Contents

- 1 1. Introduction: Why Embedded Crypto Payments Matter in 2026

- 2 2. What Are Embedded Crypto Payments?

- 3 3. Embedded Crypto Payments vs Traditional Crypto Gateways

- 4 4. How Embedded Crypto Payments Work (Step-by-Step)

- 5 5. Why Embedded Crypto Payments Are Gaining Momentum in 2026

- 6 6. Benefits for Merchants and Consumers

- 7 7. Real-World Use Cases & Case Studies

- 8 8. Top E-Commerce Platforms Supporting Embedded Crypto Payments

- 9 9. Implementation Best Practices

- 10 10. Challenges & Limitations of Embedded Crypto Payments

- 11 12. Future Trends & Regulatory Outlook

- 12 13. FAQs: Embedded Crypto Payments

- 13 14. Conclusion

1. Introduction: Why Embedded Crypto Payments Matter in 2026

In 2026, the way customers pay online is evolving faster than ever. What used to be an optional “nice-to-have” for a handful of tech-savvy merchants is now on track to become a mainstream expectation: Embedded Crypto Payments.

E-commerce platforms like Shopify, WooCommerce, and Magento are no longer treating crypto as a fringe experiment. Instead, they’re working closely with payment gateways to make cryptocurrency acceptance as seamless as credit card processing. This shift is happening alongside global regulatory changes — such as the European Union’s MiCA framework and ongoing U.S. discussions on stablecoin legislation — which are giving merchants clearer rules for handling digital assets.

The numbers tell the story. A 2024 report by Deloitte found that over 60% of Gen Z consumers are more likely to shop from merchants that offer crypto payments. With digital wallets becoming as common as email accounts, the question for businesses is no longer “Should we accept crypto?” but rather “How can we make it effortless for our customers to pay this way?”

That’s where Embedded Crypto Payments come in — a quiet but powerful shift in online retail.

2. What Are Embedded Crypto Payments?

At its core, Embedded Crypto Payments means that cryptocurrency payment capability is built directly into the merchant’s existing checkout process, without sending customers to a third-party page.

Think about the difference between:

- Clicking “Pay with Crypto” and being redirected to an unfamiliar site, versus

- Selecting “Pay with Bitcoin or Stablecoin” and completing the payment right there on the store’s secure checkout page.

The second experience is what embedded really means — it’s native, smooth, and doesn’t interrupt the buyer’s journey.

Key features of embedded crypto payments include:

- Native integration into the e-commerce platform’s payment settings.

- Multi-asset support: Bitcoin, Ethereum, USDC, USDT, and others.

- Real-time conversion to local currency for merchants who don’t want to hold volatile assets.

- Regulatory compliance built in, including AML and sanction screening.

This approach benefits both sides. Customers trust the familiar look and feel of the merchant’s checkout, while merchants enjoy higher conversion rates and lower cart abandonment.

Table 1: Embedded Crypto Payments vs Traditional Payments in E-Commerce

| Feature / Criteria | Embedded Crypto Payments | Traditional Payments (Credit Cards, PayPal) |

|---|---|---|

| Transaction Speed | Near-instant settlement (seconds to minutes). | 1–3 business days for settlement. |

| Global Reach | Borderless — no need for currency conversion or cross-border fees. | Often limited by regional payment networks; high FX and cross-border fees. |

| Transaction Fees | Lower, especially using Layer-2 or stablecoins (as low as 0.1%). | Typically 2–4% + fixed processing fees. |

| Fraud Risk | Reduced risk with blockchain transparency and address screening. | Higher risk of chargebacks and fraudulent transactions. |

| Chargebacks | Not possible; refunds handled directly by merchant. | Common and costly; disputes can take weeks. |

| Integration Complexity | Quick plugin/API integration; no special hardware required. | Often requires payment terminals, merchant accounts, or complex setup. |

| Volatility Protection | Auto-conversion to stablecoins or fiat to avoid crypto price swings. | Stable by default, but subject to currency inflation in some markets. |

| Privacy for Buyers | Improved privacy with no card details stored. | Requires sharing sensitive banking/card information. |

| Best Use Case | Global digital goods, high-value items, emerging market sales. | Domestic retail, physical stores, or markets with low card rejection rates. |

| Future-readiness | Built for Web3, tokenized assets, and blockchain-native loyalty programs. | Limited adaptation for blockchain and emerging digital asset ecosystems. |

