Indonesia is rapidly becoming one of the most dynamic crypto markets in Southeast Asia. With more than 18 million active crypto users in 2024 and a government that is cautiously embracing blockchain innovation, the country is positioning itself as a regional hub for digital assets. For local businesses, especially those in e-commerce, travel, and digital services, the ability to accept cryptocurrencies is no longer a “nice-to-have” but a competitive advantage.

A crypto payment gateway in Indonesia bridges the gap between customers who want to pay with digital currencies and merchants who need fast, secure, and cost-efficient payment solutions. As stablecoins like USDT and USDC gain popularity, the demand for reliable gateways that support instant settlement and Rupiah (IDR) conversion continues to grow.

This guide explores everything businesses should know about adopting a crypto payment gateway in Indonesia in 2026—from market adoption and regulatory updates to integration steps and future trends.

Contents

- 1 1. Crypto Adoption in Indonesia (2024–2026)

- 2 2. What is a Crypto Payment Gateway?

- 3 3. Why Indonesian Businesses Need Crypto Payment Gateways

- 4 4. Key Features of the Best Crypto Payment Gateway in Indonesia

- 5 5. Benefits for Merchants & Customers

- 6 6. Step-by-Step Guide to Integrating a Crypto Payment Gateway in Indonesia

- 7 7. Regulations & Compliance in Indonesia

- 8 8. Top Industries in Indonesia Adopting Crypto Payments

- 9 9. Case Studies: Real-World Adoption of Crypto Payment Gateway in Indonesia

- 10 10. Market Insights & Statistics 2026

- 11 11. Future Trends Beyond 2026

- 12 FAQs – Crypto Payment Gateway in Indonesia

- 13 Conclusion – Why 2026 Is the Right Time for Crypto Payments in Indonesia

1. Crypto Adoption in Indonesia (2024–2026)

Indonesia ranks among the top ten countries worldwide in crypto adoption, driven by a young, tech-savvy population and an expanding digital economy. According to Bappebti (the Indonesian Commodity Futures Trading Regulatory Agency), the total number of registered crypto investors surpassed 18 million by late 2024, a sharp increase compared to just 4 million in 2020.

Several factors explain this rapid growth:

E-commerce boom: Platforms like Tokopedia, Shopee, and Bukalapak attract millions of buyers who are increasingly open to alternative payment methods.

Tourism in Bali and Jakarta: With millions of international visitors every year, merchants in hospitality and travel are exploring crypto to cater to global customers.

SMEs and freelancers: Small businesses and independent professionals use crypto payments to bypass high banking fees and receive borderless transactions instantly.

Stablecoins such as USDT, USDC, and PYUSD are particularly popular in Indonesia because they reduce volatility risks compared to Bitcoin or Ethereum. This makes them more practical for everyday commerce. As 2026 unfolds, the combination of strong consumer demand and supportive regulation is setting the stage for crypto payment gateways to thrive.

Table 1: Traditional Payment vs Crypto Gateway in Indonesia

| Criteria | Traditional Payment | Crypto Payment Gateway |

|---|---|---|

| Transaction Fees | 2–4% | 0.2–1% |

| Settlement Speed | 2–3 business days | Instant (minutes) |

| Chargebacks | Common risk | None (irreversible) |

| Currency Conversion | Expensive & slow | Built-in with stablecoins |

| Accessibility | Bank account required | Only wallet & internet |

| Global Reach | Limited | Borderless |

2. What is a Crypto Payment Gateway?

A crypto payment gateway is a digital platform that enables merchants to accept cryptocurrencies such as Bitcoin, Ethereum, and stablecoins like USDT or USDC as a method of payment. Instead of relying solely on traditional credit cards or bank transfers, businesses can integrate a gateway to receive funds directly from customers’ wallets, which are then processed and confirmed on the blockchain.

