Contents

- 1 1. Introduction – The Rise of Crypto Payments in ICO Fundraising

- 2 2. What Are Crypto Payments in ICOs?

- 3 3. Why Crypto Payments Are Essential for ICOs

- 4 4. Expert Insights on ICO Payments

- 5 5. Case Studies – Successful ICO Payments Models

- 6 6. How to Set Up Crypto Payments for Your ICO

- 7 7. Challenges of Using Crypto Payments for ICOs

- 8 8. Best Practices for ICO Payment Integration

- 9 9. Future of ICO Crypto Payments in 2026 and Beyond

- 10 10. Comparison Table – Crypto Payments vs Traditional Bank Transfers in ICOs

- 11 FAQs on Crypto Payments for ICOs

- 12 Conclusion – Why Crypto Payments Power the Future of ICOs

1. Introduction – The Rise of Crypto Payments in ICO Fundraising

The global fundraising landscape for blockchain startups has transformed significantly in the past decade. Among various models, the Initial Coin Offering (ICO) continues to play a crucial role as a tool for projects to raise capital quickly and efficiently. Unlike traditional methods that depend on banks, venture capital, or complex regulatory approvals, ICOs leverage crypto payments to connect startups directly with investors worldwide.

In 2026, crypto payments for ICOs are no longer a niche practice but the dominant standard. Reports from Messari and Chainalysis show that more than 70% of ICO funding flows through cryptocurrencies, particularly stablecoins such as USDT and USDC. These payment methods not only offer speed and low transaction costs but also help projects mitigate the volatility traditionally associated with digital assets.

Governments are also playing a part. The United States has introduced clearer rules around stablecoin-backed fundraising, while the European Union’s MiCA (Markets in Crypto-Assets Regulation) is setting a transparent framework for token issuance and payment processing. These moves reduce uncertainty and attract institutional investors who were previously hesitant.

As ICOs evolve, the importance of crypto payment gateways cannot be overlooked. They enable projects to automate contributions, distribute tokens via smart contracts, and ensure compliance with KYC/AML regulations. This article provides a comprehensive guide on crypto payments for ICOs in 2026: why they matter, which cryptocurrencies dominate, the technical setup required, challenges to expect, and best practices to ensure successful token fundraising.

2. What Are Crypto Payments in ICOs?

At its core, a crypto payment for ICO refers to investors purchasing newly issued tokens using cryptocurrencies such as Bitcoin, Ethereum, or stablecoins instead of traditional fiat currencies like USD or EUR. This method has been the foundation of token fundraising since the ICO boom of 2017, when thousands of projects collectively raised billions of dollars. While the market has matured since then, crypto remains the backbone of ICO participation.

Key Characteristics of Crypto Payments in ICOs

Speed and Efficiency – Crypto transactions settle within minutes on the blockchain. Compared to international wire transfers that may take three to five business days, this speed gives ICOs a massive advantage in attracting global investors.

Borderless Participation – Anyone with a crypto wallet can contribute, regardless of their banking status or geographic location. This inclusivity allows startups to reach investors in regions underserved by traditional finance.

Transparency and Security – All payments are recorded on public blockchains, enabling investors to verify transactions in real time. This level of openness builds trust in the fundraising process.

Lower Costs – Without banks or payment intermediaries, projects save significantly on fees. Investors also benefit, as their contributions are not eaten up by conversion charges or international transfer fees.

Fiat vs. Crypto Payments for ICOs

| Factor | Fiat Payments | Crypto Payments |

|---|---|---|

| Processing Time | 3–5 days | Minutes |

| Geographic Access | Limited | Global |

| Transparency | Low | High (on-chain) |

| Costs | High fees | Low fees |

| Investor Control | Restricted | Full ownership |

Real-World Example

In 2024, a blockchain startup in Singapore raised over $50 million in its ICO by accepting payments in USDC and ETH through a secure crypto payment gateway. Investors from more than 30 countries participated, and token distribution was automated via a smart contract. The project succeeded largely because it avoided fiat bottlenecks, ensured instant settlement, and reduced volatility risk by prioritizing stablecoin contributions.

This example illustrates why crypto payments for ICOs have become the standard method for fundraising in 2026. They simplify access, enhance security, and create a global investment ecosystem far more inclusive than traditional financial systems.