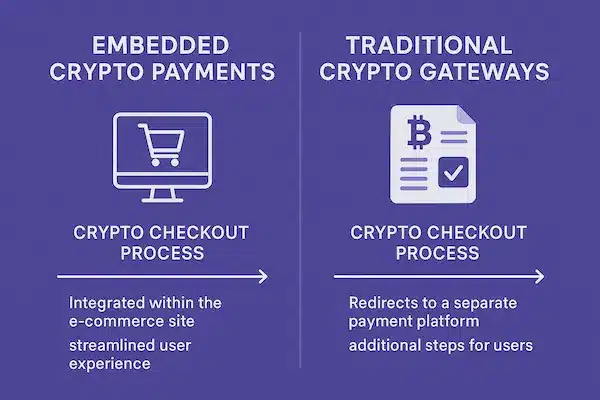

3. Embedded Crypto Payments vs Traditional Crypto Gateways

Before we dive deeper, it’s worth understanding how Embedded Crypto Payments differ from the “traditional” way of accepting crypto online. While both methods let merchants receive digital asset payments, the user experience — and the impact on sales — can be dramatically different.

3.1 Traditional Crypto Gateways: The Redirect Model

For years, most merchants integrated crypto payments using what’s known as the redirect model. Here’s how it works:

- Customer chooses “Pay with Crypto” at checkout.

- They’re redirected to an external payment page hosted by the crypto gateway provider.

- The customer selects their coin, scans a QR code, and confirms the payment in their wallet.

- They’re redirected back to the merchant’s site after completion.

While this approach is functional, it has two major drawbacks:

- Friction & Cart Abandonment: Leaving the site interrupts the flow, and some customers drop off if the new page looks unfamiliar or suspicious.

- Brand Dilution: The payment process feels separate from the merchant’s brand, which can erode trust.

Imagine shopping for sneakers on a brand’s website, then suddenly landing on a page with a completely different design and URL. Even if the payment is secure, the change in environment can make people hesitate.

3.2 Embedded Crypto Payments: The Native Experience

With embedded payments, the entire transaction happens inside the merchant’s own checkout page:

- No redirects.

- Consistent branding.

- The same SSL certificate and trust indicators as the rest of the store.

From a customer’s perspective, it feels just like paying with a credit card or PayPal — only with Bitcoin, Ethereum, or a stablecoin.

From a merchant’s perspective, it reduces drop-off rates and helps keep the buyer’s focus on completing the purchase.

3.3 Why the Difference Matters for 2026

E-commerce competition is fierce, and small improvements in checkout conversion can translate into big revenue gains. A/B tests from multiple retailers show that embedded payment flows can increase completed transactions by 5–12% compared to redirect models.

On top of that, embedded systems can:

- Offer real-time currency conversion without leaving the checkout.

- Integrate loyalty programs or discounts directly into the payment process.

- Provide instant payment confirmation without waiting for an external page to validate.

For merchants eyeing crypto as a serious payment channel — not just an experiment — embedded solutions represent the next stage of maturity.

Table 2: Embedded Crypto Payments vs Traditional Crypto Gateways

| Feature / Criteria | Embedded Crypto Payments | Traditional Crypto Gateways |

|---|---|---|

| Checkout Experience | Integrated directly into e-commerce platform; no redirection. | Often redirects customers to an external payment page. |

| Speed | Instant wallet connection and confirmation; faster UX. | Slower due to redirect and additional confirmation steps. |

| Conversion Rate | Higher — customers stay on the same page. | Lower — cart abandonment risk during redirect. |

| Integration Effort | Simple plugin or API; setup in under 1 hour for most platforms. | More complex integration; often requires manual setup and configuration. |

| Supported Assets | Multi-chain support (BTC, ETH, stablecoins, Layer-2). | Often limited to a few main chains. |

| Volatility Management | Built-in instant fiat/stablecoin conversion. | May require manual transfer to exchange for conversion. |

| Regulatory Compliance | Built-in KYC/AML, transaction monitoring. | Compliance depends on the gateway provider; may require additional merchant setup. |

| Refund Process | Managed through embedded system; can automate refunds with APIs. | More manual; merchants must process refunds separately. |

| Fee Structure | Lower transaction fees, especially on Layer-2 networks. | Higher fees, especially for BTC/ETH on mainnet. |

| Ideal For | Merchants seeking seamless, modern payment experiences with higher conversion rates. | Merchants prioritizing basic crypto acceptance without UX optimization. |

