Contents

- 1 Introduction: The Stablecoin Boom in the Payments Industry

- 2 What is Driving the Stablecoin Race in Payments?

- 3 USDT – The Global Liquidity Leader

- 4 USDC – The Regulation-First Contender

- 5 PYUSD — PayPal’s Entry into the Stablecoin Race in Payments

- 6 Head-to-Head Comparison of USDT, USDC, and PYUSD

- 7 Regulation’s Role in the Stablecoin Race in Payments

- 8 Beyond the Big Three — Other Players in the Race

- 9 Predictions for the Stablecoin Race in Payments (2026–2030)

- 10 Merchant’s Guide to Accepting Stablecoin Payments

- 11 Case Studies of Stablecoin Payments in Action

- 12 Expert Insights on the Stablecoin Race in Payments

- 13 Conclusion — The Future of the Stablecoin Race in Payments

- 14 FAQs – The Stablecoin Race in Payments and Its Impact on Global Transactions

Introduction: The Stablecoin Boom in the Payments Industry

In 2026, the way money moves around the world is being rewritten – not by central banks, but by a trio of digital dollars battling for dominance. The Stablecoin Race in Payments has put USDT (Tether), USDC (USD Coin), and PYUSD (PayPal USD) at the center of a high-stakes contest. This isn’t just about market caps or trading volume. It’s a race to become the go-to currency for e-commerce checkouts, travel bookings, subscription services, and cross-border remittances.

Over the past two years, stablecoins have gone from niche crypto tools to mainstream payment options. From a hotel in Bali accepting USDT to a U.S. software company billing clients in PYUSD, these coins are quietly reshaping commerce. And unlike volatile cryptocurrencies such as Bitcoin, stablecoins keep their value steady, pegged to the U.S. dollar — making them far more appealing to everyday consumers and risk-conscious businesses.

But the race is heating up. Regulations are tightening, adoption is accelerating, and each contender is sharpening its strategy. For merchants, investors, and policymakers, understanding the dynamics of the Stablecoin Race in Payments is no longer optional – it’s essential.

What is Driving the Stablecoin Race in Payments?

The rise of stablecoins in payments didn’t happen overnight. Several converging factors have propelled them into the spotlight – and together, they’ve created the perfect environment for a competitive race.

Definition of Stablecoins and Their Role in Payments

A stablecoin is a type of cryptocurrency designed to maintain a stable value, typically pegged to a reserve asset like the U.S. dollar. The peg reduces volatility, which has been one of the biggest barriers to crypto adoption in daily transactions.

In payment systems, stability is critical. If a merchant receives $500 worth of cryptocurrency today, they expect it to be worth $500 tomorrow. Stablecoins make that possible while retaining blockchain’s speed and transparency.

Why 2026 is a Turning Point for Payment Technology

Three big shifts have converged in 2026:

- Maturing Regulation – Governments are finally providing legal clarity for stablecoin usage.

- Merchant Integration – Payment gateways and platforms now offer plug-and-play stablecoin acceptance.

- Global Economic Factors – Inflation, currency instability, and rising cross-border trade have increased demand for digital dollars.

The Role of Cross-Border Commerce and E-Commerce Growth

For global e-commerce, stablecoins solve two persistent problems: high transaction fees and slow settlement times. A business in Vietnam selling to a customer in Germany can now receive payment in seconds, not days, and with minimal fees. That’s a game-changer for industries like travel, software, and international retail.

USDT – The Global Liquidity Leader

When people talk about the Stablecoin Race in Payments, one name inevitably comes up first: USDT, also known as Tether. Since its launch in 2014, USDT has grown into the most widely traded cryptocurrency in the world — even surpassing Bitcoin in daily transaction volume. Its dominance isn’t accidental. It’s the result of deep market penetration, unmatched liquidity, and a willingness to operate where traditional banking struggles to reach.

Market Dominance and Adoption Across Borders

USDT is available on almost every blockchain that supports tokens – from Ethereum and Tron to Solana and Avalanche. This multi-chain approach allows it to adapt to user preferences in different regions. In Asia, for example, Tron-based USDT has become the de facto settlement currency for small import/export businesses because of its ultra-low transaction fees.

In Latin America, particularly in Argentina and Venezuela, USDT is being used as a digital dollar hedge against inflation. In Africa, it’s helping bypass slow and expensive remittance channels. These use cases make USDT not just a trading asset, but a lifeline for everyday commerce.

