The first time I heard that some companies started accepting payments made in cryptocurrency, I believed it was a technological trend. Boy, was I mistaken. My online electronics store accepts crypto payment and I started using it six months ago and with the implementation, my store sales have grown tremendously by 30 percent. It is not a mere success story, though; it is also the step-by-step analysis of how crypto increased sales made my business idea the most profitable one.

Contents

- 1 My Journey: From Skeptic to Crypto Convert

- 2 The Numbers Don’t Lie: My Sales Transformation

- 3 Why Crypto Payments Boost Sales: The Psychology Behind It

- 4 Step-by-Step: How I Implemented Crypto Payments

- 5 The Unexpected Benefits: Beyond Sales Growth

- 6 Overcoming Common Challenges

- 7 Real Customer Stories: Why They Choose Crypto

- 8 Advanced Strategies to Maximize Crypto Sales

- 9 The Technical Side: What Actually Happens

- 10 Managing the Financial Side

- 11 Looking Forward: The Future Impact

- 12 Practical Tips for Implementation Success

- 13 The Competitive Advantage

- 14 Risk Management Strategies

- 15 Measuring Success: Key Performance Indicators

- 16 Conclusion

- 17 Frequently Asked Questions

My Journey: From Skeptic to Crypto Convert

I have been operating an online electronic company over eight years, and I have witnessed the rise and fall in payment dynamics. Online payments have been transformed with PayPal, check out happened through mobile wallets, however nothing could have made me assume the effect of accepting cryptocurrency.It was a game-changer when I saw my competitors accepting crypto payments and appealing to more young technologically advanced customers.

One day, after losing quite a few high-value sales to these competitors, I chose to look at how accepting digital currencies could make me gain more sales with crypto.

Planting the tree 20 years ago is the best time to plant the tree. The opportune moment is the second best.” This is one Chinese proverb that best describes my thoughts when I resolved to go into accepting cryptocurrency payments.

The Numbers Don’t Lie: My Sales Transformation

Before diving into the how-to, let me share the concrete results that convinced me crypto payments were game-changers:

|

Metric |

Before Crypto |

After Crypto |

Improvement |

|

Monthly Revenue |

$45,000 |

$58,500 |

+30% |

|

Average Order Value |

$125 |

$165 |

+32% |

|

International Sales |

15% |

35% |

+133% |

|

Customer Retention |

22% |

31% |

+41% |

These numbers represent real data from my business over six months of crypto payment integration. The results speak for themselves about how effectively you can increase sales with crypto.

Why Crypto Payments Boost Sales: The Psychology Behind It

1. Early Adopter Appeal

Cryptocurrency users are typically early adopters with higher disposable income. These customers are willing to spend more on quality products and cutting-edge technology. By accepting crypto, I tapped into this lucrative market segment.

2. Global Accessibility

Traditional payment methods often fail international customers due to banking restrictions or high fees. Cryptocurrency eliminates these barriers, allowing me to serve customers worldwide seamlessly.

3. Privacy and Security

Many customers prefer crypto payments for their enhanced privacy and security features. Unlike credit cards, crypto transactions don’t expose sensitive financial information, making customers feel safer about online purchases.

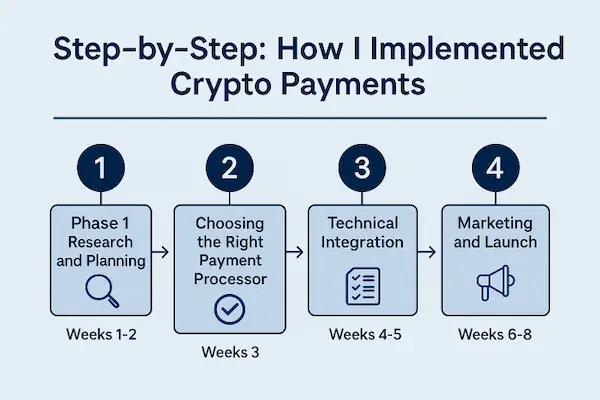

Step-by-Step: How I Implemented Crypto Payments

Phase 1: Research and Planning (Week 1-2)

I started by researching which cryptocurrencies would best serve my customer base. Bitcoin and Ethereum emerged as the clear winners, with growing interest in stablecoins like USDC for their price stability.

Key considerations during planning:

- Customer demographics and preferences

- Transaction fees and processing times

- Regulatory compliance requirements

- Integration complexity with existing systems

Phase 2: Choosing the Right Payment Processor (Week 3)

After evaluating multiple options, I selected a payment processor that offered:

- Support for major cryptocurrencies

- Automatic conversion to USD

- Reasonable transaction fees (2-3%)

- Easy integration with my e-commerce platform

- Comprehensive customer support

|

Payment Processor Comparison |

Fees |

Supported Coins |

Auto-Convert |

Integration Ease |

|

Processor A |

2.5% |

10+ |

Yes |

Excellent |

|

Processor B |

3.2% |

15+ |

Yes |

Good |

|

Processor C |

1.8% |

5 |

No |

Fair |

Phase 3: Technical Integration (Week 4-5)

The technical implementation was surprisingly straightforward. Most modern e-commerce platforms offer crypto payment plugins that integrate seamlessly with existing checkout processes.