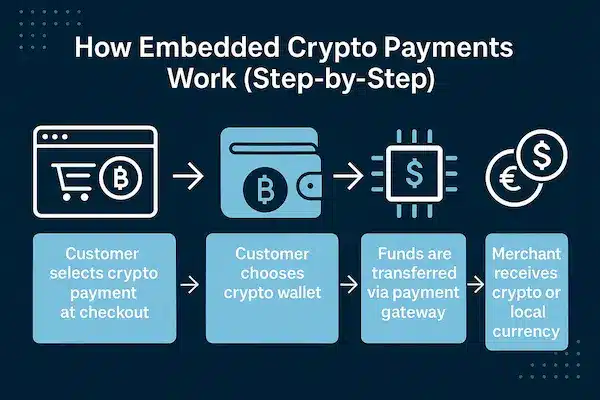

4. How Embedded Crypto Payments Work (Step-by-Step)

If you’ve only ever used traditional credit card processing, the idea of taking crypto payments inside your checkout might sound complicated. In reality, the process is surprisingly straightforward once the integration is in place. Let’s break it down step-by-step.

Step 1: Customer Chooses “Pay with Crypto” at Checkout

The journey begins just like any other online purchase. The customer browses products, adds items to their cart, and heads to the checkout page.

Here’s where embedded crypto payments differ: instead of being sent away to a third-party site, the crypto option appears right alongside credit cards, PayPal, or “Buy Now, Pay Later” services — all within the same branded checkout flow.

Step 2: Select Cryptocurrency & Network

Once the customer chooses the crypto option, they can pick:

- Which currency to pay in (e.g., Bitcoin, Ethereum, USDC).

- Which network to use (e.g., Ethereum mainnet, Polygon, Solana).

Many embedded solutions automatically recommend the cheapest or fastest network available for that asset. For example, paying with USDC on Polygon might cost just a fraction of a cent in transaction fees.

Step 3: QR Code & Wallet Connection

A dynamic QR code is displayed directly on the checkout page, along with the payment amount and a time window for completing the transaction. Customers can:

- Scan the QR code with their mobile wallet, or

- Click “Connect Wallet” for a browser-based wallet like MetaMask or Phantom.

Because everything is happening within the merchant’s own site, the trust factor is higher — the customer never has to wonder if they’ve been redirected to a phishing page.

Step 4: Real-Time Payment Verification

Once the customer confirms the transaction in their wallet, the payment gateway detects it almost instantly. On fast blockchains, this confirmation can take seconds; even on slower networks, it’s often under a minute.

The key here is real-time status updates: the checkout page shows a live confirmation message without the customer having to refresh or navigate away.

Step 5: Auto-Conversion & Settlement

For merchants who don’t want to hold crypto, the gateway can:

- Convert the received crypto into fiat currency in real time.

- Transfer the equivalent amount to the merchant’s bank account or stablecoin wallet.

This step protects the merchant from price volatility while still giving them access to the global crypto-paying audience.

Step 6: Order Confirmation & Fulfillment

Once payment is confirmed, the order is processed like any other. The merchant’s system updates the order status, sends confirmation emails, and triggers fulfillment. The difference? The entire crypto payment process happened without breaking the customer’s buying flow.

A Real-World Example

Let’s say a Shopify store selling premium headphones integrates an embedded crypto solution.

A customer in Brazil wants to pay in USDC via Polygon. They select “Pay with Crypto,” scan the QR code, confirm in their wallet, and receive instant order confirmation — all within the same page. The merchant receives stablecoins, which are auto-converted to USD and settled in their U.S. bank account within the same business day.

This smooth, embedded experience is why more e-commerce merchants are making the switch in 2026.

5. Why Embedded Crypto Payments Are Gaining Momentum in 2026

The acceleration of Embedded Crypto Payments in 2026 isn’t a coincidence. It’s the result of several powerful forces converging — regulatory clarity, technological improvements, changing consumer behavior, and strategic moves by e-commerce platforms.

5.1 Regulatory Clarity Driving Merchant Confidence

For years, one of the biggest barriers to crypto adoption was legal uncertainty. Merchants feared sudden policy changes or compliance headaches. That’s now changing:

- Europe: The Markets in Crypto-Assets (MiCA) regulation started enforcement in mid-2026, providing a unified framework for stablecoins, crypto service providers, and cross-border payments within the EU.

- United States: Stablecoin legislation is moving forward, with draft bills outlining reserve requirements and licensing for issuers. This is expected to make stablecoin payments as legally sound as traditional card payments.

- Asia: Singapore, Hong Kong, and Japan have each issued guidelines allowing licensed gateways to process crypto for retail purchases.

When the rules are clear, merchants feel safer integrating new payment methods — and embedded crypto fits naturally into this new regulatory environment.

5.2 Consumer Demand is Skyrocketing

Data from Chainalysis shows that global crypto transaction volume for everyday purchases grew over 250% from 2023 to 2024.

- Gen Z and Millennials: More than 60% say they would spend crypto if it was accepted at checkout.