Strengths in the Stablecoin Race in Payments

- Unmatched Liquidity – With a market cap exceeding $100 billion in 2026, USDT offers deep liquidity for both individuals and institutions.

- Ubiquitous Acceptance – From Binance Pay to local OTC desks, USDT is everywhere.

- Low-Cost Transfers – Especially on Tron, transactions can cost less than a cent.

For merchants, this means customers are far more likely to already hold USDT, reducing friction at checkout.

Regulatory Concerns and Transparency Challenges

However, USDT’s dominance comes with baggage. Tether has faced years of criticism over the transparency of its reserves. While the company now publishes regular attestation reports, critics still call for full, real-time audits.

On the regulatory front, USDT operates from jurisdictions that some Western regulators view with suspicion. This has led to speculation about potential restrictions in the U.S. and EU, which could impact institutional adoption.

USDT Adoption Trends in 2026

Recent data from blockchain analytics firms shows USDT processing more than $35 billion in daily transactions, much of it for payments rather than speculative trading. Adoption is especially strong in countries with weak local currencies or capital controls.

In the context of the Stablecoin Race in Payments, USDT’s strategy is clear: dominate emerging markets, offer near-instant transfers at minimal cost, and rely on its massive liquidity to stay ahead.

USDC – The Regulation-First Contender

If USDT wins on liquidity and global reach, USDC (USD Coin) is staking its claim in the Stablecoin Race in Payments by focusing on something different: compliance, transparency, and trust. Issued by Circle, a U.S.-based fintech company, USDC has positioned itself as the “clean” alternative in a market where regulatory scrutiny is intensifying.

How USDC Wins Institutional Trust

From day one, Circle has worked closely with regulators, auditors, and financial institutions. USDC reserves are held in cash and short-term U.S. Treasury bonds, with monthly attestation reports verified by independent accounting firms.

This commitment to openness has made USDC the preferred choice for companies that can’t afford to take regulatory risks — think fintech apps, corporate treasuries, and payment processors that operate under strict compliance rules.

Advantages in Compliance and Transparency

- Regulated in the U.S. — Aligns with proposed U.S. stablecoin legislation.

- Bank-Grade Integrations — Partnerships with Visa, Mastercard, Stripe, and Shopify.

- Clear Audit Trail — Every USDC in circulation is matched by one U.S. dollar (or equivalent) in reserve.

These factors make USDC attractive for high-value transactions where both parties need assurance that the payment medium is secure and legitimate.

Limitations Compared to USDT in the Global Market

While USDC excels in regulated environments, it hasn’t penetrated informal or emerging market ecosystems as deeply as USDT. Part of this is due to:

- Higher transaction fees on some blockchains (like Ethereum mainnet).

- Limited accessibility in regions where U.S. banking partners have restrictions.

- A more cautious approach to onboarding unverified users.

USDC’s Expansion in 2026 Payment Networks

In 2026, Circle has aggressively expanded USDC’s footprint:

- Asia-Pacific push — Partnerships with Singaporean fintech firms to streamline cross-border trade.

- Multi-chain rollout — Support on Solana, Base, and Avalanche for faster, cheaper transfers.

- CBDC interoperability tests — Pilots with central banks to connect USDC with future government-backed digital currencies.

In the Stablecoin Race in Payments, USDC’s strategy is to win where regulation is king — major economies, institutional finance, and industries where reputational risk is unacceptable.

PYUSD — PayPal’s Entry into the Stablecoin Race in Payments

When PayPal announced the launch of PYUSD (PayPal USD) in 2023, it wasn’t just another stablecoin hitting the market — it was a strategic move from one of the most recognized brands in online payments. In the Stablecoin Race in Payments, PYUSD has the advantage of starting with an already massive merchant and consumer network. Unlike USDT and USDC, which had to build their payment ecosystems from scratch, PYUSD was born inside an existing infrastructure used by over 30 million merchants and 400 million active PayPal accounts.

The PayPal Advantage and Merchant Integration

PayPal didn’t just launch a token; it gave PYUSD instant utility. Merchants already using PayPal can accept PYUSD without adding any new payment processor or wallet. Consumers can hold, send, and spend PYUSD directly from the PayPal app, alongside their existing balances and linked bank accounts.

This seamless integration means that for the average online shopper, paying with PYUSD feels no different from paying with USD — except the settlement happens on blockchain rails, enabling faster and potentially cheaper cross-border transactions.

