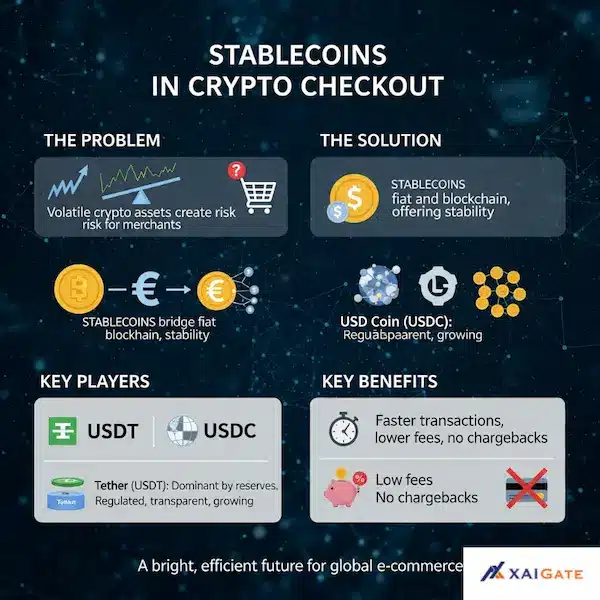

For many modern businesses and consumers, crypto checkout has redefined the way online transactions take place by providing a decentralized, borderless method as opposed to the traditional payment gateways. For years, the use of cryptocurrencies for everyday purchases failed to materialize due to one primary hindrance: extreme price volatility. Though the decentralized and borderless aspects of cryptocurrencies such as Bitcoin and Ethereum were deemed an appealing alternative to standard banks, their value could change within hours drastically, thus rendering them unfeasible for trade. This set a wide gap between what was promised about a cryptocurrency-run economy and what real business operations entailed. Stablecoins, a revolutionary method that combines the steady nature of regular paper money with quickness and safety on blockchain technology, come in. Two stablecoins that are developing very rapidly have undoubtedly become the powerhouses of crypto checkout at the front. This paper shall discuss why these two major digital players control the payment gateway landscape by discussing their distinguishing features, practical advantages that accrue from using them, and the kind of future they are creating for global e-commerce.

Contents

- 1 The Dawn of Crypto Checkout: A New Era for E-commerce

- 2 Understanding Stablecoins: The Best of Both Worlds

- 3 USDT and USDC: The Titans of Stablecoin Payments

- 4 Why USDT & USDC Dominate Crypto Checkout

- 5 The Practical Application: How Crypto Checkout Works for Businesses

- 6 A Comparative Analysis: USDT vs. USDC in the Payments Landscape

- 7 The Future of Crypto Checkout and Stablecoins

- 8 FAQs – Why USDT & USDC Dominate Crypto Checkout

- 9 Embracing the Future of Digital Commerce

The Dawn of Crypto Checkout: A New Era for E-commerce

The e-commerce world is ever-changing, and the new frontier is opening up to cryptocurrency transactions. It’s easy to picture a world without borders making transactions at a fraction of their current cost, and paying instantly at any time of the day or night. This is not science fiction; this is the reality of crypto checkout. While the logic of using digital assets to pay for goods and services is over a decade old, the widespread adoption of this mode of payment has been hampered by one big stumbling block: its volatility. The crazy price gyrations of cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH) simply do not make them a medium suitable for everyday commerce. A merchant selling goods at $100 could find that his payment in BTC translated to just $90 within a matter of hours, thereby turning into a financial headache, plus logistic nightmares. This inherent instability was cited as the number one reason why crypto payments failed to gain mainstream acceptance.

Facing Volatility: Why Bitcoin and Ethereum Might Not Be Best for Payments

Bitcoin, of course, “the king of cryptocurrencies,” maybe it is just better known as “digital gold,” a store of value. In this, it performs admirably but its extreme price volatility renders it unsuitable as a medium of exchange. Consider a vendor offering a product for a set price in traditional currency would have to keep up with changing BTC prices to reflect the current state of the market. Not only would this create an unwieldy user experience for consumers, but it also injects a huge amount of risk into the business model. Similarly, though Ether underpins decentralized finance (DeFi) and smart contracts, its price is by the same token very sensitive to market swings. As a customer buying a coffee or a corporate making that B2B payment and paying the same rate, this just cannot be accepted. Currencies are meant to be stable units of account but unfortunately, this very basic tenet could not be fulfilled by the early pioneers of crypto.

