Contents

- 1 1. Introduction – Why USDT Is Reshaping Digital Payments

- 2 2. What Is a Crypto USDT Payment Gateway?

- 3 3. Benefits of Using a Crypto USDT Payment Gateway

- 4 4. How a Crypto USDT Payment Gateway Works

- 5 5. Top Use Cases of Crypto USDT Payment Gateways

- 6 6. Challenges & Risks of Crypto USDT Payment Gateways

- 7 7. Comparison – USDT vs Other Stablecoin Gateways

- 8 8. Choosing the Right Crypto USDT Payment Gateway Provider

- 9 9. Future of Crypto USDT Payment Gateways (2026–2030)

- 10 FAQs – Best Crypto USDT Payment Gateway

- 11 Conclusion – Why Businesses Should Adopt a Crypto USDT Payment Gateway

1. Introduction – Why USDT Is Reshaping Digital Payments

In the evolving world of digital finance, USDT (Tether) has emerged as the most widely adopted stablecoin. Its value is pegged to the U.S. dollar, which gives it the stability merchants and customers need when making cross-border transactions. Unlike Bitcoin or Ethereum, which fluctuate daily, USDT maintains a consistent price, making it an attractive option for real-world payments.

As global commerce moves online, many businesses are exploring ways to simplify international transactions. This is where a crypto USDT payment gateway comes in. By using blockchain infrastructure, merchants can process payments quickly, securely, and at a fraction of the cost of traditional bank transfers or credit card systems.

According to CoinGecko, over 70% of stablecoin transactions in 2024 were conducted in USDT. This market dominance shows that businesses worldwide are adopting stablecoin payments not only in e-commerce but also in industries like travel, gaming, and non-profit organizations. For many of them, the gateway is becoming an essential tool to stay competitive in a borderless economy.

2. What Is a Crypto USDT Payment Gateway?

At its core, a crypto USDT payment gateway is a system that enables merchants to accept payments in USDT directly from customers. Instead of routing transactions through banks or card processors, the gateway relies on blockchain technology to verify and settle payments in real time.

This approach eliminates many of the inefficiencies of legacy systems. A card payment may take two or three days to clear, while a USDT transaction is usually completed within seconds. For businesses operating internationally, this speed can significantly improve cash flow and customer experience.

Another important benefit is predictability. Because USDT is stable, merchants don’t have to worry about sudden drops in value after a sale. An online store in Asia, for instance, can sell products to a customer in Europe and receive the same value in USDT, without exchange rate surprises.

For companies looking to expand globally, integrating a crypto USDT payment gateway into their websites or apps provides a reliable way to reach new customers while reducing costs and transaction risks.

3. Benefits of Using a Crypto USDT Payment Gateway

For many businesses, adopting a crypto USDT payment gateway is not just about keeping up with trends—it’s about gaining clear financial and operational advantages. By integrating this type of solution, companies can reduce costs, improve transaction speed, and access a truly global customer base.

1. Cost Efficiency for Merchants

Traditional card processors and international banks often charge between 2–5% per transaction. With a USDT gateway, fees are usually less than 1%, making it much more cost-effective, especially for high-volume or cross-border sales.

2. Instant Settlement & Improved Cash Flow

Instead of waiting days for funds to clear, payments made with USDT typically arrive in seconds. This allows merchants to access liquidity immediately, strengthening cash flow and reducing reliance on credit.

3. Lower Risk of Chargebacks and Fraud

One of the most overlooked benefits of a blockchain-based gateway is the irreversible nature of transactions. Once a payment is confirmed, it cannot be reversed, which means businesses are better protected against fraudulent chargebacks.

Quick Comparison: USDT Gateway vs Traditional Payments

| Feature | Crypto USDT Payment Gateway | Credit Cards / Banks |

|---|---|---|

| Transaction Speed | Seconds | 1–3 business days |

| Average Fee | <1% | 2–5% |

| Chargeback Risk | None (irreversible) | High |

| Global Access | Borderless | Limited by region |

| Currency Volatility | Stable (pegged to USD) | Not applicable |

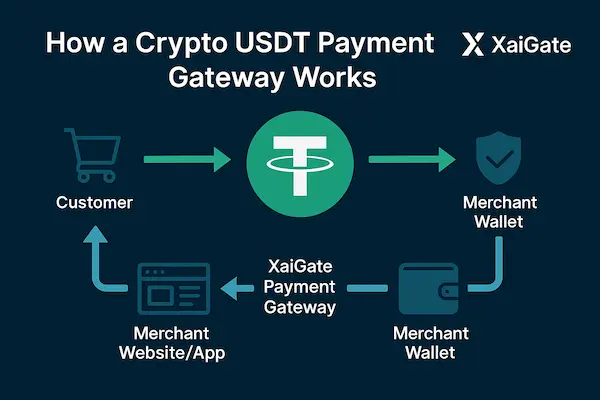

4. How a Crypto USDT Payment Gateway Works

Although the technology behind blockchain payments may sound complex, the actual process of using a crypto USDT payment gateway is straightforward for both merchants and customers. It functions as a bridge between a buyer paying in USDT and a business receiving funds securely in their wallet or preferred currency.

