Before we get into regulations and diagrams, it helps to ground Crypto Payments Indonesia in the real market. Indonesia combines a huge mobile gaming audience, a zero tolerance stance on online gambling and a fast maturing framework for crypto as a regulated asset. If you want any gaming or casino strategy to survive, you have to see all three at once instead of looking at crypto payments in isolation.

Contents

- 1 1. Gaming, Gambling And Crypto Payments In Indonesia

- 2 2. What Does The Law Really Say About Crypto Payments Indonesia?

- 3 3. Enforcement Trends – How Crackdowns Shape Crypto Payments Indonesia

- 4 4. Opportunity Map – Where Crypto Payments Indonesia Can Fit For Gaming And Casino Merchants

- 5 5. Designing Compliant Crypto Payment Flows For Indonesian Gaming Merchants

- 6 6. Risk Controls, KYC And Monitoring In Crypto Payments Indonesia

- 7 7. Scenario-Based Case Studies For Crypto Payments Indonesia

- 8 FAQs On Crypto Payments Indonesia

- 9 Conclusion

1. Gaming, Gambling And Crypto Payments In Indonesia

Indonesia is a mobile first country with millions of active gamers and widespread use of e wallets and other digital payment methods. For publishers, the market looks perfect: huge player numbers, fast moving trends and familiar payment habits. That is why many teams start exploring Crypto Payments Indonesia as soon as they see how engaged local players are.

1. Indonesian Gaming And Mobile Economy At A Glance

Most players are on smartphones, bouncing between battle royales, casual titles and local IP. Top ups and in game items are already funded through digital wallets, virtual accounts and carrier billing. Lifetime value per user is still developing, but volume makes up for it and gaming is firmly part of the broader digital economy story.

2. Online Gambling Crackdown And Social Sensitivity

By contrast, real money gambling – especially online casinos and betting – is treated as a hard red line. Dedicated taskforces block sites, freeze related accounts and publicly name operators. Community and religious leaders also criticise online gambling as a social harm, which reinforces political will. For any merchant, this means a Crypto Payments Indonesia model that looks like a hidden casino rail for locals is not just risky, it is almost guaranteed trouble.

3. Crypto Adoption And Tax Revenue Signals

Crypto sits in the middle. Many Indonesians trade or hold coins through licensed platforms, and tax collections show that activity is meaningful. Regulators have chosen to manage this through licensing and tax rules rather than a blanket ban. But the framing is clear: crypto as an asset to invest in and report, not as everyday money at the checkout. Sensible Crypto Payments Indonesia strategies respect that line and think in terms of investment flows, treasury and offshore settlement, not “pay in Bitcoin” buttons for domestic users.

4. What This Market Picture Means For Merchants

In practice, merchants should draw a few simple conclusions:

- Indonesia is a high potential gaming market, but gambling is a legal and social no go.

- Crypto is mainstream as a regulated asset, yet off limits as a direct payment method onshore.

- Sustainable Crypto Payments Indonesia strategies focus on compliant use cases around this reality instead of trying to sneak crypto casino rails into the local market.

2. What Does The Law Really Say About Crypto Payments Indonesia?

Before anyone sketches a product flow, they need a sober view of the rules. For Crypto Payments Indonesia, the baseline is clear: rupiah is the only legal means of payment inside the domestic system, while crypto is treated as a regulated financial asset that can be traded, taxed and supervised, but not used like everyday money at the checkout.

1. Crypto As Investment Asset, Not Everyday Money

Regulators have repeated the same message in different formats: crypto is not recognised as a payment instrument in Indonesia. It belongs in the “digital financial asset” bucket, alongside other products that require licences, disclosures and risk controls. In practice, that means a Crypto Payments Indonesia strategy cannot assume local players will pay their gaming or casino bills directly in Bitcoin, stablecoins or any other token. Onshore spend is expected to stay in rupiah, through approved payment channels.