PYUSD’s Market Position and Early Growth

PYUSD started with limited availability in the U.S., but even in its early months, it captured headlines by:

- Partnering with Venmo for peer-to-peer transfers.

- Enabling instant settlement for certain e-commerce purchases.

- Allowing merchants to convert PYUSD to fiat instantly at no extra cost.

In less than two years, PYUSD has become the go-to stablecoin for PayPal-native transactions, especially among U.S.-based small businesses and freelancers working with international clients.

Geographic Expansion and Regulatory Approvals in 2026

In 2026, PayPal expanded PYUSD’s reach to the UK, EU, and Canada, after securing the necessary regulatory approvals.

- Europe: PYUSD now complies with the EU’s MiCA framework, allowing it to be offered across the European Economic Area.

- Canada: Integrated with PayPal’s cross-border payment service for Canadian SMBs.

- Asia-Pacific: Pilot programs in Singapore and Hong Kong, focusing on tourism and digital goods sectors.

This expansion signals PayPal’s intent to position PYUSD as not just a PayPal-specific asset but a global stablecoin competitor — one that leverages brand trust to attract merchants who have never accepted crypto before.

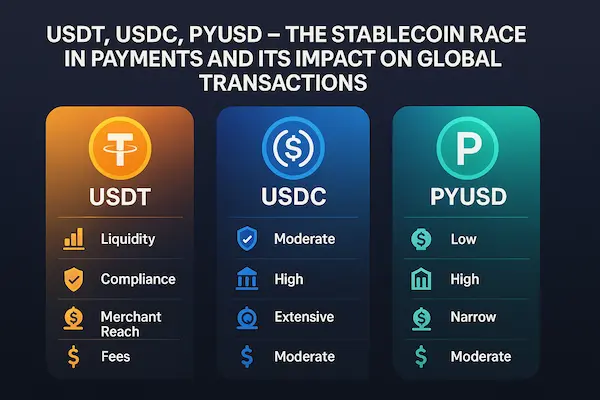

Head-to-Head Comparison of USDT, USDC, and PYUSD

In the Stablecoin Race in Payments, each contender brings its own strengths, weaknesses, and ideal use cases. For merchants, investors, and payment processors, choosing the right stablecoin isn’t about picking a “winner” — it’s about finding the one that aligns with their business needs, market, and compliance requirements.

Transaction Speed and Fees

- USDT: Extremely fast on most supported blockchains, with Tron-based USDT transfers costing less than $0.01. Ideal for high-frequency, low-margin businesses.

- USDC: Speed varies by network; on Solana or Base, transactions are near-instant and cost a fraction of a cent, while Ethereum mainnet transfers can be more expensive.

- PYUSD: Transfers within PayPal’s ecosystem are instant and feel seamless to users, but blockchain transfers outside PayPal may incur slightly higher fees.

Verdict: USDT wins on raw cost efficiency, USDC is competitive on fast networks, PYUSD offers frictionless internal settlement for PayPal merchants.

Merchant Adoption and Integration Ease

- USDT: Accepted by virtually every crypto-friendly merchant and payment gateway worldwide.

- USDC: Strong adoption among regulated platforms, fintech apps, and large enterprises.

- PYUSD: Unique advantage of instant availability to millions of PayPal merchants with zero technical setup.

Verdict: PYUSD dominates for PayPal-native merchants, while USDT leads in global, crypto-first commerce.

Compliance and Market Trust

- USDT: Faces ongoing scrutiny over reserves and offshore regulatory status.

- USDC: Regarded as the most compliant, with monthly attestations and U.S. oversight.

- PYUSD: Fully integrated with PayPal’s compliance framework, leveraging its long-standing regulatory relationships.

Verdict: USDC and PYUSD are neck-and-neck for compliance trust; USDT still commands user trust through market dominance despite controversies.

Through XaiGate, companies gain access to a robust best crypto payment gateway that ensures secure transactions, seamless integration, and future-ready financial solutions.

Which Stablecoin Fits Which Use Case?