Step 1: Customer Checkout

A customer selects USDT as the payment option on a website or mobile app. Instead of entering card details, the gateway generates a wallet address or QR code for the transaction.

Step 2: Payment Processing on Blockchain

The customer sends USDT from their crypto wallet. This payment is recorded on the blockchain, which confirms the transaction within seconds. The crypto USDT payment gateway ensures that the correct amount is transferred and securely logged.

Step 3: Merchant Receives Funds

Once the payment is verified, the funds are delivered directly to the merchant’s crypto wallet. Depending on the gateway provider, the merchant can either keep the balance in USDT or convert it automatically into fiat currency (e.g., USD, EUR).

Step 4: Settlement and Reporting

The gateway also provides reporting tools and APIs that allow merchants to track payments, reconcile accounts, and integrate with existing e-commerce or ERP systems. This creates a seamless experience that rivals—and in many cases surpasses—traditional payment networks.

On-Chain vs Off-Chain Transactions

On-chain transactions are recorded directly on the blockchain, offering maximum transparency but slightly higher network fees.

Off-chain or Layer-2 solutions can batch transactions, reducing costs while maintaining speed—ideal for businesses processing large volumes.

API Integration vs Plugins

Merchants can integrate a crypto USDT payment gateway in two main ways:

API Integration: Offers full customization, often chosen by larger businesses or platforms.

Plugins: Quick, ready-to-use solutions for Shopify, WooCommerce, Magento, and other e-commerce systems.

5. Top Use Cases of Crypto USDT Payment Gateways

The adoption of stablecoins is not limited to the crypto industry. Today, a crypto USDT payment gateway is being used across a wide range of sectors, helping businesses expand globally while lowering costs and improving customer trust.

1. E-Commerce & Retail

Online stores are among the earliest adopters. Accepting USDT allows merchants to reach customers in regions where credit card usage is low or where cross-border payments are expensive. By integrating a crypto USDT payment gateway, e-commerce platforms can reduce cart abandonment rates and provide shoppers with a modern, borderless payment option.

2. Travel & Hospitality

Airlines, travel agencies, and hotel chains are beginning to recognize the value of stablecoin payments. With USDT, international travelers can book flights or accommodations without worrying about currency exchange fees. A payment gateway makes the process seamless by instantly converting crypto transactions into the business’s preferred settlement method.

3. Online Gaming & Casinos

Digital gaming platforms and online casinos often deal with international players. For them, speed and security are essential. A crypto USDT payment gateway allows instant deposits and withdrawals, eliminating long wait times and reducing the risk of fraud. This creates a better user experience and keeps players engaged.

4. Adult Industry & NGOs

Two sectors with very different goals—entertainment and charity—share one common challenge: limited access to traditional payment processors. In regions where financial institutions restrict certain transactions, USDT gateways provide a reliable alternative. For NGOs, this also ensures that donations reach them quickly without being reduced by heavy fees.

Case Study: USDT in Online Casinos

Several online casinos in Europe and Asia have reported a significant increase in new players after adding USDT as a payment option. By using a crypto USDT payment gateway, they were able to process instant deposits, reduce fraud, and appeal to a younger, crypto-savvy audience.

Case Study: Travel Agencies Adopting Stablecoins

A mid-sized travel agency in Southeast Asia integrated USDT payments to attract international customers. Within six months, bookings from Europe increased by 20%, largely because clients appreciated the ability to pay in a stable cryptocurrency without hidden charges.

6. Challenges & Risks of Crypto USDT Payment Gateways

While the advantages of a crypto USDT payment gateway are clear, businesses should also be aware of the challenges that come with adopting stablecoin payments. From regulatory uncertainty to custodial risks, these issues must be considered before full-scale integration.

1. Compliance and Regulatory Hurdles

The legal status of stablecoins varies widely across jurisdictions. Some countries embrace them, while others impose restrictions or demand strict KYC/AML procedures. Merchants using a crypto USDT payment gateway must ensure they remain compliant with local regulations to avoid penalties.

