In the world of philanthropy, the use of digital currencies is becoming more common. Charities, nonprofits, and individuals alike are on the lookout for ways to receive crypto donations. This new approach certainly has its advantages, including faster international transfers and even tax benefits for the donor. At the same time, nonprofits focused on autonomy and wishing to limit their use of third-party custodians and extensive Know Your Customer (KYC) identification procedures may struggle to navigate the freedoms this landscape offers.

This all-inclusive guide offers a streamlined approach to receive crypto donations without incurring the burdens of custodial wallets or KYC procedures, granting maximum operational control. We will also explore how a dedicated donation platform for non-profits can still provide valuable support.

Contents

- 1 1. The Changing World of Cryptocurrency Donations

- 2 2. Exploring Custodial and Non-Custodial Wallets

- 3 3. Accept crypto donations without KYC: the no KYC approach

- 4 4. Technical Considerations for Your Crypto Donation Infrastructure

- 5 5. Tax and Legal Considerations When Receive Crypto Donations (No KYC)

- 6 6. Challenges and Limitations of Receiving Crypto Donations Without KYC

- 7 7. Exploring Platforms: A Simplified Hybrid Approach to Accepting Crypto Donations

- 8 FAQs: How to Receive Crypto Donations Without a Custodial Wallet or KYC

1. The Changing World of Cryptocurrency Donations

Cryptocurrency has evolved to the point where it is no longer limited to a niche of dedicated investors. The digital asset has matured and now can be employed in multiple transactions, including donations. Understanding this shift is the first step to being able to truly receive crypto donations.

Why organizations wish to receive crypto donations

Many organizations are now more willing to receive crypto donations for a few reason. To start with, it allows access to a new group of tech-friendly donors who are willing to donate through digital currency. Also, crypto donations are likely to be more popular because of the tax benefits they provide to the donor in a lot of regions. Lastly, for global companies, crypto currency often sidesteps traditional banking fees and delays, ensuring that funds are received in a more effective and economical manner. Adopting new methods of donations and crypto currency can greatly increase a charity’s donor and financial reach.

The appeal of non-custodial and KYC-free solutions

The popularity of crypto donations has emerged in part to a growing desire for control and decentralization. Existing payment processors and crypto exchanges offer custody services in the form of holding your funds, while simultaneously applying KYC rules. By looking for non-custodial and KYC-free solutions, organizations strive to obtain greater control and retain full ownership of the received donations. This strategy explains the desire to control the crypto donations and to receive them on your own conditions.

Comparison Table: Methods to Receive Crypto Donations (2026)

| Feature | XAIGATE (Managed Donation Gateway) | Direct Wallet Transfers (DIY) | Custodial Platforms (e.g. Donorbox Crypto) |

|---|---|---|---|

| Ease of Setup | Plugin or link-based—ready in minutes | Instant, but manual setup per wallet | Quick setup via platform wizard |

| Onboarding for Donors | No KYC for donors; minimal donor friction | Donors transfer to wallet manually | KYC required on donor platform in most cases |

| Transaction Fees | 0.2%–0.3% flat, transparent | Only network (gas) fees | ~1%–2% plus platform fees |

| Donation Receipt & Tax Docs | Automated issuance and export tools | Manual tracking required | Platform-generated contributions summary |

| Wallet Custody | Non-custodial; you control funds | Full self-custody | Custodial; provider holds and disburses funds |

| Refund Capability | Manual refund logic via dashboard/API | Not typical—donor must resend | Refunds managed by platform policy |

| Donation Tracking & Analytics | Real-time donor dashboard, webhook alerts | Manual ledger updates | Basic contribution tracking via UI |

| Supported Assets | 9,800+ tokens incl. stablecoins | Varies by wallet used | Limited to supported coins (e.g. BTC, ETH, USDC) |

| Brand & UX Control | Fully customizable branded donation pages | Static wallet address on website | Platform-branded experience |

| Regulatory Compliance | Tiered compliance, donor privacy preserved | Depends on hosting site | Platform handles KYC, but donor data stored externally |

| Best For | Non-profits, open-source projects, creators wanting crypto ease | Informal donations, small projects | Organizations processing moderate donation volumes |

2. Exploring Custodial and Non-Custodial Wallets

The core difference between these two wallets comes down to who has the control over the private keys. For crypto donations, this makes a significant difference for organizations who do not want to be externally managed.

