If you run an iGaming brand, your gambling payments platform is the engine that decides how many players fund, how fast they cash out, and how safely you stay compliant. Look for broad local methods, smart routing, progressive KYC/AML, and instant withdrawals with clear ETAs. Validate everything with a 14‑day A/B pilot focused on approval rate, payout speed, and chargebacks.

Contents

- 1 1. What Is a Gambling Payments Platform?

- 2 2. Why Payments Decide Profit in iGaming

- 3 3. How It Works: From Deposit to Withdrawal

- 4 4. Payment Methods & Where They Win

- 5 5. Core Capabilities of a Gambling Payments Platform (Checkout → Settlement)

- 6 6. Operator Ops: Finance, Reconciliation, Disputes

- 7 7. Case Studies & Proof — Real Outcomes with a Gambling Payments Platform

- 8 FAQs on iGaming Payments & Profit

- 9 Conclusion – Scale iGaming with a Gambling Payments Platform (Convert Faster, Risk Less)

1. What Is a Gambling Payments Platform?

A gambling payments platform is the connective tissue between your cashier and every way a player wants to move money—cards, bank transfers, open‑banking rails, e‑wallets, cash vouchers, and instant bank payouts. Unlike a general PSP, it adds gaming‑specific controls: geolocation, responsible‑gaming limits, affordability checks, device intelligence, and regulator‑ready logs. The right choice keeps conversion high while quietly handling compliance in the background.

What great looks like

- Conversion first: issuer‑aware routing and local acquiring to reduce needless declines.

- Player trust: fast, transparent withdrawals; status updates in the cashier.

- Defense in depth: layered risk, adaptive 3‑D Secure, and dispute evidence that actually wins.

- Operational calm: clean reconciliation, regulator exports, and predictable support SLAs.

A mid‑size sportsbook added open‑banking deposits in two EU markets and saw players complete first funding in under three minutes on average. That small UX change lifted activation and shortened time to first bet.

2. Why Payments Decide Profit in iGaming

In iGaming, margin isn’t made in the lobby—it’s made at the cashier. A high-performing gambling payments platform turns marketing spend into revenue by lifting deposit conversion, reducing fraud and chargebacks, speeding withdrawals, and surfacing real-time cost data so you can optimize profit per player and per market every day.

1. Boost first-time deposit conversion

The biggest leaks happen at first deposit. Trim form fields, auto-detect card type and currency from BIN, and support one-tap deposits for verified players. A gambling payments platform with smart retries, card/account updater, and network tokens quietly rescues borderline declines and converts more sign-ups into funded accounts.

2. Raise authorization rates with orchestration

Route each transaction to the best acquirer by issuer BIN, region, MCC, and risk score. Failover instantly when an acquirer degrades. Local acquiring plus domestic methods (cards and APMs) can add double-digit uplifts in approvals—directly improving ROAS and shortening CAC payback.

3. Control fraud without crushing acceptance

Layer device intelligence, velocity rules, behavioral signals, and adaptive 3-D Secure. Let low-risk traffic flow while stepping up only when needed. Fewer false positives mean more successful deposits; fewer chargebacks mean lower scheme fees and risk reserves—both compounding into higher net gaming revenue.

4. Make KYC/AML compliant and fast

Stage verification to the risk of the action (e.g., higher checks before large withdrawals). Pre-fill data, support automated document checks, and reuse verified identities across brands. Friction belongs where regulators require it—not on every small top-up.

5. Win trust with instant, transparent payouts

Fast withdrawals are retention features. Offer real-time rails where available, communicate clear ETAs elsewhere, and avoid hidden FX spreads. Reducing payout friction cuts support tickets and churn, turning one-time depositors into repeat, higher-LTV players.

6. Know your true costs in real time

Profit requires visibility. Your gambling payments platform should expose issuer-level decline reasons, acquirer take-rates, method-level fees, FX/FXP impact, chargeback ratios, and refund costs by corridor. With this telemetry, Growth and Risk teams can tune routing, pricing, and promos for daily margin gains.

7. Protect rebills and VIP uptime

Tokenization, account updater, and lifecycle management prevent “silent churn” from expired cards and changed accounts. For subscriptions, bonuses with wagering, and VIP programs, keeping payment credentials alive preserves ARPU without any additional marketing spend.

