Cryptocurrency has steadily gained mainstream acceptance in Singapore, thanks to the country’s forward-thinking regulatory framework and commitment to financial innovation. For businesses and startups interested in leveraging crypto as a payment method, understanding the crypto regulations in Singapore by MAS (Monetary Authority of Singapore) is essential.

This 2026 guide provides a deep dive into crypto compliance requirements, licensing obligations, legal definitions, and best practices for operating within the Singaporean crypto landscape.

Contents

- 1 Overview of Crypto Regulations Singapore

- 2 What Is the MAS and Its Role in Regulating Crypto?

- 3 Key Provisions of the Payment Services Act (PSA)

- 4 Digital Payment Token (DPT) Services Explained

- 5 Licensing Types and Requirements in Singapore

- 6 AML/CFT Obligations for Crypto Businesses

- 7 Who Needs to Apply for a License?

- 8 Compliance Checklist for Crypto Payment Providers

- 9 Enforcement, Audits, and Penalties

- 10 Legal Risks and Grey Areas

- 11 MAS Updates for 2026

- 12 FAQs: Crypto Regulations in Singapore (MAS 2026)

- 13 Conclusion: Building a Compliant Crypto Business

Overview of Crypto Regulations Singapore

Singapore has taken a balanced and pragmatic approach to cryptocurrency regulation. Rather than banning crypto or over-regulating the space, Crypto Regulations Singapore MAS seeks to foster innovation while managing risks.

Since the enactment of the Payment Services Act (PSA) in 2020, digital assets have been governed under a tiered framework based on the type of financial activity conducted.

This allows businesses to:

- Accept crypto payments legally

- Apply for appropriate licenses if needed

- Understand clear guidelines on AML/CFT compliance

What Is the MAS and Its Role in Regulating Crypto?

The Monetary Authority of Singapore (MAS) is the central bank and primary financial regulatory authority in Singapore. MAS is responsible for:

- Regulating financial institutions and payment systems

- Issuing licenses for Digital Payment Token (DPT) services

- Enforcing Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) measures

- Providing policy guidance on emerging financial technologies

Crypto Regulations Singapore MAS aims to ensure that crypto service providers operate within a transparent, accountable, and secure financial ecosystem.

Key Provisions of the Payment Services Act (PSA)

The Payment Services Act consolidates various regulatory requirements into a single framework. It defines and regulates seven categories of payment services:

- Account issuance services

- Domestic money transfer services

- Cross-border money transfer services

- Merchant acquisition services

- Electronic money issuance

- Digital payment token (DPT) services

- Money-changing services

Crypto-related businesses typically fall under Digital Payment Token Services if they deal with Bitcoin, Ethereum, USDT, or other cryptocurrencies.

More info: Guide to accepting crypto payments in Singapore

Digital Payment Token (DPT) Services Explained

A Digital Payment Token is any cryptographic token used for payment that is not pegged to any currency. MAS defines DPT services as:

- Buying or selling DPTs

- Facilitating the exchange of DPTs

- Custodial wallet services

- Operating DPT ATMs

If a business engages in any of these activities, it is required to register and potentially license the service under Crypto Regulations Singapore MAS guidelines.

Licensing Types and Requirements in Singapore

There are three main types of licenses under the PSA:

a. Money-Changing License

For businesses dealing solely in physical currency exchange.

b. Standard Payment Institution License

For businesses with:

- Monthly transactions under SGD 3 million (for any service)

- Lower risk operations

c. Major Payment Institution License

For businesses exceeding the SGD 3 million threshold or operating cross-border services. DPT services of significant scale typically fall under this license.

Applicants must fulfill:

- Capital requirements

- Risk management protocols

- AML/CFT frameworks

- Technology audit standards

AML/CFT Obligations for Crypto Businesses

Crypto service providers must implement stringent Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) policies:

- Conduct Know-Your-Customer (KYC) checks

- Perform Customer Due Diligence (CDD)

- Monitor suspicious transactions

- Submit Suspicious Transaction Reports (STRs) to Crypto Regulations Singapore MAS

- Maintain transaction records for at least 5 years

Failure to comply can lead to penalties, suspension, or criminal charges.

Who Needs to Apply for a License?

The following entities must apply for a DPT license in Singapore:

- Crypto exchanges operating in or from Singapore

- Businesses offering DPT wallet or custody services

- Companies facilitating crypto-fiat conversions

- OTC desks and brokerages

- Payment gateways that process crypto transactions on behalf of merchants

Freelancers or merchants accepting crypto directly may not require licensing if they are not facilitating third-party transactions or conversions.

Compliance Checklist for Crypto Payment Providers

To ensure full compliance, crypto businesses should:

- Register with Crypto Regulations Singapore MAS as a DPT service provider

- Implement AML/CFT policy and internal controls

- Designate a Compliance Officer

- Integrate KYC verification solutions

- Secure digital infrastructure with regular audits

- Ensure proper data protection and cybersecurity protocols

Enforcement, Audits, and Penalties

MAS performs periodic audits, requires regular reporting, and enforces compliance through:

- Monetary penalties

- Revocation of licenses

- Legal injunctions

- Public reprimands

In 2024, MAS fined two unlicensed exchanges and issued warnings to several wallet providers operating without adequate AML/CFT controls.

