The business environment in the world has changed a lot in the recent years as businesses are now widely undertaking business transactions over international boundaries. The question of crypto vs card payments transactions is more topical than ever since more companies consider the ways to settle down their international transactions. This in-depth comparison looks at the two forms of payments in order to help you conclude and identify the solution that best fits your international business requirements.

Contents

- 1 Understanding Cross-Border Payment Challenges

- 2 Cost Analysis: Crypto vs Card Payments

- 3 Speed and Settlement Comparison

- 4 Security and Risk Assessment

- 5 Regulatory and Compliance Considerations

- 6 User Experience and Customer Acceptance

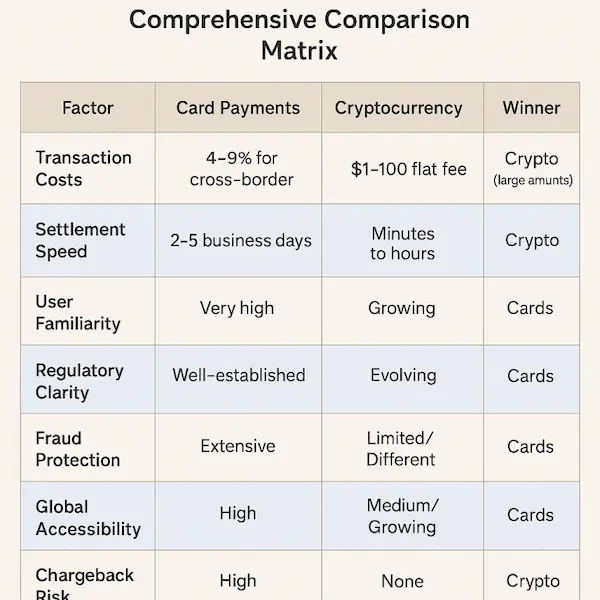

- 7 Table 3: Comprehensive Comparison Matrix

- 8 Industry-Specific Considerations

- 9 Making the Right Choice for Your Business

- 10 Future Trends and Developments

- 11 Implementation Strategies

- 12 Conclusion

- 13 Frequently Asked Questions – Crypto vs Card Payments for Global Transactions

Understanding Cross-Border Payment Challenges

Traditional Payment System Limitations

The international trade between countries has been cumbersome with challenges affecting the performance of businesses and the generation of returns. Conventional card payment networks face numerous difficulties over international payments.

The problem is always in processing delays, as the international card payments frequently require 2-5 business days to get fully settled. Such delays may interfere with cash flow and cause operational problems to business organizations that need to receive rapid payments.

International banking relationships are also very complicated thereby causing friction on the old payment system. A single transaction can involve multiple intermediate banks which take their own processing time and possible failure points as well.

Emerging of Competitor Payment Solutions

Cryptocurrency has become its possible way of dealing with numerous challenges in cross-border payments. The 40 percent of customers paying in cryptocurrency are new to businesses, and their purchases are already twice as valuable as transactions with credit cards, which also speaks of increasing consumer acceptance and increasing the level of values of transactions.

This is because digital currencies run over decentralized systems avoiding the conventional banking infrastructure, which has the possibility of providing a quicker settlement system as well as less reliance on various financial institutions.

