In a rapidly evolving financial ecosystem, traditional banking institutions are growing more risk-averse, particularly when dealing with businesses considered “high-risk.” From online casinos and adult entertainment to forex trading platforms and decentralized marketplaces, many businesses find themselves locked out of essential payment services. To fill this void, a new class of solutions has emerged: high-risk merchant crypto gateway, especially those that do not require Know Your Customer (KYC) verification.

This article explores why high-risk businesses are flocking to these no-KYC crypto gateways, how they function, what advantages they provide, and the regulatory landscape shaping their future.

Contents

- 1 What Are High-Risk Merchant Businesses?

- 2 The Rise of No-KYC Crypto Payment Gateways

- 3 Benefits for High-Risk Merchants

- 4 Common Features of High-Risk No-KYC Crypto Gateways

- 5 Risks and Challenges

- 6 Case Study: Online Casino Scaling with a No-KYC Gateway

- 7 Regulatory Landscape

- 8 How to Choose a High-Risk Merchant Crypto Gateway

- 9 The Future of No-KYC Gateways

- 10 Why High-Risk Merchants Are Switching to Crypto Gateways Without KYC

- 11 Global Forces Accelerating High-Risk Merchant Crypto Gateway Adoption

- 12 FAQs: High-Risk Merchant Crypto Gateway

- 13 Conclusion: A Strategic Move for the Bold

What Are High-Risk Merchant Businesses?

High-risk businesses are categorized by banks and payment processors as those with a greater potential for chargebacks, legal uncertainty, or reputational damage. Common examples include:

- Online gambling and iGaming platforms

- Adult content providers

- Multi-level marketing (MLM) companies

- CBD and cannabis vendors (in some jurisdictions)

- Forex and binary options brokers

- VPN and cybersecurity services

These industries often face significant hurdles when trying to secure traditional banking or fiat payment processing solutions.

The Rise of No-KYC Crypto Payment Gateways

What Are No-KYC Crypto Gateways?

A no-KYC crypto payment gateway allows merchants to accept cryptocurrency payments without subjecting users to identity verification. Unlike regulated platforms such as BitPay or Coinbase Commerce, these solutions operate with minimal or no KYC checks, offering fast onboarding and a frictionless user experience.

A no-KYC crypto payment gateway is a solution that enables merchants—especially those in high-risk industries—to accept digital currencies without forcing customers through lengthy identity verification. Unlike regulated providers such as Coinbase Commerce or BitPay, a high-risk merchant crypto gateway operates with minimal compliance checks, delivering instant onboarding and a smoother checkout experience.

Why Are No-KYC Gateways Becoming Popular?

- Regulatory Arbitrage: These gateways often operate from jurisdictions with relaxed crypto regulations.

- Global Accessibility: Merchants can accept payments from users in countries where fiat transactions are difficult or censored.

- Speed and Privacy: No need to wait days or weeks for approval. Merchants can start accepting payments immediately.

- Lower Operating Costs: Reduced compliance overhead translates to lower fees and simpler integration.

Table 1: KYC Gateways vs. No-KYC Gateways

| Criteria | Traditional KYC Gateways | High-Risk Merchant Crypto Gateway (No-KYC) |

|---|---|---|

| Onboarding Time | Weeks to months | Hours to days |

| Compliance Burden | Heavy documentation, strict checks | Minimal, flexible requirements |

| Customer Privacy | Limited – full ID verification | Strong – transactions without KYC |

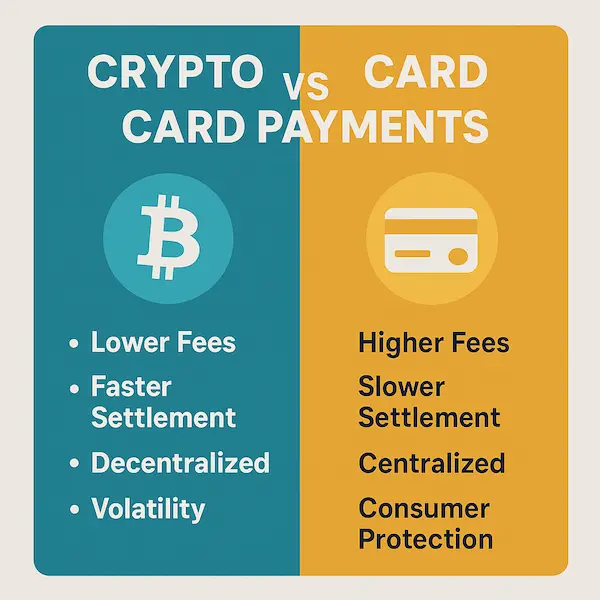

| Transaction Fees | 2%–3% | 0.1%–0.5% |

| Global Access | Restricted in high-risk markets | Open, borderless adoption |

Benefits for High-Risk Merchants

1. Faster Onboarding and Transaction Speed

Unlike traditional merchant accounts that take weeks for approval and chargebacks, no-KYC crypto gateways enable instant setup and real-time transactions, essential for fast-moving high-risk industries.