Bringing in Stablecoins as a Solution

It’s the entire reason stablecoins are hailed as the unsung heroes of the crypto payments revolution. Of course, there is that unique category of cryptocurrencies called stablecoins, which do the job of minimizing price fluctuations by attaching the price to another asset, most usually the U.S. Dollar. Keeping parity with the dollar at 1:1, this is fast, safe, and easy to use everywhere and on every platform in the international crowd using blockchain technologies – but it’s also stable against traditional fiat money. Such an innovation impelled a shift in paradigm regarding how businesses approached crypto checkout, ensuring frictionless and risk-free payment experience for both merchants and consumers.

Table 1: Traditional Payments vs. Stablecoin Payments (USDT & USDC) — The Dawn of Crypto Checkout

| Aspect | Traditional Payment Methods | Stablecoin Payments (USDT & USDC) |

|---|---|---|

| Speed | 1–5 business days for cross-border transfers | Near-instant settlement (seconds to minutes) |

| Transaction Cost | 2–5% for card processors, plus FX fees | Often <$1 or fractions of a cent on low-fee blockchains |

| Currency Volatility | Subject to FX rate fluctuations | Pegged 1:1 to USD, stable value |

| Geographic Reach | Limited by banking networks and sanctions | Borderless, accessible globally via blockchain |

| Operational Hours | Dependent on banking hours (closed on weekends/holidays) | 24/7/365 availability |

| Chargebacks & Reversals | Risk of chargebacks and disputes | Irreversible, reducing fraud risk for merchants |

| Integration Complexity | Requires bank/processor contracts, compliance checks | API integration with crypto payment gateways |

| Customer Base | Primarily banked populations | Includes unbanked and underbanked users |

| Compliance | Strongly regulated per country | Gateway-dependent; USDC offers higher compliance alignment |

| Best Use Cases | Domestic payments, regulated industries | Cross-border e-commerce, global digital services, remittances |

Understanding Stablecoins: The Best of Both Worlds

Not all stablecoins are the same. The method of maintaining the peg is the main differentiator, which is why it is important to understand why some stablecoins have emerged as leaders in the world of payments.

What are Stablecoins? A Quick Primer

At the most fundamental level, it’s a digital asset that is supposedly valued at a fixed rate. Imagine a cryptocurrency of the U.S. dollar, that’s what it is. Each stablecoin – say, one Tether (USDT) – is supposed to always equal one US dollar. This is why they are so appealing for making payments – it erases the risk of using something whose value is constantly changing. Businesses can thus happily receive stablecoins in lieu of money for their items or services without worrying about their returns suddenly dipping in value. Such a basic but powerful move links the lapse between traditional ‘normal’ world finance and the futuristic decentralized finance.

Understanding Stability: How They Keep Their Value Steady

Stablecoins mainly keep their values in three different ways. The most usual application for payments is fiat-backed. That is to say, the issuer of every stable coin holds so many traditional currency units (such as the USD) in reserve that the stable coin in circulation equals the value of this traditional currency. This serves as collateral so that each stable coin can be redeemed to the value at pegging. The other one is that crypto-backed stablecoins use other cryptocurrencies like collateral, which most often are over-collateralized to make up for volatility. The last one is algorithmic stablecoins which use complicated smart contracts and mechanisms of demand and supply to uphold their pricing peg although these have been proven to be unreliable and caused considerable controversies in the past. For the purpose of payments, therefore, the commonly accepted choice is fiat-backed stablecoins because they are reliable and pretty much simple in operation.

Different Kinds of Stablecoins: A Varied World

Although fiat-backed stablecoins are the most common in payment gateways, the taxonomy of stablecoins is not to be underestimated. Other stablecoins are pegged towards other commodities like gold, whereas some may be tied to the value of a basket of several fiat currencies for diversifying risks. But when the conversation turns to most of the crypto checkout solutions, it all instantly flips over into dollar-pegged stablecoins. They are highly adopted, liquid deep, and rather simple in value; X equaling one for both business and consumer convenience.

USDT and USDC: The Titans of Stablecoin Payments

If you’re measuring the cryptos checkout landscape from after a far slight angle stands Tether USDT and USDC. The numbers one and two biggest pieces of the pie in this market, these stablecoins are pretty much what every crypto payment gateway defaults to.

