In 2026, buying Bitcoin, Ethereum and stablecoins directly from your phone feels normal. You open an exchange or a crypto app, tap pay, and see two familiar options next to your saved cards: Google Pay and Apple Pay. On the surface they look almost the same, but in real life there are differences in fees, regional support, bank reactions and how often a payment actually goes through. This guide looks at real world behavior rather than marketing promises so you can make a clear choice when it comes to Google Pay vs Apple Pay crypto purchases.

Contents

- 1 1. Is Google Pay Or Apple Pay Better For Buying Crypto In 2026?

- 2 2. How Google Pay Works When You Buy Crypto On Exchanges And Wallets

- 3 3. How Apple Pay Works For Buying Crypto In 2026

- 4 4. Google Pay vs Apple Pay Crypto – Feature Comparison At A Glance

- 5 5. Fees, FX Rates And Hidden Costs When Using Mobile Wallets To Buy Crypto

- 6 6. Security, Privacy And Chargeback Risk For Wallet Based Crypto Buys

- 7 7. User Experience – Speed, Friction And Success Rates

- 8 8. Regional Snapshot – Where Google Pay Or Apple Pay Works Best For Crypto

- 9 9. Compliance, Bank Policies And Card Network Rules You Cannot Ignore

- 10 10. Buyer Personas – Which Wallet Fits Your Crypto Buying Style

- 11 11. What Changed Recently For Google Pay And Apple Pay Crypto Access

- 12 FAQs About Using Google Pay And Apple Pay To Buy Crypto

- 13 Final Verdict – Google Pay vs Apple Pay Crypto Decision Matrix

1. Is Google Pay Or Apple Pay Better For Buying Crypto In 2026?

This section gives you the fast version before we dive into details. If you only have a few minutes and just want to know which wallet is more practical for your situation, start here.

1. Short verdict for busy readers

For most everyday buyers, the best option is the wallet that fits your device and local banking system. If you live in a market where exchanges, on ramps and banks already work smoothly with Google services, buying crypto with Google Pay often feels cheaper and less fussy. In Apple centric regions with strong iOS adoption and good card support, Apple Pay can deliver a smoother, highly polished flow for the same kind of purchase. Neither wallet magically bypasses bank rules or card network restrictions, so your experience still depends heavily on where you live and which platform you use.

2. Key takeaways for Google Pay vs Apple Pay crypto

- Both wallets are just payment layers on top of your cards and bank accounts, so KYC and compliance still happen at the exchange or on ramp.

- In many Android heavy markets, it is easier to find apps that let you buy crypto with Google Pay, while Apple Pay tends to dominate on iPhone and iPad.

- Fees come from the exchange, on ramp, card network, FX spread and sometimes your bank, not from the wallet alone.

- Success rate matters as much as headline fees. Some banks are friendlier to card based crypto purchases through one wallet than the other.

- Neither option is ideal for very large or high frequency trades. At a certain size, bank transfer or dedicated on ramp rails are usually more stable and predictable.

3. Who should care most about this comparison

- First time buyers who want to start with a small Bitcoin or stablecoin purchase using a familiar mobile wallet instead of typing card numbers.

- Long term holders who plan to make regular, modest top ups from their phone and care about smooth user experience, not just raw price.

- Mobile first users who already live inside one ecosystem and want to know whether it is worth switching devices or wallets just to make crypto purchases easier.

If you recognise yourself in any of these groups, the rest of this guide will help you decide when to lean on Google Pay, when Apple Pay makes more sense, and when you should skip both and use a different funding method instead.

2. How Google Pay Works When You Buy Crypto On Exchanges And Wallets

To really understand Google Pay vs Apple Pay crypto performance, you first need to see what is happening behind the scenes when you buy crypto with Google Pay on an exchange or wallet app.

1. How Google Pay routes your card payment

When you use Google Pay for a crypto purchase, you are still paying with your normal debit or credit card:

- Your card details are stored as a secure token inside Google Pay, not as plain numbers in the app.

- At checkout, you choose Google Pay and confirm the Google Pay crypto payment on your phone.

