Anonymous crypto donations provide a special means for people to support causes they care about while still being somewhat private. Let’s check out how donations of anonymous cryptocurrency work and what benefits the platforms offer to users in the legal frameworks.

Contents

How Anonymous Crypto Donations Work

Blockchain technology is notable for its anonymity and immutability of user transactions. This enables cryptocurrency donations to remain anonymous when making cryptocurrency gifts. As a result, a wallet address will be linked to this donation.

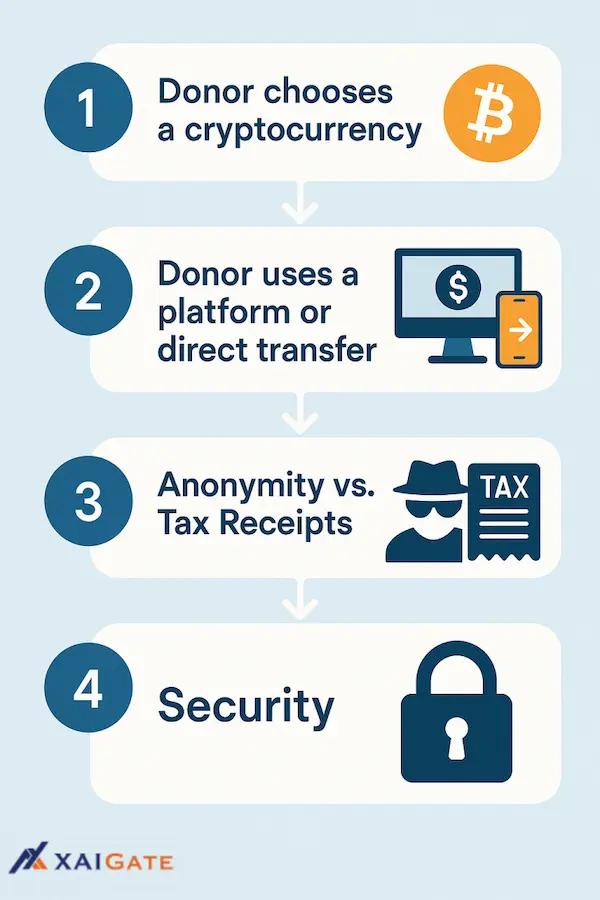

Here’s a general process:

- Donor chooses a cryptocurrency: Donors select the cryptocurrency they wish to donate (e.g., Bitcoin, Ethereum, or many others)

- Donor uses a platform or direct transfer:

- Through a third-party platform: Many nonprofits turn to reputable platforms in the market to create an account for the purpose of cryptocurrency donations. XAIGATE – a platform that accepts anonymous crypto donations such as Bitcoin, USDT, USDC, SOL, LINK, etc. and allows users to donate to NGOs through the user’s account on the platform. The contributor will send the cryptocurrency to this address from their wallet. The platform will then conduct the necessary procedures to verify and transfer to the charity in fiat currency, such as USD. Donors can often choose to remain anonymous through this method while still sending an email to receive a tax receipt.

- Direct transfer to a charity’s wallet: It’s possible that some nonprofits own cryptocurrency wallets. The donor transfers straight in this instance. However, since it handles the conversion and donor data collecting, employing an intermediary platform is frequently recommended for real anonymity and tax receipt.

- Anonymity vs. Tax Receipts: The ability to preserve privacy while possibly still obtaining tax benefits is a crucial component of anonymous cryptocurrency donations. Many platforms provide contributors the option to remain anonymous when interacting with the public, but they must still supply an email address in order to receive a tax-compliant receipt. The applicable tax authorities (such as the IRS in the United States) would have the required information if the donor claimed the deduction, but their personal information isn’t publicly connected to the contribution.

- Security: A safe and unchangeable record of transactions is made possible by blockchain technology. This usually ensures that cryptocurrency donations are safe and get to the right person.