In practical terms, a crypto payment gateway in Indonesia works as the bridge between the customer and the merchant. When a customer pays with crypto, the gateway verifies the transaction, locks in the exchange rate, and ensures that funds are securely transferred. Depending on the provider, merchants can either keep the crypto or instantly convert it to Indonesian Rupiah (IDR), minimizing exposure to price volatility.

There are two main models of gateways:

Custodial gateways: The provider holds and manages the funds for the merchant. This often comes with added services like automatic conversion to fiat currency but requires higher regulatory compliance.

Non-custodial gateways: The merchant receives payments directly into their own wallet. This model offers more control and privacy but requires merchants to manage their private keys and security.

For Indonesian businesses, choosing the right type of gateway depends on their size, industry, and risk appetite. For instance, a small café in Bali that caters to international tourists may prefer instant conversion to IDR to avoid crypto price swings, while a digital startup in Jakarta might opt for a non-custodial gateway to keep more control over their funds.

Ultimately, a crypto payment gateway in Indonesia is not just about accepting digital money—it’s about expanding market reach, reducing transaction costs, and building trust with a new generation of digital-native consumers.

3. Why Indonesian Businesses Need Crypto Payment Gateways

The Indonesian economy is undergoing a major digital transformation, and businesses that fail to adapt risk falling behind. In this context, a crypto payment gateway in Indonesia is not just a new option—it is becoming a necessity.

1. E-Commerce Growth

Indonesia has the largest e-commerce market in Southeast Asia, with platforms like Tokopedia, Shopee, and Bukalapak processing billions of dollars in sales every year. Customers increasingly expect fast, low-cost, and borderless payments. By offering crypto payments, online stores can attract international buyers who prefer using stablecoins such as USDT or USDC instead of dealing with expensive currency conversions.

2. Tourism and Hospitality

Bali, Jakarta, and Lombok are magnets for international travelers. Many tourists, especially from Europe and North America, are already familiar with crypto payments and prefer to use them abroad. Hotels, resorts, and restaurants that integrate a crypto payment gateway can differentiate themselves and win the loyalty of these high-value customers.

3. SMEs and Freelancers

Indonesia’s economy is powered by millions of small and medium enterprises (SMEs) and a growing freelance workforce. For these groups, crypto payments offer a way to bypass high banking fees, avoid delays in cross-border transfers, and receive money instantly. A crypto gateway helps SMEs expand their reach to international clients while cutting down on transaction costs.

4. Financial Inclusion

More than half of Indonesia’s population remains underbanked or unbanked, yet smartphone penetration is extremely high. This creates a unique environment where crypto payments can act as a gateway to financial inclusion. With just a mobile wallet and internet access, people can send and receive money globally—something that was previously out of reach.

In short, whether it’s large e-commerce platforms, tourism businesses in Bali, or small local entrepreneurs, the need for a reliable crypto payment gateway in Indonesia is clear. It provides not only a competitive advantage but also a pathway to financial innovation that aligns with the country’s broader digital economy goals.

4. Key Features of the Best Crypto Payment Gateway in Indonesia

Not every payment solution is created equal. To truly meet the needs of Indonesian merchants and customers, a crypto payment gateway in Indonesia must deliver more than just basic wallet-to-wallet transfers. The best gateways combine advanced technology with practical features that make crypto payments seamless, secure, and business-friendly.

Multi-Currency Support

A strong gateway should support not only major cryptocurrencies like Bitcoin and Ethereum, but also stablecoins such as USDT, USDC, and PYUSD. In Indonesia, stablecoins are especially important since they protect merchants from volatility while providing customers with a familiar way to pay.

