In 2025, more people and businesses are looking for fast, borderless, and low-cost ways to send money. One solution that stands out is the ability to pay with USDT, a stablecoin designed to hold its value against the U.S. dollar. Unlike traditional bank transfers or credit card payments that often come with high fees and delays, USDT transactions settle within minutes and can be sent anywhere in the world.

This article explores why paying with USDT is becoming one of the most practical payment methods today. From e-commerce and travel to gaming and cross-border remittances, USDT is offering stability, speed, and convenience. We will also look at the benefits, risks, and real-world use cases so that readers can understand how USDT payments are reshaping digital finance in 2025.

Contents

- 1 1. What Does “Pay with USDT” Mean?

- 2 2. Key Benefits of Paying with USDT

- 3 3. Risks & What to Watch Out For

- 4 4. Real-World Use Cases

- 5 5. How to Pay with USDT – Step by Step

- 6 6. Merchant Integration Essentials

- 7 7. Compliance & Taxes

- 8 8. Choose the Right USDT Network

- 9 9. Fees Breakdown & Cost Control

- 10 10. Security Best Practices

- 11 11. USDT vs. Traditional Methods

- 12 12. Mini Case Studies

- 13 13. 2025 Trends & Outlook

- 14 FAQs about “Pay with USDT”

- 15 Conclusion

1. What Does “Pay with USDT” Mean?

To pay with USDT means using Tether, a U.S. dollar-pegged stablecoin, as the method of payment instead of relying on cash, cards, or bank transfers. Since 1 USDT is designed to equal 1 USD, the value remains stable, making it easier for both consumers and merchants to trust it for everyday use.

The process is simple: a buyer sends USDT from a wallet to a seller’s wallet address, often by scanning a QR code or pasting the payment address. Depending on the chosen blockchain network—Tron (TRC-20), Ethereum (ERC-20), or Solana (SPL)—the transaction usually clears within seconds to minutes.

Today, thousands of online stores, booking platforms, and freelancers already accept USDT as payment. For them, the option to let customers pay with USDT means lower costs, faster settlement, and access to a truly global market without the traditional barriers of banking systems.

2. Key Benefits of Paying with USDT

Choosing to pay with USDT offers more than just convenience. It combines the stability of a U.S. dollar–pegged asset with the flexibility of blockchain technology. For individuals, it means faster and cheaper transactions, while for businesses, it provides an opportunity to access new customers worldwide. Below are the main advantages that make USDT one of the most practical payment options in 2025.

1. Stability Against Volatility

Unlike Bitcoin or Ethereum, which can change value by 5–10% in a single day, paying with USDT offers stability because it is pegged to the U.S. dollar. This makes it suitable for everyday purchases, business contracts, and even salary payments. Merchants know exactly how much they will receive, and customers don’t need to worry about sudden price drops.

2. Low Transaction Costs

Traditional bank transfers, especially across borders, can be expensive. Credit cards often charge 2–3% fees, while international wire transfers may take days and include hidden costs. By contrast, when you pay with USDT, transaction fees are typically under one dollar, no matter the amount. This cost efficiency is one of the main reasons USDT is quickly becoming a preferred payment option worldwide.

3. Fast Settlement Times

Speed is another clear advantage. Sending money through banks often means waiting until the next business day, or even longer for cross-border transfers. In contrast, USDT payments are processed in minutes, and sometimes seconds, depending on the blockchain network. This near-instant settlement is ideal for businesses that need cash flow quickly and for consumers who want immediate confirmation.

4. Global Reach

Banking systems often limit payments across countries due to regulations, time zones, and different currencies. With USDT, you can send and receive value almost anywhere, 24/7, without needing intermediaries. For merchants, offering the option to pay with USDT means opening the door to global customers who may not have access to international credit cards or banking services.

3. Risks & What to Watch Out For

While choosing to pay with USDT brings many benefits, it is not without risks. Users and businesses must understand potential challenges to avoid mistakes and ensure safe adoption. Here are the main issues to keep in mind when using USDT for payments.

