For many Singapore merchants, payments are now a cost strategy, not just a back office function. Instead of accepting card and PayNow fees as a given, more teams are testing crypto rails and asking a simple question: in crypto vs traditional payment gateway Singapore, which option really leaves more profit after FX, chargebacks and compliance work. This guide breaks down how each gateway type operates, what they truly cost over time and when a mixed setup can outperform relying on a single payment rail.

Contents

- 1 1. Overview Of Payment Gateways In Singapore Today

- 2 2. Regulatory Landscape For Crypto And Traditional Gateways In Singapore

- 3 3. Cost Comparison – Crypto Vs Traditional Payment Gateway Singapore

- 4 4. Beyond Fees – Risk, Compliance And Customer Experience

- 5 5. Use Cases Where Crypto Payment Gateways Save More

- 6 6. When Traditional Payment Gateways Still Win For Singapore Merchants

- 7 7. Hybrid Strategy – Using Both Crypto And Traditional Gateways

- 8 8. Implementation Guide – How To Choose And Integrate The Right Gateway

- 9 9. Latest Regulatory Trends For Crypto Payment Gateways In Singapore

- 10 FAQs – Crypto Vs Traditional Payment Gateway Singapore

- 11 Conclusion – Which Gateway Really Saves More

1. Overview Of Payment Gateways In Singapore Today

To make a fair comparison in crypto vs traditional payment gateway singapore, you first need a clear picture of the two main rails merchants actually use. On one side are bank and card based gateways built around cards, PayNow and local transfer systems, on the other are crypto gateways that let customers pay with digital assets or stablecoins while you still manage revenue, reporting and treasury primarily in SGD.

1. What Is A Traditional Payment Gateway In Singapore?

A traditional payment gateway links your checkout or POS to card networks, banks and local options like PayNow or e wallets. It encrypts payment data, sends it for authorisation and returns an approve or decline to your site or terminal. You get a dashboard, reports, refund and chargeback tools plus a contract that defines fees and settlement times.

2. What Is A Crypto Payment Gateway For Singapore Merchants?

A crypto payment gateway lets customers pay in crypto or stablecoins while you choose to receive crypto, SGD or both. At checkout it shows a QR code, wallet address or deep link, then confirms the transaction on chain and credits your merchant balance or converts to fiat. The provider handles wallets, network fees and basic screening so your team can treat it as another payment method.

3. Why Are Merchants Comparing These Two Options Now?

More Singapore businesses sell cross border, feel pressure on margins and see customers holding digital assets. Traditional gateways still work well for domestic and low risk flows, but crypto gateways can reduce some FX and cross border costs and speed up settlement in specific segments. That is why merchants are now putting both options into the same cost and compliance model instead of treating crypto as something separate.

2. Regulatory Landscape For Crypto And Traditional Gateways In Singapore

In Singapore, the question of crypto vs traditional payment gateway Singapore is always tied to regulation. A setup that ignores MAS rules might look cheap on paper but can create serious banking and compliance problems later.

1. How The Payment Services Act Treats Digital Payment Tokens

The Payment Services Act is the core law for payments in Singapore. Traditional gateways usually operate under merchant acquisition or money transfer licences. Crypto payment gateways that handle coins or tokens directly are treated as digital payment token services and must meet stricter standards for AML, technology risk and safeguarding of customer assets.

2. Digital Token Service Providers Under FSMA

A newer framework also covers digital token service providers that run their business from Singapore while serving users or merchants overseas. This closes the gap for firms that are “offshore in clients but onshore in operations”. For merchants, it is safer to treat any serious crypto gateway that markets from Singapore as something that should be clearly inside this regime, not outside it.

3. Stablecoins And What They Mean For Gateways

Singapore is building a dedicated regime for certain single currency stablecoins with clear rules on reserves and redemption. Over time this will create a visible line between regulated stablecoins and generic tokens. Crypto payment gateways that rely on higher quality stablecoins will be easier to justify to boards, banks and auditors than those that only use unregulated assets.

4. What Merchants Can And Cannot Do Without A Licence

Most merchants do not need their own licence if they simply accept payments through regulated providers and only get paid for their own goods and services. You move towards licence territory if you start holding customer crypto, matching buyers and sellers or transmitting digital assets for third parties. The safest path is to stay a user of licensed gateways, document why each provider is allowed to operate, and avoid side deals that look like you are running your own mini exchange. That way, the crypto vs traditional payment gateway Singapore decision remains a vendor and risk choice, not an accidental move into financial regulation.