- Global P2P transfers in emerging markets → USDT

- Institutional payments & regulated industries → USDC

- E-commerce via PayPal’s merchant network → PYUSD

Table 1: USDT vs USDC vs PYUSD in the Stablecoin Race in Payments

| Feature / Metric | USDT (Tether) | USDC (USD Coin) | PYUSD (PayPal USD) |

|---|---|---|---|

| Launch Year | 2014 | 2018 | 2023 |

| Issuer | Tether Limited (Hong Kong) | Circle (U.S.) | PayPal (U.S.) |

| Primary Strength | Largest liquidity & global reach | Regulatory compliance & transparency | Seamless PayPal merchant integration |

| Market Cap (2026) | ~$105B | ~$34B | ~$2B |

| Blockchain Support | Ethereum, Tron, Solana, Avalanche, more | Ethereum, Solana, Base, Avalanche, more | Ethereum (ERC-20), PayPal ecosystem |

| Transaction Fees | Lowest on Tron (<$0.01) | Near-zero on Solana/Base, higher on Ethereum | Free within PayPal, network fees on blockchain |

| Settlement Speed | Seconds to minutes | Seconds (on fast chains) | Instant in PayPal, seconds on blockchain |

| Regulation Level | Offshore, limited audits | U.S.-regulated, monthly audits | U.S.-regulated, PayPal compliance |

| Best Use Cases | Global remittances, emerging markets | Institutional payments, regulated industries | E-commerce, PayPal-native merchants |

| Adoption Highlights | Widest acceptance in crypto commerce | Preferred by enterprises & fintech | Instant access for 30M+ PayPal merchants |

| Risks / Limitations | Reserve transparency concerns | Slower growth in informal markets | Limited blockchain presence, early-stage adoption |

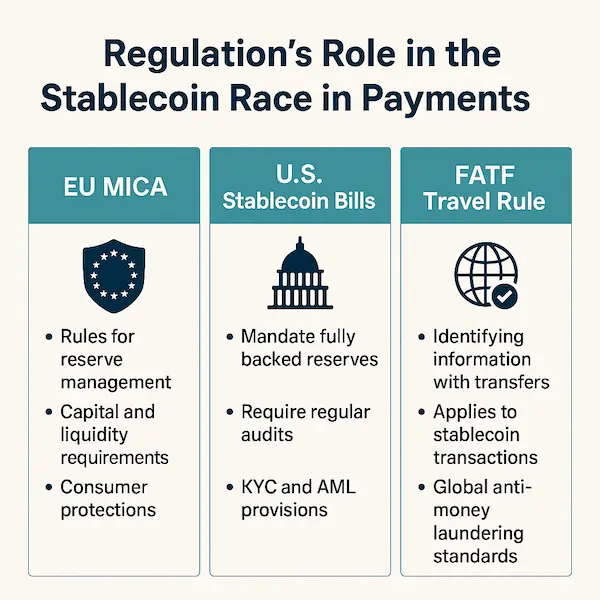

Regulation’s Role in the Stablecoin Race in Payments

No matter how innovative a stablecoin is, its long-term success in the Stablecoin Race in Payments will depend heavily on regulation. As 2026 progresses, governments and international bodies are rolling out new frameworks that could make or break the top contenders.

EU’s MiCA Rules and Impact on Stablecoin Issuers

The European Union’s Markets in Crypto-Assets (MiCA) framework officially came into effect in 2024, setting strict rules for reserve transparency, capital requirements, and consumer protection.

- USDC: Already aligned with many MiCA standards, giving it a head start in the European market.

- PYUSD: Gained EU approval in 2026, enabling PayPal to roll out the coin across its European merchant base.

- USDT: Faces more hurdles due to its offshore status, though Tether has recently stepped up compliance reporting to meet EU standards.

For European merchants, these rules bring clarity — but also create barriers for stablecoins that cannot meet the regulatory bar.

U.S. Stablecoin Bills and Compliance Standards

In the United States, proposed stablecoin legislation focuses on:

- Fully backed reserves held in cash or short-term Treasuries.

- Regular third-party audits.

- KYC/AML requirements for issuers and major distributors.

This environment strongly favors USDC and PYUSD, given their U.S. roots and existing compliance infrastructure. USDT remains dominant globally but may see limited growth in U.S.-regulated payment systems unless it adapts.

FATF Guidelines and Global AML Requirements

The Financial Action Task Force (FATF) is pushing for Travel Rule compliance in crypto transactions, including stablecoins. This means that identifying information must accompany transfers above a certain threshold.

While this adds operational complexity, it could increase trust among institutional players. Payment gateways that integrate Stablecoin Race in Payments solutions will need to ensure these compliance rules are met without compromising user experience.

