For freelancers and digital nomads, managing payments across borders often involves hidden fees, long wait times, and unreliable financial intermediaries. In a world that’s increasingly remote, mobile, and global, the need for a faster, cheaper, and more independent payment solution has never been more urgent.

That’s where USDT (Tether) comes in. This stablecoin, pegged 1:1 to the US dollar, is transforming how location-independent professionals receive and manage their income. In this guide, we explore how a USDT payment gateway for Freelancers can empower freelancers and digital nomads to work without financial borders.

Contents

- 1 1. The Payment Challenges Facing Freelancers and Nomads

- 2 2. Why Stablecoins and Especially USDT — Are Transforming Freelance Payments

- 3 3. What Is a USDT Payment Gateway for Freelancers

- 4 4. Key Benefits of Using a USDT Payment Gateway for Freelancers and Remote Professionals

- 5 5. How to Set Up a USDT Payment Gateway for Freelancers Work

- 6 6. Real Use Cases: Freelancers Leveraging USDT Today

- 7 7. Risks, Limitations, and Best Practices

- 8 8. Why Choose XAIGATE for Your USDT Payments

- 9 9. Why Businesses Are Rapidly Adopting the USDT Payment Gateway

- 10 FAQs – USDT Payment Gateway for Freelancers

- 11 Final Thoughts

1. The Payment Challenges Facing Freelancers and Nomads

The rise of freelancing and digital nomadism has unlocked a new level of professional freedom, but traditional financial systems haven’t evolved fast enough to support this borderless workforce. Many independent professionals quickly discover that the way they get paid is just as important as the projects they take on:

-

High transaction fees: Popular platforms like PayPal, Wise, Payoneer, and even conventional banks often charge significant percentages on every transfer. For freelancers with slim margins, these costs can quietly erode monthly income.

-

Slow settlement times: Payments can take anywhere from 2–7 business days to reach an account, creating cash flow stress, especially when juggling multiple clients across different time zones.

-

Currency conversion losses: Each conversion from USD to local currency chips away at earnings, and fluctuating FX rates make income unpredictable.

-

Geopolitical restrictions: Freelancers in certain countries may face outright blocks from major payment platforms or encounter limitations due to shifting compliance rules.

-

Unexpected account freezes: Having funds suddenly held or accounts restricted without clear explanation disrupts trust and financial stability.

For professionals working with clients across continents, these issues don’t just add up—they compound, creating daily stress around something as basic as receiving payment.

This is why alternative solutions like a USDT payment gateway for Freelancers are gaining momentum. Unlike legacy platforms, USDT transactions settle almost instantly, with minimal fees, and bypass unnecessary intermediaries. For digital nomads living in multiple countries or freelancers collaborating with clients worldwide, a USDT-based payment system ensures stability, speed, and transparency—qualities the modern workforce urgently needs.

2. Why Stablecoins and Especially USDT — Are Transforming Freelance Payments

For freelancers and digital nomads, choosing the right payment method is no longer just about convenience; it’s about survival in a globalized economy. Stablecoins bridge the gap between crypto innovation and fiat stability, making them one of the most practical financial tools for independent professionals.

-

Crypto-level efficiency: Transactions are borderless, secure, and confirmed within minutes—without the banking delays that stretch into days.

-

Fiat-level stability: With its 1:1 peg to the U.S. dollar, USDT shields freelancers from the volatility risks of Bitcoin or Ethereum while keeping their earnings predictable.

-

Unmatched liquidity: Among all stablecoins, USDT stands out as the most widely accepted and integrated across multiple chains (TRC20, ERC20, BEP20), ensuring easy transfers and maximum flexibility.

This explains why many independent professionals in emerging markets now rely on a USDT payment gateway for Freelancers as their default choice. It solves the exact problems that traditional systems create—slow settlement, high FX fees, and limited access.

With a USDT-powered gateway, freelancers can:

-

Receive payments almost instantly from clients worldwide.

-

Eliminate hidden foreign exchange costs, preserving more of their hard-earned income.

-

Secure their funds in a stable crypto wallet with global accessibility.

-

Easily convert to local fiat or spend directly via crypto-linked cards, giving them full financial freedom wherever they live or travel.

In short, USDT isn’t just another payment option—it’s quickly becoming the financial backbone for freelancers who want speed, reliability, and control in today’s borderless economy.

3. What Is a USDT Payment Gateway for Freelancers

A USDT payment gateway for Businesses is a tool or service that lets freelancers accept payments in USDT from clients around the world.