- Google sends an encrypted request to the processor, which then talks to the card network and your bank.

From the exchange or on ramp side it still looks like a standard card transaction, just with extra security and no card number typed into the crypto platform.

2. Where Google Pay is usually supported for crypto

Whether you can buy crypto with Google Pay depends on three things working together:

- Google Pay must be available and supported in your country.

- Your bank and card network must allow online card payments that involve crypto merchants.

- The exchange, broker or on ramp must have integrated Google Pay and enabled it for your region.

This is why one user may see a Google Pay button next to Apple Pay for crypto, while another user in a different country only sees “Card” or “Bank transfer”.

3. Limits, KYC and extra checks with Google Pay

Google Pay only handles the payment layer in the Google Pay vs Apple Pay crypto journey, not your trading profile:

- KYC, spending tiers and trading limits are set by the exchange or on ramp, not by Google.

- Your bank can still block or cap card payments it flags as high risk, including some Google Pay crypto purchases.

- Extra security such as 3D Secure, OTP or push approvals may still appear on top of the Google Pay confirmation.

So Google Pay can make it faster and smoother to fund your account, but it cannot override bank decisions or bypass the compliance rules of the crypto platform you use.

3. How Apple Pay Works For Buying Crypto In 2026

To judge Google Pay vs Apple Pay crypto fairly, you need to see what actually happens when you tap the Apple Pay button inside a crypto app.

1. How Apple Pay routes your card for crypto

When you buy crypto with Apple Pay, you are still paying with a normal debit or credit card stored in Apple Wallet. The card is turned into a secure token, you confirm the payment with Face ID, Touch ID or a passcode, and Apple sends an encrypted request to the processor, card network and your bank. For the exchange, it looks like a standard card payment with an extra security layer.

2. Where Apple Pay is available for crypto purchases

You can only use Apple Pay for crypto if three things line up: Apple Pay is supported in your country, your bank allows card payments to crypto merchants, and the exchange or on ramp has integrated Apple Pay for your region. That is why two iPhone users in different markets can see very different payment options inside the same app.

3. Limits, checks and chargebacks with Apple Pay

Apple Pay does not change KYC or risk rules. The crypto platform still sets identity checks and trading limits, and your bank can still block or cap a card payment if it flags it as high risk. Extra steps like 3D Secure or SMS codes may appear on top of the Apple Pay sheet, and exchanges often handle chargebacks very cautiously for card funded crypto. In the broader Google Pay vs Apple Pay crypto discussion, Apple Pay usually suits users who already live in the Apple ecosystem, but it remains subject to the same bank and card network rules as any other card payment.

4. Google Pay vs Apple Pay Crypto – Feature Comparison At A Glance

When you compare these two wallets for buying crypto, most of the differences come from devices, regions and how well each option is integrated into your favourite exchange or app.

1. Core feature comparison between the two wallets

- Google Pay runs across a wide range of Android phones and some web flows, while Apple Pay is limited to Apple devices.

- Apple Pay often feels more polished on iOS thanks to Face ID / Touch ID, while Google Pay wins on flexibility in Android heavy markets.

- On both sides, real world experience depends more on your bank and region than on any single feature.

Table 1 – Google Pay vs Apple Pay for buying crypto in 2026

| No. | Criteria | Google Pay | Apple Pay |

|---|---|---|---|

| 1 | Device ecosystem | Many Android devices and some web checkouts | Apple devices only (iPhone, iPad, some Mac flows) |

| 2 | Regional availability | Strong where Google services are widely adopted | Strong where Apple Wallet usage is high |

| 3 | Exchange / on ramp support | Often prioritised by Android focused platforms | Often prioritised by iOS focused platforms |

| 4 | UX and confirmation | Simple, familiar for Google account users | Very smooth sheet with Face ID or Touch ID |

| 5 | Transaction limits & checks | Bound by card, bank and exchange rules on every app | Bound by card, bank and exchange rules on every app |

2. Which wallet fits different kinds of crypto buyers

If you mainly use Android and local banks already work well with Google services, Google Pay will usually feel like the natural choice for small, fast buys. If you live inside the Apple ecosystem and already use Apple Wallet for daily payments, Apple Pay tends to be the smoother option. In practice, the winner in the Google Pay vs Apple Pay crypto debate is simply the wallet that your own bank and preferred exchange support most reliably.

