Doing business in 2026 still entails dealing with payment processing issues and other industry blockages, especially for high-risk businesses. For “high-risk” businesses, many traditional financial institutions tend to shy away due to increased risks in chargebacks, fraud, or regulatory complexities. Thus, for such businesses, finding the best payment gateway for high risk business is not just a convenience, but indeed a question of survival and a great business opportunity.

In this guide, we will specifically define a high risk business, successfully acquire a specialized merchant account, and identify attributes that a high risk business payment gateway ought to possess. Further, we will gain critical information regarding reliable high risk payment processors.

Contents

- 1 Why traditional payment processors are hesitant

- 2 The Principal Obstacles in Obtaining a High Risk Payment Processor

- 3 Steps to Take to Obtain a High Risk Merchant Account: Complete Your Action Plan

- 4 Comparison Table: Payment Gateways for High‑Risk Businesses (2026)

- 5 Essential Characteristics of the Best Payment Gateway for High Risk Business

- 6 Xaigate: A new option for your high-risk payment gateway requirements

- 7 FAQs – Best Payment Gateway for High‑Risk Businesses

Why traditional payment processors are hesitant

Traditional payment processors and banks are understandably reluctant towards high risk business payment gateways as they are inherently fraught with unpredictability. Because high-risk industries often come with less stability, there’s increased regulatory scrutiny, often leading mainstream processors to decline applications. These providers want to avoid potential losses and legal complications associated with chargebacks, while still gaining flexibility without restrictive terms.

The Principal Obstacles in Obtaining a High Risk Payment Processor

Getting the best payment gateway for high risk business is not a simple task. Companies that fall under these categories encounter distinct challenges that need to be expertly bypassed.

Increased costs and rolling reserves

One of the most prominent hurdles pertains to cost. High risk businesses have to deal with higher processing rates as compared to low risk business counterparts. In addition, a good number of high risk payment processor providers may require a “rolling reserve.” This is a percentage of your daily sales that is held for a specific time frame (say 90 or 180 days) as insurance against potential chargebacks. While this system may protect the processor, it severely restricts cash flow. Oftentimes, finding the best payment gateway for high risk business is a matter of optimizing the cash flow costs.

Enhanced monitoring and compliance demands

Businesses placed in high-risk categories tend to face more omnibearing compliance – including enhanced KYC (Know Your Customer) checks and AML (Anti Money Laundering) Policies. The selected high risk payment processor will certainly have to tailor their operations in order to meet these requirements that demand more paperwork and continuous monitoring. This is the crux of the problem when you want a specialized payment gateway for high risk merchant accounts.

Fewer choices and risk of account cancellation

The number of providers who will service high-risk businesses is smaller. This means you have less options and less leverage. Also, even a high-risk account can be terminated if chargeback ratios are too high or terms are violated. This highlights the need for high risk business payment gateway providers who fully understand your business model and support it.

Steps to Take to Obtain a High Risk Merchant Account: Complete Your Action Plan

With the best payment gateway for high risk business, it all begins with applying for a high-risk merchant account and having a proper payment processor application strategy. Follow this simple structure to get everything done

Step 1: Gather all the required business documents

Make sure to collect everything. Before contacting any high risk payment processor, ensure to collect all the crucial documents. Typical documents include: business license, financial documents such as statement for the previous 3 to 6 months, bank statements, any existing processing history, and thorough descriptions of the offered products or services. Having all these documents ready and organized can fast track the application process for your payment gateway for high risk merchant accounts.

Step 2: Look for specialized high risk payment processors

Don’t spend time applying to standard processors that will most likely decline you. Focus on those that actively market and work with high-risk businesses. Check their track record within your business segment; study testimonials and find out their pricing, as well as other terms and conditions. This focus boosts your odds of getting the best payment gateway for high risk business.

Step 3: Explain everything about your business model

No need to sugarcoat things, remember that during application, honesty really is the best payment strategy. Explain fully the components of your venture, even if it falls under the high-risk category. If you choose to hide certain details, you will be stuck in processes that take forever or worse, get outright no. A good high risk payment processor will tell you that they want truthful information so they can price and manage risk properly while ensuring compliance.

