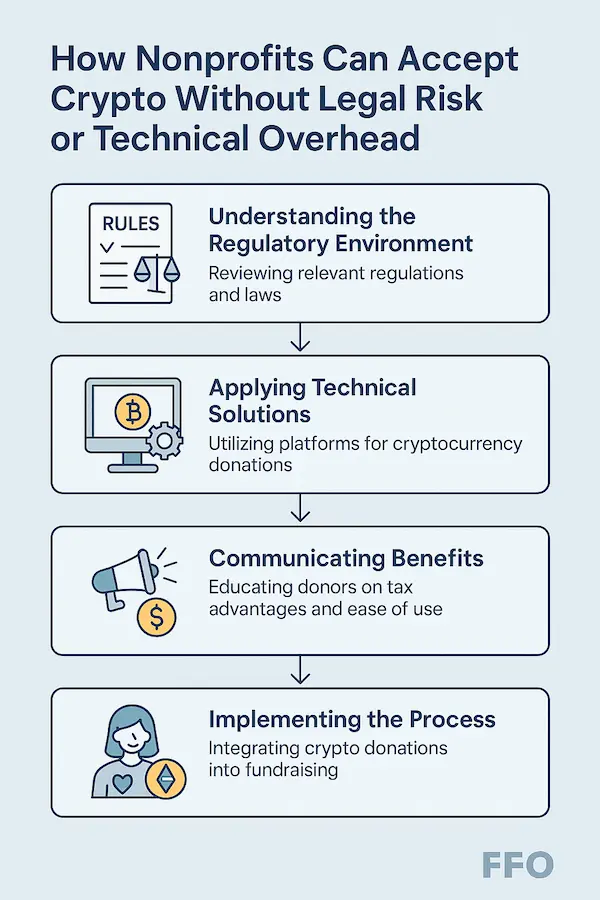

There is a digital shift in fundraising in the nonprofit sphere where cryptocurrency donations are becoming a great opportunity. As crypto donations are projected to surpass 2.5 billion in 2026, progressive nonprofits are experimenting to find the way to an Accept Crypto Without Legal Risk or Technical Overhead but not to be exposed to the risk of a potential legal case. This full-scale guide will enable all nonprofit organizations to go through the legal environment, apply technical solutions and fully exploit the advantages of cryptocurrency donations.

Contents

- 1 Understanding the Regulatory Environment for Nonprofit Crypto Donations

- 2 Essential Compliance Requirements

- 3 Table 1: Compliance Requirements by Donation Size

- 4 Technical Solutions for Crypto Acceptance

- 5 Strategic Implementation Framework

- 6 Table 2: Implementation Timeline and Resource Requirements

- 7 Risk Management and Security Considerations

- 8 Marketing and Donor Engagement Strategies

- 9 Table 3: Donor Education Resource Checklist

- 10 Financial Management and Accounting

- 11 Advanced Strategies and Future Considerations

- 12 Measuring Success and Impact

- 13 Moving Beyond Compliance – How Nonprofits Can Intelligently Accept Crypto Without Legal Risk

- 14 Conclusion

- 15 Frequently Asked Questions

Understanding the Regulatory Environment for Nonprofit Crypto Donations

IRS Classification and Tax Implications

IRS treats cryptocurrency as a property rather than a currency and this provides certain benefits to the donors and nonprofits. Such a classification implies that investors who give appreciated cryptocurrency to qualified nonprofits may pay no further taxes on the appreciation, as well as may claim the entire fair market value as a charitable deduction.

In the case of nonprofits, this type of property makes numerous compliance issues simple. In sharp contrast to businesses, which need to report crypto income, qualified 501(c) (3) entities will not lose their tax exemption status of accept crypto without legal risk. Nevertheless, appropriate documentation and reporting are crucial to compliance.

Legal Framework for Crypto Acceptance

The legal framework governing nonprofit cryptocurrency acceptance is well-established and favorable. The IRS incentivizes donations of crypto similarly to gifts of stock. Cryptocurrency is considered property and donating it is a nontaxable event for the donor, making it an attractive giving option.

Nonprofits can accept crypto without legal risk by following existing donation acknowledgment procedures with minor modifications for digital assets. The same principles that govern stock donations apply to cryptocurrency contributions, providing a familiar legal foundation.

