Money has become invisible with the increasing number of business that accept cryptocurrency in 2025, like Baba Vanga predicted “What was, will be no more”.

Of course, Baba Vanga couldn’t have predicted the potential of cryptocurrencies with absolute accuracy, that’s because in her time, paper money was even hard to come by.

(And because there was no crypto payment gateway as good as XAIGATE in the 20th century! JK!)

Contents

1. DIFFICULTIES OF USING TRADITIONAL CURRENCY

Money at the present time is invisible, but it’s not completely invisible.

Hard to keep up with trends

Cash is still the main type of asset traded in many countries that are not yet highly developed in technology. Even in many rural areas, shopkeepers do not accept bank transfers, they only accept coins and paper money.

Let’s imagine: You go to a rural area in East Germany like Saxony or Brandeburg, carrying a black card worth millions of dollars on the street. All you want is a honey Bienenstich for breakfast. The old lady asks you for 3 euros in cash, and of course, do not accept transfers! All you can do is starve, go home and wait for your local friend to bring you some sausages smelling of parsley for breakfast! What a terrible morning!

It’s a funny story that might make people laugh and poke fun at you, but in reality, I don’t think it’s all that funny. It’s not just about not getting the cake—it highlights a deeper issue. Such situations reflect how some rural areas are falling behind, disconnected from the rapidly advancing world that is increasingly focused on future technologies.

Being controlled

Moreover, digital banking still uses traditional currencies. All your transactions remain under the radar of the central bank or financial institution, along with a lot of fees a year to renew a galactic card. You lose financial autonomy, why? Because you are always dependent on the policies of the banks and the control of the government.

Inflation

With cash, there is a very painful problem that I probably shouldn’t go into too much here – inflation. Any country that tends to print more cash (fiat) to compensate for the budget deficit will gradually become uncontrolled and suffer from severe inflation. At that time, sadly, the value of their currency will slide down the international currency list.

Venezuela is a typical example of inflation. Buying a can of Coca Cola here costs tens of millions of old bolivars. What a price! So, the government of this country had to change to new bolivars to simplify all transactions.

2. WHY SHOULD WE SWITCH TO CRYPTOCURRENCY?

Convenience

Clearly, I’ve noticed that credit cards have become a convenient way to carry out transactions. In countries with strong tech industries, like China or Vietnam, where QR codes are integrated into payment gateways in most stores—even street vendors—people only need to bring their smartphones with an internet connection, linked to their bank cards. It’s incredibly convenient!

Imagine a future where you can go abroad and just need your phone for transaction. Just use a reputable crypto payment gateway (nice to meet you, XAIGATE again!) and you don’t have to worry about transferring denominations, worrying about slow speeds, or losing any coins on the road.

Still true to the nature of money

Additionally, as discussed in Homo Sapiens, from a philosophical standpoint, money is merely a “fiction” that society collectively agrees to believe in to maintain economic order, not something with inherent, permanent physical value. Whether it’s cash, crypto, or credit cards, the money they represent is an abstract concept built by people. Using crypto isn’t a fundamental change, but rather a transformation to a higher level of trust. We trust in Bitcoin and the scale of the community that uses it, and because of this trust, it holds value.

Just like in the past we believed that the United States dollars were the strongest currency in the world, the trust of the users makes the power of that currency, not the face of George Washington printed on the $1 bill! Am I right?

The legal shift

Let’s dive into the politics of it for a moment. Laws evolve alongside the broader developments in the world, and global powers are certainly not excluded from this new trend. In countries like the US, Japan, and Singapore, regulations around cryptocurrencies are typically embedded within existing laws on transactions and payment services. The European Union, however, takes a more unified approach with the implementation of MiCA regulations across the bloc. In contrast, China has maintained its distinct, communist-style stance, with the People’s Bank of China completely banning personal cryptocurrencies while focusing on developing the national Digital Yuan. This demonstrates just how significant cryptocurrencies have become, to the point where every country needs a solid legal framework to effectively manage them.

XAIGATE has mentioned the new EU MiCA regulation HERE! Read more analysis!