Read more: Low Fee Crypto Payment Gateway Solutions

Comparison Table: Payment Gateways for High‑Risk Businesses (2026)

| Feature | XAIGATE (Crypto & Stablecoin Gateway) | High‑Risk Fiat Processors (e.g. eMerchantBroker, PaymentCloud) | Crypto Custodial Payment Gateways (CoinPayments, NOWPayments) | Open‑Source Self‑Hosted (e.g. BTCPay Server) |

|---|---|---|---|---|

| Accepts High‑Risk Verticals | ✅ Yes — supports gaming, adult sites, supplements, CBD | Limited/Case-by-case, often high fees or blocked | Some crypto-friendly but with custodial control | Flexible—depends on user policy and hosting jurisdiction |

| Chargeback Exposure | None — crypto irreversible with optional refund logic | Full risk — high rates, reserves, rolling penalties | Custodial & charges refunds per policy | None — custom refund logic needed |

| Settlement Speed | Under 5 minutes (supports fast chains like TRC20) | 1–3 business days typical | Minutes to hours depending on chain | Customizable; dependent on node and network setup |

| Fee Structure | 0.2%–0.3% flat per transaction | 2%–5% + setup and reserve fees | 0.5%–1.5% depending on volume | No platform fees—only gas and hosting cost |

| KYC / Compliance Flexibility | Tiered & optional for low volume; tailored flows | Strict KYC makes onboarding difficult for high‑risk verticals | Mandatory KYC in most zones | None—self-hosted and anonymous if needed |

| Wallet Custody | Non-custodial—you control private keys | Fully custodial | Custodial or optional | Fully non-custodial |

| Token & Confirmation Support | Supports 9,800+ tokens including stablecoins | Fiat only; no multisig or token flexibility | Limited to major crypto tokens | Fully customizable by user |

| Integration & Platform Support | Plugins for WooCommerce, Magento, OpenCart, Shopify | API-based, often slow integration | Plugin & API support | Developer-heavy setup required |

| Refund/Dispute Together Logic | Customizable refund controls & API logic | Handled through merchant’s acquiring bank | Customer support model varies, refunds per platform policy | Manual implementation and reconciliation required |

| Support & SLA | 24/7 live support with SLA-backed uptime | Varied—often limited post‑onboarding | Tiered support plans |

Community-based support

|

Why High‑Risk Businesses Choose XAIGATE

-

Seamless compatibility with high-risk verticals such as casinos, esports, supplements, or adult content.

-

No chargeback vulnerability, sidestepping costly refunds and reserves common in fiat processors.

-

Fast, global settlement via stablecoin rails—ideal for businesses that need real-time liquidity.

-

Flexible KYC approach, reducing onboarding friction for low-volume or privacy-conscious merchants.

-

Non-custodial architecture gives users full control over their crypto assets—unlike custodial payment platforms.

For businesses in risk-heavy industries that still want payment flexibility with minimal friction and operational cost, XAIGATE offers a modern solution combining speed, compliance, and transparency—all while avoiding traditional high-risk processor limitations.

Essential Characteristics of the Best Payment Gateway for High Risk Business

The best payment gateway for high risk business is not only concerned with accepting high-risk clients. They also have features that seek to efficiently address the operational challenges of these businesses.

Cutting edge fraud prevention tools

Businesses operating in high-risk industries often face fraud challenges. That’s why the best payment gateway for high risk business must provide robust tools for fraud detection and prevention. Informational features such as geolocation, IP address blocking, customizable fraud filters, chargeback management systems, and 3D Secure authentication are essential. These features go a long way in minimizing risks and strengthening your revenue stream. An efficient payment gateway for high risk merchant accounts will enable strong fraud protection.

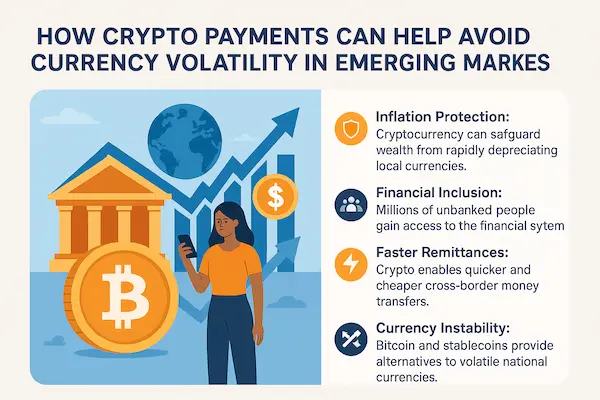

Multi-currency and international payment capability

Many high-risk businesses deal internationally. The best payment gateway for high risk business includes comprehensive support for multi-currency transactions and international processing without friction. This is often important in expanding your customer base and simplifies trade across borders for certain industries. These advantages play a vital role when selecting your high risk payment processor.

