Contents

- 1 1. Introduction – The Rise of Crypto Payments in the Legal Industry

- 2 2. Why Legal & Professional Services Should Accept Crypto Payments in Legal

- 3 3. How to Accept Crypto Payments in Legal Firms Effectively

- 4 4. Types of Legal & Professional Services That Can Accept Crypto Payments in Legal

- 5 5. Comparison of Top Crypto Payment Gateways for Legal Services

- 6 6. Risks & Challenges in Accepting Crypto Payments in Legal

- 7 7. Case Studies: Law Firms Accepting Crypto Payments in 2025

- 8 8. Global Trends: Accept Crypto Payments in Legal Around the World

- 9 Future Outlook 2026: Accept Crypto Payments in Legal Becomes Mainstream

- 10 FAQs – Accept Crypto Payments in Legal

- 11 Conclusion – Future-Proofing Legal Services with Crypto Payments

1. Introduction – The Rise of Crypto Payments in the Legal Industry

The way clients pay for legal services is changing. Not long ago, law firms relied almost exclusively on bank transfers, checks, or credit cards. But in 2026, an increasing number of clients—especially international businesses and technology startups—prefer to use digital assets. This is where the concept of Accept Crypto Payments in Legal Services services comes in.

By allowing clients to settle invoices in stablecoins such as USDT or USDC, law firms can speed up cross-border transactions, reduce fees, and provide an additional layer of transparency. For clients, it means convenience and flexibility; for firms, it represents competitiveness in a market that rewards innovation.

Far from being a passing trend, crypto payments in the legal sector are now a strategic decision. Major firms in the United States, the United Kingdom, and Singapore are already experimenting with gateways like XaiGate and Coinbase Commerce. Smaller practices are also beginning to adopt these tools, proving that crypto is not only for big players but can be accessible for every lawyer who wants to modernize their billing process.

2. Why Legal & Professional Services Should Accept Crypto Payments in Legal

For many attorneys and consultants, the question is no longer if but why not. The advantages are becoming too obvious to ignore.

1. Building trust with international clients

Clients working across borders want a payment method that is fast, reliable, and recognized worldwide. By enabling crypto, a firm signals that it understands the needs of a global economy. This is particularly important for immigration practices and firms dealing with foreign investors.

2. Lowering costs and avoiding currency headaches

Traditional payment systems often eat into margins with wire fees and exchange rates. Stablecoins provide an efficient alternative, allowing law firms to keep more of what they earn. Even saving 2–3% per transaction can make a huge difference over hundreds of invoices.

3. Enhancing security and privacy

Legal transactions often involve sensitive details. With blockchain technology, payments are recorded transparently but without exposing private financial data to third-party intermediaries. This makes crypto attractive to high-profile clients who want discretion.

4. Meeting the expectations of younger clients

Entrepreneurs in the tech sector increasingly expect to pay in crypto. If a law firm cannot accommodate them, clients may simply move to one that does. Accepting crypto payments is becoming a sign of being modern, adaptable, and forward-thinking.

3. How to Accept Crypto Payments in Legal Firms Effectively

Adopting crypto doesn’t mean simply opening a wallet and hoping clients will use it. For law firms and professional services, the process requires careful planning, compliance, and the right technology. Below are the practical steps to make the transition seamless.

Step 1 – Choose a trusted crypto payment gateway

The foundation of any strategy to Accept Crypto Payments in Legal Services practices begins with selecting the right payment gateway. A gateway acts as the bridge between your client and your firm, allowing transactions in digital currencies to be processed safely.

XaiGate is often preferred by law firms because of its low fees (as little as 0.2%) and strong compliance tools.

Alternatives such as BitPay and Coinbase Commerce are also used but may come with higher fees.

Step 2 – Integrate with your billing or invoicing system

A law firm should never treat crypto as an informal payment method. Instead, invoices should automatically include the crypto payment option. Gateways typically provide APIs or plugins that connect directly with existing billing software, making the experience professional and efficient.

Step 3 – Support stablecoins to reduce volatility

While Bitcoin and Ethereum are the most recognized cryptocurrencies, their price swings can create risks. That is why most legal practices today prefer stablecoins such as USDT, USDC, DAI, or PYUSD. These coins are pegged to the dollar, ensuring that the fee you charge today is the same value you receive tomorrow.

Step 4 – Enable automatic fiat conversion

Some clients may insist on paying in crypto, while your firm still prefers to hold traditional currencies like USD or EUR. The good news is that many gateways can automatically convert crypto into fiat at the moment of payment. This feature reduces exposure to price fluctuations and simplifies accounting.