1. Regulatory Uncertainty

The legal status of stablecoins differs by country. Some regions encourage digital assets, while others restrict or ban them. Before allowing customers to pay with USDT, businesses should verify local compliance rules to avoid penalties.

2. Custodial vs. Self-Custody Risks

If funds are stored in a custodial wallet or with a payment provider, users rely on that third party’s security. Non-custodial wallets give more control but require technical knowledge. Each choice carries trade-offs that can affect safety when making USDT payments.

3. Operational Complexity

Integrating crypto payments is not always straightforward. From setting up wallets and APIs to training staff, businesses may face challenges. Small mistakes, like sending on the wrong blockchain, can result in lost funds. This complexity makes it important to work with trusted providers before letting customers pay with USDT.

4. Irreversible Transactions

Unlike credit cards, blockchain payments cannot be reversed. Once a customer confirms a USDT transfer, it cannot be canceled. Merchants must establish clear refund policies and educate customers to prevent disputes.

4. Real-World Use Cases

The chance to pay with USDT has expanded far beyond crypto communities. In 2025, entire industries—from online retail to international remittances—are embracing stablecoin payments. These practical examples highlight how USDT brings speed, lower costs, and reliability to different sectors of the economy.

1. E-commerce & Online Shopping

E-commerce merchants are among the earliest adopters of USDT. By allowing customers to pay with USDT, online shops can cut down transaction fees, avoid currency conversion losses, and serve international buyers with ease. For shoppers, it means they can complete purchases instantly, even if their local banks block international card transactions. This makes USDT a natural choice for platforms targeting global audiences.

2. Travel & Hospitality

Travel agencies, airlines, and hotel chains are also embracing stablecoin payments. When travelers pay with USDT, they avoid the stress of carrying cash or dealing with fluctuating exchange rates. For businesses, accepting USDT reduces chargeback risks and speeds up bookings, ensuring that reservations are confirmed in real time. As global tourism rebounds, this payment option gives both sides greater flexibility and trust.

3. Gaming & Digital Services

The gaming industry thrives on instant payments and small transactions. By enabling users to pay with USDT, platforms can settle game credits, in-app purchases, and subscription fees in seconds. This approach reduces reliance on traditional payment processors that may block gaming-related transactions in certain countries. It also offers gamers a borderless experience, letting them participate no matter where they live.

4. Remittances & Cross-Border Transfers

One of the most powerful use cases for USDT is international remittances. Migrant workers often lose 5–10% of their salaries to remittance fees, but when they pay with USDT, families receive almost the full amount. Transfers are settled quickly and can be withdrawn through local exchanges or peer-to-peer markets. For millions of people, this means more money in their pockets and less dependence on expensive middlemen.

5. B2B Payments & Contractors

Companies working with overseas contractors or suppliers are increasingly choosing stablecoins for payments. By letting partners pay with USDT, businesses eliminate delays tied to international banking hours and wire transfers. Contractors benefit from predictable value, as one USDT equals one dollar, making it easier to budget income. This has become especially valuable for freelancers in regions with limited access to global banking systems.

5. How to Pay with USDT – Step by Step

For many people, making their first USDT transaction can feel unfamiliar, but the process is straightforward. Whether you’re shopping online, booking a flight, or sending money overseas, the steps to pay with USDT are simple if you follow them carefully.

1. Choose a Wallet or Trusted Gateway

The first and most important step is selecting a secure and reliable way to handle your USDT. While there are many wallets available, businesses and individuals often prefer using a trusted payment gateway to simplify the process. A solution like XaiGate allows users to manage USDT payments safely, with lower fees and faster settlement. By choosing a professional gateway such as XaiGate, you reduce risks and make it easier to pay with USDT in everyday transactions.