- Global shoppers: In emerging markets like Brazil, Nigeria, and the Philippines, crypto is often easier and cheaper to use than traditional banking.

The takeaway? Merchants who enable embedded crypto payments aren’t just adding a new option — they’re tapping into a fast-growing, loyal customer base.

5.3 E-Commerce Platforms are Making It Easier

Platforms like Shopify and WooCommerce have expanded their plugin ecosystems to include crypto payment modules that can be installed in minutes.

- Shopify App Store now lists multiple embedded crypto payment providers with one-click integration.

- WooCommerce has plugins that display crypto as a native payment method in checkout without any redirect.

This means that even small merchants with no technical team can offer a smooth, embedded crypto experience.

5.4 Technology Has Caught Up

Early crypto payments often suffered from slow confirmation times and high fees. In 2026, that’s changing:

- Layer-2 solutions (like Arbitrum, Optimism, Base) enable sub-cent fees and near-instant settlement.

- High-throughput blockchains (like Solana) can process thousands of transactions per second with minimal latency.

- Stablecoin adoption ensures price stability, removing volatility concerns at the point of sale.

With these advancements, embedded crypto payments now rival — and sometimes surpass — traditional payment rails in speed and cost.

5.5 Strategic Benefits for Merchants

Merchants adopting embedded crypto payments in 2026 are:

- Expanding into new international markets without dealing with foreign exchange contracts.

- Increasing margins by reducing payment processing fees.

- Positioning themselves as forward-thinking brands — a valuable marketing edge.

In short, the momentum behind embedded crypto payments isn’t just hype; it’s the result of a maturing ecosystem ready for mainstream adoption.

6. Benefits for Merchants and Consumers

The appeal of Embedded Crypto Payments goes beyond just “accepting crypto.” By integrating the payment process directly into the checkout, merchants and customers gain advantages that traditional methods simply can’t match.

6.1 Lower Fees and Instant Settlement

Traditional payment processors — especially credit card networks — charge merchants between 2.5% and 3% per transaction, plus additional cross-border and currency conversion fees.

With embedded crypto payments:

- Transaction fees can be as low as 0.2% (XaiGate) or even less on efficient networks.

- Settlement is near-instant on Layer-2 or high-throughput blockchains, improving cash flow and reducing working capital needs.

For example, a merchant processing $100,000/month could save $2,000–$2,500 in fees by switching part of their transactions to embedded crypto rails.

6.2 Borderless Commerce Without FX Hassles

Accepting crypto allows merchants to sell to customers anywhere in the world without:

- Negotiating with foreign payment processors.

- Paying hidden FX markups.

- Waiting days for international transfers.

A customer in Argentina can pay in USDC, and the merchant in France can receive the equivalent amount in euros — all within minutes.

6.3 Higher Conversion Rates at Checkout

Every extra click or redirect in checkout increases the risk of cart abandonment. Embedded payments:

- Keep customers on the same page from start to finish.

- Maintain consistent branding and trust signals.

- Offer payment options that appeal to Web3-savvy users.

In A/B tests from multiple retail case studies, embedded flows delivered 5–12% higher completion rates than redirect-based crypto gateways.

6.4 Access to a New Customer Segment

Crypto holders are not just tech enthusiasts anymore — they include:

- Freelancers paid in stablecoins.

- International travelers avoiding currency exchange fees.

- Gen Z consumers who use crypto as their “digital cash.”

Merchants who integrate embedded crypto payments position themselves to capture this growing demographic before competitors do.

6.5 Future-Proofing the Business

By adopting embedded crypto payments now, merchants lay the groundwork for:

- Accepting tokenized assets as payment.

- Running on-chain loyalty programs directly tied to purchases.

- Integrating with social commerce platforms that will natively support crypto in the near future.

Just as businesses that adopted online payments early in the 2000s gained a lasting edge, merchants who embrace embedded crypto today are setting themselves up for long-term success.

7. Real-World Use Cases & Case Studies

The true power of Embedded Crypto Payments becomes clear when we look at how real businesses are using them today. These examples show how merchants in different industries leverage this technology to solve unique problems and capture new opportunities.

7.1 Fashion Retailer Scaling Internationally

A mid-sized streetwear brand based in Paris wanted to expand into Latin America, but high credit card rejection rates and currency conversion fees were hurting sales.

By integrating embedded crypto payments into their Shopify store:

- Customers in Brazil, Argentina, and Mexico could pay in USDT or USDC directly at checkout.

- Transactions settled in euros via automatic conversion, eliminating FX risk.

- The brand saw a 15% increase in completed orders from these markets within three months.