3. Why Crypto Payments Are Essential for ICOs

The success of an ICO often depends on how easily investors can participate. Crypto payments for ICOs provide a frictionless, transparent, and global method of contribution that simply cannot be matched by traditional banking systems. In 2026, accepting crypto payments is not just an option—it is a necessity for projects that want to scale quickly and attract a diverse investor base.

1. Global Accessibility and Investor Participation

One of the most powerful benefits of crypto payments in ICO fundraising is global accessibility. Unlike fiat transfers, which are subject to banking hours, currency restrictions, and cross-border limitations, crypto payments allow anyone with a digital wallet to invest instantly.

For example, a potential investor in Nigeria or Argentina might face difficulties sending U.S. dollars to participate in a token sale. However, with crypto payments for ICOs, they can easily send USDT, ETH, or BTC from their mobile wallet and receive tokens within minutes. This inclusivity dramatically broadens the investor pool and ensures that startups can tap into emerging markets where fiat-based fundraising is not feasible.

By removing geographic and banking barriers, crypto payments democratize access to ICOs, making them a truly global fundraising mechanism.

2. Speed and Transparency of Blockchain Transactions

Traditional fundraising and bank wire transfers often involve waiting periods of several days, not to mention delays caused by intermediary banks. In contrast, crypto payments for ICOs are processed in minutes, with confirmations visible on the blockchain in real time.

This speed not only enhances investor confidence but also improves cash flow for the project. Startups can deploy funds faster, initiate development earlier, and deliver on their roadmap without unnecessary waiting times. Transparency also plays a key role—since all transactions are recorded on-chain, both projects and investors can independently verify the status of payments.

Transparency minimizes fraud risk and builds trust, which is essential for ICOs that often face skepticism from mainstream media and regulators.

3. Lower Fees and Direct Transfers

Banking intermediaries, remittance services, and cross-border transaction providers all charge significant fees, which reduce the amount of funding a project can retain. In contrast, crypto payments for ICOs significantly lower these costs by cutting out middlemen.

For instance, a wire transfer of $10,000 across borders may cost an investor up to $100 in fees and take several business days. A similar transfer using USDC on a blockchain network may cost less than $1 and settle in under a minute. The direct nature of blockchain transfers ensures that nearly the full amount contributed by investors reaches the project’s wallet.

Lower fees are particularly important for early-stage startups that need every dollar of capital to fuel development and marketing.

4. Stablecoin Usage for Reduced Volatility

One of the biggest risks of fundraising in crypto is volatility. Bitcoin and Ethereum, while popular, are prone to dramatic price swings, which can undermine the value of funds raised. To counter this, more ICOs in 2026 are adopting stablecoins like USDT, USDC, and DAI as their primary method of fundraising.

Using stablecoins in crypto payments for ICOs provides projects with predictable value, allowing them to budget and allocate funds effectively. Investors also prefer stablecoin contributions because they are confident that the value of their investment will not fluctuate dramatically between the time of payment and token distribution.

This is why many modern crypto payment gateways for ICOs are designed with built-in support for stablecoins, making them the backbone of secure and reliable fundraising.

4. Expert Insights on ICO Payments

In order to understand the growing relevance of crypto payments for ICOs, it is essential to look at the insights shared by industry leaders, payment gateway providers, and blockchain analysts. Their perspectives highlight both the opportunities and the risks involved in adopting crypto-based fundraising.

Expert Opinions on Stablecoins and Security

John Smith, CEO of a global crypto payment gateway, notes:

“Over 60% of ICO contributions in 2026 are made using stablecoins like USDC and USDT. Projects prefer them because of price stability, while investors see them as a safe way to avoid volatility during token sales.”

Meanwhile, blockchain analyst Maria Chen emphasizes the importance of transparency and compliance:

“ICOs that publish their smart contract addresses, implement multi-signature wallets, and use audited payment gateways gain more investor trust. Without these practices, projects risk losing credibility in an increasingly regulated market.”

Regulatory Voices

Regulators are also beginning to acknowledge the value of crypto-based fundraising. A European Union report on digital assets highlighted that crypto payments in ICOs can enhance capital flows for innovation, provided projects adhere to KYC/AML compliance. This reflects a shift from skepticism to structured oversight.

The combined voice of experts shows that crypto payments for ICOs are no longer experimental, but the backbone of modern token fundraising.