2. Select the USDT Network

USDT is available on multiple blockchains, including Tron (TRC-20), Ethereum (ERC-20), and Solana (SPL). Each has different costs and speeds, so the choice depends on your needs. For daily transactions, TRC-20 is the most popular thanks to its low fees, while ERC-20 is often preferred for larger transfers. Picking the right network ensures your USDT payment goes through quickly and without unnecessary costs.

3. Generate or Scan the Merchant Address

After setting up your wallet or gateway, you’ll receive a merchant’s wallet address or QR code. Simply copy and paste the address or scan the code within your app. Always double-check that the network matches what the merchant requested. If you want to pay with USDT, accuracy is critical, because sending to the wrong network could result in permanent loss of funds.

4. Confirm Amount and Details

Before sending, verify the amount, wallet address, and blockchain network. Since blockchain payments are final, errors cannot be reversed. Many wallets and gateways will show a preview with the total fees and the exact USDT amount the recipient will get. Taking a few seconds to confirm details ensures your USDT transaction is accurate and successful.

5. Send and Wait for Confirmation

Once confirmed, your wallet broadcasts the payment to the blockchain. Depending on the network, it may take from seconds to a few minutes. The recipient usually sees the funds appear right away, which makes paying with USDT much faster than traditional bank transfers. For businesses, this means instant order confirmation; for individuals, it means peace of mind.

6. Save the Receipt or Transaction Hash

Every transaction generates a unique hash that proves payment. Saving this receipt protects you in case of disputes or questions later. Most gateways, including XaiGate, provide easy access to receipts and transaction logs. By keeping a record, you’ll always have proof whenever you pay with USDT, strengthening trust on both sides of the transaction.

6. Merchant Integration Essentials

For businesses, adding the option to pay with USDT can open new revenue streams and attract customers worldwide. However, successful integration requires the right tools, planning, and compliance measures. Below are the key elements merchants should focus on when adopting USDT payments.

1. Integration Options: Plugins, APIs, or Hosted Checkout

Merchants can choose different integration methods depending on their technical resources. Ready-made plugins work well for e-commerce platforms like Shopify or WooCommerce. Larger businesses often prefer custom API integration for full control. Another option is hosted checkout pages from a trusted USDT payment gateway such as XaiGate, which reduces the need for in-house development while ensuring secure transactions.

2. User Experience at Checkout

The checkout process must be simple for customers. Offering the choice to pay with USDT should be as easy as using a credit card. Clear instructions, QR codes, and automatic network detection help minimize errors. Merchants who streamline checkout reduce cart abandonment and increase conversion rates, especially with international buyers.

3. Stable Treasury & Auto-Conversion

While USDT is stable against the dollar, some businesses prefer converting crypto revenue into fiat instantly. Gateways like XaiGate provide auto-conversion tools so merchants can keep their treasury balanced. This ensures companies benefit from the flexibility of letting customers pay with USDT without holding large crypto balances.

4. Reconciliation and Accounting

Accurate reporting is vital for long-term success. Merchants must track each USDT transaction with invoices, receipts, and transaction hashes. Many payment gateways generate automated reports compatible with accounting software. Having a clear reconciliation process builds trust with auditors, regulators, and customers alike.

5. Customer Support & Refunds

Unlike card payments, blockchain transfers cannot be reversed automatically. Merchants need to create clear refund policies for customers who pay with USDT. A professional gateway can assist by generating return transactions, helping businesses manage disputes smoothly while maintaining customer satisfaction.

7. Compliance & Taxes

For any business that decides to accept USDT, legal and tax considerations are just as important as technology. Regulations around stablecoins are still evolving, and each country may treat transactions differently. To safely let customers pay with USDT, companies should keep the following points in mind.

1. KYC/AML Requirements

Many jurisdictions require merchants to follow Know Your Customer (KYC) and Anti-Money Laundering (AML) rules. This means verifying customer identities and monitoring suspicious activity. Businesses using gateways like XaiGate benefit from built-in compliance tools, making it easier to stay within the law when customers pay with USDT.