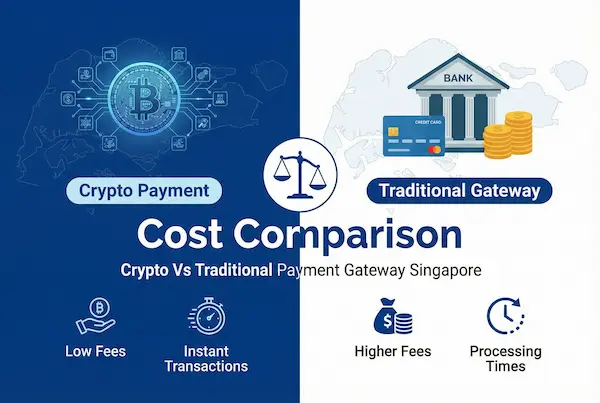

3. Cost Comparison – Crypto Vs Traditional Payment Gateway Singapore

At the core of crypto vs traditional payment gateway Singapore is one question: for your mix of payments, which rail has the lower real cost after fees, FX, disputes and delays.

1. Fee structure for traditional payment gateways

Traditional gateways usually charge:

- A percentage fee per transaction

- Different rates for local vs foreign cards and some alternative methods

- Extra fees for chargebacks and sometimes monthly or minimum charges

For mainly local SGD flows, this can be quite predictable. Once more customers pay with foreign cards or other currencies, FX spreads and cross border mark ups quietly lift the real rate above the card price list.

2. Fee structure for crypto payment gateways

Crypto payment gateways typically charge:

- A percentage fee on the crypto or stablecoin amount

- Network fees, included or passed through

- A spread when converting back to SGD

- Possible payout fees to your bank or treasury wallet

On cross border flows, especially with stablecoins, this can beat card rails, but costs vary by chain, token and payout route, so you need to model actual scenarios, not a single sales quote.

3. FX, settlement and hidden costs

With traditional gateways, hidden cost often sits in FX and timing:

- Extra spread whenever customer and settlement currencies differ

- Bank and scheme conversion charges

- Settlement that can take several working days on some corridors

With crypto gateways:

- Funds can reach you soon after on chain confirmation and scheduled payout

- Stablecoin rails can reduce FX steps

- Conversion to SGD still has a spread, but it is easier to negotiate as a clear line item

Table 1 – Cost and risk snapshot: crypto vs traditional payment gateway Singapore

| Factor | Traditional gateway – local SGD | Traditional gateway – cross border | Crypto payment gateway – stablecoins or major coins |

|---|---|---|---|

| Typical per transaction fee | Local card and PayNow rates, relatively stable | Higher MDR for foreign cards and international flows | Gateway fee on crypto volume plus any on chain network fee |

| FX costs | None for pure SGD | FX spread and bank conversion charges | FX mainly when converting crypto or stablecoins to SGD |

| Settlement time | Same day to several business days | Often longer due to cross border clearing | On chain confirmation plus payout cycle, often faster for cross border |

| Chargebacks | Yes, with formal dispute process | Yes, with extra cost and effort | No native chargeback, refunds handled by merchant policy |

| Fraud and risk tools | Mature tools built into acquirers and PSPs | Similar tools, extra checks for high risk MCCs | Wallet screening, on chain analytics, custom rules |

| Compliance focus | Card scheme rules and payment licences | More scrutiny on certain industries and corridors | Digital asset and travel rule requirements, token policies |

| Customer familiarity | Very high for local consumers | High for international cardholders | Higher in crypto native, gaming and Web3 segments |

| Operational complexity | Well understood by finance and ops teams | More reconciliation for multi currency flows | New workflows for treasury, accounting and support |

4. Chargebacks, disputes and fraud

Card payments include a built in chargeback right. It protects customers but costs merchants in dispute fees, lost revenue on reversals and staff time. High chargeback ratios also tend to mean tougher terms and pricing.

Crypto payments have no native chargeback once a valid transaction settles on chain. Refunds are a new outbound payment. This can sharply reduce dispute cost in some sectors, but only if your refund rules and support process are clear and visible.

5. Total cost of ownership

The cheaper rail depends on your profile, not on one headline rate:

- Local, low risk, low FX: traditional gateway often wins

- Cross border, digital goods, gaming or high chargebacks: a crypto payment gateway added next to the traditional one can cut FX, dispute and delay costs over a full year of payments

That is why the next sections move from theory to concrete use cases, so you can map your own numbers onto the crypto vs traditional payment gateway Singapore trade off.

4. Beyond Fees – Risk, Compliance And Customer Experience

Once basic pricing is clear, the crypto vs traditional payment gateway Singapore choice is decided by risk, workload and how customers actually pay.