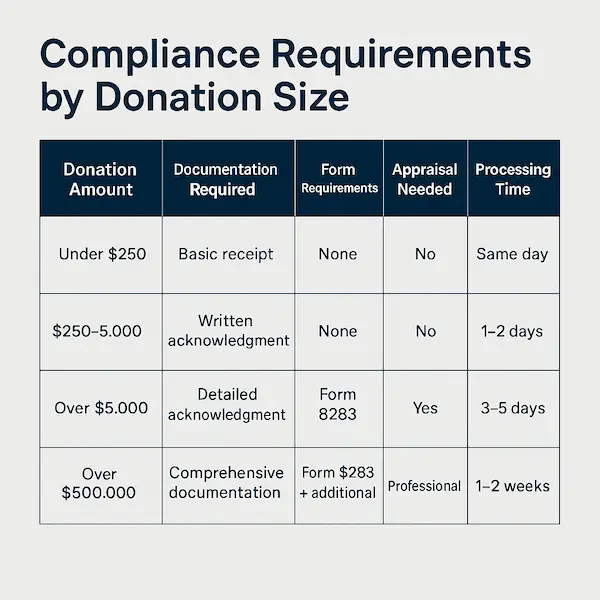

Essential Compliance Requirements

Documentation and Acknowledgment Standards

Donations of more than $250 require a contemporaneous written acknowledgement. For donations of more than $5,000, the charity needs to sign IRS Form 8283, Part V, acknowledging that the charity is a qualified charity under Internal Revenue Code (Code) §170(c).

The documentation requirements for Accept Crypto Without Legal Risk mirror traditional asset donations:

- Under $250: Standard donation receipt with crypto type and amount

- $250-$5,000: Written acknowledgment with no goods or services statement

- Over $5,000: Form 8283 signature required, and qualified appraisal needed

Record-Keeping Best Practices

Nonprofits need to report any income received from cryptocurrency donations accurately. This includes maintaining detailed records of each transaction, including the date, amount, and type of cryptocurrency received.

Essential records include:

- Transaction date and time

- Type and amount of cryptocurrency received

- Fair market value at time of donation

- Donor information and contact details

- Blockchain transaction IDs for verification

- Conversion records if crypto is sold

Table 1: Compliance Requirements by Donation Size

| Donation Amount | Documentation Required | Form Requirements | Appraisal Needed | Processing Time |

| Under $250 | Basic receipt | None | No | Same day |

| $250-$5,000 | Written acknowledgment | None | No | 1-2 days |

| Over $5,000 | Detailed acknowledgment | Form 8283 | Yes | 3-5 days |

| Over $500,000 | Comprehensive documentation | Form 8283 + additional | Professional | 1-2 weeks |

Technical Solutions for Crypto Acceptance

Professional Donation Platforms

The most effective way for nonprofits to accept crypto without legal risk or technical complexity is through specialized donation platforms. Platforms like Every.org, The Giving Block, and Engiven make it easy for nonprofits to accept top cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), convert to cash, and issue receipts.

These platforms handle:

- Wallet security and management

- Real-time conversion to fiat currency

- Automatic tax documentation

- Donor receipt generation

- Compliance monitoring and reporting

Platform Comparison and Selection

XAIGATE introduces an AI-driven crypto donation gateway designed for scalability and automation. It supports over 50 cryptocurrencies, provides real-time fraud detection, and features dynamic tax compliance reporting powered by machine learning. XAIGATE is ideal for data-driven nonprofits seeking high-level transparency and seamless integration with CRMs and accounting systems.

The Giving Block offers comprehensive crypto donation services with autosell conversion to cash functionality. Their platform integrates with existing fundraising systems and provides detailed analytics.

Every.org focuses on simplicity, where by accept crypto without legal risk and granting it out to nonprofits in cash, Every.org saves charities from extra legal, accounting, or administrative work.

Engiven specializes in complex giving solutions, offering crypto giving widgets and time-saving software help nonprofit organizations securely engage with cryptocurrency transactions.

