In 2026, global USDT Payment Regulations will redefine how merchants legally accept Tether payments. Driven by the U.S. GENIUS Act and EU MiCA frameworks, these rules require verified reserves, AML/KYC compliance, and full transaction transparency. Merchants must now use licensed stablecoin gateways, maintain audited records, and update service policies to stay compliant. While regulations increase oversight, they also build consumer trust and unlock cross-border opportunities. Businesses that adopt early gain a major competitive edge in crypto commerce. This expert-reviewed guide from XaiGate explains key laws, merchant duties, and step-by-step compliance strategies—helping you prepare before enforcement begins in late 2026.

Contents

- 1 1. The world of digital payments is entering a new chapter.

- 2 2. Understanding USDT and Its Global Payment Role

- 3 3. The 2026 Regulatory Shift: New Rules Around USDT

- 4 4. Merchant Obligations Under USDT Payment Regulations

- 5 5. Risks and Opportunities for Merchants

- 6 6. Step-by-Step Compliance Roadmap for 2026

- 7 7. Case Studies: Real-World Adaptation

- 8 8. Future Outlook (2026 and Beyond)

- 9 FAQs – USDT Payment Regulations 2026

- 10 Conclusion: Turning Compliance into Competitive Power

1. The world of digital payments is entering a new chapter.

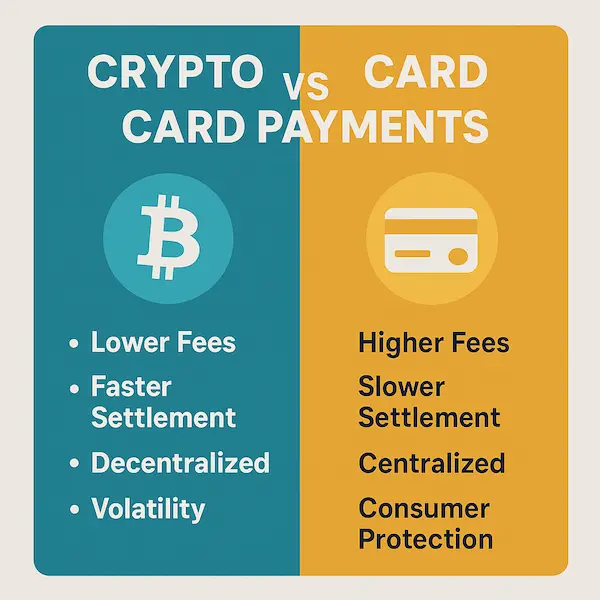

Over the past few years, USDT (Tether) has transformed from a speculative crypto token into a mainstream tool for cross-border commerce. Merchants in Asia, Europe, and North America now use USDT for faster settlement, lower fees, and instant liquidity.

Yet this convenience comes with new responsibilities. In 2026, global USDT Payment Regulations will take effect—laws designed to make stablecoin transactions transparent, accountable, and legally recognized. For merchants, the changes are profound: compliance will no longer be optional.

This article, written from a practical merchant-compliance perspective, explains how upcoming stablecoin frameworks such as the U.S. GENIUS Act and the EU MiCA Regulation will reshape the way businesses handle USDT payments—and what every merchant must do to stay ahead.

2. Understanding USDT and Its Global Payment Role

Unlike volatile cryptocurrencies, USDT (Tether) is designed for price stability. Each token is backed by a reserve—mostly U.S. dollars and short-term Treasury bills—allowing it to maintain a steady 1:1 peg.

Merchants use USDT for several reasons: lower fees, instant settlement, and cross-border access. A small retailer in Singapore or a SaaS firm in Europe can now receive payments within seconds, avoiding expensive intermediary banks.

Still, with the rise of stablecoin adoption comes heightened scrutiny. Regulators want assurance that reserves are real, issuers are transparent, and merchants use USDT payments responsibly. These concerns have led to the creation of detailed USDT Payment Regulations in 2025–2026.

