Web3 revolution has introduced something unprecedented to the world of online payments, and the payment space has been amongst the most prolific ones, yet there has been one bottleneck that has persistently stood in the way of full-scale adoption: user experience. Invisible crypto payments are the next step in shifting the gears of blockchain, which will eliminate friction and millions of people never experienced the magic of decentralized finance and Web3-based applications.

With the rapid advances of blockchain innovation, one of the greatest challenges that are yet to be addressed is the problem of making the UX so obvious that it can be understood by the mainstream. The point is that, in an ideal situation, blockchain transactions must be fully transparent to the end user, thus making payment experiences comparable to that of a standard e-commerce experience, but with the added advantage of following cryptocurrency transactions.

Contents

- 1 Understanding Invisible Crypto Payments

- 2 The Current State of Web3 UX Challenges

- 3 Key Technologies Enabling Invisible Crypto Payments

- 4 Implementation Strategies for Businesses

- 5 Industry Use Cases and Applications

- 6 Security Considerations and Best Practices

- 7 Overcoming Technical Challenges

- 8 Future Developments and Innovations

- 9 Business Impact and ROI

- 10 Implementation Roadmap

- 11 Measuring Success

- 12 Conclusion

- 13 Frequently Asked Questions – Invisible Crypto Payments

Understanding Invisible Crypto Payments

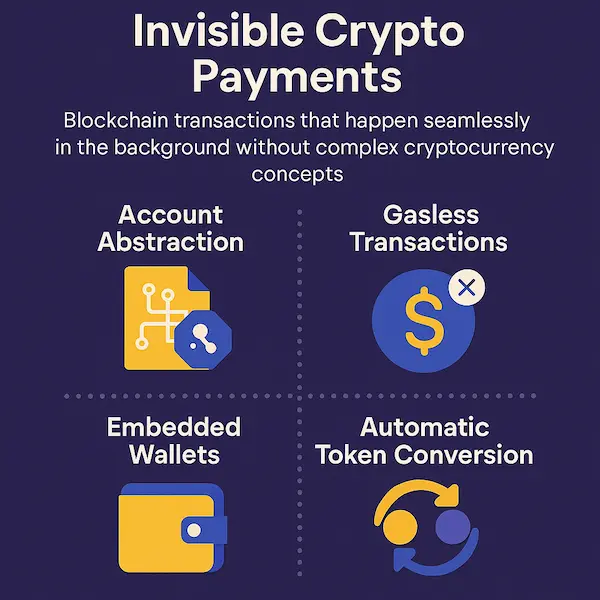

What Makes Payments “Invisible”

Invisible crypto payments refer to blockchain transactions that happen seamlessly in the background without requiring users to understand complex cryptocurrency concepts, manage gas fees, or navigate complicated wallet interfaces. These payments appear to users as simple, one-click transactions similar to traditional payment processors like PayPal or Stripe.

The core components that enable invisible crypto payments include:

- Account abstraction – Smart contract wallets that handle complex operations automatically

- Gasless transactions – Sponsored transactions where third parties pay network fees

- Embedded wallets – Wallets integrated directly into applications without separate installations

- Automatic token conversion – Real-time swapping between different cryptocurrencies

- Simplified authentication – Social logins and biometric verification instead of seed phrases

The Technical Foundation

The infrastructure powering invisible crypto payments relies heavily on account abstraction, which proposes a different model: make every account a smart contract, programmable and customizable. This enables wallets to define their own logic for authorizing transactions, recovering access, or paying gas fees.

Account abstraction enables fee delegation, gasless transactions, and batched operations, improving transaction efficiency. This technical advancement removes the traditional barriers that made cryptocurrency payments cumbersome for everyday users.

The Current State of Web3 UX Challenges

Traditional Crypto Payment Friction

Current Web3 payment experiences create numerous friction points that discourage user adoption:

Complex wallet management: Users must download, install, and secure separate wallet applications with complicated seed phrases and private keys.

Gas fee confusion: Every transaction requires users to understand and pay network fees, often leading to failed transactions when fees are insufficient.

Token compatibility issues: Users frequently need to hold specific tokens or convert between different cryptocurrencies to complete transactions.

Network switching: Many applications require users to manually switch between different blockchain networks, creating confusion and potential errors.

Multi-step approval processes that require separate transactions for token approvals before the actual payment can be processed.