2. Gaming Versus Gambling In Indonesian Law

The law also separates mainstream games from gambling. Video games, in game items and e-sports are generally treated as part of the digital creative economy. Real money gambling, including online casinos and betting, is explicitly prohibited and has been the target of aggressive crackdowns. When you combine gaming, wagering and tokens in one product, regulators are likely to treat it as gambling first and technology second. Any Crypto Payments Indonesia idea that looks like a backdoor way to fund bets for Indonesian players is therefore sitting in a danger zone from day one.

Table 1 – Regulatory Timeline For Crypto Payments Indonesia

| Year / Period | Regulation / Event | Impact On Crypto Payments Indonesia And Gaming |

|---|---|---|

| 2017–2018 | Early central bank statements on crypto and legal tender | Crypto explicitly excluded from use as a domestic payment instrument |

| 2019–2021 | Crypto trading formally allowed under investment framework | Crypto recognised as asset class, not everyday money |

| 2022–2023 | New financial and tax rules for digital assets | Trading and holding brought under tighter reporting and tax duties |

| 2024–2025 | Shift of supervision to a digital financial asset regime | Crypto treated more like a financial product than a commodity |

| 2025+ | Ongoing updates to payments and asset rules | Any new Crypto Payments Indonesia model must adapt to stricter oversight |

This timeline shows a steady move from “experimental asset” to “supervised product” without ever crossing the line into legal payment method onshore.

3. Why This Legal Baseline Matters For Merchants

For merchants, this baseline is not an academic detail, it is a filter. If a proposal assumes crypto will function as a day-to-day payment rail for Indonesian users, it clashes with how the system is built. If instead it treats crypto as an investment, treasury or offshore settlement tool while keeping onshore spend in rupiah, it has a chance to fit into a credible Crypto Payments Indonesia strategy that legal, risk and banking partners can defend.

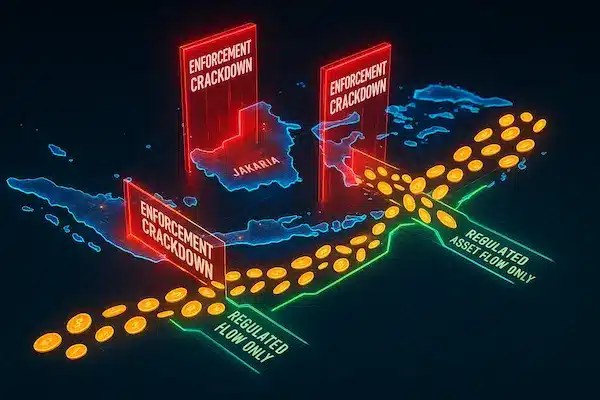

3. Enforcement Trends – How Crackdowns Shape Crypto Payments Indonesia

To understand Crypto Payments Indonesia, you have to look at enforcement, not just black letter rules. In the last few years, authorities have treated online gambling as a national problem and have built joint taskforces to go after both content and money flows. That mood sets the tone for anything that touches gaming, casinos and crypto.

1. The Scale Of The Online Gambling Crackdown

Hundreds of thousands of gambling sites, mirror domains and promo pages have been blocked, with new ones taken down on a rolling basis. Payment accounts, e wallets and bank channels linked to betting rings are being frozen or closed, sometimes in large batches. From a merchant point of view, the message is clear: if something looks like a gambling rail, it will eventually attract attention, regardless of the technology you use on top.

2. Payment And Fintech Platforms Under The Microscope

Enforcement is no longer aimed only at obvious casino operators. Banks, e money issuers, payment gateways and even super apps are being questioned about how their services might be used to fund illegal gambling. That is why any Crypto Payments Indonesia idea that quietly routes chips through on chain transfers is extremely risky. If investigators believe crypto is being used to bypass local payment rules or to disguise betting flows, the platform and its partners can end up in the same spotlight as the gambling sites themselves.

3. What This Enforcement Climate Means For Merchants

For merchants, this climate turns theory into very practical constraints. A sustainable Crypto Payments Indonesia strategy cannot rely on being small enough or clever enough to go unnoticed. It has to be designed so that, even if regulators review your flows, what they see is gaming spend in rupiah on licensed rails, and crypto only in clearly separated roles like investment, treasury or offshore B2B settlement. When you plan new products, the question is not just “Can we build this?” but “Would we be comfortable defending this Crypto Payments Indonesia model in front of a regulator or banking partner?”.

