The way people shop online is evolving faster than ever. Consumers are no longer satisfied with slow bank transfers, high card fees, or limited payment options that stop at national borders. In this new digital era, e-commerce businesses need payment solutions that are not only secure but also instant and global. That is where the USDT Payment Gateway for E-Commerce comes in.

USDT, as a stablecoin pegged to the U.S. dollar, combines the stability of fiat with the speed and transparency of blockchain. For online retailers, this means accepting payments that settle in seconds, reducing transaction costs, and reaching customers across every continent without worrying about currency barriers. From fashion and electronics to gaming and digital services, the adoption of USDT in online transactions is quickly becoming more than a trend — it is shaping the future of borderless commerce.

Contents

- 1 1. What is a USDT Payment Gateway for E-Commerce?

- 2 2. Key Benefits of USDT Payment Gateway in Online Retail

- 3 3. Why E-Commerce & Retailers Are Turning to USDT

- 4 4. How a USDT Payment Gateway Works in E-Commerce

- 5 5. Integration Guide: How to Add USDT Payment Gateway to Your Store

- 6 6. Security & Compliance Considerations

- 7 7. Market Insights 2026

- 8 8. Future Trends 2026+

- 9 FAQs – USDT Payment Gateway for E-Commerce

- 10 Final Conclusion

1. What is a USDT Payment Gateway for E-Commerce?

A USDT Payment Gateway for E-Commerce is a digital bridge that allows online stores to accept USDT — a stablecoin tied to the U.S. dollar — as a method of payment. Just like traditional gateways process credit card or PayPal transactions, a crypto gateway verifies the transaction, transfers the funds, and confirms payment to the merchant. The difference lies in speed, cost, and flexibility.

Unlike bank transfers that may take days or card payments that involve high fees, USDT transactions are completed within seconds on the blockchain. Because USDT is a stablecoin, businesses avoid the volatility issues often linked with Bitcoin or Ethereum, while still benefiting from the advantages of cryptocurrency. This makes USDT one of the most practical payment options for online retailers who want to combine stability with innovation.

For e-commerce owners, integrating a USDT gateway is not just about adding another checkout option. It represents a shift toward borderless retail, where customers from anywhere in the world can pay in a stable digital currency without facing hidden costs, currency exchange fees, or payment delays.

Table 1 – USDT Payment Gateway vs Traditional Payment Gateway

| Feature | USDT Payment Gateway | Traditional Gateway (Credit Cards/PayPal) |

|---|---|---|

| Speed | Seconds | 1–3 business days |

| Fees | 0.2–1% | 2–4% + conversion fees |

| Borders | Global, borderless | Restricted by country and bank networks |

| Security | Blockchain-backed | Centralized & subject to chargebacks |

| Settlement | Real-time | Delayed, often requiring intermediaries |

2. Key Benefits of USDT Payment Gateway in Online Retail

Adopting a USDT Payment Gateway for E-Commerce gives online retailers several advantages that go beyond simple cost savings. It enhances the overall shopping experience, builds trust with international customers, and prepares businesses for the future of digital commerce.

1. Fast & Real-Time Transactions

One of the biggest frustrations in online shopping is waiting for payments to clear. With USDT, transactions settle in seconds, allowing merchants to confirm orders instantly and ship products faster. This speed not only improves cash flow for businesses but also gives customers confidence that their purchase has been completed without delay.

2. Lower Fees Compared to Credit Cards & PayPal

Traditional gateways often charge between 2% and 4% per transaction, plus hidden currency conversion fees. A USDT gateway typically reduces this cost to below 1%. For businesses handling thousands of transactions every month, the savings are significant and can directly improve profit margins.

3. Global Borderless Payments

E-commerce is no longer limited by geography. Accepting USDT allows a store in Europe to seamlessly sell to a customer in Asia or Latin America without worrying about currency exchange or international card restrictions. This borderless approach gives retailers access to new markets and customers who prefer paying in stablecoins.