Cost Analysis: Crypto vs Card Payments

Traditional Card Payment Costs

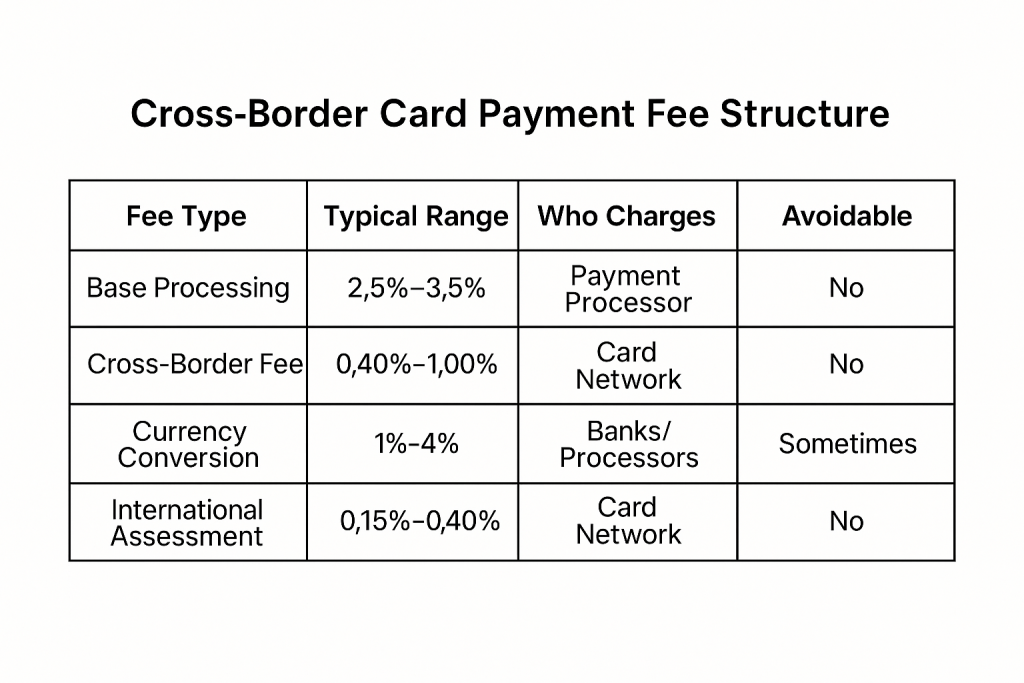

Credit card processing for cross-border transactions involves multiple fee structures that can significantly impact your bottom line. Understanding these costs is crucial for making informed payment decisions.

Standard Cross-Border Fees

Payment processors typically charge a standard fee of 2.9% of the transaction total for basic processing, but cross-border transactions incur additional charges.

Cross border fees are non-negotiable and issued by credit card networks such as Visa, Mastercard, Discover, or American Express, meaning businesses have little flexibility in avoiding these charges when accepting international card payments.

Table 1: Cross-Border Card Payment Fee Structure

| Fee Type | Typical Range | Who Charges | Avoidable |

| Base Processing | 2.5-3.5% | Payment Processor | No |

| Cross-Border Fee | 0.40-1.00% | Card Network | No |

| Currency Conversion | 1-4% | Banks/Processors | Sometimes |

| International Assessment | 0.15-0.40% | Card Network | No |

| Total Estimated Cost | 4-9% | Combined | No |

Cryptocurrency Transaction Costs

Cryptocurrency offers a different cost structure that can be significantly more attractive for cross-border transactions.

Bitcoin transfers might cost a few dollars, while some newer cryptocurrencies charge just cents, representing substantial savings compared to percentage-based card fees.

Bitcoin transactions can be between $1 and $5, while Ethereum can be anywhere from $5 to $100 depending on how congested the network is, showing that costs vary based on network conditions rather than transaction amounts.

Cryptocurrency Cost Considerations

The total cost of crypto transactions includes several components:

- Network transaction fees – Paid to miners or validators

- Exchange fees – For converting between crypto and fiat currency

- Wallet fees – Some wallet providers charge service fees

- Conversion spreads – The difference between buy and sell prices

For large transactions, cryptocurrency often provides significant cost advantages, while smaller transactions may not show the same benefits due to fixed network fees.

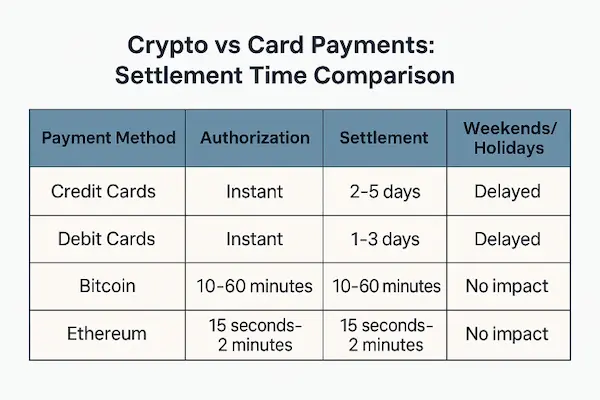

Speed and Settlement Comparison

Traditional Card Settlement Times

International card payments follow a complex settlement process that can create delays for businesses needing quick access to funds.

