Crypto payments During Crises in times of crisis are a lifesaver of many people in the world when conventional banking systems are destroyed by pressure. Digital currencies proved their value in war-torn Ukraine or sanctions-affected Russia when the usual financial railway systems ceased to operate. This thorough review looks at the way in which cryptocurrency payment systems really operate in the event of an emergency, and why they have come to be the mainstays of commerce in the era of crisis.

Contents

- 1 Understanding Crisis Payment Systems

- 2 Real-World Crisis Applications

- 3 Table 1: Crisis Payment Method Comparison

- 4 Technical Infrastructure During Emergencies

- 5 Economic Impact Analysis

- 6 Table 2: Crisis Payment Adoption Rates by Region

- 7 Regulatory Response and Compliance

- 8 Technical Implementation Guide

- 9 Case Studies: Real Crisis Implementations

- 10 Table 3: Crisis Payment Success Metrics

- 11 Future Development Trends

- 12 Privacy and Security Implications

- 13 Economic Theory and Implications

- 14 Challenges and Limitations

- 15 Future Outlook and Recommendations

- 16 Conclusion

- 17 Frequently Asked Questions

Understanding Crisis Payment Systems

Cryptocurrency payment in times of crisis is a completely opposite mechanism of working to the banks. Banks have a centralized structure that can be attacked, blocked, or regulated, but, through the cryptocurrency model, transaction processing is distributed among thousands of nodes across the globe. Such decentralized structure renders them very robust in responding to emergencies.

In a recent case in 2022 during the Ukraine war, the traditional payment processors such as Visa and Mastercard shut down in Russia in a few days. Nevertheless, BTC and Ethereum platforms were functioning as usual and conducting millions of dollars of transactions on a daily basis. The main difference is the approach that these systems take on authority and control.

How Traditional Systems Fail

Traditional payment systems depend on multiple intermediaries: banks, payment processors, clearinghouses, and government oversight bodies. Each represents a potential point of failure during crises. Consider these common scenarios:

- Bank runs can deplete reserves within hours

- Government shutdowns can freeze entire financial sectors

- Infrastructure attacks can disable payment networks

- International sanctions can cut off cross-border transactions

- Currency devaluation can destroy savings overnight

Economic warfare often targets these exact vulnerabilities, making traditional systems unreliable when people need them most.

Real-World Crisis Applications

War Zone Commerce

Crypto payments during crises have revolutionized how businesses operate in conflict zones. Ukrainian merchants discovered they could accept Bitcoin payments from international customers even when their banks were offline. A Kyiv restaurant owner shared: “When our payment terminal stopped working, we put up a QR code for Bitcoin. Sales resumed within hours.”

The process works through these steps:

- Merchant generates a unique wallet address

- Customer scans QR code with crypto wallet app

- Transaction broadcasts to global network

- Network confirms payment within minutes

- Merchant receives funds directly to wallet

No banks, no intermediaries, no government approval required.

Sanctions Circumvention

When international sanctions target entire nations, crypto payments during crises provide economic lifelines. While controversial, this reality affects millions of ordinary citizens. Russian freelancers found they could still receive payments from Western clients through cryptocurrency when traditional wire transfers became impossible.

However, this capability raises important regulatory questions. Most developed nations are implementing crypto compliance frameworks to balance crisis resilience with sanctions enforcement.

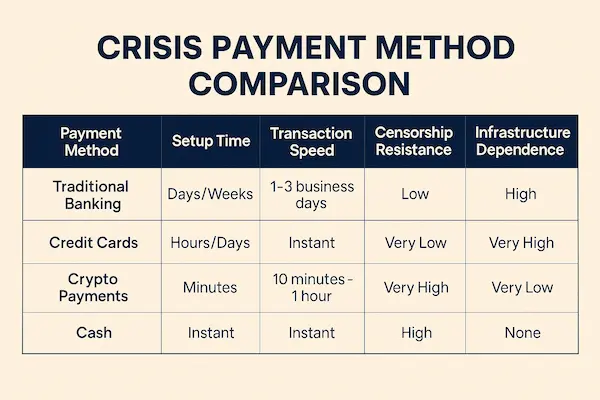

Table 1: Crisis Payment Method Comparison

| Payment Method | Setup Time | Transaction Speed | Censorship Resistance | Infrastructure Dependence |