Table 1: Crypto Payment Options for ICOs – Pros & Cons

| Crypto Option | Pros for ICOs | Cons for ICOs |

|---|---|---|

| Bitcoin (BTC) | High liquidity, widely recognized | Volatile, slower confirmation times |

| Ethereum (ETH) | Smart contract integration, large ecosystem | Gas fees can spike, still volatile |

| USDT/USDC (Stablecoins) | Price stability, fast, widely supported | Dependence on centralized issuers |

| DAI (Decentralized Stablecoin) | Decentralized, stable value | Less adoption compared to USDT/USDC |

| Altcoins | Wider investor participation, niche communities | Low liquidity, higher risk |

5. Case Studies – Successful ICO Payments Models

Real-world examples illustrate how crypto payments for ICOs can make or break a fundraising campaign.

Case Study 1: A Success Story with Stablecoins

In 2024, a Singapore-based blockchain project launched an ICO that accepted contributions in USDC and ETH through a trusted payment gateway. The project raised $50 million in under 30 days, attracting investors from over 30 countries. Thanks to stablecoin usage, the funds maintained their value during the token sale, allowing the team to immediately deploy resources into product development and marketing.

Key Lesson: Integrating stablecoin support via a crypto payment gateway ensures both stability and investor confidence.

Case Study 2: Missed Opportunities with Only Bitcoin

In contrast, a European startup relied exclusively on Bitcoin payments for its ICO in 2023. While BTC is liquid and widely known, the price dropped 12% during their token sale, wiping out millions in expected funding. Investor complaints followed, and the project had to scale down its roadmap due to reduced resources.

Key Lesson: Relying solely on volatile assets like BTC can jeopardize ICO success. Incorporating stablecoins is now a best practice.

Case Study 3: Compliance and Trust-Building

A U.S.-based project raised $20 million in 2026 by integrating KYC verification with its crypto payment process. Investors appreciated the security and transparency, and regulators did not flag the project for suspicious activity. This proactive compliance boosted the project’s credibility and allowed it to gain listings on major exchanges more quickly.

Key Lesson: Compliance integrated with crypto payments increases both investor trust and long-term project sustainability.

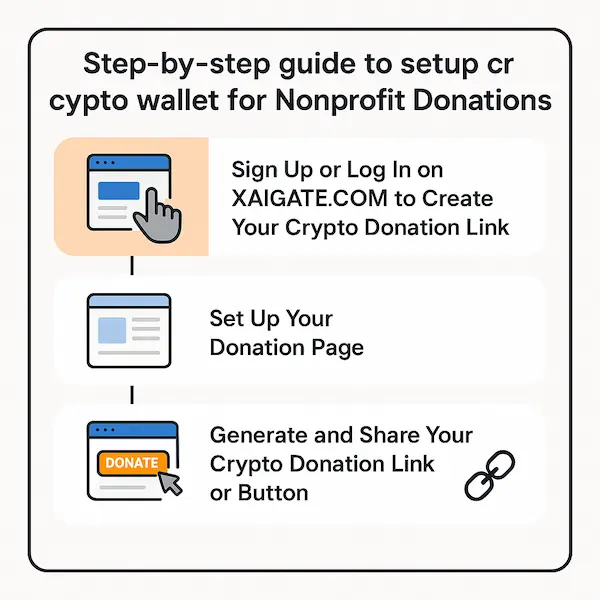

6. How to Set Up Crypto Payments for Your ICO

Launching an ICO is not just about creating tokens—it also requires building a secure and efficient infrastructure for investors to contribute. Setting up crypto payments for ICOs properly ensures smooth fundraising, regulatory compliance, and investor trust. Below is a step-by-step guide that projects can follow in 2026.

Step 1 – Create a Secure Wallet (Hot & Cold Options)

The first step is setting up digital wallets that can safely store the contributions you will receive.

Hot Wallets (online): Useful for quick transactions and real-time token distribution, but more vulnerable to hacks.

Cold Wallets (offline): Hardware wallets or multi-signature cold storage, designed for long-term secure holding of raised funds.

Best Practice: Use a multi-sig wallet where at least two or three team members must approve fund movements. This prevents unauthorized access.