Integration steps:

- Install the payment processor plugin

- Configure cryptocurrency options

- Set up automatic conversion settings

- Test transactions thoroughly

- Train customer service staff

Phase 4: Marketing and Launch (Week 6-8)

Simply accepting crypto isn’t enough – you need to actively promote this new payment option to increase sales with crypto. I launched a comprehensive marketing campaign that included:

- Website banners highlighting crypto acceptance

- Email announcements to existing customers

- Social media campaigns targeting crypto communities

- Special promotions for crypto payments (5% discount)

- Press releases to tech and business publications

The Unexpected Benefits: Beyond Sales Growth

Reduced Chargeback Fraud

Cryptocurrency transactions are irreversible, eliminating the costly problem of chargeback fraud that plagued my credit card transactions. This alone saved me thousands of dollars monthly.

Faster International Payments

Cross-border crypto payments settle within minutes instead of the 3-5 business days typical with traditional banking. This improved cash flow significantly impacted my ability to restock inventory quickly.

Lower Transaction Fees

While crypto payment processors charge fees, they’re often lower than credit card processing fees, especially for international transactions. My overall payment processing costs decreased by 15%.

Brand Differentiation

Accepting cryptocurrency positioned my business as innovative and forward-thinking. This reputation attracted media attention and organic social media buzz, providing free marketing worth thousands of dollars.

Overcoming Common Challenges

Price Volatility Concerns

Initially, I worried about cryptocurrency price fluctuations affecting my revenue. However, using automatic conversion to USD eliminated this risk entirely. Payments are converted to stable currency immediately upon receipt.

Customer Education

Some customers needed guidance on making crypto payments. I created simple tutorial videos and dedicated customer support resources. The investment in education paid off with increased customer satisfaction and loyalty.

Regulatory Compliance

Staying compliant with evolving cryptocurrency regulations required ongoing attention. I consulted with a tax professional and implemented proper record-keeping systems from day one.

Real Customer Stories: Why They Choose Crypto

Sarah from Germany

“I’ve been trying to buy from American tech stores for years, but my bank always blocks the transactions. With Bitcoin payment, I finally got my dream gaming setup without any hassles.”

Mike from California

“I mine cryptocurrency as a hobby, so paying with crypto feels natural. Plus, I don’t have to worry about credit card fraud or sharing my financial details online.”

Jennifer from Canada

“The 5% crypto discount made my $2,000 purchase significantly cheaper. It was a win-win situation.”

Advanced Strategies to Maximize Crypto Sales

1. Cryptocurrency-Specific Promotions

I regularly offer special discounts for crypto payments, typically 3-5% off regular prices. These promotions drive crypto adoption while maintaining healthy profit margins.

2. Targeted Marketing to Crypto Communities

Engaging with cryptocurrency forums, Discord servers, and Reddit communities helped me connect with potential customers who actively seek crypto-friendly merchants.

3. Multiple Cryptocurrency Options

While Bitcoin and Ethereum handle most transactions, offering alternatives like Litecoin, Bitcoin Cash, and stablecoins caters to diverse customer preferences.

4. Transparent Pricing

I display crypto prices alongside traditional currency prices, making it easy for customers to understand exactly what they’re paying without hidden conversion fees.

The Technical Side: What Actually Happens

Understanding the technical process helped me optimize the customer experience and troubleshoot issues effectively:

- Customer selects crypto payment at checkout

- System generates unique wallet address for the transaction

- Customer sends exact amount to provided address

- Payment processor confirms transaction on blockchain

- Funds automatically convert to USD in my account

- Order processing begins immediately after confirmation

This entire process typically takes 5-15 minutes for Bitcoin and 1-3 minutes for Ethereum, depending on network congestion.

Managing the Financial Side

Accounting Considerations

Cryptocurrency transactions require careful record-keeping for tax purposes. I maintain detailed logs of:

- Transaction amounts in crypto and USD

- Exchange rates at time of transaction

- Processing fees and costs

- Customer information for compliance

Cash Flow Management

While automatic conversion provides stability, I keep a small percentage of payments in cryptocurrency as a hedge against inflation and potential appreciation.

Looking Forward: The Future Impact

Six months into accepting cryptocurrency, I’m convinced this decision will continue paying dividends. The crypto user base grows daily, and early adoption gives my business a competitive advantage that compounds over time.

Recent trends supporting continued growth:

- Increasing mainstream crypto adoption

- Major corporations accepting cryptocurrency

- Improved regulatory clarity

- Enhanced payment processing technology

- Growing international e-commerce markets

Practical Tips for Implementation Success

Start Small and Scale

Begin with Bitcoin and Ethereum support before expanding to other cryptocurrencies. This approach minimizes complexity while capturing the majority of crypto users.