Excellent customer support and account management

In the case of high-risk processing, exceptional customer service is a must. The best payment gateway for high risk business has specialized account managers who understand the difficulties your business faces and know how to help. Trouble-free and fast issue resolution, clear communication, and effective service throughout the partnership with your high risk payment processor are essential components for enduring success.

Read more: Crypto payment gateway and customer experience

Xaigate: A new option for your high-risk payment gateway requirements

As high-risk merchants require specialized solutions, companies like Xaigate are developing modern payment gateways that meet the needs of contemporary merchants. Xaigate is designed to efficiently manage high risk merchant account payments while providing complete transparency, strong security features, and low processing fees. They work to overcome the pain points of high-risk businesses by guaranteeing fast approvals and responsive customer service, giving them a shot at being the best payment gateway for high risk business in 2026. Their focus on low risk and easy transaction management stands out in the world of high risk payment processors.

Choosing the best payment gateway for high risk business is critical to developing a successful enterprise within difficult industries. It involves examining a niche provider’s fee breakdown, compliance requirements, and assessing their fraud prevention capabilities. Meeting these outlined requirements ensures that you process your applications methodically and that all advanced features optimization is done, you’ll obtain a payment gateway for high risk merchant accounts without a hassle. Opting for Xaigate or other modern providers guarantees informed choices that propel your business forward while skillfully maneuvering the intricate landscape of risk-laden payment processing in 2026.

FAQs – Best Payment Gateway for High‑Risk Businesses

1. What makes a payment gateway suitable for high-risk businesses?

High-risk businesses need gateways that support industries like crypto, gaming, or adult services. These gateways offer fraud protection, flexible KYC/AML, and multi-currency support to handle chargebacks and compliance.

2. Why is XAIGATE a good choice for high-risk merchants?

XAIGATE charges only 0.2% fees, supports no-KYC crypto payments, and offers decentralized infrastructure—ideal for high-risk industries needing global, fast, and secure transactions without compliance overload.

3. Can I use XAIGATE for adult, gambling, or CBD eCommerce?

Yes. XAIGATE supports crypto payments for adult sites, gambling platforms, CBD shops, and other high-risk sectors with no monthly fees or contract lock-ins.

4. What cryptocurrencies does XAIGATE support for high-risk businesses?

XAIGATE supports Bitcoin, Ethereum, USDT (TRC20, ERC20), BNB, Solana, and more—letting high-risk merchants accept stablecoins or volatile assets with low transaction fees.

5. Is there any limit on transaction volume using XAIGATE?

No. XAIGATE allows unlimited transaction volumes without extra costs or KYC requirements for low-to-moderate risk levels, making it highly scalable for global merchants.

6. Do I need a license to accept crypto with XAIGATE?

It depends on your location. Many jurisdictions allow crypto payments without a license for decentralized, non-custodial platforms like XAIGATE. Check your local laws.

7. Does XAIGATE work with WooCommerce and Shopify for high-risk merchants?

Yes. XAIGATE provides plugins for WooCommerce, Magento 2, and Shopify, allowing easy crypto checkout integration for high-risk online stores.

8. How fast are payments processed with XAIGATE?

Most payments are confirmed in seconds to a few minutes depending on the blockchain. XAIGATE supports fast networks like Tron and Solana for high-speed checkout.

9. Are XAIGATE’s fees really 0.2%?

Yes. XAIGATE charges only 0.2% per transaction with no setup or monthly fees—ideal for high-risk businesses looking to cut costs while scaling globally.

10. Can I settle into fiat currency using XAIGATE?

XAIGATE is a crypto-native, non-custodial gateway, so it does not convert crypto to fiat directly. You can connect to third-party off-ramps for fiat settlement if needed.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)!