Legal Risks and Grey Areas

Some regulatory grey zones remain:

- DeFi protocols and DAO platforms

- NFT marketplaces using tokenized payments

- Non-custodial wallet tools

- Peer-to-peer crypto payments without intermediaries

Crypto Regulations Singapore MAS is expected to address these in upcoming regulatory guidance. Until then, businesses should exercise caution and consult legal experts.

MAS Updates for 2026

Recent updates to the Crypto Regulations Singapore MAS framework include:

- Expanded licensing scope for DeFi and Web3 platforms

- Mandatory Travel Rule compliance for cross-border crypto payments

- Greater consumer disclosures on risk warnings

- Stricter criteria for stablecoin issuers

- Increased cooperation with international regulators

Businesses must stay updated to avoid violations and ensure operational continuity.

FAQs: Crypto Regulations in Singapore (MAS 2026)

1. Is cryptocurrency legal in Singapore?

Yes. Cryptocurrency is legal in Singapore, and businesses can accept or operate crypto services if they comply with the Monetary Authority of Singapore (MAS) regulations under the Payment Services Act (PSA).

2. What is the MAS role in regulating crypto?

MAS regulates crypto by licensing Digital Payment Token (DPT) service providers, enforcing AML/CFT compliance, and monitoring crypto-related activities under the PSA to ensure financial stability and consumer protection.

3. Do I need a license to run a crypto business in Singapore?

If your business buys, sells, holds, or exchanges digital tokens, or offers wallet or payment gateway services, you must register and apply for a license with Crypto Regulations Singapore MAS. Simple merchants accepting crypto may not need licensing.

4. What is a Digital Payment Token (DPT) under the PSA?

A DPT refers to any crypto asset used as a medium of exchange and not pegged to fiat. Bitcoin, Ethereum, and USDT are common examples. DPT-related services are subject to MAS regulation.

5. What are the AML/CFT requirements for crypto in Singapore?

Under MAS rules, crypto businesses must perform Know Your Customer (KYC), Customer Due Diligence (CDD), monitor transactions, file Suspicious Transaction Reports (STRs), and retain records for at least 5 years.

6. What happens if I operate a crypto service without a MAS license?

Operating unlicensed crypto services in Singapore is a criminal offense. MAS can impose fines, revoke operations, freeze assets, or pursue prosecution against non-compliant companies.

7. Are stablecoins regulated under MAS in 2026?

Yes. As of 2026, Crypto Regulations Singapore MAS has introduced stricter guidelines for stablecoin issuers, requiring full reserve backing, proper disclosures, and regulatory approval before circulation within Singapore.

Conclusion: Building a Compliant Crypto Business

Singapore continues to lead Asia in smart, innovation-friendly crypto regulation. By aligning with Crypto Regulations Singapore MAS policies, businesses can:

- Operate legally and confidently

- Gain customer trust

- Avoid penalties and reputation risks

- Scale crypto services sustainably

If your business involves crypto in any form, understanding and adhering to the crypto regulations Singapore MAS enforces is not just recommended—it’s essential.

Consider consulting legal professionals, investing in compliance infrastructure, and partnering with trusted payment gateways to build a compliant and successful crypto venture in Singapore.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!

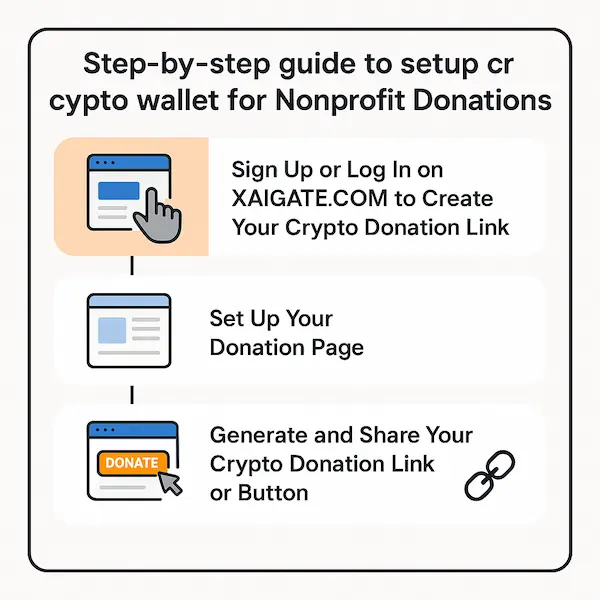

Don’t miss out on the opportunity to elevate your business with XAIGATE’s best cryptocurrency payment gateway in Singapore. The three-step process is designed to be user-friendly, making it accessible for all businesses. Embrace this modern payment solution to provide customers with a secure and efficient way to pay. Take the first step towards a competitive edge in the digital realm and unlock the benefits of cryptocurrency payments for online casino today.