You can buy crypto with PayPal on select exchanges and fiat on-ramps by creating an account, completing KYC, and linking your verified PayPal wallet. Expect higher fees than bank transfer and possible withdrawal holds due to chargeback risk. For small, instant purchases, PayPal is convenient; for larger buys, consider ACH/SEPA to minimize costs.

Contents

- 1 1. How to Buy Crypto with PayPal in 3 Steps

- 2 2. Where You Can Buy Crypto with PayPal: Region × Platform Matrix

- 3 3. Total Cost to Buy Crypto with PayPal vs ACH/SEPA vs Card

- 4 4. Pros & Cons of Buying Crypto with PayPal

- 5 5. Security, Chargebacks & Compliance (Read Before You Buy)

- 6 6. Step-by-Step Walkthrough: Your First Purchase Using PayPal (Realistic Flow)

- 7 7. Real-World Case Studies: When PayPal Wins (and When It Doesn’t)

- 8 FAQs – How to buy crypto with Paypal

- 9 Conclusion: The Smart Way to Buy Crypto with PayPal (2026)

1. How to Buy Crypto with PayPal in 3 Steps

Buying is fast if you prepare correctly. Here’s the safest, fee-aware way to buy crypto with PayPal while avoiding the usual holds and errors.

Step 1: Pick a supported platform and pass KYC

Choose a reputable exchange or fiat on-ramp that lists PayPal as a funding method in your country. Create an account and complete identity verification before you attempt to buy crypto with PayPal—limits and withdrawals depend on it.

Pre-flight checks

- Name match: Your PayPal full name must match your exchange profile exactly.

- Region & coins: Confirm PayPal is enabled for your location and for the asset you want (BTC/ETH/major stablecoins).

- Security first: Turn on 2FA (authenticator app), set a withdrawal allowlist, and bookmark the official domain.

- Costs: Note the platform buy fee, expected spread, and any FX if your PayPal balance is in a different currency.

Step 2: Link PayPal as a payment method (and verify)

Go to Payments/Funding → Add PayPal and follow the prompts. Keep your PayPal account verified (email, phone, funding source) to reduce review flags.

Set up cleanly

- Use your PayPal balance or a stable funding source; avoid rapid card changes that trigger velocity checks.

- Disable VPN and ad-blockers during linking; they can break the PayPal pop-up.

- If the option doesn’t appear, switch to your legal name, confirm address, or re-check country settings.

Step 3: Choose asset, review total cost, buy, and secure storage

Pick the asset (BTC/ETH/stablecoin), enter the amount, and review total cost = platform fee + PayPal funding fee + spread (+ FX if any). Confirm only if the all-in price makes sense.

After you buy

- Withdrawal policy: PayPal is reversible, so some platforms add temporary withdrawal holds. Plan for a short wait on first purchases.

- Test first: Start with a small transaction (e.g., $50–$200) before scaling.

- Self-custody: For long-term holding, move funds to a wallet you control; keep seed phrases offline.

- Records & tax: Save the (redacted) receipt and execution details for accounting.

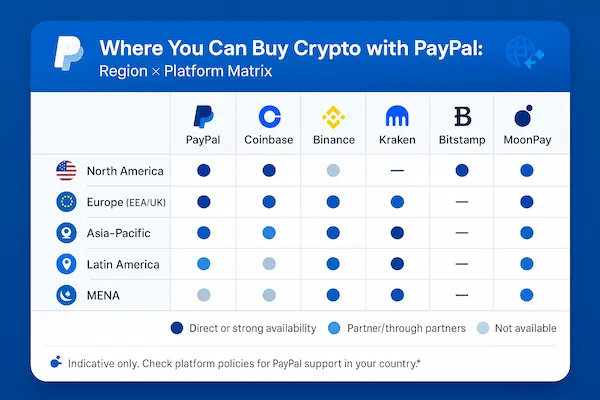

2. Where You Can Buy Crypto with PayPal: Region × Platform Matrix

Not every country or platform lets you buy crypto with PayPal in the same way. Availability depends on licensing, chargeback policies, and your verification tier. Use the matrix below as a practical decision map before you start a purchase.

Fast eligibility checklist (do this first):

- Confirm PayPal is listed for your country of residence (not just your current IP).