2. Global Market Reach

Crypto is borderless. Merchants are no longer tied to the limitations of regional banking systems. This is especially beneficial for:

- Countries with capital controls

- Sanctioned regions

- Emerging markets without PayPal or Stripe access

3. Enhanced Privacy and Security

Both the merchant and the customer enjoy a higher degree of privacy. No intrusive KYC forms mean less data to manage and a reduced risk of data breaches.

4. High Conversion Rates

Fewer roadblocks in the checkout process mean customers are more likely to complete purchases. In industries like adult content or gambling, anonymity can be the deciding factor.

5. Reduced Risk of Deplatforming

By avoiding traditional banks and payment processors, merchants eliminate the risk of suddenly losing access to their funds due to a policy change or reputational issue.

Common Features of High-Risk No-KYC Crypto Gateways

| Feature | Description |

|---|---|

| No KYC Required | Merchants can start immediately without ID submission |

| Multi-Coin Support | Accept BTC, ETH, USDT, and more |

| Instant Settlement | Receive crypto directly to wallet without delays |

| Anonymous Checkout | No user data stored or transmitted |

| API & SDK Integration | Easy to connect with eCommerce, CMS, or custom platforms |

Risks and Challenges

1. Regulatory Uncertainty

Operating outside KYC frameworks places these gateways in legal gray areas. Businesses must stay informed of regulatory changes in both their home country and those of their customers.

2. Higher Fraud Exposure

While crypto itself is secure, the lack of identity verification can open the door to malicious actors. Merchants must implement their own fraud prevention tools.

3. Limited Fiat Off-Ramps

Exiting crypto profits into fiat currency can still require KYC, especially when using centralized exchanges.

4. Reputation Management

Using no-KYC services may be viewed unfavorably by partners or investors, especially in highly regulated sectors.

Case Study: Online Casino Scaling with a No-KYC Gateway

A European-based online casino previously struggled with monthly chargebacks and payment freezes via PayPal and Skrill. After integrating a no-KYC crypto gateway like XAIGATE, the platform saw:

- 30% increase in successful checkouts

- 50% drop in transaction-related support tickets

- $500K saved annually on chargeback fees and compliance overhead

Regulatory Landscape

| Country | Status on No-KYC Crypto Use |

| El Salvador | Legal tender – No KYC required for P2P use |

| UAE | Flexible for business crypto transactions |

| US | KYC mandatory for business transactions |

| EU | Increasing push toward AMLD5 compliance |

| Panama | No comprehensive KYC law for crypto yet |

Merchants must conduct legal audits based on their target customer regions.

How to Choose a High-Risk Merchant Crypto Gateway

Key Evaluation Criteria:

- No-KYC Policy Transparency

- Supported Coins and Chains

- Uptime and Speed

- Developer Documentation and APIs

- Security Protocols

- Reputation in High-Risk Communities

Suggested Providers:

- XAIGATE – Designed specifically for high-risk sectors

- NOWPayments – Simple UI, but limited no-KYC options

- BTCPay Server – Open-source, fully self-hosted

The Future of No-KYC Gateways

As the demand for financial privacy grows and more businesses go global, no-KYC gateways are likely to evolve with:

- Layer 2 integration for scalability

- Privacy-enhanced tokens and mixers

- Decentralized identifiers (DIDs) replacing traditional KYC

- Jurisdiction-specific compliance plugins

Still, growing pressure from regulators may push some services to adopt hybrid KYC models where only large transactions trigger identity checks.

Why High-Risk Merchants Are Switching to Crypto Gateways Without KYC

High-risk businesses—such as iGaming platforms, adult content sites, and cross-border fintech startups—are increasingly finding traditional payment processors restrictive. Lengthy KYC processes often block growth and lead to higher customer churn. That’s why the demand for a high-risk merchant crypto gateway with minimal or no KYC is booming.

1. Pain Points of Traditional Payment Processors

Conventional providers often label high-risk sectors as unbankable. This means weeks of waiting, heavy compliance checks, and even sudden account freezes. For high-risk merchants, these hurdles can lead to lost revenue and damaged customer trust.

2. Advantages of No-KYC Crypto Gateways

By leveraging blockchain-based payment rails, a high-risk merchant crypto gateway reduces onboarding times, cuts compliance overhead, and ensures smooth payment flows. Customers benefit from instant access, while businesses experience fewer abandoned transactions.

Comparison Table: Traditional vs. High-Risk Merchant Crypto Gateway

| Criteria | Traditional Payment Gateways | High-Risk Merchant Crypto Gateway (No-KYC) |

|---|---|---|

| Onboarding Time | Weeks to months | Hours to days |

| Compliance Complexity | Heavy KYC/AML paperwork | Flexible to minimal |

| Customer Drop-Off Rate | High due to friction | Significantly lower |

| Industry Acceptance | Limited for high-risk sectors | Broad support across industries |

Global Forces Accelerating High-Risk Merchant Crypto Gateway Adoption

The momentum behind No-KYC solutions isn’t accidental—it’s tied to global economic and regulatory trends. For high-risk businesses seeking stability and global reach, the high-risk merchant crypto gateway has become a strategic lifeline.