4. Opportunity Map – Where Crypto Payments Indonesia Can Fit For Gaming And Casino Merchants

So far, the picture around Crypto Payments Indonesia has been mostly about limits. This section flips the lens and asks a different question: if you fully respect those limits, where are the genuine openings for gaming and casino related businesses? The answer is less about flashy “pay in crypto” buttons for local players and more about careful use of crypto in offshore, B2B and treasury contexts that sit beside, not inside, domestic payment rails.

Table 2 – Crypto Payments Indonesia Opportunity Matrix

| Use Case | Target Users | Legal View (High Level) | Opportunity Level | Risk Level |

|---|---|---|---|---|

| Direct crypto payments from Indonesian players | Indonesian residents | Crypto payment plus gambling – very likely illegal | None | Extreme |

| Offshore casino with strong geofencing for Indonesia | Non Indonesian players | Depends on offshore licence and real geoblocking | Medium | Medium |

| Indonesian game studio selling globally, settled in crypto offshore | Foreign users only | Possible if onshore users stay on fiat/payment rails | Medium | Medium |

| Onshore gaming company using crypto for treasury or investment | Indonesian entity | Crypto as asset under financial and tax rules | Medium | Low |

| B2B settlement between offshore partners in crypto | Offshore entities | Outside onshore payment system, still regulated offshore | Medium | Medium |

1. Offshore Licensed Casinos With Strong Geofencing

One realistic pattern for Crypto Payments Indonesia sits entirely outside the country’s consumer market. A casino operator licensed in another jurisdiction might accept crypto from its global players while using strict geofencing, KYC and marketing controls to exclude Indonesian residents. In that design, local law is respected because onshore users never see a crypto casino offer, even though crypto is part of the global payment mix elsewhere.

For Indonesian regulators and banks, what matters is that domestic users and domestic rails are not being pulled into gambling activity through back doors. For the operator, the opportunity is to use crypto as an extra option for non-Indonesian players, while treating Indonesia as a market that must be deliberately fenced off in any Crypto Payments Indonesia planning.

2. Indonesian Game Studios Serving Global Users

Another opportunity involves Indonesian game studios that primarily serve players abroad. These companies often receive revenue from foreign app stores, publishers or payment processors. In some cases, those counterparties may choose to settle part of the revenue in crypto to manage FX or speed.

Here, Crypto Payments Indonesia is more about how the studio structures its cross-border receivables and treasury than about how players pay. End users abroad still pay in fiat through normal channels; the crypto leg appears only between the foreign platform and the Indonesian studio, usually outside the local retail payment system. The key is keeping onshore players on rupiah rails while using crypto, carefully and transparently, in the background of global business relationships.

3. Corporate Treasury And B2B Settlement Use Cases

A third pattern focuses on corporate balance sheets and partner settlements. A gaming or entertainment group with exposure to multiple markets may hold a small allocation of crypto as part of its treasury strategy, or settle invoices with offshore partners in digital assets when that is commercially sensible. In that context, Crypto Payments Indonesia is a question of governance, accounting and tax: how you document those positions, which licensed intermediaries you use, and how you report gains and losses.

Crucially, these flows do not replace local consumer payments. Players in Indonesia still top up in rupiah through licensed PSPs; crypto lives in a separate layer where finance teams manage cross-border obligations or diversification. For many serious operators, this treasury-first mindset turns out to be the most defensible way to bring crypto into the picture without blurring lines around domestic gambling spend.

4. What This Opportunity Map Means For Merchants

Taken together, the matrix above shows that Crypto Payments Indonesia is not a simple story of switching on crypto deposits for every player. The safest and most durable openings tend to be:

- Offshore flows where Indonesian residents are clearly and consistently excluded.

- B2B and treasury use cases where crypto is an asset and settlement tool, not a consumer payment rail.

- Global publishing models where Indonesian users stay on rupiah while studios quietly optimise cross-border flows.

