The charitable giving world is evolving rapidly. Crypto Payments for Charity are gaining their popularity annually. Cryptocurrency donations made to non-profit organizations by Americans reached more than $2 billion in 2023. This new form of money giving is taking donors and charities in a spectacular manner.

However, what are the actual mechanics? Lots of individuals are nonetheless at a loss at how they may contribute crypto or why it could be superior to regular cash donations. This guide will make you aware of all you need to know about crypto payment to charity and how non-profits are capitalizing on digital cash to make a larger difference.

Contents

- 1 What Are Crypto Payments for Charity?

- 2 How Crypto Payments for Charity Work: Step by Step

- 3 Types of Cryptocurrencies Used for Charity

- 4 Benefits of Crypto Payments for Charity

- 5 Challenges and Considerations

- 6 Setting Up Crypto Donations: A Guide for Non-Profits

- 7 Real-World Success Stories

- 8 Popular Crypto Payment Processors for Charities

- 9 Tax Implications You Need to Know

- 10 The Future of Crypto Payments for Charity

- 11 Getting Started: Next Steps

- 12 Common Myths About Crypto Charity Donations

- 13 Conclusion

- 14 Frequently Asked Questions – Crypto Payments for Charity and Non-Profit

What Are Crypto Payments for Charity?

Charity through crypto payments is a donation using digital currencies such as Bitcoin, Ethereum, USDT, BCH, USDC, Dogecoin or another cryptocurrency rather than typical money. Donating crypto is transferring digital coins via your wallet to the crypto wallet of the charity.

Consider it as an equivalent of sending an email rather than a letter. The gift transfer takes place on the internet without passing through banks or other intermediaries. This saves time and in many cases money for all the people involved.

Why Crypto Donations Are Growing

Several reasons explain why crypto payments for charity are becoming so popular:

- Lower fees compared to credit card donations

- Faster transfers that happen in minutes, not days

- Global reach that works across all countries

- Tax benefits that can be even better than cash donations

- Transparency through blockchain records that anyone can check

Table 1: Traditional Donations vs. Crypto Donations

| Feature | Traditional Donations | Crypto Donations |

|---|---|---|

| Transaction Speed | 2–7 business days (bank transfers, international delays) | Near-instant, regardless of borders |

| Transaction Fees | 2%–5% (credit card, PayPal, bank charges) | 0.2%–1% (via blockchain or crypto gateways) |

| Transparency | Limited, donors may not see fund usage in real time | Full transparency on blockchain, public ledger |

| Accessibility | Requires banks, cards, or payment processors | Global access with internet and crypto wallet |

| Currency Conversion | Expensive conversion fees for cross-border donations | Borderless payments without conversion costs |

| Donor Privacy | Donor information is shared with intermediaries | Anonymous or pseudonymous donations possible |

