Adopting crypto payment systems is foundational for the growth of the global digital economy. Any business looking to growth, innovate and provide best in class experiences to customers must implement this technology. Any business on the future of payment must understand the workings, benefits and pitfalls of these systems. This guide analyzes the evolution of crypto payment systems and their importance, and the empowerment systems provide merchants and consumers.

Contents

- 1 1. Understanding the evolution of crypto payment systems

- 2 2. Unrivaled Advantages for Your Business Acceptance

- 3 3. How a Payment System Functions

- 4 Finding the right payment gateway for your e-commerce business

- 5 4. Integrate cryptocurrency payments into your website

- 6 5. Security and Compliance: Pillars of a Reliable Crypto Payment System

- 7 Xaigate: A Potential Partner in Your Crypto Payment Journey

- 8 FAQs – Crypto Payment System

- 9 Conclusion: Why Crypto Payment Systems Matter Today

1. Understanding the evolution of crypto payment systems

Every new technology brings pitfalls along with benefits, and crypto payment systems technology is no different. To understand their value, the answer to the question, ‘what are payment crypto systems, how do they work and why are they disrupting the world’ must be answered.

Crypto payment systems essence is providing the infrastructure for businesses to receive payments in digital currencies like Bitcoin, Ethereum, and stablecoins. These systems serve as middlemen, taking care of the intricate details of cross-blockchain transactions, allowing customers and merchants to concentrate on the payment process.

Table: Comparison of Different Types of Crypto Payment Systems

| Type of Crypto Payment System | Integration Complexity | Control & Customization | Security Responsibility |

|---|---|---|---|

| Hosted Payment Gateway | Low – Quick setup with provider’s dashboard/API | Medium – Limited to provider’s available features | Low – Provider manages security and compliance |

| Self-Hosted Payment Processor | High – Requires server, blockchain sync, coding | Very High – Full control over all features | Very High – You handle all security & maintenance |

| Hybrid Payment System | Medium – Combine third-party API with own wallet | High – Custom workflows with external security layer | Medium – Shared between you and provider |

| POS-Based Crypto Payment System | Low – Install POS software or hardware | Low – Standard checkout options | Low – Managed by POS provider |

| Custom API-Integrated System | Medium to High – API integration with backend | High – Can tailor checkout flow and reporting | Medium – You manage some security layers |

2. Unrivaled Advantages for Your Business Acceptance

Practical uses for commerce and not just speculation crypto assets. With crypto systems, businesses not only improve operational efficiency and cost management, but also gain access to new and fresh market opportunities. Here are the main advantages of crypto systems that explain the increasing popularity of this payment solution.

New customers are had in modern commerce with new digital payment options

Businesses willing to accept digital currencies gain the ability to reach new, modern, and technologically savvy customers that choose to spend crypto. It also allows merchants to serve customers that do not use the formal banking system or those that use banking alternatives for cross-border transactions. For international businesses this sort of payment system provides the opportunity to expand and diversify.

Save money while minimizing complaints

Using conventional methods of payment involves intermediaries such as banks, processors, and clearinghouses, which increases transaction costs. On the other hand, crypto payment systems reduce the number of intermediaries. This is particularly beneficial for international payments where traditional methods are expensive. Lower costs improve profit margins and reduce the likelihood of chargebacks and payment disputes.

Speed and security are a double benefit

Bank transfers can take days, but payments through crypto payment systems are confirmed within minutes. With faster processing, businesses have improved liquidity and cash flow. Moreover, blockchain technology ensures every transaction is secure, encrypted, and immutable. The combination of these benefits provides protection against fraud while also boosting customers’ confidence and trust.

Table: Core Functions of a Crypto Payment System – Importance & Implementation Requirements

| Function | Importance Level | Implementation Requirements |

|---|---|---|

| Payment Processing | Critical – Core operation of the system | Secure API integration, blockchain network connectivity, transaction validation mechanisms. |

| Currency & Token Support | High – Expands merchant and customer reach | Multi-chain compatibility, regular updates to support new cryptocurrencies and stablecoins. |

| Security & Fraud Prevention | Critical – Protects funds and user trust | End-to-end encryption, multi-signature wallets, 2FA, anomaly detection systems. |

| Settlement & Conversion | High – Reduces volatility risk | Automated crypto-to-fiat conversion, configurable settlement timeframes, stablecoin integration. |

| Compliance & Regulation | High – Ensures legal operation | KYC/AML verification, GDPR compliance, ongoing monitoring for evolving legal requirements. |

| Reporting & Analytics | Medium – Supports business decision-making | Transaction dashboards, performance metrics, downloadable financial reports. |

| Scalability & Uptime | Critical – Maintains service quality | Cloud infrastructure, load balancing, redundancy systems, 99.99% uptime SLAs. |

| Developer Tools & Integration | Medium – Speeds up deployment | SDKs, sandbox environments, comprehensive API documentation, sample code libraries. |

3. How a Payment System Functions

Most people think payment systems in crypto are limited to accepting payments in crypto. This view completely disregards the payment system’s potential in transforming the entire payment system’s architecture. They add efficiency, clarity, and rapidity to every stage of the transaction cycle, and these are noticeable advantages to customers and merchants alike.