Integration with Existing Systems

Modern crypto donation platforms integrate seamlessly with popular nonprofit management systems:

- Salesforce Nonprofit Cloud: Direct integration for donor management

- Blackbaud solutions: Blackbaud has partnered with The Giving Block, a leading solution for cryptocurrency donations to enable crypto donations through their JustGiving platform

- Custom CRM systems: API connections for automated data transfer

- Accounting software: Automated transaction recording and reporting

Strategic Implementation Framework

Phase 1: Assessment and Planning

Before implementing accept crypto without legal risk, nonprofits should conduct a thorough assessment:

Legal readiness checklist:

- Review current donation policies and procedures

- Consult with legal counsel familiar with crypto regulations

- Update gift acceptance policies to include digital assets

- Ensure board approval for new donation methods

Technical readiness evaluation:

- Assess current website and donation infrastructure

- Evaluate staff technical capabilities

- Determine integration requirements with existing systems

- Plan for donor education and support

Phase 2: Platform Selection and Setup

Choose a platform based on your organization’s specific needs:

For small to medium nonprofits: Every.org offers the simplest implementation with minimal technical overhead.

For large organizations: The Giving Block provides comprehensive features and detailed reporting capabilities.

For faith-based or specialized organizations: Engiven offers customized solutions for specific nonprofit sectors.

Phase 3: Staff Training and Policy Development

Develop comprehensive training programs covering:

- Basic cryptocurrency concepts for development staff

- Platform-specific procedures for processing donations

- Donor communication strategies

- Compliance and documentation requirements

- Troubleshooting common technical issues

Table 2: Implementation Timeline and Resource Requirements

| Implementation Phase | Duration | Staff Hours Required | Primary Responsibilities |

| Assessment & Planning | 2-4 weeks | 20-30 hours | Development Director, Legal |

| Platform Setup | 1-2 weeks | 10-15 hours | IT Staff, Finance |

| Staff Training | 1 week | 15-20 hours | All relevant staff |

| Donor Education | 2-3 weeks | 25-35 hours | Marketing, Communications |

| Go-Live & Monitoring | Ongoing | 5-10 hours/month | Development, Finance |

Risk Management and Security Considerations

Platform Security Features to accept crypto without legal risk

Professional crypto donation platforms provide enterprise-level security:

- Multi-signature wallets for enhanced protection

- Cold storage for long-term asset security

- Insurance coverage against theft or loss

- Regular security audits and compliance monitoring

- 24/7 monitoring and fraud detection

Internal Security Policies

Develop internal policies to maintain security:

- Access controls: Limit platform access to essential personnel

- Regular reviews: Monthly reconciliation of crypto donations

- Backup procedures: Maintain offline copies of essential documentation

- Incident response: Clear procedures for security concerns

Avoiding Common Pitfalls

Many nonprofits encounter avoidable issues when implementing crypto donations:

Technical complexity: Using platforms eliminates the need for in-house crypto expertise

Volatility concerns: Auto-conversion features minimize price fluctuation risks

Tax compliance: Professional platforms handle most documentation automatically

Donor education: Comprehensive FAQ sections address common donor questions

Marketing and Donor Engagement Strategies

Communicating Crypto Acceptance

Effective marketing of crypto donation capabilities requires careful messaging:

Benefits for accept crypto without legal risk:

- Immediate tax deduction at full market value

- Avoidance of capital gains taxes

- Simple, secure donation process

- Support for innovative fundraising approaches

Benefits for the organization:

- Access to new donor demographics

- Potentially larger gift sizes

- Lower processing fees than credit cards

- Enhanced technological reputation

Target Audience Identification

Focus marketing efforts on likely accept crypto without legal risk:

- Technology professionals and entrepreneurs

- Younger philanthropists (ages 25-45)

- High-net-worth individuals with investment portfolios

- Existing major donors who may hold cryptocurrency

- Alumni from technology and finance industries

Educational Content Development

Create comprehensive educational materials:

- Step-by-step donation guides with screenshots

- Video tutorials for common cryptocurrencies

- FAQ sections addressing tax implications

- Testimonials from successful crypto donors

- Regular updates on crypto philanthropy trends

Table 3: Donor Education Resource Checklist

| Resource Type | Content Elements | Target Audience | Update Frequency |

| Basic Guide | What is crypto, how to donate | All potential donors | Annually |

| Tax Guide | Deduction benefits, documentation | High-value donors | Quarterly |

| Technical Tutorial | Platform walkthrough, troubleshooting | Tech-savvy donors | Semi-annually |

| FAQ Section | Common questions, quick answers | All donors | Monthly |

| Video Content | Visual demonstrations, testimonials | Younger demographics | Bi-annually |

Financial Management and Accounting

Conversion Strategy Options

Nonprofits have several options for managing cryptocurrency donations:

Immediate conversion: Convert to cash upon receipt to eliminate volatility risk. This is the most common and recommended approach for most organizations.