1. Regulatory risk and compliance overhead

With a traditional gateway, most regulatory work sits with banks and licensed payment providers. You follow familiar KYC, fraud and card scheme rules.

With a crypto payment gateway, more judgement calls come back to you: which tokens and countries you allow, how you screen wallets, how you respond to risky activity. Even if the provider is licensed, you still need simple written policies so banks, auditors and management are comfortable with how you use it.

2. Customer experience, UX and checkout conversion

Cards, PayNow and local wallets are familiar and optimised. Customers know the steps and trust the brands behind them.

Crypto adds an extra decision: open wallet, pick token, approve an on chain transaction. For crypto native users this is easy, but for others it must be guided with clear labels, real time conversion amounts and a clean way back to traditional methods if they change their mind.

3. Volatility, stablecoins and treasury management

Traditional gateways mainly create FX and timing risk. You know the settlement currency and can plan.

With crypto, you also face price risk if you hold volatile coins. Stablecoins reduce that, but you still carry issuer and chain risk and need rules on when to convert back to SGD. A short treasury policy on which assets you accept, how long you hold them and when you auto convert keeps decisions consistent.

4. Tax, accounting and audit considerations

Card and bank payments drop into existing charts of accounts and reports. Your team and auditors have seen this many times before.

Crypto flows add new steps: valuing tokens at receipt, tracking gains or losses to conversion and tying on chain transactions to invoices. A good crypto payment gateway helps with exports and payout reports, but you still need clear internal treatment so finance and audit can sign off comfortably.

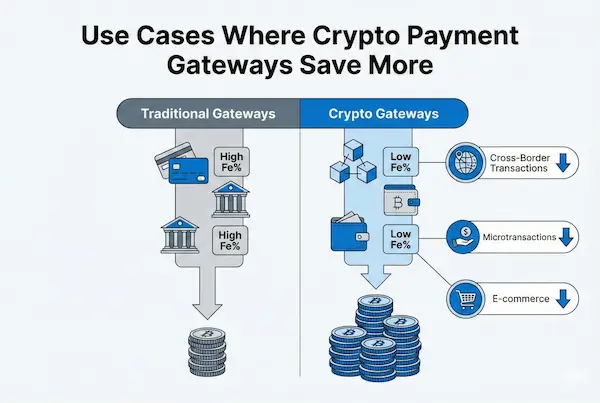

5. Use Cases Where Crypto Payment Gateways Save More

Crypto will not replace cards everywhere. In most setups, it works best as an extra rail beside your traditional gateway, not a full replacement. These are the cases where that extra rail can clearly improve the crypto vs traditional payment gateway Singapore equation.

1. Cross border ecommerce and international customers

If a big share of your revenue comes from overseas buyers, card MDR, cross border surcharges and FX spreads stack up fast. A crypto payment gateway that accepts stablecoins and settles to SGD can remove several of those layers and speed up settlement at the same time.

Table 2 – Example monthly cost at 100,000 SGD payment volume

| Merchant profile | Assumed mix of transactions | Effective rate with traditional gateway | Estimated monthly cost (traditional) | Effective rate with crypto gateway | Estimated monthly cost (crypto) | Who tends to save more? |

|---|---|---|---|---|---|---|

| Local retail chain (mostly domestic) | 95% local cards / PayNow, 5% cross border | Around 2.0% | ~2,000 SGD | Around 2.2% | ~2,200 SGD | Traditional gateway, crypto is optional add on |

| Cross border ecommerce brand | 30% local SGD, 70% overseas card and FX transactions | Around 3.2% | ~3,200 SGD | Around 2.3% | ~2,300 SGD | Crypto gateway often cheaper for cross border flows |

| Digital goods / gaming platform | 20% local, 80% high risk and high chargeback segments | Around 3.8% including chargeback costs | ~3,800 SGD | Around 2.5% | ~2,500 SGD | Crypto gateway can reduce both fees and chargebacks |

2. High risk and high chargeback segments

Digital goods, gaming and some subscription models often pay heavily for chargebacks. With cards, you pay dispute fees, lose revenue on reversals and may face tougher pricing. With crypto, there is no native chargeback once a valid on chain payment settles, so refunds follow your own policy. Combined with wallet screening, this can cut dispute cost and make genuine revenue stick better.

3. B2B invoices and large ticket payments

For large international invoices, card fees and wire delays become very visible. A crypto payment gateway can lower fees on big tickets and give faster final settlement, while you still keep cards and bank transfers for conservative clients. In practice, many Singapore merchants start to see clear savings when they route selected cross border and B2B flows through crypto and leave everyday local payments on their traditional gateway.

