As cryptocurrencies evolve from speculative assets to mainstream financial tools, nonprofits are exploring new ways to diversify their funding sources. Among the most intriguing—yet polarizing—of these methods is the acceptance of anonymous crypto donations. With privacy being one of the core tenets of blockchain culture, it’s no surprise that many donors are increasingly choosing to give without disclosing their identities.

However, accepting anonymous crypto donations brings with it a dual-edged sword. On the one hand, it opens up a global, privacy-conscious donor base. On the other, it introduces serious challenges related to anti-money laundering (AML) compliance, regulatory reporting, and organizational reputation. This in-depth guide will explore the reasons behind anonymous donations, the associated risks, legal frameworks, and actionable best practices for nonprofits to navigate this complex landscape with confidence.

Contents

- 1 Why Donors Choose Anonymous Crypto Donations

- 2 Risks of Accepting Anonymous Crypto Donations

- 3 Global Legal Frameworks and Compliance Obligations

- 4 Technology Solutions for Anonymous Crypto Compliance

- 5 Best Practices for Nonprofits Accepting Anonymous Crypto Donations

- 6 Conclusion

- 7 FAQs – Accepting Anonymous Crypto Donations

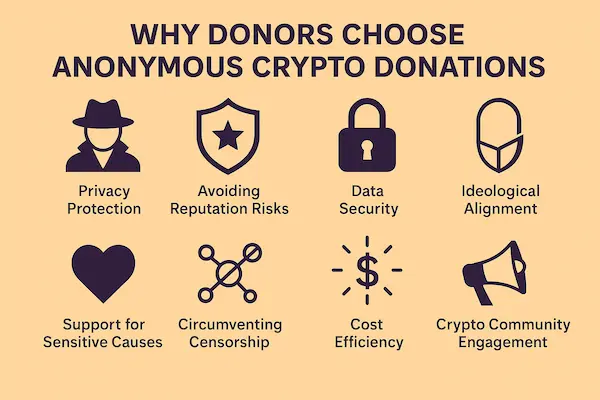

Why Donors Choose Anonymous Crypto Donations

The rise of anonymous cryptocurrency donations is not a random trend—it reflects a broader cultural shift in how people view privacy, philanthropy, and financial independence. Here are the key reasons donors prefer to give anonymously using crypto:

- Privacy and Personal Security: In politically sensitive regions or contexts involving controversial causes (e.g., whistleblower support, human rights, or protest movements), anonymity protects donors from retaliation, surveillance, or social stigma. Crypto provides a way to support these missions without exposing one’s identity.

- Alignment with Decentralized Ideals: Many early adopters of cryptocurrency are libertarian-leaning and value anonymity as part of their financial autonomy. Donating anonymously aligns with the original ethos of decentralized systems like Bitcoin.

- Avoiding Unwanted Recognition: Some high-net-worth individuals prefer not to have their names publicized on donor walls, press releases, or tax filings. Anonymous donations allow them to give generously without external expectations or solicitations.

- Tax Considerations: In jurisdictions that allow capital gains exemptions on donated crypto, anonymity can streamline giving without overcomplicating the filing process. However, anonymous giving usually precludes tax deductions unless the donor voluntarily discloses their identity.

- Global Accessibility: Crypto donations bypass banks and borders, making it possible for donors in countries with unstable financial systems to support causes worldwide without the usual red tape.

Understanding these motivations can help nonprofits tailor their messaging and infrastructure to accommodate anonymous crypto giving without alienating regulators or mainstream donors.

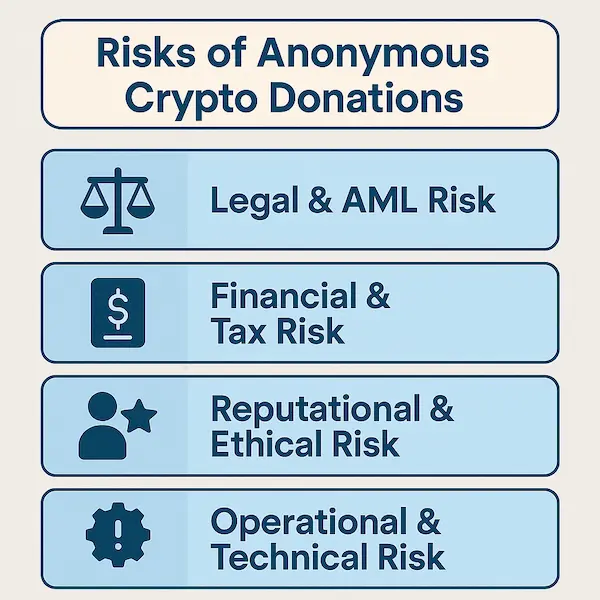

Risks of Accepting Anonymous Crypto Donations

Accepting anonymous donations via cryptocurrency offers significant benefits, but it also opens the door to critical vulnerabilities that must be managed with caution.