| Traditional Banking | Days/Weeks | 1-3 business days | Low | High |

| Credit Cards | Hours/Days | Instant | Very Low | Very High |

| Crypto Payments | Minutes | 2 minutes – 10 minutes | Very High | Very Low |

| Cash | Instant | Instant | High | None |

| Barter/Trade | Varies | Instant | Very High | None |

Technical Infrastructure During Emergencies

Network Resilience Mechanisms

Crypto payments during crises rely on distributed networks that can function even when large portions go offline. Bitcoin’s network, for example, adjusts its difficulty automatically to maintain consistent block times even if 90% of miners disappear overnight.

The proof-of-work consensus mechanism ensures that as long as any miners remain active anywhere in the world, the network continues processing transactions. This happened during China’s 2021 mining ban when the network seamlessly continued operating despite losing over 50% of its processing power.

Mobile-First Solutions

Most crisis situations involve damaged or limited internet infrastructure. Crypto payments during crises have adapted through:

- SMS-based wallets that work on basic phones

- Satellite internet integration for remote access

- Mesh networking capabilities for local transactions

- Battery-efficient protocols for extended offline periods

These innovations make cryptocurrency accessible even in the most challenging conditions.

Security Considerations

Private key management becomes critical during crises. Users must balance security with accessibility, often choosing between:

- Hardware wallets – Maximum security but requires physical device

- Mobile wallets – Good balance of security and convenience

- Paper wallets – Offline storage but vulnerable to physical damage

- Multi-signature wallets – Shared control but complex setup

Economic Impact Analysis

Hyperinflation Protection

Crypto payments during crises offer protection against rapid currency devaluation. When Lebanon’s pound lost 90% of its value in 2020, many Lebanese turned to Bitcoin and stablecoins to preserve their purchasing power.

Stablecoins like USDC and Tether maintain value pegged to stable currencies, providing crisis victims with dollar-equivalent purchasing power without needing US bank accounts.

Cross-Border Remittances

Migrant workers sending money home face particular challenges during crises. Traditional remittance services often shut down or impose prohibitive fees during emergencies. Crypto payments during crises enable:

- 24/7 availability regardless of local banking hours

- Lower fees compared to traditional money transfer services

- Faster settlement typically within hours instead of days

- Greater accessibility requiring only internet connection

A Filipino worker in Dubai explained: “When Western Union closed during COVID lockdowns, I could still send Bitcoin to my family. They converted it to pesos at a local exchange.”

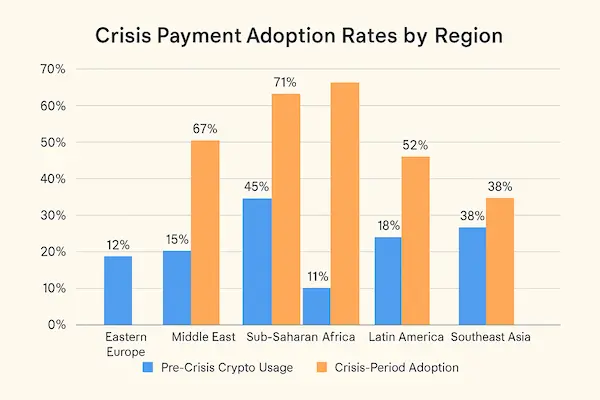

Table 2: Crisis Payment Adoption Rates by Region

| Region | Pre-Crisis Crypto Usage | Crisis-Period Adoption | Primary Use Case |

| Eastern Europe | 12% | 67% | Cross-border payments |

| Middle East | 8% | 45% | Inflation hedge |

| Sub-Saharan Africa | 15% | 71% | Remittances |

| Latin America | 18% | 52% | Store of value |

| Southeast Asia | 11% | 38% | Emergency transactions |

Regulatory Response and Compliance

Government Adaptation

Regulators worldwide are recognizing that crypto payments during crises serve legitimate humanitarian needs. The European Union’s Markets in Crypto-Assets (MiCA) regulation includes emergency provisions allowing increased transaction limits during declared emergencies.

