypto payments without legal and not having to deal with the legal nuances is quite a possibility when local businesses are well-planned and properly carried out. The most important factor is to realize that the majority of local companies have far more reduced regulation than crypto exchanges or other trading platforms.

There are three fundamental principles to allow you to succeed in paying with crypto: classifying your business type in a proper way, keeping your records excellent, and being aware of the development of regulations. You will be able to introduce dear crypto payment to your clients in full conformity with the law being guided by the information presented in this article.

Advantages of using cryptocurrency such as increased speed, reduced fee, and the availability of a new base of customers render it an appealing alternative in the eye of progressive local industry. As the regulatory strategy is becoming more transparent and more favorable to businesses, there is no better time to investigate the concept of crypto payment integration.

It is always important to know that rules are still in constant change, therefore keep contacts with competent tax correspondents and attorneys that are knowledgeable in accept crypto payments without legal. Such spending on professional mentorship may help to avoid great expenses and complications in the future.

As the crypto economy is more established, companies that are early movers in this business will have competitive advantages in servicing the ever-increasing number of customers who engage in digital forms of payments. According to the law, there is the existence of laws in regard to the cryptocurrency to be used in legitimate business- the trick is learning and knowing how to use the provided guidelines.

Expand your global reach with XaiGate, a powerful crypto payment gateway for Enterprises built for modern enterprises.

Frequently Asked Questions – How Local Businesses Can Accept Crypto Payments Without Legal Headaches

1. Do I need a special license to accept crypto payments at my local business?

Most local businesses that simply accept crypto payments without legal do not need special licenses. However, requirements vary by state, so check with your state’s financial services department for specific guidance.

2. How do I handle taxes when accepting cryptocurrency payments?

Accept crypto payments without legal must be reported as business income at their fair market value when received. Keep detailed records of all transactions and consider using specialized crypto tax software for accurate reporting.

3. What’s the difference between accepting crypto directly versus using a payment processor?

Payment processors typically handle conversion to USD automatically and manage compliance requirements, making them ideal for beginners. Direct acceptance gives you more control but requires more technical knowledge and compliance management.

4. How do I protect my business from crypto price volatility?

Most businesses use payment processors that convert crypto to USD immediately upon receipt. This eliminates volatility risk while still offering customers the convenience of crypto payments.

5. Are there transaction limits I should set for crypto payments?

While not legally required for most businesses, setting reasonable limits (such as $1,000-$10,000) can reduce compliance burdens and potential suspicious activity reporting requirements.

6. What records do I need to keep for crypto payments?

Maintain detailed records including transaction dates, amounts in both crypto and USD, customer information, wallet addresses, and the market value of crypto at the time of each transaction.

7. Can I offer refunds for crypto payments?

Yes, but establish clear policies beforehand. You can refund in USD equivalent or in the original cryptocurrency, but be aware of the tax implications of each approach.

8. How do I train my staff to handle crypto payments?

Focus on basic operational procedures rather than technical details. Staff should understand how to initiate transactions, verify payments, and provide customer support for common crypto payment questions.

9. Is accepting crypto as a local business risky in terms of regulation?

While regulations are evolving, businesses that classify their operations correctly and use trusted payment tools can accept crypto payments without legal.

10. Can I accept Bitcoin or USDC without being classified as a money transmitter?

Yes, if you’re only receiving crypto as payment and not facilitating trades or custody for others, you’re typically not considered a money transmitter.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!