1. Legal and Regulatory Risk

The most significant concern for nonprofits is legal liability arising from non-compliance with AML and counter-terrorism financing (CTF) regulations. International frameworks like the Financial Action Task Force (FATF) mandate that entities accepting large or potentially suspicious transactions conduct due diligence to determine the origin of funds.

Failure to verify the source of anonymous crypto donations may result in severe penalties. For example, accepting funds from an address tied to a sanctioned entity—such as those flagged by the U.S. Office of Foreign Assets Control (OFAC)—could lead to frozen assets, legal sanctions, or removal of nonprofit status.

2. Tax and Accounting Risk

Anonymous crypto gifts also pose difficulties in meeting tax reporting standards. In the United States, the IRS requires nonprofits to submit Form 8282 for non-cash donations exceeding $5000. But without donor contact information or proper appraisals, the nonprofit might not meet these requirements, leading to compliance issues during audits.

Further, auditors may question the valuation methods used to report anonymous crypto gifts in financial statements, especially if market volatility dramatically changes asset values within short timeframes. Lack of proper tracking could undermine the credibility of financial reports.

3. Reputational and Ethical Risk

Even if the donation is legally compliant, public perception can still be damaging. Media coverage connecting a nonprofit to anonymous funds linked to crime, hacking groups, or extremist causes could harm donor trust and organizational reputation.

Ethically, some nonprofits struggle with accepting funds without knowing the intention behind them. Were they given in good faith, or as part of a PR strategy by a controversial figure or group? Transparency becomes essential.

4. Operational and Technical Risk

From a systems perspective, handling anonymous crypto gifts requires strong internal controls, secure wallet management, and robust transaction monitoring. Technical staff must be trained in blockchain analytics to detect red flags—such as transactions that pass through mixing services or privacy coins like Monero.

Also, once a crypto donation is accepted, it cannot be reversed. Mistakenly accepting funds that should have been rejected due to legal or ethical concerns may result in irreversible complications.

Looking to integrate crypto donations to your website securely and legally? Start with this comprehensive guide from XAIGATE that walks you through anonymous giving, AML compliance, and wallet setup for nonprofits

Global Legal Frameworks and Compliance Obligations

Navigating the legal minefield of anonymous crypto donations demands an understanding of both local laws and international obligations.

1. AML and KYC Compliance

Under global AML frameworks such as those issued by FATF, nonprofit organizations engaging in crypto transactions above a certain threshold are expected to collect “travel rule” information, identifying both the originator and the recipient. This includes Know-Your-Customer (KYC) data such as names, addresses, and wallet ownership.

In the U.S., FinCEN (Financial Crimes Enforcement Network) may categorize certain nonprofits as money service businesses (MSBs) if they regularly convert or facilitate crypto-to-fiat donations. In such cases, registration, periodic audits, and Suspicious Activity Report (SAR) filings may be necessary.

2. Tax Obligations

IRS guidelines state that for a donation to be tax-deductible, the organization must issue a contemporaneous acknowledgment. This is difficult—if not impossible—without a way to identify the donor. Furthermore, charities must be able to establish the donation’s fair market value at the time of receipt, which requires accurate records of token type, value at timestamp, and wallet address.

Outside the U.S., countries like the U.K., Canada, and Australia have similar tax recognition rules that emphasize traceability, especially for digital assets.

3. Sanctions and Watchlists

To avoid legal entanglements, nonprofits must screen all incoming transactions against OFAC sanctions lists and other international databases. While this process may seem incompatible with anonymity, blockchain forensics tools can offer a workaround by analyzing wallet history, transaction patterns, and peer associations without violating donor privacy.

Non-compliance can lead to frozen accounts, fines, and long-term bans from participating in governmental grant programs.

Technology Solutions for Anonymous Crypto Compliance

1. Blockchain Analytics Tools

Firms like Chainalysis, Elliptic, and CipherTrace provide software that scans incoming crypto donations in real time to detect red flags. These include links to darknet markets, sanctioned wallets, or mixers like Tornado Cash. Tools assign risk scores to each wallet, allowing organizations to reject high-risk funds automatically.

These analytics can also be used for internal audits and to create audit trails, satisfying board members, donors, and regulators.