If a new idea does not fit one of these shapes, it is worth asking whether it belongs in your Crypto Payments Indonesia roadmap at all, or whether it is really just a risky shortcut dressed up as innovation.

5. Designing Compliant Crypto Payment Flows For Indonesian Gaming Merchants

Once you accept the legal and enforcement limits, the real work begins: designing flows that still create value. A serious Crypto Payments Indonesia strategy is not about hiding what you are doing, it is about making sure every screen, API call and reporting line matches the story you would comfortably tell a regulator or banking partner.

1. Core Design Principles For Crypto Payments Indonesia

A few principles should sit on the wall of any product room working on this topic:

- Onshore consumer spending stays in rupiah, through licensed, mainstream payment methods.

- Crypto sits in clearly separated lanes such as investment, treasury or offshore B2B settlement, not mixed into day to day player spend.

- Flows must be traceable end to end, with clean logs and a simple diagram that explains how money and value move.

If a proposal breaks any of these rules, it probably does not belong in a responsible Crypto Payments Indonesia roadmap.

2. Working With Licensed Payment And Crypto Partners

Design starts with partner choice. You want local PSPs and wallet providers that understand gaming and know how to stay clear of gambling risk, and crypto partners that are licensed, have real compliance teams and offer proper reporting. In a strong Crypto Payments Indonesia setup, these partners are not afterthoughts: they help you shape limits, monitoring and escalation paths before the first user ever sees a “top up” button. That makes it much easier to defend your model later.

3. UX, Copy And Geo Logic That Match Legal Reality

On the front end, the interface must reflect the same boundaries you use in risk discussions. Screens for Indonesian users should talk about rupiah payments, not “pay in Bitcoin”. If you serve multiple markets, geo logic, KYC country and even language variants should work together so that features allowed abroad do not quietly leak into Indonesia. Done well, this kind of UX makes Crypto Payments Indonesia feel boringly clear to regulators and reassuringly honest to users, instead of clever and opaque.

4. What This Design Layer Means For Merchants

For merchants, the takeaway is that design is not cosmetic. Small choices about partner selection, wording, feature flags and reporting either support or undermine your Crypto Payments Indonesia strategy. The merchants who thrive in this environment are the ones who treat compliance, product and engineering as one team: they design for scrutiny from day one, so when new rules arrive or banks ask hard questions, the flows are already robust enough to stand up to inspection.

6. Risk Controls, KYC And Monitoring In Crypto Payments Indonesia

Even the best product design will fail if the control layer is weak. A real Crypto Payments Indonesia strategy lives or dies on how well you know your users, how you track their behaviour and how you respond when something looks wrong. Regulators do not just read your policy slides, they look at onboarding files, transaction logs and the way you escalate cases in practice.

1. Customer Onboarding And Profiling

KYC for gaming and casino related flows has to go beyond ticking boxes. At a minimum you need to verify identity, understand where the user is based and check whether they should even see certain features. For Crypto Payments Indonesia, that means country and residency checks cannot be optional. If your terms say Indonesian residents cannot access crypto or gambling style products, your onboarding logic and your database must actually enforce that.

Good profiling also looks at intent and patterns. A casual mobile gamer topping up small amounts in rupiah should not be treated the same as a high value account with complex cross-border activity. The more your KYC and profiling reflect real risk tiers, the more credible your Crypto Payments Indonesia posture will appear when someone outside the company reviews it.

2. Transaction Monitoring And Gambling Red Flags

Once users are in, you need eyes on their activity. For a gaming or casino context, monitoring should be tuned to spot patterns that resemble funding or cashing out bets, even if the front end looks like a normal game. Repeated small deposits, links to known high risk sites, unusual withdrawal routes or tight loops between wallets and payment instruments are all signals that deserve attention.

In a Crypto Payments Indonesia environment, you also have to think about how fiat and on chain data speak to each other. If crypto is used for treasury or B2B settlement, your team needs tools to see when those flows might be indirectly touching players or affiliates in Indonesia. The goal is not to block everything, but to be able to explain why you allowed or stopped specific patterns.