Beyond the Big Three — Other Players in the Race

The spotlight is on USDT, USDC, and PYUSD, but the Stablecoin Race in Payments is not a three-horse sprint. Several contenders are shaping niches that matter for merchants, developers, and regulators.

DAI, GUSD, and Other Regulated or Decentralized Stablecoins

- DAI (MakerDAO): DAI’s hybrid collateral model (increasingly backed by real-world assets in addition to crypto collateral) appeals to builders who value openness and programmability. For payments, DAI’s draw is its decentralized governance—useful for communities and platforms that prefer fewer centralized choke points.

- GUSD (Gemini Dollar): Regulated by the New York Department of Financial Services (NYDFS), GUSD positions itself as a compliance-first USD stablecoin. While not as widely used as USDC, its strong regulatory posture can be a fit for U.S. enterprises piloting on-chain settlement.

- FDUSD, TUSD, EUR- and GBP-pegged coins: Increasingly, merchants serving European or UK customers experiment with EUR- and GBP-pegged stablecoins to reduce FX friction at checkout. For specialized marketplaces, matching customer currency with a local-fiat-pegged stablecoin can raise conversion rates.

Takeaway for payments: DAI shines where decentralization and composability are strategic. GUSD and similar regulated coins can grease the wheels for pilots with banks and public companies. Euro/sterling stablecoins help merchants localize the final step of the checkout.

Table 2: Other Players in the Stablecoin Race in Payments

| Stablecoin | Issuer / Governance | Peg | Competitive Edge | Limitations | Best Use Cases | 2026 Trends |

|---|---|---|---|---|---|---|

| DAI | MakerDAO (decentralized) | USD (overcollateralized with crypto + RWAs) | Decentralized governance, composability in DeFi | Peg stability relies on collateral quality, governance risk | DAO treasuries, Web3-native platforms, DeFi payments | Growing share of reserves in U.S. Treasuries, improving peg resilience |

| GUSD | Gemini Trust Company (regulated in NY) | USD (fully backed) | NYDFS regulation, strong compliance posture | Low market cap, limited liquidity | Enterprise pilots, U.S.-regulated PSP integrations | Partnering with banks for on-chain settlement pilots |

| FDUSD | First Digital Labs (Hong Kong) | USD (fully backed) | Strategic partnerships with Binance and Asian PSPs | New entrant, regional adoption limits | Asia-Pacific payments, exchange settlements | Integration with Hong Kong’s digital asset regulations |

| EURC | Circle (EU branch) | Euro | Familiar brand via USDC issuer, compliance-ready | Limited merchant adoption outside EU | Euro-denominated e-commerce, EU remittances | Leveraging MiCA for broader EU rollout |

| XSGD | StraitsX (Singapore) | Singapore Dollar | Strong regional banking ties, MAS-regulated | Low liquidity outside Singapore | Local e-commerce, regional cross-border trade | Integration with regional real-time payment systems |

| CBDCs | Central banks | National fiat | Sovereign backing, legal tender status | Limited interoperability with DeFi, privacy concerns | Domestic retail payments, government transfers | Pilots expanding to cross-border corridors with stablecoin bridges |

Regional Stablecoins and Vertical-Specific Use Cases

Regional issuers—licensed fintechs or bank consortiums—are piloting industry-specific stablecoins (for trade finance, supply chain invoices, or B2B marketplaces). While volumes are modest today, the fit is tight: faster netting/settlement and automated reconciliation for sectors where payments are embedded deep inside operational workflows.

CBDCs as Potential Competitors or Partners

Central bank digital currencies may compete with USD stablecoins in domestic retail payments, but they could also interoperate with commercial stablecoins for cross-border corridors. In practice, expect a hub-and-spoke future: CBDCs for domestic rails, stablecoins as bridge assets across jurisdictions or platforms that need composability with DeFi and Web3.

Predictions for the Stablecoin Race in Payments (2026–2030)

Forecasting five years out is tricky—but certain trajectories feel durable.

Likely Market Leaders by Region

- Americas & EU: USDC and PYUSD gain share where regulatory alignment and card-network partnerships matter most.

- Emerging Markets (LATAM, Africa, parts of APAC): USDT maintains lead on P2P liquidity and low-fee rails.

- Niche/Tech-Forward Ecosystems: DAI and select regional coins see steady adoption among developer-centric products and DAO-native platforms.

