In 2025, the world of cryptocurrency payments is undergoing a profound transformation. Merchants are no longer questioning whether they should accept cryptocurrency—they’re now focused on finding the solution that delivers the best performance, the lowest fees, the highest security, and the most global scalability. From no-KYC models and stablecoin adoption to multi-chain integration and instant settlement, the features that define a leading cryptocurrencypayment gateway have evolved rapidly.

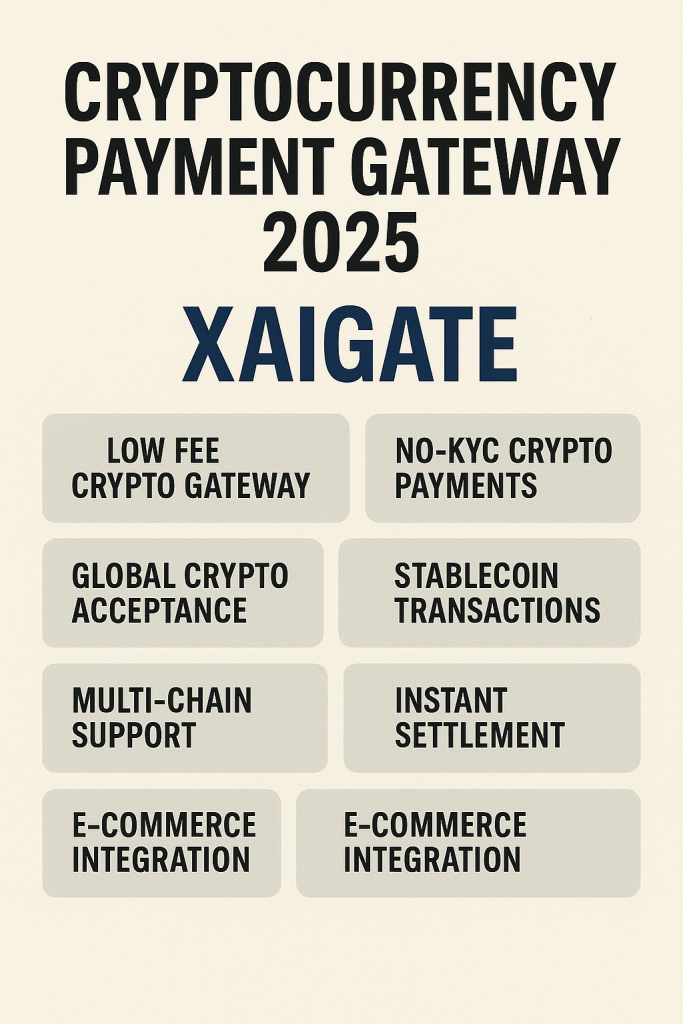

This article delves into what makes a cryptocurrency payment gateway truly competitive in 2025, what trends are fueling widespread adoption, and why platforms like XAIGATE are at the forefront of the shift, offering businesses the tools they need to embrace the future of digital payments.

Contents

1. BACKGROUND

Given the volatility of Bitcoin, predicting its future is speculative. However, many believe that this is a critical turning point for Bitcoin, one that could lead to a major shift in its trajectory. The significant fluctuations in its price are largely influenced by advancements in technology organizations, which continue to develop software features to maximize the usefulness of cryptocurrencies, national regulations, and technological innovations.

According to a report by Statista, the cryptocurrency payment market is expected to grow by 17% annually by 2023. This represents a significant market opportunity. Moreover, Global Market Insight has valued this market at 1.2 billion USD, with an annual growth rate of 15%.

At present, around 560 million people use cryptocurrency worldwide, with 327 million users based in Asia. This large market presents a unique opportunity for business owners aiming to expand globally. By offering cryptocurrency-based services, businesses can differentiate themselves from competitors and attract a broader audience.

Advantages of Cryptocurrencies for Buyers and Sellers

For both buyers and sellers, cryptocurrencies offer undeniable advantages. Many businesses have been quick to embrace these benefits, actively setting up infrastructure for digital transactions and partnering with payment gateways to leverage technology and accept cryptocurrency payments. This allows them to improve their bottom line while staying ahead of the competition.