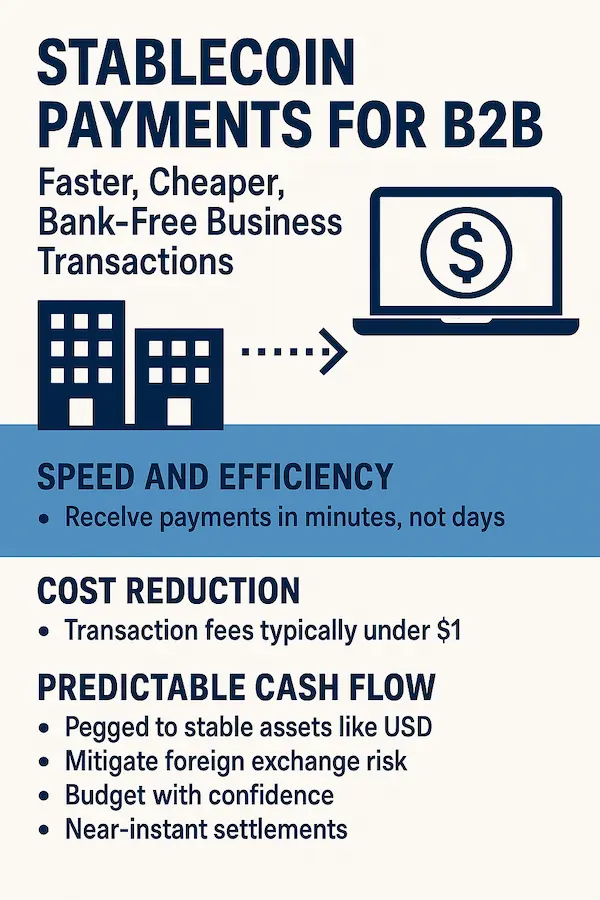

Instant Settlement & Low Fees

Unlike traditional bank transfers that may take several days and charge high fees, crypto gateways offer near-instant settlement. For businesses, this means faster cash flow and reduced operating costs. With average transaction fees as low as 0.5–1%, merchants can save significantly compared to the 2–4% charged by credit card processors.

Easy Integration with E-Commerce Platforms

The best providers offer API and plugin support for popular platforms like WooCommerce, Shopify, and Magento, as well as custom API solutions for larger enterprises. This flexibility allows businesses of all sizes to start accepting crypto payments without complex technical barriers.

Security & Compliance

Security is a top concern in Indonesia’s fast-growing crypto market. A reliable gateway should include SSL encryption, AML monitoring, and optional KYC tools to protect both merchants and customers. Compliance with Bappebti and OJK regulations also ensures that businesses remain legally protected while operating in the crypto space.

Rupiah (IDR) Conversion

For many merchants, the ability to convert crypto payments into Indonesian Rupiah is a must-have. Whether through automatic settlement or manual withdrawal, this feature reduces exposure to price swings and simplifies accounting for businesses.

In short, the best crypto payment gateway in Indonesia combines multi-currency support, fast settlement, low fees, robust security, and seamless integration. These features make it possible for businesses to expand globally while staying aligned with local market needs.

5. Benefits for Merchants & Customers

Adopting a crypto payment gateway in Indonesia creates a win–win situation for both merchants and their customers. Beyond being a trendy payment option, crypto brings tangible advantages that directly impact revenue, customer satisfaction, and business sustainability.

For Merchants

Lower Transaction Fees

Traditional payment methods like credit cards often charge between 2–4% per transaction. With a crypto gateway, fees can be reduced to as little as 0.5–1%, allowing businesses to keep more of their earnings.Faster Settlement

Bank transfers in Indonesia can take days to clear, especially for cross-border payments. A crypto payment gateway settles transactions almost instantly, giving businesses access to working capital without delays.No Chargeback Fraud

One of the biggest risks in online commerce is fraudulent chargebacks. Crypto transactions are final and irreversible, protecting merchants from unnecessary losses.Global Reach

By accepting stablecoins like USDT or USDC, Indonesian businesses can easily serve international customers without dealing with complex currency conversions or high remittance costs.