The Customer’s Experience: Wallet to Merchant

For your customers paying with crypto on your site, the entire transaction initiates and completes with no glitches period:

- An invoice generated to include the payment required and merchant wallet address and QR code.

- The customer accesses their crypto wallet, scans the QR code, and approves the payment.

- The validator on the payment gateway receives the confirmed crypto transaction and instantly alerts the merchant.

- Merchant can now execute the order without the bank’s delay.

Overall, the payment system architecture provides real-time payment guarantees. This lack of friction also benefits customers.

The Role of Portals, Blockchain, and Trading Systems in Crypto Payments

Every cryptocurrency transaction is recorded on the blockchain in perpetuity, as the digital ledger is transparent, immutable, and irreversible. Therefore, the payment tampering and chargeback fraud that occurs on traditional payment systems is impossible. Here, the crypto payment gateway can funnel the transaction directly to the merchant’s crypto wallet or preconvert the cryptocurrency to the euro or dollar equivalent. Then, the business can accept cryptocurrency while sidestepping the volatility crypto exposure.

Finding the right payment gateway for your e-commerce business

For e-commerce merchants, the right system is essential to your business. It should fit your operational workflow and customer journey, and align with your business’s long-term objectives. Transaction speed and currency conversion options are fundamental, as is support for global customers, while integration with existing systems is a prerequisite for seamless implementation.Essential Features for an Online Store

A strong crypto payment solution for e-commerce encompasses:- Plug-and-play functionality with leading services such as Shopify, WooCommerce, and Magento.

- Fully automated payments with minimal human interference to quicken order fulfillment.

- Active crypto volatility tools to shield merchants from quick crypto price fluctuations.

- Full report tools to watch payments, check trends, and make accounting easier.

- Shopper-happy pay ways that lower cart drop by keeping checkout quick and clear.

With the integration of these elements, web-based shops will gauge a rise in conversion rates uplifted client contentment as well as getting a solid spot around the world market.

Important Details: Supported Currencies and Fiat Conversion

For reasonable cryptocurrency payment services, Enterprise Payment Tokens (cryptocurrencies payment services) should offer Bitcoin, Ethereum and several stablecoins. For businesses trying to avoid the risks associated with cryptocurrency, it is fundamental to offer instant conversion to fiat currencies, specifically to the US dollar or euro. This will address customer needs and ensure predictable income with less risk instead of paying with high volatility cryptocurrencies.

4. Integrate cryptocurrency payments into your website

Once you have evaluated the proposed cryptocurrency payment solution, the next step is to integrate it into your online platform. This section details how to effectively accept cryptocurrency payments on your website.Choose the right integration method

The main ways to incorporate a crypto payment system are through plugins and direct API integration. Depending on your site’s infrastructure and your skill level, one option will be more appealing than the other. Understanding how to accept cryptocurrency payments on your website starts with choosing the right approach. Which Solution is Better for Your Cryptocurrency Payment System: Plugin or API?-

- Using a Plugin: Those using an e-commerce platform like Shopify, WordPress, or Magento may find using a dedicated cryptocurrency payment plugin faster than others that integrate via an API. Such plugins aim to be simple, requiring little or no skill to set up. Most of the time, all that is required is installation and activation, along with entering your API key.

- Custom API Integration: For private websites or corporate web applications, embedded APIs provide full control and configuration in managing the payment flow. Typically, this means the developer needs to go hands-on with the system’s API documentation and write custom code to link components to ensure they meet specific standards and requirements.

Create and test your cryptocurrency payment gateway

After selecting the integration method, you should register with the selected provider, create an account and go through the KYC/AML verification steps configured by the provider while generating the necessary keys for the access tokens required in the integration guide provided by them, the integration SDK guide verifies the testing cycles that have been performed after the system is ready to go through the operational state, performing each stage starting from transaction request to receiving funds, checking if there are any issues that arise during the processing.5. Security and Compliance: Pillars of a Reliable Crypto Payment System

In any financial process, especially one involving crypto payment systems, both security and compliance are important. These measures ensure the safety of your business and your customers.

Protect transactions and data

Transaction and data security includes stringent measures such as information gathering through advanced encryption, using multi-signature wallets to keep funds in cold storage (especially when withdrawing large amounts), and sophisticated fraud detection systems to prevent breaches.Navigating the regulatory landscape (KYC/AML)

Compliance with know your customer and anti-money laundering protocols is common for crypto payment system providers. These policies require some level of identity verification for merchants and sometimes customers to limit financial crime. While this may seem like extra layers of authentication, it protects users from having their crypto payment system used as a legal loophole that undermines confidence in the financial integrity of the system over time.Xaigate: A Potential Partner in Your Crypto Payment Journey

