Contents

1. How to Make a Cryptocurrency: A Comprehensive Guide

Creating a digital currency involves several crucial stages. To understand How to Make a Cryptocurrency?, it’s essential to first grasp the core concepts of blockchain technology. Additionally, learning programming languages such as C++ and Solidity, which are used for coding the currency itself, is key. Securing the network and ensuring compliance with legal requirements are also critical to the success of your cryptocurrency launch.

Understanding Cryptocurrencies

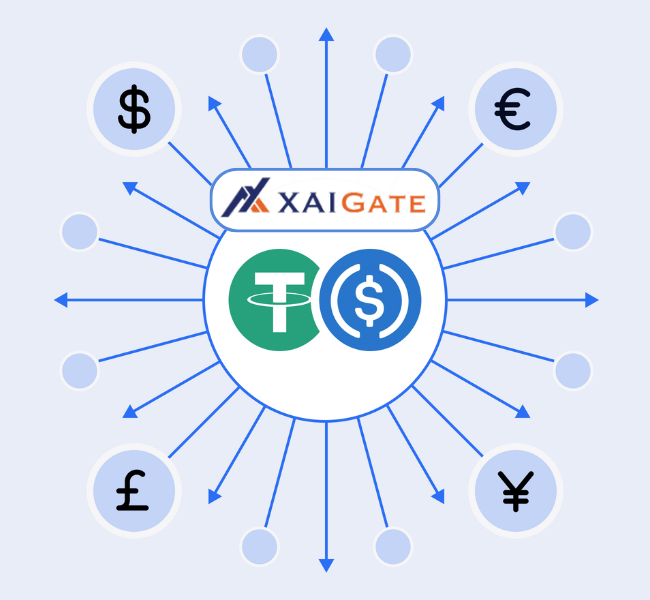

To begin learning how to make a cryptocurrency, it’s vital to understand what cryptocurrencies are and how they function within the decentralized framework of blockchain technology. Studying well-established currencies like Bitcoin, Ethereum, USDT, and USDC will provide valuable insights into their functionality, market dynamics, and operations. This foundational knowledge is essential for developing a secure and effective digital coin.

Definition and Basic Concepts

A cryptocurrency is digital or virtual money that uses cryptographic techniques to secure transactions. It operates outside the control of any central authority. Key concepts to understand include blockchain technology, which records transactions on a distributed ledger, and decentralization, ensuring that no single entity can dominate the network. Other important characteristics include anonymity, transparency, and immutability of data.

Types of Cryptocurrencies

Cryptocurrencies come in different types, each serving different purposes. The first and most widely known cryptocurrency, Bitcoin, primarily acts as an online store of value. Altcoins like Ethereum offer additional functionalities, such as enabling smart contracts, while stablecoins are pegged to a reserve asset to maintain their value stability. There are currently more than 20,000 cryptocurrencies in the market, each catering to different needs and niches.

Planning Your Cryptocurrency

How To set up your crypto checkout, start by defining its purpose and target audience. Develop a detailed whitepaper outlining technical specs, the economic model, and governance. Assemble a skilled team of developers and advisors to help build and launch your coin.

When learning set up your crypto checkout one of the first steps is to define its purpose and target audience. Creating a detailed whitepaper that outlines the technical specifications, economic model, and governance structure is crucial. It’s also important to assemble a skilled team of developers and advisors to assist in building and launching your cryptocurrency.

Purpose and Use Case

When you ask how to make a cryptocurrency, understanding its purpose and use case is critical. Identifying the problem your cryptocurrency will solve or the niche it will serve will guide the features and development of your coin. Clear use cases help ensure that the cryptocurrency meets user needs and has a practical deployment in the market.

Choosing a Consensus Mechanism

One of the key decisions when learning how to make a cryptocurrency is selecting a consensus mechanism. This mechanism determines how transactions are validated and added to the blockchain. Proof of Work (PoW) offers high security but can be energy-intensive, while Proof of Stake (PoS) is more energy-efficient and offers scalability. The choice of consensus mechanism will impact your cryptocurrency’s performance, security, and scalability.

2. Technical Aspects of Creating a Cryptocurrency

To create a cryptocurrency, you’ll need to decide whether to build a new blockchain or use an existing platform like Ethereum. Developing smart contracts and implementing secure consensus mechanisms for transaction verification are essential steps. Additionally, understanding encryption processes and network protocols is vital to creating a reliable and secure digital currency.

Selecting a Blockchain Platform

Choosing the right blockchain platform is crucial when learning how to make a cryptocurrency. The platform you select should align with your goals. For instance, Ethereum is ideal for creating smart contracts, while Binance Smart Chainis a more cost-effective option for creating tokens. Consider scalability, security, and community support when choosing your platform to ensure it can effectively support your cryptocurrency project.

Developing the Core Code

The core code is a crucial step in developing the cryptocurrency. This includes writing the blockchain protocol, specifying the transaction processing, and determining the security issues. Proficiency in programming languages such as C++ or Solidity is required for making a strong and effective currency.

Creating Smart Contracts

Smart contracts are one of the most important steps in learning “how to make a cryptocurrency?”. These self-executing contracts will automate transactions and enforce rules without the need for intermediaries. Smart contract coding can thus help you define your cryptocurrency’s functionality as well as its conditions of use, ensuring that it operates transparently and efficiently.

