As cryptocurrency adoption continues to evolve, more eCommerce merchants are seeking ways to streamline payments while maintaining privacy. Stablecoins like USDT (Tether) have emerged as a preferred method for cross-border transactions due to their price stability and fast settlement. But many business owners ask: is it possible to accept USDT without going through Know Your Customer (KYC) procedures?

The answer is yes—with the right tools and strategies. In this guide, we’ll explore how to accept USDT without KYC on your eCommerce website, the legal implications, recommended payment gateways, and step-by-step instructions for secure implementation.

Contents

- 1 Why Accepting USDT Without KYC Is Gaining Popularity

- 2 Legal Considerations: Is It Legal to Accept USDT Without KYC?

- 3 Advantages of Accepting USDT Without KYC

- 4 Recommended No-KYC USDT Payment Gateways

- 5 Step-by-Step: How to Accept USDT Without KYC on Your Website

- 6 Managing and Securing Your No-KYC USDT Transactions

- 7 Real-World Use Cases for No-KYC USDT Payments

- 8 FAQs: Accept USDT Without KYC

- 9 Final Thoughts

Why Accepting USDT Without KYC Is Gaining Popularity

Cryptocurrency payments are redefining digital commerce. USDT, a stablecoin pegged to the U.S. dollar, combines the best of both fiat and crypto: value stability, low fees, and blockchain transparency. As a result, it’s increasingly favored by merchants and consumers alike.

The no-KYC approach is especially attractive in the current climate of growing concerns around data privacy, government surveillance, and centralization. Merchants operating in restrictive regions or serving international audiences find no-KYC payment options a liberating alternative to traditional banking systems. In markets where onboarding friction can reduce conversion rates, offering a seamless, anonymous payment option gives businesses a strong competitive edge.

However, many crypto gateways still require KYC checks—introducing friction and delays. Merchants who prioritize fast onboarding, privacy, and global accessibility are turning to no-KYC USDT payment solutions.

Key motivations include:

- Privacy-conscious customers: No need to submit sensitive ID documents.

- Fast integration: Get started without waiting for identity verification.

- Borderless commerce: Reach users in jurisdictions where KYC is burdensome or unavailable.

Table 1: Key Differences Between KYC and No-KYC Gateways

| Criteria | KYC-Required Gateways | No-KYC Gateways (e.g. XAIGATE, BTCPay Server) |

|---|---|---|

| Onboarding | Verification process takes days and requires documents | Instant setup — connect wallet and start |

| Privacy | Personal data stored by provider | No data collection, transactions remain private |

| Control of Funds | Often custodial — provider holds your balance | Non-custodial — funds arrive directly in your wallet |

| Transaction Speed | Delays possible due to compliance checks | Transactions settle in real-time |

| Limits & Restrictions | Higher daily/annual limits once verified | May have lower default caps, but flexible for SMEs and freelancers |

| Cost Structure | Fees can include hidden charges beyond base percentage | Transparent pricing, usually lower (around 0.2%–1%) |

| Best Fit For | Enterprises operating under heavy regulation | Online shops, startups, and merchants prioritizing speed and simplicity |

Legal Considerations: Is It Legal to Accept USDT Without KYC?

The legality of accepting USDT without KYC depends heavily on your jurisdiction and the nature of your business. Here’s what you need to know:

1. Non-Custodial vs. Custodial Gateways

- Non-custodial solutions let customers send crypto directly to your wallet. You retain full control and don’t handle customer identity data. These are typically considered legal in most jurisdictions when used for payments, not custody.

- Custodial gateways hold funds on your behalf and require regulatory compliance—including KYC.

2. Jurisdictional Landscape

- United States / EU: Requires KYC for custodial services. Non-custodial payments may not trigger KYC obligations, but businesses should keep clean financial records.

- Singapore / UAE / El Salvador: Generally crypto-friendly with clear stablecoin guidelines.

- Vietnam / Nigeria / India: Often operate in regulatory gray zones. Merchants should proceed with caution and monitor updates.

Disclaimer: Always consult with a legal advisor to ensure compliance with local laws.

Advantages of Accepting USDT Without KYC

There are tangible benefits to integrating no-KYC payment flows:

- Immediate setup: Skip time-consuming onboarding.

- Low-cost transactions: Especially when using TRON (TRC20) network.

- Increased conversions: Fewer checkout steps means higher cart completion.

- Full control: You hold the keys—literally.

- Enhanced customer trust: Users are more likely to pay when no sensitive info is collected.