2. Record-Keeping & Invoicing

Every USDT payment should be documented with invoices and receipts. This not only helps with bookkeeping but also provides evidence in case of audits. Clear transaction records, including the date, amount, and network used, are essential for both merchants and customers.

3. Tax Reporting Obligations

In most countries, USDT transactions are treated as regular income when received by a business. Merchants must declare these payments and pay the applicable taxes, even if they immediately convert USDT into fiat. Understanding how local tax laws apply to stablecoins ensures that the decision to let customers pay with USDT does not create unexpected liabilities.

4. International Regulations

Cross-border payments can trigger additional reporting rules. For example, sending large amounts of USDT abroad might require disclosures to financial authorities. Merchants serving global customers should stay updated on how different regions regulate stablecoin transactions to avoid compliance risks.

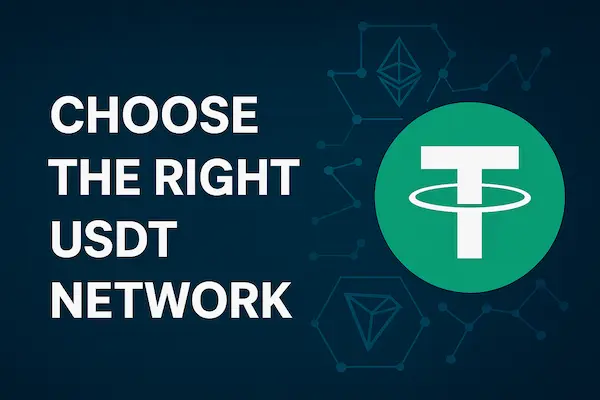

8. Choose the Right USDT Network

One of the most important steps when you decide to pay with USDT is choosing the right blockchain network. Since USDT is available on multiple chains, each with its own speed and fees, selecting the best option can make a big difference in cost and efficiency. Merchants and customers should understand these networks before making a payment.

Comparison – USDT Networks for Payments

| Network | Typical Speed | Average Fee | Best Use Case |

|---|---|---|---|

| Tron (TRC-20) | ~3 seconds | <$0.10 | Everyday transactions, e-commerce, frequent small payments |

| Ethereum (ERC-20) | ~10–15 seconds | $1–10 | Institutional transfers, high-value payments, DeFi compatibility |

| Solana (SPL) | ~1 second | <$0.01 | High-volume micropayments, gaming, in-app transactions |

Each option has advantages. TRC-20 is the most popular for daily payments due to its low fees. ERC-20, though more expensive, is widely used for integrations with DeFi platforms. Solana provides ultra-fast and cheap transfers, making it ideal for microtransactions. By matching the network to the type of payment, both businesses and individuals can pay with USDT more efficiently.

9. Fees Breakdown & Cost Control

Although choosing to pay with USDT is often cheaper than using banks or credit cards, there are still some costs involved. Understanding these fees helps both businesses and individuals plan better, avoid surprises, and keep transactions cost-efficient.

1. Network Fees

Every USDT transaction includes a network fee, also called a gas fee. This fee is paid to the blockchain validators who process the transaction. On Tron (TRC-20), fees are usually a few cents, while Ethereum (ERC-20) can cost several dollars during busy periods. Knowing the difference helps users decide which network is most suitable when they pay with USDT.

2. Gateway or Exchange Fees

If you use a crypto payment gateway, there may be a small service fee for processing payments. These fees are typically much lower than credit card charges but can vary depending on the provider. Businesses that let customers pay with USDT often choose gateways like XaiGate because of transparent and competitive pricing.

3. Conversion Costs

Some merchants convert USDT to local currency right after receiving payment. In this case, exchanges may charge a conversion fee or spread. While it adds to the cost, it also protects businesses from holding too much crypto. Understanding conversion costs ensures that accepting USDT remains profitable.

4. Optimizing for Volume

Frequent users can take steps to minimize expenses. For example, choosing TRC-20 for high-frequency payments or batching transactions for suppliers can reduce fees over time. By learning these strategies, businesses and individuals make it cheaper and more efficient to pay with USDT regularly.