Multi-Stablecoin Ecosystem Scenarios

Rather than one coin to rule them all, merchants will support 2–4 stablecoins simultaneously, choosing by customer geography, fee profile, and compliance needs. Gateways and PSPs will abstract this choice, routing to the optimal coin per transaction—similar to how acquirers route card transactions today.

Technology Innovations Driving the Next Phase

- Account abstraction & smart wallets: Customers pay with any stablecoin; merchants receive their preferred asset automatically.

- Real-time FX and auto-conversion: On-chain liquidity smooths multi-currency settlement behind the scenes.

- Risk engines + AI: Transaction scoring reduces fraud/chargebacks and flags sanctions/AML risks before settlement.

Table 3: Strategic Comparison of USDT, USDC, and PYUSD in the Stablecoin Race in Payments

| Criteria | USDT (Tether) | USDC (USD Coin) | PYUSD (PayPal USD) |

|---|---|---|---|

| Market Strategy | Dominate emerging markets and global P2P transfers | Target enterprises, financial institutions, and regulated markets | Leverage PayPal’s existing merchant and user network |

| Primary Audience | Users in unstable currency regions, remittance corridors | B2B enterprises, fintechs, compliance-focused PSPs | Merchants and consumers already on PayPal |

| Competitive Edge | Massive liquidity, ultra-low fees, multi-chain support | Strong regulatory compliance, transparent reserves, Visa/Mastercard partnerships | Seamless integration with PayPal & Venmo |

| Limitations | Transparency concerns, ongoing regulatory scrutiny | Slower adoption in informal markets, higher ETH fees | Recently launched, limited blockchain support |

| Key Growth Regions | Asia, LATAM, Africa | U.S., EU, Singapore, Japan | U.S., EU, Canada, APAC pilots |

| Transaction Speed & Cost | Near-instant, <$0.01 on Tron | Instant on Solana/Base, higher on ETH | Instant within PayPal, seconds on blockchain |

| Adoption Level | Widest in global crypto commerce | Favored by large enterprises & regulated PSPs | Instant access to 30M+ PayPal merchants |

| 2026 Trends | Expanding reserves in U.S. Treasuries | Multi-chain expansion, CBDC interoperability tests | International rollout, deeper e-commerce integrations |

Merchant’s Guide to Accepting Stablecoin Payments

For operators, here’s a practical, non-fluffy playbook to tap the Stablecoin Race in Payments without drowning in technicalities.

Choosing the Right Stablecoin for Your Market

- Audience geography:

- Emerging-market customers → include USDT (Tron/Solana).

- Regulated B2B or enterprise buyers → include USDC.

- PayPal-native e-commerce → add PYUSD for frictionless uptake.

- Checkout UX: Keep options to 2–3 coins max to reduce cognitive load.

- Treasury policy: Decide what to hold vs. auto-convert (and to which fiat).

Integration Options for E-Commerce and POS Systems

- Crypto gateways (e.g., XAIGATE): One API/plug-in, multi-coin support, built-in compliance tooling.

- Direct wallet integrations: Maximum control, but higher maintenance and compliance overhead.

- PayPal ecosystem: For merchants already using PayPal, PYUSD can be turned on with minimal effort.

Tip: Treat stablecoin rails as additional acquiring routes—run A/B tests by geography and basket size, then standardize on what converts best.

Security Best Practices for Stablecoin Transactions

- Address allow-listing for payouts; per-transaction limits for refunds.

- Multi-sig or hardware-secured custody for hot wallets.

- Real-time blockchain screening (OFAC/sanctions, mixing, scam patterns).

- Segregate settlement wallets from operating wallets; keep an audit trail for every conversion event.

Case Studies of Stablecoin Payments in Action

Concrete stories help teams align on why and how to proceed.

E-Commerce Using USDC for Instant Settlement

A cross-border electronics retailer serving EU and U.S. customers added USDC on Solana at checkout. Chargeback-prone orders dropped (on-chain finality), and cash conversion cycles improved because funds settled in minutes, not days. The finance team now auto-converts a portion to EUR/USD daily while retaining a USDC buffer for supplier payments.

Travel Platforms Leveraging USDT for Global Customers

A mid-size OTAs (online travel agency) noticed high abandonment from LATAM and Southeast Asia due to card declines and FX fees. By adding USDT (Tron), the site reduced payment friction for price-sensitive travelers and saw repeat bookings increase—USDT held by customers functioned like a prepaid travel wallet.

