Since the advent of cryptocurrency and Web3, the concept of financial transactions and consumer protection has radically transformed. Crypto refunds are an entirely different beast than the traditional payment methods, where reversibility is impossible and it is a fact and not a bug. The knowledge of what can be done (and what cannot) with regard to dispute resolution in the crypto field is paramount to both consumers and merchants who have to operate in this new digital economy.

Conventional payment methods such as credit cards have inbuilt consumer safeguards that can reverse a transaction through a process known as a chargeback whereas cryptocurrency transactions are irreversible and final. This change bears problems and potential when it comes to developing novel practices of dispute resolution that are fit to operate with the decentralized environment of Web3.

Contents

- 1 Understanding Traditional vs. Crypto Payment Reversals

- 2 The Reality of Crypto Refunds

- 3 Web3 Solutions for Dispute Resolution

- 4 Current Limitations and Challenges

- 5 Practical Strategies for Consumers

- 6 Emerging Technologies and Future Solutions

- 7 Best Practices for Merchants

- 8 Real-World Case Studies

- 9 Regulatory Considerations

- 10 Consumer Education and Awareness

- 11 Conclusion

- 12 Frequently Asked Questions

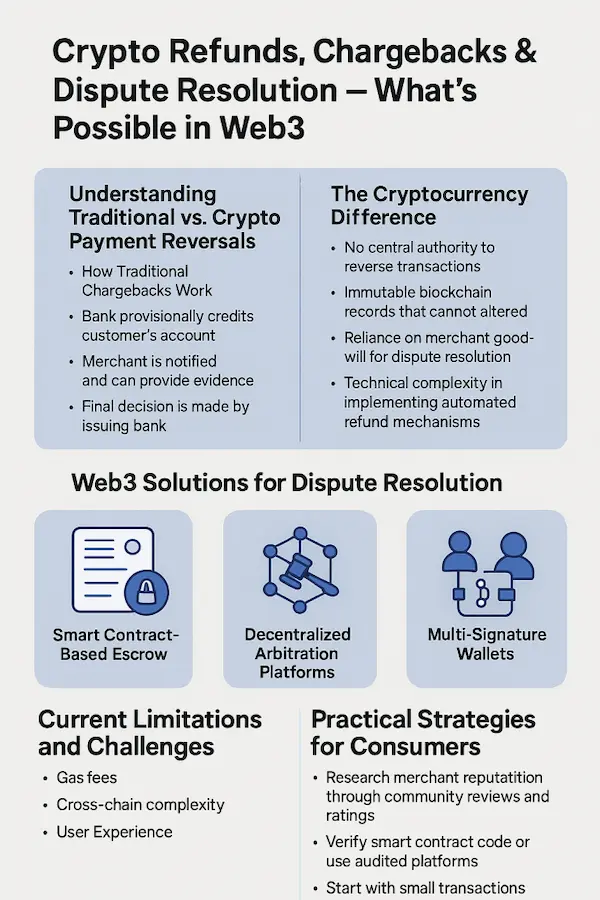

Understanding Traditional vs. Crypto Payment Reversals

How Traditional Chargebacks Work

In the traditional financial system, chargebacks serve as a safety net for consumers. When you dispute a credit card transaction, your bank can reverse the payment and return funds to your account while investigating the claim. This process is governed by regulations like the Fair Credit Billing Act (FCBA) in the United States.

The traditional chargeback process typically follows these steps:

- Customer disputes a transaction with their bank

- Bank provisionally credits the customer’s account

- Merchant is notified and can provide evidence

- Final decision is made by the issuing bank

- Funds are permanently allocated based on the outcome

The Cryptocurrency Difference

Cryptocurrency transactions are fundamentally different because they cannot be reversed once confirmed on the blockchain. This immutability is by design—it’s what makes cryptocurrencies trustless and eliminates the need for intermediaries like banks to manage disputes.

However, this doesn’t mean crypto refunds are impossible. Instead, they require voluntary cooperation from merchants or the implementation of smart contract-based solutions that build protections directly into the transaction structure.

The Reality of Crypto Refunds

Direct Cryptocurrency Transactions

When dealing with pure peer-to-peer cryptocurrency transactions, traditional chargebacks simply don’t exist. Although crypto transactions cannot be reversed, they can be refunded by the merchant, but this requires the merchant’s voluntary cooperation.