Partial holding: Convert a percentage immediately while holding some crypto as a potential investment. This requires more sophisticated accounting and risk management.

Full holding: Maintain crypto assets long-term. This approach requires significant expertise and is generally not recommended for most nonprofits.

Accounting Integration

Modern platforms simplify accounting integration:

- Automated journal entries for major accounting systems

- Real-time valuation using market data

- Detailed transaction reports for auditing purposes

- Monthly reconciliation reports for financial oversight

Audit Considerations

Prepare for audit requirements by maintaining:

- Complete transaction histories with blockchain verification

- Fair market value documentation at donation time

- Platform statements and conversion records

- Donor acknowledgment documentation

- Professional appraisals for large donations

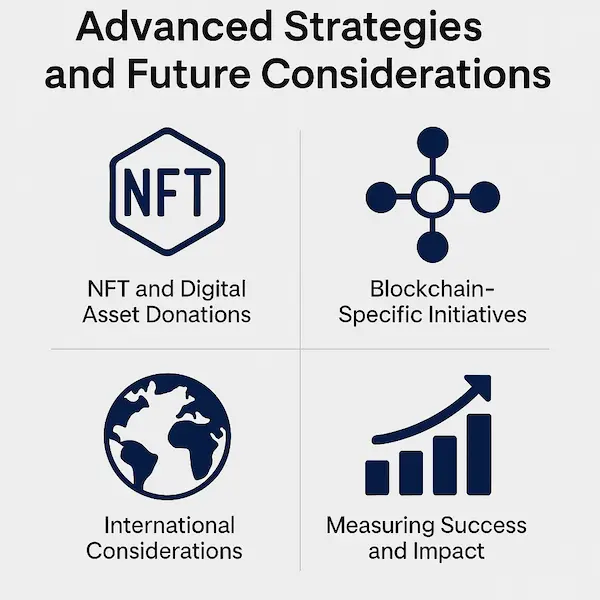

Advanced Strategies and Future Considerations

NFT and Digital Asset Donations

Some nonprofits are exploring non-fungible token (NFT) donations. Transferring an NFT directly to a qualified charity is non-taxable, but any NFT sale proceeds are taxable before donation. An expert appraisal is often recommended for these complex assets.

Consider NFT acceptance only after establishing traditional crypto donation programs and developing appropriate expertise.

Blockchain-Specific Initiatives

The global safe drinking water nonprofit charity:water announced the launch of its first crypto-native Bitcoin Water Trust initiative. The trust will allow the trust to receive and “hodl” bitcoin donations to fund global water projects until 2026.

Such initiatives demonstrate how nonprofits can align crypto acceptance with their mission while building donor engagement.

International Considerations

Accept crypto without legal risk can facilitate international giving:

- Reduced transaction costs for international donors

- Faster processing than traditional wire transfers

- Simplified compliance compared to foreign currency donations

- Greater accessibility for donors in countries with banking restrictions

As digital giving evolves, forward-thinking nonprofits are leveraging crypto to reach global supporters and reduce transaction costs. Explore the full guide on how to accept cryptocurrency donations for nonprofit fundraising at XAIGATE

Measuring Success and Impact

Key Performance Indicators

Track meaningful metrics to evaluate accept crypto without legal risk programs:

Financial metrics:

- Total crypto donations received

- Average donation size compared to traditional gifts

- Conversion rates from website visitors to crypto donors

- Cost savings compared to credit card processing

Operational metrics:

- Time to process crypto donations vs. traditional gifts

- Staff hours required for crypto donation management

- Donor satisfaction scores for crypto giving experience

- Technical support requests and resolution times

Long-term Strategy Development

Plan for the evolution of crypto donations:

- Technology upgrades: Stay current with platform improvements

- Regulatory changes: Monitor IRS and state-level developments

- Market expansion: Consider additional cryptocurrencies as they mature

- Integration opportunities: Explore connections with other fundraising initiatives

Moving Beyond Compliance – How Nonprofits Can Intelligently Accept Crypto Without Legal Risk

Crypto Acceptance Requires More Than IRS Compliance

While the IRS has provided fairly straightforward guidance—classifying cryptocurrency as property and allowing donors to deduct the fair market value—nonprofits must understand that legal safety doesn’t end with following IRS rules. To truly accept crypto without legal risk, organizations need to go deeper: establishing airtight internal policies, documenting every stage of the donation process, and aligning key departments around a unified crypto strategy.

