Nonprofit is undergoing the phase of digital transformation, and donations in cryptocurrency are playing a very big role in the fundraising strategy. Nonprofits will be able to use their cryptocurrency donation in order to access an expanding donor base and open new funding sources as digital currencies enter the mainstream. How Nonprofits Can Accept Crypto Donations? This extensive article explains ways in which the inclusion of cryptocurrency donations in the fundraising strategies of organizations can be achieved successfully.

Contents

- 1 Understanding Crypto Donations

- 2 Legal Framework and Compliance

- 3 Setting Up Cryptocurrency Donation Systems

- 4 Technical Implementation Process

- 5 Financial Management and Accounting

- 6 Marketing and Donor Engagement

- 7 Risk Management and Best Practices

- 8 Case Studies and Success Stories When Accept Crypto Donations

- 9 Future Trends and Considerations

- 10 Frequently Asked Questions

- 11 Conclusion

Understanding Crypto Donations

Crypto donations are a recent phenomenon in charity donation practice that allows donors to give their charitable contributions in a digital form to non-profit organizations. In contrast to the donation that implies delivering some real goods, crypto donations imply exchanging digital ones, such as Bitcoin, Ethereum, or any other altcoin available in the wallet of a donor and the digital wallet of a nonprofit.

Cryptocurrency donations are appealing as they are motivated by a few aspects. There are many crypto owners who have enjoyed massive increases in their digital assets and want to make donations without going through the process of converting their assets into cash. This method may be less tax-expensive on the part of the donors and give nonprofits potentially useful assets.

Why Donors Choose Crypto

Different reasons are attracting more donors to use crypto donations. Transparency of blockchain technology is an attractive aspect to those who need to monitor their contributions. Moreover, younger generaton, more prone to keep the cryptocurrency, is fond of the convenience and novelty of non-cash giving.

The anonymity that may be offered by cryptocurrency is also of value to many crypto donors, but nonprofits need to avoid violating the law with respect to disclosures. Cryptocurrency is especially interesting in terms of international donors who may have problems with conventional banking networks.

Legal Framework and Compliance

Before accepting crypto donations, nonprofits must understand the legal landscape surrounding digital assets. The IRS treats cryptocurrency as property, not currency, which has important implications for both donors and recipients.

IRS Guidelines for Crypto Donations

Internal Revenue Service has come up with clear guidelines on crypto donations. When received, nonprofits are to report crypto at fair market value. It implies that organizations require mechanisms that can monitor and record the amount of value received during a transfer of cryptocurrency.

On the side of donors, charitable gifts of cryptocurrencies can be treated similar to other capital assets whose donation will be deductible at the fair market value of the donated assets. Special rules are provided, however, in case of cryptocurrency held less than a year, amounts of deductions can be restricted.

State and Federal Regulations

Beyond IRS requirements, nonprofits must comply with state fundraising regulations. Some states have specific requirements for organizations accepting crypto donations, including additional disclosure requirements or registration processes.

Organizations should also consider anti-money laundering (AML) and know-your-customer (KYC) requirements, especially for larger donations. While cryptocurrency can provide anonymity, nonprofits may need to implement procedures to verify donor identities for compliance purposes.

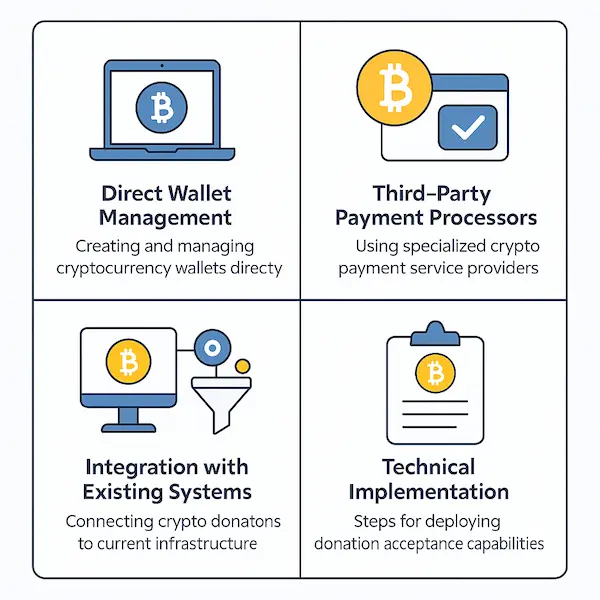

Setting Up Cryptocurrency Donation Systems

Implementing a crypto donation system requires careful planning and the right infrastructure. Organizations have several options for accepting digital currency donations, each with different advantages and considerations.