Subscription Services with PYUSD Integration

A U.S. SaaS tool for freelancers turned on PYUSD within PayPal. Customers paying from PayPal balances experienced zero onboarding friction; refunds and plan upgrades used the same rails, simplifying support workflows. Internally, the company set rules to auto-settle PYUSD to USD daily to reduce treasury volatility.

Expert Insights on the Stablecoin Race in Payments

What do seasoned operators emphasize when they deploy stablecoins at scale?

- “Abstract choice from the user.” Let buyers pay with what they already hold; handle conversion server-side.

- “Route by outcome, not ideology.” For a given cart: if USDT yields the cheapest, fastest clearance to the merchant’s target asset, route there; if the buyer is enterprise-grade and needs attestations, prefer USDC; if they’re PayPal-native, PYUSD reduces friction.

- “Compliance is a product feature.” Embedding KYC/KYB, Travel Rule messaging, and sanctions checks into the payment flow increases authorization rates with partners and lowers enterprise sales friction.

- “Measure net margin, not just fees.” Faster settlement and fewer chargebacks can offset higher nominal network fees on some chains.

These principles show up repeatedly in teams that scale on-chain payments without derailing finance or legal.

Conclusion — The Future of the Stablecoin Race in Payments

The Stablecoin Race in Payments is less about branding and more about fit-for-purpose rails.

- USDT leads where ubiquity and low cost rule.

- USDC excels where compliance, attestations, and enterprise trust drive decisions.

- PYUSD lowers the barrier for PayPal-native merchants and consumers, turning stablecoin payments into a familiar click.

For most merchants, the winning strategy isn’t picking a champion—it’s supporting a short list, routing intelligently, and automating treasury so finance stays in control. Payments have always been about cost, conversion, and control; stablecoins merely give operators more dials to turn.

FAQs – The Stablecoin Race in Payments and Its Impact on Global Transactions

1. What are stablecoins and why are they important in global payments?

Stablecoins are cryptocurrencies pegged to a stable asset, like the US dollar, to reduce volatility. They help businesses and individuals send money internationally with faster settlement times and lower costs compared to traditional banking.

2. How does USDT differ from USDC and PYUSD in payment use cases?

USDT is the most widely used stablecoin, offering high liquidity across exchanges. USDC is regulated in the U.S. and often preferred by institutions, while PYUSD, issued by PayPal, is designed to integrate directly with mainstream payment platforms.

3. Which stablecoin is most commonly used for cross-border transactions?

Currently, USDT dominates cross-border payments due to its high adoption in emerging markets and broad availability. However, USDC is growing in regulated markets, and PYUSD is targeting retail adoption through PayPal’s ecosystem.

4. Why is the stablecoin race significant for global financial systems?

The competition among USDT, USDC, and PYUSD drives innovation in payment speed, cost reduction, and financial inclusion. It also pressures traditional banking systems to modernize their cross-border payment infrastructure.

5. Is PYUSD a safer option because it’s backed by PayPal?

PYUSD benefits from PayPal’s compliance infrastructure and brand trust, but safety also depends on factors like regulatory clarity, reserve transparency, and market adoption—not just the issuer’s reputation.

6. How do regulations impact the use of stablecoins in payments?

Regulations influence where and how stablecoins can be used. Stricter rules may increase trust but can limit adoption in certain regions, while looser regulations encourage faster growth but carry higher risks.

7. Are stablecoins better than traditional bank transfers for international payments?

In most cases, stablecoins offer faster transactions, lower fees, and 24/7 availability compared to bank wires. However, they require users to manage crypto wallets and understand basic blockchain technology.

8. How do transaction fees compare between USDT, USDC, and PYUSD?

Fees vary by blockchain network. For example, USDT on Tron often has near-zero fees, USDC on Ethereum can have higher gas costs, and PYUSD aims for low-cost transfers within PayPal’s payment ecosystem.

9. What risks should businesses consider before accepting stablecoin payments?

Key risks include regulatory uncertainty, blockchain network congestion, and reliance on the issuer’s reserve management. Businesses should also have secure custody solutions for digital assets.

10. Will stablecoins replace traditional payment methods in the future?

It’s unlikely stablecoins will fully replace traditional payments soon, but they are expected to become a core part of global finance, especially for cross-border trade and digital commerce.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!