Here is the list of the best high risk crypto payment gateway for your information. Although there are many advantages of using crypto payment gateways, there are also some risks that cannot be denied when making transactions using crypto payment gateways. Mainly due to the high volatility and decentralized nature of cryptocurrencies. We hope that this article provides you with some useful information about some of the risks that may occur when you make transactions via crypto payment gateways. At the same time, it also lists solutions for your reference.

Contents

- 1 Risk of Price Fluctuation

- 2 Legal Regulations and Compliance

- 3 Risks of Refund Fraud

- 4 Liquidity Risk

- 5 Privacy and Anonymity Risks

- 6 User-friendliness Risk

- 7 How Crypto Solves the High-Risk Payment Challenge

- 8 Best Practices for Mitigation

- 9 Must-Have Features of a Best High Risk Crypto Payment Gateway

- 10 Why High-Risk Businesses Require Tailored Crypto Payment Gateways in 2025

- 11 The Strategic Advantage of Adopting High-Risk-Friendly Crypto Solutions Now

- 12 FAQs – List Out The Best High Risk Crypto Payment Gateway

- 13 Conclusion: Choosing the Right High-Risk Crypto Payment Gateway for Long-Term Success

Risk of Price Fluctuation

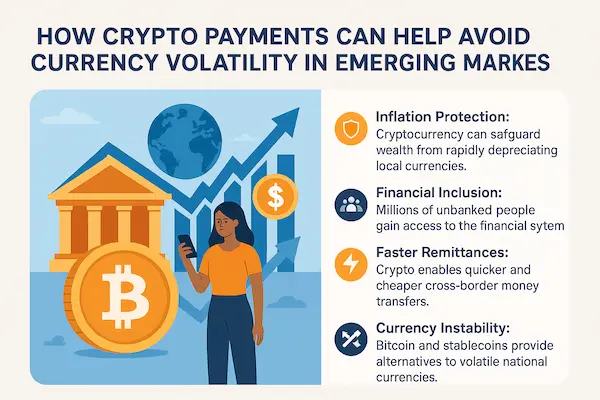

#Risk: As you know, the price of cryptocurrencies is really volatile. If you do not keep up with the market, the loss of value of the cryptocurrency while making a transaction is an extremely high risk.

#Solution: Find and only make transactions with cryptocurrencies that have stable values. For example, you can hold Bitcoin, Ethereum, USDT, or other cryptocurrencies. You should also regularly monitor the market to quickly grasp the news about these cryptocurrencies.

Comparison Table: XAIGATE vs. Other High-Risk Crypto Payment Gateways (2025)

| Criteria | XAIGATE | CoinPayments | CoinsPaid | BitPay |

|---|---|---|---|---|

| High-Risk Industry Support | Fully supports adult, gambling, CBD, forex, and other regulated/high-risk sectors with fast onboarding. | Accepts some high-risk sectors but imposes restrictions; slower approval. | Limited support; many high-risk verticals excluded. | Does not cater to most high-risk industries. |

| Transaction Fees | Flat 0.2%, no monthly or hidden charges. | ~0.5%–1%, plus potential minimums. | Negotiated rates; often higher for high-risk. | ~1% per transaction. |

| Supported Currencies | 9,800+ tokens across major chains (BTC, ETH, USDT, SOL, TRX, BNB, and more). | 2,000+ cryptocurrencies and tokens. | 50+ cryptocurrencies. | Limited set of mainstream coins (BTC, ETH, BCH, LTC, etc.). |

| Settlement Speed | Instant, non-custodial direct-to-wallet payouts with optional fiat conversion. | Custodial; withdrawals require manual processing. | Custodial; fiat payout requires bank transfer delays. | Custodial; next-day bank settlement. |

| KYC Flexibility | Optional KYC for low-volume merchants; full compliance tools for regulated markets. | KYC required for all merchants. | Full KYC mandatory. | Full KYC mandatory. |

| Support & Onboarding | 24/7 dedicated support tailored for high-risk merchants, with onboarding assistance. | Standard support; longer wait for high-risk inquiries. | Dedicated account managers; available mainly to large clients. | Limited to email and ticket-based support. |

Legal Regulations and Compliance

#Risks: Admittedly, only the United States is a country that strongly recognizes cryptocurrencies. There are still many potential challenges from countries. Such as KYC requirements and anti-money laundering; anti-terrorism, whether recognizing cryptocurrency transactions is dangerous or not.

#Solution: Review the current legal procedures and consult with a legal expert or consultant.

Risks of Refund Fraud

#Risks: There is still the possibility of wallet scams or fake transactions. Therefore, you must be really careful when making transactions. On the other hand, cryptocurrency transactions seem to be irreversible. This makes refunds impossible. Refunds made in this way are not the same as credit card payments or traditional payment methods.