The typical settlement timeline for cross-border card payments includes:

- Authorization: Instant to 3 seconds

- Capture: 1-2 business days

- Settlement: 2-5 business days

- Currency conversion delays: Additional 1-2 days

These timeframes can extend further during weekends, holidays, or when dealing with banks in different time zones.

Cryptocurrency Settlement Speed

Crypto transactions settle in minutes, while wire transfers can take days—great for international transactions, offering a significant speed advantage for businesses requiring quick settlement.

Table 2: Settlement Time Comparison

| Payment Method | Authorization | Settlement | Weekends/Holidays |

| Credit Cards | Instant | 2-5 days | Delayed |

| Debit Cards | Instant | 1-3 days | Delayed |

| Bitcoin | 10-60 minutes | 10-60 minutes | No impact |

| Ethereum | 15 seconds-2 minutes | 15 seconds-2 minutes | No impact |

| Stablecoins | Seconds-minutes | Seconds-minutes | No impact |

The 24/7 nature of cryptocurrency networks means transactions can be processed any time, unlike traditional banking systems that operate on business day schedules.

Security and Risk Assessment

Card Payment Security Features

Credit card payments benefit from established fraud protection mechanisms and consumer protection laws. These include:

- Chargeback protection for consumers

- Fraud monitoring by card networks

- PCI compliance standards for merchants

- Established dispute resolution processes

- Insurance coverage for fraudulent transactions

However, these protections come with trade-offs, including the possibility of chargebacks that can impact merchant cash flow and the requirement for extensive compliance procedures.

Cryptocurrency Security Considerations

Cryptocurrency transactions offer different security characteristics that businesses must carefully evaluate:

Advantages:

- Irreversible transactions eliminate chargeback risk

- Cryptographic security protects against tampering

- Decentralized networks reduce single points of failure

- Lower fraud rates due to transaction immutability

Risks:

- Wallet security responsibility falls on users

- Price volatility can affect transaction values

- Technical complexity requires user education

- Regulatory uncertainty in some jurisdictions

Regulatory and Compliance Considerations

Card Payment Compliance Requirements

Businesses accepting international card payments must navigate complex regulatory requirements across multiple jurisdictions.

Key compliance areas include:

- PCI DSS standards for data security

- Anti-money laundering (AML) regulations

- Know Your Customer (KYC) requirements

- International banking regulations

- Consumer protection laws in different countries

These requirements often involve significant ongoing costs and administrative overhead.

Cryptocurrency Regulatory Landscape

The regulatory environment for cryptocurrency continues to evolve, with businesses needing to stay informed about changing requirements.

Cryptocurrencies offer an alternative financial system for the unbanked population, particularly in developing countries, but regulatory clarity varies significantly between jurisdictions.

Businesses must consider:

- Tax reporting requirements for crypto transactions

- Money transmission licenses in some states

- International regulatory differences

- Compliance with sanctions and anti-terrorism financing rules

User Experience and Customer Acceptance

Card Payment Familiarity

Credit and debit cards remain the most familiar payment method for consumers worldwide. This familiarity translates to:

- High customer comfort levels with card payments

- Established checkout processes that customers understand

- Wide merchant acceptance across industries

- Integrated fraud protection that customers trust

- Easy dispute resolution through established channels

Cryptocurrency User Experience Challenges

While growing rapidly, cryptocurrency adoption still faces user experience hurdles:

Barriers to adoption:

- Technical complexity in wallet management

- Price volatility concerns among consumers

- Limited merchant acceptance compared to cards

- Educational requirements for safe usage

Improving factors:

- User-friendly wallets making crypto more accessible

- Stablecoin adoption reducing volatility concerns

- Payment processor integration simplifying acceptance

- Growing mainstream awareness increasing comfort levels

Table 3: Comprehensive Comparison Matrix

| Factor | Card Payments | Cryptocurrency | Winner |

| Transaction Costs | 4-9% for cross-border | $1-100 flat fee | Crypto (large amounts) |

| Settlement Speed | 2-5 business days | Minutes to hours | Crypto |

| User Familiarity | Very high | Growing | Cards |

| Regulatory Clarity | Well-established | Evolving | Cards |

| Fraud Protection | Extensive | Limited/Different | Cards |

| Global Accessibility | High | Medium/Growing | Cards |

| Chargeback Risk | High | None | Crypto |

| 24/7 Availability | Limited | Always | Crypto |

Industry-Specific Considerations

E-commerce and Digital Services

Online businesses often benefit more from cryptocurrency payments due to:

- Digital-native customer base more comfortable with crypto

- Higher average transaction values making flat fees attractive

- Global reach requiring efficient cross-border solutions

- Reduced chargeback fraud in digital goods sales

B2B and Enterprise Transactions

Business-to-business transactions have different considerations:

- Large transaction amounts favor crypto’s flat fee structure

- Established accounting processes may favor traditional payments

- Compliance requirements may necessitate traditional banking

- Cash flow predictability important for business operations

Subscription and Recurring Payments

Recurring payment models face unique challenges with each payment method:

Card payments:

- Well-established recurring billing systems

- Automatic retry mechanisms for failed payments

- Customer expectation of easy cancellation

Cryptocurrency:

- Smart contract automation possibilities

- Reduced processing costs for high-frequency payments

- Challenges with subscription management and customer support

Making the Right Choice for Your Business

Assessing Your Business Needs

Choosing between crypto vs card payments requires careful evaluation of your specific business circumstances:

Consider cryptocurrency if:

- Your average transaction values are high (>$1,000)

- You need fast settlement for cash flow reasons

- Your customers are tech-savvy and crypto-friendly

- You operate in industries with high chargeback rates

- International expansion is a key growth strategy

Stick with cards if:

- Your customer base prefers traditional payment methods

- You need extensive fraud protection and dispute resolution

- Regulatory compliance is heavily regulated in your industry

- Your transactions are typically small amounts

- Predictable costs are more important than optimal costs

Hybrid Payment Strategy

Many successful businesses implement both payment methods to maximize benefits:

- Offer choice to customers based on their preferences

- Use crypto for large B2B transactions where cost savings are significant

- Maintain cards for consumer transactions where familiarity matters

- Implement smart routing based on transaction characteristics

- Monitor performance metrics to optimize payment mix

Future Trends and Developments

Emerging Technologies

The payments landscape continues evolving with new technologies that may influence the crypto vs card payments debate:

Central Bank Digital Currencies (CBDCs) may combine the benefits of both systems, offering government backing with digital efficiency.

Layer 2 solutions for cryptocurrencies are reducing transaction costs and improving speed, making crypto more attractive for smaller transactions.

Improved card network innovations including real-time settlement and reduced cross-border fees may address traditional payment system weaknesses.

Market Adoption Trends

Many credit card networks also offer online cross-border payments while simultaneously exploring cryptocurrency integration, suggesting a future where both systems coexist and complement each other.

The growing acceptance of cryptocurrency by major corporations and financial institutions indicates continued mainstream adoption, while card networks remain dominant in consumer transactions.

Implementation Strategies

Getting Started with Cryptocurrency Payments

Businesses considering crypto payments should follow a structured implementation approach:

- Start small with a pilot program for specific customer segments

- Choose established payment processors that handle compliance automatically

- Educate your team on cryptocurrency basics and customer support

- Set clear policies for handling crypto transactions and conversions

- Monitor and measure results to guide expansion decisions

Optimizing Traditional Card Processing

Even if maintaining card payments, businesses can optimize their cross-border processing:

- Shop payment processors for better international rates

- Consider local acquiring in key markets to reduce cross-border fees

- Implement fraud prevention tools to reduce chargeback costs

- Optimize currency conversion timing to minimize exchange rate impact

Conclusion

The issue of crypto vs card payments as cross-border business does not allow general answers. Both payment options have their own benefits which are particularly applicable to various business models and customer requirements.