Direct Wallet Management

The most straightforward approach involves creating and managing cryptocurrency wallets directly. This method gives organizations complete control over their digital assets but requires significant technical expertise and security measures.

| Wallet Type | Advantages | Disadvantages |

| Hot Wallets | Easy access, quick transactions | Higher security risk |

| Cold Wallets | Maximum security | Less convenient for frequent use |

| Multi-signature | Enhanced security through multiple approvals | Complex setup and management |

Organizations choosing direct wallet management must implement robust security protocols, including secure key storage, regular backups, and staff training on cryptocurrency handling procedures.

Third-Party Payment Processors

Many nonprofits prefer working with specialized cryptocurrency payment processors that handle the technical aspects of digital currency acceptance. These services typically convert donations to traditional currency immediately, reducing volatility risk.

Popular crypto donation platforms include:

- Coinbase Commerce: Offers easy integration with existing donation systems

- BitPay: Provides comprehensive merchant services for nonprofits

- The Giving Block: Specializes specifically in nonprofit cryptocurrency donations

- Engiven: Focuses on faith-based organizations and nonprofits

Integration with Existing Systems

Successful crypto donation programs integrate seamlessly with existing fundraising infrastructure. This includes connecting crypto donation systems with customer relationship management (CRM) systems, donor databases, and financial reporting tools.

Organizations should ensure their chosen solution can:

- Generate proper tax receipts for donors

- Track donation values accurately

- Integrate with existing accounting systems

- Provide detailed reporting for compliance purposes

Technical Implementation Process

Setting up crypto donations capabilities involves several technical steps that require careful execution. Organizations must balance accessibility for donors with security for their digital assets.

Choosing Supported Cryptocurrencies

Not all cryptocurrencies are equal when it comes to donations. Organizations should focus on widely-held, stable cryptocurrencies that donors are likely to possess. The most common choices include:

Bitcoin (BTC): The most recognized cryptocurrency, held by many potential donors Ethereum (ETH): Popular for its smart contract capabilities and wide adoption Litecoin (LTC): Often chosen for lower transaction fees Bitcoin Cash (BCH): Preferred by some for faster transaction times

Security Considerations

Security represents the most critical aspect of crypto donations systems. Organizations must protect both incoming donations and stored digital assets from theft or loss.

Essential security measures include:

- Multi-factor authentication for all accounts and wallets

- Cold storage for long-term asset holding

- Regular security audits of systems and procedures

- Staff training on cryptocurrency security best practices

- Incident response plans for potential security breaches

Donation Processing Workflow

A well-designed donation processing workflow ensures smooth transactions while maintaining proper records. The typical process includes:

- Donor initiates donation through the organization’s website or platform

- System generates unique wallet address for the specific transaction

- Donor transfers cryptocurrency to the provided address

- Organization confirms receipt and records donation details

- Tax receipt generated based on fair market value at receipt time

- Assets processed according to organization’s policy (hold or convert)

Financial Management and Accounting

Managing cryptocurrency donations requires specialized financial practices that differ from traditional fundraising. Organizations must develop policies for handling digital assets while maintaining accurate financial records.

Valuation and Recording

Proper valuation of cryptocurrency donations is crucial for both financial reporting and tax compliance. Organizations must determine fair market value at the time of receipt, which can be challenging given cryptocurrency’s volatility.