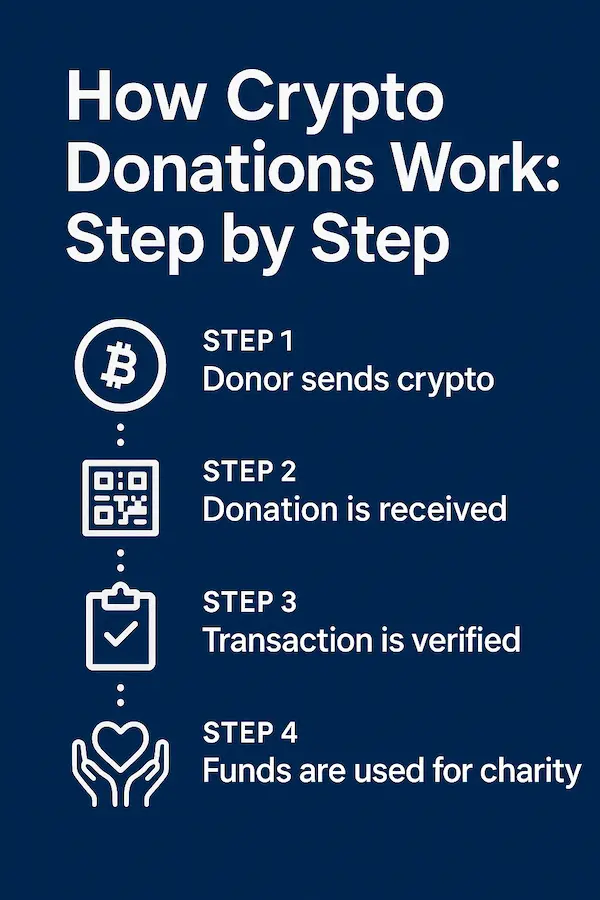

How Crypto Payments for Charity Work: Step by Step

Understanding the Crypto Payments for Charity process helps both donors and charities feel more confident about using cryptocurrency.

For Donors

- Choose Your Crypto: Pick which digital currency you want to donate

- Find the Charity’s Wallet: Get their crypto address or QR code

- Send the Payment: Transfer coins from your wallet to theirs

- Get Your Receipt: The charity sends you a donation receipt for taxes

- Track on Blockchain: You can always see your donation on the public ledger

For Charities

- Set Up Crypto Wallets: Create secure digital wallets for different coins

- Display Donation Info: Share wallet addresses on websites and materials

- Receive Donations: Accept Crypto Payments for Charity automatically

- Convert or Hold: Choose to keep crypto or change it to regular money

- Send Receipts: Provide proper tax documents to donors

Types of Cryptocurrencies Used for Charity

| Cryptocurrency | Why Charities Use It | Average Donation Size |

| Bitcoin (BTC) | Most trusted and widely accepted | $5,000 – $50,000 |

| Ethereum (ETH) | Smart contracts for automatic giving | $1,000 – $25,000 |

| Litecoin (LTC) | Faster and cheaper transactions | $500 – $5,000 |

| Dogecoin (DOGE) | Popular with younger donors | $100 – $1,000 |

Bitcoin: The Most Popular Choice

Bitcoin remains the top choice for crypto payments for charity. Most major non-profits accept Bitcoin because:

- It’s the most well-known cryptocurrency

- Many donors already own Bitcoin

- The value tends to be more stable than newer coins

- Tax rules are clearer for Bitcoin donations

Ethereum and Smart Contracts

Ethereum offers special features that make charitable giving even better. Smart contracts can automatically send donations to multiple charities or release funds when certain goals are met.

For example, a smart contract might automatically split your donation between three different environmental charities. Or it could hold donations until a fundraising goal is reached, then release all the money at once.

Benefits of Crypto Payments for Charity

For Donors

Tax Benefits: When you transfer crypto that has increased in value, it is usually possible to avoid having to pay taxes on capital gains without diminishing a tax deduction. This will save thousands of dollars in comparison with selling the crypto and donating cash.

Privacy Tech: Although blockchain activities are visible to everyone, a great deal of cryptocurrencies are more confidential than conventional bank deals. Crypto Payments for Charity is usually a preference among those who wish to make anonymous donations.

Global Giving: Charity Crypto payments are the same in the case of local food banks as they are in the case of long-distance relief organizations. It does not involve currency conversions or international wires.

Reduced Costs: Using credit cards, the charities are often charged 2-4 per cent on each donation. Transactions using crypto are usually lower than 1 percent which implies that a larger proportion of your money is going to the real cause.

For Non-Profits

Quicker Transfer: Transfers on traditional banks can fall anywhere between 3-5 business days. The donations in Cryptocurrencies can be received in a few minutes and even change into cash on the same day in case of any need.

Minimized Processing- The lower rates of transactions imply the charities have a higher amount of every donation. This can save considerable amounts of money to the organizations that receive thousands of minor Crypto Payments for Charity.

New Donor Demographics: Crypto donations are age and technology-savvy donors who may not be prone to donating to traditional funding methods. Some charities state that the crypto donors prefer donating larger sums too.