6. When Traditional Payment Gateways Still Win For Singapore Merchants

Even with a strong case for crypto, there are clear situations where the traditional side of crypto vs traditional payment gateway Singapore still comes out ahead.

1. Mainly local B2C with low chargebacks

If your customers are mostly in Singapore, pay in SGD with cards, PayNow or local wallets, and your chargeback rate is low, a traditional gateway is usually best:

- Sharp and predictable local pricing

- High customer trust and familiar flows

- Simple refunds, disputes and reporting

In this case, a crypto rail often adds complexity without meaningful savings.

2. Corporates and institutions with no crypto appetite

Listed companies, public bodies, schools and healthcare groups often want bank and card rails only. They prefer:

- Clean audit trails with no token price issues

- No internal debate about digital assets

- Minimal reputational and regulatory noise

Here, a traditional gateway is the only realistic option for getting paid smoothly.

3. Merchants that must protect key banking relationships

If you already sit in a sensitive or higher risk industry, or depend on one or two core banks, keeping your stack simple can matter more than chasing marginal fee savings. Until your banking position is very secure, prioritising a solid traditional setup over a visible crypto rollout is often the safer choice.

7. Hybrid Strategy – Using Both Crypto And Traditional Gateways

For many merchants, the best answer to crypto vs traditional payment gateway Singapore is not choosing one rail forever, but running both side by side and giving each a clear job. A good hybrid setup lets your core card and bank stack stay stable while a focused crypto payment gateway Singapore handles the flows where it adds real value.

1. Why this is often a false binary

Cards, PayNow and bank transfers are hard to beat for local SGD shoppers and conservative buyers. Crypto rails usually work best for cross border, digital, high chargeback or large ticket payments. Treating them as rivals forces an all or nothing decision, while treating them as tools lets you route each transaction type to the rail with the best mix of cost, speed and risk.

2. Practical hybrid setup for Singapore merchants

A simple hybrid design can be:

- Traditional gateway as the default for local B2C and mainstream online checkouts

- A crypto payment gateway Singapore option for overseas customers, digital goods, gaming or B2B invoices

- Limited assets and a capped share of volume at the start, expanded only if the numbers and risk profile look good

This way you test the crypto rail on the segments most likely to benefit, without disturbing your main checkout.

3. Governance, risk and internal policy checklist

To keep a hybrid model safe and bank friendly, write down a few basic rules:

- Which customer segments and use cases can use the crypto rail

- Which tokens and chains are allowed, and who approves changes

- When you convert funds back to SGD, and who owns that decision

- How fees and refunds are explained to customers

With this in place, crypto vs traditional payment gateway Singapore becomes an ongoing optimisation exercise, not a one time gamble.

8. Implementation Guide – How To Choose And Integrate The Right Gateway

To make crypto vs traditional payment gateway Singapore a real business decision, you need a simple way to pick providers and measure them over time.

1. Due diligence on providers

For every candidate, ask the same basics: licence status in Singapore, full fee stack and FX spreads, settlement times, fraud and AML controls, support quality and real merchant references. With any crypto payment gateway Singapore, add which tokens and chains they support, how they custody assets and how wallet screening and blacklists are handled.

2. Integration and testing

Have your tech team review APIs, plugins and export formats, then run a short sandbox or pilot: real test orders, refunds, failed payments and payouts. The goal is to see how cleanly the crypto rail plugs in beside your existing gateway without breaking checkout, accounting or reporting.

3. KPIs and ongoing optimisation

Decide upfront how you will compare both rails over a year: effective fee by method, dispute rate, settlement speed and impact on conversion. A simple monthly report is enough to show when the crypto payment gateway Singapore should carry more volume and where the traditional gateway still deserves to be the default.

9. Latest Regulatory Trends For Crypto Payment Gateways In Singapore

Regulation keeps shifting, so any serious view of crypto vs traditional payment gateway Singapore has to reflect how MAS is tightening rules around digital assets and payments.

1. MAS focus on unlicensed and offshore services

MAS has been steadily warning against unlicensed or lightly regulated offshore platforms targeting Singapore users. For merchants, this means a basic filter when choosing a crypto payment gateway Singapore: the provider should be clearly regulated in a credible jurisdiction, willing to answer questions on governance, and not positioning itself as a way to “avoid” Singapore rules.

2. Stablecoins and tokenised money

Regulators are moving toward stricter regimes for fiat linked stablecoins with strong reserves and clear redemption rights, alongside pilots in tokenised cash and deposits. Over time, this favours gateways that rely on high quality, well documented assets instead of opaque tokens, and it makes it easier to defend your crypto payment setup to banks and auditors.