Tether (USDT): The First and Still Largest in the Game

Established in 2014, Tether was among the pioneers to bring the idea of a fiat-backed digital currency to the market. Being the first major stablecoin, it was quick to become one of the most traded cryptocurrencies and has stayed the largest by market capitalization. Its long history along with deep liquidity has made it an important thing for traders, and also one of the main solutions for crypto payments. Its huge ecosystem is on many blockchains and hence is really useful to pull in from various entities including business as well as users.

Examining USDT’s Reserves and Ecosystem Up Close

Though the dominance of Tether is a known fact, it has over the years invited many controversies among which the most important is regarding the effectiveness and clarity of its reserves. The company behind USDT, Tether Holdings, has always seen questioning whether their stablecoins are well-supported by cash and cash equivalents. All said controversy’s notwithstanding the USDT ecosystem still stands enormous with integration over uncountable exchanges, wallets, and payment platforms. Simply because of its enormous size and volume people just can’t ignore it in their crypto dealings and for many of them, it serves as the real de facto stable coin.

USDC: A Clear Choice

Where Tether has always been surrounded by controversy, USD Coin is another stable coin co-founded by Circle and Coinbase, the later based in the US and its reputation is built on transparency and regulatory compliance. USD Coin was launched only in 2018 so it is relatively newer but the adoption grew quickly putting it as the second largest stablecoin within such a short time. Its issuers were members of the CENTRE consortium which promised a fully reserved coin audited and compliant. Such emphasis on trust and following regulations has been liked by many corporate houses as well as institutional investors, where transparency and security are given prime importance.

Why Regulatory Compliance and Audits Are So Appealing

The monthly attestation reports provided by a reputable accounting firm regarding the assets in its reserves are a selling point for USDC, the details of which solidly back each token issued. These have been extremely necessary, more so for big enterprises and entities engaged in certain regulated sectors where the need for each unit of USDC to have a backing in a USD is specifically maintained in separate accounts within the bank. This makes USDC very much useful for businesses that would want to work with crypto payments minus the pain of unknown yet possible non-transparent stablecoins. regulatory

Table 2 USDT vs. USDC: Feature-by-Feature Comparison in Payment Gateway Usage

| Feature | USDT (Tether) | USDC (USD Coin) |

|---|---|---|

| Issuer | Tether Limited | Circle & Coinbase (via Centre Consortium) |

| Launch Year | 2014 | 2018 |

| Blockchain Support | Ethereum (ERC-20), Tron (TRC-20), Solana, BNB Chain, Polygon, Avalanche, and more | Ethereum (ERC-20), Solana, Algorand, Stellar, Avalanche, and more |

| Market Cap (2026) | ~$110B+ (largest stablecoin) | ~$35B+ (second largest stablecoin) |

| Peg Mechanism | Fiat-backed, reserves held by Tether Limited | Fiat-backed, fully reserved and regularly audited |

| Transparency & Auditing | Monthly attestations, less frequent third-party audits | Monthly attestations, regulated under U.S. state money transmitter laws, frequent third-party audits |

| Transaction Fees | Very low on Tron (TRC-20); varies by blockchain | Typically higher on Ethereum; competitive on low-fee chains like Solana and Algorand |

| Settlement Speed | Seconds to minutes depending on blockchain | Seconds to minutes depending on blockchain |

| Merchant Adoption | Extremely high — widely supported by global payment gateways | High and growing, especially in regulated markets and with institutional partners |

| Regulatory Perception | Higher scrutiny over reserves and operations | Strong institutional trust due to strict compliance and U.S. regulation |

| Geographic Popularity | More popular in Asia, Latin America, Africa | More popular in North America, Europe |

| Best Use Cases | High-volume, low-cost international transfers; crypto trading settlements | Regulated merchant services, corporate payments, cross-border commerce with compliance requirements |

Why USDT & USDC Dominate Crypto Checkout

What sets these two stablecoins apart from the crowd that enables them to corner the cryptocurrency checkout space in such a way? It is those forces acting together that generate a formidable and synergistic whole, populating them as the best suitor for payment processing.