- Check the specific asset you want (BTC/ETH/major stablecoins) is permitted when funded by PayPal.

- Read the withdrawal policy for PayPal-funded crypto (first-purchase holds are common).

- Ensure exact name match between your PayPal account and the exchange profile.

Table 1: Where You Can Buy Crypto with PayPal

| Platform Type | Example Regions Enabled* | Coins via PayPal | Typical All-in Fees** | Starting Daily Limits** | Withdrawal Rules** | Best For / Notes |

|---|---|---|---|---|---|---|

| Global Exchange (custodial) | US, EU, UK, CA, AU, SG (varies by KYC) | BTC / ETH / some stables | Medium | Medium (rises with KYC) | Short holds for first-time buyers | Convenience + liquidity; broadest features |

| Regional Broker / On-ramp | Region-specific (e.g., EU only, or UK only) | BTC / ETH (limited alts) | Medium–High | Low–Medium | Often instant once trust is built | Clear pricing, simple UX, fewer coins |

| Non-custodial On-ramp → Wallet | Select markets | BTC / ETH / stables direct to your wallet | Medium | Medium | No custodial hold; network confirms | Self-custody first approach; wallet setup needed |

| P2P Marketplace (escrow) | Broad but seller-dependent | Varies by seller/listing | Varies | Seller-set | Depends on escrow release | Highest diligence; learn escrow hygiene |

Why availability differs

- Licensing & country rules: Platforms unlock PayPal by jurisdiction and KYC tier.

- Chargeback risk: Because PayPal payments can be reversible, risk teams cap limits or add temporary holds.

- Funding source: Some platforms allow PayPal balance only; others permit card-backed PayPal with tighter controls.

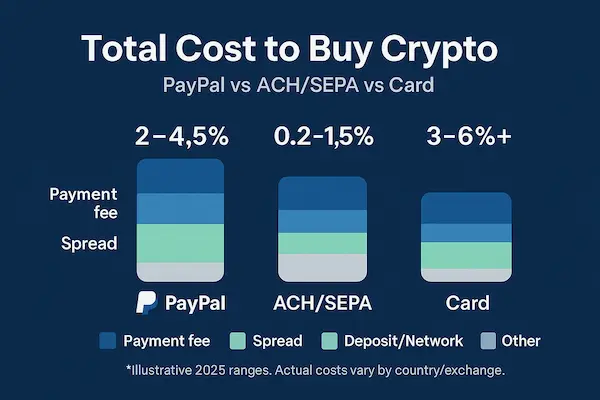

3. Total Cost to Buy Crypto with PayPal vs ACH/SEPA vs Card

When you buy crypto with PayPal, judge the all-in cost, not just the headline fee. The real price you pay includes fees, spread, and any currency conversion.

All-in cost formula Total Cost = Platform Buy Fee + PayPal Funding Fee + Spread + FX (if your PayPal currency ≠ quote currency).

| Purchase Size | PayPal (All-in) | Bank Transfer (ACH/SEPA) | Card (Visa/MC/Apple/Google Pay) | What It Means for You |

|---|---|---|---|---|

| $100 | ~3.5%–5.0% | ~0.5%–1.5% | ~4.0%–6.0% | Small, instant buys: PayPal/card win on speed; bank wins on cost |

| $500 | ~2.5%–3.8% | ~0.3%–1.0% | ~3.5%–5.5% | Mid-size: ACH/SEPA usually cheaper; PayPal still convenient |

| $2,000 | ~1.8%–3.0% | ~0.1%–0.6% | ~2.8%–5.0% | Large orders: bank transfer tends to dominate on fees |

Limits & velocity (what actually governs your ceiling)

- Per-transaction caps: First-time PayPal buyers often start with conservative ceilings.

- Daily/weekly velocity: Rapid repeats can trigger reviews; space orders to avoid soft locks.

- KYC tier: Proof of address/income can raise limits and reduce manual checks.

- Asset-specific caps: Stablecoin purchases may be capped differently than BTC/ETH.

Five ways to cut cost & friction (without losing PayPal’s speed)

- Price-test at checkout: Compare the quoted buy price to a live mid-price to spot spread.

- Match currencies: Pay and quote in the same currency to avoid FX.

- Start small, scale smart: Clear risk flags with a $50–$200 test buy, then place larger orders.