8. Localize methods and UX to each market

Players pay with what they trust. Support local APMs (e-wallets, bank transfers, vouchers), local currency pricing, and culturally familiar flows. Translate copy, show fees up front, and default to the market’s preferred rail. Localization drives both approval rate and user satisfaction.

9. Engineer reliability and speed

Sub-second cashier loads, graceful degradation, and clear error states increase completion. Sandbox every issuer/rail change, monitor acquirer health, and auto-failover on SLO breaches. Every avoided timeout is a saved deposit—and a saved session.

10. Treat payments as a profit engine, not a utility

Payments isn’t back-office plumbing; it’s the lever that compounds revenue and reduces cost. The right gambling payments platform aligns Risk, Growth, and Finance around the same dashboards and KPIs, so you can systematically turn approvals, compliance, and payouts into durable iGaming profit.

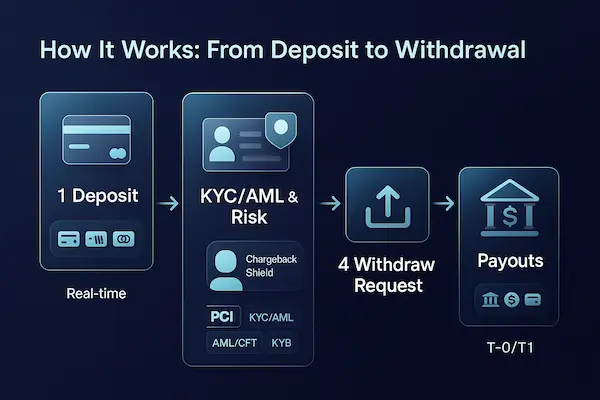

3. How It Works: From Deposit to Withdrawal

A Gambling Payments Platform sits between your app and multiple rails to decide, in real time, how each transaction should move—balancing approval odds, cost, and compliance. It scores risk before money moves, applies SCA/3-D Secure only when needed, and uses smart routing to pick the best acquirer. Successful deposits post to a sub-ledger and the player wallet; failed ones feed back into routing models. For withdrawals, the platform rechecks KYC/AML, runs velocity and sanctions rules, then pays out on the fastest legal rail (RTP/FPS, open banking, e-wallet, ACH/SEPA). Every step leaves an audit trail—crucial for regulators, disputes, and Google News-friendly transparency.

Deposit flow (7 steps)

- Method selection: Card, open banking, instant bank, e-wallet, ACH/SEPA, voucher, or (where legal) stablecoin.

- Pre-risk checks: Device fingerprint, geo/IP, velocity, account history → preliminary score.

- Adaptive SCA/3DS: Step-up only when issuer/BIN/amount/risk warrants it.

- Authorization & routing: Send to the best acquirer; enable network tokens for repeat deposits.

- Ledger & wallet credit: Create sub-ledger entries; credit the player wallet on success.

- Receipts & webhooks: Confirm UX; emit

payment.succeededfor game/wallet/accounting. - Learning loop: Log outcomes to improve routing, 3DS policy, and fraud rules.

Withdrawal flow (7 steps)

- KYC/SoF refresh: Validate identity level and source-of-funds as required by license.

- Sanctions & velocity: Screen lists; enforce cooling-off and daily/weekly limits.

- Rail selection: Choose RTP/FPS, open banking, e-wallet, or ACH/SEPA by coverage, cost, and SLA.

- Real-time decisioning: Approve, queue, or request extra documents based on risk.

- Treasury & reconciliation: Deduct wallet; create payout instruction; prepare recon files.

- Player notification: Status, ETA, and reference for support traceability.

- Audit trail: Immutable events for regulators and dispute handling.

Wallet, Limits & Responsible Gaming

- Configurable limits: Per day/week/month; brand/market/VIP tiers.

- Self-exclusion sync: Respect central and operator lists across deposits and payouts.

- Geo controls: Show only licensed methods per state/country; block out-of-bounds usage.

- Timeouts & cooling-off: Enforce pauses after risky patterns or user-requested breaks.