2. Custodial vs Non-Custodial Risks

Depending on the provider, funds may be held temporarily by the gateway before being released to the merchant. Custodial solutions can create exposure to counterparty risks if the provider faces technical issues or insolvency. Non-custodial gateways, on the other hand, give businesses full control but require more technical knowledge.

3. Dependence on Tether’s Stability

Although USDT is pegged to the U.S. dollar, questions about Tether’s reserves have been raised in the past. While the token remains stable in practice, businesses relying on a crypto USDT payment gateway should be aware of these debates and monitor market developments.

4. Security and Operational Risks

No system is entirely immune to cyber threats. Merchants must ensure they choose a payment gateway provider with strong encryption, secure APIs, and multi-layer fraud detection. Employee training and proper wallet management are also key to reducing operational risks.

Practical Tips for Businesses

Always check if the gateway provider is licensed or regulated in your region.

Consider using non-custodial gateways to maintain control over funds.

Diversify by offering multiple stablecoins (USDT, USDC) to reduce reliance on a single token.

Establish internal protocols for wallet management and security audits.

7. Comparison – USDT vs Other Stablecoin Gateways

When businesses consider integrating stablecoin payments, they often compare USDT with alternatives such as USDC or DAI. Each option has its strengths, but the crypto USDT payment gateway remains the most widely adopted due to liquidity and market reach.

Market Adoption

USDT has been in circulation since 2014 and dominates the stablecoin sector. USDC, issued by Circle, is considered more transparent but has less global penetration. DAI is decentralized but less predictable in extreme market conditions.

Regulatory Position

USDC is known for strict compliance and audited reserves, which makes it attractive in regions with strong financial oversight. USDT faces mixed opinions regarding its reserves, but its scale and liquidity keep it at the center of most stablecoin transactions. DAI’s decentralized nature appeals to DeFi communities but creates uncertainty for mainstream businesses.

Fiat Conversion

A crypto USDT payment gateway offers strong liquidity across global exchanges, making it easy for merchants to convert USDT into fiat currencies. USDC also has strong fiat support, particularly in the U.S. DAI, while useful within DeFi, is less convenient for direct conversion into government-issued money.

Comparison Table

| Feature | USDT Gateway | USDC Gateway | DAI Gateway |

|---|---|---|---|

| Market Adoption | Very High (global leader) | High (U.S.-centric) | Medium (popular in DeFi) |

| Stability | Pegged to USD, strong liquidity | Pegged to USD, audited reserves | Algorithmic peg, less predictable |

| Regulatory Standing | Mixed, under scrutiny | Strong compliance reputation | Decentralized, regulatory gray |

| Fiat Conversion | Broad global support | Strong in regulated markets | Limited outside DeFi |

| Best Use Case | Global payments & retail adoption | U.S. merchants & compliance-heavy | DeFi ecosystems |

8. Choosing the Right Crypto USDT Payment Gateway Provider

Not all gateways are created equal. While the concept of a crypto USDT payment gateway is straightforward, providers differ greatly in terms of cost, reliability, compliance, and integration options. For merchants, selecting the right partner is as important as the decision to accept stablecoin payments in the first place.

Key Factors to Consider

Transaction Fees – Low fees are one of the main reasons businesses move to stablecoins. Compare gateway providers carefully, as rates can vary from under 1% to more than 2%.

Integration Options – A flexible API or ready-made plugins for Shopify, WooCommerce, and Magento make adoption much smoother.

Liquidity and Fiat Support – Ensure the provider allows quick conversion of USDT to fiat currencies relevant to your business.

Regulatory Compliance – In some industries, KYC and AML procedures are mandatory. Choose a provider that can align with your compliance requirements.

Security Standards – Look for features like multi-signature wallets, encryption, and fraud detection tools.

Custodial vs Non-Custodial Solutions

Custodial gateways manage funds on behalf of the merchant. They’re easy to use but involve counterparty risk.

Non-custodial gateways give businesses full control of their funds, which enhances security but requires more technical oversight.

Leading Providers in 2026

XaiGate – Specializes in stablecoin payments, low fees, strong API integration, and global reach. Ideal for merchants who want a dedicated USDT solution.

BitPay – One of the oldest crypto payment processors, with support for multiple coins, but fees and fiat settlement options can be less competitive.

NOWPayments – Known for its easy integration and wide crypto support, though not as stablecoin-focused as XaiGate.

Choosing the right provider ultimately comes down to matching your business model with the gateway’s strengths. For most global merchants looking for stable, low-cost, and scalable solutions, a dedicated crypto USDT payment gateway like XaiGate offers the best balance between functionality and future-proof adoption.