5. Fees, FX Rates And Hidden Costs When Using Mobile Wallets To Buy Crypto

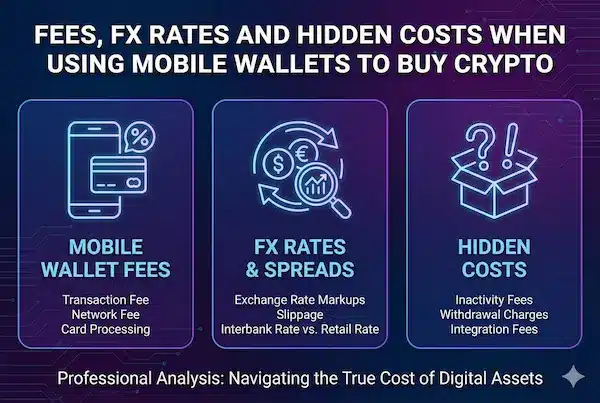

Fees are where many people misread the real gap in the Google Pay vs Apple Pay crypto debate. The app shows one clean total, but several layers of cost sit behind that number.

1. The fees you actually see

At checkout most platforms will show:

- The exchange or on ramp fee

- Any explicit “card” or “instant buy” surcharge

- The final amount of crypto you will receive

These are the obvious costs and they are easy to compare between wallets.

2. The costs you do not see immediately

Under the surface, a few quiet charges can still reduce what lands in your wallet:

- FX spread and bank markup when your card currency differs from the pricing currency

- Card network and processor fees baked into the rate the on ramp offers

- Extra bank or issuer surcharges for high risk or cross border payments

You rarely see these listed separately; they simply appear as a worse effective rate.

Table 2. Cost Structure When You Buy Crypto With Google Pay Or Apple Pay

| No. | Cost element | Who charges it | Impact on final crypto |

|---|---|---|---|

| 1 | Exchange / on ramp fee | Crypto platform | Directly reduces amount |

| 2 | Card processing fee | Processor / card network | Built into rate or card fee |

| 3 | FX spread / bank markup | Bank / card network | Worse exchange rate |

| 4 | Extra issuer surcharge | Your bank / card issuer | Small % on top of transaction |

| 5 | Blockchain network fee | Blockchain itself | Taken from crypto, not fiat |

To compare Google Pay vs Apple Pay crypto fairly, the safest approach is to run a few small test buys with each, note fiat spent versus coins received, và coi chênh lệch đó là “all in cost” thật sự của từng ví.

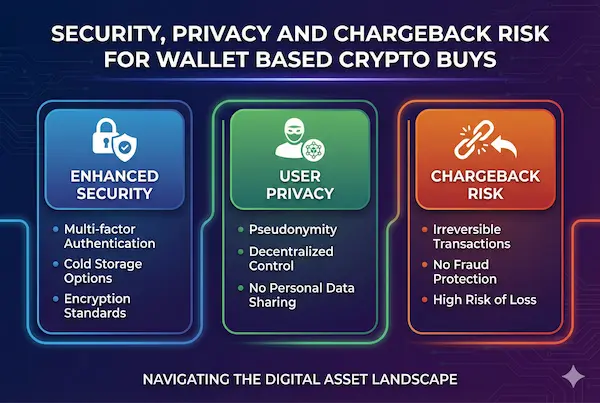

6. Security, Privacy And Chargeback Risk For Wallet Based Crypto Buys

Security is one of the main reasons people feel comfortable using mobile wallets for crypto, but it is also where misunderstandings appear in the Google Pay vs Apple Pay crypto conversation. Both tools add extra protection, yet neither can erase the underlying risks of card funded purchases.