It may come in different forms:

- A link-based invoice system

- API integration for platforms and apps

- Plugin for websites or online portfolios

The gateway typically includes:

- A crypto wallet address (TRC20 recommended)

- Automatic invoice tracking and payment updates

- Optional conversion to fiat

- Dashboard to view and manage payments

Advanced Comparison Table — XAIGATE vs. Traditional vs. Crypto Gateways

| Criteria | XAIGATE (USDT Gateway) | Traditional Gateways (PayPal, Payoneer, Wise) | Other Crypto Gateways (e.g. BitPay, NOWPayments) |

|---|---|---|---|

| Custodial vs. Non-Custodial | 🔓 Non-custodial — freelancer receives USDT directly in wallet | 🔒 Fully custodial — funds held by third party until withdrawn | Mostly custodial; some support partial non-custodial setups |

| Smart Contract Support | ✅ Optional (for enterprise invoicing / automated flows) | ❌ Not supported | ⚠️ Limited; depends on provider |

| API / SDK Integration | 🛠️ Full REST API with JS/PHP SDK; webhook callback, USDT checkout widget | ⚠️ Limited for freelancers (PayPal REST API mostly for platforms, not individuals) | 🛠️ REST API, but complexity varies by provider |

| Settlement Time | ⚡ ~30 sec with TRC‑20/BEP‑20 chains (no banking hours) | 🕓 T+2–5 days, delays on weekends/holidays | ⏱️ 1–60 min depending on coin network & confirmations |

| Cross-Chain Flexibility | ✅ Supports TRC‑20, BEP‑20, ERC‑20 | ❌ Not applicable | ⚠️ Varies; some support multi-chain (e.g. NOWPayments), others single-chain |

| Geo-Political Censorship Risk | 🛡️ Low — blockchain-level delivery; no fiat route required | 🚫 High — payments may be frozen in sanctioned or high-risk countries | ⚠️ Moderate — depends on provider’s KYC/AML controls |

| Identity Exposure (KYC Level) | 🧩 Optional KYC (volume-based tiers); anonymous invoicing supported | 🧾 Mandatory KYC (name, ID, bank verification); often rejects some countries | 🧾 Required on most platforms (BitPay, CoinPayments, etc.) |

| Auditability / Transparency | 🧮 Full on-chain transaction record, verifiable in block explorer | 🕳️ Private ledger — only visible within platform; no public traceability | ⚠️ Partial — on-chain record exists, but platform fees & flows may be opaque |

| Chargeback / Dispute Protection | 🚫 Not possible — crypto is final (no chargebacks, but needs trust) | ✅ Buyer protection, but often abused (freelancers vulnerable to fraud) | 🚫 No chargebacks (like XAIGATE), same tradeoff |

| Currency Stability | 🧷 Pegged to USD — eliminates volatility while retaining crypto benefit | 💵 Fully fiat (USD, EUR) | ⚠️ Depends — some support stablecoins, others primarily BTC/ETH |

| Tokenomics / Compliance Risk | ✅ Uses stablecoin (USDT), low volatility, widely accepted | ✅ Fully regulated fiat | ⚠️ Some gateways use volatile or lesser-known tokens |

| Integration for Platforms | ✅ Suitable for SaaS / marketplaces via white-label options | ✅ Easy for platforms, but limited for freelancers | ⚠️ Depends on provider; some require custom development |

| Mobile & Web UX | 📱 Simple payment link (no login for client); embeddable on site or via email | 🖥️ Traditional web/app flows; clients need accounts | ⚠️ Often require crypto-savvy clients; UX not standardized |

| Recurring / Subscription Support | 🔄 Supported via smart invoice + webhook/cron logic | 🔁 Natively supported via platform APIs | ⚠️ Not natively supported — needs off-chain logic |

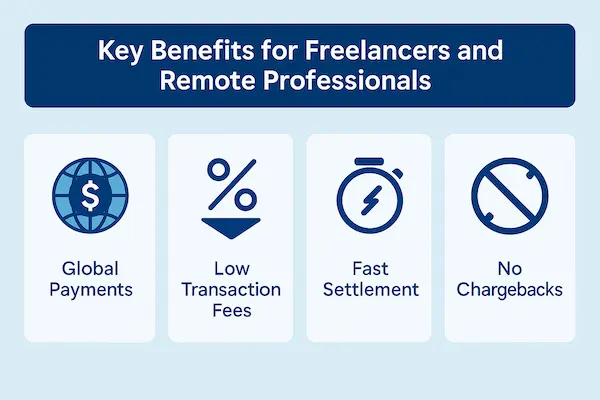

4. Key Benefits of Using a USDT Payment Gateway for Freelancers and Remote Professionals

Independent professionals thrive on flexibility, but that freedom often comes with financial friction. A USDT payment gateway for Freelancers eliminates those barriers by offering a faster, safer, and more cost-effective way to get paid across borders. Here’s why it matters:

1. Instant Settlements

Forget waiting three to five business days for funds to clear. With TRC20-based USDT transactions, payments arrive within seconds, ensuring freelancers have immediate access to their earnings.