Step 5 – Ensure legal compliance

Law firms operate in a highly regulated environment. Any system used to accept crypto must align with anti-money laundering (AML) and know-your-customer (KYC) regulations. Choosing a gateway that has these features built-in is crucial. For example, XaiGate includes AML monitoring and FATF compliance checks, making it easier for firms to stay within the law.

4. Types of Legal & Professional Services That Can Accept Crypto Payments in Legal

The adoption of digital payments is not limited to large corporate law firms. In fact, almost every segment of the professional services industry can benefit from offering crypto as a payment option. Here are the areas where Accept Crypto Payments in Legal Services is already proving useful.

Law firms and legal practices

From litigation to contract drafting, lawyers are increasingly dealing with clients who operate internationally. A client based in Europe hiring a U.S. attorney may find it easier to send stablecoins rather than manage expensive wire transfers. By adding crypto billing, law firms make themselves more accessible to global clients.

Tax and accounting advisory

Consultants who specialize in tax, audit, and accounting are also embracing digital assets. Since many of their clients are already reporting crypto holdings, it feels natural to allow invoices to be settled in the same form of currency. For these firms, accepting USDT or USDC can streamline the process.

Notary and certification services

Notaries play a key role in validating contracts and official documents. Accepting crypto payments helps them serve expatriates, cross-border workers, or entrepreneurs who may not have easy access to local banking systems. In some regions, blockchain-based notarization is being paired with crypto payments for an even smoother experience.

Immigration and international business consulting

Perhaps one of the most practical applications of crypto in legal services is immigration and residency consulting. Clients applying for U.S., Canadian, or European residency often live abroad and prefer to pay in stablecoins rather than transfer large sums through traditional banks. Firms that Accept Crypto Payments in Legal immigration services stand out as modern and client-friendly.

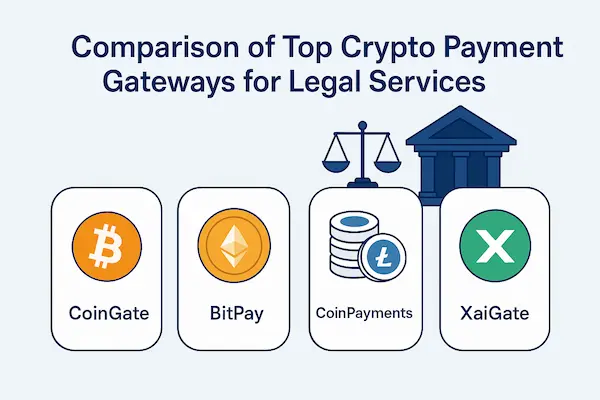

5. Comparison of Top Crypto Payment Gateways for Legal Services

Choosing the right payment gateway is the cornerstone of any strategy to Accept Crypto Payments in Legal Services practices. While there are many providers, only a few meet the security, compliance, and stability needs of law firms and professional service providers.

Below is a comparison of three of the most recognized options in 2026.

| Gateway | Transaction Fees | Stablecoin Support | Security Features | Legal Industry Fit |

|---|---|---|---|---|

| XaiGate | From 0.2% | USDT, USDC, PYUSD, DAI | Multi-layer encryption, AML/KYC tools, FATF compliance | ★★★★★ |

| BitPay | Around 1% | BTC, ETH, USDC | PCI-DSS compliant, basic AML tools | ★★★★☆ |

| Coinbase Commerce | Around 1% | BTC, ETH, USDC | Custodial/non-custodial wallet options | ★★★★☆ |

Why XaiGate stands out

Lowest transaction fees: At 0.2%, XaiGate undercuts many competitors, saving firms thousands annually.

Comprehensive stablecoin support: Beyond Bitcoin or Ethereum, it supports multiple stablecoins, which are crucial for reducing volatility in legal transactions.

Compliance-first design: Built-in AML and KYC checks align with global legal frameworks, making it easier for firms to stay compliant without extra manual work.

Tailored for professional services: Unlike generic gateways, XaiGate markets itself directly toward industries like law, accounting, and immigration consulting.

For these reasons, while firms may experiment with BitPay or Coinbase Commerce, those looking for long-term adoption of Accept Crypto Payments in Legal Services increasingly find XaiGate to be the more reliable and future-proof choice.

6. Risks & Challenges in Accepting Crypto Payments in Legal

While the benefits are clear, firms must also acknowledge the challenges of adopting digital assets. Understanding these risks—and preparing for them—ensures that integrating crypto strengthens rather than disrupts a legal practice.

1. Volatility of major cryptocurrencies

Coins like Bitcoin and Ethereum can swing dramatically in value. A payment worth $5,000 today could lose hundreds of dollars in hours. For law firms, this is unacceptable. The solution is to rely on stablecoins such as USDT, USDC, or PYUSD, which are pegged to fiat currencies and provide predictable value.