What comes to mind a custodial wallet and the implications it has?

A custodial wallet is one where third parties, centralized exchanges like Coinbase and Binance, or even dedicated payment processors store your private keys. This model offers ease and simplicity. Unfortunately, it comes with a cost, lack of control. In order to access your crypto and make any movement with it, you will have to depend on the custodian who has a strict KYC process. With receive crypto donations custodial wallets, the donations technically belong to the custodian until you withdraw, which frequently activates a KYC process. The flexibility offered by non custodial wallets.

The non-custodial wallets for the donations: freedoms

Unlike custodial wallets, a non-custodial wallet allows an individual full control over the private keys. Therefore, access and control over the cryptocurrency is limited to the specific individual. Examples of non-custodial wallets, both hardware and software, are Ledger, Trezor, MetaMask, Trust Wallet, and Electrum. In the case of crypto donations, the individual gets full control of the assets the moment they are received, and there is no intermediary involved. This removes the requirement for the wallet provider to obtain your KYC details, allowing crypto donations to be received with absolute freedom.

3. Accept crypto donations without KYC: the no KYC approach

In order to receive crypto donations without the custodial wallet and KYC, the fundamental principle of cryptocurrency must be used, which is the peer-to-peer transfer of value. This means you will need to sign up for your own non-custodial wallet and use it.

How to Set Up a Non-Custodial Wallet for Donations

This involves choosing and setting up a non-custodial wallet that is tailored to the specific needs of your organization that will be receiving donations.

- Select a Wallet: Select a trustworthy non-custodial wallet that works with the cryptocurrencies you want to receive crypto donations. For larger amounts, hardware wallets provide the best security. For easier access and smaller amounts, software wallets are more convenient.

- Create a New Wallet: Different from any personal cryptocurrencies a user holds, a user can create a new wallet.

- Secure Your Seed Phrase/Private Keys: This is critical. The 12 or 24 word phrases or recovery phrases should done and the phrase should be kept in multiple offline safe locations. The phrases allow free access to the account and should never be kept digitally or shared.

Non-custodial wallets for an organization

The organization’s goals and features determine the correct options. For long-term and larger amounts, hardware wallets like Ledger or Trezor are best for the donations’ security. For frequent and smaller donations, a MetaMask and Trust Wallet would work best for EVM compatible chains and are easier for web app integration. Take into account the expected cryptocurrencies.

Creating and viewing your public crypto addresses

After you set up your non-custodial wallet, you are required to generate the public receiving addresses for every cryptocurrency that you wish to receive crypto donations. Every cryptocurrency, for e.g. Bitcoin, Ethereum, Solana, has its own address format.

- Open Your Wallet: Navigate to your non-custodial wallet’s interface.

- Select Cryptocurrency: Select the specific crypto that you wish to receive crypto donations, for e.g, Bitcoin, Ethereum, or USDC.

- Find receive or deposit: Look for buttons labeled receive or deposit. These buttons will display your public wallet address and frequently, a QR code.

- Copy the Address: Copy the full address string.

Best practices for presenting your addresses to donors

Clarity and security are paramount. In order to optimize the acceptance of crypto donations, these addresses should be as clear as possible on your website or donation page.

- Dedicated Donation Page: A dedicated page for receiving donations should be created on your website to accept crypto donations.

- Provide clear guidance: Donors should be guided and told to send the accurate cryptocurrency to the proper network address.

- Copy-Paste & QR Codes: Always provide the address in both QR code format as well as copyable text. This reduces the chances of making donor mistakes.

