The entire world of finance is going through an overhaul of monumental change as crypto payments in emerging markets are proving indispensable in maintaining balance and growth in the sphere of finance. Where the old banking system is suffering on the ground of currency fluctuations and inaccessibility, cryptocurrency is a new trend which is changing the way money is handled by people and business in the developing countries.

Unstable currency has been a major issue of concern to emerging economies as it may ruin the savings overnight and also lead to immensely risky international trade. Nonetheless, the introduction of crypto payments in the developing economies is a new channel of financial stability, protecting against fluctuation in the currency without taking the pain of cross-border transactions.

Contents

- 1 Understanding Currency Volatility in Emerging Markets

- 2 How Crypto Payments Address Currency Volatility

- 3 The Rise of Crypto Adoption in Emerging Markets

- 4 Benefits of Crypto Payments for Emerging Market Economies

- 5 Challenges and Considerations

- 6 Success Stories and Case Studies

- 7 Future Outlook and Trends

- 8 Frequently Asked Questions

- 9 Conclusion

Understanding Currency Volatility in Emerging Markets

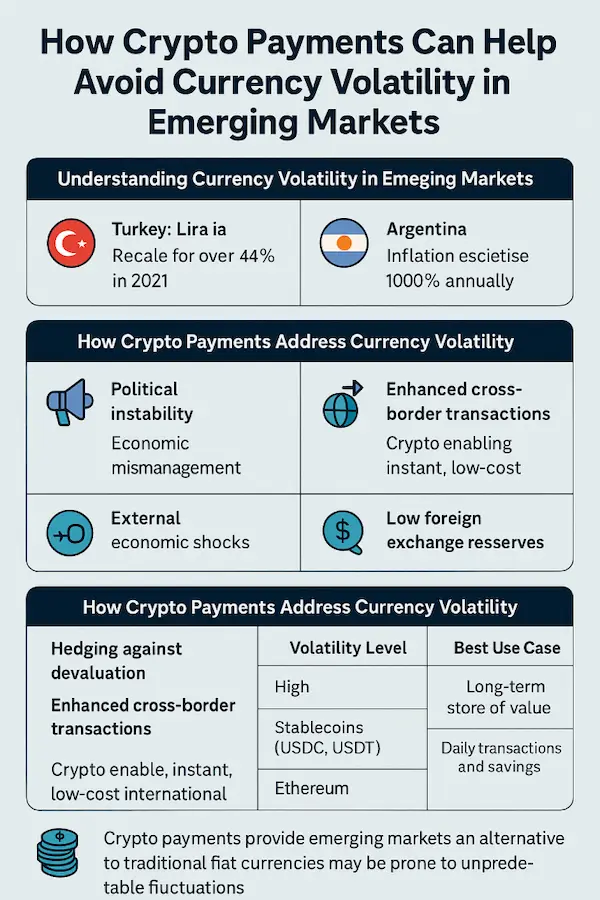

Currency volatility refers to the rapid and often unpredictable changes in exchange rates that can devastate emerging economies. Unlike stable currencies such as the US dollar or euro, emerging market currencies frequently experience dramatic swings that can occur within hours or days.

The Root Causes of Currency Instability

Currency instability in emerging economies is caused by a number of factors:

Capital flight in huge proportions is usually caused by political instability that leads to the investor losing trust towards government policies. Foreign investors are known to pull out their investments as soon as the political tension is high and this causes the local currency to lose value.

Currency stability can be destroyed due to economic mismanagement either as a result of poor fiscal policies, heavy government expenditures, or the burden of an unsustainable amount of debt. The act of printing money in order to fund government activities usually leads to hyperinflation where the currency of that particular country has little or no value.

The emerging market currencies can be devastated by external economic shocks like international recessions, changes in commodity prices or alteration in the international trade policies. They tend to be economies with so much reliance on export of raw materials and thus are subject to the swings in the global market.

Limited foreign exchange reserves make it difficult for central banks to defend their currencies during periods of intense selling pressure. Without adequate reserves, governments cannot intervene effectively to stabilize exchange rates.