7.2 SaaS Startup Serving Global Freelancers

A project management SaaS company with users in over 50 countries found that some customers didn’t have reliable access to credit cards or PayPal.

After adding an embedded crypto option to their subscription checkout:

- Freelancers in Africa and Southeast Asia began paying in stablecoins, avoiding bank delays.

- Churn dropped among users in emerging markets, as they could now renew instantly without failed card charges.

- Revenue from crypto payments grew to 8% of total subscriptions within the first year.

7.3 Luxury Goods Marketplace

An online marketplace for luxury watches and jewelry faced a common challenge: high-value international orders often triggered fraud alerts and payment holds from banks.

By enabling embedded Bitcoin and Ethereum payments:

- High-net-worth buyers could complete purchases instantly without bank intervention.

- Sellers received payment confirmation within minutes and shipped sooner.

- The marketplace reduced order disputes related to payment holds by over 60%.

7.4 Event Ticketing for Global Audiences

A music festival in Singapore wanted to sell tickets to fans worldwide. Traditional payment methods involved:

- Multiple currencies.

- High FX costs.

- Refund delays for canceled orders.

With embedded crypto payments:

- Fans from over 30 countries paid in their preferred stablecoin directly on the ticketing site.

- Refunds were processed instantly in the same currency.

- The event sold 20% more international tickets compared to the previous year.

8. Top E-Commerce Platforms Supporting Embedded Crypto Payments

Not long ago, adding cryptocurrency as a payment option required complex custom code and a dedicated development team. In 2026, leading e-commerce platforms have made it simple to integrate Embedded Crypto Payments through plugins, apps, and native APIs.

8.1 Shopify

- Integration Method: Through the Shopify App Store, merchants can install crypto payment apps that add a native crypto option to the checkout flow.

- Supported Assets: Bitcoin, Ethereum, and multiple stablecoins such as USDC and USDT.

- Merchant Benefits:

- Seamless setup without coding skills.

- Embedded checkout ensures customers never leave the store’s domain.

- Automatic fiat conversion available.

- 2026 Update: Shopify has begun piloting direct crypto integration with select enterprise clients, aiming to cut processing fees by 50% for certain payment types.

8.2 WooCommerce

- Integration Method: WordPress plugins that add “Pay with Crypto” buttons directly in the WooCommerce checkout page.

- Supported Assets: Wide range, including BTC, ETH, LTC, SOL, and stablecoins.

- Merchant Benefits:

- Highly customizable payment flow to match store branding.

- Option to settle directly in crypto or auto-convert to fiat.

- Easy to integrate with existing WooCommerce extensions.

- 2026 Update: Several WooCommerce crypto payment plugins now feature Layer-2 network support, cutting transaction costs to near zero.

8.3 Magento 2

- Integration Method: API-first approach, allowing merchants to build a fully branded embedded payment experience.

- Supported Assets: Major cryptocurrencies and stablecoins, with optional multi-chain support.

- Merchant Benefits:

- Full control over UX and backend workflows.

- Ideal for enterprise merchants with complex payment requirements.

- Robust security and compliance features.

- 2026 Update: Magento’s enterprise partners are exploring stablecoin-based loyalty programs integrated directly with payment systems.

8.4 BigCommerce

- Integration Method: App marketplace integrations with crypto payment providers offering embedded checkout.

- Supported Assets: BTC, ETH, USDC, USDT, and select altcoins.

- Merchant Benefits:

- Quick installation for mid-size merchants.

- Unified dashboard to track both fiat and crypto transactions.

- Minimal training required for staff.

- 2026 Update: BigCommerce has expanded its partnership with blockchain payment gateways to include instant refunds in crypto.

8.5 Emerging & Specialty Platforms

- Shopware and PrestaShop: Increasing availability of embedded crypto modules for European merchants.

- Headless Commerce Solutions (e.g., Commerce.js, Saleor): Developers can embed crypto payments into highly customized storefronts with API calls.

- Social Commerce Platforms: Instagram Shops and TikTok Shops are piloting crypto-enabled embedded checkouts in select markets.

Key Insight:

In 2026, embedded crypto payments are no longer limited to tech giants. From niche marketplaces to large-scale retail, merchants of all sizes can integrate crypto payments natively — and most can go live within hours.