Liquidity and Market Capitalization Like No Other

Liquidity is the ease with which an asset can be sold without adversely affecting its market value in cash.USDT and USDC have tremendous market capitalizations and are traded in staggering volumes every single day. This deep liquidity is very important for a payment gateway because it makes it possible for merchants to instantaneously convert the stablecoins they receive into fiat (or other cryptocurrencies) with less or even no slippage. Thus, a payment gateway receiving such a stablecoin payment would be able to process the transaction immediately and settle the funds with the merchant since it knows there is a huge ‘market’ out there to help with the conversion.A sheer size of their markets makes them incredibly reliable.

Smoothly Mixing with Payment Systems

USDT and USDC are pretty old so that they enjoy support from almost every major cryptocurrency payment gateway and wallet. This makes the incorporation of these payment options very easy for businesses. A seller can very easily provide USDT and USDC as checkout options with minimal technical effort and can then access a huge already existing stablecoin holding user base; hence, the dominance of these coins.

Quickness, effectiveness, and low fees

The main advantage of crypto payments is speed and cost-effectiveness. This is way faster than traditional banking systems which take days to settle and involve quite an amount of cost in transactions. In fact, transactions among stablecoins over a blockchain settle within minutes, usually with fractions of a penny’s worth of fees. This is truly disruptive with cross-border payments, wherein traditional methods are notoriously slow, and expensive. For a business, this means the ability to access funds much more quickly and reduced operational costs. For a customer, it means fast and smooth checkouts. The latter has been provided by the blockchain technologies while the former by the maturity of the USDT and USDC.

AI-generated: Worldwide Impact and Access to Finance

Stablecoins go beyond national borders as well as working hours of banking. It runs globally all the time throughout the year and hence, it makes a great companion for overseas electronic trading. A consumer in one corner of the world can immediately pay a trader in another, minus the conversion charges in between, slow SWIFT transfers, or tangles of international banking. That can be a world of opportunity for business houses to explore fresh markets and serve such consumers who may not have access to banking facilities in any adequate manner, something that traditional systems do not have the power to remedy.

Expand your global reach with XaiGate, a powerful crypto payment gateway built for modern enterprises.

The Practical Application: How Crypto Checkout Works for Businesses

Let’s break the process down from the merchant’s perspective and understand how easy and beneficial these payments are. Integrating a Crypto Payment Gateway It is almost no different for a business to integrate a crypto payment gateway than to add a traditional credit card processor or broker. The merchant signs on with a service, which will offer the necessary APIs or plugins tailored to the merchant’s given e-commerce platform. When the customer selects ‘crypto checkout’ at the payment review screen, this gateway creates an invoice comprised of a unique wallet address and QR code. End users just send USDT or USDC at that address to the tune of the specified amount, and the transaction gets mined on the blockchain.

From Checkout to Payment: The Merchant’s Path

When the blockchain confirms payments, the payment gateway would inform the merchant system about getting payments. That can keep those stablecoins in their wallet or let the payment gateway automatically convert the stablecoins into their local fiat currency (USD, EUR) and deposit that into their bank account. The whole process is automated, and the main aim is to ensure the merchant gets the amount they own fast and easily without any hassle and, finally, completely doing away with any volatility.

Reducing Chargeback Risk: A Big Shift for Online Shopping

However, chargebacks are arguably one of the greatest financial risks for e-commerce merchants. Such as when a customer calls their bank to dispute a transaction, the business ends up losing both the money and the product. Transactions done on a blockchain are irreversible by design. This means that once a customer pays a merchant in USDT or USDC, there is no way to reverse that transaction – or “chargeback” the money. It’s an extremely secure mode of payment and final in its operation, a huge advantage for the merchants especially the ones operating in high-risk industries.

A Comparative Analysis: USDT vs. USDC in the Payments Landscape

While both USDT and USDC are dominant players, they cater to slightly different needs and priorities. Understanding these differences is key for a business making a choice.

| Feature | Tether (USDT) | USD Coin (USDC) |

| Market Share | Largest stablecoin by market cap and trading volume. | Second-largest stablecoin, rapidly growing. |

| Transparency | Faces scrutiny over reserve transparency and auditing. | Highly transparent, with monthly attestation reports. |

| Regulatory Standing | Has faced historical regulatory challenges and investigations. | Built with a focus on regulatory compliance and oversight. |

| Ecosystem | Vaster and more widely integrated, especially in trading. | Strong institutional backing and growing in DeFi and payments. |

| Primary Use Case | High-volume trading, cross-border transfers. | Institutional use, secure and compliant payments. |

Picking the Best Stablecoin for Your Business

For a business that puts a premium on liquidity and flexibility in using different platforms, USDT may be deemed more attractive. This big ecosystem makes it a much more familiar mode of payment among many cryptocurrency users. But for those businesses that rank transparency, compliance, and institutional backing highly, USDC is the best choice. The audited reserves and compliance framework give some level of security and peace of mind that can be quite priceless, mostly for larger companies. As such, in fact, most of the modern crypto payment gateways do provide both. It allows the business to let the customers choose and have a share in the broader market.