1. What Google Pay and Apple Pay add on top of cards

Both wallets protect your real card number by turning it into a token stored on the device. Payments are then confirmed with biometrics or a device lock instead of just a CVV. That means:

- Your card details are not typed into the exchange or broker.

- A stolen database from a crypto app will not reveal your full card number.

- Lost or stolen phones can be locked or wiped remotely, cutting off payment access.

This is a clear upgrade over entering raw card data, but it does not make the transaction anonymous or risk free.

2. What happens when a wallet based crypto payment fails

Even with strong device security, card issuers and banks still run their own fraud checks:

- Transactions to some crypto merchants may be declined automatically based on risk rules.

- Cross border payments or unusually large amounts can trigger manual reviews or temporary blocks.

- If a payment is authorised but the crypto side fails, refunds often move slowly through card rails and you may wait days to see the money return.

Chargebacks are particularly sensitive. Because crypto, once delivered, is hard to reverse, many platforms treat card disputes cautiously and may freeze accounts or tighten limits if they see repeated problems.

3. How to stay safe when using wallets for crypto

A few habits make mobile wallets much safer for funding crypto accounts:

- Use strong device locks and turn on all available security options in your wallet.

- Start with small test purchases before trusting large amounts to any new app or on ramp.

- Keep cards that you use for crypto separate from cards used for everyday household spending.

- Read the exchange refund and chargeback policy before relying on card payments as your main funding route.

If you treat wallet based card payments as a convenient bridge rather than a magic shield, you will move through the Google Pay vs Apple Pay crypto landscape with far fewer surprises.

7. User Experience – Speed, Friction And Success Rates

For many everyday buyers, speed and smoothness matter more than tiny fee differences, so user experience can quietly decide the Google Pay vs Apple Pay crypto winner in real life.

1. First time setup for wallet based crypto buyers

On the first run, both flows feel familiar because they reuse cards you already added to each wallet. Google Pay setup usually lives inside a broader Google account environment on Android, while Apple Pay setup is tied tightly to Apple Wallet on iOS. The main difference for a new crypto buyer is how clearly the exchange explains each step, not the wallet itself, so a clean on screen guide often matters more than the logo you tap.

2. One tap repeat buys and small, regular top ups

Once everything is connected, both wallets shine for small recurring purchases. You open the app, pick an amount and confirm with a single tap and biometric check. This works well for people who DCA into Bitcoin or stablecoins and do not want to type card numbers or deal with bank transfers every time. The more often you repeat the flow without errors, the more natural it becomes to treat these wallets as the default path into crypto.

3. Common friction points and how to reduce failures

Most friction comes from outside the wallets themselves: 3D Secure prompts, bank declines on “risky” merchants, cross border flags, or low card limits. You can reduce failed payments by starting with modest amounts, avoiding late night first tries, keeping your bank informed that you use a regulated exchange, and having a backup method such as bank transfer ready. If you track where payments fail over a few attempts, you will quickly see whether your bank plays more nicely with one wallet and can let that guide your final Google Pay vs Apple Pay crypto choice.

8. Regional Snapshot – Where Google Pay Or Apple Pay Works Best For Crypto

The Google Pay vs Apple Pay crypto picture changes a lot by region. A wallet that feels perfect in one country can be awkward or simply unavailable in another, depending on banks, regulators and device habits.

1. United States and Canada – mature cards, mixed crypto stance

Both wallets sit on strong card rails, but banks treat crypto very differently. Some issuers allow card funded buys with few issues, others block or flag them as high risk. On iPhone, Apple Pay is often the default choice; on Android, Google Pay can be just as smooth if your bank is friendly to wallet based crypto payments.

2. Europe and UK – tight rules and extra security steps

Strong customer authentication, PSD2 and local risk policies make card based crypto more controlled. Buyers on both wallets still face 3D Secure prompts and occasional declines, especially with newer or cross border platforms. In practice, the better option is usually whichever wallet local banks and major exchanges already support most smoothly.