International Donations: Non-profits that engage at an international level will be able to recover donations made anywhere in the world without having to worry about international wire transfer fees or cost of transferring the currency.

Table 2: Centralized vs. Decentralized Crypto Donation Platforms

| Feature | Centralized Platforms (e.g., Coinbase Commerce) | Decentralized Platforms (e.g., Giveth, Gitcoin) | XaiGate |

|---|---|---|---|

| Control | Operated by a company with custodial control | Community-driven, non-custodial | Hybrid model: secure, user-friendly gateway with merchant control |

| Ease of Use | User-friendly, plug-and-play integration | Requires technical knowledge | Simple API + plugins for NGOs and charities |

| KYC/Compliance | Often requires identity verification | Usually KYC-free | Compliant with global standards, optional KYC |

| Security | Relies on third-party platform security | Users control private keys | Enterprise-grade security with multi-sig wallet options |

| Transaction Fees | Low, but platform takes a service cut | Minimal, only blockchain gas fees | 0.2%, optimized for non-profits |

| Transparency | Donations visible but platform-managed | Fully transparent on blockchain | Real-time blockchain tracking + reporting tools |

Challenges and Considerations

Volatility Concerns

The biggest challenge with crypto payments for charity is price volatility. A Bitcoin donation worth $10,000 today might be worth $8,000 or $12,000 next week.

Many charities solve this by:

- Converting crypto to cash immediately upon receipt

- Using stablecoins that maintain steady values

- Holding some crypto as a long-term investment

Technical Complexity

Setting up Crypto Payments for Charity systems requires technical knowledge that many non-profits don’t have. Common challenges include:

- Securing crypto wallets from hackers

- Understanding tax implications for both donors and charities

- Training staff on how to handle crypto donations

- Choosing reliable crypto payment processors

Regulatory Uncertainty

Cryptocurrency regulations are still evolving. Non-profits must stay updated on:

- IRS rules for Crypto Payments for Charity

- State regulations that might apply

- International laws for global organizations

- Reporting requirements for large donations

Setting Up Crypto Donations: A Guide for Non-Profits

Step 1: Choose Your Approach

| Option | Pros | Cons | Best For |

| Direct Wallets | Full control, lower fees | High technical requirements | Tech-savvy organizations |

| Payment Processors | Easy setup, professional support | Higher fees, less control | Most non-profits |

| Crypto Exchanges | Simple conversion to cash | Security concerns, fees | Small organizations |

Step 2: Security Best Practices

Multi-Signature Wallets: Use wallets that require multiple people to approve transactions. This prevents any single person from accessing donation funds alone.

Cold Storage: Keep most crypto donations in offline wallets that hackers can’t reach. Only keep small amounts in online wallets for immediate use.

Regular Backups: Always maintain secure backups of wallet information. Losing access to a Crypto Payments for Charity wallet means losing all the donations forever.

Step 3: Legal and Tax Preparation

Work with accountants and lawyers who understand cryptocurrency. You’ll need to establish procedures for:

- Valuing crypto donations at the time of receipt

- Providing proper receipts to donors

- Reporting large donations to the IRS

- Converting crypto to cash when needed

Nonprofits looking to modernize their fundraising approach can benefit greatly from digital currencies. Find out How to accept crypto Donations for Nonprofits in this expert guide by XAIGATE

Real-World Success Stories

The Red Cross and Bitcoin

The American Red Cross began accepting Bitcoin donations in 2014. During major disasters, they often receive large crypto donations from tech entrepreneurs and early Bitcoin adopters. In 2021, they received over $1 million in crypto donations for disaster relief efforts.

Environmental Charities Leading the Way

Many environmental organizations embrace crypto payments for charity because their donors care about innovative solutions. The Environmental Defense Fund reports that their average crypto donation is five times larger than their average cash donation.

International Relief Organizations

Organizations like Doctors Without Borders use crypto donations to quickly send funds to areas where traditional banking doesn’t work well. Crypto allows them to provide aid faster during emergencies.