It’s not uncommon for risk to emerge not from the IRS or state regulators, but from within—miscommunications with donors, unclear gift acknowledgment procedures, or failure to properly appraise and report large contributions. Nonprofits must treat crypto like any other complex asset: subject to legal review, governed by a gift acceptance policy, and tracked with meticulous records. This not only prevents regulatory issues but strengthens trust with donors, auditors, and board members.

Operational Frameworks That Reduce Legal Exposure

Leading organizations are going beyond basic compliance and investing in structured crypto acceptance frameworks. These include:

- Multi-signature wallet protocols to reduce theft risk

- Pre-defined holding/conversion policies that minimize volatility concerns

- Board-approved gift acceptance amendments that explicitly address crypto

- Centralized documentation procedures for all appraisals and Form 8283 filings

- Audit-ready recordkeeping powered by integrations with platforms like XAIGATE or Engiven

By proactively managing these internal controls, nonprofits build the infrastructure required to accept crypto without legal risk, turning what was once perceived as a legal gray area into a stable and scalable fundraising channel.

Conclusion

It is possible to engage in accept crypto without legal risk in nonprofits with no risk to legal liability and without overhead in technical complications by using the expertise of professional organizations on donation platforms and adhering to developed procedures. A regulatory system designed to benefit crypto donations is established and remains positive, as crypto donations are treated more or less equal to stock donations.

The most important part of being a successful school is to choose the appropriate platform partner, to follow correct documentation steps and to train the staff together with the donor community about the whole process. Contemporary crypto giving systems remove most of the technical peculiarities and provide perfect IRS compliance.

The organizations that accept cryptocurrency donation now acquire a place to gain profit out of the rising crypto philanthropy market along with their donors that would rather use digital forms of giving. The overall positive implications that crypto donations have on any nonprofit organization and donors are tax-wise is what makes it a suitable addition to the fundraising strategy.

The very best thing to do is to begin. Select a respectable platform, provide minimal policies, and start receiving crypto-donations. The technical and legal challenges which in the past made crypto donations difficult has been overcome because of professional platforms to some extent and well-defined regulatory guidance.

As the crypto economy grows, nonprofits that build the ability to accept crypto without legal risk first stand to gain huge benefits in accessing new donors and generating its full fundraising potential. The legal framework is in place to facilitate crypto donations in a safe and successful way – the possibility exists to be utilized by organizations willing to welcome this trend of growing philanthropy.

Start accepting crypto today with XaiGate, the all-in-one crypto payment gateway built for growth and scalability.

Frequently Asked Questions

1. Is it legal for nonprofits to accept cryptocurrency donations?

Yes, it’s completely legal. The IRS treats cryptocurrency donations the same as stock donations, and 501(c)(3) organizations can accept crypto without legal risk while maintaining their tax-exempt status.

2. Do we need special licenses or registrations to accept crypto donations?

No special licenses are required for nonprofits to accept crypto donations. Your existing 501(c)(3) status covers cryptocurrency acceptance just like traditional donations.

3. How do we handle the technical aspects of crypto donations?

Use professional platforms like The Giving Block, Every.org, or Engiven that handle all technical requirements including wallet management, security, and conversion to cash.

4. What documentation is required for crypto donations?

Documentation requirements are the same as traditional donations: receipts for donations over $250, Form 8283 for donations over $5,000, and qualified appraisals for very large gifts.

5. How do we protect against cryptocurrency price volatility?

Most nonprofit platforms offer automatic conversion to cash upon receipt, eliminating volatility risk. This is the recommended approach for most organizations.

6. Are there tax benefits for donors who give cryptocurrency?

Yes, donors can claim the full fair market value as a charitable deduction while avoiding capital gains taxes on appreciated cryptocurrency.

7. How long does it take to set up crypto donation acceptance?

Setup typically takes 1-2 weeks using professional platforms. The entire implementation process, including staff training and donor education, usually takes 4-6 weeks.

8. What types of cryptocurrency should we accept?

Start with major cryptocurrencies like Bitcoin and Ethereum, which have the largest donor bases and most stable platforms support.

9. How do we educate our donors about crypto donations?

Create simple educational materials explaining the tax benefits, donation process, and security measures. Most platforms provide template materials you can customize.

10. Can international donors use cryptocurrency to support our organization?

Yes, accept crypto without legal risk can simplify international giving by reducing transaction costs and processing times compared to traditional international wire transfers.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!