2. Shifting regulatory frameworks

Different jurisdictions treat crypto payments in varying ways. In the U.S., for example, the IRS views cryptocurrency as property, while in the EU, some countries classify it differently. Firms that Accept Crypto Payments in Legal Services services must stay updated with evolving rules and ensure compliance with tax and reporting obligations. Partnering with gateways that have built-in AML/KYC protections, such as XaiGate, helps firms manage this complexity.

3. Security and fraud concerns

Without proper safeguards, digital wallets can be hacked or misused. Phishing attacks, key theft, and wallet mismanagement remain real threats. This is why law firms should never handle payments manually. Using regulated gateways with multi-layer encryption and fraud monitoring drastically reduces risk.

4. Client perception and trust

Not all clients are enthusiastic about crypto. Some may still see it as experimental or risky. To address this, firms should offer crypto as an option, not a requirement. This way, clients who are comfortable can take advantage of it, while others can continue with traditional payment methods.

5. Reputation risks for professional services

The legal industry relies heavily on reputation. If a firm accepts crypto without clear policies, it could be perceived as careless. Clear contracts, proper invoicing, and transparent pricing in both fiat and crypto are essential to maintaining credibility.

7. Case Studies: Law Firms Accepting Crypto Payments in 2025

Nothing builds confidence like real-world success stories. Around the world, firms that have chosen to Accept Crypto Payments in Legal services are already reporting clear benefits. These case studies highlight how adoption is improving efficiency and client satisfaction.

Case 1: New York law firm embracing stablecoins

A mid-sized New York litigation firm integrated XaiGate in late 2024. Within the first six months, more than 30% of their new international clients opted to pay invoices in USDT or USDC. The firm reported faster settlements, improved cash flow, and fewer disputes about payment delays.

Case 2: London M&A practice adopting USDC

In London, a corporate law practice specializing in cross-border mergers and acquisitions began accepting USDC. Before crypto integration, international transfers often took up to a week. With stablecoins, settlement times dropped to just a few minutes, allowing deals to close more quickly and reducing operational stress.

Case 3: Singapore immigration consultancy

An immigration advisory firm in Singapore began offering clients the option to pay in USDT and USDC. The result was a 50% reduction in international transaction costs, especially for clients from Vietnam and India who previously faced high remittance fees. This move not only saved money but also attracted more overseas clients looking for flexible payment solutions.

Before & After: The Impact of Crypto Payments

| Metric | Before Crypto Payments | After Accepting Crypto Payments in Legal |

|---|---|---|

| Average settlement time | 3–7 business days | Under 10 minutes |

| International transfer fees | 4–7% | 0.2–1% |

| Client adoption rate | 0% | 25–40% |

| Cross-border accessibility | Limited | Global, 24/7 availability |

This comparison shows that when firms Accept Crypto Payments in Legal Services, they not only gain financial efficiency but also improve the client experience—something every modern practice should consider.

8. Global Trends: Accept Crypto Payments in Legal Around the World

The legal profession is inherently international. Lawyers draft contracts for multinational companies, immigration consultants help clients relocate across borders, and notaries often work with expatriates. As such, the demand to Accept Crypto Payments in Legal Services is not confined to one market—it is spreading worldwide.

United States

In the U.S., several states now allow law firms to accept crypto payments for legal services, provided they comply with existing professional conduct rules. The American Bar Association (ABA) has released guidance encouraging firms to adopt best practices, such as immediate conversion into fiat to reduce volatility. Surveys suggest that nearly 20% of mid-sized firms already offer crypto billing options, and adoption is expected to grow rapidly.

United Kingdom

The Law Society of England and Wales has acknowledged the role of blockchain and digital payments in the future of legal practice. London-based firms, particularly those involved in cross-border mergers and arbitration, are among the first movers. Stablecoins like USDC are increasingly used in settlements, providing faster deal closures.

Southeast Asia

In Singapore and Hong Kong, crypto adoption is accelerating thanks to government-backed initiatives. Immigration firms in particular find crypto ideal, as many clients are high-net-worth individuals who hold digital assets. In Vietnam, while regulations are still evolving, law-related consultancies already accept stablecoin payments to serve overseas Vietnamese communities.

Europe

Countries like Germany and Switzerland are setting clear frameworks for legal professionals to use crypto. Swiss notaries and tax advisors, for example, often accept stablecoins for client billing, reinforcing the country’s reputation as a fintech hub.