Step 2 – Integrate a Crypto Payment Gateway

A payment gateway acts as the backbone of processing crypto payments for ICOs. Gateways like XaiGate allow projects to accept multiple cryptocurrencies—including stablecoins—and automate token allocation.

Key features to look for in a payment gateway:

Multi-crypto support (BTC, ETH, USDT, USDC)

Smart contract automation for instant token distribution

Regulatory compliance tools such as KYC/AML verification

Escrow services for added security

Step 3 – Deploy Smart Contracts for Token Distribution

Smart contracts remove human error by automating the distribution of tokens once a payment is confirmed. This ensures transparency and trust, since both investors and regulators can audit the process directly on the blockchain.

Example: When an investor sends 1,000 USDC to the ICO smart contract, the system automatically allocates X number of tokens to their wallet.

Step 4 – Ensure KYC/AML Compliance

While not every jurisdiction requires it, most reputable ICOs in 2026 integrate KYC (Know Your Customer) and AML (Anti-Money Laundering) processes.

Protects against regulatory penalties

Attracts institutional investors

Reduces fraud and fake contributions

Many payment gateways now include KYC modules directly in the contribution process, simplifying compliance for startups.

Step 5 – Secure Funds with Multi-Signature & Escrow

Investor confidence grows when projects show they have strong fund protection in place.

Multi-signature wallets prevent misuse of raised funds.

Escrow services (third-party custodians) ensure that contributions are released only when milestones are met.

These features signal professionalism and significantly increase trust.

Quick Checklist for Setting Up Crypto Payments in ICOs:

✅ Set up multi-sig wallets (hot + cold storage)

✅ Choose a trusted crypto payment gateway (XaiGate recommended)

✅ Accept BTC, ETH, and stablecoins (especially USDC/USDT)

✅ Deploy an audited smart contract for automatic token distribution

✅ Integrate KYC/AML compliance for global legitimacy

✅ Protect investor funds with escrow + multi-signature security

Why This Matters:

Projects that follow these steps build credibility, security, and compliance—all of which are crucial in attracting global investors. In 2026, ICOs that fail to properly integrate crypto payments risk losing investor trust and regulatory approval.

7. Challenges of Using Crypto Payments for ICOs

While crypto payments for ICOs provide speed, transparency, and global reach, they also come with challenges that projects must carefully manage. Ignoring these risks can damage credibility, cause investor losses, and even result in regulatory crackdowns. Below are the main challenges ICOs face in 2026.

1. Regulatory Risks and Compliance Issues

Perhaps the biggest challenge is the uncertain regulatory environment. Different countries apply different rules to ICO fundraising, with some banning them outright and others requiring strict licensing. For example:

The U.S. SEC often treats ICOs as securities offerings, meaning projects must comply with securities law.

The European Union’s MiCA regulation demands disclosure and investor protection measures.

Some Asian countries restrict ICOs but allow regulated token sales with heavy oversight.

This patchwork creates confusion. Projects accepting crypto payments for ICOs without proper compliance may face fines, legal action, or delisting from exchanges.

Best Practice: Always integrate KYC/AML checks and consult legal experts before accepting global contributions.

2. Market Volatility of Non-Stablecoins

While Bitcoin and Ethereum are popular for ICO payments, they are also highly volatile. A 10–15% drop in price within a single week can wipe out millions from the project’s fundraising total. For example, a project that raised $10 million in BTC during an ICO in 2023 saw its funds shrink to $8.7 million within days due to price swings.

Volatility not only hurts projects but also discourages investors, who fear their contributions could lose value before tokens are even distributed.

Best Practice: Always include stablecoin payment options (USDT, USDC, DAI) to protect both projects and investors.

3. Investor Trust and Security Concerns

Fraud and hacking remain serious risks in the ICO space. Without proper safeguards, projects may suffer:

Phishing scams where fake websites trick investors into sending funds to fraudulent wallets.

Smart contract bugs that allow hackers to exploit token distribution systems.

Insider misuse of funds stored in insecure wallets.

In 2018, several ICOs lost millions due to smart contract vulnerabilities and poor wallet security. While technology has advanced since then, the risks remain in 2026, especially for projects that skip independent audits.

Best Practice: Use audited smart contracts, multi-sig wallets, and escrow services to strengthen investor trust.