Comparison Table: Anonymous Crypto Donation Methods

| Criteria | XAIGATE | Public Wallet Address | Custodial Donation Platform |

|---|---|---|---|

| Anonymity for Donor | ✅ High – no KYC, optional TOR support | ⚠️ Medium – wallet address traceable | ❌ Low – KYC often required |

| Anonymity for Receiver | ✅ High – no personal info disclosed | ❌ Low – wallet address fully public | ❌ Low – user data collected by platform |

| Ease of Setup | ✅ Very easy – no-code link/widget | ✅ Copy-paste wallet address | ⚠️ Moderate – account + integration setup |

| Custody of Funds | ✅ Non-custodial – you hold private keys | ✅ Non-custodial | ❌ Custodial – platform controls access |

| Refund Support | ✅ Built-in via dashboard or API | ❌ Not supported unless manual | ✅ Usually available via customer service |

| Supported Coins | ✅ 9,800+ tokens (ETH, BNB, USDT, etc.) | ⚠️ Depends on wallet type | ⚠️ Limited – usually only BTC, ETH, USDC |

| Fees | 🟢 Low (0.2% – 0.3%) | 🟢 None (except network fee) | 🔴 High (1% – 5% + withdrawal fees) |

| Privacy Controls | ✅ IP obfuscation, anti-tracking options | ❌ No privacy tools | ❌ Platform stores donor/receiver metadata |

| Analytics & Tracking | ✅ Real-time dashboard, CSV export, webhook | ❌ None | ✅ Basic reporting features |

| Technical Complexity | 🟢 Beginner-friendly – no hosting required | 🟢 Very easy | 🔴 Requires platform knowledge & verification |

| Legal Risk Exposure | 🟢 Minimized via off-chain + optional compliance | ⚠️ May expose recipient to on-chain tracking | ⚠️ Depends on platform’s jurisdiction & policies |

| Ideal For | Privacy-focused NGOs, creators, DAOs | Individuals accepting small donations | Registered businesses needing full documentation |

When it comes to accepting crypto donations anonymously, there’s no one-size-fits-all approach. Some methods are fast but expose too much, others are secure but complicated. It really comes down to what matters most to you — privacy, simplicity, or control.

If you’re looking for a solution that keeps both you and your donors anonymous, while still being easy to set up and manage, XAIGATE offers a balanced path forward. It removes the friction of KYC, avoids custodial risks, and respects the principles of decentralization — all without demanding technical expertise.

In a time when privacy is often overlooked or misunderstood, tools like XAIGATE are helping restore that choice to creators, nonprofits, and communities who need it most.

Regulatory Landscape

The laws governing anonymous cryptocurrency donations, particularly those made anonymously, are still developing and can be complicated. Here are some important things to think about:

- Know Your Customer (KYC) and Anti-Money Laundering (AML): Regulators are paying more attention to stopping illegal activity and money laundering using cryptocurrencies. In order to verify donor identities, especially for larger donations, platforms that facilitate cryptocurrency donations—especially those that handle conversions to fiat—are frequently required to implement KYC protocols.

- Taxation: For taxation purposes, cryptocurrencies are considered property in several jurisdictions, including the United States. Tax benefits from donating valuable cryptocurrency include avoiding capital gains tax on the donation amount. Even if donors want to stay anonymous in public, they must still report these gifts in order to claim deductions.

- Due Diligence for Charities: It is recommended that charities who accept anonymous crypto donations carry out due diligence in order to ascertain the source of the funds and guarantee adherence to pertinent laws. Because of worries about regulatory scrutiny and the requirement to confirm the source of funds, certain charities may have policies prohibiting entirely anonymous donations, particularly those of a significant size. The British Red Cross, for instance, expresses a desire to avoid receiving anonymous donations, especially those that total more than £5,000, and may need more details for due diligence.

- Transparency vs. Anonymity: Although blockchain makes transaction records transparent, the anonymity stems from the wallet address’s lack of direct personal identification. Regulators and charities have the difficulty of striking a balance between the requirement for financial supervision, preventing illicit financial flows, and donor privacy.

- Ongoing Development: Cryptocurrencies are now recognized as assets in many countries. Some countries have even begun to develop comprehensive legal frameworks to regulate cryptocurrencies. Experts advise that philanthropists, including foundations, must stay up to date on the most recent laws in their state or locality.

In short, the way anonymous crypto donations work is that the donor does not need to provide their personal information to the community. To meet this need, new platforms are offering an anonymous option for users to donate their cryptocurrency to any organization, charity, or NGO for charitable purposes. However, the level of anonymity can vary based on the platform and the donor’s requirement for a tax receipt, which usually calls for providing the intermediary with some identifying information.