2. Smart Contracts and Protocol-Level Controls

Organizations can also create smart contracts that only release funds if specific compliance checks are passed. For example, a multisig wallet could require verification from a compliance officer and financial manager before accepting any large anonymous crypto donations.

Some contracts can be coded to instantly convert volatile tokens into stablecoins, or to pause transactions above a certain threshold for manual review.

3. Custodial Platforms with Built-in Compliance

Using platforms like XAIGATE offers nonprofits a turnkey solution. XAIGATE handles KYC/AML screening for large donations, provides audit reports, and integrates wallet monitoring. This allows organizations to accept anonymous donations up to a certain risk threshold while remaining compliant.

Such platforms also automate issuance of donation receipts, reconciliation with accounting software, and even reporting to tax authorities.

Best Practices for Nonprofits Accepting Anonymous Crypto Donations

- Develop a Transparent Crypto Donation Policy: Publish clear guidelines on your website outlining accepted cryptocurrencies, thresholds for review, and how anonymous donations are handled.

- Set Review Triggers: Establish internal limits—such as flagging all anonymous gifts over $5000 for further scrutiny. Define what constitutes suspicious behavior.

- Optional Identity Disclosure: Offer donors the opportunity to identify themselves for tax purposes or to enhance transparency without making it mandatory.

- Use Blockchain Explorer Pages: Link your public wallet addresses to a read-only blockchain explorer so the public can track incoming funds without revealing identities.

- Train Staff in Crypto Compliance: Ensure that your finance, legal, and fundraising teams understand crypto basics, compliance rules, and how to use blockchain tools.

- Engage Legal Counsel: Work with attorneys familiar with cryptocurrency and nonprofit law to draft policies, structure internal controls, and prepare for audits.

- Conduct Regular Risk Assessments: Review your crypto donation practices quarterly to adjust thresholds, assess new regulations, and refine your compliance strategy.

Want to explore the full potential of crypto fundraising for your nonprofit? XAIGATE’s comprehensive guide on accepting cryptocurrency donations offers step-by-step insights, from anonymous wallet setup to legal compliance and donor engagement tactics.

Conclusion

Accepting anonymous crypto donations can revolutionize nonprofit fundraising by opening up global donor channels, enhancing privacy, and reducing overhead costs. But this opportunity comes with regulatory, ethical, and technical complexity.

To navigate this new terrain responsibly, nonprofits must adopt robust compliance practices, leverage advanced blockchain analytics, and clearly communicate their donation policies to both anonymous and identifiable donors.

Platforms like XAIGATE provide essential infrastructure that helps balance donor privacy with organizational accountability. By taking proactive steps today, nonprofits can build trust, expand reach, and stay ahead of regulatory scrutiny in a digital-first world.

FAQs – Accepting Anonymous Crypto Donations

1. Can nonprofits legally accept anonymous crypto donations?

Yes, most nonprofits can legally accept anonymous crypto donations, but they must implement proper risk management and comply with AML regulations. Using blockchain analytics tools to screen wallets and transactions is essential.

2. What are the risks of accepting anonymous cryptocurrency donations?

Risks include legal exposure to AML violations, reputational damage, audit difficulties, and challenges in verifying the source of funds. Without identity verification, organizations must be extra cautious in screening high-risk wallets.

3. How can nonprofits stay compliant when receiving anonymous crypto donations?

To stay compliant, nonprofits should implement wallet monitoring tools, set donation thresholds for review, work with platforms like XAIGATE, and publish a clear crypto donation policy.

4. Can donors receive tax receipts for anonymous crypto donations?

Generally, no. Tax-deductible receipts require identifiable donor information. If the donor chooses to remain anonymous, the organization may not be able to issue a valid tax receipt under IRS or local tax rules.

5. Is it better to use a platform or self-manage crypto donations?

Using a compliant platform like XAIGATE simplifies tax reporting, AML checks, and risk management. Self-managed wallets require technical expertise and in-house compliance procedures.

6. Do anonymous crypto donations violate KYC/AML laws?

Not necessarily, but failure to monitor for suspicious activity or sanctioned addresses can result in non-compliance. Setting clear acceptance policies and using tools to detect illicit funds is key.

7. How should anonymous crypto donations be recorded in financial reports?

Organizations should record the token type, USD equivalent at the time of receipt, and the source wallet (if available). Even if the donor is anonymous, proper valuation and documentation are still required for audits.

External Resources for Further Reading:

- FATF Travel Rule Guidance – Learn how AML standards apply to virtual assets.

- IRS Guidelines on Virtual Currency – Understand tax obligations related to crypto donations.

- OFAC Sanctions List – Check addresses and entities prohibited under U.S. law.