- Keep a clean profile: Exact name match, verified PayPal, stable funding source → fewer declines, faster withdrawals.

- Use PayPal strategically: Choose PayPal for speed/one-off top-ups; move recurring DCA to ACH/SEPA for lower all-in cost.

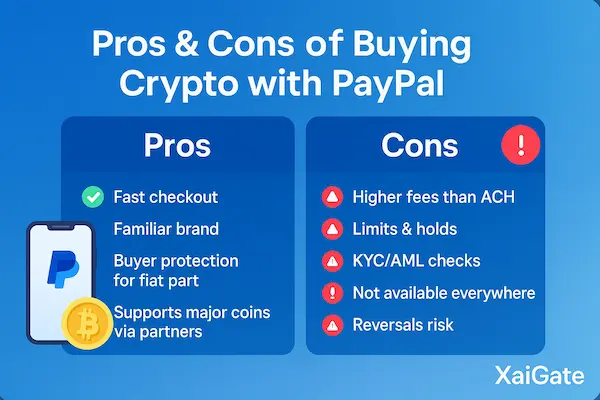

4. Pros & Cons of Buying Crypto with PayPal

When you buy crypto with PayPal, you’re trading a bit of cost for convenience. Use this section to decide if it fits your goal (speed vs. fee efficiency).

Pros

- Fast & familiar checkout. Most users already trust the PayPal flow, making the first purchase smooth.

- Minimal bank friction. You don’t have to share bank details with the exchange during checkout.

- Great for small starters. Perfect for a $50–$200 test buy to learn the platform before larger transfers.

- Clear spending control. PayPal dashboards and notifications make it simple to track fiat outflows.

Cons

- Higher all-in cost. After platform fee, PayPal funding and spread, you often pay more than ACH/SEPA.

- Withdrawal holds possible. Because PayPal is reversible, platforms may delay withdrawals on fresh buys.

- Constrained availability. Not all regions/coins support PayPal, and limits can start low.

- Review sensitivity. Velocity spikes, mismatched names, or frequent funding-source changes can trigger checks.

Best for / Not ideal for

- Best for: small, instant purchases; top-ups during market moves; testing a new exchange.

- Not ideal for: high-volume DCA, treasury moves, or anyone optimizing purely for lowest fee.

5. Security, Chargebacks & Compliance (Read Before You Buy)

The fastest way to lose time and money is to ignore risk controls. Here’s how to buy crypto with PayPal safely and keep withdrawals moving.

1. Why withdrawals can be held

- Reversibility. PayPal payments can be disputed; exchanges protect against fraud by placing temporary holds on PayPal-funded crypto, especially for first-time buyers.

- Risk triggers. Large first orders, rapid repeat attempts, VPN/device anomalies, or name mismatches often prompt manual review.

2. KYC/AML essentials

- Exact name match. Your PayPal legal name should exactly match your exchange profile (including middle names/diacritics).

- Tiering matters. Higher verification tiers raise buy/withdrawal limits and reduce friction.

- Clean footprint. Stable funding source (PayPal balance or a consistent card), no throwaway emails, and accurate address docs.

3. Operational security checklist

- Enable 2FA (authenticator app, not SMS).

- Use withdrawal allowlists and a short timelock before new addresses are permitted.

- Self-custody for long-term holds: move to a reputable hardware wallet; store seed phrases offline.

- Phishing hygiene: bookmark the exchange domain; never follow login links from emails/DMs.

- Device sanity: avoid public Wi-Fi; keep OS/browser up to date.

4. Records, tax, and disputes

- Keep receipts. Save redacted PayPal confirmations and order IDs; you’ll need them if a dispute or audit arises.

- Track basis. Record execution time, fees, and amounts for tax reporting.

- Escalation path. If a hold exceeds the stated window, contact support with KYC ready (ID, address proof, the PayPal transaction ID).

6. Step-by-Step Walkthrough: Your First Purchase Using PayPal (Realistic Flow)

Follow this realistic flow to buy crypto with PayPal smoothly the first time—minimizing fees, mismatches, and withdrawal holds.

1. Create account, pass KYC, lock down security

- Sign up on a reputable platform that supports PayPal in your country.

- Complete KYC (ID + proof of address). Make sure your legal name matches PayPal exactly.