Table 3: E-Commerce Platforms With vs Without Embedded Crypto Payments

| Feature / Criteria | With Embedded Crypto Payments | Without Embedded Crypto Payments |

|---|---|---|

| Customer Reach | Access to global crypto users, DeFi community, and Web3 natives. | Limited to fiat-paying customers; missed opportunity with crypto-savvy buyers. |

| Checkout Experience | Seamless, in-platform payment without redirection; faster conversion. | Traditional checkout only; higher cart abandonment from fewer payment options. |

| Cross-Border Sales | Instant, borderless payments without currency conversion costs. | Cross-border fees, longer settlement times, and FX rate fluctuations. |

| Fee Structure | Lower transaction fees via blockchain networks, especially Layer-2. | Higher fees from credit card processors and PayPal. |

| Settlement Speed | Seconds to minutes (especially with stablecoins). | 1–3 business days, sometimes longer for international transactions. |

| Brand Perception | Seen as innovative, tech-forward, and appealing to younger demographics. | Perceived as traditional; may appear outdated to tech-savvy audiences. |

| Volatility Management | Auto-conversion to fiat/stablecoins to avoid price swings. | Not applicable, but fiat may face inflation in certain markets. |

| Loyalty & Rewards | Ability to integrate blockchain-based loyalty tokens and NFT programs. | Limited to traditional loyalty points; no blockchain-based engagement. |

| Security & Fraud | Blockchain transparency, reduced chargebacks, and advanced KYC/AML tools. | Higher risk of chargebacks and payment fraud. |

| Future Readiness | Prepared for tokenized assets, Web3 commerce, and evolving digital payment ecosystems. | Will require major upgrades to adopt new payment technologies in the future. |

9. Implementation Best Practices

Rolling out Embedded Crypto Payments isn’t just about installing a plugin and turning it on. Merchants who approach the integration strategically see higher adoption rates, smoother operations, and fewer support headaches.

Here are the best practices that can make the difference between a “just works” integration and a truly optimized checkout experience.

9.1 Choosing the Right Provider

Not all crypto payment gateways are created equal. When evaluating providers, merchants should look for:

- Multi-chain support: Ability to process payments on multiple networks (e.g., Ethereum, Polygon, Solana, Bitcoin Lightning).

- Asset diversity: Support for major cryptocurrencies and stablecoins like USDC, USDT, and DAI.

- Regulatory compliance: Built-in KYC/AML and OFAC screening to ensure legality.

- Uptime & reliability: SLA guarantees and proven track record in high-traffic environments.

- Developer resources: Detailed API docs, SDKs, and responsive tech support.

9.2 Offering Multiple Asset and Stablecoin Options

Customer preference matters. Some want to spend BTC, others only trust stablecoins. By offering a variety of payment options:

- You capture a wider audience.

- You reduce friction for users whose preferred asset might have high fees at that moment.

- You give flexibility to shift transaction volume toward faster, cheaper networks automatically.

9.3 Enabling Auto Fiat Conversion & Managing Volatility

Crypto price volatility is a concern for many merchants. Best practice is to:

- Enable instant conversion into local currency upon payment receipt.

- Use stablecoins as an intermediate settlement option to avoid FX risk.

- Implement price-lock timers (e.g., 5–10 minutes) to prevent losses during payment confirmation.

This approach allows merchants to accept crypto without becoming currency speculators.

9.4 Optimizing UX Across Devices

A clean, intuitive checkout experience boosts completion rates:

- Ensure “Pay with Crypto” is visible alongside traditional options.

- Provide clear, step-by-step instructions for less experienced crypto users.

- Use responsive design so the payment flow works seamlessly on both desktop and mobile.

- Offer wallet connection options (e.g., MetaMask, WalletConnect, Phantom) for convenience.

9.5 Integrating Compliance and Risk Screening

Merchants should build compliance into the flow, not bolt it on afterward. This includes:

- Screening wallet addresses against sanctioned lists.

- Flagging high-risk transactions for manual review.

- Storing transaction metadata securely for audit purposes.

A proactive compliance approach not only avoids legal trouble but also builds trust with customers and partners.

9.6 Testing Before Going Live

Before announcing the new payment option, merchants should:

- Test transactions with different assets and networks.

- Verify that order statuses update correctly in the e-commerce platform.

- Check refund workflows to ensure they work smoothly with crypto.

A “soft launch” with select customers can uncover edge cases before full rollout.

Empower your business with XaiGate, the next-generation crypto payment gateway for Business designed to simplify digital payments and drive global commerce.

10. Challenges & Limitations of Embedded Crypto Payments

While Embedded Crypto Payments offer clear advantages, merchants should be aware of the potential challenges before diving in. Recognizing these limitations early allows businesses to address them proactively and keep the checkout experience smooth.

10.1 Price Volatility

The challenge:

Cryptocurrencies like Bitcoin and Ethereum can fluctuate significantly in value within minutes. If a merchant chooses to hold the asset instead of converting it to fiat, the settlement value could be lower than expected.