However, it’s important to note that the future of cryptocurrency remains uncertain. Its development will depend heavily on changes in regulations, the level of user adoption, and ongoing technological improvements.

Blockchain in Other Industries: Beyond finance, blockchain technology is being adopted in diverse industries, including supply chains. This expanded use of blockchain will further cement the role of digital assets in the global economy.

Attraction and Transparency: To attract more investors, the payment process must be transparent. While software developers and payment organizations have been building cryptocurrency payment solutions, investor confidence remains hesitant due to a lack of clear legal frameworks and governmental acceptance in many countries.

Institutional Adoption: As regulations become more transparent, institutional investors will be more likely to enter the cryptocurrencymarket. This influx of investment could provide much-needed liquidity and, in turn, lead to price stabilization.

Central Bank Digital Currencies (CBDCs): Governments are developing their own blockchain-based solutions known as CBDCs. While not cryptocurrencies in themselves, CBDCs will help familiarize the public with digital assets and may pave the way for greater acceptance of cryptocurrencies.

DeFi Expansion: Decentralized Finance (DeFi) continues to expand, offering services like lending, borrowing, and staking without the need for traditional permission-based systems. Innovations like cross-chain bridges will improve DeFi’s efficiency and accessibility, bringing it closer to the mainstream.

Sustainability: As the cryptocurrency sector grows, addressing environmental and renewable energy concerns will be a key challenge. The process of mining Bitcoin and other digital assets requires significant energy, so the industry’s approach to sustainability will be critical moving forward.

AI Integration: Artificial Intelligence (AI) has become a valuable tool in the cryptocurrency space, helping traders execute transactions securely and assisting investors in managing portfolios effectively. This integration of AI opens up new possibilities and marks the beginning of an exciting new era for cryptocurrency.

Learn more: https://www.xaigate.com/crypto-payment-gateway-wordpress-woocommerce/

2. TRENDS AND WHAT SHAPE THE FUTURE OF PAYMENT SECTOR

The market capitalization of cryptocurrencies currently exceeds $3 trillion, and it’s expected to grow at an even faster pace in the coming years. As more individuals adopt cryptocurrencies, businesses must become crypto-friendly to stay competitive. With the rise of digital currencies, technology will advance to accommodate the increasing demand for cryptocurrency payments. The continued development of blockchain and crypto technology will lead to faster, safer, and more user-friendly payment gateways.

Check Cryptocurrency Support for Your Business

When selecting the best cryptocurrency payment gateway for 2025, the first step is to verify whether it supports cryptocurrencies. A robust payment gateway should support popular options like Bitcoin, Ethereum, and stablecoins, while also being open to integrating new blockchain currencies and technologies that could benefit your business and industry.

Multi-Currency Payments and Enhanced Security

One attractive feature of cryptocurrency payment gateways is the ability to process payments in multiple currencies, providing flexibility for global transactions. However, security is paramount. Ensure that the payment gateway offers robust encryption and fraud protection, while also complying with global regulations to ensure safe and secure transactions.

Transaction Fees and Their Impact on Your Business

Transaction fees are an important consideration for businesses selecting a WooCommerce Crypto Payment Gatewayfor WordPress. These fees can significantly affect your budget and influence your decision-making process. It’s crucial to choose a gateway with competitive transaction fees, as they contribute to market competition and can impact your overall cost structure.

Customized Solutions for Better Brand Control

Many software developers are continuously enhancing payment gateways with features that cater to diverse user needs. By choosing a cryptocurrency payment gateway with customizable solutions, businesses can proactively enhance their brand by partnering with reputable software systems. This gives businesses full control over their data and ensures the security of user information.

Macro Trends Shaping the Future of Payments

According to PwC‘s report, six key macro trends are shaping the future of payments:

- Inclusion and Trust

- Digital Currency Adoption

- Digital Wallets and the Rise of Super-Apps

- The Battle of Payment Rails

- Cross-Border Payments

- Finance Crimes and Fraud Prevention

These trends are critical as businesses navigate the evolving payment landscape and prepare for future shifts in digital payments.