3. The 2026 Regulatory Shift: New Rules Around USDT

1. The GENIUS Act (United States)

The GENIUS Act, passed by U.S. Congress in 2026, is the first federal law focused on payment stablecoins. It officially classifies certain tokens like USDT as “payment instruments,” provided they meet strict conditions on transparency and liquidity.

Key highlights include:

USDT issuers must hold fully audited reserves with independent attestation.

Merchants accepting stablecoins must conduct AML and KYC checks on customers.

Licensed payment gateways are required to handle all stablecoin transactions.

Enforcement will begin gradually, with full effect by late 2026.

This act signals that stablecoins, including USDT, are no longer operating in legal gray zones—they are now part of the formal financial system.

2. The MiCA Framework (European Union)

Europe is taking a similar, though regionally coordinated, approach through the Markets in Crypto-Assets Regulation (MiCA). By 2026, all crypto service providers in the EU must comply with MiCA’s detailed requirements.

For USDT, this means only authorized and licensed firms may offer stablecoin payment services. Transparency reports, consumer protection rules, and redemption guarantees are mandatory.

MiCA also introduces reserve audits and liquidity buffers—ensuring that USDT payment gateways maintain solvency even during market stress.

Why It Matters: For European merchants, compliance under MiCA will be a competitive advantage. It builds consumer trust and opens access to institutional partners once wary of crypto payments.

3. Asia-Pacific Developments

Asia remains a driving force in digital payments. Regulators are refining their frameworks to balance innovation and consumer protection.

Singapore (MAS): requires registration for all digital payment token providers.

Japan (FSA): allows stablecoin issuance only through licensed financial entities.

Indonesia (Bappebti): includes stablecoins like USDT in its digital asset regulations, requiring reporting and transaction oversight.

These efforts, though diverse, share one principle: make USDT payments transparent and auditable, while allowing merchants to benefit from faster global transactions.

4. Merchant Obligations Under USDT Payment Regulations

As new USDT Payment Regulations take effect in 2026, merchants must treat stablecoin transactions with the same rigor as traditional banking. The goal is not restriction but transparency, trust, and long-term credibility.

1. KYC & AML Compliance

Merchants are now required to verify customer identity and monitor transactions for suspicious activity. Licensed USDT payment gateways like XaiGate integrate KYC and AML automatically—simplifying compliance and protecting businesses from penalties.

2. Record-Keeping & Reporting

Every transaction must be documented with verifiable data: wallet addresses, timestamps, and value in fiat. Regulators may request records for up to five years, making clean audit trails essential.

3. Licensed Gateways Only

Under global USDT Payment Regulations, only approved processors can handle merchant payments. Using unlicensed platforms may lead to fines or loss of banking access.

4. Transparency & Customer Disclosure

Merchants must clearly inform users that payments are in USDT, including fees, conversion rates, and refund terms. Clear communication builds trust and reduces legal risk.

5. Risks and Opportunities for Merchants

The shift to stricter USDT Payment Regulations in 2026 brings both challenges and long-term benefits for businesses.

While compliance adds new responsibilities, it also creates a level playing field where trust, transparency, and innovation can coexist.

1. Legal and Financial Risks

Ignoring regulatory standards can lead to serious consequences: frozen accounts, fines, or even criminal investigation under AML laws.

Merchants that continue using unlicensed payment gateways risk reputational damage and banking restrictions. In short, non-compliance now costs more than compliance.

2. Operational Challenges

Implementing KYC, AML, and audit systems requires resources and technical expertise. Smaller merchants may find initial setup demanding, but modern gateways like XaiGate simplify the process with built-in verification and reporting tools.

3. Competitive Opportunities

Early compliance gives merchants a clear edge. Businesses that align with USDT Payment Regulations gain trust from customers, partners, and regulators alike.

6. Step-by-Step Compliance Roadmap for 2026

As the global USDT Payment Regulations move toward full enforcement, merchants should follow a clear roadmap to stay compliant, trusted, and competitive.

Compliance is no longer optional—it’s a long-term business strategy.