9. Future of Crypto USDT Payment Gateways (2026–2030)

The role of stablecoins in global finance is expected to grow significantly in the next decade. As adoption accelerates, the crypto USDT payment gateway will likely evolve from a niche solution into a mainstream payment infrastructure used by millions of businesses worldwide.

CBDCs vs Stablecoins

Governments across the world are experimenting with Central Bank Digital Currencies (CBDCs). While CBDCs may eventually compete with stablecoins, many experts believe they will coexist. Merchants may end up offering both options, with USDT continuing to dominate international transactions due to its established network and liquidity.

Integration with DeFi and Web3

By 2030, payment gateways are expected to integrate more deeply with decentralized finance (DeFi) applications. Imagine a scenario where a crypto USDT payment gateway not only processes transactions but also automatically connects businesses to lending, yield farming, or liquidity pools—turning idle balances into revenue-generating assets.

Adoption in Emerging Markets

In regions with high inflation or limited access to banking, USDT adoption is already rising. Countries in Latin America, Africa, and Southeast Asia are seeing a surge in merchants who prefer stablecoins over unstable local currencies. The gateway model provides them with an easy entry point into the digital economy.

Cross-Industry Expansion

Beyond e-commerce and gaming, more traditional sectors such as education, healthcare, and even government services could adopt USDT payments as regulatory clarity improves. This expansion will push demand for gateways that are both secure and compliant.

More info: CoinTelegraph – Stablecoins in E-commerce

FAQs – Best Crypto USDT Payment Gateway

1. What is a Crypto USDT Payment Gateway?

It’s a system that lets merchants accept USDT payments directly through blockchain, with fast and secure settlement.

2. Why is USDT widely used for payments?

Because it’s stable, pegged to the USD, highly liquid, and supported by almost every exchange.

3. How does a USDT gateway cut costs?

Fees are usually below 1%, much lower than traditional banks or card processors that charge 2–5%.

4. Is it safe to use a Crypto USDT Payment Gateway?

Yes, when using a trusted provider with strong security, blockchain verification, and fraud prevention.

5. Which industries benefit most?

E-commerce, travel, gaming, online casinos, adult services, and NGOs gain the most from USDT payments.

6. Can merchants convert USDT into fiat?

Yes, most gateways allow instant conversion into USD, EUR, VND, or other local currencies.

7. What are the regulatory challenges?

Rules differ by country. Some accept stablecoins, others require strict KYC/AML compliance.

8. What risks come with USDT?

Concerns about Tether’s reserves exist, but it remains the most used and stable option.

9. How does it compare to traditional payments?

It’s faster, cheaper, and borderless, though traditional systems still have clearer legal protections.

10. Who is the best provider in 2026?

XaiGate leads for stablecoin-focused solutions, while BitPay and NOWPayments offer broader crypto support.

Conclusion – Why Businesses Should Adopt a Crypto USDT Payment Gateway

The global payments landscape is shifting faster than ever. With inflation concerns, rising cross-border e-commerce, and the mainstreaming of digital assets, stablecoins like USDT have become more than a trading tool—they are now a practical means of payment. A crypto USDT payment gateway gives businesses the ability to operate without borders, process transactions in seconds, and reduce costs in ways that traditional banks cannot match.

2026 is shaping up to be a pivotal year. Regulatory frameworks are tightening, CBDCs are emerging, and consumer demand for crypto-friendly merchants is accelerating. In this environment, companies that integrate a USDT gateway early will gain a competitive edge, while those who delay risk losing relevance in a digital-first economy.

Quick Summary – Top 5 Reasons to Use a Crypto USDT Payment Gateway

| Benefit | Why It Matters for Businesses |

|---|---|

| Low Fees | Reduce payment costs by 50–80% compared to cards or banks |

| Instant Settlement | Improve cash flow with near-instant transactions |

| Global Reach | Accept payments from customers worldwide without barriers |

| Stable Value | Avoid volatility seen in Bitcoin or Ethereum |

| Fraud Protection | Eliminate chargeback risks through blockchain finality |

Final Thoughts & Call to Action

The rise of stablecoins is no longer just speculation—it’s a newsworthy reality shaping the future of global commerce. Businesses that embrace this shift now will not only meet customer expectations but also position themselves as innovators in their industries.

If your company is ready to modernize payments, streamline international sales, and build trust with crypto-savvy customers, the solution is clear: start accepting USDT today.

Partner with XaiGate—a trusted provider of stablecoin payment solutions—and unlock the full potential of a crypto USDT payment gateway for your business.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!