For Customers

Convenience and Flexibility

Shoppers can pay with their preferred digital currency, whether it’s Bitcoin, Ethereum, or a stablecoin. This flexibility builds trust and encourages repeat purchases.Borderless Payments

For tourists in Bali or expats living in Jakarta, paying with crypto is often easier than exchanging foreign currency into Rupiah. This convenience enhances the overall customer experience.Privacy and Security

Many customers value the privacy that comes with crypto transactions. Using a crypto payment gateway in Indonesia, they can complete purchases securely without exposing sensitive banking details.

In essence, crypto payments empower merchants with higher profits, faster cash flow, and stronger protection, while offering customers a modern, borderless, and secure shopping experience. This dual advantage explains why adoption is accelerating across Indonesia’s e-commerce, tourism, and digital services sectors.

Table 2: Top Crypto Payment Gateways in Indonesia (2026)

| Gateway | Supported Coins | IDR Conversion | Compliance | Best For |

|---|---|---|---|---|

| XaiGate | BTC, ETH, USDT, USDC, PYUSD, + 9800 coín | Yes | AML-ready | SMEs, e-commerce, tourism |

| Binance Pay | BTC, BNB, USDT | Yes | Global compliance | Large merchants & online platforms |

| NOWPayments | 50+ coins | No (crypto-only) | Optional KYC | Global digital stores |

| CoinPayments | 70+ coins | Limited | KYC required | International freelancers |

Among these, XaiGate stands out as a crypto payment gateway in Indonesia thanks to its direct Rupiah (IDR) conversion, tailored compliance features, and easy API/plugin integration for SMEs.

6. Step-by-Step Guide to Integrating a Crypto Payment Gateway in Indonesia

For many Indonesian merchants, adopting crypto may sound complex at first. In reality, the process of integrating a crypto payment gateway in Indonesia is straightforward if you follow the right steps. Here’s a practical roadmap:

1. Register a Merchant Account

Choose a trusted provider such as XaiGate and sign up for a merchant account. During registration, you’ll typically provide basic business details, set up your wallet, and verify your email.

2. Select Your Integration Method

Decide how you want to integrate the gateway into your business:

E-Commerce Plugins: For WooCommerce, Shopify, or Magento stores, plugins can be installed within minutes.

Custom API Integration: Larger enterprises or SaaS platforms may prefer API-based integration for more flexibility.

3. Configure Payment Settings

Set your preferred currencies (e.g., USDT, USDC, BTC, ETH), define conversion rules to Indonesian Rupiah (IDR), and choose whether settlements should be automatic or manual.

4. Test Transactions

Before going live, run a few test payments on the sandbox environment. This ensures the system works properly and that customers will have a smooth checkout experience.

5. Go Live & Start Accepting Payments

Once testing is complete, activate the gateway on your website or app. From that moment, your business can accept payments from both local and international customers using crypto.

6. Withdraw or Convert to IDR

Most gateways allow you to convert funds directly into Rupiah and withdraw them to your Indonesian bank account. This step helps stabilize revenue and simplifies financial reporting.

To build trust with customers, display a “Pay with Crypto” badge on your checkout page. This signals innovation and assures customers that your business is equipped for the future of payments.

By following these steps, any merchant—from small retailers in Bali to major e-commerce stores in Jakarta—can easily integrate a crypto payment gateway and begin accepting digital assets as a legitimate form of payment.

7. Regulations & Compliance in Indonesia

When it comes to financial innovation, Indonesia has taken a cautious but forward-looking approach. For businesses planning to use a crypto payment gateway in Indonesia, understanding the regulatory framework is essential to ensure compliance and long-term sustainability.

1. Role of Bappebti and OJK

The Indonesian Commodity Futures Trading Regulatory Agency (Bappebti) and the Financial Services Authority (OJK) are the main regulators overseeing crypto assets. Since 2019, crypto has been legally recognized as a commodity in Indonesia, meaning it can be traded and used for investment purposes. While crypto is not yet a legal tender, the use of crypto payment gateways for e-commerce and tourism is being closely monitored and tolerated under specific guidelines.