4. Blockchain Security & Transparency

Every USDT transaction is recorded on the blockchain, making it nearly impossible to tamper with. For merchants, this transparency reduces the risk of fraud and chargebacks. For customers, it offers reassurance that their payment is secure and traceable.

5. Multi-Currency Support & Conversion Options

Most payment gateways that support USDT also allow businesses to settle in other stablecoins or convert directly into fiat if needed. This flexibility makes it easier for merchants to manage revenue streams and adapt to customer preferences.

3. Why E-Commerce & Retailers Are Turning to USDT

The rise of stablecoins has changed how online businesses think about payments. More retailers are embracing a USDT Payment Gateway for E-Commerce because it solves practical challenges that traditional systems cannot.

Global studies show that crypto adoption in online retail has grown by over 60% in the past three years, with USDT leading as the preferred stablecoin. According to industry research, nearly half of Gen Z and millennial shoppers are more likely to purchase from a store that accepts digital currencies. This trend is especially strong in sectors like fashion, consumer electronics, gaming, and digital services where customers are tech-savvy and international by nature.

Case studies highlight how merchants benefit from this shift. For example, an electronics retailer in Asia reported a 20% increase in cross-border sales after adding USDT as a checkout option. By removing barriers such as bank limitations and high conversion fees, the store attracted a new audience of global buyers who preferred stablecoin payments.

For e-commerce and retail brands, adopting USDT is not just about following a trend. It is about staying competitive, building trust with younger consumers, and ensuring that every customer—regardless of their location—can complete a transaction smoothly.

4. How a USDT Payment Gateway Works in E-Commerce

A USDT Payment Gateway for E-Commerce functions much like any other online payment processor, but with blockchain technology powering the transactions. Here’s how it works in practice for both merchants and customers.

1. Checkout with USDT

When a customer selects an item and proceeds to checkout, they can choose USDT as their preferred payment method. Instead of entering credit card details, the buyer simply scans a QR code or copies a wallet address to send the payment.

2. Real-Time Settlement into Merchant Wallet

Once the transaction is confirmed on the blockchain, the funds are instantly settled in the merchant’s wallet. There are no delays of one to three business days as with traditional bank transfers. This immediate settlement improves cash flow and speeds up order fulfillment.

3. API or Plugin Integration for Online Stores

Most gateways provide easy integration through APIs or plugins for platforms like Shopify, WooCommerce, and Magento. This allows merchants to add USDT payments without rebuilding their entire checkout system. The process is often as simple as installing a plugin and configuring a few settings.

4. Merchant Dashboard & Reporting

Merchants also gain access to a dashboard where they can track incoming payments, generate invoices, and monitor transaction histories. These tools help with accounting, reconciliation, and business intelligence, making stablecoin adoption more practical and professional.

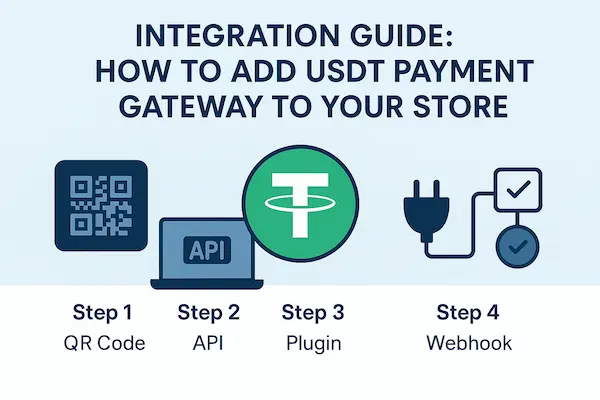

5. Integration Guide: How to Add USDT Payment Gateway to Your Store

Setting up a USDT Payment Gateway for E-Commerce is more straightforward than most merchants expect. With the right provider, the entire process can be completed in just a few steps.

Step 1 – Select a Reliable Provider

The first step is to choose a trusted payment gateway provider that supports USDT. A good provider should offer strong security, competitive fees, and easy integration with major e-commerce platforms. Merchants should also look for providers that comply with global AML/KYC standards.