- Multiple Cryptocurrencies: If you receive crypto donations in different cryptocurrencies, make sure to name each crypto with its own address.

- Disclaimers: Explain the address errors and mention the crypto transaction will not be refundable under any circumstances.

Table2: Main Ways To Receive Crypto Donations

| Option | How it works | Key advantages | Key limitations | Best fit for |

|---|---|---|---|---|

| Direct wallet address on your website | Publish one or more public wallet addresses or QR codes. | Simple, zero platform dependence, very low ongoing cost. | Harder for non crypto donors, no built in reporting or donor data. | Crypto native communities, small teams. |

| Non custodial crypto donation gateway (eg XaiGate) | Donor pays to a smart donation page and funds settle into wallets you own. | Professional UX, better reporting, non custodial control of funds. | Small gateway fee, needs basic technical onboarding and configuration. | Nonprofits, DAOs, creators who want scale and control. |

| Custodial exchange deposit address | Use a centralised exchange account and show its deposit address. | Easy conversion to fiat, familiar brand names for some donors. | Exchange holds custody, withdrawal rules apply, extra compliance overhead. | Teams that mainly want fast liquidation to fiat. |

| Dedicated crypto donation platform | Third party platform collects and optionally converts donations for you. | Turnkey setup, tax receipt tools, donor portals, some legal hand holding. | Platform branding in front of your own, higher fees, slower access to funds. | Larger charities and NGOs with complex reporting. |

| In person QR code or point of sale | Staff show a QR code or tap to pay screen at events or in store. | Good for live events, impulse giving, no need for donor to type anything. | Relies on staff training, local connectivity and donor having a crypto wallet. | Events, conferences, physical venues. |

4. Technical Considerations for Your Crypto Donation Infrastructure

It’s not enough to just have a wallet, as you need a strategy to manage the receive crypto donations.

Monitoring incoming donations

Unlike traditional bank accounts, you don’t get direct notifications for every crypto deposit unless you set up monitoring.

- Manual Checking: The most straightforward approach is to monitor the balance of your non-custodial wallet and check, periodically, the relevant transactions.

- Blockchain Explorers: You may track incoming transactions using your public address on blockchain explorers like Etherscan for Ethereum and Blockchain.com for Bitcoin.

- Wallet Notifications: Some non-custodial software wallets have very limited incoming balance alert functions.

- Third-Party Tools: For more advanced monitoring, you could utilize services that connect to blockchains and alert you when a transaction to your address occurs. Such services are very important when trying to monitor the steps you take to receive crypto donations.

Handling multiple cryptocurrencies and networks

To send you crypto donations beyond Bitcoin, a user may need to manage multiple crypto wallet addresses across different networks. Different cryptocurrencies and altcoins operate on their own blockchains, and cross-chain transfers are generally impossible to complete without the assistance of special relay services. Make sure you researched all non custodial wallets crypto assets you plan on accepting donations for, and their networks.

Addressing common misconceptions while receive crypto donations through different blockchains

This is a common point of confusion. Let’s say that you want to receive crypto donations in (ETH) and Solana (SOL) donations. You need to create separate wallets that generate addresses for each. If you intend to accept a stablecoin like USDC, you need to state the Ethereum, Polygon, or Solana network you intend to accept it on, and provide the appropriate address for that network. Not doing so is a common reason for donations getting lost.

Ensuring safety for your non-custodial holdings

Although non-custodial wallets provide independence, security risks are entirely your responsibility.

- Offline Storage for Large Amounts: For large donations, transfer them to a hardware wallet or a multi-sig wallet.

- Regular Backups: Physically separate storage locations, ensuring your seed phrase is backed up and encrypted.

- Access Control: Educate on crypto security measures aimed at phishing, malware, and other attacks for all associated team members.

- Education: Educate on crypto security measures aimed at phishing, malware, and other attacks for all associated team members

5. Tax and Legal Considerations When Receive Crypto Donations (No KYC)

Important accounting and legal organization considerations remain, even during the attempt at avoidance KYC.