1. Emerging Markets Fueling Growth

In regions where banking infrastructure is unstable or capital controls are strict, crypto gateways provide merchants with a reliable channel to reach international customers. This flexibility is especially vital for high-risk sectors that would otherwise face exclusion.

2. Privacy as a Selling Point

Today’s digital consumers, especially in online gaming and freelancing, increasingly value privacy. Businesses using a high-risk merchant crypto gateway can position themselves as “privacy-first,” attracting customers wary of oversharing personal data.

Comparison Table: Drivers Behind Adoption

| Driver | Impact of High-Risk Merchant Crypto Gateway |

|---|---|

| Tougher Global KYC Laws | Pushes businesses toward alternative solutions |

| Growth of Emerging Markets | Expands access to global customers |

| Demand for Privacy | Strengthens brand loyalty and trust |

| Cross-Border Payments | Enables fast, low-cost international settlement |

FAQs: High-Risk Merchant Crypto Gateway

1. What is a high-risk merchant crypto gateway?

A high-risk merchant crypto gateway is a payment solution that allows businesses in high-risk industries—such as iGaming, adult services, and online trading—to accept cryptocurrency transactions without relying on restrictive banking systems.

2. Why are high-risk merchants adopting crypto gateways without KYC?

Many high-risk merchants face strict compliance checks or outright bans from traditional processors. No-KYC crypto gateways provide faster onboarding, lower friction, and broader access to customers worldwide.

3. Are high-risk merchant crypto gateways legal?

Yes, but legality depends on local regulations. Some countries support crypto-friendly frameworks, while others impose stricter controls. Merchants must review compliance requirements in their jurisdiction before integrating a gateway.

4. What industries benefit most from high-risk merchant crypto gateways?

Industries such as online gaming, forex trading, adult platforms, cannabis-related businesses, and emerging fintech startups benefit most, since they often struggle with traditional payment providers.

5. How secure are high-risk merchant crypto gateways?

Most reputable gateways use blockchain transparency, advanced encryption, and multi-signature wallets. This ensures safe transactions while reducing fraud and chargeback risks.

6. Do high-risk merchant crypto gateways support instant settlements?

Yes. Unlike traditional banks that may hold funds for days, many crypto gateways offer near-instant settlement in stablecoins like USDT or USDC, making cash flow management easier.

7. What are the fees for high-risk merchant crypto gateways?

Fees typically range from 0.1%–0.5% per transaction—much lower than credit card processing fees, which average 2%–3%. This cost advantage is a key reason why merchants are switching.

8. Can a high-risk merchant crypto gateway help with global payments?

Absolutely. Merchants can accept payments from anywhere in the world, bypassing banking restrictions and offering customers more flexibility.

9. How do customers benefit from using no-KYC crypto gateways?

Customers enjoy faster onboarding, better privacy, and smoother checkout experiences without repeatedly submitting personal documents.

10. How can a business integrate a high-risk merchant crypto gateway?

Integration is simple. Merchants can use plugins for platforms like WooCommerce, Shopify, or Magento, or connect via APIs provided by leading crypto gateways.

Conclusion: A Strategic Move for the Bold

For high-risk merchants, the adoption of a no-KYC crypto gateway is not just a workaround—it’s a competitive edge. With benefits like fast onboarding, global reach, and user privacy, these gateways empower businesses to operate freely in a world where traditional financial services are increasingly constrained by compliance obligations.

However, with that freedom comes the responsibility to understand the legal landscape and implement strong internal controls. For those ready to embrace innovation while managing risk, no-KYC crypto payment gateways represent the future of high-risk commerce.

Quick Summary: Why High-Risk Merchants Choose Crypto Gateways

| Factor | Why It Matters for High-Risk Merchants | Advantage of a High-Risk Merchant Crypto Gateway |

|---|---|---|

| Onboarding Speed | Traditional banks take weeks | No-KYC gateways onboard in hours/days |

| Compliance Burden | Heavy KYC/AML checks create friction | Flexible, minimal requirements |

| Transaction Fees | Credit card fees 2%–3% | Crypto fees 0.2%–0.5% |

| Customer Conversion | High drop-off with paperwork | Smooth, privacy-first checkout |

| Global Reach | Banking restrictions in high-risk sectors | Worldwide crypto acceptance |

| Settlement Time | Banks delay funds for days | Near-instant settlement in stablecoins |

Explore how XAIGATE can empower your high-risk business with privacy-first crypto payments today.

We may also be found on GitHub, and X (@mxaigate)! Follow us!

Don’t miss out on the opportunity to elevate your business with XAIGATE’s Cryptocurrency Payment Gateway without KYC . The three-step process is designed to be user-friendly, making it accessible for all businesses. Embrace this modern payment solution to provide customers with a secure and efficient way to pay. Take the first step towards a competitive edge in the digital realm and unlock the benefits of cryptocurrency payments for online casino today.