Benefits for Charities

Non-profit organizations can benefit from accepting anonymous cryptocurrency donations in ways other than just growing their donor base.

- Access to a New Donor Demographic: The bitcoin community is broad and frequently consists of tech-savvy, younger people who would not use conventional fundraising techniques. Charities may reach this quickly expanding and frequently giving population by accepting anonymous cryptocurrency donations.

- Larger Average Donation Sizes: Donations in bitcoin experienced a notable uptick in 2024, rising 386.33% over 2023. Both an increase in the average gift size and an increase in the volume of donations were the main drivers of this expansion. For example, by November 19, 2024, Fidelity Charitable received $688 million in cryptocurrency gifts, a significant increase from $49 million for the entire year 2023. The era of Bitcoin’s supremacy has started.

- Reduced Transaction Fees: More of the donor’s money goes to the organization since bitcoin transaction fees are frequently lower than credit card processing fees, which can be several percentage points higher, especially for bigger amounts.

- Faster Settlement Times: Charities can access funds more quickly thanks to cryptocurrency transactions, which are often processed and settled far faster than traditional bank transfers.

- Transparency (of the transaction): The blockchain itself offers an unchangeable and transparent record of transactions, even though the donor’s name may be anonymous. Since the transfer of funds from the contribution platform to the charity’s wallet can be independently verified, this inherent openness can foster confidence.

- Demonstrating Innovation: By accepting cryptocurrency, a charity can recruit tech-savvy supporters and improve its public image by demonstrating that it is progressive and open to new technology.

- Potential for Asset Appreciation: Some charities may decide to keep some of the cryptocurrency as an investment, possibly profiting from future price increases, even though the majority instantly convert anonymous crypto donations to fiat in order to reduce volatility. But there is a lot of market risk associated with this tactic.

Comparison: Anonymous Crypto Donation Methods for Nonprofits (2026)

| Method | Anonymity Level | Compliance Risk | Operational Complexity | Suited For |

|---|---|---|---|---|

| Self-Managed Wallet (Direct Address) | Full anonymity (unless traced by chain analysis) | Very High — Lacks AML/KYC controls | Low technical setup, high monitoring need | Small, privacy-oriented campaigns |

| Anonymous DAF Platforms (e.g., Silent Donor) | High anonymity through fund routing | Moderate — risks from IRS/DAF regulations | Low to moderate — platform handles routing | Donors valuing privacy with tax considerations |

| Compliant Platforms with Wallet Screening (e.g., XAIGATE) | Moderate — anonymized but traceable internally | Low — platforms use AML tools and audits | Moderate — requires platform integration | NGOs needing scalable, transparent acceptance |

| Hybrid Approach (Threshold + Review) | Partial — anonymity below threshold | Moderate — large gifts undergo review | High — manual workflows + automated alerts | NGOs balancing privacy with risk management |

Challenges and Risks for Charities

Notwithstanding the many advantages, charities must also manage the possible risks and difficulties related to anonymous crypto donations:

- Market Volatility: The price of cryptocurrencies is infamously unstable. The value of a donation made one day can be much lower the next. Most platforms and charitable organizations instantly convert cryptocurrency to fiat money after receiving it in order to lessen this.

- Regulatory Complexity and Compliance: This is arguably the largest challenge. Cryptocurrencies’s regulations are continuously evolving and vary widely by location. Charity organizations must ensure that:

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: In an effort to stop illegal funding, regulators are examining cryptocurrency transactions more closely. Platforms or charities may be legally obligated to gather donor identity information for AML/KYC purposes, particularly for bigger gifts, even if the donor prefers to remain publicly anonymous. Donors’ desire for confidentiality and legal requirements may clash as a result.

- Tax Implications: Given how certain tax authorities (such as the IRS in the United States) categorize cryptocurrency as property, charities require explicit protocols for accounting and reporting gifts in this form. Donors who want to claim deductions must be given correct tax receipts.

- Source of Funds: Charities may be under pressure to confirm the authenticity of donations, especially in cases of significant or questionable transactions. A charity’s reputation could be seriously harmed and legal action could result from accepting donations from illegal sources. In order to facilitate due diligence, certain charities, such as the British Red Cross, have laws prohibiting the acceptance of entirely anonymous crypto donations over specific limits.