The Future of Crypto Checkout and Stablecoins

The narrative of stablecoins in payment gateways is not yet complete. As the digital economy further matures, more innovations and changes are expected.

Institutional Adoption and Regulatory Shifts

As more governments and financial institutions understand stablecoins, we will likely see the regulatory framework being structured. This will only make the position of transparent stablecoins such as USDC stronger and could also open the way for big financial players to issue their own stablecoins. The mainstream adoption of crypto checkout will be fostered by having an institutional ‘seal of approval’ on it.

The base tech keeps getting better, too. New chains and scaling ways mean even quicker and cheaper stablecoin deals. We see new layer-2 fixes that allow almost instant and nearly free payments making stablecoin checkout even more appealing than old card pays. Cross-chain joining up will also make it easier to send stablecoins on different networks leading to a more linked and better system.

Introducing the Future of Stablecoins

USDT and USDC are presently the most popular, but in the future, other coins may take their place. Central Bank Digital Currencies are coming soon. Although they will not be stablecoins in the usual way, their purpose is quite the same-providing a digital and stable version of money. Whether such government-supported digital dollars would crowd out or complement private stablecoins, they would have a place in determining the payments landscape of tomorrow. There might also be more decentralized non-permissioned stablecoins that could become popular.

FAQs – Why USDT & USDC Dominate Crypto Checkout

1. What does “dominate crypto checkout” actually mean?

It means removing friction at payment so more carts convert: fast invoices, clear totals, simple wallet flows, and instant order status updates via webhooks.

2. How does XAIGATE improve conversion compared with basic wallet buttons?

Customers get a clean pay page with amount, chain, and QR/URL in one place; network detection and real-time status reduce errors, retries, and drop-offs.

3. Do buyers need a specific wallet or blockchain?

No—checkout supports multiple chains and common wallets. You pick which networks/tokens to accept; the pay page guides buyers to a compatible option.

4. Can I price in stablecoins and reduce volatility risk?

Yes—you can accept major stablecoins. With appropriate settings, you can settle in the assets you prefer to help limit price swings.

5. What happens with underpayments, overpayments, or expired invoices?

Invoices include an expiry window. If the amount is short or late, the order won’t auto-confirm; you’ll receive a webhook to refund, top-up, or re-issue an invoice.

6. Are crypto payments chargeback-free?

On-chain payments don’t have card chargebacks. You still control refunds and dispute workflows from your dashboard and business policies.

7. When should I fulfill the order?

Ship or deliver after the invoice reaches the required confirmations (shown in the dashboard and webhook). You can choose stricter confirmation rules for high-value orders.

8. Can I support subscriptions or large, milestone-based invoices?

On-chain auto-charging isn’t possible, but you can programmatically create new invoices on a schedule and send reminders; for big orders, split into milestones.

9. How hard is the integration?

Start with plugins (e.g., WooCommerce) or call the REST API to create invoices and handle webhooks. Most teams test in sandbox, then flip to live with the same endpoints.

10. What analytics and reconciliation tools are available?

Use the merchant dashboard for payment status, exports, and logs; webhooks feed your ERP/OMS so finance and support always see the same truth.

Embracing the Future of Digital Commerce

Stablecoins, and particularly USDT and USDC, are not some ephemeral trend. They represent a fundamental shift in the perception of money and payments. By solving the volatility challenge, these coins fully enable the real potential for crypto checkout. At long last, businesses have access to blockchain efficiency merged with stability in fiat currency at once. This is enabling a far more efficient, inclusive, and secure global e-commerce landscape. Any business that intends to stay ahead of the curve has to embrace digital commerce as a new era, not an option but rather a must-have if it wishes to operate at the peak frontier. Quite frankly, it’s no accident that Tether.USDT and USD Coin.USDC dominate because they’re trusted by providing exactly what merchants want and what consumers want in this fast-changing world: real liquidity supporting their actual needs. Stablecoins have arrived.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!