2. Minimal Fees

Traditional platforms charge 2–5% per transfer, while banks add extra layers of costs. By contrast, USDT transactions typically cost less than $0.01, allowing freelancers to keep more of what they’ve worked for.

3. Borderless and Open Access

Freelancers no longer need to rely on local banks or payment processors. All that’s required is a crypto wallet—making payments possible even in regions where PayPal, Wise, or Payoneer are restricted.

4. Enhanced Privacy

With USDT, there’s no obligation to hand over sensitive banking details or tax IDs to every client. This protects both personal data and professional independence.

5. True Ownership and Control

Unlike centralized platforms that can freeze accounts without warning, freelancers retain full custody of their income in wallets they control, ensuring uninterrupted access to funds.

6. Expanded Global Reach

By accepting USDT, freelancers can tap into high-growth, crypto-friendly industries such as blockchain, gaming, DeFi, and Web3 startups, opening doors to clients worldwide who prefer to transact in stablecoins.

In short, adopting a USDT payment gateway for Freelancers isn’t just about saving time and money—it’s about gaining freedom, security, and global opportunity in a digital-first economy.

5. How to Set Up a USDT Payment Gateway for Freelancers Work

Step 1: Get a USDT-compatible Wallet

Recommended: TRC20 wallet like TronLink, Trust Wallet, or Ledger.

Step 2: Choose a USDT Payment Gateway for Freelancers Provider

Look for solutions that offer:

- Link-based invoicing

- Easy client experience

- Security and transparency

Step 3: Generate Your Payment Link or Embed Code

With tools like USDT Payment Gateway for Freelancers and Digital Nomads , you can create a link or button to receive USDT payments directly.

Step 4: Share with Clients

Send the link in invoices, emails, or integrate on your site.

Step 5: Monitor Payments

Use your dashboard to track confirmations, balances, and settlements.

6. Real Use Cases: Freelancers Leveraging USDT Today

For many freelancers across the globe – especially in regions with unstable local currencies, getting paid in crypto is no longer a novelty, but a necessity. Among the options, USDT (Tether) has quickly become a favorite. Why? It’s fast, stable, and easy to convert into local fiat. Unlike Bitcoin or Ethereum, its value doesn’t fluctuate wildly from day to day.

- Graphic Designers in Argentina get paid instantly by clients in Europe

- Blockchain Developers in India invoice directly in USDT

- Content Writers in Nigeria avoid PayPal restrictions and high FX spreads

- Remote Marketing Teams in Southeast Asia manage payroll with stablecoins

Freelancer platforms are slowly adopting crypto—but early adopters are already ahead.

7. Risks, Limitations, and Best Practices

Crypto Volatility (if using other tokens)

Stick to stablecoins like USDT to avoid price fluctuation.

Wallet Security

Use 2FA, hardware wallets, and avoid phishing sites.

Regulatory Considerations

Check your country’s stance on crypto income. Some regions require tax reporting.

Client Education

Be ready to explain how USDT works and why it’s better for both sides.

8. Why Choose XAIGATE for Your USDT Payments

XAIGATE is built with freelancers and remote workers in mind. With XAIGATE, you get:

- Instant link-based invoicing in USDT

- Support for TRC20, ERC20, and BEP20

- No KYC for basic usage

- Clean dashboard to track your income

- Optional fiat conversion tools

You don’t need to be a developer or own a company. Start receiving usdt payments in minutes.

Comparison Table: USDT Payment Gateways for Freelancers (2026)

| Feature | XAIGATE (Originial Stablecoin Gateway) | NOWPayments | Hurupay (LatAm focus) | Peer P2P / Freelance Platforms |

|---|---|---|---|---|

| Fees per Transaction | 0.2% flat (free up to 500 tx/month) | 01.0% depending on volume | ~1% flat plus conversion fees | Varies: typically ~0.5%–3% or platform fee |

| Onboarding / KYC Requirements | Optional for low volume; quick setup | KYC threshold based on location/volume | Required for Latin America users | Platform-based ID verification |

| Settlement Speed (TRC20) | Under 1 minute | Few minutes | Same day payout (local rails) | Varies: dependent on user-to-user transfer |

| Wallet Custody | Non-custodial: merchant controls private keys | Optional non-custodial | Hybrid: allows withdrawal to self-custody wallet | Varies; custodial in many cases |

| Invoice & Link Invoicing | Direct invoice link support; dashboard for tracking | Invoice option + link checkout | Hosted links with instant USD/USDT link | Manual invoice or peer invoicing |

| Stablecoin Support (USDT Chains) | TRC20, ERC20, BEP20 across Tron, Ethereum, BSC | Many chains including Tron and Solana | Primarily USDC/USDT on LatAm rails | Dependent on transfer method |

| Refund / Chargeback Logic | Manual refund tool; irreversible crypto eliminates chargebacks | Refund via API logic | Depends on platform policy | Hard to reverse once confirmed |

| User-Friendly Setup | Link or plugin-based; no tech required | Easy link plus API mode | Simple hosted link interface | Depends on platform UI |

9. Why Businesses Are Rapidly Adopting the USDT Payment Gateway

The USDT Payment Gateway has become one of the most effective solutions for businesses looking to combine blockchain innovation with the stability of the U.S. dollar. Unlike volatile crypto payments, USDT maintains a 1:1 peg to the dollar, giving companies the speed of crypto without the financial risk of sudden market swings.