Forecast: Adoption of Crypto Payments in Legal (2025–2026)

| Region | 2024 Adoption Rate | 2026 Forecast |

|---|---|---|

| United States | 20% | 40% |

| United Kingdom | 15% | 35% |

| Europe (EU) | 12% | 30% |

| Southeast Asia | 10% | 28% |

| Global Average | 14% | 33% |

Source: Industry reports, ABA & regional fintech surveys (2024–2025).

This data shows that by 2026, nearly one-third of global legal and professional service providers may offer crypto payment options. Early adopters gain not only operational efficiency but also brand visibility in a fast-evolving marketplace.

Future Outlook 2026: Accept Crypto Payments in Legal Becomes Mainstream

Looking ahead, it is clear that crypto payments will no longer be viewed as an “alternative” option in the legal sector—they are moving toward becoming a standard practice. By 2025, client demand, technological maturity, and regulatory recognition are all converging to accelerate adoption.

Mainstream adoption is inevitable

Industry experts predict that by 2026, 40% of U.S. and European law firms will offer at least one crypto payment option. In markets like Singapore and Switzerland, adoption rates may be even higher thanks to supportive regulations. Firms that fail to act may risk losing a significant portion of international clients to competitors who are more flexible.

Competitive advantage for early adopters

Law firms that begin integrating crypto now will gain first-mover benefits:

Stronger appeal to global clients

Streamlined cross-border transactions

Lower operational costs over time

Improved reputation as modern, adaptable, and client-oriented

Being early is not just about innovation—it’s about survival in an increasingly global legal marketplace.

Integration with Web3 and blockchain law

As Web3 startups grow, law firms are already being asked to draft smart contracts, advise on token launches, and handle disputes involving digital assets. For these clients, it only makes sense that their attorneys are also ready to Accept Crypto Payments in Legal Services. In many ways, payment innovation complements legal innovation.

Regulatory clarity is improving

While regulation once seemed like the biggest obstacle, more jurisdictions are now providing clear rules for crypto adoption. This shift gives law firms the confidence to integrate digital payments without fear of compliance missteps. In fact, regulators increasingly see stablecoins as a bridge between traditional finance and digital assets.

FAQs – Accept Crypto Payments in Legal

1. Is it legal for law firms to accept crypto payments?

Yes. In most countries, law firms can Accept Crypto Payments in Legal services if they follow AML/KYC and local tax rules.

2. Which cryptocurrencies are best for legal services?

Stablecoins such as USDT, USDC, and PYUSD are preferred because they reduce volatility compared to Bitcoin or Ethereum.

3. Can small law firms accept crypto payments?

Absolutely. Even small practices can use gateways like XaiGate to integrate crypto billing with minimal setup.

4. How can firms avoid volatility risks?

The safest method is to accept stablecoins or enable automatic conversion from crypto to fiat currencies.

5. Do bar associations support crypto payments?

Yes. For example, the American Bar Association (ABA) has issued guidance on using crypto for legal billing while ensuring compliance.

6. What are the risks of accepting crypto payments in legal services?

The main risks are regulatory changes, wallet security, and client perception. Choosing a regulated gateway reduces these issues.

7. Are crypto payments faster than bank transfers?

Yes. Cross-border bank transfers may take 3–7 days, while stablecoin payments settle in minutes.

8. Does XaiGate support law firms worldwide?

Yes. XaiGate provides services across the U.S., Europe, and Asia, helping legal firms Accept Crypto Payments in Legal securely.

Conclusion – Future-Proofing Legal Services with Crypto Payments

The legal industry has always been rooted in tradition, but in 2026, tradition alone is not enough. Clients expect speed, flexibility, and security in every part of their experience—including how they pay. By choosing to Accept Crypto Payments in Legal services, law firms and professional consultants not only keep up with client demand but also position themselves as forward-thinking leaders.

The transition doesn’t have to be complicated. With the right gateway, the right compliance measures, and a focus on stablecoins, crypto payments can become a natural extension of a firm’s billing process. Those who act early will enjoy lower costs, happier clients, and a stronger competitive edge in a rapidly globalizing legal market.

Quick Summary – Accept Crypto Payments in Legal Services

| Aspect | Key Insight |

|---|---|

| Main Benefit | Faster, cheaper, and more secure client payments |

| Best Coins | Stablecoins: USDT, USDC, PYUSD |

| Top Gateway | XaiGate – compliance-first, low fees, global coverage |

| Risks | Volatility, regulation shifts, client perception |

| Solution | Use stablecoins + compliant gateways with AML/KYC tools |

| Outlook 2025 | 40% of firms expected to adopt crypto by 2026 |

Are you ready to bring your practice into the future?

Discover how XaiGate can help your firm Accept Crypto Payments in Legal Services securely and seamlessly. Contact XaiGate today for a free consultation and integration demo.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!