Step 2 – Generate API Keys & Configure Wallet

Once registered, the merchant receives API keys to connect their store with the payment system. At this stage, the business also sets up a secure wallet to receive USDT payments. It’s important to use multi-signature or cold storage solutions for added protection.

Step 3 – Test Transactions in Sandbox Mode

Before going live, most gateways allow merchants to run test transactions in a sandbox environment. This ensures that payments are processed correctly and that the checkout experience is smooth for customers. Testing also helps merchants identify potential errors before launch.

Step 4 – Go Live & Optimize Checkout Experience

After successful testing, the gateway can be activated on the live store. Merchants should highlight USDT payment availability on product pages and at checkout to encourage adoption. Over time, analyzing payment data and customer behavior can help optimize conversions and refine the checkout process.

6. Security & Compliance Considerations

While the advantages of a USDT Payment Gateway for E-Commerce are clear, merchants must also pay attention to security and regulatory requirements. Handling digital assets requires both technical safeguards and compliance with international standards.

AML & KYC Requirements

Most reputable gateways require merchants to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. This protects both the business and its customers by ensuring that payments are legitimate and traceable. For global e-commerce brands, meeting these standards is essential to avoid penalties and maintain customer trust.

PCI-DSS & Data Protection

Even though USDT payments are processed on the blockchain, gateways still interact with traditional systems, dashboards, and customer data. Providers that follow PCI-DSS (Payment Card Industry Data Security Standard) ensure that sensitive information is encrypted and protected from cyberattacks.

Stablecoin Regulations & Updates

Stablecoins like USDT are under increasing regulatory review around the world. Merchants need to stay updated on local rules regarding digital assets, especially if they serve customers in regions such as the U.S., EU, or Asia. A compliant payment gateway will provide updates and adapt its framework to meet these evolving regulations.

Building Customer Confidence

By working with a provider that prioritizes compliance and transparency, online stores can build stronger relationships with their customers. Shoppers are more likely to complete a purchase when they know their payment is both secure and legally compliant.

Table 2 – USDT vs Bitcoin/Ethereum in E-Commerce

| Criteria | USDT (Stablecoin) | Bitcoin / Ethereum (Volatile Crypto) |

|---|---|---|

| Volatility | Stable (1:1 to USD) | High fluctuations |

| Transaction Speed | Seconds | Minutes (BTC) / High gas fees (ETH) |

| Fees | Low, predictable | Medium to high depending on network |

| Suitability | Retail, daily transactions | Investment or large-value transfers |

| Customer Trust | High due to stability | Mixed, depends on market conditions |

7. Market Insights 2026

The adoption of stablecoins in online retail has grown at a remarkable pace, and USDT leads the trend. For businesses exploring a USDT Payment Gateway for E-Commerce, the year 2026 marks a tipping point where stablecoins are no longer an experimental option but a mainstream payment method.

Recent reports show that nearly 40% of global e-commerce businesses are considering adding crypto payment options, with USDT ranking as the most widely used stablecoin. Data from Asia and Latin America highlight a surge in demand, as customers in these regions increasingly turn to digital currencies to bypass high conversion fees and unreliable banking systems.

Demographic insights also play a key role. Surveys reveal that Gen Z and Millennial shoppers are twice as likely to trust and use stablecoins for online purchases compared to older generations. For these customers, using USDT is not only about convenience but also about aligning with a digital-first lifestyle.

Analysts forecast that by the end of 2026, stablecoin transactions could account for up to 10% of all global e-commerce payments, driven by platforms that integrate user-friendly gateways. This growth presents both an opportunity and a challenge: businesses that move quickly can gain a competitive edge, while those that delay may find themselves losing younger, tech-savvy customers.

8. Future Trends 2026+

Looking beyond 2026, the role of stablecoins in online commerce is expected to grow even further. For businesses considering a USDT Payment Gateway for E-Commerce, understanding future trends is essential to stay competitive.