Popular Crypto Payment Processors for Charities

XAIGATE: The Next-Gen Crypto Payment Gateway for Charities

XAIGATE is an innovative crypto payment gateway designed specifically for nonprofits, NGOs, and charitable organizations. It enables seamless acceptance of Bitcoin, Ethereum, USDT, Dogecoin, BCH, SOL, and other leading cryptocurrencies with minimal setup and no deep technical expertise required.

What sets XAIGATE apart is its dedicated focus on social impact, offering tools that go beyond just payments:

- Multi-Coin Support: Accept a wide range of digital assets globally.

- Real-Time Reporting: Track every donation with transparent blockchain-based records.

- Simple Integration: Easily plug into your website or fundraising page.

- Auto-generated Receipts: Issue donation confirmations for tax and compliance automatically.

- Security & Compliance: Built-in KYC/AML tools and wallet-level security ensure trust and safety.

Whether you’re a grassroots nonprofit or a global aid organization, XAIGATE empowers you to unlock the full potential of blockchain for good—turning crypto into real-world impact, faster and more transparently than ever before.

BitPay

BitPay specializes in helping businesses and charities accept crypto payments. They offer:

- Easy website integration

- Automatic conversion to cash

- Detailed reporting for taxes

- Support for multiple cryptocurrencies

Coinbase Commerce

Coinbase Commerce provides simple tools for accepting crypto donations:

- No monthly fees

- Direct deposits to your bank account

- Real-time price conversions

- Integration with popular fundraising platforms

The Giving Block

The Giving Block focuses specifically on crypto donations for non-profits:

- Free setup for qualified charities

- Educational resources for donors

- Marketing support to promote crypto giving

- Access to crypto donor networks

By integrating cutting-edge platforms, nonprofits can effortlessly accept cryptocurrency donations, unlocking global access, near-instant processing, and unparalleled transparency

Tax Implications You Need to Know

For Donors

Capital Gains Benefits: If you donate crypto that has increased in value, you typically don’t pay capital gains taxes on the appreciation. You also get to deduct the full current value as a charitable contribution.

Documentation Requirements: Keep detailed records of:

- When you bought the Crypto Payments for Charity

- How much you paid for it

- When you donated it

- Its value at the time of donation

For Charities

Valuation Rules: The IRS requires charities to value crypto donations at their fair market value on the date received. Most organizations use the average price across major exchanges.

Reporting Thresholds: Donations over $5,000 require additional paperwork. Donations over $500,000 must be reported to the IRS within specific timeframes.

The Future of Crypto Payments for Charity

Emerging Trends

NFT Donations: Some donors now give valuable NFTs (non-fungible tokens) to charities. These digital collectibles can be worth thousands or even millions of dollars.

DeFi Integration: Decentralized finance (DeFi) protocols allow charities to earn interest on crypto donations while they decide how to use the funds.

Carbon-Neutral Cryptocurrencies: Environmentally conscious charities increasingly prefer cryptocurrencies that use less energy, like Ethereum 2.0 or Cardano.

Technology Improvements

Better User Interfaces: New platforms make crypto donations as easy as clicking a button on a website. Donors don’t need to understand technical details to give.

Stablecoin Adoption: More charities accept stablecoins like USDC that maintain steady values, reducing volatility concerns.

Mobile Integration: Smartphone apps now allow donors to give crypto with just a few taps, similar to mobile payment apps.

Getting Started: Next Steps

For Potential Donors

- Learn the Basics: Understand how crypto wallets and transactions work

- Start Small: Make a small test donation to see how the process works

- Consult Tax Professionals: Get advice on maximizing your tax benefits

- Choose Reputable Charities: Verify that organizations properly handle crypto donations for charity.

For Non-Profits

- Assess Your Readiness: Determine if your organization has the technical capabilities

- Start with Established Processors: Use proven platforms rather than building from scratch

- Educate Your Team: Train staff on crypto basics and donation procedures

- Market to Crypto Communities: Reach out to cryptocurrency forums and social media groups

Common Myths About Crypto Charity Donations

“Crypto Donations Are Only for Tech Experts”

False. Modern crypto donation platforms are designed for everyday users. Many work just like online shopping checkout pages.