Possible solutions:

- Use stablecoins (USDC, USDT, DAI) to minimize volatility.

- Enable instant fiat conversion through the payment gateway.

- Apply a price-lock timer during checkout to secure the exchange rate.

10.2 Network Congestion & Fees

The challenge:

During periods of high blockchain activity, transaction fees can spike, and confirmation times can slow down. This can frustrate customers and delay order processing.

Possible solutions:

- Support multiple chains so transactions can be routed through lower-fee networks.

- Display estimated transaction costs to customers before payment.

- Offer Layer-2 solutions like Arbitrum, Optimism, or Bitcoin Lightning for speed and cost efficiency.

10.3 Regulatory Complexity

The challenge:

Different countries have different rules for crypto payments. Merchants selling internationally may need to comply with multiple sets of regulations, from KYC/AML requirements to tax reporting.

Possible solutions:

- Partner with gateways that have built-in compliance features.

- Consult with legal experts on cross-border crypto transactions.

- Keep transaction records securely for audit purposes.

10.4 Customer Education

The challenge:

Not every customer is familiar with sending crypto payments or using wallets. Confusion at checkout can lead to abandoned carts.

Possible solutions:

- Provide clear instructions and FAQs directly on the checkout page.

- Offer a test transaction option for first-time crypto customers.

- Use a payment flow that feels familiar, such as one-click wallet connections.

10.5 Refunds & Disputes

The challenge:

Crypto transactions are irreversible, making refunds more complex than credit card chargebacks.

Possible solutions:

- Implement store credit or crypto refund policies with stablecoins.

- Automate refund workflows through the payment provider’s API.

- Clearly communicate the refund policy before checkout.

11.1 Why XAIGATE.COM Stands Out

XAIGATE.COM has been built from the ground up for the next generation of e-commerce payments. Its core strengths align directly with the needs of merchants who want to embed crypto into their checkout:

- Multi-Chain Support: Accept Bitcoin, Ethereum, USDC, USDT, BCH, SOL, LINK, and more across major blockchains, including high-speed Layer-2 networks.

- Seamless Integrations: Pre-built plugins for Shopify, WooCommerce, Magento 2, OpenCart, Prestashop, and API access for custom headless commerce setups.

- Security & Compliance by Design: Built-in KYC/AML screening, OFAC list checks, and transaction monitoring to keep merchants on the right side of regulations.

- Auto-Conversion Engine: Instantly convert received crypto to local currency or stablecoins, protecting merchants from volatility.

11.2 Quick Integration Setup

One of the main reasons merchants choose XAIGATE.COM is the speed of deployment. In most cases:

- Install the plugin for your platform or connect via API.

- Select supported assets and preferred payout methods.

- Go live with “Pay with Crypto” embedded into checkout — often in under an hour.

The setup process is designed to require minimal technical expertise, making it accessible to businesses of all sizes.

11.3 Merchant Support & Reporting Tools

XAIGATE.COM offers more than just payment rails:

- Unified dashboard to track both crypto and fiat settlements in real time.

- Detailed reporting for accounting and tax compliance.

- Dedicated merchant support for onboarding, troubleshooting, and strategic advice.

12. Future Trends & Regulatory Outlook

The evolution of Embedded Crypto Payments is still in its early stages. Over the next 12–18 months, several trends and regulatory developments are likely to shape how merchants and consumers interact with crypto at checkout.

12.1 Broader Stablecoin Regulation

- United States: Draft stablecoin legislation could be finalized in late 2026, establishing clear rules for reserve backing, licensing, and redemption rights. This could make USDC and other regulated stablecoins a mainstream payment method.

- Europe: MiCA’s full enforcement by 2026 will standardize stablecoin usage across the EU, reducing fragmentation and boosting merchant confidence.

- Asia-Pacific: Jurisdictions like Singapore and Hong Kong are positioning themselves as global hubs for regulated crypto payments.

12.2 Expansion of Layer-2 and High-Speed Networks

- Ethereum Layer-2 adoption (e.g., Arbitrum, Optimism, Base) is expected to grow, enabling sub-cent fees for crypto transactions.

- Solana, Aptos, and other high-throughput chains will continue to push settlement speeds closer to real-time, making crypto checkout as fast as tapping a contactless card.

12.3 Tokenized Real-World Assets at Checkout

- In 2026–2027, merchants may start accepting RWA-backed tokens (e.g., tokenized treasury bills, gold-backed stablecoins) for high-value purchases.

- This will appeal to customers who want payments tied to tangible, low-volatility assets.

