A revolutionary shift is taking place in the business payments setting and firms are learning more and more the force of stablecoin payments for B2B transactions. Stablecoins drive $36 billion in business-to-business payments and now, as clear regulatory guidance is taking shape with new landmark laws, the cryptocurrency quickly becomes one timely tool through which businesses can manage cash flows much faster, more predictable, and more cost-effectively with no bank involvement.

Since businesses are on the lookout for an alternative to the high cost of wire transfers and the long settlement delays, stablecoin payments to B2B would provide an appealing option as it balances between stability of traditional currencies and the efficiency of the blockchain. The guide covers the ways and means through which businesses can adopt stablecoin payment systems to smoothen their operations and aid financial predictability.

Contents

- 1 1. Understanding the Current Stablecoin Landscape

- 2 2. Key Benefits of Stablecoin Payments for B2B

- 3 3. Popular Stablecoins Paymetns for B2B Transactions

- 4 4. Implementation Strategies for B2B Companies

- 5 5. Overcoming Common Implementation Challenges

- 6 6. Financial Benefits and Cash Flow Impact

- 7 7. Industry-Specific Applications

- 8 8. Future Outlook and Strategic Considerations

- 9 9. Best Practices for Success

- 10 Frequently Asked Questions

- 11 Conclusion

1. Understanding the Current Stablecoin Landscape

Market Growth and Adoption

The market of stablecoins has grown exponentially with active stablecoin wallets growing by 53 percent year over year up to a sum of more than 30 million in February 2025, as compared to 19.6 million in February 2024. The growth shows how cryptocurrencies and other digital assets have become accepted in business deals and how the ecosystem is coming of age.

Established companies and banking institutions have also been using the stablecoins in their payment systems as they continue to realize that stablecoins enable them to enjoy great benefits compared to the complicated traditional banking systems. The increasing institutional acceptance has resulted in the establishment of a more stable and trustful environment of the B2B transactions.

Osiris Regulatory Breakthrough: The GENIUS Act

The fact that the GENIUS Act was passed in the year 2025 is a breaking point in terms of stabilitycoin payments as a means of carrying out B2B operations. The Act fills the existing regulatory loophole in the issuance of payment stablecoins and custody of stablecoin reserves and seeks to enhance consumer protection, responsible innovation, and enhance the U.S. dollar as the reserve currency of the world.

The GENIUS Act makes clear that payment stablecoins are not securities subject to SEC regulation but are instead subject to banking-like examination, supervision, and enforcement, providing businesses with the regulatory certainty needed for widespread adoption.

2. Key Benefits of Stablecoin Payments for B2B

Speed and Efficiency

Traditional cross-border B2B payments can be painfully slow and expensive. Traditional cross-border transfers can take up to five business days and involve a daisy chain of correspondent banks, each clipping a fee. With stablecoins, money moves globally with internet speed, enabling businesses to receive payments in minutes rather than days.

This speed advantage is particularly valuable for:

- Supply chain financing and payments

- International contractor payments

- Time-sensitive business transactions

- Emergency cash flow management

Cost Reduction

Stablecoin payments for B2B dramatically reduce transaction costs by eliminating traditional banking intermediaries. While traditional wire transfers can cost $15-50 per transaction plus exchange rate markups, stablecoin payments typically cost less than $5 and often under $1 for domestic transfers.

Predictable Cash Flow

Unlike volatile cryptocurrencies, stablecoins maintain price stability by being pegged to stable assets like the US dollar. This stability enables businesses to:

- Budget accurately without worrying about currency fluctuations

- Maintain consistent pricing for international customers

- Predict cash flow timing with near-instant settlements

- Reduce foreign exchange risk in international transactions

Stablecoin vs. Traditional B2B Payment Methods

|

Feature |

Traditional Wire Transfer |

ACH Payments |

Stablecoin Payments |

|

Settlement Time |

1-5 business days |

1-3 business days |

Minutes to hours |

|

Cost per Transaction |

$15-50 + fees |

$0.50-3.00 |

$0.10-5.00 |

|

International Capability |

Yes (expensive) |

Limited |

Global |

|

Weekend/Holiday Processing |

No |

No |

Yes |

|

Transparency |

Limited |

Limited |

Full blockchain visibility |

|

Regulatory Status |

Established |

Established |

Newly regulated (GENIUS Act) |

3. Popular Stablecoins Paymetns for B2B Transactions

USD Coin (USDC)

USD Coin has emerged as a preferred choice for businesses due to its regulatory compliance and transparency. USDC offers businesses widespread acceptance, being available on more than 400 exchanges and supported across multiple blockchains including Ethereum, Tron, Solana, and Algorand.