Establishing the Cryptocurrency

Creating a cryptocurrency involves designing and launching it on a blockchain, defining features like total supply and consensus, and integrating wallets and exchanges. Strong security and compliance are essential for its success and legitimacy.

Minting Your Cryptocurrency

Digitally minting a currency entails the generation of new coins and their distribution within a particular blockchain. Generally, it would require determining the overall amount, establishing smart contracts and confirming that the coins comply with the requirements of that specific platform. It is therefore necessary to properly address this issue in order for cryptocurrencies to become workable and safe as they are launched.

Setting Up a Wallet

An essential step in setting up a cryptocurrency is setting up a wallet that allows users to store their digital assets securely and manage them accordingly. You will need to select from software wallets for convenience or hardware wallets to boost your security level. If you want to keep your cryptocurrency safe, you need to set up your wallet appropriately and back it up.

Ensuring Security and Compliance

When setting up a cryptocurrency, it is crucial to prioritize both security and compliance to prevent fraud, legal issues, and ensure long-term success. Implementing robust encryption, conducting regular security audits, and adhering to legal and regulatory guidelines are key steps to maintain both the safety and lawfulness of your project.

Security Best Practices

When developing a cryptocurrency, security best practices are essential to protect against theft, fraud, and hacking.

-

Strong Encryption: Implement state-of-the-art encryption techniques to safeguard sensitive data and transactions.

-

Regular Software Updates: Keep the software up-to-date to ensure vulnerabilities are addressed promptly.

-

Multi-Signature Wallets: Utilize multi-signature wallets for an extra layer of security, ensuring that multiple parties must authorize transactions.

-

Vulnerability Awareness: Stay informed about the most common vulnerabilities in the crypto space and remain vigilant to potential attack vectors.

By following these best practices, you can significantly reduce the risks of fraud and maintain the integrity of your cryptocurrency.

Legal and Regulatory Considerations

Navigating legal and regulatory considerations is one of the most critical aspects of creating a cryptocurrency. Compliance with local laws and regulations is essential to avoid legal issues that could halt your project.

-

AML and KYC Compliance: Adhere to Anti-Money Laundering (AML) laws and Know Your Customer (KYC) requirements to prevent fraudulent activities and ensure the legitimacy of your cryptocurrency.

-

Legal Expertise: Work with legal experts who specialize in cryptocurrency laws to help navigate the complex regulatory landscape. This ensures your project stays compliant with local and international laws.

By securing expert advice and following these guidelines, you can avoid legal pitfalls and ensure the ongoing success of your cryptocurrency.

3. Launching Your Cryptocurrency

The launch of your cryptocurrency is a crucial phase that requires thorough planning and coordination. Here’s how to ensure a smooth and successful launch:

-

Finalizing Technical Aspects: Before launching, finalize all technical details, including blockchain infrastructure, consensus mechanisms, and transaction protocols.

-

Conducting a Comprehensive Security Audit: Perform a comprehensive security audit to identify and fix any vulnerabilities in your system.

-

Marketing and Promotion: Employ effective marketing strategies to attract investors and users. This might include social media campaigns, influencer partnerships, and content marketing to promote your coin.

-

Target Audience Engagement: Ensure your marketing efforts reach the right audience to create interest and drive adoption. A successful launch involves engaging the community, getting their feedback, and building trust.

By coordinating these steps, you ensure your cryptocurrency not only launches successfully but also gains traction in the market, allowing it to thrive in the competitive space.

Building a Community

Creating a cryptocurrency requires building a community, which is crucial for gaining support and engaging people in your project. Establish trust in potential users and investors through social media, forums, or events. A good, active community can encourage adoption or help your cryptocurrency to thrive.

Marketing and Promotion

Success of any cryptocurrency depends fundamentally on effective marketing and promotion. For instance, a strong online presence can be achieved for your currency through social media, forums, targeted campaigns etc., to attract both investors and users. Furthermore, being part of the community is vital; as such, it is imperative to utilize a clear message that passes on an idea during the day-to-day running of the business. This will ultimately lead to more visibility and widespread acceptance in future.

4. Maintaining and Updating Your Cryptocurrency

Long-term success and security of your cryptocurrency depend on regular maintenance and updates. Keeping it current with bug fixes, feature improvements, and technological advancements ensures a reliable platform that adapts to evolving digital trends.

Ongoing Development

In creating and maintaining a successful cryptocurrency, ongoing development is essential. Regular updates and improvements serve to address security vulnerabilities, improve functionality, and adapt to market changes. Continuous community engagement and developer activities are important for ensuring that the cryptocurrency evolves in line with the fast-changing digital environment.

Scaling and Future Plans

The creation of cryptocurrencies requires scaling and future planning as important elements to ensure success in the long run. Once your currency gains popularity, prepare for an upsurge in demand and put money into options that can manage growing transaction volumes efficiently. Additionally, coming up with a platform that can make way for better versions of itself also helps when it comes to technology changes since there are also changes in market trends.

5. Conclusion

As a way out, acquiring knowledge on “How to Make a Cryptocurrency?” entails grasping the concept of blockchain technology, choosing the appropriate platform alongside making sure compliance with the law. If these essentials are well mastered and fortified by good security measures, you are able to create your own money that can be circulated across borders easily. Additionally, continuous improvements might not only help the sustainability but also keep track of changes in politics over time which directly affect its progress.