Best practices for valuation include:

- Using established exchanges for price reference

- Documenting the specific time and date of donation receipt

- Maintaining records of valuation sources and methods

- Implementing consistent valuation procedures across all donations

Conversion Strategies

Organizations must decide whether to hold cryptocurrency donations or convert them to traditional currency. This decision impacts both financial risk and potential returns.

| Strategy | Benefits | Risks |

| Immediate Conversion | Eliminates volatility risk | Misses potential gains |

| Hold Strategy | Potential for appreciation | Significant volatility risk |

| Partial Conversion | Balances risk and opportunity | Requires active management |

Tax Implications for Nonprofits

While nonprofits generally don’t pay taxes on donations, cryptocurrency contributions can create complex reporting requirements. Organizations must track the fair market value of received cryptocurrencies and report them appropriately on tax filings.

Key tax considerations include:

- Form 990 reporting requirements for cryptocurrency donations

- Unrelated business income implications if actively trading

- State reporting requirements that may vary by jurisdiction

- International tax implications for global organizations

Marketing and Donor Engagement

Successfully implementing crypto donations requires effective marketing and donor engagement strategies. Organizations must educate potential donors about the benefits and process of crypto giving.

Targeting Crypto Donors

Cryptocurrency donors often have different motivations and preferences compared to traditional donors. They tend to be younger, more tech-savvy, and interested in innovative approaches to charitable giving.

Effective targeting strategies include:

- Social media campaigns on platforms popular with crypto enthusiasts

- Partnerships with cryptocurrency communities and influencers

- Educational content about cryptocurrency donation benefits

- Transparency about how crypto donations are used

Educational Resources

Many potential donors may be interested in crypto donations but lack knowledge about the process. Organizations should provide comprehensive educational resources that explain:

- How to make cryptocurrency donations

- Tax benefits of crypto giving

- Security considerations for donors

- The organization’s policy on handling crypto donations

Communication Strategies

Clear communication about crypto donation policies builds donor confidence and encourages participation. Organizations should be transparent about:

- Which cryptocurrencies they accept

- How donations are processed and valued

- Security measures in place

- The organization’s approach to holding or converting crypto assets

Risk Management and Best Practices

Crypto donations are associated with new threats which organizations have to oversee. Formulating the risk management plans safeguards the organization as well as the donors.

Volatility Management

Cryptocurrency values can fluctuate dramatically, creating financial risk for organizations that hold digital assets. Effective volatility management strategies include:

- Immediate conversion policies for risk-averse organizations

- Dollar-cost averaging for organizations that choose to hold crypto

- Diversification across multiple cryptocurrencies

- Regular review of crypto holding policies

Operational Risks

Beyond financial volatility, organizations face various operational risks when accepting cryptocurrency donations. These include:

- Technical failures in wallet or payment systems

- Human error in handling cryptocurrency transactions

- Regulatory changes affecting cryptocurrency operations

- Security breaches resulting in asset loss

Compliance Monitoring

Maintaining compliance with evolving regulations requires ongoing monitoring and adaptation. Organizations should:

- Stay informed about regulatory changes

- Maintain detailed records of all crypto transactions

- Implement robust internal controls

- Regularly review policies and procedures

Case Studies and Success Stories When Accept Crypto Donations

Learning from organizations that have successfully implemented crypto donation programs provides valuable insights for others considering similar initiatives.

Large Nonprofit Success

The United Way implemented a comprehensive crypto donation program that increased their donor base by 15% within the first year. Their success factors included:

- Comprehensive staff training on cryptocurrency handling

- Partnership with established crypto payment processors

- Clear communication about their crypto donation policy

- Regular evaluation and optimization of their processes

Small Organization Innovation

A local animal shelter partnered with a crypto payment processor to accept Bitcoin donations. Despite their small size, they successfully raised over $50,000 in cryptocurrency donations by:

- Focusing on their tech-savvy donor base

- Providing excellent donor education resources

- Maintaining transparent communication about fund usage

- Leveraging social media for outreach

Future Trends and Considerations

The cryptocurrency donation landscape continues to evolve rapidly. Organizations must stay informed about emerging trends and technologies that could impact their fundraising strategies.