4. Fraudulent ICO Projects and Scams

One of the reasons regulators remain cautious is the history of fraudulent ICOs. During the 2017–2018 boom, dozens of projects raised money and disappeared, leaving investors with worthless tokens. Even in 2026, bad actors exploit the anonymity of crypto to launch “rug-pull” ICOs.

Such scams damage the reputation of the entire industry, making investors wary. Legitimate projects must therefore work harder to differentiate themselves and prove they are trustworthy.

Best Practice: Publish transparent roadmaps, undergo third-party audits, and clearly communicate tokenomics to assure investors.

8. Best Practices for ICO Payment Integration

For startups launching a token sale, simply accepting crypto payments for ICOs is not enough. Success requires a combination of transparency, security, compliance, and investor-centric practices. Below are the best strategies to ensure that contributions are handled professionally and that the project earns long-term trust.

Publicly Disclose Smart Contract and Wallet Addresses

Transparency is the foundation of trust. Investors need to know exactly where their funds are going. By publishing the official wallet addresses and making the smart contract code open source (or at least auditable), projects show they have nothing to hide.

Example: In 2024, a Swiss ICO published its audited smart contract code on GitHub, allowing investors and third-party auditors to verify fairness in token distribution. This move boosted investor confidence and helped the project exceed its fundraising goals.

Prioritize Stablecoin Integration

While Bitcoin and Ethereum remain popular, successful projects now prioritize stablecoin payments. Accepting USDC, USDT, and DAI reduces the impact of crypto volatility and ensures that funds raised maintain their value.

Best Practice: Offer stablecoins as the primary payment method, with BTC/ETH as secondary options for investor flexibility.

Use Trusted Crypto Payment Gateways

Instead of manually handling wallets, projects should use crypto payment gateways like XaiGate. These platforms streamline the process by:

Supporting multiple cryptocurrencies.

Automating token distribution via smart contracts.

Providing built-in KYC/AML compliance features.

Offering escrow services for milestone-based fund release.

A gateway removes operational headaches and signals professionalism to investors.

Conduct Independent Smart Contract Audits

ICOs often fail due to overlooked vulnerabilities in their smart contracts. An independent audit from a reputable blockchain security firm (e.g., CertiK, Hacken, Quantstamp) reduces the risk of exploits.

Investors are more likely to participate in projects with published audit reports.

Exchanges often require audits before listing new tokens.

Best Practice: Include the audit certificate in the whitepaper or project website.

Implement Multi-Signature Wallets and Escrow

To protect raised funds, projects should never rely on a single private key.

Multi-signature wallets require approvals from multiple team members before funds can be moved.

Escrow arrangements ensure that funds are released only after predefined milestones are met (e.g., product launch, exchange listing).

This reassures investors that their contributions won’t disappear overnight.

Maintain Transparent Communication

Scams thrive on silence. Legitimate ICOs must actively communicate with their community through:

Regular project updates.

Transparent reporting on funds raised.

Clear timelines for token distribution.

Best Practice: Use platforms like Medium, Telegram, and Discord to keep investors engaged and informed.

Table 2: ICO Fundraising Methods – Crypto Payments vs DeFi Models

| Criteria | Traditional Crypto Payments | DeFi-Inspired ICO Models |

|---|---|---|

| Fundraising Style | Direct contributions in BTC, ETH, stablecoins | Investors stake assets or provide liquidity |

| Token Distribution | Automated via smart contracts | Often gradual or based on staking rewards |

| Liquidity | Tokens need exchange listing post-ICO | Tokens often backed by liquidity pools from day one |

| Investor Protection | Escrow, multi-signature wallets | Smart contract–enforced staking/vesting |

| Adoption in 2026 | Mainstream, widely accepted | Emerging trend, gaining traction |

9. Future of ICO Crypto Payments in 2026 and Beyond

The way investors contribute to token sales continues to evolve. As regulatory clarity increases and technology advances, crypto payments for ICOs are moving toward greater stability, interoperability, and compliance. Below are the major trends shaping the future of ICO payments.

1. Rise of Stablecoin-Based Contributions

Stablecoins are rapidly becoming the backbone of ICO fundraising. In 2017, ICOs were dominated by Bitcoin and Ethereum, but by 2026, over 65% of ICO contributions are made using stablecoins such as USDT, USDC, and DAI.

Why?

Price stability: Eliminates volatility risk.