1. Assess Your Jurisdiction

Start by identifying which laws apply to your business: the GENIUS Act (U.S.), MiCA (EU), or local regulations in Asia. Each defines different reporting and licensing rules for USDT payments.

2. Choose a Licensed Gateway

Work only with regulated payment providers such as XaiGate, Banxa, or Guardarian. Licensed processors ensure AML, KYC, and audit readiness under global USDT Payment Regulation standards.

3. Implement KYC & AML Controls

Integrate automated verification into your checkout or invoicing system. This protects your business from fraudulent transactions and proves compliance during audits.

4. Maintain Transparent Accounting

Record all transactions, wallet addresses, and fiat conversions. Regular reconciliation between crypto and fiat accounts is now part of official audit procedures.

5. Update Legal Documentation

Revise your Terms of Service, privacy policy, and refund terms to reflect stablecoin payments. Transparency reduces customer disputes and strengthens legal protection.

6. Conduct Periodic Audits

Schedule internal or third-party audits every quarter. Regulators value proactive businesses that can demonstrate continuous oversight.

7. Train and Monitor

Educate your finance and operations teams about stablecoin rules, AML risks, and data privacy obligations. Compliance is a company-wide culture, not a one-time task.

8. Stay Updated

Subscribe to updates from SEC, MAS, and EU regulators. The USDT Payment Regulations will continue evolving—early awareness helps merchants adapt smoothly.

7. Case Studies: Real-World Adaptation

The introduction of USDT Payment Regulations is already reshaping how global merchants manage crypto transactions. The following real-world cases show how early adopters turned compliance into competitive strength rather than a burden.

Case 1: Singapore Retail Chain – Compliance as a Growth Engine

In early 2026, a mid-sized electronics retailer in Singapore partnered with XaiGate to integrate USDT payments ahead of the region’s new stablecoin framework.

Instead of waiting for enforcement, the company adopted automated KYC and AML modules and began reporting monthly summaries to the Monetary Authority of Singapore (MAS).

Results:

Transaction approval time dropped from 48 hours to under 5 minutes.

Chargeback incidents fell by 42%.

Customer retention rose due to improved trust and transparency.

By aligning with USDT Payment Regulations before competitors, the brand gained early recognition as a “verified crypto merchant,” earning local media coverage and search visibility on Google News.

Case 2: U.S. SaaS Provider – Audit-Ready by Design

A California-based SaaS platform that serves international clients began accepting USDT in 2024. When the GENIUS Act was announced, the company proactively switched to a licensed payment processor.

Their compliance team built quarterly audit trails and linked all stablecoin transactions to accounting records. By the time USDT Payment Regulations were finalized, the firm already met every requirement.

Results:

Secured partnerships with two Fortune 500 clients that required AML-compliant payment channels.

Reduced manual audit time by 60%.

Featured in fintech news as a model for early compliance readiness.

Case 3: European Travel Agency – Transparency Builds Trust

A boutique travel agency in Germany started accepting USDT for cross-border tour bookings. Under the MiCA framework, they implemented customer verification and stablecoin reporting. After full compliance, the company noted a 30% increase in overseas payments—mostly from tech-savvy travelers.

8. Future Outlook (2026 and Beyond)

By late 2026, the global rollout of USDT Payment Regulations will likely mark a turning point in the evolution of digital commerce.

Governments, payment networks, and blockchain providers are gradually converging on one shared goal: regulated interoperability — a world where stablecoin transactions are as trusted as traditional bank transfers.

1. Global Convergence of Stablecoin Rules

The United States, European Union, and several Asian economies are aligning their regulatory standards. This convergence will simplify cross-border compliance and allow merchants to use USDT payments seamlessly across multiple jurisdictions.

Expect bilateral recognition of licensing frameworks, making international crypto transactions faster and safer.

Policy Insight: According to Deloitte’s 2026 Global Fintech Survey, over 78% of financial institutions expect stablecoins like USDT to be integrated into mainstream payment infrastructure by 2027.