4. Payment Methods & Where They Win

Method coverage makes or breaks conversion. A modern Gambling Payments Platform should expose “method packs” you can toggle by country, license, brand, and player tier—then learn which mix maximizes approvals and minimizes cost in each market.

Cards (Visa/Mastercard/Amex where allowed)

Cards still dominate first deposits thanks to familiarity and saved credentials. Aim for adaptive 3DS, issuer/BIN tuning, and network tokens for repeat-deposit lift. Watch descriptor clarity and refund latency to reduce friendly fraud.

Open Banking / Instant Bank Transfer

Great for higher-value deposits and compliant instant payouts in many EU/UK markets (and select regions like BR). Lower fees than cards, strong approval rates, and bank-grade authentication. UX polish (bank search, consent screens) drives completion.

E-Wallets

Mobile-first, fast, and sticky for repeat deposits. Useful where card acceptance is patchy or SCA creates friction. Ensure wallet eligibility under your license and verify chargeback/claim rules differ from cards.

ACH / SEPA Credit Transfer

Lower cost but slower settlement. Ideal for larger, less time-sensitive deposits and withdrawals to bank accounts. Pair with real-time notifications so players understand timing and don’t contact support prematurely.

RTP / Faster Payments (Instant Payout Rails)

Best-in-class withdrawal experience where available. Use velocity, sanctions, and SoF checks before release; publish realistic SLAs and fallbacks when a bank is offline or out-of-coverage.

Vouchers / Prepaid / Cash-to-Digital

Convert cash-preferring players in EMEA/LATAM. Useful for first deposits, but monitor bonus-abuse patterns, resale markets, and top-up loops. Set conservative limits and require KYC progression for higher tiers.

Stablecoins (Where Explicitly Legal and License-Permitted)

Low network costs and near-instant settlement across borders can help VIPs and cross-market play. Treat as high-governance: Travel Rule, enhanced KYC/SoF, chain-analysis partners, and strict geofencing. Switch off by default unless counsel approves.

Quick Comparison

| Method | Regions | KYC Friction | Approval | Speed | Fees | Best For |

|---|---|---|---|---|---|---|

| Cards | Global | Medium (SCA) | Med–High | Seconds | Medium | First deposits, broad reach |

| Open Banking / Instant Bank | EU/UK/BR/Select | Low–Med | High | Seconds–Minutes | Low | High-value deposits & payouts |

| E-Wallets | Global (varies) | Low | High | Instant | Medium | Mobile users, repeats |

| ACH/SEPA | US/EU | Low | Medium | Hours–Days | Low | Bank withdrawals, larger sums |

| RTP/FPS | US/UK | Medium | High | Instant | Low–Med | Instant withdrawals |

| Vouchers/Prepaid | EMEA/LATAM | Low | Medium | Instant | Med–High | Cash-preferring users |

| Stablecoins* | Select | Low | High | Near-instant | Low | Cross-border, VIP |

5. Core Capabilities of a Gambling Payments Platform (Checkout → Settlement)

A Gambling Payments Platform should feel seamless to players and auditable to regulators. This section maps the full money flow—deposits, wallet posting, instant payouts, risk, KYC/AML, and compliance—so casinos and sportsbooks get higher approval rates, faster cash-outs, and clean reconciliation. By centralizing these moving parts in one Gambling Payments Platform, you cut tool sprawl, lower chargebacks, and give finance/compliance a single source of truth for iGaming operations.

1. Deposits (On-Ramp)

Players see familiar, localized methods while your stack quietly optimizes outcomes. Cards (MCC 7995), open banking, e-wallets, bank transfers, and vouchers are ranked by market, device, and currency. Smart routing chooses the acquirer/APM with the best real-time approval odds; soft declines trigger adaptive 3DS2 and issuer messaging. BIN intelligence (debit/credit, prepaid, commercial) tunes both UX and risk. Network tokenization hardens saved payment flows and protects against re-issued cards. Velocity limits, device/IP fingerprinting, and negative lists filter abuse without blocking genuine first deposits—lifting conversion where it matters most.