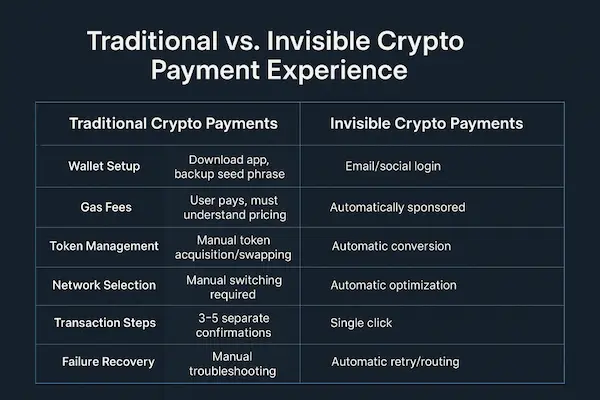

Table 1: Traditional vs. Invisible Crypto Payment Experience

| Aspect | Traditional Crypto Payments | Invisible Crypto Payments |

| Wallet Setup | Download app, backup seed phrase | Email/social login |

| Gas Fees | User pays, must understand pricing | Automatically sponsored |

| Token Management | Manual token acquisition/swapping | Automatic conversion |

| Network Selection | Manual switching required | Automatic optimization |

| Transaction Steps | 3-5 separate confirmations | Single click |

| Failure Recovery | Manual troubleshooting | Automatic retry/routing |

Barriers to Mass Adoption

While this nascent technology has revolutionized the speed at which funds can be moved across the world, the process is not UX-friendly. For starters, users have to copy an alphanumeric character string which makes up the crypto wallet, one single mistake can result in lost funds.

These UX challenges have created a significant gap between Web3’s potential and its actual adoption. Research indicates that over 70% of users abandon Web3 applications during their first interaction due to wallet connection difficulties and transaction complexity.

Key Technologies Enabling Invisible Crypto Payments

Account Abstraction (ERC-4337)

Account abstraction represents the most significant advancement in making invisible crypto payments possible. Account abstraction enables smart contracts to manage or initiate transactions instead of just relying on EOAs. Account abstraction improves security by allowing smart contracts to set up any security rules.

This technology allows developers to create wallets that:

- Handle gas payments automatically through paymasters

- Enable social recovery without seed phrases

- Support multi-signature functionality for enhanced security

- Batch multiple transactions into single operations

- Implement custom authorization logic

Gasless Transaction Infrastructure

Create seamless web3 UX by sponsoring users’ gas fees — for any & all transactions. No more disruptive transaction popups or bridging & swapping funds. Gasless transactions remove one of the biggest barriers to crypto adoption by eliminating the need for users to hold native tokens for transaction fees.

Paymaster contracts enable businesses to:

- Sponsor user transactions as part of their business model

- Set spending limits and conditions for sponsored transactions

- Create subscription-based payment models

- Implement loyalty programs with sponsored interactions

Embedded Wallet Solutions

Smart wallets are powerful for enabling a seamless web3 experience on the backend (i.e. gasless transactions) and Embedded Wallets allow users to create a wallet with just their email, social, or custom Auth logins.

Modern embedded wallets provide:

- Email and social media authentication

- Biometric security options

- Multi-device synchronization

- Automatic backup and recovery systems

- Integration with existing user account systems

Implementation Strategies for Businesses

Choosing the Right Infrastructure

Businesses looking to implement invisible crypto payments have several infrastructure options:

Turnkey Solutions: Complete payment platforms that handle all technical complexity behind the scenes, similar to traditional payment processors but powered by blockchain technology.

Modular Approaches: Combining different services for wallet management, gas sponsorship, and transaction processing to create custom solutions.

White-label Platforms: Ready-made solutions that can be branded and customized for specific business needs.

Table 2: Implementation Approaches Comparison

| Approach | Setup Time | Technical Complexity | Customization | Cost Structure |

| Turnkey Solutions | 1-2 weeks | Low | Limited | Transaction fees + monthly |

| Modular Systems | 4-8 weeks | Medium | High | Variable per service |

| White-label | 2-4 weeks | Medium | Medium | License + transaction fees |

| Custom Development | 12+ weeks | High | Complete | Development + infrastructure |

Integration Best Practices

Successful implementation of invisible crypto payments requires careful attention to user experience design:

- Progressive disclosure – Reveal Web3 features gradually as users become more comfortable

- Fallback options – Provide traditional payment methods alongside crypto options

- Clear value proposition – Communicate benefits like faster settlements or lower fees

- Transparent pricing – Show final costs without hidden blockchain fees

- Comprehensive testing across different devices and networks

Industry Use Cases and Applications

E-commerce and Retail

Online retailers implementing invisible crypto payments can offer customers:

- Instant settlements without waiting for bank processing

- Global payments without currency conversion fees

- Reduced chargebacks due to blockchain transaction finality

- Loyalty token integration for rewards and discounts

- Automatic tax compliance through programmable smart contracts

Gaming and Digital Assets

The gaming industry has emerged as a leading adopter of invisible crypto payments for:

- In-game asset purchases without wallet friction

- Cross-game asset transfers between different platforms

- Tournament prize distributions in real-time

- Subscription payments with automatic renewals

- Microtransactions with negligible processing costs

Subscription Services

Invisible crypto payments enable innovative subscription models:

- Automatic recurring payments without credit card failures

- Usage-based billing with real-time adjustments

- International subscriptions without banking restrictions

- Transparent pricing across different markets

- Instant service activation upon payment

Table 3: Industry Adoption Timeline and Benefits

| Industry | Current Adoption | Expected Growth | Primary Benefits |

| E-commerce | Early adopters | 300% by 2026 | Lower fees, global reach |

| Gaming | Mainstream | 500% by 2026 | Asset interoperability |

| DeFi | Native | 200% by 2026 | Seamless onboarding |

| Content/Media | Emerging | 400% by 2026 | Micropayments, global access |

| SaaS | Early stage | 350% by 2026 | Automated billing |

Security Considerations and Best Practices

Smart Contract Security

Invisible crypto payments rely heavily on smart contracts, which require rigorous security measures:

- Multi-signature controls for administrative functions

- Time locks on critical operations

- Audit requirements for all smart contract code

- Upgrade mechanisms with community governance

- Bug bounty programs to identify vulnerabilities

User Protection Mechanisms

Despite the “invisible” nature, robust security remains paramount:

- Transaction limits to prevent large unauthorized payments

- Approval workflows for high-value transactions

- Real-time monitoring for suspicious activity

- Insurance coverage for platform-related losses

- Recovery mechanisms for compromised accounts

Regulatory Compliance

Invisible crypto payments must navigate existing financial regulations:

- KYC/AML compliance integrated into user onboarding

- Transaction reporting for regulatory requirements

- Tax calculation and reporting automation

- Privacy protection while maintaining compliance

- Jurisdictional considerations for global operations

Overcoming Technical Challenges

Scalability Solutions

As invisible crypto payments gain adoption, scalability becomes crucial:

Layer 2 Solutions: Utilizing rollups and sidechains to reduce costs and increase transaction throughput while maintaining security.

Cross-chain Interoperability: Enabling payments across different blockchain networks without user intervention.

State Channel Implementation: Off-chain payment channels for high-frequency, low-value transactions.

Network Reliability

Ensuring consistent performance requires:

- Multiple blockchain network support

- Automatic failover mechanisms

- Transaction monitoring and retry logic

- Real-time status communication to users

Future Developments and Innovations

Emerging Technologies

Several technological developments will further enhance invisible crypto payments:

AI-powered transaction optimization that automatically selects the most efficient payment routes and timing.

Biometric authentication integration that eliminates passwords and private keys entirely.

IoT payment capabilities enabling automatic payments from connected devices.

Quantum-resistant security measures preparing for future cryptographic challenges.

Integration with Traditional Finance

The future of invisible crypto payments includes deeper integration with existing financial systems:

- Bank account connectivity for seamless fiat on/off ramps

- Credit card integration for hybrid payment options

- Central bank digital currency (CBDC) support as governments launch digital currencies

- Traditional payment processor partnerships to expand acceptance

Regulatory Evolution

Expected regulatory developments that will impact invisible crypto payments:

- Clearer guidelines for smart contract wallet operations

- Standardized compliance frameworks for gasless transactions

- International cooperation on cross-border crypto payments

- Consumer protection regulations specific to automated crypto transactions

Business Impact and ROI

Cost Benefits for Merchants

Invisible crypto payments offer significant cost advantages:

- Reduced transaction fees compared to traditional payment processors

- Eliminated chargeback costs due to blockchain finality

- Lower fraud rates through cryptographic security

- Automated reconciliation reducing operational overhead

- Instant settlement improving cash flow

Customer Acquisition Advantages

Businesses implementing invisible crypto payments often see:

- Access to crypto-native customers previously unreachable

- Improved conversion rates due to simplified checkout processes

- Global market expansion without banking partnerships

- Enhanced customer loyalty through innovative payment experiences

- Competitive differentiation in crowded markets

Implementation Roadmap

Phase 1: Foundation (Months 1-2)

- Technology stack selection and vendor evaluation

- Basic integration testing and development

- Security audit and compliance review

- Staff training and documentation creation

Phase 2: Pilot Launch (Months 3-4)