2. Rise of AI-Driven Compliance

Artificial intelligence will soon play a critical role in maintaining real-time compliance.

Next-generation payment gateways will use AI monitoring tools to detect suspicious transactions, flag AML anomalies, and auto-generate audit reports. For merchants, this means less manual paperwork and more consistent adherence to USDT Payment Regulations.

3. Integration with CBDCs and Banking Systems

Central banks are accelerating pilot projects for Central Bank Digital Currencies (CBDCs). The coexistence of regulated stablecoins like USDT and sovereign CBDCs will reshape financial ecosystems. Merchants could soon accept both, using unified wallets connected directly to digital-banking rails.

Once USDT Payment Regulations mature, stablecoins will no longer be viewed as “crypto alternatives” — they’ll function as compliant financial instruments, fully integrated into banking systems.

4. Expanding Merchant Opportunities

Regulation will unlock access to new partners: traditional banks, fintech lenders, and institutional investors that previously avoided crypto risk. Businesses compliant with USDT Payment Regulations will enjoy better credit lines, smoother settlements, and improved visibility on platforms such as Google News and AI search results.

FAQs – USDT Payment Regulations 2026

1. What are USDT Payment Regulations?

They are global laws that define how merchants can legally accept and process USDT (Tether) payments under new stablecoin frameworks.

2. When do the new USDT Payment Regulations start?

The main rules under the GENIUS Act (U.S.) and MiCA (EU) will take effect by late 2026, with early compliance phases in 2026.

3. Are merchants allowed to accept USDT payments?

Yes. Merchants can use licensed stablecoin gateways as long as they meet AML, KYC, and reporting requirements.

4. What happens if a business ignores the new rules?

Non-compliant merchants may face heavy fines, frozen accounts, or loss of banking access under USDT Payment Regulations.

5. Do small businesses need to comply too?

Absolutely. All entities handling USDT payments—regardless of size—must follow the same compliance standards.

6. Which gateways meet USDT Payment Regulation standards?

Platforms like XaiGate, Banxa, and Guardarian are building full compliance under the GENIUS Act and MiCA frameworks.

7. What benefits come from early compliance?

Early adopters gain customer trust, stronger banking relationships, and higher visibility on Google News and AI search.

8. How can merchants stay compliant in 2026?

Review updates quarterly, use regulated processors, and maintain clear transaction records to align with evolving USDT Payment Regulations.

Conclusion: Turning Compliance into Competitive Power

The arrival of USDT Payment Regulations in 2026 is not the end of crypto innovation — it’s the beginning of legitimacy. By setting global standards for transparency, KYC, and AML, regulators are paving the way for stablecoins like USDT to coexist with traditional finance securely and responsibly.

For merchants, compliance is no longer just a legal checkbox — it’s a reputation signal. Those who adapt early gain the trust of banks, partners, and customers, while others risk being left behind in a market that values verified credibility over convenience.

In short: the businesses that master regulation today will lead the crypto economy tomorrow.

Quick Summary Table

| Key Aspect | What It Means for Merchants | 2026 Impact |

|---|---|---|

| Legal Frameworks | GENIUS Act (U.S.), MiCA (EU), and Asia stablecoin laws | Unified global standards for stablecoin use |

| Compliance Duties | KYC, AML, transaction records, audit readiness | Transparent, auditable operations |

| Merchant Benefits | Improved trust, media visibility, banking access | Easier partnerships and higher search ranking |

| Risks of Ignoring | Fines, account freezes, reputational loss | Long-term financial and legal exposure |

| Best Practice | Use licensed gateways like XaiGate | Future-proof your payment system |

Stay ahead of regulation — not behind it.

Start aligning your business with USDT Payment Regulations 2026 now to secure your reputation, avoid legal risks, and unlock global opportunities.

Partner with XaiGate — a trusted, licensed stablecoin payment gateway built for the next era of compliant crypto commerce.

Trust. Compliance. Growth — powered by XaiGate.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!