Why will business that accept cryptocurrency be a trend in 2025?

I just gave an example of Mrs. Vanga, of course she could not predict which cryptocurrency would prevail, but she was right that the world is always changing. The world is now rotating around digital, cryptocurrency is inevitable.

Think about the recent job trends. Gen Z, and young Millennials are the main young workforce in the job market today. Safe and secure is no longer in the job dictionary of the majority of young people. They love technology! Young ones love working remotely! They love laptops and Starbucks sessions instead of boring offices and desktop computers! And of course they don’t like to settle for one job but can take 2-3 jobs at a time! And crypto is perfect to pay them.

Some “digital native” even do airdrops and coin mining for a living, and they are paid in cryptocurrency. Their assets are this currency, and all they need to do is find a good crypto-fiat gateway (like XAIGATE!) to receive and spend the money.

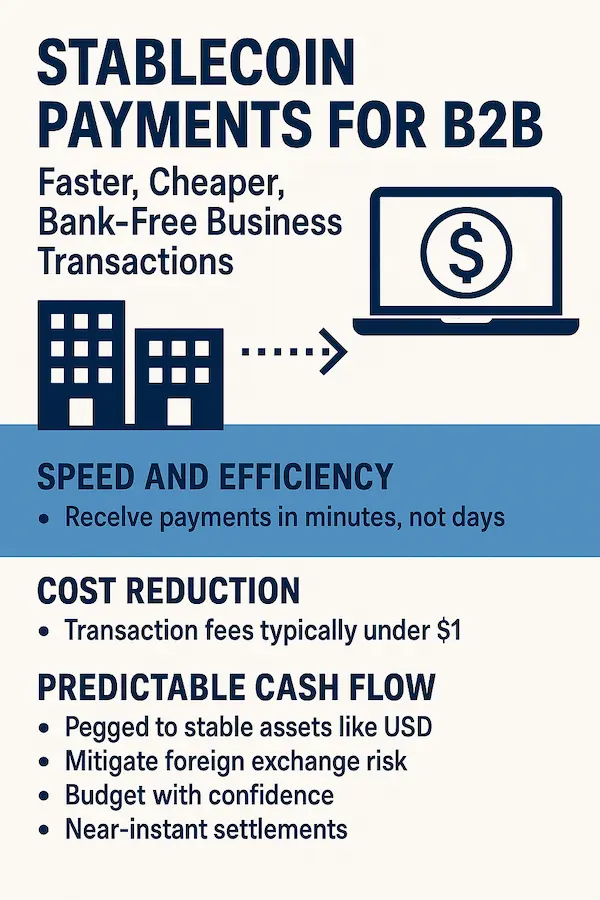

Furthermore, business that accept cryptocurrency will benefit greatly. It is clear that the petty concerns about the new wave of the market are not big enough to overshadow what it can bring to a business. Business that accept cryptocurrency will have a competitive advantage, when they can serve global customers and have fast speed when transacting across borders. The transaction system is also safe and transparent, helping to protect both businesses and customers from fraud risks. The “big guys” in many industries around the world have kept up with this trend, such as Microsoft, Tesla, Starbucks, Burger King, Home Depot, etc.

How about your business?

READ MORE: 5 REASONS Why Your Small Business Needs a Crypto Fiat Payment Gateway for Growth

3. IS YOUR BUSINESS READY?

Is your business ready to be the trendy business that accept cryptocurrency?

Trust me, How to Accept Bitcoin on WooCommerce is not just a way to “fit in”, but also a strategic move to expand the market and optimize costs. With the blockchain industry predicted to create billions of dollars in value, early participation is the key to success.

Because in the business world, winning or losing is all about the vision of the head of that business! Are you a visionary, brilliant business owner?

Register with XAIGATE today to receive a special offer and start accepting crypto payments in just a few simple steps.

SEE more at XAIGATE’s website.

We’re also on X (@mxaigate), GitHub and Linkedin! Follow us!

Cryptocurrency is the future, XAIGATE wants to draw the future with you, my dear!