Recommended No-KYC USDT Payment Gateways

Not all gateways are equal when it comes to KYC. Here are three top picks for accepting USDT without user verification:

1. XAIGATE

- Fully non-custodial

- Supports TRC20 and ERC20 USDT

- Shopify, WooCommerce, Magento integrations

- No login, no KYC required for setup

2. BTCPay Server

- Self-hosted, open-source payment processor

- Customizable for USDT payments

- Requires technical setup (ideal for developers)

3. NowPayments

- Easy to set up

- Offers USDT integration

- May require KYC above certain thresholds

Each solution has trade-offs. If you’re looking for plug-and-play functionality with no data collection, XAIGATE is the most user-friendly.

Table 2: Advanced Benefits of Using XaiGate for eCommerce Payments

| Dimension | How XaiGate Adds Value |

|---|---|

| Speed to Market | Merchants can integrate and start accepting USDT in minutes, bypassing traditional banking or compliance hurdles. |

| Cost Efficiency | Ultra-low processing fees (~0.2%), helping businesses protect margins, especially on high-volume transactions. |

| Global Reach | Works worldwide without geo-blocking, enabling merchants to serve customers in regions often ignored by banks. |

| Security & Custody | Non-custodial design — no third party holds your assets; funds settle directly into your wallet. |

| Regulatory Flexibility | Operates without mandatory KYC, giving businesses agility to test markets without bureaucratic barriers. |

| User Privacy | Both merchants and buyers maintain complete anonymity; no risk of personal data leaks. |

| Ecosystem Support | Native plugins for leading eCommerce platforms (WooCommerce, Shopify, Magento, OpenCart) ensure easy adoption. |

| Future-Proof Model | Designed around stablecoins like USDT, aligning with the trend toward faster, more private, and decentralized commerce. |

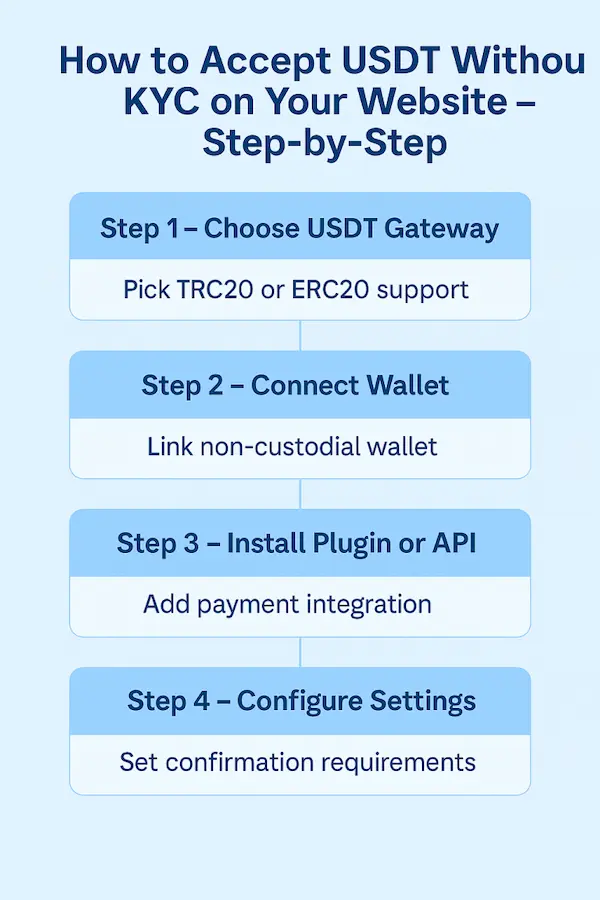

Step-by-Step: How to Accept USDT Without KYC on Your Website

Step 1: Select a Non-Custodial Gateway

Pick a gateway that does not hold your funds. Ensure it supports USDT over TRC20 (low fee) and ERC20 (high compatibility).

Step 2: Connect a Secure Wallet

Use a wallet where you control the private keys:

- Trust Wallet

- MetaMask

- XDEFI Wallet

- Hardware wallets (Ledger, Trezor)

Make sure it supports the correct network (TRON or Ethereum).