- Lack of Donor Relationship Building: While anonymity preserves donor privacy, it might impair a charity’s capacity to create enduring relationships with donors, a cornerstone of sustainable fundraising. It’s challenging to interact with them more or ask for future donations if you don’t know who their main supporters are.

- Technical Expertise: Many traditional charities might not have the technological know-how needed to manage bitcoin wallets, comprehend various blockchain networks, and integrate with crypto donation platforms. This is significantly mitigated by collaborating with specialized platforms.

- Public Perception and Misinformation: Public opinion may be negatively impacted by the link of cryptocurrencies with illegal activity, even if statistics indicates that traditional finance sees far more money laundering. Charities must inform their donors and stakeholders about the acceptable and advantageous applications of cryptocurrency giving.

- Custody and Security Risks: A charity takes on the risks of protecting digital assets, such as possible hackers, misplaced private keys, or human mistake, if it choose to retain anonymous cryptocurrencies directly. For this reason, many choose to use third-party services for an instant conversion to fiat.

The Future of Anonymous Crypto Donations

The future of anonymous cryptocurrency donations seems bright, even though legislative frameworks are still changing:

- Increased Adoption: More charities will probably employ cryptocurrency fundraising as it grows in popularity and ease of use, and more contributors will feel at ease making contributions in this manner.

- Technological Advancements: We may see more hybrid models emerge where donor anonymity is balanced with compliance through sophisticated identity management systems that only reveal information when legally required.

- Hybrid Models: More hybrid approaches that balance donor anonymity and compliance with advanced identity management systems that only divulge information when mandated by law may become more prevalent.

- AI Integration: A future in which artificial intelligence may help facilitate or even manage charitable endeavors on its own is hinted at by the first AI-led cryptocurrency gift in 2026.

- Education and Best Practices: As the industry develops, more focus will be placed on teaching donors and charities the best ways to accept and make anonymous crypto donations in a responsible and legal manner.

- Continued Regulatory Clarity: Even though it will be difficult, continued regulatory debates and ultimate clarification are essential to the long-term expansion and credibility of cryptocurrency philanthropy. It will be crucial to strike a balance between encouraging philanthropic flexibility and maintaining financial monitoring.

To sum up, anonymous crypto donations mark a substantial advancement in charitable giving. They appeal to an increasing number of donors because they provide unmatched privacy, worldwide access, and tax efficiencies. The advantages for charities are significant, notwithstanding ongoing difficulties with market volatility and, more importantly, the changing legal environment. The importance of cryptocurrencies in philanthropy, especially the fascinating aspect of anonymity, is expected to grow as the world grows more digital, influencing how we support the most important causes in the future.

FAQs – How to Accept Anonymous Crypto Donations

1. How can I accept crypto donations anonymously?

You can receive anonymous donations by using non-custodial wallets and platforms like XAIGATE that don’t require identity verification.

2. Do I need KYC to accept anonymous crypto donations?

No. Platforms like XAIGATE allow you to accept donations without going through KYC, preserving your privacy.

3. What cryptocurrencies can be used for anonymous donations?

You can accept donations in Bitcoin, Ethereum, USDT, and other major coins without revealing donor identities.

4. Are there legal risks when accepting anonymous crypto donations?

Yes. Risks include violating anti-money laundering (AML) regulations or receiving funds from suspicious sources.

5. How can I stay compliant with AML laws while accepting anonymous donations?

Use blockchain analytics tools to assess wallet risk and filter high-risk transactions without requiring donor information.

6. Can I generate a crypto donation link without revealing my identity?

Yes. Platforms like XAIGATE let you create donation links or buttons without disclosing personal details or wallet ownership.

7. Is it safe to accept crypto from anonymous donors?

Generally yes, but it’s wise to screen incoming transactions using risk assessment tools to avoid illicit sources.

8. Are there transaction fees when accepting crypto donations?

You typically only pay the standard blockchain network fees; most anonymous-friendly platforms do not charge extra.

9. How do I account for anonymous crypto donations in bookkeeping?

Track incoming transactions to your wallet address, label them by campaign or source if possible, and record values based on market rates.

10. Can anonymous crypto donations be traced back to the donor?

While pseudonymous, blockchain records are public. Without KYC, the identity remains hidden unless linked through other data.

Follow XAIGATE’s blog for daily updates!

We’re also on X (@mxaigate), GitHub and Linkedin! Follow us!