- Limited user testing with selected customers

- Performance monitoring and optimization

- User feedback collection and analysis

- Security testing under real conditions

Phase 3: Full Deployment (Months 5-6)

- Complete rollout to all customers

- Marketing campaign launch

- Customer support training completion

- Continuous monitoring and improvement

Measuring Success

Key Performance Indicators

Track the success of invisible crypto payments implementation through:

- Conversion rate improvements comparing traditional vs. crypto checkout

- Transaction volume growth month-over-month

- Customer acquisition cost reduction for crypto users

- Average transaction value changes

- Customer satisfaction scores for payment experience

Long-term Benefits

The strategic advantages of early invisible crypto payments adoption include:

- Market positioning as an innovation leader

- Customer data insights from blockchain analytics

- Partnership opportunities with Web3 projects

- Future-proofing against payment industry evolution

- Technology learning curve advantages over competitors

Conclusion

Invisible payments made in crypto are a great revolution in the way we perceive online payments. These solutions open up Web3 technology to the mainstream consumer through the elimination of friction and complexity that is usually synonymous with cryptocurrency, and provide users with the same benefits that decentralized finance can offer.

This combination of account abstraction, gasless transactions, and built-in wallets presents a business with an unprecedented level of opportunity to deliver top-level payment experiences to the audience. Competing firms that adopt such technologies early, will have substantial competitive edges as the market comes to maturity.

The future of payments is becoming more and more obvious as companies have removed all the friction out of the existing horrible UX with crypto p2p payments and have improved it to be better even than everyday consumer products such as Venmo. Internet invisible crypto-payments do not only equate the traditional payments experience, they surpass that experience.

Technical infrastructure is fast stabilizing, regulatory frameworks become more transparent, and adoption is picking up in terms of users. Companies that accept crypto payments in their invisible form today move to the first positions in the new era of digital business.

Invisible crypto payments can only be successful when proper planning and security protocols have to be in place, and when performance in regard to user experience is outstanding. Nonetheless, the rewards that can be attained are also enormous; these range between low costs, world coverage, and the ability to reach a new segment of customers, which make this investment an appealing venture to the progressive-minded business.

The issue is no longer how invisible crypto payments would become a common thing, but how fast companies would be able to further adjust to deliver such excellence of payment processes to their clients.

Frequently Asked Questions – Invisible Crypto Payments

1. What exactly are invisible crypto payments?

Invisible crypto payments are blockchain-based transactions that appear to users as simple, one-click payments similar to traditional e-commerce checkout experiences. All the complexity of cryptocurrency, gas fees, and wallet management happens automatically in the background.

2. How do gasless transactions work if someone has to pay the fees?

Gasless transactions use “paymaster” smart contracts where businesses or third-party sponsors cover the network fees as part of their service offering. This is similar to how businesses absorb credit card processing fees today.

3. Are invisible crypto payments secure?

Yes, invisible crypto payments often provide enhanced security through smart contract wallets, multi-signature controls, and programmable security rules. The “invisible” aspect refers to user experience, not security transparency.

4. Do users still own their funds with embedded wallets?

Yes, users maintain control of their funds through cryptographic keys, but these keys are managed automatically through secure authentication methods like email, social logins, or biometrics rather than traditional seed phrases.

5. What happens if the payment service goes down?

Well-designed invisible crypto payment systems include backup mechanisms and recovery options. Since funds are secured on the blockchain, users can typically recover access through alternative interfaces even if one service becomes unavailable.

6. How do invisible crypto payments handle different cryptocurrencies?

Advanced systems automatically convert between different cryptocurrencies in real-time, allowing users to pay with any supported token while merchants receive their preferred currency. This happens seamlessly without user intervention.

7. Are there transaction limits with invisible crypto payments?

Most platforms implement reasonable transaction limits for security purposes, similar to traditional payment processors. Higher limits are typically available with additional verification steps.

8. How do businesses integrate invisible crypto payments?

Integration typically involves adding a payment widget or API similar to traditional payment processors. The complexity varies depending on the chosen solution, but most modern platforms offer developer-friendly integration options.

9. What are the costs compared to traditional payment processing?

Invisible crypto payments often offer lower transaction fees than credit cards, especially for international transactions. However, businesses may pay for gas sponsorship and platform services, so total costs depend on transaction volume and chosen features.

10. Can invisible crypto payments work offline?

Currently, invisible crypto payments require internet connectivity to interact with blockchain networks. However, some solutions are exploring offline transaction capabilities for specific use cases using state channels or similar technologies.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!