1. Rise of Stablecoins in Global Retail

By 2026, stablecoins like USDT are projected to handle an even larger share of global e-commerce transactions. As more governments regulate and legitimize digital assets, merchants will find it easier to integrate them without legal uncertainty. This will make stablecoin payments as common as credit cards are today.

2. Web3 & Metaverse Commerce

The next wave of digital shopping will happen in immersive environments such as the Metaverse. In these spaces, traditional payment systems do not fit well. Stablecoins, especially USDT, provide a seamless way for consumers to buy virtual goods, attend digital events, or subscribe to online services without friction.

3. AI-Powered Payment Gateways

Artificial intelligence is also set to transform the way payment gateways operate. Future USDT gateways will use AI to detect fraud in real time, optimize transaction routing for lower fees, and provide personalized insights for merchants. This combination of blockchain and AI could redefine efficiency in digital commerce.

4. Cross-Border B2B Payments

While today’s adoption is mostly retail-focused, the future will see USDT playing a bigger role in B2B transactions. International suppliers, logistics companies, and wholesalers may rely on stablecoins to avoid costly bank processes and ensure faster settlements across countries.

For forward-looking e-commerce businesses, integrating USDT now is not just about solving today’s challenges — it’s about preparing for a future where stablecoins become the backbone of global trade.

FAQs – USDT Payment Gateway for E-Commerce

1. What is a USDT Payment Gateway for E-Commerce?

It is a digital payment system that allows online stores to accept USDT, a stablecoin pegged to the U.S. dollar, for fast and secure transactions.

2. How much are the fees for USDT payments?

Most providers charge between 0.5% and 1%, which is significantly lower than traditional credit card processors.

3. Can Shopify or WooCommerce stores integrate USDT payments?

Yes. Many providers offer ready-made plugins and APIs that work with Shopify, WooCommerce, Magento, and other e-commerce platforms.

4. Are USDT transactions safe for merchants and customers?

Yes. Transactions are recorded on the blockchain, making them transparent and highly resistant to fraud or chargebacks.

5. How do refunds work with USDT payments?

Refunds are issued directly to the customer’s USDT wallet. Merchants can process refunds quickly, often in minutes instead of days.

6. Do merchants need special licenses to accept USDT?

In most cases, merchants only need to comply with AML/KYC rules through their payment gateway provider. Some countries may have additional regulations.

7. What happens if a customer sends the wrong amount?

Gateways usually detect discrepancies and notify the merchant. In most cases, adjustments or manual refunds can be arranged.

8. Can USDT payments be converted into fiat currency?

Yes. Merchants can choose to keep payments in USDT or instantly convert them into local currencies such as USD or EUR, depending on the gateway’s features.

Final Conclusion

The global shift toward digital payments is accelerating, and stablecoins are at the center of this transformation. For online retailers, adopting a USDT Payment Gateway for E-Commerce is no longer a question of “if” but “when.” By 2026, stablecoin adoption is projected to reach record highs, with businesses that move early gaining a lasting advantage in global markets.

At the same time, regulations around digital assets are becoming clearer, giving merchants the confidence to adopt USDT without fear of uncertainty. This combination of speed, security, and legal recognition is positioning USDT as the stablecoin of choice for cross-border commerce.

Quick Summary Table

| Key Advantage | Why It Matters for E-Commerce |

|---|---|

| Speed | Payments confirmed in seconds, enabling faster order fulfillment |

| Cost | Transaction fees as low as 0.5% compared to 2–4% on cards |

| Reach | Accept payments from customers worldwide without borders |

| Security | Blockchain-backed, transparent, and resistant to fraud |

| Flexibility | Option to keep funds in USDT or convert instantly to fiat |

For e-commerce leaders, the opportunity is clear: integrating USDT payments today means tapping into the spending power of Gen Z and Millennials, who represent the future of online shopping. It also means being prepared for the next evolution of digital commerce — from Web3 marketplaces to Metaverse experiences — where stablecoins like USDT will be the default currency.

Now is the time to act. Integrate a USDT Payment Gateway for E-Commerce, reduce costs, and open your store to a truly borderless customer base.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!