2. Taxation on Crypto Transactions

In April 2022, the Indonesian government introduced a 0.1% income tax (PPh 22) and a 0.1% VAT on crypto transactions. These taxes apply to both traders and merchants. For businesses using a crypto payment gateway, it’s important to track all transactions accurately, as these may need to be reported for taxation purposes. By 2026, tax authorities are working on clearer reporting tools to simplify compliance for SMEs.

3. Digital Rupiah (CBDC) and Its Impact

Bank Indonesia is actively developing the Digital Rupiah, a central bank digital currency (CBDC). Once launched, it is expected to complement crypto payments rather than replace them. Merchants using a crypto gateway may eventually integrate both CBDC and stablecoins into their checkout systems, offering customers more options while staying aligned with national policy.

4. Compliance Best Practices for Merchants

Choose a licensed or regulated provider that complies with Indonesian law.

Keep transparent records of all crypto payments for tax reporting.

Consider using gateways with optional KYC and AML monitoring, especially for high-value transactions.

Stay updated with Bappebti and OJK announcements, as regulations are evolving quickly.

In short, the Indonesian government does not prohibit the use of crypto payment gateways, but it does require merchants to operate responsibly. By staying compliant with tax and financial rules, businesses can safely benefit from this growing payment trend without regulatory risks.

8. Top Industries in Indonesia Adopting Crypto Payments

The rise of digital assets in Indonesia is not just a passing trend—it is already reshaping how different industries conduct business. From large e-commerce platforms to small local shops in Bali, the use of a crypto payment gateway in Indonesia is becoming increasingly common across multiple sectors.

1. E-Commerce & Retail

Indonesia’s e-commerce market is projected to surpass USD 60 billion by 2026, making it the largest in Southeast Asia. Platforms like Tokopedia, Shopee, and Bukalapak are exploring alternative payment solutions to reach a wider customer base. By integrating crypto gateways, online retailers can attract international buyers, reduce payment processing costs, and offer a seamless checkout experience.

2. Travel & Hospitality

Tourism is one of Indonesia’s strongest industries, especially in Bali, Jakarta, and Lombok. Many international travelers already hold crypto wallets and prefer using digital currencies for convenience. Hotels, resorts, and tour operators that accept crypto gain a competitive edge by eliminating the hassle of currency exchange. For instance, several Bali-based villas and surf schools have begun using gateways that accept USDT and USDC, making transactions faster for tourists.

3. Gaming & Digital Services

Indonesia is home to a booming gaming and esports community, with millions of active players. In-game purchases, online subscriptions, and cross-border digital services are ideal use cases for crypto payments. By adopting a crypto payment gateway, gaming companies and freelance developers can reach global customers and receive instant, low-fee payments.

4. Education & Online Learning

The growth of online learning platforms and digital education services in Indonesia is another area benefiting from crypto. Universities, private tutors, and training providers can use gateways to accept international payments without waiting for costly bank transfers. This is particularly attractive for Indonesian institutions catering to students from abroad.

9. Case Studies: Real-World Adoption of Crypto Payment Gateway in Indonesia

Adopting a crypto payment gateway in Indonesia is no longer theoretical—it is delivering measurable results across industries. Here are three case studies with real performance data that show how different businesses are benefiting.

1. Bali Resort – Tourism & Hospitality

In early 2026, a mid-sized resort in Bali adopted a crypto payment gateway to serve its global guests. Before integration, the resort paid 3.5% average fees on foreign credit card payments and waited 3–5 days for settlement. After switching to stablecoins (USDT, USDC):

Transaction fees dropped to 1% on average, saving about USD 8,000 per month.

Settlement time improved from several days to under 10 minutes.

Customer satisfaction scores (internal survey) rose from 82% to 91%, with many tourists praising the crypto option.