Key advantages include:

- Regular attestations by major accounting firms

- Full regulatory compliance under the GENIUS Act

- Multi-blockchain compatibility

- Strong institutional adoption

Tether (USDT)

Tether remains the stablecoin pioneer and market leader, maintaining its dominant position since its 2014 launch. For B2B applications, USDT offers:

- Highest liquidity among all stablecoins payments for B2B.

- Deepest trading volume for easy conversion

- Multi-chain flexibility across numerous blockchain ecosystems

- Widespread merchant acceptance

Other Emerging Options

Several other stablecoins are gaining traction in B2B markets:

- PayPal USD (PYUSD) – Backed by major payment processor

- TrueUSD (TUSD) – Focus on transparency and compliance

- Dai (DAI) – Decentralized stablecoin with algorithmic backing

4. Implementation Strategies for B2B Companies

Assessing Business Readiness

Before implementing stablecoin payments for B2B, companies should evaluate:

- Current payment pain points – Identify where stablecoins provide the most value

- Technical infrastructure – Assess existing systems’ compatibility

- Regulatory compliance – Ensure adherence to GENIUS Act requirements

- Team expertise – Evaluate staff knowledge and training needs

- Customer and supplier readiness – Gauge partner willingness to adopt

Integration Approaches

Direct Wallet Management

Some businesses prefer managing stablecoin payments directly through corporate wallets. This approach offers:

- Maximum control over transactions and timing

- Lower per-transaction costs

- Direct blockchain interaction

- Enhanced privacy and security control

However, it requires significant technical expertise and security infrastructure.

Payment Processor Integration

Most businesses benefit from using specialized stablecoin payments for B2B processors that handle:

- Wallet management and security

- Regulatory compliance reporting

- Conversion to traditional currencies

- Integration with existing accounting systems

- Customer support and dispute resolution

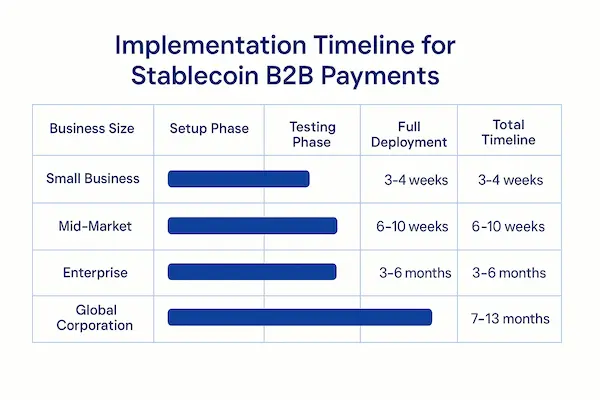

Implementation Timeline for Stablecoin B2B Payments

|

Business Size |

Setup Phase |

Testing Phase |

Full Deployment |

Total Timeline |

|

Small Business |

1-2 weeks |

1 week |

1 week |

3-4 weeks |

|

Mid-Market |

2-4 weeks |

2-3 weeks |

2-3 weeks |

6-10 weeks |

|

Enterprise |

1-3 months |

1-2 months |

1 month |

3-6 months |

|

Global Corporation |

3-6 months |

2-4 months |

2-3 months |

7-13 months |

5. Overcoming Common Implementation Challenges

Technical Integration Hurdles

Stablecoin adoption in B2B payments is hindered by inconsistent regulations, counterparty risks and complex integrations with legacy systems, which require technological upgrades and staff training to ensure compliance and efficiency.

To address these challenges:

- Partner with experienced providers who understand legacy system integration

- Implement gradual rollouts starting with smaller transactions

- Invest in staff training on blockchain technology and stablecoin operations

- Develop clear policies and procedures for stablecoin handling

Regulatory Compliance Considerations

The GENIUS Act provides clarity, but businesses must still ensure compliance with:

- Anti-money laundering (AML) requirements

- Know Your Customer (KYC) procedures

- Tax reporting obligations for digital asset transactions

- State-level money transmission licenses where applicable

Risk Management

While stablecoins payments for B2B are designed to maintain price stability, businesses should implement risk management strategies:

- Diversify across multiple stablecoins to reduce issuer risk

- Monitor reserve backing and audit reports regularly

- Maintain traditional payment alternatives as backup options

- Implement proper wallet security and insurance coverage

6. Financial Benefits and Cash Flow Impact

Improved Working Capital Management

Stablecoin payments for B2B enable more efficient working capital management through:

- Faster payment collection reducing days sales outstanding (DSO)

- Predictable payment timing improving cash flow forecasting

- Lower payment processing costs increasing net receipts

- Enhanced supplier relationships through faster payments

International Business Advantages

For companies with international operations, stablecoins offer:

- Elimination of currency conversion delays and fees

- 24/7 payment processing regardless of banking hours

- Reduced foreign exchange risk through dollar-pegged stability

- Simplified accounting with consistent currency values

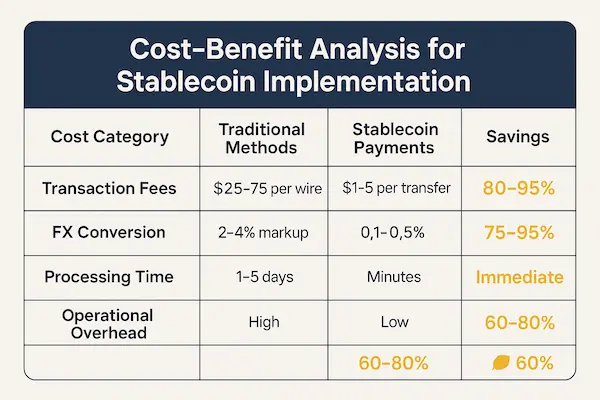

Cost-Benefit Analysis for Stablecoin Implementation

|

Cost Category |

Traditional Methods |

Stablecoin Payments |

Savings |

|

Transaction Fees |

$25-75 per wire |

$1-5 per transfer |

80-95% |

|

FX Conversion |

2-4% markup |

0.1-0.5% |

75-95% |

|

Processing Time |

1-5 days |

Minutes |

Immediate |

|

Operational Overhead |

High |

Low |

60-80% |

|

Weekend Processing |

Impossible |

Available |

Priceless |

7. Industry-Specific Applications

Supply Chain Management

Manufacturers and distributors find stablecoin payments for B2B particularly valuable for:

- Supplier payments in developing markets

- Just-in-time inventory financing

- Emergency procurement payments

- Cross-border logistics settlements

Professional Services

Consulting, legal, and technical service providers benefit from:

- Instant international client payments

- Reduced payment disputes through blockchain transparency

- Simplified invoicing for global clients

- Lower overhead for international operations

Technology Companies

Software and SaaS companies leverage stablecoins for:

- Subscription payments from global customers

- Developer and contractor payments worldwide

- Partner revenue sharing arrangements

- Acquisition and merger transactions

8. Future Outlook and Strategic Considerations

Regulatory Evolution

For the cross-border payments industry, it’s clear that 2025 is the year of stablecoins. New announcements about projects using the technology are being made on an almost daily basis, while landmark regulation is bringing stablecoins deeper into the traditional ends of the market.

The regulatory landscape continues evolving with:

- Additional state-level legislation clarifying local requirements

- Federal agency guidance on implementation best practices

- International coordination on cross-border stablecoin standards

- Industry self-regulation initiatives

Technology Advancement

Emerging developments that will impact stablecoin payments for B2B include:

- Layer 2 scaling solutions reducing transaction costs further

- Smart contract automation for complex payment arrangements

- Central bank digital currencies (CBDCs) integration

- Enhanced privacy features while maintaining compliance

Market Expansion

Expect continued growth in:

- Enterprise adoption as regulatory clarity increases

- Payment processor innovation with new service offerings

- Industry-specific solutions tailored to sector needs

- Integration with traditional financial services

9. Best Practices for Success

Security and Compliance

Implement robust security measures including:

- Multi-signature wallets for large transactions

- Regular security audits and penetration testing

- Employee training on crypto security best practices

- Comprehensive insurance coverage for digital assets

Operational Excellence

Develop clear operational procedures for:

- Transaction monitoring and approval workflows

- Record keeping for tax and audit purposes

- Customer communication about payment options

- Dispute resolution and reversal procedures

Strategic Planning

Consider stablecoins as part of broader digital transformation:

- Integration with ERP systems for seamless operations

- Data analytics on payment patterns and efficiency gains

- Customer experience optimization through faster payments

- Competitive positioning in digital-forward markets

Frequently Asked Questions

1. Are stablecoin payments legal for B2B transactions in the United States?

Yes, with the passage of the GENIUS Act in 2025, stablecoins are now regulated and legal for business transactions. The Act provides clear regulatory framework and supervision for stablecoin issuers, making them safe for business use.