3. Asia Pacific – Singapore, India, Indonesia and Vietnam

Mobile wallet habits vary sharply: some markets lean heavily Apple, others are dominated by Android and Google Pay. Support for buying crypto via either wallet can shift quickly as regulators and banks update their policies. The safest approach is to see which option appears on the top exchanges you use, run a few small test purchases with both, and then back the side of the Google Pay vs Apple Pay crypto divide that works most consistently with your local banks and cards.

9. Compliance, Bank Policies And Card Network Rules You Cannot Ignore

Behind every tap to buy coins sits card network policy, bank risk rules and local regulation. If you ignore that layer, the Google Pay vs Apple Pay crypto discussion can feel random and unfair.

1. How card networks treat wallet based crypto payments

Visa, Mastercard and other networks do not see a special “wallet payment” category – they see a merchant code and a risk profile. Most crypto platforms are classified as high risk, so transactions are monitored more closely, can trigger extra checks and are sometimes refused altogether, even if the Google Pay or Apple Pay button is visible in the app.

2. Why banks sometimes block or limit these transactions

From a bank’s point of view, card funded crypto combines volatility, cross border flows and limited chargeback options once coins are delivered. Many issuers respond by declining some merchants, setting low limits for digital asset payments or demanding extra verification for larger amounts. Two customers in the same country can therefore see very different results depending on which bank issued their card.

3. How to work with the rules instead of against them

You cannot change card and bank policy, but you can adapt to it: use regulated exchanges your bank recognises, start with small test payments during normal hours, read your bank’s public stance on crypto and keep an alternative funding method such as bank transfer ready. If you factor these rules into your Google Pay vs Apple Pay crypto choice, you will face fewer failed payments and far less frustration.

10. Buyer Personas – Which Wallet Fits Your Crypto Buying Style

Not everyone buys coins in the same way, so the best answer to Google Pay vs Apple Pay crypto depends a lot on which type of buyer you are in real life.

1. Casual first time buyer with small tickets

If you are testing crypto with small amounts and care most about comfort and familiarity, choose the wallet that already runs your everyday payments.

- Android user paying by phone in shops all the time: Google Pay will usually feel natural.

- iPhone user who already uses Apple Wallet for transport and subscriptions: Apple Pay is normally the calmer option.

In both cases, keep tickets small, accept a bit of extra fee as the price of convenience and treat this as a trial phase.

2. Regular DCA investor using mobile only

If you buy a fixed amount every week or month, you need reliability more than absolute rock bottom fees. A wallet and exchange combo that:

- works smoothly,

- rarely gets blocked by your bank,

- lets you confirm in one tap

is worth more than saving a fraction of a percent now and then. Track a few months of buys and stick with the side of this Google Pay vs Apple Pay crypto choice that fails the least, not the one that looks best on paper.

3. Higher volume user who should move beyond wallets

Once your amounts are large enough that a failed card payment would stress you out, mobile wallets should become a backup, not the main rail. At that point, bank transfers, local instant payment rails or specialist on ramps usually give better limits, clearer compliance and lower all in cost. Use wallets for quick top ups and emergencies, but run serious volume through methods that are designed for it.Extended thinking

11. What Changed Recently For Google Pay And Apple Pay Crypto Access

To keep this Google Pay vs Apple Pay crypto guide realistic, you need to remember that support for wallet based crypto payments is not fixed. Exchanges, banks and regulators keep adjusting their position, and those shifts can quietly change which option works better for you.

1. Recent updates in wallet support on crypto platforms

Crypto apps and on ramps regularly add or remove payment methods based on usage and risk. A platform might launch with card and bank transfer only, then roll out Google Pay or Apple Pay after testing, or temporarily disable one wallet in certain regions while it updates risk rules. This is why a payment button you used last month can suddenly disappear or reappear after an app update.

2. Bank and regulator moves that affect wallet based buys

Banks watch digital asset rules closely and sometimes tighten or relax their stance with little public detail. New guidance from regulators, changes in licensing for a major exchange or a wave of fraud incidents can all lead to stricter screening on card funded crypto, even when you pay through a mobile wallet. The opposite also happens: once a platform proves its reliability, some issuers quietly allow higher limits or fewer unexplained declines.