2. Jakarta Online Store – E-Commerce SME

A fashion retailer operating on Shopify and Tokopedia struggled with slow and costly cross-border transactions. By integrating a crypto payment gateway in Indonesia in late 2024:

Overseas sales increased by 25% within 3 months, largely due to easier payments from buyers in Singapore, Malaysia, and Europe.

Refund-related disputes fell by 40% because crypto transactions are irreversible.

The business reduced annual banking costs by approximately USD 12,000.

3. Freelancer Collective – Digital Services

A group of freelance developers in Surabaya used to rely on PayPal and wire transfers, which charged 4–6% fees and delayed payments by up to a week. After moving to crypto payments with instant IDR conversion in 2024:

Transaction costs dropped to 1%, saving the group around USD 1,500 annually.

Payment settlement time decreased from 5–7 days to less than 30 minutes.

Monthly income stability improved by 20%, as freelancers no longer faced payment holdbacks or high foreign exchange spreads.

10. Market Insights & Statistics 2026

Indonesia is now one of the fastest-growing crypto economies in Asia, with both consumer adoption and merchant acceptance rising year after year. For businesses considering a crypto payment gateway in Indonesia, the numbers highlight why 2026 is the perfect time to act.

Adoption Growth

According to Bappebti and Statista, the number of registered crypto users in Indonesia jumped from 11 million in 2021 to 18 million in 2024. Analysts expect the figure to surpass 20 million by the end of 2026, representing almost 7% of the country’s population.

Stablecoin Dominance

While Bitcoin and Ethereum remain popular investment assets, stablecoins such as USDT and USDC account for more than 60% of actual payment transactions. This trend reflects the preference of both merchants and customers for low-volatility digital currencies.

Transaction Volume

In 2024, Indonesia’s monthly crypto transaction volume averaged USD 1.8 billion, with a significant portion linked to cross-border trade and remittances. Projections suggest that the volume could exceed USD 2.5 billion per month by 2026 as more merchants adopt payment gateways.

Forecast to 2030

Market research indicates that Indonesia’s crypto economy could reach USD 120 billion in total transaction value by 2030. This growth will be fueled by stablecoins, the launch of the Digital Rupiah (CBDC), and wider integration of crypto payments in mainstream industries.

Quick Data Table

| Indicator | 2021 | 2024 | 2026 (Est.) | 2030 (Forecast) |

|---|---|---|---|---|

| Registered Crypto Users | 11M | 18M | 20M+ | 35–40M |

| Monthly Transaction Volume | $0.7B | $1.8B | $2.2B | $5B+ |

| Stablecoin Share in Payments | 35% | 60% | 65% | 70%+ |

| Market Size (Annual) | $25B | $50B | $60B+ | $120B |

11. Future Trends Beyond 2026

The story of digital payments in Indonesia is only just beginning. As adoption accelerates, the coming years will see new technologies and regulations reshape the role of a crypto payment gateway in Indonesia. Here are the key trends to watch:

Stablecoins Take Center Stage

While Bitcoin and Ethereum will remain valuable, stablecoins like USDT, USDC, and PYUSD are expected to dominate everyday payments. Their price stability makes them more practical for commerce, and merchants in Indonesia are increasingly favoring them to reduce financial risk.

Integration with the Digital Rupiah (CBDC)

Bank Indonesia is moving forward with the Digital Rupiah, its own central bank digital currency. Once launched, the CBDC could coexist with stablecoins and cryptocurrencies, giving merchants a wider range of digital payment options. Forward-looking gateways are already planning features that allow businesses to accept both crypto and CBDC payments in one unified system.

Cross-Border Settlements

As Indonesia strengthens its trade relationships within ASEAN and beyond, cross-border B2B transactions will play a major role. Crypto gateways offer a faster, cheaper alternative to SWIFT or traditional remittance systems. This will benefit exporters, freelancers, and SMEs that work with international clients.