2. Payouts (Off-Ramp)

Loyalty follows withdrawal speed. Your Gambling Payments Platform exposes instant rails—push-to-card, RTP/faster payments, major e-wallets—then applies withdrawal limits, cooling-off timers, and velocity rules per KYC tier. Source-of-funds/wealth prompts appear only when thresholds or risk signals demand it. Every payout writes a step-by-step audit trail (request → checks → rail → confirmation) to simplify dispute handling and regulator reviews. Treasury gets predictable settlement windows and automated reconciliation; support can quote realistic timelines with confidence.

3. Wallet & Ledger

Under the hood is a real double-entry ledger with player wallets, bonus sub-wallets, segregated balances, and reversible holds/freezes. Each event—deposit, bonus credit, wager settlement, payout—receives stable IDs, timestamps, and references for finance and BI. Idempotent posting prevents duplicates under retries and network blips. With a robust ledger layer, the Gambling Payments Platform becomes the factual backbone for accounting, CRM, risk analytics, and monthly audits—no more CSV stitching.

4. Risk & Fraud Stack

Fraudsters iterate; your defenses must iterate faster. Device and behavioral analytics spot emulators, shared fingerprints, and abnormal session velocity. A rules + ML engine consults consortium/negative lists and enriches with BIN/IIN, geo, and disposable-email intel. For disputes, pre-dispute alerts curb friendly fraud early; when you fight, auto-built evidence kits package KYC logs, device IDs, IP history, and gameplay proofs by reason code. Outcome: fewer false positives, stronger issuer trust, and healthier approval rates across your gambling payments flow.

5. KYC/AML & Responsible Gaming

Compliance is continuous, not a checkbox. Tiered KYC runs from light verification to enhanced due diligence with sanctions/PEP screening and ongoing monitoring. Affordability checks and SoF/SoW triggers align to license conditions; age/geo controls and document validation reduce entry risk. Responsible-gaming features—limits, timeouts, self-exclusion—sync across brands/devices where required. SAR/STR workflows guide analysts from alert to filing with full evidence trails, keeping your Gambling Payments Platform aligned to regulator expectations.

6. Compliance & Certifications

Treat compliance as a product feature. PCI DSS Level 1, encryption in transit/at rest, HSM-backed keys, and least-privilege IAM protect card and identity data. PSD2/SCA logic is configurable per market; GDPR/CCPA rights (access, erase, restrict) are operationalized with SLAs. Where applicable, ISO 27001/SOC reports provide external assurance. Mappings to UKGC/MGA/US state frameworks translate platform events into auditor-ready artifacts—who changed what, when, and why—so your iGaming operation scales with confidence.

6. Operator Ops: Finance, Reconciliation, Disputes

A Gambling Payments Platform should make finance predictable and auditor queries boring. This section turns messy statements, acquirer quirks, and dispute deadlines into clean, repeatable workflows. By normalizing fees, forecasting settlements, automating reconciliation, and industrializing chargeback handling, your team closes the books on time and protects ratios—while BI connects every payments tweak to revenue, margin, and LTV.

1. Treasury & Settlement: Cost, Cash, and Close

Treasury lives in the gap between approvals and cash in bank. Your Gambling Payments Platform should:

- Normalize statements across acquirers/APMs (same IDs, same columns, same currency views).

- Forecast settlement windows by rail/market and flag outliers before month-end.

- Route by unit economics, not just raw approvals (interchange+++ vs APM fee vs FX vs chargeback exposure).

- Automate reconciliation to the cent: gateway totals ↔ ledger ↔ bank statement, with reasons for deltas (timing, fees, chargebacks, reversals).

- Export regulator-ready packs (immutable IDs, actor/action/time, data lineage) in one click.

Quick win checklist (weekly):

- Review approval × fee heatmap; move traffic to higher-yield rails.

- Compare forecasted vs actual settlement; investigate >1σ variance.

- Sample 50 random payouts; verify trail: request → checks → rail → bank.

- Re-run FX revaluation on open items; post adjustments automatically.

2. Disputes & Chargebacks: Deflect Early, Win Smart

Disputes will happen; the goal is fewer losses and a healthier ratio. A tuned Gambling Payments Platform:

- Catches pre-disputes and auto-decides: refund (protect ratio) vs contest (high win-probability).