Look for providers who demonstrate a commitment to their customers by creating intuitive and innovative designs tailored to the needs of their users while looking for a reliable crypto payment system provider. This is exactly why Xaigate seeks to provide unparalleled value tailored to businesses ready to adopt cryptocurrency payments. Meeting the demands of modern technology and business, Xaigate provides a crypto payment system with maximum security features and operational efficiency. Their main concern is to streamline the payment process for merchants so that accepting cryptocurrency payments becomes simple. Providing a robust system that meets the high standards of security and performance of the industry makes Xaigate a trusted partner in the cryptocurrency payment ecosystem. With the advancements in globalization, the demand for digitally accepted payments has multiplied, forcing businesses at all levels to adopt the right strategic solutions. Adopting cryptocurrency payment options should always be done with a vision rather than just seeing it as another technology application. With the right decision, trust xbapay to assist you in capturing new markets while providing customers with what they really want along with frictionless transactions.FAQs – Crypto Payment System

1. What is a crypto payment system?

A crypto payment system enables merchants to accept cryptocurrencies like BTC, ETH, and USDT directly from customers and process those payments within their platform.2. How does a crypto payment system work?

It connects your website’s checkout to blockchain networks via plugins or APIs—generating a wallet address and confirming payments before notifying your backend.3. What are key benefits of using crypto payment systems?

They offer fast cross-border transactions, lower fees, no chargebacks, and access to privacy-focused users that traditional systems can’t reach.4. Is a crypto payment system secure?

Yes—when using trusted providers, these systems use SSL, 2FA, encrypted keys, and often non-custodial flows for added safety.5. Which platforms support crypto payment systems?

Most open‑source platforms (like WordPress, Magento, PrestaShop, WooCommerce) and custom sites can integrate with crypto payment systems via plugins or API.6. Can the system convert crypto to fiat automatically?

Some do. Auto-conversion services let merchants receive fiat in local currency via bank payouts, reducing exposure to crypto volatility.7. Do I need coding skills to set up a crypto payment system?

Not always. Many providers, including XAIGATE, offer plug-and-play modules that require minimal technical setup.8. Are there fees involved?

Yes. Providers charge transaction fees (typically 0.2 – 1 %), plus network gas fees. Some systems also offer premium features for an extra cost.9. Can I track and reconcile crypto payments easily?

Yes. Good systems provide dashboards, transaction history, webhook feeds, and reconciliation tools to simplify accounting.10. What should businesses consider before choosing a system?

Evaluate coin support, fee structure, custody model (custodial vs non-custodial), plugin/API support, fiat conversion options, and regulatory compliance.Conclusion: Why Crypto Payment Systems Matter Today

The rise of crypto payment systems is more than a passing trend—it reflects the future of global commerce. From faster cross-border transactions to lower processing fees and enhanced financial freedom, businesses and consumers are beginning to see the real-world value of digital currencies. As governments and regulators tighten rules while technology keeps advancing, the ability to adapt will decide who thrives in this new financial landscape.

By understanding the five essential facts—speed, cost efficiency, security, global access, and regulatory shifts—you position yourself ahead of the curve. Whether you are a merchant seeking alternative payment solutions or an individual looking to embrace digital assets, crypto payment systems are no longer optional—they are becoming essential.

Quick Summary Table

| Fact | Why It Matters |

|---|---|

| Speed | Instant settlements vs. waiting days with banks. |

| Cost Efficiency | Lower fees, especially for cross-border payments. |

| Security | Blockchain transparency and reduced fraud risk. |

| Global Access | Reach unbanked users and global markets with ease. |

| Regulatory Shifts | Rules are evolving quickly—awareness helps you stay compliant. |

Don’t wait for traditional payment systems to catch up. Adopt a crypto payment system today and future-proof your business with faster, cheaper, and borderless transactions.

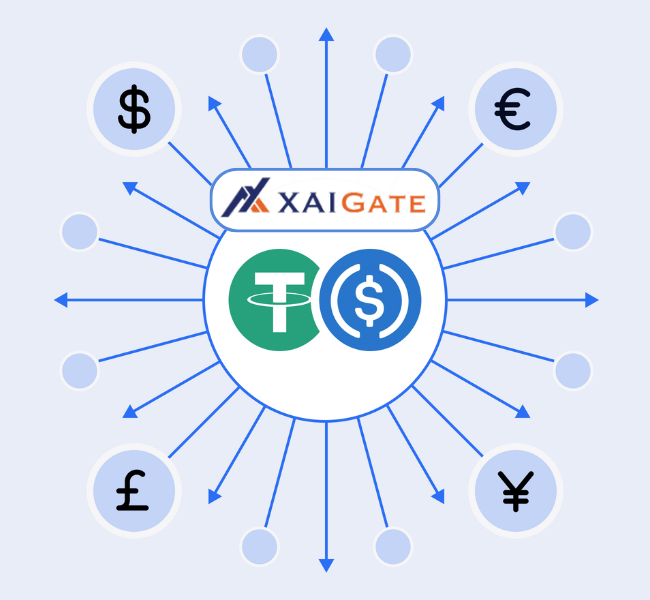

Explore solutions like XaiGate—a stablecoin-focused crypto gateway designed for merchants who want reliability, compliance, and growth in the digital economy.

For daily updates, subscribe to XAIGATE’s blog! We may also be found on GitHub, and X (@mxaigate)! Follow us!