The key differences include:

- No central authority to reverse transactions

- Immutable blockchain records that cannot be altered

- Reliance on merchant goodwill for dispute resolution

- Technical complexity in implementing automated refund mechanisms

Payment Processor Intermediaries

Many businesses accept cryptocurrency through payment processors that act as intermediaries. These services often provide traditional chargeback-like protections by:

- Converting crypto to fiat currency immediately

- Offering merchant refund policies

- Providing customer dispute resolution services

- Maintaining traditional payment method integrations

Table 1: Payment Method Comparison

| Feature | Traditional Cards | Direct Crypto | Crypto Processors |

| Reversibility | Yes (chargebacks) | No | Limited |

| Dispute Window | 60-120 days | None | Varies |

| Consumer Protection | Regulated | Minimal | Processor-dependent |

| Merchant Risk | High | Low | Medium |

| Resolution Time | 30-90 days | Immediate/Never | 7-45 days |

Web3 Solutions for Dispute Resolution

Smart Contract-Based Escrow

One of the most promising developments in crypto refunds and dispute resolution is the use of smart contracts to create automated escrow systems. Smart contracts can hold funds in escrow until predetermined conditions are met, ensuring that payment is released only when the agreed-upon deliverables are completed.

These systems work by:

- Locking funds in a smart contract during the transaction

- Setting predefined conditions for release or refund

- Automating dispute resolution through coded logic

- Enabling third-party arbitration when disputes arise

Decentralized Arbitration Platforms

Several platforms have emerged to provide decentralized dispute resolution services:

Kleros: A decentralized dispute resolution protocol where jurors consider cases and vote on winners, with rulings enforced by smart contracts.

Aragon Court: Uses a token-based jury system for resolving disputes in decentralized organizations.

OpenBazaar: Implements multi-signature escrow with third-party moderators for e-commerce disputes.

Multi-Signature Wallets

Multi-signature (multisig) wallets require multiple parties to approve transactions, creating a built-in dispute resolution mechanism:

- 2-of-3 signatures: Buyer, seller, and neutral arbitrator

- Automatic resolution when two parties agree

- Protection against single-party fraud

- Customizable approval requirements

Table 2: Web3 Dispute Resolution Methods

| Method | Trust Level | Automation | Cost | Resolution Time |

| Smart Contract Escrow | High | Full | Low | Minutes |

| Decentralized Arbitration | Medium | Partial | Medium | Days-Weeks |

| Multi-sig Wallets | High | Minimal | Low | Variable |

| Merchant Goodwill | Low | None | None | Variable |

| Centralized Exchanges | Medium | High | Medium | Days |

Current Limitations and Challenges

Technical Barriers

The current state of crypto refunds faces several technical challenges:

Gas Fees: Ethereum-based refunds can be expensive due to network fees, sometimes exceeding the refund amount for small transactions.

Cross-Chain Complexity: Disputes involving multiple blockchains require sophisticated technical solutions that are still in development.

User Experience: The technical complexity of Web3 dispute resolution can be overwhelming for average consumers.

Legal and Regulatory Gaps

Unlike traditional payment systems, cryptocurrency dispute resolution exists in a regulatory gray area:

- Lack of standardized consumer protections

- Unclear jurisdiction for international disputes

- Limited legal recourse for smart contract bugs or exploits

- Evolving regulatory frameworks that vary by country

Adoption and Infrastructure

The current Web3 ecosystem faces adoption challenges:

- Limited merchant acceptance of escrow-based payments

- Network effects requiring critical mass for effectiveness

- User education barriers for understanding new systems

- Integration complexity with existing business systems

Practical Strategies for Consumers

Due Diligence Before Transacting

Since crypto refunds are more complex than traditional chargebacks, prevention is crucial:

- Research merchant reputation through community reviews and ratings

- Verify smart contract code or use audited platforms

- Start with small transactions to test merchant reliability

- Use escrow services for high-value purchases

- Understand refund policies before making payments

Choosing the Right Payment Method

Different crypto payment methods offer varying levels of protection:

High Protection:

- Centralized exchanges with dispute resolution

- Payment processors with chargeback policies

- Smart contract escrow services

Medium Protection:

- Multi-signature wallet transactions

- Established merchant platforms

- Community-vouched sellers

Low Protection:

- Direct peer-to-peer transactions

- Unknown or new merchants

- Non-escrow crypto payments

Documentation and Evidence

When disputes do arise, proper documentation is essential:

- Transaction receipts and blockchain confirmations

- Communication records with merchants

- Product or service evidence showing non-delivery or defects

- Screenshots of merchant policies and agreements

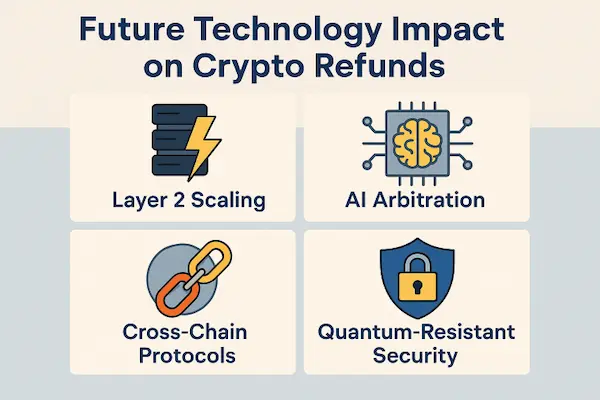

Emerging Technologies and Future Solutions

Layer 2 Solutions

Second-layer blockchain solutions are making crypto refunds more practical:

Lightning Network: Enables instant, low-cost Bitcoin transactions with potential for built-in dispute resolution.