Tax implications for entities receiving crypto donations

Tax consequences for organizations that receive crypto donations differ greatly between jurisdictions. In several countries, a donation is viewed as a non-taxable transfer, regardless if it is crypto or fiat. If the non-profit later decided to exchange the crypto for fiat currency, that exchange might be subject to capital gains tax if the cryptocurrency has appreciated. It is very important to engage a professional tax advisor that specializes in cryptocurrency and non-profit taxation to clarify obligations.

Reporting obligations relating to crypto donations

Though non-custodial donations may not require KYC (Know Your Customer) procedures at the point of receipt, non-profit organizations still have to comply to certain reporting rules. In the United States, for instance, charities are required to acknowledge receipt of donations, and for donations above a certain threshold, specific IRS documentation may be mandatory. Taxpayers also have to claim proper documentation to validate their tax deductions. Make sure that your procedures for receive crypto donations ensure that you can accurately maintain files and meet all obligations.

Internal accounting and record-keeping best practices

Accurate record maintenance is crucial. For every received crypto donation, ensure to:

- Note the exact date and time of the transaction.

- Record the specific type and quantity of cryptocurrency received.

- Retain the donor’s wallet address, where possible, and any relevant donor details for acknowledgment.

- If applicable, record the date and exchange rates for any conversion of crypto to fiat currency.

- Keep and maintain detailed and separate ledgers for all crypto assets received and disbursed.

Read more: Setup Crypto Wallet for Nonprofit Donations

6. Challenges and Limitations of Receiving Crypto Donations Without KYC

While appealing, no KYC approach has its challenges. Understanding these issues may help you determine whether it is the right approach for you.

Options for controlling volatility

The crypto market is highly volatile. For example, if you receive crypto donations and hold them directly in a non-custodial wallet, you’ll be exposed to market volatility. If the value drops significantly before you convert it to fiat or spend it, its impact might be significantly diminished. If your organization lacks a means to perform instant conversions, a plan for handling this volatility is critical. How to accept crypto donations directly is the other major concern.

Donor engagement and technical support assistance

When an organization chooses to self-manage their non-custodial crypto wallet, they simultaneously assume the role of providing donor support for crypto-related matters. There could be queries from donors concerning which crypto they would wish to send, the network to be used, or the process of transferring from their wallets. Organizations have to be willing and prepared to offer technical assistance which, without a specialized platform, can be quite onerous. This is part of the reality of how to independently receive crypto donations.

Scalability and operational efficiency concerns

For organizations expecting a higher volume of crypto donations from a wider base of donors, a non-custodial wallet could make managing everything manually so tedious and labor intensive. Streamlined processes for generating unique address for every donor question, transaction monitoring, and accurately accounting for countless tiny donations can demand a considerable amount of time. For nonprofits, the operational efficiency can greatly improve from the use of a specialized crypto donation platform.

7. Exploring Platforms: A Simplified Hybrid Approach to Accepting Crypto Donations

While there is more independence in receiving non-custodial direct donations, many organizations would greatly benefit from a specialized platform and the simplifications it offers. A nonprofit crypto donation platform can enhance the efficiency and offer the following functions.

The function of a crypto donation platform for charitable organizations

A crypto donation platform tailored for nonprofits can simplify the entire process. These platforms usually offer:

- More Accessible crypto payment options: Increased ease of acceptance for different forms of cryptocurrency.

- Automated Conversion: Real time conversion of crypto to fiat currencies helps avoid the risks of market volatility..

- Donor Experience Tools: Branded donation pages, graphical widgets, and step by step guides for the donors.

- Reporting & Compliance: Reporting and accounting tools to streamline the nonprofit’s tax liabilities and obligations.

- Customer Support: Support for the Nonprofit and the Donor.

Although these platforms may require some KYC for fiat withdrawals, they usually make it easier to enable crypto donations wherein the organization gets an address for crypto donations. After that, the organization can decide how to manage the funds. They simplify the complexities of understanding how to manage and receive crypto donations.