3. What these changes mean for everyday crypto buyers

For regular users, the lesson is simple: treat today’s setup as a snapshot, not a guarantee. If a method that once worked starts failing, check for app updates, bank messages and policy changes before assuming something is “broken”. Running small test purchases from time to time and keeping at least one alternative funding route ready will help you stay flexible as the Google Pay vs Apple Pay crypto landscape shifts over the next few years.

FAQs About Using Google Pay And Apple Pay To Buy Crypto

1. Can I buy Bitcoin with Google Pay and Apple Pay in 2026?

Yes. Many major exchanges and on-ramps support both wallets, but it depends on your country, bank and chosen platform.

2. Which is cheaper, Google Pay or Apple Pay, for buying crypto?

Neither wallet has a fixed extra fee. Total cost depends on the exchange, card network, FX rate and your bank, not just on Google Pay vs Apple Pay crypto branding.

3. Are these wallets safe for buying crypto?

Yes, they tokenise your card number and require device or biometric approval, which is safer than typing raw card details into each app.

4. Why did my bank block a payment through these wallets?

Many banks treat card-funded crypto as high risk and may decline some merchants, amounts or countries, even if the payment goes through a mobile wallet.

5. Do I still need KYC if I pay with Google Pay or Apple Pay?

Yes. Exchanges and on-ramps must run their own KYC checks, regardless of the wallet or payment method you use.

6. Can I cash out crypto directly into Google Pay or Apple Pay?

Usually no. You normally sell crypto for fiat on an exchange, withdraw to your bank, then use the card linked to your wallet.

7. What limits apply when I buy crypto with these wallets?

You face combined limits from the exchange, your bank, your card and sometimes the processor. They vary by region and issuer.

8. How can I keep costs low when using these wallets for crypto?

Use transparent, regulated platforms, watch FX if currencies differ, avoid tiny buys with high minimum fees, and test both options to see which side of the Google Pay vs Apple Pay crypto choice gives you a better all-in rate.

Final Verdict – Google Pay vs Apple Pay Crypto Decision Matrix

In 2026, there is no single winner in the Google Pay vs Apple Pay crypto debate. The best choice is the wallet that works most smoothly with your bank, your cards and the exchanges or on ramps you actually use, while still keeping costs and failed payments under control.

Quick recap of who should use which wallet

- Android first, bank friendly with Google services – Google Pay is usually the easiest way to make small, fast test buys.

- Deep in the Apple ecosystem with a bank that allows card funded crypto – Apple Pay often gives the cleanest, least stressful flow.

- Larger tickets, business use or stricter banks – treat both wallets as convenient extras and rely mainly on regulated bank rails and specialist gateways.

Google Pay vs Apple Pay Crypto Decision Matrix

| No. | Buyer type | Recommended wallet approach | Key reason |

|---|---|---|---|

| 1 | First time, small test amounts | Use the wallet you already pay with every day | Familiar UX matters more than tiny fee gaps |

| 2 | Mobile only DCA investor | Pick the wallet plus exchange combo that fails least | Reliability beats theoretical fee savings |

| 3 | Cross border, mixed currencies | Test both, keep the one with better effective FX | FX spread and bank behaviour vary by wallet |

| 4 | Higher volume or business oriented | Use wallets for small top ups, bank rails for size | Bank transfers and on ramps scale more safely |

| 5 | Very risk averse retail buyer | Use regulated exchanges and the wallet your bank likes | Bank policy often matters more than wallet brand |

Next steps – combine wallets with XaiGate for serious use

If you want something more stable than simple one tap buys, pair your preferred wallet with a crypto payment gateway that understands banks, card networks and regulation. XaiGate is built for that job – it helps you route Google Pay and Apple Pay payments through compliant on ramps, track real all in costs and keep a clean audit trail that works for both 2026 rules and future updates.

Start with a few small Google Pay or Apple Pay transactions via XaiGate, compare the effective rate and success rate with your current setup, then scale the option that proves cheaper and more reliable. That way your Google Pay vs Apple Pay crypto choice becomes part of a smarter payment strategy, not just a button you tap at checkout.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)!