3. Record Keeping, Reporting And Internal Playbooks

Controls only matter if you can prove they exist. That starts with keeping complete and searchable records: KYC files, payment logs, wallet movements, risk scores and case notes. For Crypto Payments Indonesia, those records form the backbone of any conversation with banks, auditors or regulators. If you cannot reconstruct what happened with a user or a flow, you cannot credibly claim that your controls worked.

On top of raw data, you need playbooks. Who reviews alerts? When does a case get escalated from operations to compliance or legal? At what point do you freeze an account, block a route or end a relationship with a partner? Clear, written answers to those questions turn your Crypto Payments Indonesia framework from a concept into a living process.

4. What This Risk Layer Means For Merchants

For merchants, the message is straightforward: there is no shortcut around KYC, monitoring and documentation. A strong Crypto Payments Indonesia strategy is one where you can pull up a simple diagram of the flows, show real logs behind it and walk an external reviewer through your decisions without flinching. If that level of transparency feels uncomfortable, the problem is not the regulator, it is the design of the flows themselves.

7. Scenario-Based Case Studies For Crypto Payments Indonesia

Theory only gets you so far. It is often easier to test ideas for Crypto Payments Indonesia by running them through concrete scenarios and asking a simple question: “Would I be comfortable explaining this flow, step by step, to a regulator or a banking partner?”. The three examples below are not legal advice, but they show how small design choices can move a model from defensible to dangerous.

1. Global Casino Brand With Explicit Indonesia Exclusion

Imagine a global casino brand licensed in a foreign jurisdiction. It accepts crypto from players in markets where this is allowed, and uses a mix of fiat and tokens for deposits and withdrawals. On paper that sounds like a classic Crypto Payments Indonesia problem, but the way the operator handles geography changes everything.

In the careful version, the brand blocks Indonesian IP ranges, excludes Indonesia from its KYC country list, filters local payment methods and hard codes the restriction into its terms and internal playbooks. Marketing campaigns, affiliates and app store listings are set up so that Indonesian users are never targeted. Crypto payments exist, but Indonesia is deliberately fenced off.

In that model, local authorities may still watch the brand, yet it is easier to argue that the casino is not part of the domestic consumer market. The key lesson for Crypto Payments Indonesia is that exclusion must be designed into every layer, not added as a small note in the terms and conditions.

2. Indonesian Game Publisher With Global PSP And Crypto Settlement

Now take a different case. A game publisher is incorporated in Indonesia but most of its players are in North America and Europe. Users pay in fiat through a large international PSP that handles cards, wallets and platform billing. The PSP offers the publisher a choice: take monthly settlements in dollars to a bank account, or receive part of the revenue in crypto to a treasury wallet.

In a careful implementation, end users still see only local fiat methods. They never see a “pay in crypto” option, and they never send tokens directly to the publisher. The crypto leg appears later, only between the PSP and the company, as a way to manage FX and timing. From a Crypto Payments Indonesia perspective, this is mainly a treasury and accounting topic, not a consumer payments experiment.

This kind of flow can sit inside a responsible Crypto Payments Indonesia strategy if the company uses licensed intermediaries, documents tax treatment and keeps domestic players firmly on rupiah rails. If the same publisher started letting Indonesian users pay directly in tokens, the risk picture would change completely.

3. Red Flag Scenario – Direct Crypto Casino Rails For Indonesian Players

Finally, consider the version that should set off alarms. A site markets itself as a “game of skill” but looks and feels like a casino to users. Indonesian players are encouraged to buy tokens off an exchange, send them to a wallet address and receive in game chips that can later be cashed out to different wallets or even back to local bank accounts through informal brokers.

On the surface, this may avoid traditional payment gateways. In reality, it is exactly the kind of model regulators have in mind when they talk about using crypto to bypass rupiah and gambling rules. It mixes wagering, anonymity and informal cash out routes in one funnel. No amount of clever branding can turn this into a safe Crypto Payments Indonesia design.

Seen side by side, these three scenarios show how the same basic ingredients can lead to very different outcomes. A mature Crypto Payments Indonesia roadmap leans toward the first two cases, where geography, user experience and treasury are all aligned with law, and walks away from the third, no matter how tempting the short term revenue looks.