10. Security Best Practices

Security is one of the most important aspects when you decide to pay with USDT. Since blockchain transactions cannot be reversed, even small mistakes can lead to lost funds. By following proven security practices, both businesses and individuals can make their payments safer and more reliable.

1. Address Validation & Network Matching

Before sending USDT, always confirm that the wallet address and network match the one provided by the recipient. For example, sending USDT on the Tron network to an Ethereum-only address could mean losing your funds permanently. Careful validation ensures every attempt to pay with USDT is successful.

2. Use Hardware Wallets or Multi-Signature Accounts

For larger payments, relying on hot wallets or exchanges can be risky. A safer option is to store funds in hardware wallets or set up multi-signature accounts. These tools add extra layers of protection, making it harder for hackers to compromise your assets when you pay with USDT.

3. Whitelisting Trusted Addresses

Many gateways and wallets allow users to whitelist addresses. This means only pre-approved wallets can receive payments from your account. Businesses using this feature reduce the risk of sending funds to the wrong address and make their USDT transactions more secure.

4. Train Staff & Customers

For merchants, security is not just about technology—it’s also about education. Staff should understand how USDT payments work and be trained to double-check details. Clear instructions for customers also reduce mistakes during checkout. With proper training, every party involved can safely pay with USDT without fear of errors.

5. Incident Response & Refund Policies

Even with precautions, problems can still happen. Merchants should have a clear plan for handling incidents such as incorrect transfers or phishing attempts. While refunds on the blockchain require manual steps, having policies in place reassures customers that paying with USDT is both safe and reliable.

11. USDT vs. Traditional Methods

To fully understand the value of choosing to pay with USDT, it helps to compare it with traditional payment methods such as credit cards and bank transfers. While conventional systems are still widely used, they often come with delays, high fees, and regional restrictions. USDT, on the other hand, brings speed and borderless access.

Comparison – Pay with USDT vs. Cards/Banks

| Feature | Pay with USDT | Credit Cards / Banks |

|---|---|---|

| Settlement Speed | Minutes or even seconds | 1–5 business days, depending on bank |

| Fees | <$1 per transaction | 2–7% + FX and hidden charges |

| Global Access | Borderless, 24/7 availability | Limited by banking hours & geography |

| Chargebacks | None (transactions are final) | Common, often causing merchant risks |

| Currency Stability | Pegged to USD, predictable value | Dependent on exchange rates & fees |

This comparison shows why businesses increasingly let customers pay with USDT. It not only reduces operational costs but also ensures instant confirmation, making it more efficient than legacy systems.

12. Mini Case Studies

Short, real-world stories often make the benefits of choosing to pay with USDT more tangible. Here are three quick examples showing how USDT creates value in everyday business and consumer situations.

1. Cross-Border Freelancer

A designer in Vietnam receives a $500 payment from a U.S. client in USDT (TRC-20). Instead of waiting five business days and losing 4% in bank fees, she gets the funds in minutes with almost zero cost. This shows how freelancers can safely pay with USDT or accept it as income.

2. Travel Agency in Europe

A small tour operator in Spain began accepting USDT for bookings. International customers who struggled with card payments now book instantly, and the agency saves on credit card fees. By allowing tourists to pay with USDT, the business opened access to a wider global audience.

3. Online Gaming Platform

A gaming startup integrated a USDT payment gateway for in-app purchases. Players from different countries can buy credits instantly, without card declines or high microtransaction fees. The option to pay with USDT improved user experience and boosted sales by 20% in three months.

13. 2025 Trends & Outlook

As the digital economy expands, the option to pay with USDT is expected to become more common across industries. From tourism and e-commerce to B2B trade, stablecoin adoption is moving into the mainstream. Below are the key trends shaping the future of USDT payments in 2025.

1. Clearer Stablecoin Regulations

Governments are drafting new rules to define how stablecoins like USDT can be used legally. This regulatory clarity will encourage more businesses to let customers pay with USDT without fear of compliance risks.