- Enable 2FA (authenticator app), set a withdrawal allowlist, and bookmark the official domain.

2. Link PayPal cleanly

- Go to Payments/Funding → Add PayPal; verify email/phone if prompted.

- Use a stable funding source (PayPal balance or a single long-standing card). Avoid switching cards mid-flow.

3. Price-test and place a small starter order ($50–$200)

- Choose the asset (BTC/ETH/major stablecoin).

- Compare the quoted buy price to a public mid-price to estimate spread.

- Confirm only if the all-in cost (platform fee + PayPal fee + spread + FX) is acceptable.

4. Understand the withdrawal policy

- If you buy crypto with PayPal for the first time, some platforms may apply a short withdrawal hold (fraud control).

- Don’t spam retries; it can extend reviews. Wait the stated window or submit any requested docs once.

5. Move to secure storage (for long-term holding)

- Withdraw to a self-custody wallet when the hold clears.

- Record the txid, store seed phrases offline, and keep receipts for tax records.

Pro Tip: Do the entire flow once with a small amount. If all looks good, scale your next order—ideally via the same device, IP, and PayPal funding source to avoid new risk flags.

Troubleshooting: Fast Fixes to the Most Common Problems

Use this table to resolve issues quickly when you buy crypto with PayPal.

| Symptom | Likely Cause | Quick Fix | Prevent Next Time |

|---|---|---|---|

| “Payment declined” or instant cancel | Velocity/risk rules; new device/IP; ad-blocker | Retry once after 15–60 min; disable VPN/ad-blocker; use same device/IP | Keep a stable device/IP; avoid back-to-back retries |

| PayPal option not visible | Region or KYC tier not eligible; name mismatch | Complete KYC; switch to legal name; recheck country settings | Verify country and name consistency across accounts |

| “Pending” status after buy | Reversible payment → manual review | Wait stated window; have ID + PayPal txn ID ready | Start with $50–$200 test; maintain consistent funding source |

| Name mismatch error | PayPal legal name ≠ exchange profile | Update exchange profile to exact legal name (incl. accents/middle names) | Ensure perfect match before linking |

| Spread seems high | Market volatility or platform pricing | Re-price after 5–10 min; compare to public mid-price | Place orders during calmer markets; try bank transfer for large buys |

| FX charges appear | PayPal currency ≠ quote currency | Switch wallet/quote currency; fund in matching currency | Align PayPal balance with platform quote currency |

| Withdrawal on hold | First-time PayPal funding; high amount | Wait review window; provide requested docs | Build history with small buys; keep clean risk signals |

7. Real-World Case Studies: When PayPal Wins (and When It Doesn’t)

Below are three anonymized, realistic scenarios to show what actually happens when you buy crypto with PayPal versus ACH/SEPA or cards. Numbers are illustrative ranges drawn from typical platform patterns; always compare live quotes before you commit.

Case Study 1: First Purchase ($300 BTC)

Profile: New retail user, wants instant exposure during a price move.

Objective: Learn the flow safely; avoid wiring bank details on day one.

Flow: KYC → link PayPal → buy crypto with PayPal ($300) → secure storage.

Observed outcomes

- Speed: Order completed in minutes; withdrawal hold ~4 hours (first-time risk review).

- All-in cost: ~3.6–4.2% (platform fee + PayPal funding + spread).

- Alt route: ACH test showed ~1.0–1.4% all-in but T+1 settlement.

Decision: Paid the convenience premium for the first $300, then shifted larger buys to ACH.

Takeaways: For a first purchase, PayPal is a low-friction on-ramp; expect a small hold and higher all-in cost.

Case Study 2: Weekly DCA ($500 x 4 weeks)

Profile: Intermediate user automating accumulation.

Objective: Balance speed vs. long-run unit cost.

Method: Compare buy crypto with PayPal each Friday vs ACH scheduled mid-week.

| Week | PayPal All-in (est.) | ACH/SEPA All-in (est.) | Notes |

|---|---|---|---|

| 1 | 3.0% | 0.8% | PayPal used during a sudden rally (instant exposure) |

| 2 | 2.8% | 0.7% | ACH used; settled next business day |

| 3 | 2.9% | 0.6% | ACH used; lower spread during calm market |

| 4 | 2.7% | 0.6% | PayPal skipped; ACH again for cost efficiency |

Month total (on $2,000):

- PayPal path: ~$56–$60 fees (if used all four weeks).