- Auto-assembles evidence per reason code: KYC timestamps, device fingerprints, IP/geo, session and gameplay logs, ToS acceptance, issuer-friendly narrative.

- Feeds outcomes back into risk rules (rules + ML) to block repeat patterns and promo abuse.

- Calendars deadlines and locks evidence to prevent late or inconsistent submissions.

- Segments friendly fraud vs genuine merchant error, so ops fixes root-cause friction (descriptors, 3DS policy, support SLAs).

Operational targets:

- Pre-dispute deflection: 20–40% of would-be chargebacks.

- Representment win-rate: improve 10–25% after evidence templating.

- Time-to-file: p95 under 24 hours from intake.

Template (reason code → evidence):

- “Unauthorized/No cardholder participation”: KYC pass + device continuity + 3DS data + session logs.

- “Services not as described”: timestamps of play, payout attempts, ToS/bonus terms, support transcript.

- “Duplicate”: idempotency identifiers, ledger entries, acquirer ACKs.

3: Data & BI: One Truth Across Product, Risk, and Finance

Decisions beat hunches. Your Gambling Payments Platform should ship decision-grade metrics with stable IDs, clear definitions, and auditor-proof lineage.

Core dashboards (daily):

- Approval rate by issuer/method/market (include soft/hard decline split and 3DS2 challenge rate).

- Payout p95 & failure reasons by rail; show retries and recoveries.

- Chargeback funnel: alerts → refunds → filings → wins/losses (by reason code).

- Cost per funded player & LTV by method/market (net of fees and disputes).

- KYC pass p95, EDD share, alert→SAR/STR lead time.

- RG adoption: % accounts with limits/self-exclusion synced.

A/B guardrails for payments changes:

- Ship variants behind flags; require non-inferiority on approval, payout p95, and cost per funded player.

- Auto-rollback if any KPI breaches threshold for N consecutive hours.

- Write every experiment to the ledger’s metadata so finance can reconcile promos and test cohorts.

Mini KPI table (paste into CMS; replace with your numbers):

| Metric | Target | Why it matters |

|---|---|---|

| Approval rate (issuer-weighted) | ≥ 88–92% | Direct driver of funded players & CAC |

| Payout time p95 (instant rails) | < 180s | Loyalty, NPS, lower support load |

| Pre-dispute deflection | 20–40% | Protects ratios, saves ops time |

| Representment win-rate | +10–25% vs baseline | Recovers revenue, trains risk |

| Cost per funded player | ↓ QoQ | Ties routing/fees to growth |

| KYC pass p95 | < 5 mins | Faster FTD without cutting corners |

7. Case Studies & Proof — Real Outcomes with a Gambling Payments Platform

Numbers beat promises. Below are composite, regulator-friendly outcomes showing how a modern Gambling Payments Platform moved the needle on approvals, chargebacks, and cash-out speed—without adding operational drag.

Sportsbook Case: +9.4% Approval Lift via Smart Routing & Adaptive 3DS2

Tier-1 sportsbook in regulated markets; heavy weekend spikes; card-first depositor base. Baseline approval 83.1%, high soft-decline share from a few issuers.

Intervention (8 weeks).

- Multi-acquirer smart routing with issuer-level policies (MCC 7995 tuned).

- Adaptive 3DS2: challenge only on risky BINs/devices; frictionless where issuer history is strong.

- Issuer messaging & purchase indicators; network tokenization for returning players.

- Fallback to open banking when card friction persists.

Results.

- Approval rate: +9.4% (83.1% → 92.5%).

- First-deposit conversion: +7.0%.

- Abandons at cashier: −18%.

- Support tickets related to declines: −22%.

What changed the most? Routing rules per issuer window, plus device continuity signals that cut false positives.

Replicable checklist.

- Map issuer heatmap (hour-by-hour).

- Turn on BIN-aware 3DS policies.

- Add tokenization for re-deposits.

- Offer open banking for cold issuers.

Casino Case: −32% Chargebacks with Device Risk & Pre-Dispute Alerts

Context. Multi-brand casino; promo abuse & friendly fraud; dispute ops scattered across tools.

Intervention (6 weeks).

- Device/behavioral risk (emulator flags, velocity, IP clusters).