Regulatory acceptance: Governments in the U.S. and EU are more open to stablecoin fundraising than to volatile assets.

Ease of accounting: Projects can budget accurately without worrying about rapid price swings.

Future Outlook: Expect new regulated stablecoins (such as CBDCs or tokenized fiat) to play a bigger role in ICOs by 2026–2027.

2. Cross-Chain and Layer 2 Payment Integrations

Investors today hold assets across multiple blockchains, not just Ethereum. As a result, ICOs are beginning to adopt cross-chain payment solutions and Layer 2 integrations (Polygon, Arbitrum, Optimism) to reduce costs and expand reach.

Cross-chain gateways allow investors to contribute from different networks (Ethereum, Binance Smart Chain, Solana).

Layer 2 scaling reduces transaction fees, making smaller contributions more viable.

Future Outlook: By 2026, many ICOs will be fully multi-chain, with seamless contributions across networks.

3. DeFi-Inspired ICO Models

Traditional ICOs rely on direct contributions in exchange for tokens. But in 2026, DeFi-inspired models are gaining traction:

Staking ICOs: Investors lock stablecoins or ETH in smart contracts and receive tokens gradually.

Liquidity-based ICOs: Contributions are used to seed liquidity pools, giving tokens immediate market depth.

NFT-based participation rights: Investors receive NFTs that represent their contribution tier and grant access to special rewards.

Future Outlook: The line between ICOs and DeFi fundraising will continue to blur, creating hybrid models that combine the best of both worlds.

4. Increasing Regulatory Frameworks

Regulation is no longer the enemy of ICOs—it’s becoming a key driver of legitimacy.

The U.S. SEC is exploring lighter frameworks for compliant token sales using stablecoins.

The EU’s MiCA regulation is setting global benchmarks for crypto fundraising transparency.

Asian financial hubs like Singapore, Hong Kong, and Dubai are positioning themselves as ICO-friendly jurisdictions with structured rules.

Future Outlook: By 2027, regulated ICOs that integrate KYC/AML + licensed payment gateways will dominate the landscape, leaving little room for unregulated offerings.

10. Comparison Table – Crypto Payments vs Traditional Bank Transfers in ICOs

When analyzing fundraising methods, it becomes clear that crypto payments for ICOs offer advantages that traditional bank transfers cannot match. The table below highlights the key differences between the two systems.

| Criteria | Crypto Payments (For ICOs) | Traditional Bank Payments |

|---|---|---|

| Transaction Speed | Minutes (near-instant settlement on blockchain) | 3–7 business days (delays due to intermediaries) |

| Global Accessibility | Borderless – anyone with a wallet can invest | Limited – subject to banking restrictions, currency barriers |

| Fees | Low (often <$1 for stablecoins on Layer 2) | High (wire fees, conversion charges, intermediaries) |

| Transparency | Full – all transactions verifiable on-chain | Opaque – investors rely on banks for confirmation |

| Volatility | Stable when using USDT/USDC/DAI | None (fiat stable) but slower access and higher cost |

| KYC/AML | Optional, varies by project or gateway | Mandatory, enforced by banks and regulators |

| Investor Control | Full – investors manage their own wallets | Restricted – controlled by financial institutions |

| Trust Factors | Built through audits, multi-sig, and transparency | Built on banking institutions and legacy systems |

Key Insights from the Comparison

Speed Advantage: ICOs using crypto payments can finalize contributions in real time, while traditional fundraising is slowed down by bank intermediaries.

Global Reach: Crypto payments enable participation from emerging markets where banking systems are underdeveloped or restricted.

Cost Efficiency: Stablecoin transactions on Layer 2 networks are far cheaper than international wire transfers.

Transparency & Trust: Blockchain records ensure verifiable proof of contribution, while fiat systems rely on centralized banking confirmations.

Compliance Gap: While banks enforce strict KYC/AML rules, crypto projects are increasingly integrating compliance via payment gateways to match regulatory expectations.

FAQs on Crypto Payments for ICOs

1. What are the benefits of using crypto payments for ICOs?

Crypto payments for ICOs provide speed, global accessibility, low fees, and transparency. Investors can contribute instantly from anywhere in the world, while projects receive funds without relying on traditional banking systems.