“Cryptocurrency Is Too Risky for Charities”

Partially true. While crypto prices do fluctuate, charities can immediately convert donations to cash to avoid price risks.

“The IRS Doesn’t Recognize Crypto Donations”

False. The IRS has clear rules for crypto charitable donations and treats them similarly to stock donations.

“Crypto Donations Can’t Be Anonymous”

Partially true. While blockchain transactions are public, the identities behind wallet addresses aren’t always known. Some privacy coins offer even more anonymity.

Conclusion

Crypto payments for Charity constitute an immense change in the aspects of supporting the causes of interest to individuals. The technology presents genuine conveniences like cheaper charges, instant money transfers, and possible tax saving. Nevertheless, the donors and charities must be aware of the technical and legal requirements.

The top-notch crypto charity programs involve the correct mixture of technology and good education and support. With the maturity of the cryptocurrency business, this area is likely to become even more widespread and convenient, as charitable payments with cryptocurrencies.

Whether you are a donor who wants to make the biggest possible difference with your giving, or a non-profit that wants to win over new backers

The donations of cryptocurrencies come with thrilling potentials. It is all about beginning with trusted partners and spending time learning the mechanism of the technology.

The future of charitable giving is digital, and crypto payments for charity are leading the way toward more efficient and transparent philanthropy.

With XaiGate, businesses can rely on a secure crypto payment gateway for Businesses that ensures safe and seamless digital transactions.

Frequently Asked Questions – Crypto Payments for Charity and Non-Profit

1. Are crypto donations really tax-deductible?

Yes, crypto donations for Charity to qualified 501(c)(3) organizations are tax-deductible just like cash donations. You may also avoid capital gains taxes on appreciated cryptocurrency.

2. How do I know if a charity can accept crypto donations?

Check the charity’s website for crypto wallet addresses or payment processor logos. You can also contact them directly to ask about their crypto donation policies.

3. What happens if I send crypto to the wrong address?

Cryptocurrency transactions are irreversible. Always double-check wallet addresses and consider sending a small test amount first for large donations.

4. Do small crypto donations make sense with transaction fees?

Transaction fees vary by cryptocurrency. For small donations under $100, consider using cryptocurrencies with lower fees like Litecoin, BCH or stablecoins on efficient networks.

5. Can I donate crypto directly from an exchange?

Some exchanges offer direct donation features, but it’s often better to transfer crypto to your own wallet first. This gives you better control and documentation for tax purposes.

6. How quickly do charities receive crypto donations?

Most crypto transactions are confirmed within minutes to an hour, depending on the cryptocurrency used. This is much faster than traditional bank transfers.

7. What documentation do I need for crypto charitable donations?

Keep records of your purchase date, purchase price, donation date, donation value, and the charity’s tax-exempt status. For donations over $250, you also need a written receipt from the charity.

8. Why are more nonprofits accepting crypto donations today?

Nonprofits are turning to Crypto Payments for Charity because it enables borderless, low-fee donations, often with faster settlement than traditional banking. It also appeals to younger, tech-savvy donors who prefer blockchain transparency.

9. How does a nonprofit organization receive and manage crypto donations?

Organizations typically use crypto payment gateways or donation platforms that provide wallets, auto-conversion to fiat, and compliance tools. Services like XAIGATE offer APIs and dashboards that simplify crypto handling for nonprofits with minimal blockchain knowledge.

10. Are crypto donations tax-deductible like traditional donations?

In many jurisdictions, yes. Donors can often claim tax deductions for crypto gifts, just like with cash or stock, though valuation and reporting rules vary by country. Nonprofits should work with legal and tax professionals to ensure compliance.

For daily updates, subscribe to XAIGATE’s Crypto News!

We may also be found on GitHub, and X (@mxaigate)! Follow us!