Real-World Examples of Currency Volatility

The Turkish lira lost over 44% of its value against the US dollar in 2021, devastating savings and making imports extremely expensive. Similarly, the Argentine peso has experienced chronic instability, with inflation rates exceeding 100% annually in recent years.

In Venezuela, hyperinflation has made the bolívar essentially worthless, forcing citizens to seek alternative stores of value. Lebanon’s currency crisis saw the Lebanese pound lose over 90% of its value between 2019 and 2023, creating widespread economic hardship.

How Crypto Payments Address Currency Volatility

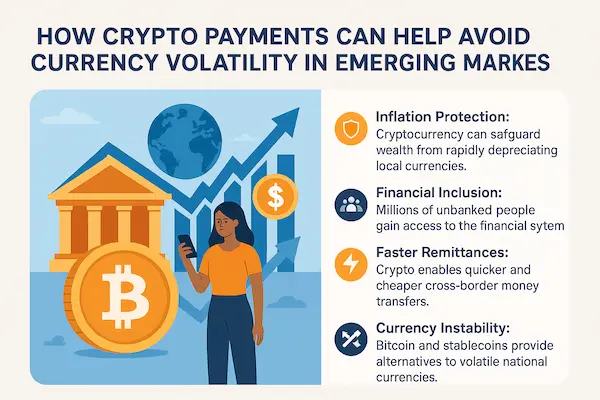

There are a number of benefits associated with trying to use crypto payments in developing nations rather than adhering to using conventional currencies in the various markets wherein people can use to safeguard their money and streamline operations that involve making payments.

Hijacking Local Currency Devaluation

Cryptocurrency acts as a hedge against the loss of value in local currencies since it retains its value irrespective of the economic situation within a country. As citizens exchange their savings to cryptocurrencies such as Bitcoin or Ethereum, they are immune to the ravaging effects of currency meltdown.

Cryptocurrency has also proved to be our lifeline in this economic crisis as a small business owner in Argentina explains. As our peso continues to lose value, my bitcoin savings has not lost their purchasing power.

Constant depth storage

Cryptocurrencies that are pegged on stable assets such as the US dollars, known as stablecoins, serve as a very good alternative to storing value in uncertain economies. Such digital currencies retain the value but they have the convenience and the ease of access using cryptocurrency technology.

|

Cryptocurrency Type |

Volatility Level |

Best Use Case |

|

Bitcoin |

High |

Long-term store of value |

|

Stablecoins (USDC, USDT) |

Low |

Daily transactions and savings |

|

Ethereum |

Medium-High |

Smart contracts and DeFi |

Enhanced Cross-Border Transactions

Traditional international money transfers can take days and cost significant fees, especially for people in emerging markets. Crypto payments in emerging markets enable instant, low-cost transfers that bypass traditional banking systems entirely.

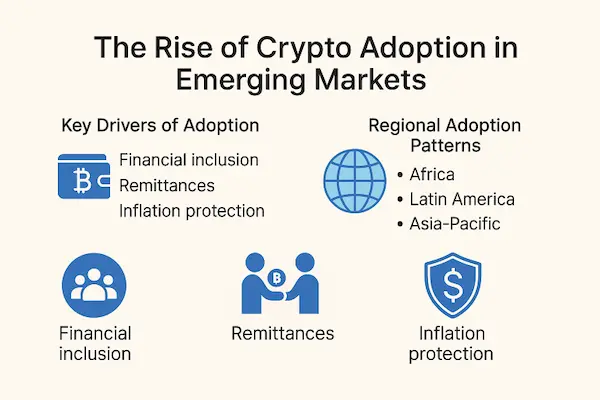

The Rise of Crypto Adoption in Emerging Markets

Emerging markets are leading global cryptocurrency adoption, with countries like Nigeria, Vietnam, and the Philippines showing the highest usage rates worldwide. This adoption stems from practical necessity rather than speculation.

Key Drivers of Adoption

Financial inclusion represents a primary driver as millions of people in emerging markets lack access to traditional banking services. Cryptocurrency provides these individuals with their first opportunity to participate in the global financial system.

Remittances play a crucial role in many emerging economies, with workers abroad sending money home to support their families. Crypto payments in emerging markets make these transfers faster and cheaper than traditional methods.