2. Which cryptocurrencies are most commonly accepted in ICO fundraising?

Most ICOs accept Bitcoin (BTC), Ethereum (ETH), and stablecoins such as USDT or USDC. Among them, stablecoins are preferred in 2026 because they reduce volatility risks and allow projects to manage budgets more predictably.

3. How do stablecoins help ICO projects reduce volatility?

Stablecoins are pegged to fiat currencies like the U.S. dollar, which makes them resistant to sharp price swings. By integrating stablecoin options, projects using crypto payments for ICOs can protect the value of their fundraising against sudden market fluctuations.

4. Are crypto payments for ICOs legal in 2026?

The legality of crypto payments for ICOs depends on the jurisdiction. Some regions, like the EU, now have structured regulations under MiCA, while others apply securities laws. Projects must ensure compliance with KYC/AML standards to operate legally and maintain investor trust.

5. How can investors make sure their ICO payments are secure?

Investors should always confirm they are sending funds to the official wallet or smart contract address provided by the project. They should also check whether the project uses audited smart contracts, multi-signature wallets, and escrow arrangements to safeguard funds.

6. Do all ICOs require KYC for crypto contributions?

Not all ICOs require KYC, but in 2026, many legitimate projects include it as part of compliance. KYC helps filter out fraudulent activity, ensures alignment with regulations, and increases the chances of tokens being listed on reputable exchanges.

7. What role does a crypto payment gateway play in ICO fundraising?

A crypto payment gateway simplifies the contribution process by enabling multiple crypto payment options, automating token distribution, and adding compliance features such as KYC verification. It also strengthens security by integrating escrow or multi-signature support.

8. Can ICOs accept both fiat and crypto payments?

Yes, some ICOs adopt a hybrid model. While fiat payments are possible, crypto payments for ICOs remain the preferred choice because they are faster, cheaper, and more inclusive, especially for international investors who face banking restrictions.

9. How do smart contracts improve the ICO payment process?

Smart contracts automatically execute token distribution once contributions are received. For example, when an investor sends stablecoins, the contract instantly allocates tokens to their wallet, ensuring fairness, transparency, and efficiency.

10. What future trends will shape crypto payments for ICOs?

Future trends include the dominance of stablecoins, cross-chain payment support, integration with Layer 2 networks to cut fees, and DeFi-inspired fundraising models like staking-based ICOs. Regulatory frameworks are also expected to strengthen, making crypto payments for ICOs more reliable and mainstream.

Conclusion – Why Crypto Payments Power the Future of ICOs

In 2026, crypto payments for ICOs are no longer an experimental option but the foundation of modern token fundraising. They provide unmatched benefits: global accessibility, instant settlement, low fees, and on-chain transparency. Stablecoins, in particular, are transforming ICO fundraising by eliminating volatility risks and making financial planning more predictable.

At the same time, challenges remain. Projects must navigate evolving regulations, guard against fraud, and adopt security best practices. Those that integrate audited smart contracts, multi-signature wallets, KYC/AML compliance, and trusted crypto payment gateways stand the best chance of winning investor confidence and achieving long-term success.

As the ICO landscape continues to evolve, the future will be shaped by stablecoin adoption, cross-chain payment solutions, and DeFi-inspired fundraising models. By following best practices and embracing compliance, ICO projects can position themselves for sustainable growth in a more mature and regulated crypto economy.

Quick Summary Box

| Factor | How Crypto Payments Benefit ICOs |

|---|---|

| Speed | Near-instant settlement vs. days for bank wires |

| Global Reach | Borderless access for all investors |

| Costs | Lower fees compared to traditional finance |

| Transparency | Fully verifiable on blockchain |

| Stability | Stablecoins reduce market volatility |

| Compliance | KYC/AML integration builds trust |

Launching an ICO in 2026 requires more than just a token and a whitepaper — you need a secure, global, and reliable payment system.

With XaiGate, your ICO can:

✅ Accept BTC, ETH, USDT, and USDC from investors worldwide.

✅ Automate token distribution through smart contracts.

✅ Ensure compliance with KYC/AML standards.

✅ Protect funds with multi-signature and escrow security.

Don’t risk your fundraising success with outdated methods. Power your ICO with XaiGate — the leading crypto payment gateway designed for seamless and secure token sales.

👉 Start accepting crypto for your ICO today with XaiGate and unlock global investor participation.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!