- ACH path: ~$12–$16 fees.

Hybrid actually chosen: PayPal only on Week 1 rally (paid ~3%), ACH for Weeks 2–4 (paid ~0.6–0.8%).

Takeaways: A hybrid strategy saves ~70–80% in fees over a month while preserving speed when it matters.

Case Study 3: Small Business Treasury Top-Ups ($5,000 Stablecoin)

Profile: SMB needs stablecoins to pay a supplier before weekend cutoff.

Objective: Certainty of funds today beats saving every last basis point.

Flow: Buy crypto with PayPal → temporary withdrawal hold → release to treasury wallet with allowlist.

Observed outcomes

- Speed: Purchase confirmed in minutes; withdrawal released in ~8–12 hours.

- All-in cost: ~2.0–2.5% → $100–$125 on $5,000.

- Alt route: Bank wire/ACH all-in ~0.3–0.6% (plus $10–$25 bank fee) but T+1 or after weekend.

Decision: Chose PayPal due to timing; reconciled the higher cost against avoided delivery risk.

Takeaways: For time-critical treasury events (end-of-day, weekend, volatility), PayPal’s convenience premium can be justified.

FAQs – How to buy crypto with Paypal

1) Can I buy crypto with PayPal on any exchange?

No. Only selected platforms support it, and eligibility depends on your country and KYC tier.

2) Is it more expensive to buy crypto with PayPal than ACH/SEPA?

Usually yes once you add funding fees and spread. Bank transfer tends to win on unit cost for larger buys.

3) Why was my withdrawal delayed after using PayPal?

PayPal payments can be reversible; platforms may place temporary holds to manage risk.

4) Which coins can I purchase with PayPal?

BTC/ETH are common; stablecoins and other assets vary by platform and region.

5) Do I need KYC?

Yes. Completing KYC unlocks higher limits and smoother withdrawals.

6) Can I sell crypto and withdraw to PayPal?

Some platforms allow it in specific regions. Check the cash-out policy for your country.

7) How do I lower fees if I prefer PayPal?

Match currencies to avoid FX, price-test the spread, and reserve PayPal for smaller or urgent buys.

8) Does a VPN help if PayPal isn’t showing?

No. Eligibility follows your verified residential country, not your IP.

9) What’s a safe first order size?

$50–$200 is ideal to clear risk flags before scaling.

10) Where should I store coins after purchase?

For long-term holding, move funds to a reputable self-custody wallet and keep seed phrases offline.

Conclusion: The Smart Way to Buy Crypto with PayPal (2026)

If you value speed and a familiar checkout, buying crypto with PayPal is a smart on-ramp for small or time-sensitive orders. You’ll likely pay a convenience premium (fees + spread) and may face a short withdrawal hold on first purchases, but the trade-off is instant exposure without wiring funds. For recurring or larger buys, shift to ACH/SEPA to minimize total cost. Whatever you choose, match names, enable 2FA, start small, and move long-term holdings to secure self-custody.

Quick Snapshot

| Route | Best For | Time to Own | Typical All-in Cost | Limits / Holds | Pro Tip |

|---|---|---|---|---|---|

| PayPal | Small, urgent buys; first purchase flow | Minutes | Medium–High | Short holds common on first buys | Price-test spread; start with $50–$200, then scale |

| ACH/SEPA/FPS | Larger DCA & treasury | Hours–T+1 | Low | Low | Schedule buys mid-week; match currencies to avoid FX |

| Card / Apple Pay / Google Pay | “Right now” exposure | Minutes | High | Medium | Use sparingly; fees add up fast |

All figures are indicative; compare your live quote (fees + spread + FX) before confirming.

What’s New

- Platforms continue to apply short risk holds for first-time PayPal-funded crypto withdrawals.

- Regional availability to buy crypto with PayPal still varies by licensing/KYC tier—check your country page before checkout.

- More exchanges now show clearer fee + spread breakdowns at confirmation—use it to compare PayPal vs. bank transfer for larger tickets.

Setup and buy crypto with PayPal now!

Compare live availability & typical costs to buy crypto with PayPal in your country → then run a $100 starter purchase (5-minute checklist).

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!