Xaigate: Simplified crypto donations for nonprofits

To aid organizations receive crypto donations, companies like Xaigate are emerging to offer streamlined services. Maintaining the core ideals of accessibility and simplicity, Xaigate seeks to mitigate the nagging issues related to digital asset giving. They aim to provide intuitive platforms for users and sponsors, possibly creating tools that automate the receipt process, minimize errors, and provide comprehensive status updates. For organizations that want to quickly start receiving crypto donations, Xaigate provides an excellent way to access this untapped donor market without the need to understand the intricacies of blockchain technology. Their focus is on simplifying the process for organizations and making it as seamless as possible to receive crypto donations.

Read more: Accept cryptocurrency donations for Nonprofit Organizations

The direct ability to receive crypto donations without needing custodial wallets or KYC processes provides unparalleled control to organizations, enabling access to an emerging philanthropic market. While the need for technical know-how and security measures is heightened, there is an added advantage of absolute control over donated assets. By setting up non-custodial wallets, monitoring transactions, and adhering to solid accounting principles, crypto donations can be confidently accepted from anywhere in the world.

Embracing cryptocurrency donations allows organizations to access new support channels and maximize their impact in today’s digital landscape. Whether you decide to go for a completely self-managed setup or use supportive platforms for nonprofit donations like Xaigate to simplify things, adopting crypto donations is a futuristic move.

FAQs: How to Receive Crypto Donations Without a Custodial Wallet or KYC

1. How can I accept crypto donations without using a custodial wallet?

You can use non-custodial platforms like XAIGATE to receive crypto donations directly to your own wallet without involving any third-party custodians.

2. Do I need to verify my identity (KYC) to collect crypto donations on XAIGATE?

No, XAIGATE allows you to receive crypto donations without KYC, ensuring full privacy and decentralization.

3. What cryptocurrencies can I receive donations in without KYC?

You can receive donations in major cryptocurrencies like Bitcoin, Ethereum, and USDT without completing any identity verification.

4. Is it safe to accept crypto donations without using a custodial service?

Yes, as long as you use a secure non-custodial solution and control your private keys, accepting crypto donations is safe.

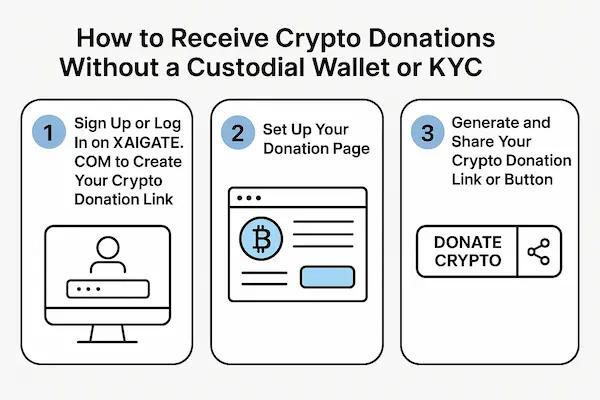

5. How do I create a crypto donation link without KYC?

Simply sign up on XAIGATE.com, enter your wallet address, and generate a donation link or button—no KYC required.

6. Can nonprofits accept crypto donations without a custodial wallet?

Absolutely. Nonprofits and individuals can both use tools like XAIGATE to accept donations directly to their wallets without custodial services.

7. Are there any fees when receiving crypto donations through XAIGATE?

XAIGATE does not charge donation processing fees; only standard blockchain network fees apply.

8. Can I embed a crypto donation button on my website without verifying my identity?

Yes, XAIGATE allows you to embed a customizable donation button on your site without any KYC process.

9. Why choose non-custodial donations over centralized services?

Non-custodial donations provide greater security, privacy, and control, while avoiding unnecessary regulations like KYC.

10. What are the benefits of accepting anonymous crypto donations?

Anonymous donations can protect both donors and recipients, especially in sensitive causes, while maintaining transparency on the blockchain.