Inflation protection motivates individuals to seek alternatives to rapidly depreciating local currencies. Cryptocurrency offers a way to preserve wealth when traditional savings accounts lose value daily.

Regional Adoption Patterns

Africa has emerged as a cryptocurrency powerhouse, with countries like Nigeria and Kenya leading adoption rates. The continent’s young population, widespread mobile phone usage, and limited banking infrastructure create ideal conditions for cryptocurrency growth.

Latin America shows strong adoption driven by currency instability in countries like Venezuela, Argentina, and Turkey. Citizens use cryptocurrency to protect their savings and conduct international transactions.

Asia-Pacific regions demonstrate growing interest, particularly in countries with large expatriate populations who need efficient remittance solutions.

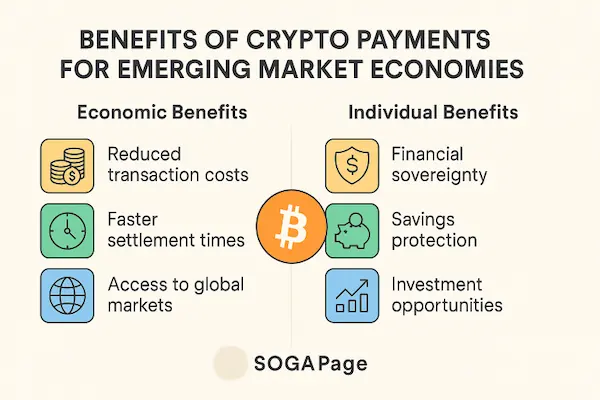

Benefits of Crypto Payments for Emerging Market Economies

The implementation of crypto payments in emerging markets offers numerous advantages that extend beyond individual users to benefit entire economies.

Economic Benefits

Reduced transaction costs make financial services more accessible to lower-income populations. Traditional banking fees can consume significant portions of small transactions, while cryptocurrency fees are typically much lower.

Faster settlement times enable businesses to operate more efficiently, improving cash flow and reducing the need for expensive credit facilities. International transactions that once took weeks can now be completed in minutes.

Access to global markets allows small businesses in emerging markets to sell their products worldwide without the barriers imposed by traditional financial systems. This access creates new opportunities for economic growth and development.

Individual Benefits

Financial sovereignty gives individuals control over their money without relying on unstable banking systems or government policies. Users can store, send, and receive money without third-party interference.

Savings protection helps families preserve their wealth during economic crises. By converting savings to cryptocurrency, individuals can avoid the devastating effects of hyperinflation and currency devaluation.

Investment opportunities provide access to global financial markets that were previously unavailable to people in emerging markets. Cryptocurrency platforms offer investment options that traditional banks cannot provide.

Challenges and Considerations

Despite the significant benefits, crypto payments in emerging markets face several challenges that must be addressed for widespread adoption.

Technical Challenges

Internet connectivity remains limited in many emerging markets, making it difficult for people to access cryptocurrency services. Rural areas often lack the infrastructure necessary for reliable internet access.

Smartphone adoption is growing but not universal, and many cryptocurrency applications require modern smartphones that may be expensive for low-income users.

Technical literacy varies widely, and many potential users lack the knowledge needed to safely use cryptocurrency wallets and applications.

Regulatory Environment

Government attitudes toward cryptocurrency vary significantly, with some countries embracing digital currencies while others impose strict restrictions or outright bans.

Legal uncertainty creates risks for both users and businesses, as regulations may change rapidly and unpredictably.

Tax implications are often unclear, making it difficult for individuals and businesses to comply with local tax laws.

|

Challenge Category |

Impact Level |

Potential Solutions |

|

Technical Infrastructure |

High |

Mobile-first solutions, offline capabilities |

|

Regulatory Uncertainty |

Medium |

Clear government guidelines, industry self-regulation |

|

User Education |

High |

Community training programs, simplified interfaces |

Security Concerns

Wallet security requires users to protect their private keys, which can be challenging for people unfamiliar with cryptocurrency technology. Lost keys mean lost funds, creating significant risks for users.