- Pre-dispute network alerts; auto-refund when loss probability > threshold.

- Evidence kits by reason code (KYC timestamps, device continuity, play logs, ToS acceptance).

- Post-dispute feedback loop to harden frontline rules.

Results.

- Chargebacks: −32%.

- Representment win-rate: +19%.

- Time-to-file (p95): <24h.

- Issuer relationship score (internal): ↑; approvals held steady.

FAQs on iGaming Payments & Profit

1. How does a gambling payments platform impact iGaming profit?

It raises deposit approvals, cuts fraud and chargeback costs, speeds withdrawals, and exposes real-time costs—directly improving margin per player and market.

2. Which features most increase first-time deposit conversion?

Payment orchestration, local APMs, BIN-based autofill, smart retries, and network tokens rescue borderline declines and convert more sign-ups into funded accounts.

3. How do I balance fraud control with acceptance?

Use layered risk (device, velocity, behavior) and adaptive 3DS so low-risk traffic flows while high-risk traffic steps up—minimizing false positives and losses.

4. What data should my gambling payments platform surface daily?

Issuer-level decline reasons, acquirer take rates, method fees, FX/FXP impact, refund and chargeback ratios, plus corridor-level approval and latency metrics.

5. Why are instant payouts so critical for retention?

Fast, transparent withdrawals build trust, reduce support tickets, and lower churn—especially among high-value cohorts—lifting LTV without extra marketing spend.

6. How does localization improve approval rates?

Domestic acquiring, local currency pricing, and market-native APMs align with issuer rules and user habits, typically delivering double-digit authorization uplifts.

7. What keeps recurring payments and VIP rebills healthy?

Tokenization, account updater, and lifecycle management prevent silent churn from expired or reissued cards, maintaining ARPU and session continuity.

8. What SLAs should I demand from providers?

Sub-second cashier loads, >99.95% uptime, acquirer failover, real-time monitoring, and clear chargeback/KYC timelines—contractually backed with credits.

Conclusion – Scale iGaming with a Gambling Payments Platform (Convert Faster, Risk Less)

When deposits, payouts, wallets, KYC/AML, fraud, and reconciliation run on one Gambling Payments Platform, payments stop being a bottleneck and start compounding growth. Approval rates rise through smarter routing and issuer-aware 3DS2; cash-outs hit sub-minutes on instant rails; disputes shrink with pre-dispute alerts and evidence kits; finance closes on time with auditable ledgers; and compliance stays regulator-ready. The result: more funded players, healthier margins, cleaner audits—and a product surface that feels fast and fair to real users in every market.

What’s New & Why It Matters

- Issuer behavior shifts & SCA enforcement: dynamic 3DS2 + network tokenization keep approvals high during policy changes.

- Instant-payout coverage expanding: push-to-card/RTP/faster payments adoption accelerates NPS and affiliate conversion.

- Heightened AML expectations: affordability and SoF/SoW triggers are moving earlier in the flow; audit trails must be turnkey.

- Open banking maturity: in several markets, bank-to-bank rails now rival cards for both cost and conversion.

One-Minute Summary

| Question | Short Answer |

|---|---|

| Why this now? | Better approvals, faster payouts, lower disputes, and regulator-ready evidence—market by market. |

| What changes first? | Smart routing, adaptive 3DS2, localized methods, instant rails, tiered KYC, pre-dispute alerts. |

| Core KPI lift | Approvals +5–12%; payout p95 < 180s; chargebacks −20–40%; cost per funded player ↓. |

| Risk & compliance | Sanctions/PEP, affordability checks, SAR/STR workflows, PCI DSS L1, GDPR/CCPA operations. |

| Finance impact | Normalized statements, automated reconciliation, forecasted settlements, clean close. |

Supercharge your iGaming growth with XaiGate – Gambling Payments Platform built for higher approvals, instant payouts, and regulator-ready compliance. Get +5–12% more deposits through smart routing and adaptive 3DS2, cut chargebacks with pre-dispute alerts and evidence kits, and keep finance calm with auditable ledgers and to-the-cent reconciliation. Launch fast across cards, open banking, and local e-wallets—then scale globally without risking your license.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!