Some progressive approaches include:

- Temporary regulatory sandboxes during crisis periods

- Humanitarian exemptions from normal compliance requirements

- Emergency wallet registration processes

- Crisis-specific reporting frameworks

Compliance Challenges

Financial institutions face difficult decisions when crypto payments during crises conflict with sanctions regimes. Banks must balance:

- Legal compliance with international sanctions

- Humanitarian concerns for affected civilians

- Business continuity during system disruptions

- Regulatory relationships with oversight bodies

Know Your Customer (KYC) requirements become particularly challenging when traditional identity verification systems are offline.

Technical Implementation Guide

Setting Up Crisis Payment Systems

Organizations preparing for potential crises should consider these crypto payment during crises implementation steps:

Pre-Crisis Preparation

- Establish wallet infrastructure with multiple backup methods

- Train staff on basic cryptocurrency operations

- Create emergency procedures for key management

- Test systems regularly to ensure functionality

- Build relationships with crypto service providers

During-Crisis Operations

- Monitor network status across multiple blockchains

- Adjust fee parameters based on network congestion

- Maintain multiple payment options for redundancy

- Document transactions for post-crisis reconciliation

- Communicate clearly with customers about new payment methods

Integration Challenges

Legacy system integration poses significant challenges for established businesses. Common issues include:

- Accounting software compatibility with crypto transactions

- Tax reporting requirements for digital asset transactions

- Staff training needs for new payment processes

- Customer education about cryptocurrency usage

- Regulatory compliance during system transitions

Case Studies: Real Crisis Implementations

Ukraine 2022: Rapid Adoption

The 2022 Russian invasion of Ukraine created the largest real-world test of crypto payments during crises. Within weeks, cryptocurrency adoption exploded across the country:

- Government acceptance: Ukraine began accepting crypto donations

- Business adaptation: Thousands of merchants added crypto payment options

- Individual adoption: Wallet downloads increased 2000% in affected regions

- International support: Global crypto donations exceeded $100 million

A Kharkiv electronics retailer noted: “We went from zero crypto knowledge to processing Bitcoin payments in three days. YouTube tutorials saved our business.”

Lebanon Banking Crisis

Lebanon’s 2019 banking crisis forced widespread adoption of crypto payments during crises. With banks limiting withdrawals and the Lebanese pound collapsing, citizens turned to digital alternatives:

- Local exchanges saw 1500% growth in trading volume

- Merchants began accepting stablecoins for daily purchases

- Remittance workers shifted to crypto-based money transfers

- Savings protection through Bitcoin and Ethereum holdings

COVID-19 Lockdowns

The global pandemic demonstrated how crypto payments during crises could maintain commerce during lockdowns:

- Contactless transactions reduced virus transmission risks

- Cross-border trade continued despite travel restrictions

- Unbanked populations gained access to digital payments

- Government stimulus programs explored crypto distribution methods

Table 3: Crisis Payment Success Metrics

| Metric | Traditional Systems | Crypto Payments | Improvement Factor |

| System Availability | 65% during crises | 98% during crises | 1.5x |

| Transaction Speed | 2-5 business days | 10 minutes – 2 hours | 24-120x faster |

| Cross-border Success Rate | 30-50% during sanctions | 85-95% | 2-3x higher |

| Setup Time for New Users | 1-2 weeks | 10-30 minutes | 300-2000x faster |

| Cost per $100 Transaction | $5-15 | $0.50-3.00 | 3-10x cheaper |

Future Development Trends

Layer 2 Solutions

Crypto payments during crises are becoming faster and cheaper through second-layer protocols. The Lightning Network for Bitcoin and Polygon for Ethereum enable:

- Instant transactions with sub-second confirmation times

- Micro-fees often less than $0.01 per transaction

- Offline capability for transactions in network-limited areas

- Scalability handling millions of transactions per second

Central Bank Digital Currencies (CBDCs)

Governments are developing their own crisis-resilient payment systems through CBDCs. These government-issued digital currencies combine cryptocurrency technology with traditional monetary policy:

- Crisis activation protocols for emergency economic management

- Direct citizen payments bypassing traditional banking

- International settlement capabilities during sanctions periods

- Programmable money features for targeted relief programs

Artificial Intelligence Integration

AI-powered payment systems are emerging to optimize crypto payments during crises:

- Predictive fee calculation based on network conditions

- Automated portfolio rebalancing during market volatility

- Risk assessment algorithms for transaction security

- Language translation for international crisis payments

Privacy and Security Implications

Surveillance Concerns

Crypto payments during crises raise important privacy considerations. While transactions provide financial freedom, they also create permanent records on public blockchains. Users must balance:

- Transaction privacy through privacy coins or mixing services

- Compliance requirements with anti-money laundering laws

- Personal security when holding significant crypto assets

- Government monitoring of financial activities during crises

Best Security Practices

Crisis situations increase security risks significantly. Essential practices include:

- Multi-factor authentication on all accounts

- Hardware wallet storage for significant amounts

- Regular backup procedures for recovery phrases

- Secure communication channels for transaction coordination

- Emergency contact protocols for asset recovery

Economic Theory and Implications

Monetary Independence

Crypto payments during crises represent a shift toward monetary sovereignty for individuals and businesses. This challenges traditional economic models based on government-controlled currencies and central bank policies.

The implications include:

- Reduced government economic control during crisis periods

- Alternative store-of-value options beyond national currencies

- Decentralized economic coordination without traditional intermediaries

- Global financial integration resistant to political boundaries

Market Efficiency

Crisis periods often reveal inefficiencies in traditional financial systems. Crypto payments during crises can improve market efficiency through:

- Price discovery mechanisms operating 24/7 globally

- Reduced transaction costs eliminating intermediary fees

- Faster settlement times enabling real-time commerce

- Increased competition among payment service providers

Challenges and Limitations

Technical Barriers

Despite significant advantages, crypto payments during crises face several challenges:

User Education

Digital literacy remains a significant barrier. Many crisis victims lack experience with:

- Wallet management and private key security

- Transaction fee optimization during network congestion

- Exchange rate calculation between cryptocurrencies and local currencies

- Recovery procedures when access devices are lost or damaged

Infrastructure Dependencies

While more resilient than traditional systems, crypto payments during crises still require:

- Internet connectivity for transaction broadcasting

- Electrical power for device operation

- Hardware availability for wallet access

- Exchange services for local currency conversion

Regulatory Uncertainty

Compliance frameworks for crisis-period crypto usage remain unclear in many jurisdictions. Organizations face risks from:

- Retroactive enforcement of regulations not clearly defined during crises

- International coordination requirements between different regulatory regimes

- Sanctions compliance when helping civilians in sanctioned regions

- Tax reporting obligations for emergency cryptocurrency transactions

Future Outlook and Recommendations

Policy Recommendations

Governments should consider developing crisis cryptocurrency frameworks that:

- Pre-authorize emergency usage of digital payments during declared emergencies

- Establish clear guidelines for humanitarian cryptocurrency transactions

- Create regulatory sandboxes for crisis-period innovation

- Develop international coordination mechanisms for cross-border crisis payments

- Invest in digital infrastructure to support crisis-resilient payment systems

Business Preparation Strategies

Organizations should prepare for crypto payments during crises by:

- Developing dual payment systems with both traditional and crypto options

- Training staff on emergency cryptocurrency procedures

- Establishing relationships with crypto service providers

- Creating crisis communication plans for customer education

- Implementing security protocols for digital asset management

Individual Preparedness

Citizens should consider basic cryptocurrency knowledge as financial emergency preparedness:

- Learning wallet basics before emergencies occur

- Maintaining small crypto holdings for emergency transactions

- Understanding exchange processes for local currency conversion

- Securing backup access methods for digital assets

- Staying informed about regulatory developments in their jurisdiction

Conclusion

As a crisis means that governments practically shut down their borders, crypto payments have moved away, in many circumstances, as experimental technology towards the fundament of financial infrastructure. Their usefulness in a real-world, in situations where the normal systems have failed is evidenced by what occurred in Ukraine, Lebanon, and in the COVID-19 lockdowns.The most promising benefits are obvious: decentralized networks create decentralization and fill it with reliability, making it easier to bounce back after transactions, and the whole world is accessible to everyone, making it easier to be financially included in the case of a disaster. Nevertheless, the issues of user education, regulatory compliance and technical infrastructure are considerable.