Scams and fraud are common in the cryptocurrency space, particularly targeting inexperienced users in emerging markets who may not recognize sophisticated scams.

Exchange security varies widely, and users must carefully choose reputable platforms to avoid losing their funds to hacks or fraudulent exchanges.

Success Stories and Case Studies

El Salvador’s Bitcoin Adoption

El Salvador became the first country to adopt Bitcoin as legal tender in 2021, demonstrating how crypto payments in emerging markets can be implemented at a national level. The country’s Chivo wallet has enabled millions of citizens to access cryptocurrency for the first time.

The initiative has shown mixed results, with some citizens embracing Bitcoin for remittances and daily transactions, while others remain skeptical. However, the experiment provides valuable insights into large-scale cryptocurrency adoption.

Nigeria’s P2P Trading Boom

Nigeria leads the world in peer-to-peer cryptocurrency trading, with citizens using platforms like Paxful and LocalBitcoins to buy and sell cryptocurrencies. This activity has created a thriving ecosystem that helps people access foreign currency and conduct international trade.

The country’s Central Bank Digital Currency (CBDC) project, the eNaira, represents an attempt to combine the benefits of cryptocurrency with government oversight.

Kenya’s Mobile Money Integration

Kenya’s successful M-Pesa mobile money system has created a foundation for cryptocurrency adoption. Several companies are now building bridges between traditional mobile money and cryptocurrency, enabling seamless transfers between the two systems.

This integration demonstrates how crypto payments in emerging markets can build upon existing financial infrastructure rather than replacing it entirely.

Future Outlook and Trends

The future of crypto payments in emerging markets looks increasingly promising as technology improves and regulatory frameworks develop.

Technological Developments

Layer 2 solutions are making cryptocurrency transactions faster and cheaper, addressing one of the primary barriers to adoption. These solutions enable thousands of transactions per second at minimal cost.

Mobile-first design is becoming standard for cryptocurrency applications, recognizing that mobile phones are the primary internet access point for most people in emerging markets.

Offline capabilities are being developed to enable cryptocurrency transactions even without internet connectivity, addressing infrastructure limitations in rural areas.

Regulatory Evolution

Central Bank Digital Currencies (CBDCs) are being developed by many emerging market governments as a way to combine the benefits of cryptocurrency with government oversight and control.

Regulatory sandboxes allow cryptocurrency companies to test new services under relaxed regulatory requirements, fostering innovation while protecting consumers.

International cooperation is increasing as governments recognize the need for coordinated approaches to cryptocurrency regulation.

Market Predictions

Industry experts predict that cryptocurrency adoption in emerging markets will continue to grow rapidly, driven by ongoing currency instability and improving technology. The total value of crypto payments in emerging markets is expected to reach hundreds of billions of dollars within the next decade.

“We’re witnessing the early stages of a financial revolution,” notes Dr. James Chen, a cryptocurrency researcher at the Institute for Digital Economics. “Emerging markets are leading this transformation because they have the most to gain from financial innovation.”

Frequently Asked Questions

1. What are the main advantages of crypto payments in emerging markets?

Crypto payments in emerging markets provide protection against currency volatility, enable faster and cheaper international transfers, offer financial inclusion for the unbanked, and provide access to global markets. They also allow individuals to maintain control over their money without relying on unstable banking systems.

2. How do stablecoins help with currency volatility?

Stablecoins are cryptocurrencies pegged to stable assets like the US dollar, providing the benefits of cryptocurrency technology while maintaining stable value. They offer an excellent solution for people in emerging markets who want to protect their savings from local currency devaluation while still being able to transact digitally.

3. What are the main risks of using cryptocurrency in emerging markets?

The primary risks include technical challenges like limited internet connectivity, regulatory uncertainty, security concerns related to wallet management, and the potential for scams and fraud. Users must also navigate tax implications and the learning curve associated with cryptocurrency technology.

4. How can someone in an emerging market start using crypto payments safely?

Start by choosing reputable exchanges and wallets, educate yourself about security best practices, begin with small amounts to learn the technology, use stablecoins for daily transactions, and stay informed about local regulations. It’s also important to never invest more than you can afford to lose.