1. Faster Settlements Compared to Banks

Traditional payment gateways usually take 2–5 business days to clear. With a USDT Payment Gateway, merchants receive funds in just minutes, improving liquidity and reducing reliance on banking hours.

2. Stable Value and Predictable Revenue

Cryptos like Bitcoin or Ethereum fluctuate in value, creating risks for e-commerce. USDT, by contrast, remains stable, ensuring predictable cash flow for merchants. This makes the USDT Payment Gateway a safer choice for global trade.

3. Lower Transaction Fees

Banks and card processors often charge 2–4% per transaction. A USDT Payment Gateway reduces fees to under 1%, which can significantly improve margins for businesses processing large volumes.

4. Global Reach and Cross-Border Support

Unlike credit cards that face restrictions in certain countries, USDT works globally. Businesses can reach new markets, cut down on conversion fees, and offer customers a seamless experience.

| Feature | Traditional Payment Gateway | USDT Payment Gateway |

|---|---|---|

| Settlement Speed | 2–5 business days | Minutes |

| Transaction Fees | 2%–4% | 0.2%–1% |

| Currency Volatility | None (fiat fixed) | Pegged 1:1 to USD |

| Cross-Border Usability | Limited, high fees | Seamless, low cost |

FAQs – USDT Payment Gateway for Freelancers

1. Can freelancers legally accept USDT payments?

In most countries, yes. Freelancers can legally accept stablecoins like USDT as payment for services. However, it’s important to check your local laws regarding cryptocurrency income and tax obligations.

2. Which USDT network is best for freelancers to receive payments?

TRC20 (Tron) is the most popular network for freelancers due to its fast confirmation times and low fees—often under $0.01. It’s ideal for high-frequency or international transactions.

3. Do I need a business or company to accept USDT?

No. You don’t need to register a company to receive USDT. Freelancers can use a personal wallet or a crypto payment gateway like XAIGATE to start accepting payments immediately.

4. How do I convert USDT into fiat currency?

You can convert USDT to fiat through major crypto exchanges like Binance or Kraken, or by using fiat off-ramp features from certain gateways. Be sure to choose trusted platforms with good liquidity and security.

5. Are USDT payments reversible?

No. USDT transactions on the blockchain are final and irreversible. While this eliminates chargebacks, it’s important to double-check the recipient’s wallet address before sending or requesting payments.

6. How do freelancers receive USDT with XAIGATE?

Freelancers can generate a USDT wallet address or payment link from their XAIGATE dashboard, then share it with clients. Payments are tracked in real time and confirmed directly on-chain.

7. What are the fees for freelancers using XAIGATE to accept USDT?

XAIGATE charges a flat 0.2% per transaction. There are no monthly subscriptions or withdrawal limits, so freelancers keep more of what they earn.

8. Can I issue invoices and track payments using XAIGATE?

Yes. XAIGATE offers an easy-to-use dashboard where freelancers can generate invoices, track payment status, review transaction history, and export reports in CSV or PDF.

9. Which blockchains does XAIGATE support for USDT?

XAIGATE supports USDT on Ethereum (ERC20), Tron (TRC20), and Solana (SPL). Freelancers can choose the most cost-effective network for each client or use case.

10. Can I accept recurring USDT payments with XAIGATE?

Yes. XAIGATE lets you create reusable payment links for monthly retainer clients. While not fully automated, this setup makes recurring crypto payments easy to manage.

Final Thoughts

For freelancers and digital nomads, the traditional financial system is often a bottleneck. But with tools like USDT payment gateway for freelancers, location no longer limits your income.

Whether you’re writing code from Bali, editing videos from Mexico City, or running a remote team from Lisbon—USDT offers freedom, flexibility, and financial control.

Make the switch. Accept USDT. Work globally. Get paid instantly.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!

Don’t miss out on the opportunity to elevate your business with XAIGATE’s USDT payment gateway for Freelancers integration. The three-step process is designed to be user-friendly, making it accessible for all businesses. Embrace this modern payment solution to provide customers with a secure and efficient way to pay. Take the first step towards a competitive edge in the digital realm and unlock the benefits of cryptocurrency payments for online casino today.