FAQs On Crypto Payments Indonesia

1. Is it legal to pay Indonesian online casinos directly in crypto?

No. Paying local casino or betting products directly in crypto conflicts with gambling rules and with the ban on using crypto as a domestic payment instrument.

2. Can Indonesian gamers top up their wallet in Bitcoin or stablecoins?

Under current rules, everyday top ups for local users are expected to be in rupiah via licensed payment methods, not directly in coins.

3. What does “Crypto Payments Indonesia” actually mean in this guide?

Here, Crypto Payments Indonesia means all the legal, tax and risk rules that apply when crypto touches payment-like flows involving Indonesian users or entities.

4. Are offshore casinos that accept crypto always safe from Indonesian law?

No. If they actively target Indonesian users or allow easy access without geofencing and KYC, they can still draw attention from local authorities and partners.

5. Where are the safest use cases for crypto in the gaming sector?

The safest patterns are offshore flows, B2B settlement and treasury use, where onshore players still pay in rupiah on licensed rails.

6. Can an Indonesian studio be paid in crypto by foreign platforms?

Yes, in principle, if it is structured as cross-border settlement or treasury, not as direct crypto payments from local players, and taxes and reporting are handled properly.

7. Who should own a Crypto Payments Indonesia strategy inside a company?

Product, legal, risk and finance should share ownership. A Crypto Payments Indonesia plan that sits only in “growth” or only in “compliance” will not be stable.

8. What is the biggest mistake companies make with Crypto Payments Indonesia?

The biggest mistake is treating crypto as a shortcut around rupiah and gambling rules instead of designing flows that keep domestic payments clean and crypto clearly separated.

Conclusion

At the end of the day, Crypto Payments Indonesia is not about turning every gamer into a crypto payer. Indonesia welcomes gaming as part of the digital economy and treats crypto as a supervised financial asset, but it is uncompromising on gambling and onshore payment rails. The merchants who last are the ones who accept those lines and still use crypto intelligently in the spaces that remain.

Crypto Payments Indonesia Quick Summary For Gaming And Casino Merchants

| Dimension | Status In Indonesia | Takeaway For Merchants |

|---|---|---|

| Crypto as payment | Not allowed as onshore payment instrument | Do not accept direct crypto from Indonesian users |

| Crypto as asset | Regulated digital financial asset | Use licensed channels for investment, treasury and reporting |

| Online gambling | Strictly prohibited with active national crackdowns | Avoid any model that looks like crypto rails for gambling |

| Gaming industry | Supported as digital creative economy | Focus on content, IP and exports, not crypto casino funnels |

| Real opportunities | Treasury, B2B, offshore and global user flows | Build Crypto Payments Indonesia strategies around law, not loopholes |

Key Takeaways For Crypto Payments Indonesia

- A sustainable Crypto Payments Indonesia plan keeps local players on rupiah rails and uses crypto only in clearly defined roles like treasury, B2B and offshore settlement.

- The strongest models are the ones you can explain on a single diagram, backed by clean logs and written policies that banks and regulators can read without surprises.

- Short term “crypto casino” tricks aimed at Indonesian users may bring revenue, but they sit directly in the path of current enforcement and are unlikely to survive.

Design A Compliant Crypto Stack With XaiGate

If you want to move from theory to execution, you do not have to do it alone. A gateway like XaiGate can help you separate rupiah payments from crypto flows, implement consistent KYC and monitoring, and give your team a single dashboard for everything tied to Crypto Payments Indonesia. Instead of stitching together fragile workarounds, you get one controlled architecture that product, risk and finance can all stand behind.

The next step is simple: pick one use case where crypto genuinely adds value, put legal and product in the same room, and bring XaiGate into that conversation from the start. Ask XaiGate to help you design a narrow pilot that respects Indonesian rules, proves real numbers and can be shown proudly to partners and regulators. Merchants who move this way are the ones most likely to rank, to be quoted and to still be operating when the rules tighten again.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)!