3. Stricter conduct standards for digital asset services

Guidance for digital asset and digital payment token services is tightening on marketing, conflicts of interest, leverage and how customer assets are held. Even if you are “only” a merchant, your choice of provider affects how your brand looks to regulators and banks. Picking a conservative partner keeps the crypto vs traditional payment gateway Singapore discussion open, while a risky one can trigger extra scrutiny just as you start to scale.

FAQs – Crypto Vs Traditional Payment Gateway Singapore

1. Are crypto payment gateways cheaper than traditional gateways in Singapore?

Often yes for cross border and high risk flows, but local SGD cards and PayNow can still be cheaper, so you must compare your own numbers.

2. Is it legal for merchants to accept crypto payments in Singapore?

Yes, if you use regulated providers, follow AML rules and do not act like an exchange or broker.

3. Do I need a MAS licence to accept crypto as a merchant?

Usually no, if you just use a regulated crypto payment gateway Singapore to get paid for your own goods or services.

4. How do chargebacks work with crypto vs cards?

Cards have built in chargebacks through banks. Crypto has no native chargeback, refunds are new outbound payments under your policy.

5. Can I accept crypto and still get paid in SGD?

Yes, many gateways let customers pay in crypto or stablecoins while you receive SGD with instant or scheduled conversion.

6. Which merchants benefit most from a crypto payment gateway Singapore?

Cross border ecommerce, digital goods, gaming, online services and some B2B exporters usually gain the most.

7. What is the safest way to test crypto vs traditional payment gateway Singapore?

Keep your traditional gateway as default, add crypto for a few segments, cap volume and auto convert to SGD, then review results.

8. What should I check before choosing a crypto gateway provider?

Check licence status, full fees, settlement terms, custody setup, incident history and support quality.

Conclusion – Which Gateway Really Saves More

After walking through costs, risk, regulation and real use cases, the picture is clearer. The smart move is not to argue for or against crypto in general, but to decide where a crypto payment gateway Singapore belongs next to your existing rails. In practice, crypto vs traditional payment gateway Singapore is less a yes-or-no question and more a portfolio decision across different customer segments.

Key takeaways for your business

There is no single winner for every merchant:

- For local, low risk SGD payments, a well priced traditional gateway is usually cheapest and easiest to run.

- For cross border, digital, high chargeback or large ticket flows, a strong crypto rail can cut FX, dispute and delay costs in ways card rails cannot match.

With MAS tightening standards and clarifying rules around digital assets and stablecoins, serious, regulated solutions are becoming easier to defend, while weak offshore options are fading out.

Quick decision matrix for Singapore merchants

| Merchant situation | Better with traditional gateway | Better with crypto payment gateway Singapore | Suggested setup |

|---|---|---|---|

| Mainly local B2C, low chargebacks | Yes, simple and cheap local SGD | Only niche demand | Traditional core, small crypto pilot if needed |

| Growing cross border ecommerce | Needed for cards and local methods | Lower FX and faster settlement for overseas buyers | Hybrid, crypto for selected cross border flows |

| Digital goods, gaming, high chargeback risk | Needed for some customers | Fewer chargebacks, better revenue stick | Crypto for risky flows, cards as backup |

| B2B invoices and large ticket payments | Required for some corporates | Lower cost and faster settlement on large international deals | Both rails, client chooses case by case |

| Reputation sensitive or very conservative firms | Yes, bank and card rails only | Only in very small, controlled pilots | Traditional only, or tiny crypto experiment |

Use this as a quick sense check. Map your own revenue streams and see which rows match your reality best, then decide where each rail should sit.

Pilot XaiGate beside your current gateway

If you want to move from theory to impact:

- Keep your current gateway as default for local SGD and conservative customers.

- Add XaiGate as your crypto rail for cross border orders, digital goods, gaming top ups or selected B2B invoices.

- Start small – a few assets, capped volume, auto convert to SGD, clear refund rules and clean reporting.

- Track the numbers for a few months: effective fee, FX cost, dispute rate, settlement speed and conversion by method.

If XaiGate consistently wins on those metrics for the right segments, you can safely route more of that traffic through your crypto payment gateway Singapore setup while your traditional gateway continues to anchor everything else.

Done this way, your move on crypto vs traditional payment gateway Singapore looks like a controlled upgrade, not a risky bet – you protect bank relationships, improve margins where the data proves it and position your business to benefit from the next wave of payment innovation in Singapore.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)!