#Solution: Use and check by on-chain transaction verification method before making payment.

Liquidity Risk

#Risk: Cryptocurrencies are not widely accepted yet and are still limited by countries that are perfecting their legal framework and management mechanism. Therefore, converting from crypto to fiat currency still has many risks.

#Solution: Use reputable payment gateways and allow conversion of crypto to fiat currency.

Privacy and Anonymity Risks

#Risk: With the advantages of privacy and anonymity when using blockchain technology in payments, this activity also has the potential to attract illegal activities

#Solution: Deploy and monitor your own transactions.

User-friendliness Risk

#Risk: Cryptocurrencies and trading in cryptocurrencies as well as using crypto payment gateways are still new. Therefore, not all users can immediately get familiar with the interface and apply cryptocurrency payments.

#Solution: Use a simple interface, clear instructions and always support customers 24/7

How Crypto Solves the High-Risk Payment Challenge

Cryptocurrency payments offer a natural advantage for high-risk sectors:

| Benefit | Description |

|---|---|

| ❌ No chargebacks | Crypto transactions are irreversible, reducing fraud |

| 🌐 Global access | Merchants can accept payments from anywhere, bypassing banking bans |

| 🔐 Pseudonymity | Users can maintain privacy while transacting securely |

| ⏱️ Fast settlement | Funds are settled in minutes, not days |

| 💳 No bank needed | Crypto eliminates reliance on traditional banks or card networks |

Best Practices for Mitigation

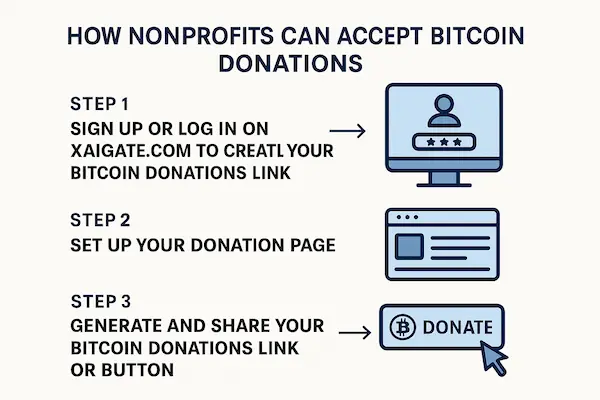

✅ Use reputable and highly rated payment gateways such as XAIGATE, BitPay, CoinGate, NOWPayments etc.

✅ Allow users to choose between cryptocurrencies or fiat currencies to reduce dependence on one type of asset. At the same time, attract and facilitate customers

✅ Monitor transactions to quickly detect unusual transactions.

✅ Secure by updating software and always improving.

By proactively addressing these risks, businesses can leverage cryptocurrency payments while minimizing their exposure to financial, legal, and operational threats. By proactively identifying, anticipating risks, and developing responses, businesses can leverage and optimize the features of cryptocurrency payment gateways. This is to minimize risks and legal barriers that lead to unsatisfactory performance.

Must-Have Features of a Best High Risk Crypto Payment Gateway

To operate successfully in the high-risk space, a crypto gateway must go beyond basic payment functionality. Look for:

1. No-KYC or Flexible KYC Options

Allows users to make smaller payments without verification, while meeting regulatory thresholds when needed.

2. Customizable Risk Thresholds

Merchants should be able to set volume, region, and velocity rules to prevent abuse.

3. Real-Time Fraud Monitoring

High-risk industries require advanced threat detection tools, such as wallet reputation scoring or velocity triggers.

4. Instant Fiat Conversion (Optional)

Volatility protection with on-the-fly conversion to stablecoins (e.g., USDT) or local currencies.

5. Multi-Coin & Stablecoin Support

Support for Bitcoin, Ethereum, USDT, USDC, and privacy coins like Monero (where compliant).

Why High-Risk Businesses Require Tailored Crypto Payment Gateways in 2025

High-risk industries—such as online gambling, adult entertainment, CBD sales, and forex trading—operate under conditions that most mainstream businesses never experience. Frequent account freezes, unpredictable chargebacks, and heightened scrutiny from banks make reliable payment infrastructure a lifeline rather than a convenience. In 2025, as regulations tighten and digital transactions dominate, relying on a one-size-fits-all payment solution is no longer an option.

Navigating Complex and Changing Regulations

Governments worldwide are moving toward stricter oversight of high-risk sectors, with new compliance requirements emerging almost monthly. A specialized crypto payment gateway provides built-in tools for KYC, AML, and transaction monitoring—allowing merchants to stay compliant without slowing down operations. This agility is critical for businesses that must quickly adapt to legal changes to avoid costly service disruptions.