Focus on User Experience

Make crypto payments as simple as traditional payments. Complex checkout processes drive away customers regardless of payment method.

Maintain Customer Support

Train support staff to handle crypto-related questions confidently. Quick, knowledgeable responses build trust and encourage repeat purchases.

Monitor and Optimize

Track crypto payment metrics separately from traditional payments. This data reveals optimization opportunities and demonstrates ROI to stakeholders.

The Competitive Advantage

Accepting cryptocurrency created a sustainable competitive advantage that’s difficult for competitors to replicate quickly. The network effects of satisfied crypto customers recommending my business to their communities generate ongoing organic growth.

Many competitors still hesitate to accept crypto due to perceived complexity or volatility concerns. This hesitation creates opportunities for forward-thinking businesses to capture market share and establish themselves as industry leaders.

Risk Management Strategies

Diversification

I don’t put all my eggs in the crypto basket. Traditional payment methods still account for 70% of transactions, providing stability while crypto payments drive growth.

Regular Security Audits

Cryptocurrency security requires ongoing vigilance. I conduct monthly security reviews and maintain updated security protocols to protect customer data and business assets.

Compliance Monitoring

Staying current with regulatory changes ensures long-term business sustainability. I subscribe to regulatory update services and maintain relationships with compliance professionals.

Measuring Success: Key Performance Indicators

Tracking the right metrics proves the value of crypto payment integration:

Revenue Metrics

- Total crypto payment volume

- Average crypto transaction value

- Month-over-month crypto sales growth

- Crypto customer lifetime value

Customer Metrics

- New customer acquisitions via crypto

- Crypto customer retention rates

- Geographic distribution of crypto customers

- Customer satisfaction scores for crypto payments

Operational Metrics

- Payment processing costs

- Transaction failure rates

- Customer support ticket volume

- Time to payment confirmation

Conclusion

Introduction of payment in cryptocurrency has revolutionized my company beyond my expectations. The 30 percent surge in sales was only a tip of the iceberg-; I have access to the world markets, the cost of processing payments is decreasing, there are no chargebacks, and now my brand is regarded as an industry pioneer.

When business owners need to decide on whether to sell more using crypto, the answer is very clear- the choice should not be if cryptocurrency will be mainstream, but whether you are prepared once it will be. Those companies that will change first, will receive the most benefits.

The experience of turning into a crypto enthusiast after being quite the doubtful and skeptical person taught me that sometimes the most significant discoveries can be made through the application of technology that appears too dangerous or intricate. A half a year ago, I could never have dreamed of implementing accepting cryptocurrency as one of the most lucrative ideas in my business.

Cryptocurrencies can be used as payment to people operating online businesses, and one cogent reason why your business should be embracing it is that you might be missing out on good profits. The infrastructure is in place, the clients are there, and competitive advantages are high. The only thing left to wonder: when are you going to begin your own personal adventure and boost sales with crypto?

Frequently Asked Questions

1. Is accepting cryptocurrency legal for businesses?

Yes, accepting cryptocurrency as payment is legal in the United States. However, businesses must comply with existing tax laws and reporting requirements. Consult with a tax professional to ensure proper compliance.

2. How much do cryptocurrency payment processors charge?

Most reputable crypto payment processors charge between 1.5% to 3.5% per transaction, often lower than traditional credit card processing fees, especially for international transactions.

3. What happens if cryptocurrency prices crash after a customer pays?

Most payment processors offer automatic conversion to USD immediately upon payment confirmation, eliminating price volatility risk for merchants.

4. Do I need technical expertise to accept cryptocurrency?

No, modern crypto payment processors offer user-friendly plugins that integrate easily with popular e-commerce platforms. Most implementations require no coding knowledge.

5. Which cryptocurrencies should I accept?

Bitcoin and Ethereum capture the majority of crypto users. Adding stablecoins like USDC can attract customers who prefer price stability.

6. How long do crypto transactions take to confirm?

Bitcoin transactions typically confirm within 10-30 minutes, while Ethereum transactions usually confirm within 1-5 minutes, depending on network conditions.

7. Can cryptocurrency payments be refunded?

Cryptocurrency transactions are irreversible, but most payment processors handle refunds by sending new crypto payments to customers’ wallets.

8. Will accepting crypto attract IRS attention?

Cryptocurrency transactions must be reported like any other business income. Proper record-keeping and tax compliance actually reduce audit risk rather than increase it.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!

Don’t miss out on the opportunity to elevate your business with XAIGATE’s Step-by-Step: How I Implemented Crypto Payments. The three-step process is designed to be user-friendly, making it accessible for all businesses. Embrace this modern payment solution to provide customers with a secure and efficient way to pay. Take the first step towards a competitive edge in the digital realm and unlock the benefits of cryptocurrency payments for Businesses today.

Looking to integrate seamless Crypto Payment Gateway for Businesses into your business? XAIGATE provides blockchain-native tools for merchants, developers, and enterprises to accept decentralized payments with confidence.