Polygon and Arbitrum: Provide faster, cheaper Ethereum transactions that make micro-refunds economically viable.

State Channels: Allow for off-chain dispute resolution before settling on the main blockchain.

Artificial Intelligence Integration

AI-powered dispute resolution is beginning to emerge in Web3:

- Automated evidence analysis for faster dispute resolution

- Pattern recognition to identify fraudulent claims

- Smart contract optimization based on dispute outcomes

- Predictive dispute prevention through transaction analysis

Cross-Chain Protocols

Future developments in cross-chain technology will enable:

- Universal dispute resolution across different blockchains

- Standardized refund protocols for interoperability

- Automated arbitration regardless of the underlying crypto network

- Seamless user experience across diverse Web3 platforms

Table 3: Future Technology Impact on Crypto Refunds

| Technology | Timeline | Impact Level | Key Benefits |

| Layer 2 Scaling | Available Now | High | Lower costs, faster resolution |

| AI Arbitration | 1-2 years | Medium | Automated dispute handling |

| Cross-Chain Protocols | 2-3 years | High | Universal compatibility |

| Quantum-Resistant Security | 5+ years | Medium | Enhanced trust and security |

| Central Bank Digital Currencies | 2-5 years | High | Regulatory compliance |

Best Practices for Merchants

Implementing Voluntary Refund Policies

Smart merchants in the crypto space are implementing clear refund policies to build customer trust:

- Clear refund windows (e.g., 30 days for digital goods)

- Automated refund systems using smart contracts

- Customer service protocols for dispute handling

- Reputation management through community platforms

- Insurance coverage for high-value transactions

Building Trust Through Transparency

Successful crypto merchants focus on building trust:

- Public audit reports for smart contracts

- Community engagement and feedback collection

- Transparent business practices and ownership information

- Regular security updates and bug bounty programs

- Clear communication about risks and protections

Risk Management

Merchants can protect themselves while offering customer protections:

- Multi-signature escrow for high-value transactions

- Identity verification for large purchases

- Fraud detection systems adapted for crypto payments

- Insurance policies covering dispute resolution costs

- Legal compliance with applicable regulations

Real-World Case Studies

Successful Escrow Implementation

Several platforms have successfully implemented crypto refunds through escrow systems:

OpenBazaar: Before its closure, this decentralized marketplace used multi-signature escrow for thousands of transactions, with dispute resolution rates comparable to traditional e-commerce.

LocalBitcoins: Implemented escrow services that protected both buyers and sellers in peer-to-peer Bitcoin trading, handling millions in dispute resolution.

Bisq: This decentralized exchange uses a security deposit system combined with arbitration to resolve trading disputes without central authority.

Smart Contract Dispute Resolution

Recent developments include platforms like SmarTrust, which uses reactive smart contracts to handle escrow and dispute resolution across multiple blockchain networks, demonstrating the evolution of automated crypto refunds.

Lessons from Failed Approaches

Several early attempts at crypto dispute resolution have provided valuable lessons:

- Silk Road’s reputation system showed the importance of community trust but highlighted regulatory risks

- Early decentralized exchanges demonstrated the need for proper user education and technical support

- ICO refund mechanisms revealed the complexity of handling disputes during market volatility

Table 4: Traditional Web2 vs. Web3 Refunds & Chargebacks

| Criteria | Web2 (Credit Cards / Banks) | Web3 (Blockchain & Crypto) |

|---|---|---|

| Transaction Reversibility | Yes – via chargebacks, up to 120 days | No – immutable once confirmed |

| Consumer Protection | Strong – backed by financial regulations | Weak – depends on platform or smart contracts |

| Dispute Resolution | Centralized – banks, card networks handle it | Decentralized – arbitration, DAOs, or escrows |

| Fraud Risk for Merchants | High – chargeback abuse and friendly fraud | Low – transactions final by default |

| Resolution Speed | Slow – 30–90 days average | Fast – minutes to days (depending on method) |

| Cost of Disputes | High – administrative and legal fees | Low to Medium – arbitration or gas fees |

| Transparency | Limited – private bank processes | High – on-chain, auditable records |

Regulatory Considerations

Current Legal Framework

The legal landscape for crypto refunds varies significantly by jurisdiction:

United States: The Fair Credit Billing Act (FCBA) governs traditional chargebacks but does not apply to cryptocurrency transactions, leaving crypto disputes largely unregulated.