Step 3: Install the Plugin or API

For WooCommerce/Shopify:

- Install the gateway plugin from your provider (e.g., XAIGATE plugin)

- Follow the setup wizard to configure wallet address, confirmations, webhook URLs

For custom sites:

- Use APIs or embeddable checkout widgets

Step 4: Customize Transaction Settings

- Set confirmation requirement: 3 for TRON, 12 for Ethereum

- Define timeout window (e.g., 30 mins)

- Choose whether to generate new address per order

Step 5: Launch and Test

- Process test payments with small USDT amounts

- Monitor webhook response and order status updates

- Check wallet for funds received

Managing and Securing Your No-KYC USDT Transactions

Without a third party managing funds, security is your responsibility. Here are tips:

- Use multi-signature wallets for large balances

- Backup seed phrases securely (offline preferred)

- Segment addresses per order for easier tracking

- Log all transactions with time, amount, TXID, status

- Avoid using shared hosting if deploying a custom solution

Pro tip: Use watch-only wallets on mobile to monitor incoming funds in real time.

Real-World Use Cases for No-KYC USDT Payments

Freelancers and Digital Nomads

Avoid banking delays and currency conversion fees. Accept payments from clients directly in USDT.

eCommerce and Dropshipping Stores

Accept stablecoin payments from customers globally. Especially useful for cross-border sales and markets with limited banking access.

High-Risk Industries

CBD, adult, gaming—sectors often excluded by traditional banks can benefit from no-KYC crypto gateways.

FAQs: Accept USDT Without KYC

1. Is it legal to accept USDT without KYC verification?

In many countries, you can legally accept USDT without requiring KYC if you use a non-custodial payment method. However, regulations vary, so it’s important to check your local compliance rules before proceeding.

2. Should I use TRC20 or ERC20 to receive USDT payments?

TRC20 (TRON) is typically cheaper and faster, making it ideal for high-volume or low-fee environments. ERC20 (Ethereum) is more broadly supported across platforms, but often comes with higher gas fees.

3. Do I need a special license to accept USDT payments?

If you’re only accepting USDT as a form of payment, usually no license is required. Licensing is generally necessary for businesses that hold, exchange, or custody crypto on behalf of others.

4. How can I convert USDT to fiat without completing KYC?

To maintain privacy, you can use decentralized exchanges (DEXs) or peer-to-peer (P2P) platforms that don’t enforce strict KYC. Some OTC (over-the-counter) providers also offer low-KYC or no-KYC options—but always verify their credibility.

5. Do I have to collect personal data from customers when using no-KYC USDT gateways?

No, if you use a non-custodial crypto gateway, you don’t need to gather KYC data. That said, you might still request a customer’s email address for order confirmation, shipping, or digital delivery purposes.

6. Can I use a DEX to cash out USDT to fiat without identity checks?

DEXs let you swap USDT for other crypto without registration. However, converting to fiat often requires a centralized exchange or a P2P buyer. Look for services with flexible KYC policies if privacy is a priority.

7. Which is safer for no-KYC payments: TRC20 or ERC20?

Both TRC20 and ERC20 are secure when used with reputable wallets. TRC20 is faster and more cost-effective, but ERC20 has longer track records and broader integration with mainstream services.

8. How do I process refunds for USDT transactions?

Since blockchain payments are final, refunds must be done manually. You’ll need the customer’s correct wallet address and transaction details. Always verify the return address before sending USDT back.

9. What’s the best wallet to accept USDT without KYC?

A non-custodial wallet like Trust Wallet, MetaMask, or Exodus lets you receive USDT without going through KYC. These wallets give you full control of your funds and don’t require identity verification during setup.

10. Are there risks in accepting USDT without KYC compliance?

Yes, while no-KYC methods offer privacy, they can expose your business to legal risks or unwanted scrutiny in certain regions. You may also encounter issues with fraud, chargebacks, or limited customer dispute resolution. Always weigh privacy against regulatory obligations.

Final Thoughts

The ability to accept USDT without KYC opens up new possibilities for merchants seeking privacy, control, and global reach. By choosing the right tools and following best practices, you can offer your customers a fast, frictionless crypto payment experience—all while staying secure and compliant.

As privacy becomes a premium feature in the digital age, businesses that adapt early will gain a competitive edge.

Ready to go live with USDT payments without jumping through KYC hoops?

👉 Explore XAIGATE – the leading no-KYC USDT gateway for eCommerce.

Start accepting crypto in minutes. No forms. No delays. No compromise.

We may also be found on GitHub, and X (@mxaigate)! Follow us!

Don’t miss out on the opportunity to elevate your business with XAIGATE’s Accept USDT Without KYC on Your eCommerce Website. The three-step process is designed to be user-friendly, making it accessible for all businesess. Embrace this modern payment solution to provide customers with a secure and efficient way to pay. Take the first step towards a competitive edge in the digital realm and unlock the benefits of cryptocurrency payments for online casino today.