Overcoming Banking System Resistance

Traditional banks often blacklist or restrict high-risk businesses, leading to frozen accounts and delayed settlements. By processing payments entirely on blockchain, crypto gateways remove these points of friction. Merchants receive funds directly to their wallets, bypassing intermediaries that could block or hold transactions without warning.

Protecting Profit Margins Through Predictable Fees

In industries where profit margins are already squeezed by marketing costs, licensing, and higher operational risks, unpredictable payment fees can erode earnings. A well-structured crypto gateway offers flat, transparent fees, eliminating surprise charges and ensuring that merchants can forecast revenue accurately.

The Strategic Advantage of Adopting High-Risk-Friendly Crypto Solutions Now

The high-risk commerce landscape is evolving at a pace that leaves no room for hesitation. Those who integrate crypto payment gateways early not only solve existing problems but also position themselves to capture future growth opportunities before competitors can react.

Meeting Growing Customer Expectations for Privacy and Speed

Customers in high-risk sectors increasingly demand payment methods that are both fast and discreet. They value the ability to transact without exposing personal banking information, and they expect deposits and withdrawals to be processed in seconds, not days. Early adopters of crypto payment solutions can use this as a competitive advantage to retain and attract customers.

Expanding Global Market Access Without Banking Restrictions

Crypto payments open the door to regions where traditional banking infrastructure is weak or hostile to high-risk industries. By accepting a wide range of cryptocurrencies—including stablecoins—merchants can build global customer bases without the roadblocks imposed by local banks or payment processors.

Building a Reputation for Innovation and Reliability

In high-risk markets, trust and reputation can make or break a business. Integrating a proven crypto gateway signals to customers and partners that the business is forward-thinking, secure, and committed to providing a frictionless payment experience. Over time, this reputation translates into higher retention rates and stronger brand loyalty.

FAQs – List Out The Best High Risk Crypto Payment Gateway

1. What defines a high-risk crypto payment gateway in 2025?

It’s a provider designed for industries with higher regulatory scrutiny or transaction risks—offering adaptive KYC, advanced fraud filters, and settlement options suited for volatile markets.

2. Why are more high-risk businesses turning to crypto gateways this year?

In 2025, stricter banking rules and higher card processing fees have pushed many high-risk merchants toward crypto, where settlement is faster and approval rates are higher.

3. How do modern gateways balance compliance and privacy?

They use modular KYC—verifying only what’s necessary for the merchant’s jurisdiction—while still meeting updated FATF and regional AML standards.

4. What’s new in fraud prevention for high-risk crypto payments?

AI-driven transaction scoring, device fingerprinting, and blockchain address risk databases now help detect suspicious activity in real time.

5. Do these gateways support instant settlement for high-risk merchants?

Yes. Many now offer same-minute settlement in stablecoins or fiat, reducing exposure to price swings and improving cash flow.

6. Which cryptocurrencies are most accepted by high-risk-friendly gateways?

Alongside Bitcoin and Ethereum, stablecoins like USDT and USDC dominate, with growing adoption of Layer-2 assets for lower fees.

7. How have regulations changed for high-risk crypto processing in 2025?

Regions like the EU and Singapore have introduced clearer frameworks, making it easier for compliant gateways to serve industries previously considered off-limits.

8. Are there volume or reserve limits for high-risk merchants?

Some gateways impose rolling reserves or daily caps, but new providers are competing by offering higher limits and faster fund releases.

9. What integration options work best for high-risk e-commerce?

Plug-and-play plugins are popular for speed, while APIs remain essential for merchants needing tailored payment flows and multi-site control.

10. Why might XAIGATE stand out for high-risk businesses in 2025?

XAIGATE offers flexible compliance settings, competitive flat fees, real-time settlement, and proven uptime—crucial for industries where every transaction counts.

Conclusion: Choosing the Right High-Risk Crypto Payment Gateway for Long-Term Success

In 2025, the payment challenges facing high-risk businesses are not just operational—they are strategic. From navigating complex compliance rules to overcoming banking restrictions, every transaction is an opportunity to either build resilience or expose vulnerabilities. The right high-risk crypto payment gateway can mean the difference between stalled growth and sustained expansion.

Platforms like XAIGATE are proving that it’s possible to combine speed, security, and compliance in a way that empowers merchants instead of restricting them. By offering instant settlements, broad cryptocurrency support, and flexible KYC options, XAIGATE gives high-risk businesses the tools they need to compete in an increasingly digital and regulated marketplace.

As the industry moves toward tighter oversight and higher customer expectations, waiting to adopt a robust payment solution could mean losing ground to faster, more adaptable competitors. The businesses that act now—before these changes become unavoidable—will not just survive the shift, they’ll lead it.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!