12.4 Social Commerce Integration

- Platforms like TikTok Shop and Instagram Shopping are already experimenting with embedded payment APIs.

- The next step will be native crypto payment options in social commerce, allowing instant purchases in-app without redirects.

12.5 Privacy-Preserving Payments

- Zero-Knowledge Proofs (ZKPs) will enable buyers to prove they meet KYC or purchase requirements without revealing personal details.

- This could open crypto payments to industries where privacy is valued but compliance is mandatory.

12.6 AI-Driven Fraud Prevention

- AI-powered risk scoring will become standard, enabling real-time analysis of blockchain addresses and transaction patterns to detect suspicious behavior before settlement.

13. FAQs: Embedded Crypto Payments

1. What are Embedded Crypto Payments?

Embedded Crypto Payments are cryptocurrency payment options integrated directly into an e-commerce platform’s checkout process. Customers can pay in crypto without being redirected to an external site, creating a faster, more trusted experience.

2. How do Embedded Crypto Payments benefit merchants?

They reduce transaction fees, speed up settlement, expand global reach without FX costs, and improve checkout conversion rates by keeping customers on the same page. Merchants can also attract new audiences, such as crypto-savvy consumers and freelancers paid in stablecoins.

3. Are Embedded Crypto Payments secure?

Yes — when implemented through a reputable gateway. Leading providers use encryption, address screening, and compliance tools like KYC/AML checks to ensure secure transactions.

4. Can I integrate Embedded Crypto Payments with Shopify or WooCommerce?

Absolutely. Both platforms support embedded crypto payment plugins, allowing merchants to add the option in minutes without custom coding.

5. What cryptocurrencies can I accept with Embedded Crypto Payments?

It depends on the provider, but most support Bitcoin (BTC), Ethereum (ETH), and major stablecoins like USDC, USDT, and DAI. Some also accept altcoins and Layer-2 network payments.

6. How do I handle refunds for crypto payments?

Since crypto transactions are irreversible, merchants typically process refunds by sending the equivalent amount in crypto or stablecoins, or by issuing store credit. A clear refund policy should be displayed at checkout.

7. Do customers need technical knowledge to use Embedded Crypto Payments?

Not necessarily. With wallet connection options and step-by-step checkout instructions, even customers new to crypto can complete transactions easily.

8. How long does it take to set up Embedded Crypto Payments?

For most e-commerce platforms, setup can be completed in under an hour using pre-built plugins. Custom integrations via API may take a few days depending on complexity.

9. Do I have to hold cryptocurrency to accept Embedded Crypto Payments?

No. Many gateways offer instant conversion to fiat or stablecoins, allowing you to receive funds without exposure to crypto market volatility.

10. Are Embedded Crypto Payments suitable for small businesses?

Yes. The low setup cost, reduced transaction fees, and quick integration make them accessible and beneficial for small and medium-sized businesses, not just large enterprises.

14. Conclusion

In just a few years, Embedded Crypto Payments have moved from a niche concept to a serious competitive advantage in e-commerce. The combination of lower fees, faster settlement, global reach, and improved checkout conversion makes them a powerful tool for merchants looking to grow in 2026 and beyond.

The technology is ready. Regulations in major markets are becoming clearer. Consumers — especially younger, digital-native buyers — are increasingly comfortable using crypto for everyday purchases. And thanks to embedded solutions, adding this payment method no longer requires deep technical knowledge or a custom-built site.

For merchants, the opportunity is straightforward:

- Meet customers where they are.

- Reduce friction at the most critical moment — the checkout.

- Position your business for the next wave of commerce innovation.

Quick Summary: Why Embedded Crypto Payments Matter for E-Commerce in 2026

| Key Benefit | Why It’s Important |

|---|---|

| Faster Checkout | Keeps customers on the same page, boosting conversion rates. |

| Lower Transaction Fees | Saves 1–3% per sale compared to credit card processors. |

| Global Reach | Accept payments from anywhere without currency conversion costs. |

| Fraud Reduction | Eliminates chargebacks and reduces fraudulent transactions. |

| Future-Ready | Prepares your store for Web3, tokenized assets, and blockchain-based loyalty. |

| Easy Integration | Quick setup with plugins for Shopify, WooCommerce, Magento, OpenCart, and more. |

If you’ve been waiting for the “right time” to explore crypto payments, that time is now.

With solutions like XAIGATE.COM, you can embed crypto into your checkout quickly, securely, and in full compliance — all while keeping the focus on your brand and your customers.

Next step: Explore how embedded crypto payments could fit into your business model. The sooner you start, the sooner you can capture new markets, lower costs, and future-proof your payment infrastructure.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!