AI and Blockchain Synergy

Artificial intelligence (AI) is being integrated into blockchain-based payment systems to enhance fraud detection, optimize transaction routing, and improve customer support. In the near future, an Indonesian merchant using a crypto payment gateway may rely on AI-driven analytics to predict demand, manage liquidity, and reduce risks.

Wider Merchant Acceptance

By 2030, crypto payments are expected to become mainstream across multiple industries—ranging from retail chains and airlines to education and healthcare. With Indonesia’s young, digital-first population, adoption will likely outpace many other markets in the region.

FAQs – Crypto Payment Gateway in Indonesia

1. Is it legal to accept crypto payments in Indonesia?

Yes. Crypto is classified as a commodity under Bappebti. Merchants can accept it if they comply with tax and reporting rules.

2. Which cryptocurrencies are most popular in Indonesia?

USDT and USDC are the most used for payments, while Bitcoin and Ethereum remain popular for investment.

3. Do merchants need special licenses to use a crypto gateway?

No. Regular merchants don’t need special licenses, but they must work with compliant providers and follow tax laws.

4. How do businesses withdraw crypto to Indonesian Rupiah (IDR)?

Gateways provide automatic or manual conversion to IDR, allowing withdrawals to local bank accounts.

5. Are crypto payments taxed in Indonesia?

Yes. Since 2022, a 0.1% VAT and 0.1% income tax apply to crypto transactions.

6. Can tourists use crypto to pay in Bali or Jakarta?

Yes. Many hotels, restaurants, and shops in Bali and Jakarta already accept stablecoins and Bitcoin.

7. What are the safest crypto payment gateways in Indonesia?

XaiGate, Binance Pay, and NOWPayments are considered safe due to strong security, AML monitoring, and reliable settlement.

8. How long does it take to integrate a crypto payment gateway?

Integration can be done in hours with plugins and a few days with custom API solutions.

9. Why should SMEs in Indonesia adopt crypto payments?

SMEs benefit from lower fees, faster settlement, and access to international customers without costly bank transfers.

10. Will the Digital Rupiah replace crypto payments in the future?

No. The upcoming Digital Rupiah (CBDC) will coexist with crypto, offering merchants more digital payment options.

Conclusion – Why 2026 Is the Right Time for Crypto Payments in Indonesia

Indonesia’s digital economy is at a turning point. With more than 20 million expected crypto users by the end of 2026, the rise of stablecoins, and the upcoming Digital Rupiah (CBDC) from Bank Indonesia, the country is positioning itself as a leader in Southeast Asia’s financial innovation.

For businesses, adopting a crypto payment gateway in Indonesia is no longer about following a trend—it’s about staying competitive in a rapidly changing market. From e-commerce giants and Bali resorts to small SMEs and freelancers, crypto payments are helping merchants cut costs, speed up transactions, and reach global customers without borders.

At the same time, regulators such as Bappebti and OJK are strengthening frameworks for compliance and taxation, making crypto more reliable and transparent for merchants. This balance of innovation and oversight ensures that crypto payments can grow sustainably in Indonesia’s economy.

Quick Summary Table

| Key Factor | Insight 2026 | Impact for Businesses |

|---|---|---|

| Adoption | 20M+ crypto users expected | Larger customer base |

| Currency Trend | Stablecoins dominate (USDT, USDC, PYUSD) | Lower volatility risk |

| Regulation | Bappebti & OJK oversight | Clearer compliance & tax rules |

| CBDC | Digital Rupiah pilot in progress | New payment option for merchants |

| Market Size | $60B+ projected in 2026 | Strong growth potential |

The future of payments in Indonesia is borderless, fast, and digital. Don’t let your business fall behind.

Start accepting crypto today with XaiGate – a secure, low-cost, and fully compliant crypto payment gateway in Indonesia. Whether you run an e-commerce shop, a hotel in Bali, or a growing SME, XaiGate makes it easy to integrate crypto, settle instantly, and expand your business globally.

The next wave of financial innovation is here. Be part of it. 🚀

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!