Cryptocurrency is becoming an ideal choice in situations that need instant settlement, cheap high-value transfers, and lower chance of a chargeback. This is because the round the clock nature and flat rate of the technology makes this product irresistible especially to businesses with high international transaction values.

Card payments will continue being better than those conduited through wallets to any business that values customer familiarity, compliance with corresponding regulators, and risk-elimination on a wide scale identifying fraud. Cards are an essential part of most business models as a result of the existing infrastructure and the trust of the consumers.

A combination of strategies in using the two methods of payment has proven the best in most businesses. Through accepting cryptocurrency among the customers who use it and card among customers who use cards, companies will not limit their markets and also will save on transaction fees.

With the current movement of payments environment it is prudent businesses should analyze payment strategy on a regular basis. Regulation of cryptocurrency is increasingly clear, and the established payment systems are exploring the possibility of their shortcomings.

The winning strategy is the concern of customer selection and optimization of business instead of selection of one payment method only. The simpler way of determining the right payment mix to achieve cross-border success would be to understand your customer base, transaction patterns and business objectives.

The future will probably give us further coexistence and combination of both the choice of payment method, and the smart businesses will take profit of respective advantages in service of their customers and to optimise their operations.

Frequently Asked Questions – Crypto vs Card Payments for Global Transactions

1. Are crypto payments legal for cross-border business transactions?

Yes, cryptocurrency payments are legal in most countries, but regulations vary. Businesses should consult local legal experts and ensure compliance with anti-money laundering and tax reporting requirements in their jurisdiction.

2. How do I handle accounting for crypto payments versus card payments?

Crypto payments require recording the USD value at the time of receipt and tracking capital gains/losses if holding cryptocurrency. Card payments follow traditional accounting methods. Many businesses use specialized crypto accounting software for accurate reporting.

3. What happens if a crypto transaction fails or gets lost?

Crypto transactions are generally irreversible once confirmed on the blockchain. However, transactions can fail due to insufficient network fees or technical issues. Most reputable payment processors provide customer support and transaction monitoring to minimize these risks.

4. Can I accept both crypto and card payments simultaneously?

Yes, many payment processors offer hybrid solutions that accept both cryptocurrency and traditional card payments through a single integration. This allows customers to choose their preferred payment method.

5. How do exchange rates affect crypto vs card payments?

Card payments typically use bank exchange rates with spreads of 1-4%. Crypto payments may involve conversion fees when exchanging to/from fiat currency, but the rates can be more competitive, especially for larger transactions.

6. What’s the minimum transaction size that makes crypto payments worthwhile?

This depends on current network fees, but generally transactions over $500-1,000 show clear cost advantages with cryptocurrency due to flat fee structures versus percentage-based card fees.

7. How do I protect my business from crypto price volatility?

Most business crypto payment processors offer instant conversion to USD or other fiat currencies, eliminating volatility risk. You can also use stablecoins, which are designed to maintain stable values relative to traditional currencies.

8. Are there any industries where crypto payments are particularly advantageous?

Digital services, software licensing, international consulting, and high-value B2B transactions often benefit most from crypto payments due to reduced costs and faster settlement times.

9. What makes crypto payments more efficient than card payments in global transactions?

Crypto payments bypass traditional intermediaries like banks and card networks, enabling faster confirmation, lower fees, and final settlement within minutes. XAIGATE leverages blockchain rails to remove the inefficiencies and delays commonly found in card-based systems—especially for high-volume or cross-border B2B flows.

10. How does XAIGATE address trust concerns compared to using credit cards?

While credit cards offer built-in dispute mechanisms, they also expose merchants to chargeback risks and fraud. XAIGATE ensures transactional integrity via immutable blockchain records and offers refund mechanisms where applicable, while maintaining merchant control. This strikes a better balance between security and transparency in payments.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!