2. How do I handle taxes when receiving stablecoin payments for B2B?

Stablecoin payments for B2B are treated as regular business income at their USD value when received. Since most stablecoins are pegged to the dollar, this simplifies tax reporting compared to volatile cryptocurrencies. Consult with a tax professional familiar with digital assets.

3. What happens if a stablecoin loses its peg to the dollar?

Under the GENIUS Act, regulated stablecoins must maintain full reserves backing their tokens. However, businesses should diversify across multiple stablecoins and maintain traditional payment backups as risk management measures.

4. How long does it take to set up stablecoin payments for my business?

Implementation timelines vary by business size and complexity. Small businesses can typically deploy solutions in 3-4 weeks, while enterprise implementations may take 3-6 months including testing and integration with existing systems.

5. Can I convert stablecoins to traditional currency immediately?

Yes, most payment processors offer instant or near-instant conversion to USD. This allows businesses to benefit from fast settlement while maintaining exposure to traditional currency if preferred.

6. What are the main risks of using stablecoin Payments for B2B payments?

Primary risks include technology/security risks, regulatory changes, counterparty risk with stablecoin payments issuers, and operational risks from system integration. These can be managed through proper due diligence, security measures, and working with regulated providers.

7. Do my customers need technical knowledge to pay with stablecoins?

Modern stablecoin payments for B2B solutions are designed to be user-friendly. Many operate similarly to traditional payment methods, with payment processors handling the technical complexity behind simple interfaces.

8. How do stablecoin payments compare to international wire transfers?

Stablecoins are typically 80-95% cheaper than international wires, settle in minutes instead of days, operate 24/7 including weekends, and provide full transaction transparency through blockchain records.

Conclusion

Stablecoin payments in B2B hold key changes in the processes of business cash flow management and financial transactions within the company. The regulatory framework is now set by the GENIUS Act and year-over-year active stablecoin wallets increase 53 percent, so companies can be confident in deploying them to accomplish confidence in predictable cash flow free of traditional bank constraints.

The advantages are obvious: settlement can be faster with reduced cost, better predictability within cash flow and effectiveness in operation. Although implementation of it must be well-planned and risk management, the competitive advantages of stablecoin payments for B2B make it a necessity every company with the view to the future should consider.

Whether stablecoin implementation will be successful or not will be related to a successful selection of technology partners, regulators or technology partners be met and operational procedures strengthened. Firms who are ready to get started by implementing these new solutions will largely benefit in rapidity, expenditure, and cash management when compared to other firms that are still using traditional means of payment.

B2B payments fact that the future is digital, stable and immediate. Stablecoin Payments to B2B will give the business a chance to liberate itself of the conventional banking limits in the meantime guaranteeing the predictability in financing it needs to succeed. Stablecoins will remain an element in the current business payment structure as technology matures further, and there is a greater understanding of its regulation.

Quick Summary Table

| Key Aspect | Traditional Banking | Stablecoin Payments (B2B) |

|---|---|---|

| Speed | 2–5 business days for international transfers | Near-instant, 24/7 settlements |

| Cash Flow Predictability | Subject to bank delays and cut-off times | Real-time payments ensure predictable cash flow |

| Costs | High fees (wire, FX, intermediaries) | Low transaction costs, minimal FX exposure |

| Accessibility | Limited by banking hours, jurisdictions | Borderless, always-on payments |

| Transparency | Opaque tracking, multiple intermediaries | Blockchain ledger ensures full transparency |

| Volatility Management | Bank FX spreads + delays | Stablecoins (USDT, USDC, PYUSD) peg to USD for stability |

| Integration | Complex setup with banks | Easy API/plug-and-play gateway integration |

| Best For | Legacy finance, domestic transactions | Global B2B trade, startups, digital services, supply chains |

The firms planning this shift are advised to begin with pilot projects, form partnerships with established providers, and extend the functionality of their stablecoins payments slowly. It is time to do it and those who do it first will get the greatest rewards of using such an innovative technology in payments.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!

Don’t miss out on the opportunity to elevate your business with XAIGATE’s Stablecoin Payments for B2B: Fast, Low-Cost, Bank-Free. The three-step process is designed to be user-friendly, making it accessible for all businesses. Embrace this modern payment solution to provide customers with a secure and efficient way to pay. Take the first step towards a competitive edge in the digital realm and unlock the benefits of cryptocurrency payments for online casino today.

Looking to integrate seamless Crypto Payment Gateway for small Businesses