2. Wider Merchant Adoption

E-commerce platforms, travel agencies, and even physical stores are expected to add stablecoin payment options. The ability to pay with USDT will no longer be niche but a standard choice alongside cards and digital wallets.

3. Integration with CBDCs

Central Bank Digital Currencies (CBDCs) are being tested in many countries. Analysts predict that USDT may coexist and even integrate with CBDC systems, making cross-border transactions seamless. In this landscape, choosing to pay with USDT could feel as natural as using a bank app today.

4. AI-Driven Fraud Detection

Payment gateways are beginning to deploy AI tools to detect suspicious activity in real time. This will make it safer for merchants and customers to transact, giving more confidence to those who pay with USDT for daily expenses.

5. Growth in Gaming and Microtransactions

Gaming, streaming, and digital content platforms are expected to be the fastest-growing adopters of USDT. With ultra-low fees and instant settlement, the option to pay with USDT perfectly matches the needs of these industries.

FAQs about “Pay with USDT”

1. What does “Pay with USDT” mean?

It means completing a payment using the Tether stablecoin (USDT), which is pegged to the U.S. dollar.

2. Is it safe to pay with USDT?

Yes, as long as you use trusted wallets or gateways and confirm the correct address and network.

3. Which USDT network is best for payments?

TRC-20 is cheap and fast, ERC-20 is widely supported, and Solana is ideal for microtransactions.

4. How much does it cost to pay with USDT?

Most transactions cost less than $1, depending on the blockchain network.

5. Can I use USDT for travel bookings?

Yes, many hotels, airlines, and agencies now accept customers who choose to pay with USDT.

6. Are USDT payments legal everywhere?

No, legality varies by country. Always check local rules before sending or receiving USDT.

7. How do refunds work with USDT?

Since blockchain payments are final, refunds require the merchant to send a new transaction back to you.

8. Can businesses convert USDT into local currency?

Yes, most payment gateways allow instant conversion into fiat to manage treasury needs.

9. What happens if I send USDT on the wrong network?

Funds may be lost or very hard to recover. Always confirm the network before making a transfer.

10. Will paying with USDT become more common in 2025?

Yes, adoption is growing across e-commerce, gaming, and B2B sectors worldwide.

Conclusion

The rise of stablecoins has changed the global payment landscape, and the ability to pay with USDT is now one of the clearest examples of this shift. In 2025, when international trade, digital services, and travel demand faster and more reliable methods, USDT stands out as a tool that reduces costs while maintaining trust.

Unlike speculative tokens, Tether’s dollar peg gives both merchants and consumers the stability they need to transact daily. Combined with instant settlement and global reach, USDT is no longer just a crypto alternative—it is becoming part of mainstream finance. Governments are drafting regulations, businesses are racing to integrate gateways, and customers worldwide are beginning to see pay with USDT as a normal option, just like paying with PayPal or Visa.

For businesses, adopting this payment method is not just about keeping up with trends—it is about unlocking new markets and staying competitive in a borderless economy. For individuals, it provides control, speed, and savings that traditional systems rarely deliver.

Quick Table

| Key Point | Insight 2025 |

|---|---|

| Core Keyword | Pay with USDT |

| Value Proposition | Stable, low-cost, borderless payments |

| Emerging Trend | Wider adoption in travel, e-commerce, and gaming |

| Main Risk | Compliance requirements & network errors |

| Best Network Choice | TRC-20 for cost efficiency, SPL for high-volume transactions |

| Future Outlook | Integration with CBDCs and AI-powered fraud detection |

The future of payments is no longer a distant promise—it is here today. If you want to reduce costs, speed up settlements, and expand globally, it’s time to pay with USDT. For merchants, integrating a trusted USDT payment gateway like XaiGate ensures compliance, security, and customer satisfaction.

Don’t wait until your competitors move first. Start adopting USDT payments today and position yourself at the center of the borderless digital economy.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!