European Union: The Payment Services Directive provides some protections for crypto payments through licensed providers but not for direct cryptocurrency transactions.

Asia-Pacific: Countries like Japan and Singapore have developed more comprehensive frameworks for crypto consumer protection.

Evolving Regulations

Recent court rulings in 2026 are shaping how smart contracts and dispute resolution mechanisms are legally enforced, with implications for the future of crypto refunds.

Key regulatory trends include:

- Standardization efforts for crypto consumer protection

- Integration with existing consumer protection laws

- Cross-border cooperation for international disputes

- Smart contract legal recognition and enforceability

Consumer Education and Awareness

Understanding the Risks

Consumers need to understand the fundamental differences in crypto refunds:

- Irreversibility of blockchain transactions

- Reliance on merchant cooperation for refunds

- Limited regulatory protection compared to traditional payments

- Technical complexity of dispute resolution mechanisms

Making Informed Choices

Education initiatives should focus on:

- Risk assessment tools for evaluating crypto transactions

- Platform comparison guides for choosing secure payment methods

- Step-by-step tutorials for using escrow services

- Community resources for sharing merchant experiences

- Legal rights awareness in different jurisdictions

Conclusion

The scenery of crypto refunds, chargebacks, and dispute resolution in Web3 is one of the essential changes in the system of consumer protection. Even though the immutable character of cryptocurrency rules out the possibility of chargebacks, it has also led to innovation in automated dispute resolutions in the form of smart contracts, decentralized arbitration and escrow services.

The existing method of crypto returns forces customers to be more active in safeguarding themselves by undertaking due diligence, recording, and selecting the merchants and systems that have alternative dispute decision processes in place. The task has changed to the individual and plugged-in systems at the expense of banks and regulators.

In the future, novel systems such as arbitration using AI, cross-chain protocols, and Layer 2 solutions will enable people to be able to get crypto refunds more conveniently than current processes. Nevertheless, the effectiveness of these systems will be associated with their mass use, consistency in regulation, and innovation in the context of protecting consumers within the framework of the decentralized nature of Web3.

This is the golden rule of negotiating in the new environment: crypto refunds are not unheard of, they only differ. Through the appropriate utilization of tools, selection of well-established merchants and awareness of new remedies, consumers as well as businesses can take part in the crypto-economy without undermining the proper degree of security and redress.

As Web3 evolves, we are likely to see more complex dispute resolution systems that have the advantages of decentralized systems with some valuable consumer protections to act upon. The next frontier of crypto refunds is not redefining the way the old system works, but rather creating something new that fits the reality of the digital world.

Empower your business with XaiGate, the next-generation crypto payment gateway designed to simplify digital payments and drive global commerce.

Frequently Asked Questions

1. Can I get a chargeback on a cryptocurrency payment like I can with a credit card?

No, traditional chargebacks don’t exist for direct cryptocurrency transactions because they cannot be reversed once confirmed on the blockchain. However, some crypto payment processors offer chargeback-like protections by acting as intermediaries.

2. What should I do if a merchant refuses to provide a crypto refund?

Your options are limited compared to traditional payments. You can try community-based dispute resolution platforms, report to relevant platforms where the merchant operates, or pursue legal action if the amount justifies it. Prevention through research and using escrow services is key.

3. Are smart contract escrow services safe for large transactions?

Smart contract escrow can be very safe when properly implemented and audited, but you should verify the contract code has been audited by reputable security firms. Start with smaller amounts to test the system before conducting large transactions.

4. How long do crypto refunds typically take when merchants cooperate?

Voluntary crypto refunds can be nearly instantaneous since they’re just new transactions from the merchant to you. However, dispute resolution through decentralized platforms typically takes days to weeks depending on the complexity and platform used.

5. Do crypto payment processors like BitPay offer consumer protections?

Many crypto payment processors offer some level of consumer protection by converting crypto to fiat immediately and providing traditional refund mechanisms. However, protections vary significantly between providers, so check their specific policies.

6. What information should I keep when making crypto purchases?

Save transaction hashes, wallet addresses, purchase receipts, communication with merchants, screenshots of product listings, and any terms of service or refund policies. This documentation is crucial if disputes arise.

7. Are there any regulations protecting consumers in crypto transactions?

Consumer protection for direct crypto transactions is limited in most jurisdictions. Some protections exist when using licensed crypto service providers, but the regulatory landscape is still evolving and varies by country.

8. Can I dispute a crypto transaction if I was scammed?

While you can’t reverse the blockchain transaction, you can report scams to relevant authorities, warn others in community forums, and potentially pursue legal action. Some platforms also offer mediation services for disputes between users.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!