5. What role do governments play in crypto adoption in emerging markets?

Governments can either facilitate or hinder cryptocurrency adoption through their regulatory policies. Some countries have embraced cryptocurrencies as legal tender or developed their own digital currencies, while others have imposed restrictions or bans. The regulatory environment significantly impacts adoption rates and the development of cryptocurrency infrastructure.

6. How do crypto payments compare to traditional remittance services?

Crypto payments in emerging markets typically offer faster transaction times (minutes versus days), lower fees (often 1-3% versus 7-10%), and greater accessibility since they don’t require traditional banking infrastructure. However, they may require more technical knowledge and face regulatory uncertainty in some jurisdictions.

7. Why are stablecoins popular in developing countries?

In countries where inflation is high and currencies lose value quickly, stablecoins like USDT and USDC are a safer option. Personally, I use them to protect my savings because they’re tied to the US dollar, so I don’t have to worry about my local currency losing value overnight.

8. Can unbanked people use cryptocurrency?

Yes—and that’s one of the biggest advantages. I don’t have a traditional bank account, but with just a smartphone and a crypto wallet, I can receive money, make payments, and even save. It gave me access to financial tools I never had before.

9. Is it safe to use crypto? I’m afraid of scams.

I had the same fear when I started. But after learning the basics—like keeping my private keys secure, using trusted exchanges like Binance or Coinbase, and avoiding “get-rich-quick” offers—I feel much safer. Start small, stay informed, and never share your wallet details.

10. Is cryptocurrency a long-term solution to currency problems?

In many ways, yes. When I see how people in places like Venezuela, Nigeria, or Kenya are using crypto daily—for savings, remittances, and trade—it feels like more than a short-term fix. With better tech and smart regulations, I believe crypto could be a lasting financial solution.

Conclusion

Crypto payments in emerging markets represent a powerful solution to the persistent problem of currency volatility that has plagued developing economies for decades. By providing protection against local currency devaluation, enabling efficient cross-border transactions, and offering financial inclusion to millions of unbanked individuals, cryptocurrency is transforming the financial landscape in these regions.

The success stories from countries like El Salvador, Nigeria, and Kenya demonstrate that cryptocurrency adoption is not just theoretical but a practical reality that’s improving lives and creating economic opportunities. While challenges remain, including technical infrastructure limitations, regulatory uncertainty, and security concerns, the trajectory clearly points toward continued growth and innovation.

As technology continues to evolve and regulatory frameworks mature, crypto payments in emerging markets will likely become even more accessible and user-friendly. The combination of mobile-first design, improved security features, and growing government acceptance creates an environment where cryptocurrency can thrive and provide real solutions to real problems.

The financial revolution happening in emerging markets today may well preview the future of global finance, where traditional barriers to economic participation are eliminated and individuals have greater control over their financial destiny. For the millions of people in emerging markets who have long been underserved by traditional financial systems, cryptocurrency offers hope for a more inclusive and stable economic future.

|

Benefit Category |

Traditional Finance |

Crypto Payments |

|

Transaction Speed |

3-5 days international |

Minutes to hours |

|

Cost |

7-10% for remittances |

1-3% typical fees |

|

Accessibility |

Requires bank account |

Only needs internet |

|

Currency Protection |

Limited options |

Multiple hedging strategies |

The evidence is clear: crypto payments in emerging markets are not just a technological novelty but a fundamental shift toward a more equitable and efficient global financial system. As adoption continues to grow and technology improves, these digital payment solutions will play an increasingly important role in promoting economic development and financial stability in emerging markets worldwide.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!

Don’t miss out on the opportunity to elevate your business with XAIGATE’s Best Crypto payments Platforms. The three-step process is designed to be user-friendly, making it accessible for all businesses. Embrace this modern payment solution to provide customers with a secure and efficient way to pay. Take the first step towards a competitive edge in the digital realm and unlock the benefits of cryptocurrency payments for online casino today.

Looking to integrate seamless crypto payment gateway into your business? XAIGATE provides blockchain-native tools for merchants, developers, and enterprises to accept decentralized payments with confidence. Why How Crypto Payments Can Help Avoid Currency Volatility in Emerging Markets.