How Payment Systems Are Evolving: Insights from McKinsey

McKinsey highlights several ways to reshape the future of payments:

- E-wallets and Account-to-Account Transfers will take the lead in payment methods, accelerating the shift towards digital transactions.

- Cross-value Chain Integration and Industry Consolidation will enhance the efficiency of payment systems.

- International and Local Collaborations will help strengthen global payment networks.

- B2B Alternatives and Cross-Border Payment Solutions will become widely available, providing businesses with more options for global transactions.

- Faster Settlements and Lower Merchant Discount Rates will benefit merchants by reducing fees and accelerating cash flow.

Challenges and Considerations for Cryptocurrency Payments

Despite the growing adoption of cryptocurrency payments, several challenges still need to be addressed:

- Volatility: Events such as geopolitical conflicts or changes in regulations can significantly disrupt the market, causing price fluctuations.

- Scalability: Blockchain networks and cryptocurrencies often face high transaction fees and slow processing times, limiting scalability.

- Regulation: Legal restrictions on cryptocurrencies can stifle innovation and hinder their adoption.

- Environmental Concerns: Cryptocurrency mining’s environmental impact may lead to regulations or bans in the future, raising sustainability concerns.

- Usability: The complexity of DeFi platforms and cryptocurrency wallets can be challenging for regular consumers. Improving user experience is key for broader adoption.

3. POTENTIAL IDEAS

- Merchant services, including subscription management and onboarding;

- Integration platforms that link merchants to various ecosystems (e.g., Doordash, Instacart);

- Online marketplace payout solutions; and consumer payment boosters that sit on top of credit card payments

4. WHAT YOU WOULD NEED TO BELIEVE

The volume of online marketplaces will continue to rise as SMEs move online. Analytics will play a bigger role in payments. Value-added services can reach an existing user base. New ecosystems are sticky even after crises and will be a differentiating feature for the merchant. Sellers will continue to migrate online and value digital-specific functionality that aids in migration as a differentiating feature.

5. Stablecoins and Multi-Chain Compatibility: The Foundation of Scalable Crypto Payments

To build a future-proof payment infrastructure, businesses must go beyond merely accepting Bitcoin or Ethereum. Leading cryptocurrency gateways in 2025 now emphasize stablecoin support and multi-chain architecture, two features that solve key pain points for global merchants. Stablecoins like USDT and USDC provide price stability, which is essential for high-volume retailers who can’t afford the volatility of traditional cryptocurrencies. When paired with fast and low-fee blockchains like Solana, Tron, or BNB Chain, the result is a payment system that’s both scalable and economically viable.

For example, a merchant processing hundreds of transactions per day can’t rely on Ethereum during peak congestion, when gas fees can spike to over $20. But by routing payments through Solana or Tron and settling in stablecoins, businesses can bring their transaction costs down to fractions of a cent. This efficiency, combined with the assurance that payments won’t lose value minutes after confirmation, is a game-changer for sectors like eCommerce, SaaS, and Web3 gaming. Additionally, multi-chain gateways offer broader wallet compatibility, allowing customers to pay using their preferred network—eliminating barriers and boosting adoption. With this level of flexibility, merchants aren’t just adopting crypto—they’re doing it smarter, faster, and more securely.

6. CONCLUSION

Overall, technological advancements and the lessons learned in practice which might be brought about by cryptocurrencies would drive major advancements in the upcoming years. . However, the potential for cryptocurrencies remains uncertain due to market volatility and other factors.

Despite the challenges, cryptocurrencies and blockchain technology still look very promising. We cannot deny the benefits that this technology brings to our lives as well as economic development. Several reports, as well as expert analysis, have shown us how blockchain technology has been applied in the real world.

In order to increase profits, investors still believe that cryptocurrencies offer many opportunities for growth. Understanding that, some software developers have trained AI to help not only traders, investors, or users overcome and automate complex trading. Regardless of the user’s level of knowledge about blockchain, learning about the cryptocurrency market is still something worth experiencing today.

Visit our pages: https://www.facebook.com/xaigate