Emerging Technologies

New developments in cryptocurrency and blockchain technology offer additional opportunities for nonprofits. These include:

- Smart contracts for automated donation processing

- Decentralized finance (DeFi) protocols for yield generation

- Non-fungible tokens (NFTs) for unique fundraising campaigns

- Stablecoins for reduced volatility risk

Regulatory Evolution

Cryptocurrency regulations continue to develop, with potential impacts on nonprofit operations. Organizations should monitor:

- Federal legislation affecting cryptocurrency operations

- State-level regulatory changes

- International regulations for global organizations

- Tax law modifications affecting crypto donations

Growing Acceptance

As cryptocurrency becomes more mainstream, donation programs are likely to become standard practice for many nonprofits. Early adopters may gain competitive advantages through:

- First-mover benefits in attracting crypto donors

- Enhanced technical capabilities

- Stronger relationships with the cryptocurrency community

- Better understanding of digital asset management

To explore the full step-by-step framework on accepting crypto donations, visit: https://www.xaigate.com/accept-cryptocurrency-donations-for-nonprofit/.

Frequently Asked Questions

1. Is it legal for nonprofits to accept crypto donations?

Yes, it is legal for 501(c)(3) nonprofits to accept crypto donations. The IRS treats cryptocurrency as property, and donations must be reported at fair market value.

2. What cryptocurrencies should nonprofits accept?

Most organizations start with major cryptocurrencies like Bitcoin and Ethereum, which have the largest user bases and are most familiar to potential donors.

3. How do nonprofits handle cryptocurrency volatility?

Organizations can manage volatility by immediately converting donations to traditional currency, holding assets for potential appreciation, or using a mixed approach.

4. Are there fees associated with cryptocurrency donations?

Yes, there are typically network transaction fees for cryptocurrency transfers, and payment processors may charge service fees. Organizations should factor these costs into their donation strategies.

5. How do donors claim tax deductions for cryptocurrency donations?

Donors can claim tax deductions based on the fair market value of the donated cryptocurrency at the time of donation. Nonprofits must provide appropriate documentation for tax purposes.

6. What security measures should nonprofits implement?

Essential security measures include using reputable payment processors, implementing multi-factor authentication, storing assets in secure wallets, and maintaining robust backup procedures.

7. How do nonprofits track and report crypto donations?

Organizations must maintain detailed records of all cryptocurrency transactions, including timestamps, values, and donor information, for both internal tracking and regulatory compliance.

8. Can international donors use cryptocurrency to support US nonprofits?

Yes, cryptocurrency’s global nature makes it particularly useful for international donations, though organizations must ensure compliance with both US and international regulations.

Conclusion

The fact that nonprofits can now receive crypto donations is huge since there is no better way to give nonprofits a way in which they can increase their fundraising rates and tap into new segments of the donor population. Although incorporating cryptocurrency donation platforms presupposes thorough planning and constant monitoring, it may entail tremendous outcomes in case the organization is eager to adopt this digital way of engaging in acts of kindness.

In order to succeed at raising funds by cryptocurrency, one needs to be well prepared, use effective security and communicate effectively to the donor. Organizations are tasked to weigh out the opportunities presented with digital currencies against the risks they are faced with and compliance mandates.

With the cryptocurrency environment constantly changing, nonprofits who have built the necessary frameworks in the admission of digital donations will be in good position to take advantage of this rising popularity. The most important point here is to begin with a sound background of the legal and technical requirements, apply the right security measures and have the flexibility to work according to the new circumstances.

Nonprofits may integrate crypto donations in a regulatory- and best-practice compliant environment with and succeed in opening new pathways to funding by adhering to the guidelines and best practices defined in this guide.

their important work. The future of charitable giving increasingly includes digital currencies, and organizations that prepare now will be ready to capitalize on these emerging opportunities.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!

Don’t miss out on the opportunity to elevate your business with XAIGATE’s Accept cryptocurrency donations for Nonprofit Organizations. The three-step process is designed to be user-friendly, making it accessible for all businesses. Embrace this modern payment solution to provide customers with a secure and efficient way to pay. Take the first step towards a competitive edge in the digital realm and unlock the benefits of cryptocurrency payments for online casino today.