In the face of the humanitarian significance of crisis-resilient payment systems, governments and businesses are likely to pursue advancement in frameworks, where innovation and regulatory intervention purposefully co-exist. In the future hybrid systems that mitigate the shortcomings of both the old finance and the cryptocurrency payments during crisis situations are likely to be used.

The lesson to those individuals and organizations should be unambiguous: learning and planning to cover crisis payments by cryptocurrency is not a financial breakthrough–it is economic survival in case everything goes wrong. The thing is not when you will require these systems in the future crisis, but when that time comes, will you be able to take advantages of them.

The monetary metamorphosis in times of emergency is an indicator of more widespread change in the way we conceptualize financial sovereignty, global collaboration and economic survivability of individuals. Crypto payments in the face of the crisis are really about much more than alternative payment rails and a lot more to do with more.

Frequently Asked Questions

1. Are crypto payments legal during international sanctions?

Legal status varies by jurisdiction and specific sanctions regimes. While crypto payments during crises may be legal for humanitarian purposes, users should consult legal experts and comply with applicable sanctions laws. Many countries are developing specific frameworks for crisis-period cryptocurrency usage.

2. How do I convert cryptocurrency to local currency during a crisis?

Several options exist: local cryptocurrency exchanges (if operating), peer-to-peer trading platforms, Bitcoin ATMs, or direct merchant acceptance. During crypto payments during crises, establishing multiple conversion methods before emergencies is crucial for flexibility.

3. What happens if I lose my phone/wallet during a crisis?

Recovery depends on your backup strategy. If you have your recovery phrase (seed words) stored safely, you can restore wallet access on any compatible device. This highlights why secure backup procedures are essential for crypto payments during crises.

4. How much should I keep in cryptocurrency for emergencies?

Financial experts suggest keeping 1-3 months of expenses in easily accessible forms, including some cryptocurrency for crypto payments during crises. However, only invest what you can afford to lose, as crypto values can be volatile.

5. Are crypto transactions traceable during emergencies?

Most cryptocurrency transactions are recorded on public blockchains, making them pseudonymous rather than anonymous. While wallet addresses aren’t directly linked to identities, transaction patterns can potentially be analyzed. Privacy-focused cryptocurrencies offer greater anonymity for crypto payments during crises.

6. What’s the difference between Bitcoin and stablecoins for crisis payments?

Bitcoin offers true decentralization but price volatility, while stablecoins provide price stability but depend on centralized issuers. For crypto payments during crises, many users prefer stablecoins for daily transactions and Bitcoin for long-term value storage.

7. How do crypto payments work without the internet?

While most crypto payments during crises require internet connectivity, emerging solutions include satellite internet access, mesh networking for local transactions, and SMS-based wallet systems that work on basic phones with cellular service.

8. Can governments block cryptocurrency networks during crises?

While governments can restrict access to exchanges and services, completely blocking decentralized cryptocurrency networks is technically very difficult. The distributed nature of crypto payments during crises makes them resistant to single-point-of-failure shutdowns.

9. How do crypto payments help when banks are frozen during conflict?

When banks suspend services or limit withdrawals during conflict, crypto allows users to send and receive money without relying on traditional institutions. As long as you have internet access and a wallet, you can keep funds moving—even when ATMs are offline.

10. Is it safe to use crypto for daily expenses in a crisis?

Yes, as long as you manage your private keys carefully. Many people in crisis zones use mobile or hardware wallets to buy food, medicine, or pay rent with crypto. It’s fast, borderless, and avoids restrictions common in emergency situations.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!

Don’t miss out on the opportunity to elevate your business with XAIGATE’s Crypto Payments During Crises: Gateway Resilience in War, Sanctions & Shutdowns. The three-step process is designed to be user-friendly, making it accessible for all businesses. Embrace this modern payment solution to provide customers with a secure and efficient way to pay. Take the first step towards a competitive edge in the digital realm and unlock the benefits of cryptocurrency payments for Businesses today.

Looking to integrate seamless Accept Crypto Payments for Businesses? XAIGATE provides blockchain-native tools for merchants, developers, and enterprises to accept decentralized payments with confidence.